Intelligent Pipeline Pigging Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428677 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Intelligent Pipeline Pigging Services Market Size

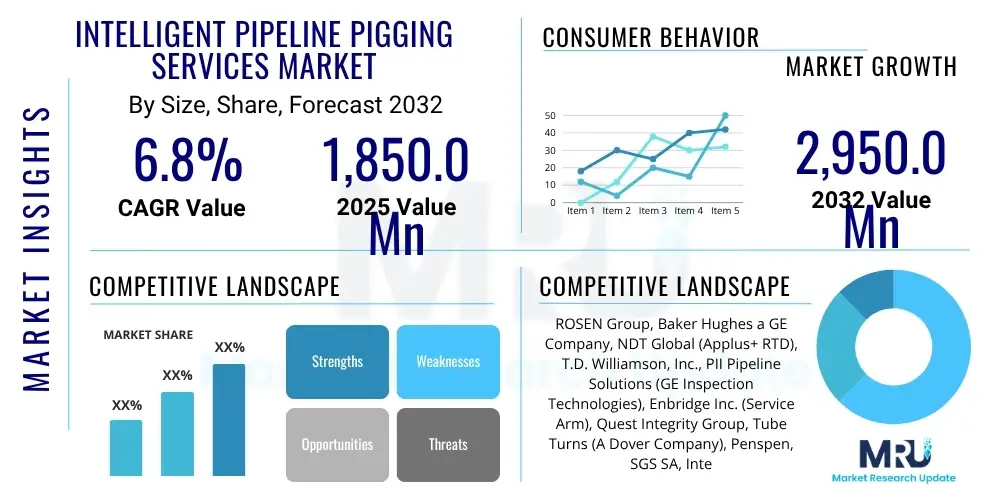

The Intelligent Pipeline Pigging Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $1,850.0 Million in 2025 and is projected to reach $2,950.0 Million by the end of the forecast period in 2032.

Intelligent Pipeline Pigging Services Market introduction

The Intelligent Pipeline Pigging Services Market encompasses advanced inline inspection (ILI) technologies utilized for comprehensive assessment and maintenance of pipeline infrastructure. Intelligent pigging, often referred to as smart pigging, involves deploying autonomous inspection tools, known as pigs, through pipelines to gather critical data about the pipeline's condition. These sophisticated devices are equipped with an array of sensors, including magnetic flux leakage (MFL), ultrasonic testing (UT), and caliper tools, which record detailed information regarding metal loss, corrosion, cracks, dents, and other anomalies that could compromise pipeline integrity. The primary objective of these services is to enhance operational safety, ensure regulatory compliance, extend asset lifespans, and prevent costly and environmentally damaging incidents such as leaks or ruptures.

The core product within this market segment includes a range of intelligent pigs designed for various pipeline diameters, materials, and product types. These pigs are integrated with advanced data acquisition systems, onboard processing capabilities, and navigation modules. Major applications span across critical sectors such as oil and gas transmission and distribution, chemical processing, and water utility networks. In the oil and gas industry, intelligent pigging is indispensable for assessing crude oil, refined products, and natural gas pipelines, ensuring their reliability and preventing potential failures that could lead to significant economic losses and environmental disasters. Similarly, in chemical and water industries, these services are crucial for maintaining the integrity of pipelines transporting hazardous chemicals or potable water, safeguarding public health and environmental quality.

The benefits derived from intelligent pipeline pigging services are substantial, including improved accuracy in defect detection, enhanced predictive maintenance capabilities, and reduced operational downtime. These services allow pipeline operators to proactively identify and address potential issues before they escalate, thereby minimizing risks and optimizing maintenance schedules. Key driving factors propelling market growth include the global aging pipeline infrastructure, which necessitates regular and thorough inspection to avert catastrophic failures. Additionally, increasingly stringent regulatory frameworks mandating higher safety standards and environmental protection, coupled with the rising demand for reliable energy and water transportation, are compelling operators to adopt advanced pigging technologies. The continuous technological advancements in sensor technology, data analytics, and robotic systems are further fueling innovation and adoption within this specialized market.

Intelligent Pipeline Pigging Services Market Executive Summary

The Intelligent Pipeline Pigging Services Market is experiencing robust growth, driven by an urgent need for enhanced pipeline integrity management across critical infrastructure sectors globally. Business trends indicate a significant shift towards digitalization and data-centric solutions, with pipeline operators increasingly investing in services that offer not just inspection data but also actionable insights derived from advanced analytics and artificial intelligence. This focus on predictive maintenance and asset performance optimization is reshaping service offerings, moving beyond traditional inspection to integrated digital platforms that provide real-time monitoring and holistic pipeline health assessments. Strategic partnerships between technology providers and service companies are also on the rise, aiming to deliver comprehensive, end-to-end solutions that address the complex challenges of pipeline maintenance and regulatory compliance.

From a regional perspective, North America continues to be a dominant market, largely due to its extensive and aging pipeline network, coupled with strict regulatory mandates for integrity management. Europe also holds a substantial share, driven by stringent environmental regulations and a strong emphasis on safety standards, pushing for continuous innovation in pigging technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid industrialization, increasing energy demand, and the construction of new pipeline infrastructure, particularly in countries like China and India. Latin America and the Middle East & Africa (MEA) are also emerging as significant markets, with substantial investments in oil and gas exploration and production, leading to expanding pipeline networks that require intelligent inspection services.

Segment trends highlight the increasing adoption of advanced pigging technologies such as ultrasonic testing (UT) and electromagnetic acoustic transducers (EMAT) for more precise defect detection, especially for stress corrosion cracking and microscopic anomalies. Magnetic Flux Leakage (MFL) remains a cornerstone technology, continuously evolving with enhanced sensor sensitivity and data resolution. Furthermore, the market is witnessing a strong uptake of services focused on data analytics and software solutions, as operators seek to maximize the value of the vast amounts of data collected by intelligent pigs. The demand for multi-sensor platforms that can simultaneously detect various types of defects is also growing, offering a more efficient and comprehensive approach to pipeline integrity assessment. This evolution in technology and service delivery underscores the market's commitment to improving the safety, efficiency, and longevity of global pipeline assets.

AI Impact Analysis on Intelligent Pipeline Pigging Services Market

Common user questions regarding AI's impact on the Intelligent Pipeline Pigging Services Market frequently revolve around its ability to process the massive datasets generated by smart pigs, improve the accuracy of anomaly detection, enable truly predictive maintenance, and optimize inspection schedules. Users are keen to understand how AI can reduce false positives, enhance data interpretation capabilities, and ultimately lower operational costs while increasing safety and efficiency. There are also queries about the implementation challenges, data security, and the integration of AI models with existing pipeline management systems, highlighting a balance between high expectations for technological advancement and practical concerns about deployment and reliability. The overarching theme is a strong desire to leverage AI for more proactive, precise, and cost-effective pipeline integrity management.

AI's influence on intelligent pipeline pigging is transformative, primarily by elevating the analytical capabilities far beyond traditional methods. It empowers sophisticated algorithms to sift through terabytes of raw inspection data, identify subtle patterns, and correlate various types of sensor readings that human analysts might miss. This enables a more accurate and rapid identification of anomalies such as corrosion, cracks, and geometrical defects, significantly reducing the risk of misinterpretation and improving the reliability of integrity assessments. Moreover, AI-driven predictive models can forecast future pipeline degradation rates, allowing operators to transition from reactive or time-based maintenance to a truly predictive approach, optimizing resource allocation and preventing failures before they occur. The integration of machine learning algorithms is making smart pigs "smarter" by enhancing their ability to learn from past inspection data and improve their detection capabilities over time, ultimately leading to safer and more efficient pipeline operations.

- Enhanced Data Analysis and Interpretation: AI algorithms process large volumes of sensor data, identifying subtle patterns and anomalies more effectively than manual analysis, leading to more accurate defect detection.

- Predictive Maintenance Capabilities: AI-driven models analyze historical and real-time data to predict future pipeline degradation, enabling proactive maintenance scheduling and minimizing unexpected failures.

- Reduced False Positives and Negatives: Machine learning refines defect classification, significantly decreasing erroneous alerts and improving the reliability of inspection results.

- Automated Anomaly Detection: AI automates the identification of corrosion, cracks, dents, and other defects, speeding up the assessment process and reducing human error.

- Optimized Inspection Scheduling: AI algorithms consider various factors like pipeline age, material, product carried, and environmental conditions to recommend optimal inspection frequencies and routes.

- Improved Asset Lifecycle Management: By providing deeper insights into pipeline health, AI supports better decision-making for repairs, replacements, and overall asset management, extending the operational life of pipelines.

- Real-time Monitoring and Alerting: Integration of AI with IoT sensors allows for continuous monitoring and immediate alerts on critical pipeline conditions, enabling rapid response to potential issues.

- Cost Efficiency: AI-driven precision in defect identification and predictive maintenance reduces unnecessary inspections, optimizes resource utilization, and prevents costly emergency repairs.

- Enhanced Data Integration: AI facilitates the fusion of data from various sources (pigging, SCADA, geographical information systems) to create a comprehensive digital twin of the pipeline.

- Development of Autonomous Pigging Systems: Future advancements will see AI enabling pigs to make autonomous decisions regarding data collection and navigation within complex pipeline networks.

DRO & Impact Forces Of Intelligent Pipeline Pigging Services Market

The Intelligent Pipeline Pigging Services Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, all contributing to its overall impact forces. Key drivers propelling market expansion include the global aging energy infrastructure, particularly an extensive network of oil and gas pipelines that are increasingly susceptible to corrosion, fatigue, and other integrity issues, necessitating advanced inspection. Furthermore, the proliferation of stringent regulatory frameworks worldwide, aimed at enhancing pipeline safety, environmental protection, and preventing hazardous spills, mandates the adoption of sophisticated inspection technologies. The escalating demand for energy resources, which drives the construction of new pipelines and the continuous operation of existing ones, also fuels the need for reliable integrity management services. Technological advancements in sensor development, data analytics, and robotic systems are continuously improving the capabilities of intelligent pigs, making them more accurate, efficient, and versatile.

Conversely, several restraints impede the market's growth trajectory. The high initial capital expenditure associated with intelligent pigging services, including the purchase or lease of advanced inspection tools and the specialized expertise required for their operation and data interpretation, can be a significant barrier for smaller operators. Technical complexities, such as the need for highly skilled personnel to operate the sophisticated equipment, process the vast amounts of data, and accurately diagnose potential issues, present ongoing challenges. Moreover, pipeline accessibility issues, particularly in remote or challenging terrains, and the presence of complex pipeline geometries (e.g., tight bends, varying diameters) can limit the deployability and effectiveness of certain pigging technologies. The operational downtime required for pigging operations, although minimized by advanced planning, can still result in temporary disruptions to product flow, posing an economic disincentive for operators. These factors collectively contribute to the cost-benefit analysis that operators must undertake when considering intelligent pigging solutions.

Despite these restraints, the market is rife with opportunities for growth and innovation. Untapped markets, especially in developing regions where pipeline infrastructure is expanding rapidly but integrity management practices are still maturing, represent significant growth potential. The growing integration of intelligent pigging with other advanced technologies like the Internet of Things (IoT), Digital Twin technology, and cloud computing presents avenues for developing more holistic and real-time pipeline monitoring solutions. There is also an increasing focus on expanding intelligent pigging applications beyond traditional oil and gas to other sectors such as water, chemicals, and industrial gases, diversifying the market's revenue streams. Furthermore, the continuous development of next-generation intelligent pigs, featuring enhanced sensor arrays, improved navigability, and superior data processing capabilities, promises to address existing technical limitations and open up new possibilities for comprehensive pipeline assessment, thereby shaping the impact forces of technological advancement and regulatory compliance.

Segmentation Analysis

The Intelligent Pipeline Pigging Services Market is comprehensively segmented to cater to the diverse needs of pipeline operators and address specific integrity challenges across various industries. This segmentation allows for a detailed understanding of market dynamics, technological preferences, and application-specific demands, enabling service providers to tailor their offerings effectively. The market can be broadly categorized by the type of technology employed, the specific application or defect being targeted, the nature of the pipeline being inspected, and the type of service rendered throughout the pigging lifecycle. Each segment exhibits distinct growth drivers and challenges, reflecting the evolving landscape of pipeline integrity management and the continuous advancements in inspection methodologies. Understanding these segments is crucial for stakeholders to identify key growth areas and formulate targeted market strategies.

The technological segmentation highlights the primary methods used by intelligent pigs to detect anomalies, with Magnetic Flux Leakage (MFL) and Ultrasonic Testing (UT) being the dominant approaches. MFL is highly effective for detecting metal loss and corrosion, while UT excels at identifying cracks and wall thickness measurements, particularly in liquid-filled pipelines. Caliper pigs, used for geometry assessment, complement these technologies. Application-based segmentation focuses on the specific types of defects or conditions that operators aim to identify, such as general corrosion, stress corrosion cracking, dents, or pipeline ovality, each requiring specialized pigging tools and data analysis. Pipeline type segmentation distinguishes between liquid pipelines (e.g., crude oil, refined products, water) and gas pipelines (e.g., natural gas, NGLs), as the operational environment and pig design considerations differ significantly. Finally, service type segmentation delineates the stages of pigging intervention, from pre-inspection planning to in-inspection execution and post-inspection data analysis and reporting, offering a full lifecycle approach to pipeline integrity.

- Technology Type

- Magnetic Flux Leakage (MFL) Pigging: Utilized extensively for detecting corrosion, pitting, and metal loss in ferrous pipelines by measuring variations in magnetic flux. Highly effective for both internal and external defects.

- Ultrasonic Testing (UT) Pigging: Employs sound waves to measure wall thickness, detect internal and external corrosion, laminations, and stress corrosion cracking. Ideal for liquid-filled pipelines and providing high-resolution data.

- Caliper Pigging: Used for geometry inspection, detecting dents, buckles, ovality, wrinkles, and other changes in the pipeline's internal diameter. Essential for assessing pipeline integrity and ensuring smooth product flow.

- Electromagnetic Acoustic Transducer (EMAT) Pigging: A non-contact ultrasonic method capable of inspecting gas pipelines for cracks and stress corrosion cracking, overcoming the need for a liquid couplant.

- Other Technologies: Includes eddy current, optical, gamma ray, and advanced mapping technologies like Inertial Measurement Units (IMU) for precise crack detection and pipeline mapping.

- Application

- Metal Loss/Corrosion Detection: The most common application, focusing on identifying internal and external corrosion, pitting, and general wall thickness reductions.

- Geometry/Denting Detection: Crucial for locating mechanical damage such as dents, buckles, and ovality that can compromise pipeline integrity and flow efficiency.

- Cracking Detection: Specialized tools and analysis for identifying stress corrosion cracking, fatigue cracks, and hydrogen-induced cracking, which are critical failure mechanisms.

- Mapping and Bend Analysis: Utilizes IMU and GPS technologies for accurate pipeline mapping, verifying as-built drawings, and analyzing strain in bends.

- Leak Detection: While primary pigging is for integrity, some advanced pigs integrate leak detection capabilities or can contribute data to external leak detection systems.

- Pipeline Type

- Liquid Pipelines: Includes pipelines transporting crude oil, refined petroleum products, water, and chemical liquids. UT and MFL are commonly used.

- Gas Pipelines: Encompasses natural gas, NGL (Natural Gas Liquids), and other gaseous product pipelines. MFL and EMAT are key technologies here.

- Service Type

- Pre-Inspection Services: Includes project planning, piggability assessment, cleaning pig runs, and pipeline preparation before the intelligent pig run.

- In-Inspection Services: The actual deployment and operation of intelligent pigs to collect integrity data.

- Post-Inspection Services: Involves data analysis, interpretation, reporting, defect assessment, and recommendations for maintenance and repair.

Value Chain Analysis For Intelligent Pipeline Pigging Services Market

The value chain for the Intelligent Pipeline Pigging Services Market begins with upstream activities focused on the research, development, and manufacturing of the sophisticated components that constitute intelligent pigs. This includes specialized sensor technologies, such as advanced MFL modules, ultrasonic transducers, and precise caliper arms, as well as high-performance data acquisition systems, battery units, and robust mechanical structures designed to withstand harsh pipeline environments. Key players in this segment are often highly specialized engineering firms and technology developers who invest heavily in materials science, electronics, and software development to produce cutting-edge inspection tools. The quality and innovation at this upstream stage are paramount, as they directly impact the accuracy, reliability, and capabilities of the entire pigging service.

Moving further along the value chain, the core of the market lies in the provision of comprehensive intelligent pigging services. This midstream segment involves the deployment of these advanced tools into pipelines, the execution of the inspection run, and the subsequent retrieval of the pig and its collected data. Service providers in this area require extensive operational expertise, specialized logistics, and highly trained field technicians to ensure successful pigging operations, often navigating complex pipeline networks and challenging environmental conditions. Following data acquisition, a critical part of the value chain is the downstream analysis and interpretation of the vast amounts of data generated by the intelligent pigs. This involves employing advanced proprietary software, artificial intelligence, and machine learning algorithms to process raw data, identify anomalies, characterize defects, and generate detailed integrity reports that inform pipeline operators about the health of their assets.

Distribution channels for intelligent pipeline pigging services are predominantly direct, involving direct contracts between service providers and pipeline operators. Due to the highly specialized and critical nature of these services, operators typically engage directly with established providers who possess the necessary technology, expertise, and certifications. Indirect channels can include partnerships with engineering, procurement, and construction (EPC) firms that incorporate pigging services into larger infrastructure projects, or through consultants who recommend specific service providers. The emphasis is consistently on building long-term relationships through proven performance and technological reliability. Furthermore, post-inspection services, including ongoing consultancy for integrity management, rehabilitation planning, and technology upgrades, also form a crucial part of the downstream value chain, ensuring that pipeline operators receive continuous support and maximize the value derived from their inspection data, thereby closing the loop of comprehensive asset management.

Intelligent Pipeline Pigging Services Market Potential Customers

The primary potential customers for Intelligent Pipeline Pigging Services are entities that own, operate, or manage extensive pipeline networks for the transportation of various substances. This segment is dominated by companies within the global oil and gas industry, which includes major integrated energy companies, national oil companies, independent exploration and production firms, and midstream pipeline operators. These organizations rely on vast networks of pipelines to transport crude oil, natural gas, natural gas liquids, and refined petroleum products across continents and within countries. For these customers, intelligent pigging is not merely a maintenance task but a critical component of their asset integrity management strategy, essential for ensuring operational safety, minimizing environmental risks, and complying with stringent regulatory mandates.

Beyond the core oil and gas sector, the market for intelligent pipeline pigging services extends to other industries with significant pipeline infrastructure. Chemical companies, for instance, utilize pipelines to transport a wide array of raw materials, intermediates, and finished products, many of which are hazardous or corrosive. Maintaining the integrity of these pipelines is paramount to prevent leaks, ensuring worker safety and environmental protection. Similarly, large industrial complexes and utility providers, including those involved in power generation or water distribution, operate extensive pipeline systems that require regular inspection and maintenance to ensure uninterrupted service and public safety. These entities seek advanced pigging solutions to detect internal corrosion, structural defects, and other anomalies that could lead to operational failures or environmental contamination.

Government agencies and municipal water authorities also represent a growing customer base for intelligent pipeline pigging services. With aging water and wastewater infrastructure across many urban centers, the need for accurate assessment of pipeline condition to prevent leaks, bursts, and contamination is increasing. Intelligent pigging offers a non-invasive and highly effective method for inspecting large-diameter water transmission mains and sewer force mains, allowing for targeted repairs and optimizing capital expenditure on infrastructure renewal. Ultimately, any organization with significant investment in pipeline assets, a commitment to safety and environmental stewardship, and a need to comply with regulatory standards, stands as a potential buyer of these specialized and technologically advanced integrity management services, seeking to protect their assets and ensure continuous, safe operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1,850.0 Million |

| Market Forecast in 2032 | $2,950.0 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ROSEN Group, Baker Hughes a GE Company, NDT Global (Applus+ RTD), T.D. Williamson, Inc., PII Pipeline Solutions (GE Inspection Technologies), Enbridge Inc. (Service Arm), Quest Integrity Group, Tube Turns (A Dover Company), Penspen, SGS SA, Intertek Group plc, Corrpro Companies Inc., Lin Scan Advanced Pipeline & Tank Services, A. Hak Industrial Services, Cokebusters Ltd., Enduro Pipeline Services Inc., IPIC (Inline Pipeline Inspection Company), HalfWave AS, Romacon Petro, 3P Services GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Pipeline Pigging Services Market Key Technology Landscape

The Intelligent Pipeline Pigging Services Market is characterized by a rapidly evolving technological landscape, where innovation is paramount to addressing increasingly complex pipeline integrity challenges. At its core, the technology relies on a diverse array of sensors housed within specialized pigging tools. Magnetic Flux Leakage (MFL) remains a foundational technology, with continuous advancements focusing on increasing sensor density, improving resolution for smaller defect detection, and enhancing the ability to distinguish between internal and external flaws. Ultrasonic Testing (UT) pigging has also seen significant evolution, particularly in improving transducer arrays for better coverage and higher accuracy in wall thickness measurements and crack detection, especially for stress corrosion cracking. The development of Electro-Magnetic Acoustic Transducer (EMAT) technology is particularly crucial for gas pipelines, offering a non-contact method for crack detection that does not require a liquid couplant, overcoming a significant operational limitation.

Beyond primary inspection sensors, the modern intelligent pig incorporates a suite of complementary technologies. Inertial Measurement Units (IMUs) and GPS systems (where applicable for above-ground pipelines or combined with surface tracking) provide highly accurate mapping and geographical positioning, crucial for precisely locating defects and understanding pipeline geometry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager