Inter Array Offshore Wind Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429868 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Inter Array Offshore Wind Cable Market Size

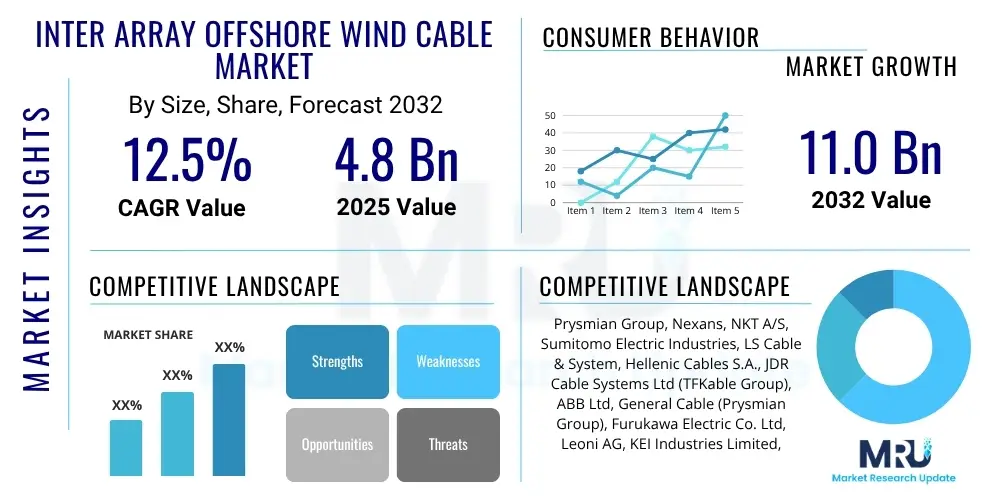

The Inter Array Offshore Wind Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at $4.8 Billion in 2025 and is projected to reach $11.0 Billion by the end of the forecast period in 2032.

Inter Array Offshore Wind Cable Market introduction

The Inter Array Offshore Wind Cable Market is a critical component within the rapidly expanding global offshore wind energy sector. These specialized submarine power cables are indispensable for connecting individual wind turbines within an offshore wind farm to a central offshore substation, or directly to another turbine, forming the electrical backbone of the entire installation. As global efforts to transition to renewable energy sources intensify, the demand for efficient and reliable power transmission infrastructure, particularly for offshore wind, continues its substantial upward trajectory. This market encompasses a range of advanced cable technologies designed to withstand harsh marine environments while ensuring minimal power loss and maximum operational longevity.

The primary product in this market is the inter array cable, typically medium to high voltage Alternating Current (AC) or Direct Current (DC) cables, armored for protection against physical damage and corrosive elements. These cables are designed to transmit the electricity generated by each turbine to a collector substation, which then aggregates the power before it is exported to the onshore grid via export cables. Major applications are exclusively within offshore wind farms, supporting both fixed-bottom and increasingly, floating offshore wind installations. The benefits derived from these cables include robust power evacuation, reduced transmission losses, enhanced grid stability, and the facilitation of large-scale renewable energy generation that contributes significantly to decarbonization goals.

The market is primarily driven by supportive government policies promoting renewable energy, ambitious offshore wind development targets globally, and a continuous decline in the Levelized Cost of Energy (LCOE) for offshore wind projects. Technological advancements in cable design, materials, and installation techniques are further enhancing the efficiency and cost-effectiveness of these critical infrastructure components. As countries aim to bolster energy security and meet climate commitments, the indispensable role of inter array cables in delivering clean power from sea to shore solidifies the market's strong growth prospects.

Inter Array Offshore Wind Cable Market Executive Summary

The Inter Array Offshore Wind Cable Market is experiencing robust growth, propelled by the global imperative for renewable energy and increasing investments in offshore wind infrastructure. Key business trends include the consolidation of major cable manufacturers, intense competition driving innovation in cable technology, and a growing emphasis on optimizing supply chain logistics to manage increasing project complexities and lead times. Manufacturers are focusing on developing higher voltage capacity cables, particularly for larger turbines and further-from-shore projects, alongside solutions for dynamic environments presented by floating offshore wind. The market also observes a trend towards vertically integrated solutions, where cable suppliers offer comprehensive packages including design, manufacturing, installation, and maintenance services, enhancing efficiency and project delivery timelines for developers.

Regionally, Europe remains the dominant market, particularly led by the UK, Germany, and the Netherlands, which have established mature offshore wind sectors and ambitious expansion plans. However, the Asia Pacific region is rapidly emerging as a significant growth engine, with China, Taiwan, Japan, and South Korea making substantial investments in offshore wind capacity, driven by strong government support and industrial capabilities. North America, especially the United States, is poised for significant growth, with a robust project pipeline and favorable federal and state policies designed to catalyze offshore wind development. Emerging markets in Latin America and the Middle East and Africa are also beginning to explore their offshore wind potential, albeit at an earlier stage of development, indicating future avenues for market expansion.

In terms of segment trends, the market is primarily segmented by voltage type (AC vs. DC), insulation material (XLPE being dominant), and application (fixed-bottom vs. floating). There is a clear shift towards higher voltage AC cables (66 kV and above) to support larger wind turbines and minimize losses across expansive wind farms. Furthermore, the development of dynamic cables capable of managing the movement of floating platforms represents a critical and rapidly growing sub-segment. The demand for advanced monitoring and fault detection systems integrated within the cables is also on the rise, enhancing operational reliability and reducing maintenance costs, reflecting a broader trend towards smart infrastructure within the energy sector.

AI Impact Analysis on Inter Array Offshore Wind Cable Market

User inquiries concerning AI's influence on the Inter Array Offshore Wind Cable Market primarily revolve around optimizing operational efficiency, enhancing predictive maintenance capabilities, and improving the design and installation processes. There is a strong interest in how AI can be leveraged to reduce costs, minimize downtime, and extend the lifespan of these critical assets. Users seek to understand AI's potential in detecting anomalies, forecasting equipment failures, and streamlining complex logistical challenges inherent in offshore environments. Furthermore, questions arise about AI's role in optimizing cable routing, material selection, and ensuring environmental compliance throughout the project lifecycle. The overarching theme is the pursuit of intelligence-driven solutions to overcome existing challenges and unlock new efficiencies in the burgeoning offshore wind sector.

- AI driven predictive maintenance extends cable lifespan by identifying potential faults before they escalate.

- Optimized cable design through AI algorithms reduces material usage and improves electrical performance.

- AI enhances installation efficiency by predicting optimal weather windows and managing vessel logistics.

- Real-time monitoring systems powered by AI detect anomalies and provide immediate operational insights.

- Supply chain management benefits from AI forecasting demand for raw materials and components.

- AI supports environmental impact assessment and mitigation during cable routing and laying.

- Automated inspection of cable manufacturing processes using AI ensures higher quality control.

- Machine learning models analyze operational data to refine cable performance and reliability metrics.

DRO & Impact Forces Of Inter Array Offshore Wind Cable Market

The Inter Array Offshore Wind Cable Market is significantly shaped by a confluence of driving forces, inherent restraints, and burgeoning opportunities, all under the influence of various impact forces. The primary drivers include robust government support and favorable regulatory frameworks that incentivize offshore wind development, such as ambitious renewable energy targets and carbon reduction mandates. The continuous decline in the Levelized Cost of Energy (LCOE) for offshore wind, driven by larger turbines and improved project efficiencies, makes these projects increasingly economically viable, thereby fueling the demand for associated infrastructure like inter array cables. Furthermore, global efforts to enhance energy security and reduce reliance on fossil fuels are accelerating investments in offshore wind, directly boosting the cable market. Technological advancements in cable materials, design, and manufacturing processes also play a crucial role, allowing for higher voltage capacities and greater resilience in challenging marine conditions.

Despite these powerful drivers, the market faces several significant restraints. High upfront capital expenditure for offshore wind projects, including the substantial cost of submarine cables and their installation, can be a deterrent, especially in nascent markets. Environmental concerns, complex permitting processes, and potential impacts on marine ecosystems can lead to project delays and increased costs. Supply chain bottlenecks, particularly for specialized cable-laying vessels and skilled labor, often pose challenges, leading to extended lead times and cost escalations. Geopolitical tensions and trade barriers can also disrupt the global supply of raw materials and finished cable products, introducing an element of unpredictability to market operations. Technical complexities associated with deepwater installations and dynamic cables for floating wind platforms also present design and engineering hurdles.

Opportunities within this market are substantial and diverse. The rapid expansion of floating offshore wind technology opens up vast new areas for development in deeper waters, requiring innovative dynamic cable solutions. Emerging markets in Asia Pacific, particularly countries like Vietnam, India, and Australia, alongside North America, offer significant untapped potential for new offshore wind projects. Furthermore, advancements in smart grid technologies and the integration of offshore wind with hydrogen production or battery storage systems present new avenues for cable applications. Retrofitting and upgrading existing offshore wind farms with higher capacity or more efficient cables also offer long-term market opportunities. The continuous drive towards standardization of cable components and installation practices could lead to further cost reductions and increased deployment efficiency across the industry.

Segmentation Analysis

The Inter Array Offshore Wind Cable Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. These segmentations allow for a granular analysis of market trends, technological preferences, and regional adoption patterns, enabling stakeholders to identify specific growth areas and tailor strategies effectively. The market is primarily categorized by cable type, voltage level, insulation material, and application, each reflecting different technical requirements and market demands within the offshore wind sector. Understanding these segments is crucial for manufacturers, developers, and investors alike to navigate the complexities of this rapidly evolving industry.

- By Type

- AC (Alternating Current) Cables

- DC (Direct Current) Cables

- By Voltage

- Below 66 kV

- 66 kV to 132 kV

- Above 132 kV

- By Insulation

- XLPE (Cross-linked Polyethylene)

- EPR (Ethylene Propylene Rubber)

- Other Insulation Types

- By Application

- Fixed-Bottom Offshore Wind Farms

- Floating Offshore Wind Farms

Value Chain Analysis For Inter Array Offshore Wind Cable Market

The value chain for the Inter Array Offshore Wind Cable Market is intricate, involving multiple stages from raw material sourcing to end-use deployment and maintenance, underscoring a complex ecosystem of specialized participants. At the upstream end, the chain begins with the extraction and processing of essential raw materials such as copper and aluminum for conductors, lead and steel for armoring, and polymers for insulation (e.g., XLPE, EPR). Key players at this stage include mining companies, metal refiners, and chemical manufacturers, who supply these critical components to cable manufacturers. The quality and availability of these raw materials significantly influence the cost and performance of the final cable product. Ensuring a stable and ethically sourced supply of these materials is a persistent challenge that market participants must address to mitigate supply chain risks and maintain production efficiency.

Moving downstream, the primary activities involve the design, manufacturing, testing, and installation of the inter array cables. Cable manufacturers, often large industrial conglomerates with extensive R&D capabilities, play a central role in transforming raw materials into sophisticated subsea cables. These manufacturers collaborate closely with offshore wind farm developers and EPC (Engineering, Procurement, and Construction) contractors to customize cable solutions that meet specific project requirements, including voltage, length, and environmental resilience. The installation phase is highly specialized, requiring advanced cable-laying vessels, trenching equipment, and experienced marine engineering crews to ensure precise and secure deployment on the seabed. This phase is often undertaken by specialized offshore construction companies or the cable manufacturers themselves, sometimes in partnership.

Distribution channels in this market are predominantly direct, characterized by long-term contracts and bespoke agreements between cable manufacturers and offshore wind farm developers or EPC contractors. Given the high-value, project-specific nature of inter array cables, there is limited reliance on indirect distribution through intermediaries. Direct engagement allows for close technical collaboration, quality assurance, and customized delivery schedules. Indirect influences in the value chain include engineering consultancies that provide design and project management expertise, insurance providers, and regulatory bodies that set standards and ensure compliance. Furthermore, maintenance and repair services post-installation form a crucial part of the downstream value chain, often involving long-term service agreements with specialized marine contractors or the original equipment manufacturers to ensure continuous operational integrity and longevity of the offshore assets.

Inter Array Offshore Wind Cable Market Potential Customers

The primary potential customers and end-users of inter array offshore wind cables are entities engaged in the development, construction, and operation of offshore wind farms globally. These sophisticated buyers typically possess extensive technical expertise and substantial financial resources, requiring reliable, high-performance cable solutions that can withstand harsh marine environments for decades. Their purchasing decisions are heavily influenced by factors such as cable capacity, durability, installation costs, maintenance requirements, and alignment with project timelines and regulatory standards. The relationship between cable suppliers and these customers is often long-term and collaborative, extending from the project design phase through to installation and beyond.

Key customers include large utility companies and independent power producers (IPPs) that are investing heavily in renewable energy portfolios to meet decarbonization goals and energy demand. These entities act as owners and operators of offshore wind assets, directly procuring or overseeing the procurement of all necessary infrastructure components. Offshore wind farm developers, who manage the entire lifecycle of a project from concept to commissioning, are also crucial buyers. They often engage directly with cable manufacturers to secure optimal solutions for their specific project sites. Moreover, Engineering, Procurement, and Construction (EPC) contractors specializing in offshore energy projects frequently serve as the direct purchasers of these cables, responsible for integrating them into the broader wind farm infrastructure and managing the installation process.

As the offshore wind industry expands into new geographies and adopts more advanced technologies, the customer base is also evolving. Governments and national energy agencies, particularly in emerging markets, may indirectly influence procurement decisions through policy directives, subsidies, and tender requirements. Research and development institutions, while not direct buyers, play a role in shaping future demand by developing innovative offshore wind concepts that may necessitate new types of cable technologies. The growing interest in hybrid offshore projects, combining wind with other forms of generation or storage, could also broaden the customer base to include entities focused on grid modernization and energy storage solutions, further diversifying the market for advanced inter array cabling systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.8 Billion |

| Market Forecast in 2032 | $11.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, NKT A/S, Sumitomo Electric Industries, LS Cable & System, Hellenic Cables S.A., JDR Cable Systems Ltd (TFKable Group), ABB Ltd, General Cable (Prysmian Group), Furukawa Electric Co. Ltd, Leoni AG, KEI Industries Limited, Polycab India Ltd, Universal Cables Ltd, Southwire Company LLC, Marmon Group, ZTT International Limited, Orient Cable (NBO), Cablel Hellenic Cables Group, Shanghai Nanyang Cable Group Co. Ltd |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inter Array Offshore Wind Cable Market Key Technology Landscape

The Inter Array Offshore Wind Cable Market is characterized by a dynamic and evolving technology landscape, driven by the increasing demands of larger turbines, deeper water installations, and the shift towards floating offshore wind platforms. A core technological advancement is in high-voltage Alternating Current (HVAC) and Direct Current (HVDC) cable systems, with a prominent trend towards higher voltage AC cables (e.g., 66 kV, 132 kV) to handle the greater power output of modern, larger-capacity wind turbines and minimize transmission losses across extensive wind farms. This necessitates robust insulation materials, with Cross-linked Polyethylene (XLPE) remaining the dominant choice due to its excellent dielectric properties, thermal stability, and long operational life. Continuous research is focused on improving XLPE compounds for even higher voltage and temperature performance, and alternative insulations like Ethylene Propylene Rubber (EPR) are also utilized for specific applications requiring enhanced flexibility.

Another significant technological focus is on dynamic cables, which are essential for floating offshore wind farms. Unlike static cables for fixed-bottom installations, dynamic cables must accommodate constant movement, bending, and tension caused by waves, currents, and platform motion. This requires innovative cable designs featuring enhanced flexibility, fatigue resistance, and specialized buoyant sections to manage strain. Furthermore, the integration of fiber optic elements within power cables for real-time monitoring of temperature, strain, and partial discharges is becoming standard practice. These integrated monitoring systems enhance operational safety, enable predictive maintenance, and help optimize the performance and lifespan of the cables by providing crucial diagnostic data. This smart cable technology contributes significantly to reducing operational expenditures and improving reliability.

Moreover, advancements in manufacturing processes, such as improved extrusion techniques for insulation and advanced stranding methods for conductors, are critical for producing longer, more reliable, and cost-effective cables. Innovations in cable protection systems, including enhanced armoring, rock dump solutions, and specialized burial techniques, are also continuously developed to mitigate external damage risks in harsh marine environments. The trend towards modular design and standardized interfaces for cable connections aims to simplify installation and reduce overall project timelines. As the industry moves towards greater grid integration and interconnection, the development of robust and reliable cable accessories, such as joints and terminations designed for offshore conditions, also remains a vital part of the technological evolution in the inter array offshore wind cable market.

Regional Highlights

- Europe: The undisputed leader in offshore wind development, particularly the UK, Germany, Denmark, and the Netherlands. This region boasts the most mature market for inter array cables, driven by ambitious renewable energy targets, established supply chains, and significant government support. Projects here often serve as benchmarks for global developments, showcasing advanced cable technologies and installation methodologies.

- Asia Pacific (APAC): A rapidly expanding market, poised for exponential growth. China leads global installations, while Taiwan, Japan, South Korea, and Vietnam are emerging as key players with substantial project pipelines. Government policies promoting renewable energy and growing energy demand are primary drivers. This region is witnessing significant investment in manufacturing capabilities and infrastructure to support its burgeoning offshore wind sector, creating robust demand for inter array cables.

- North America: An emerging market with strong growth potential, primarily driven by the United States. Federal and state-level policies, such as the Inflation Reduction Act, are providing significant incentives for offshore wind development. The East Coast, particularly states like New York, Massachusetts, and Virginia, is a hotspot for new projects. Canada is also exploring its offshore wind potential. The market here is characterized by new entrants and substantial infrastructure build-out.

- Latin America: Currently a nascent market for offshore wind, but with considerable future potential, particularly in countries like Brazil and Colombia. Exploration and early-stage development projects are underway, indicating future opportunities for inter array cable demand as the region diversifies its energy mix.

- Middle East and Africa (MEA): This region is in the very early stages of offshore wind development, with a few pilot projects and exploratory initiatives. Countries with extensive coastlines and strong renewable energy ambitions, such as Saudi Arabia, UAE, and South Africa, could become future growth areas, gradually contributing to the global demand for offshore wind cables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inter Array Offshore Wind Cable Market.- Prysmian Group

- Nexans

- NKT A/S

- Sumitomo Electric Industries

- LS Cable & System

- Hellenic Cables S.A.

- JDR Cable Systems Ltd (TFKable Group)

- ABB Ltd

- General Cable (Prysmian Group)

- Furukawa Electric Co. Ltd

- Leoni AG

- KEI Industries Limited

- Polycab India Ltd

- Universal Cables Ltd

- Southwire Company LLC

- Marmon Group

- ZTT International Limited

- Orient Cable (NBO)

- Cablel Hellenic Cables Group

- Shanghai Nanyang Cable Group Co. Ltd

Frequently Asked Questions

What are inter array offshore wind cables?

Inter array offshore wind cables are specialized submarine power cables that connect individual wind turbines within an offshore wind farm to an offshore substation or to other turbines, efficiently transmitting the generated electricity before it is exported to the onshore grid.

What drives the growth of the Inter Array Offshore Wind Cable Market?

The market's growth is primarily driven by global renewable energy policies, ambitious offshore wind development targets, declining Levelized Cost of Energy (LCOE) for offshore wind, and technological advancements in cable design and installation.

What are the key technical challenges in this market?

Key technical challenges include designing cables for high voltage and power capacity, ensuring durability in harsh marine environments, developing dynamic cables for floating offshore wind, and managing complex installation logistics in deep waters.

How does floating offshore wind impact inter array cable design?

Floating offshore wind requires dynamic cables capable of withstanding constant movement, bending, and tension from waves and platform motion. This necessitates enhanced flexibility, fatigue resistance, and specialized buoyant sections in cable design, differentiating them from static fixed-bottom cables.

Which regions are leading in inter array cable deployment?

Europe is the leading region, particularly the UK, Germany, and the Netherlands, with Asia Pacific (China, Taiwan, Japan) emerging as a rapid growth market. North America, especially the United States, is also poised for significant expansion in deployment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager