Interface IC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429701 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Interface IC Market Size

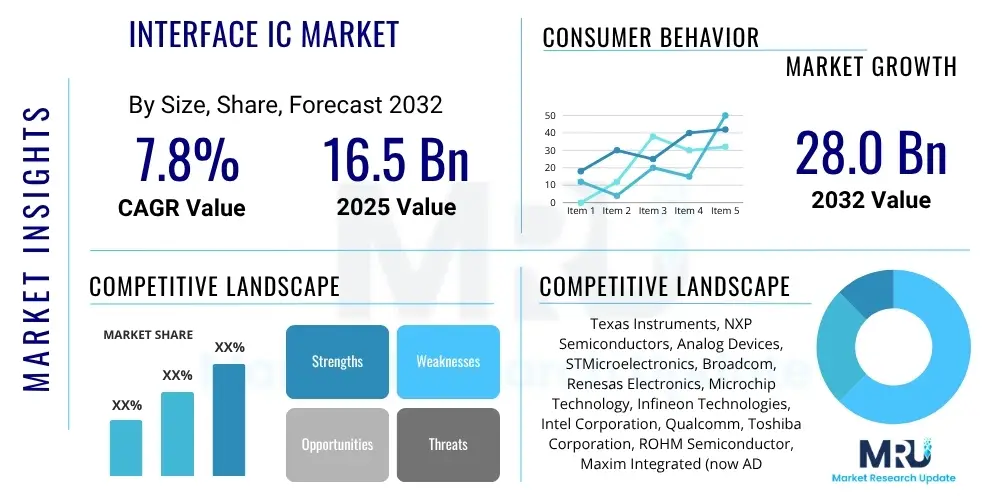

The Interface IC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $16.5 billion in 2025 and is projected to reach $28.0 billion by the end of the forecast period in 2032.

Interface IC Market introduction

Interface Integrated Circuits (ICs) are fundamental electronic components designed to enable seamless communication and signal conversion between disparate electronic systems or subsystems. These crucial devices bridge the compatibility gaps that often arise from varying voltage levels, data rates, communication protocols, and physical standards across different components within a single electronic product or across networked devices. Their primary function involves ensuring signal integrity, managing data flow, and facilitating efficient interaction, thereby forming the backbone of modern electronic architecture in a multitude of applications.

The product portfolio encompasses a wide array of specialized ICs, including transceivers, buffers, level shifters, serializer/deserializers (SerDes), repeaters, and bridge ICs, each engineered for specific communication needs. Major applications span across critical sectors such as automotive infotainment and ADAS, industrial automation and control systems, high-performance computing, telecommunications infrastructure (including 5G), and an expansive range of consumer electronics like smartphones, laptops, and smart home devices. The inherent benefits of utilizing interface ICs include enhanced system reliability, improved signal integrity, reduced power consumption, increased data transfer speeds, and simplified design processes by offering standardized solutions for complex connectivity challenges.

The market's expansion is primarily driven by the escalating demand for faster, more reliable, and energy-efficient data transmission capabilities across virtually all electronic devices and systems. Key driving factors include the proliferation of IoT devices generating vast amounts of data, the continuous advancement of 5G networks requiring robust backhaul and front-haul solutions, the rapid evolution of artificial intelligence and machine learning necessitating high-bandwidth interconnections, and the increasing sophistication of autonomous vehicle technologies that rely heavily on real-time data exchange between numerous sensors and processing units. These macroscopic trends collectively foster an environment of sustained innovation and growth within the Interface IC market, compelling manufacturers to develop increasingly advanced and versatile connectivity solutions.

Interface IC Market Executive Summary

The Interface IC market is experiencing robust growth, propelled by relentless innovation in various end-use sectors. Business trends indicate a significant push towards high-speed and low-power interface solutions, driven by the increasing complexity of electronic systems and the imperative for energy efficiency. There is a noticeable trend of market consolidation, with larger semiconductor companies acquiring specialized interface IC manufacturers to broaden their product portfolios and gain a competitive edge. Furthermore, companies are investing heavily in research and development to address the evolving demands of next-generation communication protocols and data transfer standards, focusing on enhanced signal integrity and reduced latency, which are critical for applications like AI and autonomous driving.

Regional trends highlight Asia Pacific as the dominant region, primarily due to its expansive manufacturing base for consumer electronics, automotive components, and telecommunications equipment, alongside a burgeoning digital infrastructure. North America continues to be a hub for technological innovation, leading in the development and adoption of advanced interface solutions for high-performance computing, data centers, and AI applications. Europe demonstrates steady growth, particularly in industrial automation and automotive electronics, driven by stringent regulatory standards and a strong emphasis on smart factory initiatives. Emerging markets in Latin America and the Middle East and Africa are showing nascent but accelerating growth, fueled by increasing digitization and infrastructure development.

Segment trends underscore the burgeoning demand for high-speed SerDes and transceivers, particularly those supporting PCIe Gen4/5/6, USB 3.x/4, and HDMI 2.1 standards, reflecting the need for faster data throughput in consumer and enterprise applications. Automotive-grade interface ICs are witnessing rapid adoption, driven by the sophisticated electronic architectures of electric vehicles and advanced driver-assistance systems (ADAS), which require highly reliable and robust communication components. Similarly, the industrial segment is seeing increased uptake of durable and resilient interface ICs designed for harsh operating environments, crucial for the reliable functioning of IoT-enabled machinery and smart manufacturing processes. The continuous innovation in these segments is pivotal for the overall market's trajectory.

AI Impact Analysis on Interface IC Market

User inquiries frequently revolve around how Artificial Intelligence (AI) fundamentally reshapes the demand and technological requirements for Interface ICs. Key themes include the necessity for interface ICs to handle the massive data volumes and high-speed processing characteristic of AI workloads, their role in bridging communication between AI accelerators (GPUs, ASICs, FPGAs) and other system components, and the imperative for power-efficient solutions in both cloud and edge AI applications. Users also express interest in how AI might influence the design methodologies of interface ICs themselves, potentially leading to more intelligent and adaptive connectivity solutions. The overall expectation is that AI will be a primary catalyst for innovation, driving the development of increasingly sophisticated and specialized interface technologies to support its computational demands.

- Increased demand for high-speed, high-bandwidth interface ICs to manage extensive data transfer between AI processors, memory, and storage.

- Crucial for enabling communication within AI accelerators (e.g., between processing cores and on-chip memory).

- Essential for connectivity in data centers supporting AI workloads, requiring advanced SerDes, PCIe, and Ethernet transceivers.

- Drives the need for low-latency interface solutions to ensure real-time processing in AI applications, particularly in autonomous systems and robotics.

- Accelerates the development of power-optimized interface ICs to reduce energy consumption in power-intensive AI hardware, for both cloud and edge deployments.

- Promotes innovation in specialized interface protocols and architectures tailored for neural network processing and machine learning inference.

- Influences design automation tools and methodologies, potentially leveraging AI to optimize interface IC layouts and performance.

- Facilitates the proliferation of edge AI devices by enabling efficient communication with sensors and local processing units.

DRO & Impact Forces Of Interface IC Market

The Interface IC market is significantly influenced by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all shaped by broader impact forces. Key drivers include the exponential growth in data generation and consumption across industries, the widespread adoption of IoT devices, the global rollout of 5G networks, and the relentless advancement in automotive electronics, particularly ADAS and electric vehicles. Furthermore, the increasing complexity of industrial automation systems and the burgeoning cloud computing infrastructure necessitate highly efficient and reliable interface solutions, thereby fueling market demand. These factors collectively create a robust growth environment for interface IC manufacturers, pushing the boundaries of connectivity technology.

However, the market also contends with several restraints that can impede its growth trajectory. The escalating design complexity of advanced interface ICs, particularly for high-speed and multi-protocol applications, presents a significant challenge, leading to extended development cycles and higher R&D costs. Intense competition and pricing pressures within the semiconductor industry, coupled with the capital-intensive nature of manufacturing, can impact profitability. Furthermore, the global supply chain volatility, exemplified by recent chip shortages, continues to pose risks, affecting production timelines and market stability. Power consumption concerns, especially in high-performance computing and edge devices, also represent a constraint, demanding continuous innovation in energy-efficient designs.

Despite these challenges, the Interface IC market presents numerous attractive opportunities. The advent of advanced packaging technologies like 3D stacking and chiplets offers new avenues for integrating complex interface functionalities, enabling higher performance and smaller form factors. The increasing demand for custom interface solutions tailored to specific industry needs, especially in niche markets like medical devices and aerospace, provides significant growth prospects. Emerging markets with rapidly expanding digital infrastructure represent untapped potential for market penetration. Moreover, the continuous evolution of communication standards and the imperative for energy-efficient designs provide ongoing opportunities for technological differentiation and market leadership, particularly in developing solutions for hybrid connectivity and software-defined interfaces.

Segmentation Analysis

The Interface IC market is segmented based on various critical attributes to provide a comprehensive understanding of its structure and dynamics. These segmentations typically include product type, application, and data rate, among others. Each segment reflects distinct technological requirements, market demands, and growth trajectories, allowing for a granular analysis of market trends and opportunities. Analyzing these segments is essential for stakeholders to identify key growth areas, understand competitive landscapes, and formulate targeted strategies, ultimately facilitating informed decision-making within the diverse ecosystem of electronic connectivity.

- By Product Type

- Transceivers (e.g., Ethernet, USB, PCIe, CAN, LIN, RS-232/485)

- Buffers and Repeaters

- Level Shifters

- Serializer/Deserializer (SerDes)

- Bridge ICs

- Specialty Interface ICs (e.g., Display Interface, Audio Interface)

- By Application

- Consumer Electronics (Smartphones, Laptops, Tablets, TVs, Gaming Consoles, Wearables)

- Automotive (Infotainment, ADAS, Powertrain, Body Electronics)

- Industrial (Factory Automation, Robotics, Building Automation, Test & Measurement)

- Telecommunications (5G Infrastructure, Data Center Interconnects, Networking Equipment)

- Data Center & Enterprise Computing (Servers, Storage, Networking)

- Medical Devices

- Aerospace & Defense

- By Data Rate

- Low-Speed Interface ICs (<100 Mbps)

- Medium-Speed Interface ICs (100 Mbps - 10 Gbps)

- High-Speed Interface ICs (>10 Gbps)

Value Chain Analysis For Interface IC Market

The value chain for the Interface IC market begins with the upstream segment, which involves the foundational elements and resources required for manufacturing. This phase includes raw material suppliers, primarily providers of high-purity silicon wafers, along with various chemicals, gases, and specialized metals crucial for semiconductor fabrication. Intellectual Property (IP) core providers and Electronic Design Automation (EDA) tool vendors also form a critical part of the upstream segment, offering essential design blueprints, verification tools, and software platforms that enable the complex design and simulation of Interface ICs. Foundry services, which fabricate the integrated circuits based on design specifications, are also a vital part of this initial stage, converting raw materials into functional silicon dies.

Moving downstream, the value chain progresses to the core manufacturing and integration stages. Semiconductor companies design and often fabricate or outsource the fabrication of these ICs, followed by assembly, testing, and packaging. Post-manufacturing, these Interface ICs are then supplied to Original Equipment Manufacturers (OEMs) across various industries. These OEMs integrate the ICs into their final products, which include consumer electronics, automotive systems, industrial machinery, telecommunications equipment, and data center infrastructure. The downstream segment is characterized by the high volume production and intricate integration processes that transform individual components into functional electronic systems, creating significant value by enabling advanced capabilities in end products.

The distribution channel plays a crucial role in bridging the gap between Interface IC manufacturers and their diverse customer base. Direct sales channels are typically employed for large-volume customers and strategic partnerships, such as major automotive Tier 1 suppliers or global consumer electronics brands, ensuring customized support and streamlined logistics. Indirect distribution, leveraging a network of authorized distributors, resellers, and value-added integrators, serves smaller OEMs and a broader range of regional customers. These indirect channels provide market reach, technical support, and localized inventory, making products accessible across various geographical locations and industry segments. Both direct and indirect models are essential for comprehensive market penetration and efficient delivery of Interface IC solutions to a global clientele.

Interface IC Market Potential Customers

The Interface IC market serves a broad and diverse range of potential customers, essentially encompassing any industry that relies on electronic systems requiring robust and efficient data communication between components. A primary segment includes consumer electronics manufacturers who integrate these ICs into smartphones, laptops, smart TVs, gaming consoles, and various smart home devices to manage data flow for displays, memory, storage, and peripheral connectivity. These manufacturers consistently demand smaller, faster, and more power-efficient interface solutions to enhance device performance and battery life, driving innovation in compact and high-performance ICs for mass-market adoption.

Another significant customer segment is the automotive industry, particularly Tier 1 suppliers and vehicle manufacturers. With the rapid evolution of Advanced Driver-Assistance Systems (ADAS), infotainment systems, electric powertrains, and autonomous driving capabilities, there is an escalating need for highly reliable, robust, and low-latency interface ICs. These components are critical for ensuring seamless and safe communication between sensors, microcontrollers, and various electronic control units in harsh automotive environments, requiring adherence to stringent quality and safety standards like AEC-Q100. This segment often demands custom-designed solutions that can withstand extreme temperatures, vibrations, and electromagnetic interference.

Furthermore, industrial automation companies, telecommunications infrastructure providers, and data center operators represent substantial end-users. Industrial customers require durable and resilient interface ICs for factory automation, robotics, and industrial IoT applications, emphasizing reliability and extended operational life in challenging environments. Telecommunication and data center clients demand extremely high-speed, low-power SerDes, Ethernet transceivers, and PCIe switches to handle massive data throughput for 5G networks, cloud computing, and high-performance computing clusters. Medical device manufacturers also constitute a vital niche, seeking high-precision, low-power interface ICs for sensitive diagnostic and therapeutic equipment, where reliability and signal integrity are paramount for patient safety and device performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $16.5 billion |

| Market Forecast in 2032 | $28.0 billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texas Instruments, NXP Semiconductors, Analog Devices, STMicroelectronics, Broadcom, Renesas Electronics, Microchip Technology, Infineon Technologies, Intel Corporation, Qualcomm, Toshiba Corporation, ROHM Semiconductor, Maxim Integrated (now ADI), ON Semiconductor, Cypress Semiconductor (now Infineon), Diodes Incorporated, Semtech Corporation, Silicon Labs, Nexperia, Richtek Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interface IC Market Key Technology Landscape

The Interface IC market is characterized by a rapidly evolving technological landscape, driven by the continuous demand for higher data rates, improved power efficiency, and enhanced signal integrity. Key technologies powering this market include various high-speed serial communication standards that enable modern electronic systems to exchange vast amounts of data seamlessly. These standards are critical for ensuring compatibility and performance across diverse platforms. The constant drive for miniaturization and integration also shapes the technological direction, pushing manufacturers to develop more compact and multi-functional solutions.

Prominent interface technologies adopted across industries include Peripheral Component Interconnect Express (PCIe), which is crucial for high-speed communication in servers, data centers, and AI accelerators. Universal Serial Bus (USB), in its various iterations (e.g., USB 3.x, USB4, USB-C), remains indispensable for consumer electronics connectivity due to its versatility and widespread adoption. High-Definition Multimedia Interface (HDMI) and DisplayPort are foundational for display connectivity, supporting high-resolution video and audio transmission. Double Data Rate (DDR) memory interfaces are essential for connecting processors to dynamic random-access memory (DRAM), while Mobile Industry Processor Interface (MIPI) standards are vital for camera and display connectivity in mobile and embedded applications.

Furthermore, advanced SerDes (Serializer/Deserializer) technology is pivotal for converting parallel data into high-speed serial streams for long-distance transmission, commonly found in data centers, networking, and telecom equipment. Ethernet standards are fundamental for wired network connectivity, evolving to support ever-increasing speeds. Low-Voltage Differential Signaling (LVDS), Inter-Integrated Circuit (I2C), and Serial Peripheral Interface (SPI) are widely used for robust, efficient communication within and between ICs in various embedded and industrial applications. The integration of advanced power management features and robust electrostatic discharge (ESD) protection circuits are also critical components of the modern interface IC technology landscape, ensuring reliability and energy efficiency.

Regional Highlights

- North America: This region is a powerhouse of innovation and a leading adopter of advanced technologies. It boasts a strong presence of key semiconductor companies and a robust ecosystem for research and development. The demand for high-performance interface ICs is particularly high in data centers, artificial intelligence, aerospace, and defense sectors. The early adoption of new communication standards and a significant investment in autonomous vehicle technology also contribute to its prominent market share.

- Europe: Europe demonstrates steady growth, primarily fueled by its strong automotive industry and a proactive stance in industrial automation and Industry 4.0 initiatives. Countries like Germany, France, and the UK are key contributors. There is a high demand for robust and reliable interface ICs that comply with stringent industrial standards. Furthermore, the region's focus on sustainable technology also drives the development of energy-efficient interface solutions.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Interface ICs, driven by its massive manufacturing capabilities in consumer electronics, a burgeoning automotive sector, and rapid expansion of telecommunications infrastructure (including 5G). Countries like China, Japan, South Korea, Taiwan, and India are central to this growth. The region benefits from a large consumer base, government support for semiconductor manufacturing, and significant investment in data centers and smart city projects.

- Latin America: This region represents an emerging market with increasing digitalization and investment in telecommunications infrastructure. Countries such as Brazil and Mexico are witnessing growth in the automotive and consumer electronics manufacturing sectors, leading to a rising demand for interface ICs. While smaller in scale compared to other regions, the market is poised for gradual expansion as economic development and technological adoption accelerate.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily driven by investments in digital transformation initiatives, smart city projects, and the expansion of IT and telecommunications infrastructure. Countries like UAE, Saudi Arabia, and South Africa are leading the adoption. The market for interface ICs here is nascent but shows potential, especially with increasing efforts to diversify economies away from oil and gas and towards technology-driven sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interface IC Market.- Texas Instruments

- NXP Semiconductors

- Analog Devices

- STMicroelectronics

- Broadcom

- Renesas Electronics

- Microchip Technology

- Infineon Technologies

- Intel Corporation

- Qualcomm

- Toshiba Corporation

- ROHM Semiconductor

- ON Semiconductor

- Diodes Incorporated

- Semtech Corporation

- Silicon Labs

- Nexperia

- Richtek Technology

- MaxLinear

- Synaptics Incorporated

Frequently Asked Questions

What are Interface ICs?

Interface ICs are integrated circuits designed to manage and optimize communication between different electronic components or systems, ensuring compatibility, signal integrity, and efficient data transfer across various protocols and voltage levels.

Why are Interface ICs important in modern electronics?

They are critical for enabling seamless interaction within complex electronic devices, facilitating high-speed data exchange, converting signals, and ensuring proper functionality in applications ranging from consumer gadgets to industrial machinery and automotive systems.

What are the main drivers of growth for the Interface IC market?

Key growth drivers include the exponential increase in data generation, the proliferation of IoT devices, the rollout of 5G networks, advancements in automotive electronics like ADAS, and the expanding adoption of AI and cloud computing technologies.

What challenges does the Interface IC market face?

The market faces challenges such as increasing design complexity for high-speed, low-power solutions, high research and development costs, supply chain volatility, intense competition leading to pricing pressures, and the continuous need for power efficiency.

How is AI impacting the demand for Interface ICs?

AI significantly drives the demand for faster, higher-bandwidth, and more power-efficient interface ICs to support massive data processing in AI accelerators, data centers, and edge devices, requiring advanced communication protocols and specialized interconnects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager