Inventory Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429732 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Inventory Robots Market Size

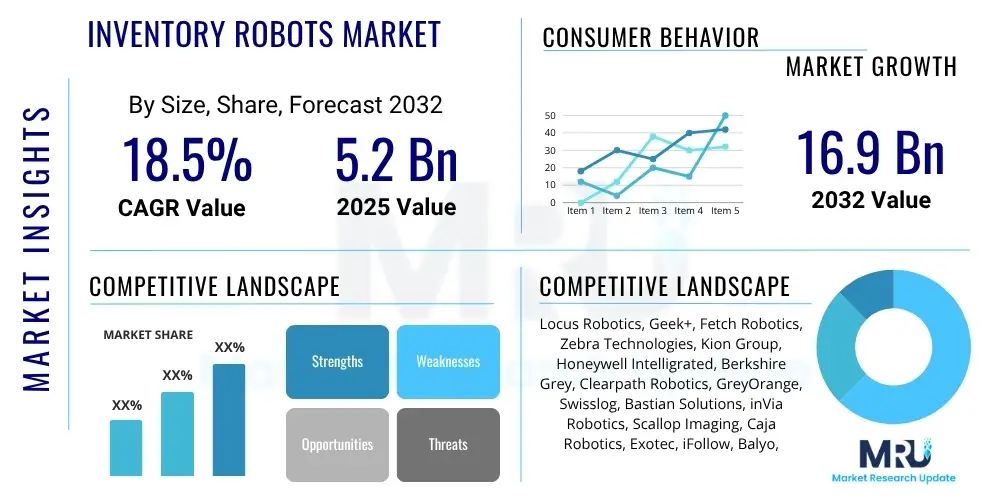

The Inventory Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 5.2 billion in 2025 and is projected to reach USD 16.9 billion by the end of the forecast period in 2032.

Inventory Robots Market introduction

Inventory robots are autonomous or semi-autonomous machines designed to automate and optimize various tasks within inventory management, primarily in warehousing, logistics, manufacturing, and retail environments. These robots typically feature advanced navigation systems, sensors, and sometimes robotic arms, enabling them to perform functions such as stock counting, picking, packing, sorting, and material handling without constant human intervention. The primary goal is to enhance efficiency, accuracy, and speed in inventory operations, leading to significant cost savings and improved operational throughput.

The product encompasses a range of robotic solutions, including Autonomous Mobile Robots (AMRs) for flexible navigation, Automated Guided Vehicles (AGVs) for structured paths, and robotic arms for precise manipulation tasks. Major applications span e-commerce fulfillment centers, large-scale retail stores, automotive plants, and pharmaceutical warehouses where meticulous inventory control is paramount. Benefits include reduced labor costs, minimized human error, increased operational speed, enhanced worker safety, and the ability to operate 24/7. These advantages collectively drive the widespread adoption of inventory robots across various industries seeking to streamline their supply chain and logistics processes.

Key driving factors propelling market growth include the exponential surge in e-commerce demand, necessitating faster and more accurate order fulfillment, persistent labor shortages in logistics and warehousing sectors, and the continuous technological advancements in robotics, artificial intelligence, and machine learning. Furthermore, the global emphasis on supply chain resilience and optimization post-pandemic has accelerated investments in automation solutions. The need for real-time inventory visibility and data-driven decision-making also contributes significantly to the escalating demand for sophisticated inventory robot systems, transforming traditional inventory practices into highly automated and efficient operations.

Inventory Robots Market Executive Summary

The Inventory Robots Market is experiencing robust expansion, primarily driven by transformative business trends such as the pervasive growth of e-commerce, which mandates heightened efficiency in order fulfillment and warehousing operations. Businesses are increasingly prioritizing automation to mitigate rising labor costs, address chronic labor shortages, and improve the speed and accuracy of inventory management. There is a notable shift towards flexible, scalable robotic solutions like Autonomous Mobile Robots (AMRs) that can adapt to dynamic warehouse layouts and operational demands, signaling a broader industry move away from rigid automation toward more intelligent and adaptable systems. The convergence of IoT, AI, and cloud computing is enabling more sophisticated robot capabilities, fostering greater data integration and actionable insights for inventory optimization.

Regionally, Asia Pacific is emerging as a significant growth engine, fueled by its burgeoning manufacturing sector, rapid e-commerce expansion, and substantial investments in logistics infrastructure, particularly in countries like China, India, and Japan. North America and Europe continue to be dominant markets, characterized by early adoption of advanced robotics, high labor costs, and a strong emphasis on supply chain optimization. These regions are also hubs for technological innovation, leading to the development and deployment of next-generation inventory robotics. Latin America, the Middle East, and Africa, while nascent, are demonstrating increasing interest and investment in inventory automation as their economies mature and supply chains modernize, presenting significant future growth opportunities.

Segment-wise, the Autonomous Mobile Robots (AMRs) segment is poised for substantial growth due to their inherent flexibility, ease of deployment, and ability to collaborate with human workers. The retail and e-commerce end-user segment remains the largest and fastest-growing, reflecting the intense pressure on online retailers to deliver faster and more efficiently. The software component segment, encompassing navigation, fleet management, and AI-driven optimization platforms, is also witnessing rapid innovation and adoption, as it is critical for orchestrating complex robotic operations and extracting maximum value from hardware investments. The trend indicates a future where integrated hardware and intelligent software solutions will dominate the market, offering comprehensive automation capabilities across various inventory functions.

AI Impact Analysis on Inventory Robots Market

Common user questions regarding AI's impact on the Inventory Robots Market frequently revolve around the degree of autonomy robots can achieve, the integration complexity of AI systems with existing infrastructure, potential job displacement, and the tangible benefits in terms of operational efficiency and data analytics. Users are concerned with how AI can enhance decision-making in dynamic environments, improve predictive capabilities for demand and stock levels, and ensure seamless human-robot collaboration. There is also significant interest in the cost implications of AI integration and the scalability of AI-powered solutions across different operational sizes, alongside queries about data security and privacy when sensitive inventory data is processed by AI algorithms. The overarching expectation is for AI to elevate inventory robots from mere automated tools to intelligent, self-optimizing partners in supply chain management.

- Enhanced autonomous navigation and path planning, allowing robots to operate in complex, unstructured environments.

- Improved object recognition and manipulation through advanced computer vision and machine learning algorithms, reducing errors in picking and placing.

- Predictive inventory management capabilities, enabling robots to anticipate stock needs and optimize storage locations based on real-time data and demand forecasts.

- Optimized fleet management and task allocation, where AI algorithms dynamically assign tasks to robots for maximum efficiency and throughput.

- Real-time anomaly detection and predictive maintenance for robots themselves, minimizing downtime and extending operational lifespans.

- Seamless human-robot collaboration, with AI facilitating more intuitive interaction and shared workspaces.

- Data-driven insights for warehouse optimization, turning raw sensor data into actionable intelligence for supply chain managers.

- Adaptive learning capabilities, allowing robots to improve performance over time by learning from their operational experiences.

DRO & Impact Forces Of Inventory Robots Market

The Inventory Robots Market is significantly shaped by a confluence of Drivers, Restraints, and Opportunities, which collectively represent the impact forces determining its trajectory. Key drivers include the relentless expansion of the e-commerce sector, which demands ever-faster and more precise fulfillment, compelling businesses to invest in automation. Persistent global labor shortages in warehousing and logistics further accelerate the adoption of robots as a solution to operational continuity and cost management. The increasing demand for supply chain visibility and optimization, coupled with technological advancements in robotics, AI, and IoT, also acts as a powerful catalyst, enabling more sophisticated and efficient robotic solutions. These drivers are fundamental in pushing enterprises towards higher levels of automation to remain competitive and responsive to market dynamics.

However, the market faces considerable restraints. The high initial capital investment required for purchasing and deploying inventory robot systems can be a significant barrier for small and medium-sized enterprises (SMEs) and even large companies with budget constraints. Technical complexities associated with integration into existing legacy systems, data security concerns, and the need for specialized IT infrastructure and personnel for maintenance and operation pose further challenges. Furthermore, regulatory hurdles, particularly concerning robot safety, interoperability standards, and potential job displacement anxieties, can slow down adoption rates and necessitate careful planning and public relations efforts. Addressing these restraints effectively is crucial for sustained market growth.

Opportunities for market expansion are substantial and multifaceted. The development of Robotics-as-a-Service (RaaS) models is lowering the entry barrier, making advanced automation accessible to a wider range of businesses by converting high capital expenditure into operational expenditure. Expanding applications into new verticals such as healthcare, pharmaceuticals, and cold chain logistics, where precision and efficiency are critical, offers significant growth avenues. Continued advancements in AI, machine learning, and sensor technology will unlock new functionalities and enhance robot capabilities, creating opportunities for more intelligent and versatile solutions. The growing emphasis on sustainability and energy efficiency in logistics also presents an opportunity for robot manufacturers to innovate with eco-friendly designs and operational models, aligning with corporate social responsibility goals.

Segmentation Analysis

The Inventory Robots Market is extensively segmented to provide a granular understanding of its diverse components and applications. These segmentations allow for a detailed analysis of market dynamics across different technologies, end-user industries, functional capabilities, and underlying components. Understanding these segments is crucial for stakeholders to identify specific growth areas, competitive landscapes, and strategic investment opportunities within the rapidly evolving automation space. Each segment represents distinct market needs and technological progressions, contributing uniquely to the overall market valuation and growth projections.

- Type

- Autonomous Mobile Robots (AMRs)

- Automated Guided Vehicles (AGVs)

- Robotic Arms

- Drones

- End-User Industry

- Retail and E-commerce

- Manufacturing

- Logistics and Warehousing

- Healthcare and Pharmaceuticals

- Automotive

- Food and Beverage

- Others

- Function

- Picking and Placing

- Inventory Scanning and Counting

- Material Handling and Transport

- Sortation

- Loading and Unloading

- Component

- Hardware

- Sensors (LiDAR, Cameras, Ultrasonic)

- Actuators and Motors

- Controllers and Processors

- Batteries and Charging Systems

- Chassis and Mechanical Parts

- Software

- Navigation and Mapping

- Fleet Management Systems

- AI and Machine Learning Algorithms

- Inventory Management Software Integration

- Security Software

- Services

- Installation and Integration

- Maintenance and Support

- Consulting and Training

- Robotics as a Service (RaaS)

- Hardware

Value Chain Analysis For Inventory Robots Market

The value chain for the Inventory Robots Market begins with extensive upstream activities involving the research and development of core robotic technologies and the sourcing of critical components. This includes the manufacturing of advanced sensors such as LiDAR, cameras, and ultrasonic sensors, which are vital for robot navigation and perception. It also encompasses the production of precision motors, actuators, high-performance processors, and advanced battery systems. Software development firms play a crucial upstream role by creating sophisticated algorithms for navigation, artificial intelligence, machine learning, and fleet management systems. The quality and innovation at this stage directly impact the capabilities and reliability of the final inventory robot products.

Moving downstream, the value chain involves the design, assembly, and integration of these components into functional inventory robots. Robot manufacturers are central at this stage, focusing on product development, prototyping, and large-scale manufacturing. System integrators also play a pivotal role, customizing robot solutions to fit specific warehouse layouts, operational requirements, and integrating them with existing enterprise resource planning (ERP) or warehouse management systems (WMS). Post-sales activities include installation, training for operational staff, ongoing maintenance, and technical support, which are critical for ensuring optimal robot performance and customer satisfaction. The efficiency of these downstream operations directly influences the total cost of ownership and the return on investment for end-users.

The distribution channel for inventory robots primarily involves a mix of direct sales and indirect channels. Direct sales allow manufacturers to engage directly with large enterprises, offering tailored solutions and comprehensive support. Indirect channels include a network of value-added resellers (VARs), distributors, and third-party integrators who provide regional access, specialized expertise, and localized support, particularly for smaller businesses. The choice of distribution strategy often depends on the target market segment, geographical reach, and the complexity of the solution. Effective direct and indirect channels are essential for expanding market penetration and ensuring that inventory robot solutions reach a diverse customer base, facilitating broad adoption and market growth.

Inventory Robots Market Potential Customers

The potential customers for inventory robots span a broad spectrum of industries that manage vast quantities of goods, materials, or products and seek to optimize their inventory processes. These end-users are primarily driven by the need to reduce operational costs, enhance efficiency, improve inventory accuracy, and accelerate order fulfillment times in an increasingly demanding market landscape. Key buyers are enterprises facing challenges such as labor shortages, rising labor expenses, intense competition from e-commerce giants, and the imperative for real-time inventory visibility. Their operational scale often necessitates automation to handle high volumes and complex logistics.

Leading segments of potential customers include large-scale e-commerce fulfillment centers and retail chains that manage extensive product catalogs and high order volumes. Manufacturing facilities, particularly in the automotive, electronics, and aerospace sectors, also represent significant buyers for optimizing parts inventory, work-in-progress tracking, and material handling within production lines. The logistics and warehousing sector, encompassing third-party logistics (3PL) providers and cold storage facilities, is another crucial customer base, leveraging robots for efficient storage, retrieval, and sorting of goods. Furthermore, healthcare organizations, including hospitals and pharmaceutical warehouses, are increasingly adopting these robots for precise tracking and management of medical supplies and drugs, where accuracy is paramount for patient safety and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.2 billion |

| Market Forecast in 2032 | USD 16.9 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Locus Robotics, Geek+, Fetch Robotics, Zebra Technologies, Kion Group, Honeywell Intelligrated, Berkshire Grey, Clearpath Robotics, GreyOrange, Swisslog, Bastian Solutions, inVia Robotics, Scallop Imaging, Caja Robotics, Exotec, iFollow, Balyo, Knapp, AutoStore, Dematic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inventory Robots Market Key Technology Landscape

The Inventory Robots Market is underpinned by a sophisticated array of technologies that enable their autonomous operation, intelligent decision-making, and seamless integration into complex logistical environments. At the core are advanced robotics hardware, including robust chassis, powerful motors, and high-capacity batteries that provide mobility and operational endurance. Sensor technology is paramount, with LiDAR (Light Detection and Ranging) systems, 3D cameras, ultrasonic sensors, and RFID readers providing critical data for navigation, obstacle avoidance, object detection, and precise inventory identification. These sensors work in conjunction to create a detailed perception of the robot's surroundings and the items it needs to manage.

Software is equally crucial, encompassing sophisticated navigation and mapping algorithms that allow robots to build and traverse digital maps of warehouses, along with advanced fleet management systems that orchestrate the movements and tasks of multiple robots. Artificial Intelligence (AI) and Machine Learning (ML) play a transformative role, enabling robots to learn from their environment, optimize routes, improve picking accuracy, and make autonomous decisions in dynamic scenarios. Computer vision systems, powered by AI, allow robots to accurately identify and classify various inventory items, even in challenging lighting conditions. The Robotics Operating System (ROS) often serves as a flexible framework for developing and deploying these robotic applications, fostering interoperability and accelerating innovation.

Connectivity solutions, such as Wi-Fi, 5G, and cloud computing, are integral for real-time data exchange between robots, central control systems, and enterprise software like WMS and ERP. This connectivity facilitates remote monitoring, software updates, and the collection of vast amounts of operational data for further analysis and optimization. Edge computing is also gaining prominence, allowing some data processing and decision-making to occur on the robot itself, reducing latency and enhancing responsiveness. The continuous evolution of these technologies, combined with ongoing research in areas like human-robot interaction and adaptive learning, promises even more capable and versatile inventory robot solutions in the foreseeable future, driving market growth and expanding application possibilities across various industries.

Regional Highlights

- North America: This region stands as a leader in inventory robot adoption, driven by high labor costs, a mature e-commerce market, and a strong emphasis on supply chain efficiency. The presence of major technological innovators and early adopters in the United States and Canada contributes significantly to market growth. Investments in automation within warehousing, retail, and manufacturing sectors are substantial, aiming to enhance productivity and address labor shortages.

- Europe: European countries are rapidly integrating inventory robots into their logistics and manufacturing processes, spurred by automation initiatives, stringent safety regulations, and a focus on industrial efficiency. Germany, the UK, and France are key markets, characterized by advanced manufacturing capabilities and a growing e-commerce footprint. Regulatory support for industrial automation and collaborative robotics also boosts adoption rates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily fueled by the explosive growth of e-commerce, booming manufacturing sectors in China, India, and Japan, and increasing investments in logistics infrastructure. The region benefits from a large consumer base and government initiatives promoting smart warehousing and industrial automation. Lower initial manufacturing costs for some robotic components also contribute to its competitive edge.

- Latin America: This region is an emerging market for inventory robots, with increasing industrialization, growing e-commerce penetration, and a rising awareness of automation benefits. Countries like Brazil and Mexico are leading the adoption, particularly in automotive manufacturing and retail logistics, as they seek to modernize their supply chains and improve operational efficiencies.

- Middle East and Africa (MEA): The MEA region is at an early stage of adoption but shows promising growth potential. Investments in logistics hubs, smart city initiatives, and economic diversification efforts are driving the demand for advanced automation solutions. Countries like UAE and Saudi Arabia are investing heavily in infrastructure development, which includes modernizing their warehousing and distribution networks with robotic technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inventory Robots Market.- Locus Robotics

- Geek+

- Fetch Robotics (Zebra Technologies)

- Kion Group (Dematic)

- Honeywell Intelligrated

- Berkshire Grey

- Clearpath Robotics (Part of Rockwell Automation)

- GreyOrange

- Swisslog (KUKA Group)

- Bastian Solutions (Toyota Advanced Logistics)

- inVia Robotics

- Scallop Imaging (now part of Kion Group)

- Caja Robotics

- Exotec

- iFollow

- Balyo

- Knapp AG

- AutoStore

- Mobile Industrial Robots (MiR)

- Omron Adept Technologies

Frequently Asked Questions

What are inventory robots and how do they benefit businesses?

Inventory robots are autonomous machines that automate tasks like stock counting, picking, and material handling. They benefit businesses by reducing labor costs, increasing accuracy, speeding up operations, and improving overall supply chain efficiency, crucial for e-commerce and logistics.

What are the primary types of inventory robots used today?

The primary types include Autonomous Mobile Robots (AMRs) for flexible navigation, Automated Guided Vehicles (AGVs) for structured paths, robotic arms for precise manipulation, and drones for aerial scanning and counting in large spaces.

What key factors are driving the growth of the Inventory Robots Market?

Key growth drivers include the rapid expansion of e-commerce, persistent labor shortages in warehousing, the need for enhanced supply chain optimization and visibility, and continuous advancements in AI, machine learning, and sensor technologies.

What are the main challenges hindering the adoption of inventory robots?

Major challenges include the high initial capital investment required for deployment, complexities in integrating robots with existing legacy systems, concerns about data security, and the need for specialized technical expertise for maintenance and operation.

How is AI impacting the capabilities of inventory robots?

AI significantly enhances robot capabilities through improved autonomous navigation, advanced object recognition for picking and manipulation, predictive inventory management, optimized fleet coordination, and adaptive learning, leading to more intelligent and efficient operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager