IoT Chipset Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428001 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

IoT Chipset Market Size

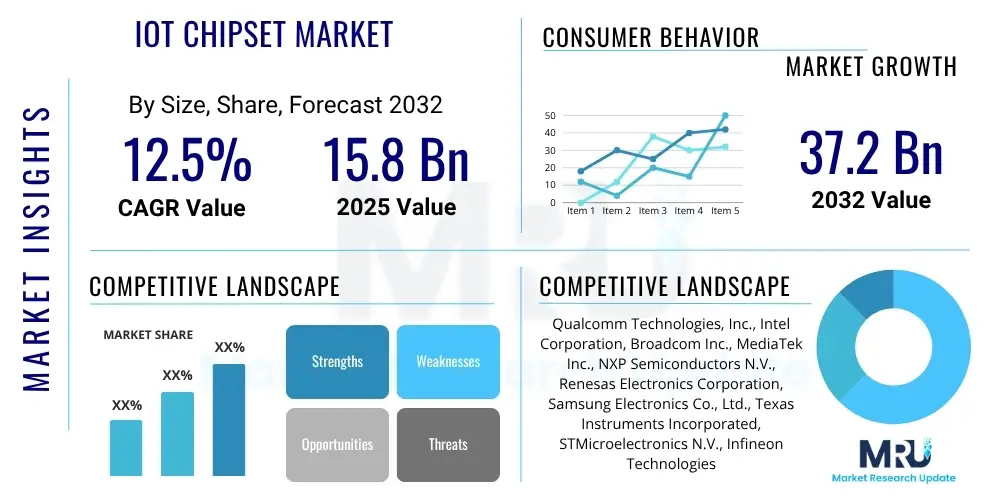

The IoT Chipset Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 37.2 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by the escalating demand for connected devices across various industries, including consumer electronics, automotive, healthcare, and industrial applications. The proliferation of advanced wireless technologies such as 5G, Wi-Fi 6, and LPWAN (Low-Power Wide-Area Network) solutions is fostering an environment ripe for the deployment of a new generation of IoT devices, each requiring sophisticated and efficient chipsets.

The market expansion is further propelled by ongoing innovations in chipset design, focusing on power efficiency, enhanced security features, and advanced processing capabilities at the edge. These technological advancements enable more complex tasks to be performed directly on IoT devices, reducing reliance on cloud infrastructure and improving real-time response times. Furthermore, the increasing adoption of artificial intelligence and machine learning at the edge, integrated within IoT chipsets, is creating new opportunities for market players to deliver more intelligent and autonomous solutions, thereby solidifying the market's robust growth trajectory towards 2032.

IoT Chipset Market introduction

The IoT Chipset Market encompasses the design, development, and manufacturing of integrated circuits specifically tailored for Internet of Things devices. These chipsets are the fundamental building blocks that enable connectivity, processing, sensing, and security functionalities in a vast array of connected applications, ranging from smart home gadgets and wearable technology to complex industrial machinery and autonomous vehicles. They are designed to meet the unique requirements of IoT, such as ultra-low power consumption, compact size, cost-effectiveness, and robust security measures, facilitating seamless communication and data exchange between devices and cloud platforms. The primary goal of these chipsets is to empower devices to collect, process, and transmit data efficiently, thereby transforming raw information into actionable insights.

Major applications of IoT chipsets span across numerous sectors. In the consumer electronics segment, they power smart speakers, fitness trackers, smartwatches, and various smart home devices like thermostats, lighting systems, and security cameras. Within industrial IoT (IIoT), these chipsets are integral to predictive maintenance systems, asset tracking, remote monitoring, and automated manufacturing processes. The automotive industry utilizes them for advanced driver-assistance systems (ADAS), in-car infotainment, telematics, and vehicle-to-everything (V2X) communication. Healthcare benefits from IoT chipsets in remote patient monitoring, smart medical devices, and digital health solutions, while smart city initiatives leverage them for intelligent infrastructure, environmental monitoring, and public safety applications.

The key benefits derived from IoT chipsets include enabling pervasive connectivity, facilitating edge intelligence, ensuring energy efficiency for prolonged device life, and integrating robust security protocols from the hardware level. These attributes are crucial for the widespread adoption and successful implementation of IoT ecosystems. Driving factors for this market include the global surge in internet connectivity, the rapid deployment of 5G networks, increasing investments in smart infrastructure, and the growing consumer demand for convenience and automation. Moreover, the evolution of edge computing and the integration of AI capabilities directly into chipsets are significant catalysts, enhancing the functionality and efficiency of IoT devices and opening new avenues for innovation and market expansion.

IoT Chipset Market Executive Summary

The IoT Chipset Market is undergoing a transformative period, characterized by rapid technological advancements and expanding application horizons. Business trends indicate a strong focus on consolidation among major semiconductor players, coupled with a surge in strategic partnerships aimed at developing specialized chipsets for niche IoT verticals. There is an increasing emphasis on creating highly integrated System-on-Chip (SoC) solutions that combine processing, connectivity, and security features into a single package, reducing Bill of Material (BoM) costs and accelerating time-to-market for device manufacturers. Furthermore, the shift towards subscription-based services and platform-as-a-service (PaaS) models in conjunction with hardware offerings is redefining business strategies, allowing for recurring revenue streams and deeper customer engagement. Companies are also investing heavily in R&D to address growing concerns around power consumption and data security, driving innovation in low-power wide-area network (LPWAN) technologies and hardware-level encryption.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily due to robust manufacturing capabilities, significant government investments in smart city projects, and the large-scale adoption of consumer IoT devices, particularly in China, Japan, and South Korea. North America and Europe also maintain substantial market shares, driven by advanced industrial IoT deployments, smart home penetration, and stringent regulatory frameworks that encourage secure and efficient IoT solutions. Emerging economies in Latin America, the Middle East, and Africa are showing nascent but accelerating growth, fueled by increasing internet penetration, digital transformation initiatives, and growing interest in smart agriculture and logistics solutions. These regions present significant opportunities for market expansion, albeit with unique challenges related to infrastructure and regulatory landscapes.

Segmentation trends reveal a dynamic landscape where connectivity technologies like 5G and LPWAN are experiencing exponential growth, reflecting the diverse range of IoT deployment scenarios, from high-bandwidth automotive applications to ultra-low-power environmental sensors. The processor segment continues to evolve, with an increasing demand for edge AI capabilities embedded directly into chipsets, enabling local data processing and real-time decision-making. Security chipsets are also gaining paramount importance as cyber threats become more sophisticated, leading to heightened investment in hardware-based security solutions. Moreover, the end-use application segments, particularly industrial IoT, automotive, and healthcare, are witnessing significant growth due to the critical nature of these applications and the value derived from enhanced connectivity and data analytics, driving demand for specialized and high-performance IoT chipsets tailored to their specific operational requirements.

AI Impact Analysis on IoT Chipset Market

Common user questions regarding AI's impact on the IoT Chipset Market frequently revolve around how AI integration will redefine device capabilities, the challenges associated with deploying AI at the edge, and the implications for power consumption and security. Users are keen to understand whether AI will necessitate entirely new chipset architectures, how it will affect data processing and privacy, and what the long-term economic benefits and competitive landscape changes will be. There is particular interest in the balance between cloud-based AI and on-device AI, and the role of chipsets in facilitating this distributed intelligence. The primary themes emerging are the desire for greater autonomy and real-time responsiveness in IoT devices, the need for efficient AI inferencing, and the imperative for robust security mechanisms to protect AI models and the data they process.

The integration of Artificial Intelligence (AI) into IoT chipsets represents a pivotal shift, creating what is increasingly known as AIoT. This convergence allows for data processing and decision-making to occur directly at the device level, reducing latency, conserving bandwidth, and enhancing data privacy by minimizing the need to transmit sensitive information to the cloud. Chipset manufacturers are designing specialized AI accelerators, such as neural processing units (NPUs) or digital signal processors (DSPs), directly into their silicon. This on-device intelligence enables IoT devices to perform complex tasks like image recognition, natural language processing, and anomaly detection in real-time, making devices smarter, more autonomous, and more responsive to their environments without constant cloud intervention. This capability is critical for applications where immediate responses are vital, such as autonomous vehicles, industrial automation, and critical healthcare monitoring.

The profound impact of AI on the IoT chipset market is transforming product roadmaps and driving significant innovation. Chipsets are no longer just about connectivity; they are becoming intelligent nodes capable of learning and adapting. This shift demands higher computational power within strict power budgets, pushing the boundaries of low-power AI acceleration. Furthermore, the proliferation of AI at the edge necessitates robust security features embedded within the chipsets to protect AI models from tampering and ensure the integrity of the data being processed and inferences being drawn. The future of IoT chipsets will increasingly be defined by their ability to seamlessly integrate AI, offering scalable, secure, and energy-efficient solutions that unlock unprecedented capabilities for a new generation of intelligent connected devices.

- Enhanced Edge Intelligence: AI enables local data processing and real-time decision-making on IoT devices, reducing latency.

- Optimized Power Consumption: Specialized AI accelerators in chipsets allow efficient AI inferencing with minimal power draw.

- Improved Data Privacy: Processing data locally on the device reduces the need for transmitting sensitive information to the cloud.

- Advanced Security Features: AI chipsets integrate robust hardware-level security to protect AI models and data integrity.

- New Chipset Architectures: Development of NPUs and DSPs tailored for AI workloads directly within chipsets.

- Predictive Analytics: AI-powered chipsets facilitate predictive maintenance, anomaly detection, and proactive responses in industrial and automotive applications.

- Personalized User Experiences: Smart devices can learn user preferences and adapt behavior more effectively with on-device AI.

DRO & Impact Forces Of IoT Chipset Market

The IoT Chipset Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside various impact forces that continuously redefine its landscape. Key drivers include the exponential growth in the number of connected IoT devices across consumer, commercial, and industrial sectors, fueled by the omnipresence of internet connectivity and the increasing demand for automation and data-driven insights. The rapid global deployment of 5G infrastructure is significantly enhancing bandwidth and reducing latency, enabling more sophisticated IoT applications that require high-speed, reliable communication. Furthermore, the growing trend towards edge computing, where data processing occurs closer to the source, directly impacts the demand for more powerful yet efficient chipsets capable of handling localized computational tasks, thus reducing cloud reliance and improving response times. Government initiatives and investments in smart cities, smart agriculture, and digital transformation across various industries also act as significant catalysts, fostering an environment conducive to IoT chipset adoption.

Despite these powerful drivers, several restraints pose challenges to the market's growth. Prominent among these are persistent concerns regarding data security and privacy. The increasing number of connected devices presents a larger attack surface, making IoT ecosystems vulnerable to cyber threats and data breaches, which can erode user trust and slow adoption. High development and integration costs associated with advanced IoT chipsets, particularly for specialized industrial or medical applications, can be prohibitive for smaller enterprises. Moreover, the lack of universal standardization across different IoT protocols and platforms creates fragmentation, complicating interoperability and hindering seamless ecosystem integration. The inherent complexity of the IoT value chain, involving numerous stakeholders from hardware manufacturers to software developers and service providers, often leads to integration challenges and slower deployment cycles, further impacting market momentum.

Opportunities for the IoT Chipset Market are abundant and diverse. The emergence of Artificial Intelligence of Things (AIoT), where AI capabilities are embedded directly into IoT chipsets, represents a significant growth avenue, promising more intelligent, autonomous, and efficient devices. There is a burgeoning demand for ultra-low-power chipsets, particularly for battery-operated devices and applications in remote or inaccessible locations, driving innovation in energy-efficient designs. Geographic expansion into developing regions, where internet penetration and digital infrastructure are rapidly improving, offers untapped market potential for various IoT applications. Additionally, a strong focus on developing vertical-specific solutions, such as specialized chipsets for healthcare, smart manufacturing, or logistics, allows manufacturers to cater to precise industry needs, delivering tailored performance and robust functionalities. These opportunities, coupled with ongoing technological advancements, are expected to significantly mitigate existing restraints and propel the market forward in the coming years.

Segmentation Analysis

The IoT Chipset Market is highly diversified, segmented based on various factors including type, connectivity technology, end-use application, and vertical. This segmentation provides a granular view of the market dynamics, highlighting key growth areas and technological preferences across different sectors. Each segment addresses specific requirements and functional needs of IoT devices, from fundamental processing units to advanced sensing and security modules, and leverages distinct communication protocols to enable seamless data exchange. Understanding these segments is crucial for market participants to tailor their product offerings, identify lucrative niches, and formulate effective market entry and expansion strategies, reflecting the complex and interconnected nature of the IoT ecosystem. The evolving landscape sees continuous innovation within each segment, driven by new use cases and technological advancements.

By dissecting the market into these segments, it becomes evident that growth drivers and competitive pressures vary significantly across the board. For instance, the demand for processor chipsets is intrinsically linked to the need for greater edge intelligence and AI capabilities, while the connectivity segment is heavily influenced by the rollout of 5G and LPWAN technologies. Similarly, end-use applications like industrial IoT and automotive require robust, high-performance, and secure chipsets, contrasting with the emphasis on ultra-low power and cost-effectiveness in consumer wearables. This intricate interplay between technological evolution, application demands, and market forces defines the trajectory of each segment, demonstrating the multifaceted nature of the IoT chipset industry and its potential for continued expansion.

- By Type

- Processor Chipsets (Microcontrollers, Microprocessors, DSPs, AI Accelerators)

- Connectivity Chipsets (RF Transceivers, Baseband Processors, Modems)

- Sensing Chipsets (MEMS sensors, Environmental sensors, Image sensors)

- Security Chipsets (Hardware Security Modules (HSMs), Trusted Platform Modules (TPMs))

- By Connectivity Technology

- Wi-Fi (Wi-Fi 4/5/6/7)

- Bluetooth (Bluetooth LE, Bluetooth Mesh)

- Zigbee

- Cellular (2G/3G/4G LTE, 5G)

- LPWAN (LoRa, NB-IoT, Sigfox)

- NFC

- Ethernet

- By End-Use Application

- Smart Home (Home Automation, Smart Appliances, Security Systems)

- Wearables (Smartwatches, Fitness Trackers, Medical Wearables)

- Industrial IoT (Asset Tracking, Predictive Maintenance, Industrial Automation)

- Automotive (Infotainment, ADAS, Telematics, V2X Communication)

- Healthcare (Remote Patient Monitoring, Smart Medical Devices, Telemedicine)

- Smart Cities (Smart Lighting, Waste Management, Smart Parking, Environmental Monitoring)

- Retail (Inventory Management, Smart Shelves, POS Systems)

- Agriculture (Precision Farming, Livestock Monitoring)

- Logistics & Transportation (Fleet Management, Cold Chain Monitoring)

- By Vertical

- Consumer Electronics

- Healthcare

- Automotive & Transportation

- Industrial

- Retail

- IT & Telecom

- Energy & Utilities

- Agriculture

Value Chain Analysis For IoT Chipset Market

The value chain for the IoT Chipset Market is an intricate network involving multiple stages, from raw material sourcing to end-user deployment, illustrating the complex ecosystem required to bring connected devices to life. Upstream analysis focuses on the initial stages, encompassing intellectual property (IP) design houses that develop core processor architectures and connectivity modules, as well as specialized foundries that fabricate silicon wafers. Key players in this stage provide critical components like EDA (Electronic Design Automation) tools, semiconductor manufacturing equipment, and various raw materials such as silicon, rare earth elements, and chemical compounds. The efficiency and innovation at this stage directly impact the performance, cost, and availability of the final chipsets, making it a foundation for the entire value chain. Strategic partnerships between IP providers and foundries are essential for driving technological advancements and ensuring high-volume production capabilities.

Further along the value chain, the midstream involves the core chipset manufacturers who integrate various IPs, design custom architectures, and produce the final IoT chipsets. These companies are responsible for the complex process of system-on-chip (SoC) integration, embedding processors, memory, connectivity modules, security features, and various sensor interfaces into a single, compact package. This stage also includes rigorous testing, packaging, and quality assurance processes to ensure the chipsets meet stringent performance, power efficiency, and reliability standards required for diverse IoT applications. The ability of these manufacturers to innovate in areas such as low-power design, enhanced security, and edge AI capabilities is paramount for maintaining a competitive edge in the rapidly evolving IoT landscape, influencing the entire ecosystem’s capability to deliver advanced solutions.

Downstream activities involve the distribution channel, where finished chipsets are supplied to Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who then integrate them into their final IoT products. This includes consumer electronics manufacturers, industrial equipment makers, automotive suppliers, and healthcare device companies. Distribution can be direct, where chipset manufacturers sell directly to large-scale OEMs, or indirect, through a network of distributors, value-added resellers (VARs), and system integrators who provide broader market reach and specialized support to smaller enterprises. These partners play a crucial role in delivering tailored solutions, offering technical expertise, and managing logistics for diverse customers across various verticals. The effectiveness of the distribution channel is critical for ensuring market penetration and enabling the widespread adoption of IoT technologies, completing the journey from silicon to functional connected device.

IoT Chipset Market Potential Customers

The potential customers for the IoT Chipset Market are incredibly diverse, spanning across nearly every major industry vertical due to the pervasive nature of connected technologies. End-users or buyers of these chipsets are primarily Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who embed these components into their final products. This includes major consumer electronics brands that produce smart home devices, wearables, and personal assistants, demanding chipsets optimized for power efficiency, compact size, and seamless connectivity. Companies in the automotive sector, from Tier-1 suppliers to vehicle manufacturers, are significant customers, integrating chipsets for infotainment systems, Advanced Driver-Assistance Systems (ADAS), telematics, and vehicle-to-everything (V2X) communication, requiring robust performance and high reliability in harsh environments.

Furthermore, the industrial sector represents a burgeoning customer base, with enterprises looking to implement Industrial IoT (IIoT) solutions for factory automation, predictive maintenance, asset tracking, and supply chain optimization. These customers require chipsets that can withstand extreme temperatures, vibrations, and offer long-term operational stability, alongside advanced processing capabilities for edge analytics. Healthcare providers and medical device manufacturers are also key potential customers, utilizing IoT chipsets for remote patient monitoring systems, smart medical implants, diagnostic equipment, and telehealth solutions, with a strong emphasis on data security, regulatory compliance, and ultra-low power consumption for prolonged battery life in critical applications. The demand here is driven by the need for continuous, real-time health data and improved patient outcomes.

Beyond these core industries, smart city initiatives driven by municipal governments and urban development corporations are significant buyers, deploying chipsets in smart lighting, waste management, environmental sensing, and intelligent transportation systems. Retail businesses utilize them for inventory management, smart shelves, and point-of-sale (POS) systems, aiming to enhance customer experience and operational efficiency. The agriculture sector employs IoT chipsets in precision farming equipment, livestock monitoring, and soil analysis, optimizing resource utilization. Essentially, any entity involved in creating a connected product or system that requires data collection, processing, and communication capabilities represents a potential customer for IoT chipsets, reflecting the foundational role these components play in the evolving digital landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 37.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies, Inc., Intel Corporation, Broadcom Inc., MediaTek Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, Cypress Semiconductor Corporation (now part of Infineon), Analog Devices, Inc., Marvell Technology, Inc., Microchip Technology Inc., Nordic Semiconductor ASA, Realtek Semiconductor Corp., Semtech Corporation, Silicon Labs Inc., Synaptics Incorporated, Dialog Semiconductor Plc (now part of Renesas) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IoT Chipset Market Key Technology Landscape

The IoT Chipset Market's technological landscape is characterized by continuous innovation aimed at optimizing performance, power efficiency, and security for diverse applications. Key technologies shaping this market include advanced processor architectures, such as ARM Cortex-M and Cortex-R series for microcontrollers (MCUs) and Cortex-A for microprocessors (MPUs), which provide the computational backbone for IoT devices. The trend towards integrating AI acceleration directly into these processors, often through specialized neural processing units (NPUs) or digital signal processors (DSPs), is becoming paramount for enabling on-device intelligence and real-time analytics. Furthermore, the development of System-on-Chip (SoC) solutions that combine processing, memory, and various connectivity modules onto a single die is a dominant trend, driving down costs and reducing device footprint, thereby enabling the creation of smaller, more complex, and more integrated IoT devices across various industries.

Connectivity technologies are another cornerstone of the IoT chipset landscape. The proliferation of 5G New Radio (NR) modules offers unprecedented speeds, ultra-low latency, and massive device connectivity, facilitating mission-critical IoT applications and high-bandwidth data transfers. Concurrently, Low-Power Wide-Area Network (LPWAN) technologies like LoRa, NB-IoT, and Sigfox are critical for applications requiring long-range communication with minimal power consumption, suitable for remote monitoring and asset tracking where battery life is paramount. Short-range wireless technologies such as Wi-Fi 6/6E (and upcoming Wi-Fi 7), Bluetooth Low Energy (BLE), and Zigbee remain essential for local area networking and device-to-device communication, offering robust and energy-efficient solutions for smart homes and industrial environments. The ability of chipsets to support multiple communication protocols is also crucial for interoperability within fragmented IoT ecosystems.

Security and power management technologies are increasingly integrated at the silicon level, addressing two of the most critical challenges in IoT deployment. Hardware-based security features, including secure boot, trusted execution environments (TEEs), cryptographic accelerators, and tamper-detection mechanisms, are being embedded directly into chipsets to protect data integrity, device identity, and intellectual property from cyber threats. For power management, advancements in ultra-low-power design methodologies, power harvesting capabilities, and dynamic voltage and frequency scaling (DVFS) are extending battery life and enabling energy-autonomous IoT devices, crucial for applications deployed in remote or hard-to-reach locations. The convergence of these technological innovations—advanced processing, versatile connectivity, robust security, and efficient power management—defines the cutting edge of the IoT chipset market, enabling a new generation of intelligent, secure, and sustainable connected solutions.

Regional Highlights

The global IoT Chipset Market exhibits significant regional variations, influenced by differing levels of technological adoption, economic development, regulatory frameworks, and industrial infrastructure. Each region presents a unique set of opportunities and challenges for market players, driving specific demand patterns for IoT chipsets. Understanding these regional dynamics is crucial for formulating targeted business strategies and optimizing supply chains. The concentration of manufacturing capabilities, government support for digital transformation, and consumer readiness for smart technologies are primary factors that differentiate regional market landscapes and their growth trajectories in the burgeoning IoT ecosystem.

Asia Pacific, for instance, stands out as the largest and most rapidly growing market, propelled by its vast manufacturing base, aggressive government investments in smart cities and 5G infrastructure, and a large consumer market for smart devices. Countries like China, South Korea, and Japan are at the forefront of IoT adoption, driving demand for chipsets across consumer electronics, industrial automation, and automotive sectors. North America and Europe, while more mature, continue to hold substantial market shares due to advanced industrial IoT deployments, robust smart home ecosystems, and strong innovation in healthcare and automotive IoT. These regions are characterized by a strong emphasis on security, data privacy regulations, and the development of high-value, specialized IoT applications. Such nuanced regional demands necessitate highly adaptable chipset solutions.

- North America: A mature market driven by strong R&D, early adoption of IoT in industrial and automotive sectors, and significant investments in smart infrastructure. High demand for AI-enabled and secure chipsets.

- Europe: Focus on industrial IoT (Industry 4.0), smart cities, and stringent data privacy regulations (GDPR) driving demand for secure and compliant chipsets. Germany, UK, and France are key contributors.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by manufacturing hubs, smart city initiatives, 5G deployment, and a huge consumer electronics market in countries like China, Japan, South Korea, and India.

- Latin America: Emerging market with increasing internet penetration, smart agriculture, and logistics IoT deployments. Brazil and Mexico are leading the adoption.

- Middle East and Africa (MEA): Nascent but rapidly growing, with significant government investments in smart cities (e.g., NEOM in Saudi Arabia) and digital transformation initiatives in various sectors, leading to demand for IoT infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IoT Chipset Market.- Qualcomm Technologies, Inc.

- Intel Corporation

- Broadcom Inc.

- MediaTek Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- Infineon Technologies AG

- Cypress Semiconductor Corporation (now part of Infineon)

- Analog Devices, Inc.

- Marvell Technology, Inc.

- Microchip Technology Inc.

- Nordic Semiconductor ASA

- Realtek Semiconductor Corp.

- Semtech Corporation

- Silicon Labs Inc.

- Synaptics Incorporated

- Dialog Semiconductor Plc (now part of Renesas)

Frequently Asked Questions

Analyze common user questions about the IoT Chipset market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an IoT chipset and how does it differ from a regular semiconductor chip?

An IoT chipset is a specialized integrated circuit designed for Internet of Things devices, optimized for low power consumption, compact size, cost-effectiveness, and robust security. Unlike general-purpose semiconductor chips, IoT chipsets integrate specific functionalities like diverse wireless connectivity (Wi-Fi, Bluetooth, LPWAN), dedicated processing for edge intelligence, and hardened security features to meet the unique demands of connected, often battery-powered, devices.

What are the primary factors driving the growth of the IoT Chipset Market?

Key drivers include the exponential increase in IoT device adoption across consumer and industrial sectors, the global rollout of 5G networks enhancing connectivity, the growing demand for edge computing capabilities, and significant investments in smart city and digital transformation initiatives worldwide. These factors collectively create a robust demand for efficient and advanced IoT chipsets.

How is Artificial Intelligence (AI) impacting the development of IoT chipsets?

AI is profoundly impacting IoT chipsets by enabling "AIoT" – the integration of AI capabilities directly into the silicon. This allows for on-device data processing, real-time decision-making, reduced latency, and enhanced data privacy. Chipsets are being designed with specialized AI accelerators (e.g., NPUs) to efficiently handle machine learning tasks at the edge, making devices smarter and more autonomous while optimizing power consumption.

What are the main challenges faced by the IoT Chipset Market?

The market faces several challenges, including persistent concerns over data security and privacy due to the expanding attack surface of connected devices. Additionally, high development and integration costs, the lack of universal standardization across fragmented IoT ecosystems, and the complexity of the IoT value chain pose significant hurdles for widespread adoption and seamless interoperability.

Which regions are leading in IoT chipset adoption and why?

Asia Pacific is the leading and fastest-growing region for IoT chipset adoption, primarily driven by its vast manufacturing base, aggressive government investments in smart infrastructure, and a large consumer market. North America and Europe also hold significant market shares, propelled by advanced industrial IoT deployments, established smart home ecosystems, and strong innovation in vertical-specific applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager