IP Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429843 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

IP Camera Market Size

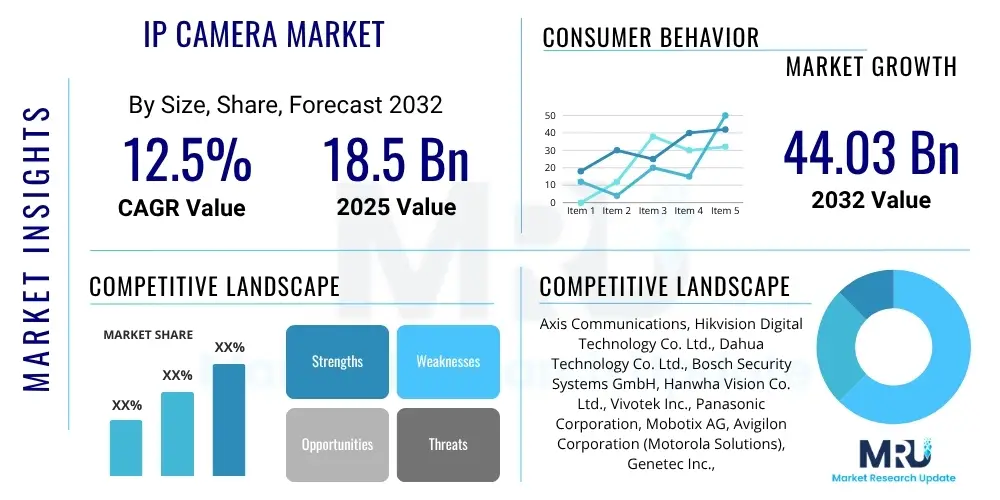

The IP Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 44.03 Billion by the end of the forecast period in 2032.

IP Camera Market introduction

The IP Camera Market encompasses a diverse and rapidly evolving landscape of digital video surveillance technologies that leverage Internet Protocol (IP) networks for data transmission. These advanced devices fundamentally transform traditional security paradigms by converting optical images into digital signals, which are then transmitted over a network, enabling remote viewing, recording, and sophisticated analysis. Unlike their analog predecessors, IP cameras offer a multitude of benefits, including significantly higher resolution capabilities, enhanced scalability, and unparalleled flexibility in deployment and integration with existing IT infrastructures. This transition from analog to digital surveillance has been a pivotal shift, driven by the increasing demand for more effective, versatile, and intelligence-driven monitoring solutions across a broad spectrum of applications.

The product portfolio within the IP camera market is extensive, ranging from fixed-lens cameras designed for general area surveillance to highly advanced Pan-Tilt-Zoom (PTZ) cameras that offer dynamic coverage. Specialized variants include dome cameras, bullet cameras, multi-sensor cameras providing panoramic views, and thermal or infrared cameras for low-light or challenging environmental conditions. Major applications span critical sectors such as residential security, where homeowners seek peace of mind through remote monitoring; commercial properties, including retail, offices, and hospitality, for loss prevention and operational oversight; industrial facilities for process monitoring and safety compliance; and extensive government and public infrastructure projects, pivotal for smart city initiatives and public safety. The inherent advantages of IP camera systems, such as superior image clarity, advanced video analytics, two-way audio communication, and seamless integration with other smart devices, collectively contribute to their widespread and increasing adoption.

Several crucial factors are driving the robust growth of the IP camera market. Foremost among these is the escalating global concern over security threats, ranging from petty crime to organized terrorism, compelling both public and private sectors to invest in sophisticated surveillance. The rapid proliferation of smart city initiatives, aiming to enhance urban safety, traffic management, and resource allocation through interconnected sensors and cameras, places IP cameras at their core. Furthermore, the relentless advancements in artificial intelligence and machine learning are revolutionizing video analytics, enabling cameras to perform intelligent functions like facial recognition, object tracking, and anomaly detection. The expanding Internet of Things (IoT) ecosystem also acts as a powerful catalyst, facilitating seamless integration of IP cameras with other connected devices, creating comprehensive and intelligent security networks. These combined driving forces, alongside continuous technological innovation in sensor technology, video compression, and cybersecurity, ensure the market's dynamic expansion throughout the forecast period, cementing IP cameras as indispensable tools for modern security and operational efficiency.

IP Camera Market Executive Summary

The IP Camera Market is currently experiencing a period of dynamic evolution, marked by several prominent business, regional, and segmental trends that are reshaping its competitive landscape and growth trajectory. From a business perspective, the market is witnessing significant consolidation, with major players acquiring smaller innovators to expand their technological capabilities and market share, particularly in niche areas like AI analytics and cloud services. There is a strong industry shift towards offering comprehensive, end-to-end solutions, moving beyond just hardware to include software, cloud platforms, and managed services (VSaaS). Cybersecurity has emerged as a top priority, driving manufacturers to integrate advanced encryption, secure boot processes, and regular vulnerability patches to protect sensitive video data from increasing cyber threats. Furthermore, the adoption of subscription-based models for cloud storage and AI analytics is gaining traction, providing recurring revenue streams and lowering entry barriers for end-users.

Regionally, the market exhibits varied growth dynamics influenced by economic development, regulatory environments, and security imperatives. The Asia Pacific (APAC) region continues its dominance, fueled by massive government investments in smart city projects, rapid urbanization, and a burgeoning middle class in countries like China and India, leading to widespread adoption in both public and private sectors. North America and Europe, representing mature markets, are characterized by high-value professional installations, sophisticated analytics demand, and a strong emphasis on data privacy and regulatory compliance. These regions are at the forefront of adopting advanced AI and cloud-based solutions. Latin America and the Middle East and Africa (MEA) are emerging as high-growth markets, driven by increasing security concerns, expanding commercial infrastructure, and rising disposable incomes, prompting significant investments in modern surveillance systems, though often with a focus on cost-effective and scalable deployments to meet diverse needs.

Segment-wise, several key trends are defining the market's evolution. The demand for higher resolution cameras, including 4K and 8K, is steadily increasing as users require greater detail for forensic analysis and broader area coverage, though this also drives innovation in efficient video compression technologies. Wireless IP cameras, utilizing Wi-Fi and increasingly 5G cellular connectivity, are gaining substantial popularity due to their ease of installation, flexibility, and suitability for temporary deployments or locations where cabling is challenging, especially in the residential and SME segments. Perhaps the most impactful trend is the exponential growth of the video analytics segment, powered by AI and machine learning. This enables advanced functionalities such as real-time object detection, facial recognition for access control, intelligent behavioral analysis, and automated anomaly detection, transforming IP cameras from passive recording devices into proactive security and operational intelligence tools. Cloud storage and edge computing are also critical segments, providing scalable, secure, and efficient data management solutions, reducing bandwidth strain and enhancing real-time processing capabilities, respectively.

AI Impact Analysis on IP Camera Market

The integration of Artificial Intelligence (AI) into the IP camera market is a transformative force, fundamentally reshaping the capabilities and applications of surveillance systems. Users frequently inquire about how AI enhances the effectiveness of IP cameras in detecting threats, streamlining operations, and improving overall security posture. Key themes revolve around the accuracy of AI algorithms in reducing false alarms, the potential for predictive analytics to prevent incidents, and the efficacy of advanced features like facial recognition and behavioral analysis. There is also considerable interest and concern regarding the ethical implications of AI-powered surveillance, particularly concerning data privacy, algorithmic bias, and potential misuse of technology. Users expect AI to deliver more intelligent, automated, and proactive security solutions that can analyze vast amounts of video data more efficiently than human operators, while simultaneously adhering to privacy regulations and societal expectations.

AI's influence extends beyond mere detection, impacting various facets of IP camera functionality and application. It enables cameras to "understand" visual information in ways previously impossible, distinguishing between humans, vehicles, and animals, or identifying specific objects and patterns. This intelligence allows security personnel to focus on genuine threats rather than sifting through irrelevant footage. Furthermore, AI facilitates automation of routine tasks, such as triggering alarms for specific events, managing access control based on facial recognition, or generating detailed reports on traffic flow or crowd density. This leads to significant operational efficiencies, reducing the need for constant human monitoring and allowing security teams to be more strategically deployed. The ability of AI to learn from data also means that IP camera systems can continuously improve their performance over time, adapting to new environments and evolving threats, making them increasingly sophisticated and reliable tools for modern security.

- Enhanced object detection and classification capabilities, significantly reducing false alarms caused by non-threatening movements and improving the accuracy of alerts.

- Advanced facial recognition and identification for secure access control, VIP recognition, and watchlist monitoring, augmenting overall security protocols.

- Sophisticated behavioral analytics to detect unusual patterns, suspicious activities, or predefined anomalies, such as loitering, crowd formation, or unattended objects.

- Predictive analytics and threat assessment, allowing systems to identify potential risks or developing situations based on historical data and real-time events, enabling proactive security responses.

- Automated incident reporting and real-time alerts delivered to security personnel or integrated security platforms, ensuring rapid response to critical events.

- Efficient video search and retrieval functionalities, enabling users to quickly locate specific events, individuals, or objects within vast amounts of recorded footage.

- Edge AI processing, which allows cameras to perform analytics directly on the device, minimizing data transmission, reducing bandwidth consumption, and ensuring faster response times.

- Improved low-light performance and image quality through AI-driven noise reduction and image enhancement algorithms, delivering clearer footage in challenging lighting conditions.

- Seamless integration with other smart security and building management systems, creating comprehensive and interconnected smart environments.

- Support for anonymization and privacy-preserving features, crucial for compliance with data protection regulations and addressing ethical concerns related to public surveillance.

DRO & Impact Forces Of IP Camera Market

The IP Camera Market's trajectory is shaped by a confluence of compelling drivers, inherent restraints, strategic opportunities, and external impact forces. A primary driver is the escalating global concern over security, propelled by rising crime rates, geopolitical instabilities, and an increased awareness of potential threats, which motivates both individuals and organizations to invest in robust surveillance solutions. This heightened security consciousness is pervasive across residential, commercial, and governmental sectors. Concurrently, the proliferation of smart city initiatives worldwide, aimed at enhancing urban living through improved public safety, optimized traffic flow, and efficient resource management, heavily relies on IP cameras as foundational components for data collection and analysis. Furthermore, the rapid expansion of the Internet of Things (IoT) ecosystem enables IP cameras to integrate seamlessly with other smart devices, creating interconnected and intelligent monitoring networks, thus amplifying their utility. The demand for remote monitoring capabilities, significantly boosted by the global shift towards remote work and distributed operations, also serves as a critical catalyst, allowing users to oversee properties and operations from any location, anytime.

Despite these powerful growth drivers, the IP camera market faces several significant restraints. The comparatively high initial investment required for advanced IP camera systems, particularly those incorporating high-resolution capabilities, extensive storage, and sophisticated AI analytics, can be a considerable barrier for small and medium-sized enterprises (SMEs) and budget-conscious consumers. This cost factor often necessitates a careful return-on-investment analysis. Cybersecurity vulnerabilities represent another major restraint; as network-connected devices, IP cameras are susceptible to hacking, data breaches, and unauthorized access, which raises profound concerns about data privacy and the integrity of surveillance systems. High-profile security breaches involving IP cameras have underscored these risks, prompting increased scrutiny. Moreover, stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and evolving privacy laws globally, impose strict requirements on how video data is collected, stored, and used, adding complexity and compliance costs for manufacturers and operators. Technical complexities related to network infrastructure requirements, professional installation, intricate configuration, and ongoing system maintenance also act as deterrents, particularly for less technically proficient end-users.

However, the market is rife with strategic opportunities that promise substantial future growth. The continuous advancement and integration of Artificial Intelligence and Machine Learning (AI/ML) algorithms offer unparalleled opportunities to enhance video analytics, moving beyond basic motion detection to predictive threat assessment, advanced object classification, and highly nuanced behavioral analysis, transforming surveillance into a proactive intelligence gathering tool. The ongoing evolution of cloud-based video surveillance-as-a-service (VSaaS) models presents an opportunity for scalable, cost-effective, and flexible deployments, attracting a broader customer base by reducing the need for on-premise hardware and simplifying management. The global rollout of 5G networks is expected to revolutionize wireless IP camera applications by providing ultra-high bandwidth, significantly lower latency, and enhanced edge computing capabilities, paving the way for more sophisticated mobile surveillance, drone-mounted cameras, and distributed systems. Furthermore, niche applications in specialized sectors like healthcare (e.g., patient monitoring, fall detection), industrial automation (e.g., quality control, robotic guidance), and environmental monitoring (e.g., wildlife tracking, disaster assessment) offer untapped market potential. Key impact forces that continuously shape the market include rapid technological advancements introducing new features and improving performance, evolving regulatory landscapes dictating data privacy and product standards, global economic shifts affecting consumer and business spending patterns, and a dynamic competitive landscape characterized by new market entrants and intensified innovation pressures among established players.

Segmentation Analysis

The IP Camera Market is intricately segmented across multiple dimensions, providing a granular understanding of its diverse components and the varied demands of its user base. This detailed segmentation is instrumental for market participants to identify specific growth areas, tailor product development strategies, and effectively target particular customer segments. Analyzing the market through these various lenses allows for a comprehensive overview of technological preferences, application-specific needs, and geographical adoption patterns. Each segment presents unique market dynamics, competitive considerations, and opportunities for innovation, collectively contributing to the overall complexity and potential of the IP camera industry. This structured breakdown aids in strategic planning and competitive differentiation within the global surveillance landscape.

The market can be primarily segmented by the physical characteristics and functional capabilities of the cameras, such as type and resolution. Further distinctions arise from connectivity methods, whether wired for robust infrastructure or wireless for flexibility, and the specific end-use applications which dictate camera features and system requirements. The underlying technological approach, whether centralized processing, edge computing, or cloud-based services, also forms a crucial segmentation. Understanding these differentiations enables manufacturers to design products that meet specific technical standards and performance expectations, while also allowing integrators and service providers to build customized solutions that address the unique operational challenges and security objectives of different client environments. This multi-faceted segmentation ensures that the IP camera market remains responsive to evolving technological trends and diverse customer demands.

- By Type

- Fixed Cameras: These are stationary cameras providing a constant view of a specific area. They are cost-effective and widely used in general surveillance applications.

- PTZ (Pan Tilt Zoom) Cameras: Offering mechanical control over direction and zoom, PTZ cameras provide flexible coverage over large areas and allow operators to track subjects.

- Dome Cameras: Characterized by their discreet, vandal-resistant dome casing, these cameras are commonly used indoors and outdoors where aesthetics and durability are important.

- Bullet Cameras: Easily recognizable by their cylindrical shape, bullet cameras are often used for outdoor surveillance, offering a clear line of sight and robust weatherproof housing.

- Box Cameras: These are highly customizable cameras without integrated lenses or housing, allowing users to choose specific lenses and enclosures to suit various applications.

- Multi-sensor Cameras: Featuring multiple lenses within a single unit, these cameras provide wide-area or panoramic surveillance, reducing the number of cameras needed for extensive coverage.

- By Resolution

- Standard Definition (SD): Older or more basic IP cameras offering lower resolution, suitable for general monitoring where high detail is not critical.

- High Definition (HD 720p/1080p): Provides clear images and videos, widely adopted for a balance of quality and storage efficiency.

- Full HD (1080p): A common standard offering excellent detail, suitable for most commercial and residential applications.

- 4K (Ultra HD): Delivering four times the resolution of Full HD, 4K cameras provide exceptional detail, ideal for large areas or forensic analysis.

- 8K and Beyond: Emerging high-resolution cameras for specialized applications requiring extreme detail over expansive areas.

- By Connectivity

- Wired (Ethernet): Offers stable and secure network connection, often powered via Power over Ethernet (PoE), common in professional installations.

- Wireless (Wi-Fi, Cellular 4G/5G): Provides flexible installation without extensive cabling, increasingly popular for residential, small business, and remote surveillance.

- By Application

- Commercial: Includes various business environments such as:

- Retail: For loss prevention, customer flow analysis, and employee monitoring.

- Office Buildings: For access control, perimeter security, and general surveillance.

- Hospitality: Hotels and resorts for guest safety, asset protection, and operational oversight.

- Banking and Finance: For high-security surveillance, ATM monitoring, and transaction verification.

- Residential: Home security, property monitoring, and integration with smart home systems.

- Industrial: Manufacturing plants, logistics, and warehousing for process monitoring, safety, and asset tracking.

- Manufacturing: For quality control, production line monitoring, and worker safety.

- Logistics and Warehousing: For inventory management, asset security, and dock monitoring.

- Energy and Utilities: For critical infrastructure protection and remote site surveillance.

- Government and Public Infrastructure: Essential for urban safety and critical asset protection.

- Smart Cities: For public safety, traffic management, and urban planning initiatives.

- Transportation: Airports, train stations, and public transit for passenger safety and operations.

- Law Enforcement: For evidence collection, public event monitoring, and crime deterrence.

- Critical Infrastructure: Power plants, water treatment facilities, and communication hubs.

- Healthcare: Hospitals and clinics for patient monitoring, asset security, and facility safety.

- Education: Schools and universities for campus security, student safety, and asset protection.

- Commercial: Includes various business environments such as:

- By Technology

- Centralized IP Cameras: Traditional setup where video is sent to a central NVR or server for recording and processing.

- Decentralized IP Cameras (Edge AI): Cameras with onboard processing capabilities that perform analytics and potentially storage locally, reducing network load.

- Cloud-based IP Cameras (VSaaS): Video surveillance delivered as a service, with footage stored and managed in the cloud, offering scalability and remote access.

Value Chain Analysis For IP Camera Market

The value chain for the IP Camera Market is a complex ecosystem involving a multitude of stakeholders, from component suppliers to end-users, all contributing to the creation, distribution, and utilization of surveillance products. The upstream segment is foundational, focusing on the research, development, and manufacturing of critical components that form the core of an IP camera. This includes the production of high-performance image sensors (CMOS, CCD), advanced chipsets (for video compression, analytics, and network processing), sophisticated lenses, and integrated circuit boards. Key players at this stage are specialized semiconductor companies, optics manufacturers, and embedded software developers, whose innovations directly dictate the performance, resolution, and intelligent capabilities of the final product. Strategic partnerships and extensive R&D investments in this segment are crucial for driving technological advancements and maintaining competitive advantages in the rapidly evolving market.

Moving downstream, the core manufacturing stage involves the assembly of these components into complete IP camera units, alongside firmware development, rigorous quality control, and product packaging. This stage is dominated by established IP camera brands and large Original Equipment Manufacturers (OEMs) who leverage economies of scale and expertise in design and production. Following manufacturing, the distribution channel becomes paramount in bringing products to market. These channels are diverse, encompassing direct sales to large governmental entities or corporate clients requiring tailored solutions, indirect sales through a vast network of wholesale distributors who manage inventory and logistics for a broad range of products, and value-added resellers (VARs) who provide customized system integration and support for complex projects. Online retailers and consumer electronics stores also play an increasingly significant role in reaching residential and small business consumers, offering convenience and competitive pricing for off-the-shelf solutions. This multi-tiered distribution strategy ensures wide market penetration and accessibility for various customer segments.

The final stages of the value chain involve system integration, deployment, and crucial post-sales support. System integrators are pivotal, responsible for designing comprehensive surveillance solutions, installing cameras and associated infrastructure, configuring networks, and integrating IP cameras with Video Management Software (VMS), Network Video Recorders (NVRs), and other security systems like access control or alarm panels. Their expertise ensures that complex systems function optimally and meet specific client requirements. End-users, encompassing residential, commercial, industrial, and public sectors, represent the ultimate destination of the product, utilizing the surveillance systems for security, operational oversight, and data collection. Post-sales services, including technical support, regular software updates, maintenance contracts, and system upgrades, are vital for ensuring long-term product reliability, customer satisfaction, and building lasting brand loyalty. The efficiency and effectiveness across all these stages directly impact market share, profitability, and the overall perception of value for IP camera solutions.

IP Camera Market Potential Customers

The IP Camera Market caters to an exceptionally broad and diverse spectrum of potential customers, each with distinct needs, budget considerations, and deployment requirements, ranging from individual homeowners to multinational corporations and expansive government agencies. Residential users constitute a significant and growing customer segment, driven by an increasing desire for personal and property security, remote monitoring of homes, children, and pets, and seamless integration with smart home automation systems. These consumers typically prioritize ease of installation, user-friendly mobile applications, affordability, and features such as motion detection alerts, two-way audio, and cloud storage options. The accessibility of consumer-grade IP cameras, often available through online retail or DIY channels, has significantly expanded this customer base, making advanced home surveillance commonplace.

Commercial enterprises form another cornerstone of the IP camera market, spanning a wide array of business types from small and medium-sized businesses (SMBs) to large, multi-site corporations. This segment includes retail stores, restaurants, offices, hotels, banking and financial institutions, and warehouses. Commercial customers primarily seek robust surveillance solutions for loss prevention, employee supervision, operational efficiency, compliance monitoring, and protecting valuable assets. Their demands often include high-resolution cameras for forensic detail, extensive video storage capabilities, advanced video analytics for business intelligence (e.g., foot traffic analysis, queue management), and seamless integration with existing access control systems, point-of-sale (POS) systems, and alarm infrastructure. The need for comprehensive coverage and centralized management across multiple locations is also a key driver for large enterprises.

Furthermore, the public sector and critical infrastructure segments represent major end-users, encompassing government agencies, law enforcement bodies, urban planning departments for smart cities, and operators of essential utilities and transportation networks. These customers require highly reliable, scalable, and resilient IP surveillance systems capable of operating in demanding environments, often demanding specialized features such as license plate recognition, facial detection for public safety, crowd monitoring, and integration with emergency services. The industrial sector, including manufacturing plants, logistics hubs, and energy generation facilities, also constitutes a vital customer segment, utilizing IP cameras for process automation, quality control, perimeter security, occupational health and safety compliance, and remote site inspection. Lastly, sectors such as healthcare (for patient monitoring, asset security, and facility management) and education (for campus safety, student protection, and resource security) further exemplify the pervasive and critical role of IP cameras in modern society, continually expanding the market's reach and impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 44.03 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axis Communications, Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Bosch Security Systems GmbH, Hanwha Vision Co. Ltd., Vivotek Inc., Panasonic Corporation, Mobotix AG, Avigilon Corporation (Motorola Solutions), Genetec Inc., Uniview (Zhejiang Uniview Technologies Co. Ltd.), D-Link Corporation, Pelco Inc. (Motorola Solutions), Arlo Technologies, Inc., Ring LLC (Amazon), Google Nest, Sony Corporation, Canon Inc., FLIR Systems (Teledyne FLIR), Verkada Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IP Camera Market Key Technology Landscape

The technological landscape of the IP Camera Market is characterized by continuous innovation and the integration of cutting-edge solutions designed to enhance surveillance capabilities, improve operational efficiency, and address evolving security challenges. A paramount development is the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which empower IP cameras to transcend basic recording. These AI capabilities enable sophisticated video analytics, including highly accurate object detection and classification (distinguishing between humans, vehicles, and animals), advanced facial recognition for access control and identification, intelligent behavioral analysis to flag suspicious activities like loitering or unauthorized access, and precise license plate recognition. Such AI integration, often executed at the edge, on the camera itself, or through cloud-based processing, significantly reduces false alarms, transforms raw video data into actionable intelligence, and enables proactive security responses, thereby revolutionizing the efficacy of surveillance systems.

Another pivotal technological trend is the increasing reliance on cloud computing to facilitate Video Surveillance as a Service (VSaaS) models. Cloud-based solutions offer immense scalability and flexibility, allowing users to securely store vast amounts of video footage off-site, access live or recorded streams from any internet-connected device, and manage their entire surveillance infrastructure with greater ease. This approach mitigates the need for substantial on-premise hardware like Network Video Recorders (NVRs) and servers, reducing initial capital expenditures and simplifying system maintenance. Alongside cloud capabilities, edge computing is gaining traction, wherein IP cameras are equipped with onboard processors to perform analytics and, in some cases, store data locally. This decentralization significantly reduces network bandwidth consumption, minimizes latency, and enhances privacy by processing sensitive data closer to the source, making it critical for real-time applications and ensuring resilience even during network outages.

Furthermore, advancements in core camera components and connectivity solutions are driving market growth. The market leverages sophisticated sensor technologies, such as Starlight sensors for exceptional color imaging in extremely low-light conditions, thermal imaging cameras for detection in complete darkness or through smoke/fog, and multi-sensor designs that offer expansive panoramic views from a single device. Efficient video compression standards, particularly H.265 (HEVC) and its successors, are crucial for managing the enormous data volumes generated by high-resolution (4K, 8K) cameras, optimizing storage requirements, and ensuring efficient network transmission without compromising image quality. Cybersecurity remains a paramount technological focus, with manufacturers implementing robust encryption protocols, secure boot processes, multi-factor authentication, and continuous firmware updates to protect against evolving cyber threats and ensure the integrity and privacy of surveillance data. The advent of 5G networks is also set to dramatically impact the market, offering ultra-high bandwidth, extremely low latency, and enhanced reliability for wireless IP camera deployments, opening new possibilities for mobile, remote, and distributed surveillance applications, and fostering deeper integration within the broader Internet of Things (IoT) ecosystem.

Regional Highlights

- North America: This region stands as a technologically mature market for IP cameras, characterized by high adoption rates across commercial, governmental, and critical infrastructure sectors. The United States and Canada are pivotal contributors, driven by stringent security regulations, a strong emphasis on smart building technologies, and an early embrace of advanced surveillance features including AI-powered analytics and cloud-based VSaaS solutions. The market here is sustained by ongoing investments in smart city initiatives, continuous infrastructure upgrades, and a robust demand for high-performance, intelligent video surveillance systems that prioritize both security efficacy and data privacy.

- Europe: Europe represents a significant and highly regulated market, where demand is heavily influenced by strict data protection legislation such as the GDPR, necessitating privacy-by-design principles in IP camera solutions. Key economies like Germany, the United Kingdom, and France are at the forefront of adopting sophisticated IP surveillance for urban security, retail environments, and industrial applications. The region demonstrates a strong preference for high-quality, reliable systems, with a growing trend towards edge AI processing, robust cybersecurity measures, and advanced analytics to comply with regulations while maximizing security benefits. Investments in smart cities and critical infrastructure also drive demand.

- Asia Pacific (APAC): APAC remains the largest and most rapidly expanding market for IP cameras globally, propelled by unparalleled rates of urbanization, extensive infrastructure development projects, and substantial government investments in smart city programs across economic powerhouses like China, India, Japan, and South Korea. This region exhibits a dual demand for both cost-effective, scalable surveillance solutions and cutting-edge AI-driven analytics. Heightened public safety concerns, flourishing residential construction, and a strong domestic manufacturing base for surveillance equipment further stimulate market growth, making APAC a critical hub for innovation and adoption.

- Latin America: This region is an emerging market experiencing consistent growth, largely attributed to increasing crime rates and proactive government initiatives aimed at enhancing public safety and security infrastructure. Countries such as Brazil and Mexico are leading the adoption, primarily in commercial segments like retail, banking, and transportation, alongside burgeoning demand in residential sectors. The market is characterized by a strong need for reliable, affordable surveillance solutions, coupled with a growing interest in cloud-based services and the integration of basic AI features to enhance monitoring capabilities and asset protection across various urban and commercial settings.

- Middle East and Africa (MEA): The MEA region is witnessing substantial growth in the IP camera market, significantly driven by ambitious government-led smart city projects, particularly in the UAE and Saudi Arabia, alongside substantial investments in critical infrastructure and tourism. Increasing geopolitical stability and a rising awareness about the imperative of robust security systems contribute to market expansion. South Africa also plays a crucial role in regional growth, with strong demand from commercial, industrial, and residential sectors for advanced surveillance technologies. The market in MEA is characterized by large-scale project deployments and a demand for high-end, intelligent solutions tailored to diverse and often challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IP Camera Market.- Axis Communications AB

- Hikvision Digital Technology Co. Ltd.

- Dahua Technology Co. Ltd.

- Bosch Security Systems GmbH

- Hanwha Vision Co. Ltd.

- Vivotek Inc.

- Panasonic Corporation

- Mobotix AG

- Avigilon Corporation (a Motorola Solutions Company)

- Genetec Inc.

- Uniview (Zhejiang Uniview Technologies Co. Ltd.)

- D-Link Corporation

- Pelco Inc. (a Motorola Solutions Company)

- Arlo Technologies, Inc.

- Ring LLC (an Amazon Company)

- Google Nest (a Google LLC subsidiary)

- Sony Corporation

- Canon Inc.

- FLIR Systems (part of Teledyne FLIR)

- Verkada Inc.

Frequently Asked Questions

What is an IP camera?

An IP camera, or Internet Protocol camera, is a type of digital video camera that receives control data and sends image data via an Internet Protocol network, such as a local area network (LAN) or the internet. Unlike traditional analog CCTV cameras, IP cameras offer a range of advanced features including higher resolution video, remote accessibility from various devices, and sophisticated integration capabilities with other network systems, making them an integral part of modern security and surveillance infrastructure. They typically convert optical signals into digital format, transmitting them over a network to a storage device or viewing platform, providing superior clarity and flexibility.

How does AI enhance IP cameras?

Artificial Intelligence (AI) profoundly enhances IP cameras by integrating advanced intelligent video analytics capabilities directly into the surveillance system. This includes highly precise object detection and classification, allowing cameras to differentiate between humans, vehicles, and animals, significantly reducing false alarms. AI also enables sophisticated facial recognition for access control or watchlist monitoring, advanced behavioral analysis to detect suspicious activities like loitering or unusual crowd formations, and predictive analytics that can identify potential threats before they escalate. By processing video data intelligently, AI transforms IP cameras from mere recording devices into proactive security tools that offer actionable insights and automate responses, dramatically improving the efficiency and effectiveness of surveillance operations.

What are the main benefits of using IP cameras?

The primary benefits of utilizing IP cameras in modern surveillance systems are multifaceted and substantial. They offer significantly superior image quality and higher resolutions, including 4K and 8K, enabling clearer identification and more comprehensive coverage of large areas. IP cameras provide unparalleled remote accessibility, allowing users to view live feeds or recorded footage from anywhere in the world via a smartphone, tablet, or computer. Their inherent network-based architecture ensures exceptional scalability, making it easy to add or remove cameras from a system without extensive re-cabling. Furthermore, IP cameras seamlessly integrate with other smart security components and IoT devices, forming cohesive and intelligent security ecosystems. The integration of advanced video analytics also allows for smarter, more proactive security, leading to enhanced threat detection and operational efficiencies.

What are the key considerations when choosing an IP camera system?

Selecting an optimal IP camera system requires careful consideration of several key factors to ensure it meets specific security and operational requirements. Critical aspects include determining the required video resolution (e.g., HD, Full HD, 4K) based on the level of detail needed for identification and coverage area. The choice of connectivity, whether wired Power over Ethernet (PoE) for stability or wireless (Wi-Fi, 5G) for flexibility, is also important. Evaluating storage solutions, such as on-site Network Video Recorders (NVRs), cloud-based Video Surveillance as a Service (VSaaS), or edge storage, is essential for data retention. Crucially, assessing the need for AI-powered analytics, cybersecurity features (encryption, secure access), ease of installation, and compatibility with existing infrastructure or smart home systems will guide the selection process, ensuring a robust and future-proof surveillance solution.

What is the future outlook for the IP camera market?

The future outlook for the IP camera market is exceptionally promising, poised for continuous innovation and expansive growth. Key trends driving this positive trajectory include the deeper and more sophisticated integration of Artificial Intelligence and Machine Learning for advanced predictive analytics, autonomous surveillance, and hyper-personalized security solutions. The widespread adoption of cloud-based Video Surveillance as a Service (VSaaS) models is expected to accelerate, offering greater flexibility, scalability, and cost-effectiveness. The rollout and maturation of 5G networks will unlock new possibilities for highly reliable wireless deployments, supporting ultra-high-definition streaming and edge computing at unprecedented scales. Furthermore, an increasing emphasis on robust cybersecurity measures and privacy-preserving technologies will be paramount, driven by evolving regulations and consumer demand. The market is also expected to see expansion into more specialized and niche applications, extending the utility of IP cameras beyond traditional security into broader operational intelligence and smart environment management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager