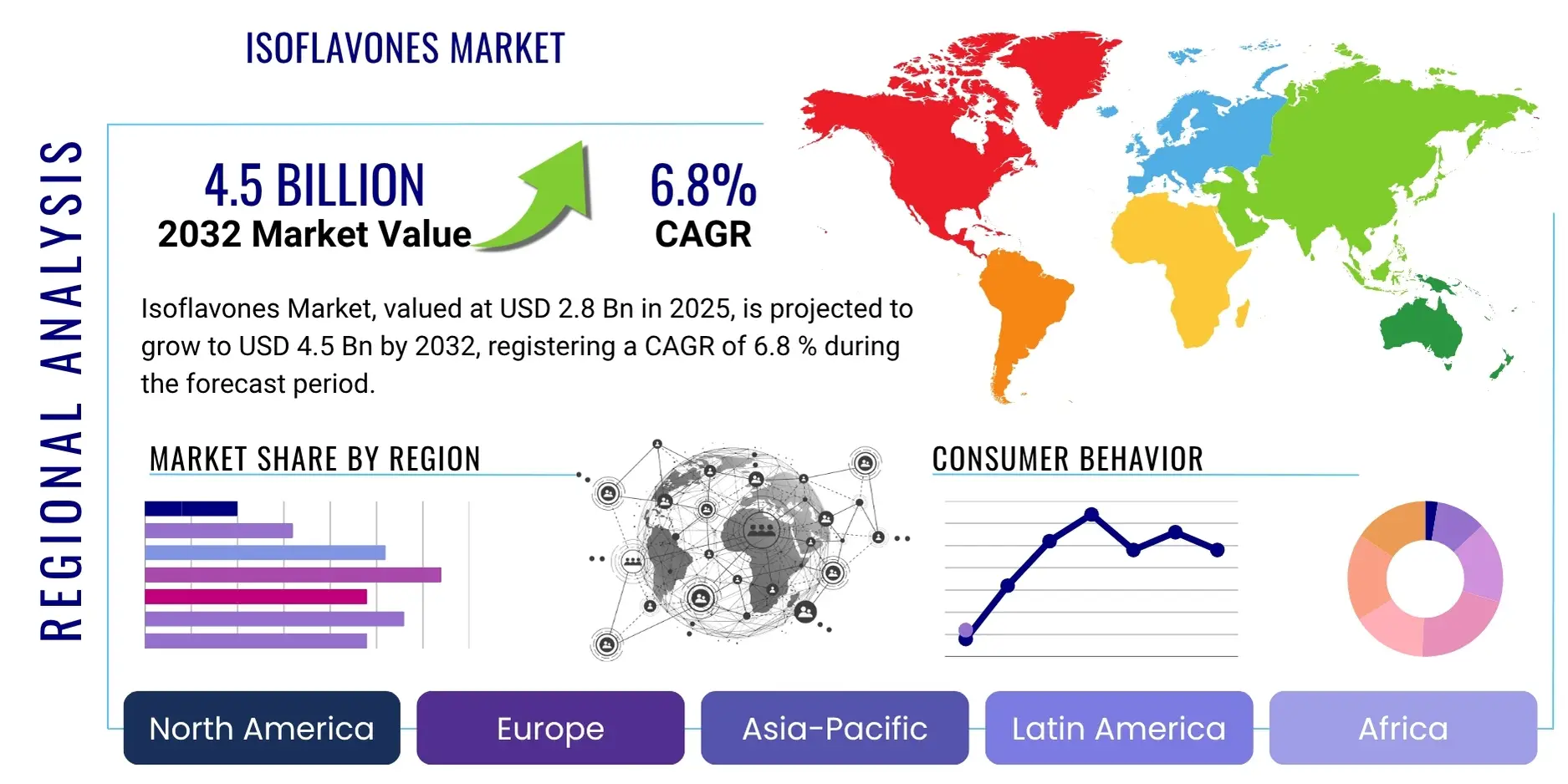

Isoflavones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428294 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Isoflavones Market Size

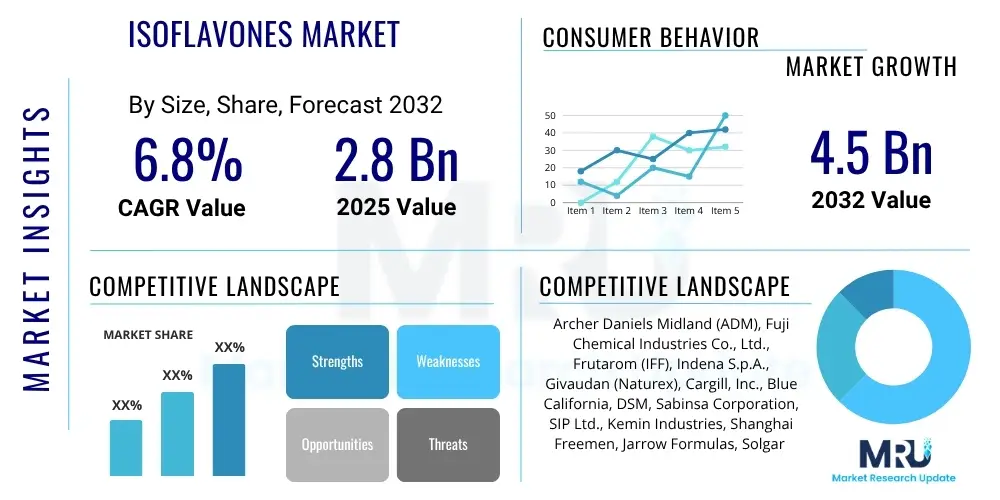

The Isoflavones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2032.

Isoflavones Market introduction

The Isoflavones Market encompasses a diverse array of plant-derived compounds, primarily found in legumes such as soybeans, chickpeas, and red clover, recognized for their phytoestrogenic properties and an expansive range of health benefits. These natural compounds mimic the effects of estrogen in the human body, albeit with significantly weaker activity, making them subjects of intense scientific research and commercial interest. Genistein, daidzein, and glycitein are the most prominent isoflavones, playing pivotal roles in various physiological processes. Their unique chemical structures allow them to bind to estrogen receptors, modulating hormonal balance, and contributing to overall wellness. The market's foundational strength lies in the rich historical use of soy in Asian diets, where populations exhibit lower incidences of hormone-related health issues, fueling global investigation into these beneficial compounds.

Isoflavones are increasingly utilized across multiple sectors, driven by consumer demand for natural, functional ingredients that support health proactively. In the dietary supplement industry, they are formulated into products aimed at alleviating menopausal symptoms, promoting bone health, and supporting cardiovascular well-being. The functional foods and beverages segment incorporates isoflavones into fortified dairy alternatives, health drinks, and snack bars, targeting consumers seeking added nutritional value. Furthermore, their potent antioxidant and anti-inflammatory properties have found applications in the burgeoning cosmetics and personal care industry, particularly in anti-aging and skin health formulations. The pharmaceutical sector also explores isoflavones for their potential in disease prevention and treatment, including cancer research and hormone-related conditions. The market's expansion is fundamentally propelled by a global paradigm shift towards preventive healthcare, an aging population more susceptible to chronic diseases, and a burgeoning interest in plant-based nutrition, all of which underscore the growing recognition of isoflavones as vital components for health and wellness.

Isoflavones Market Executive Summary

The Isoflavones Market is experiencing robust growth, propelled by evolving consumer preferences for natural and plant-derived solutions in health and wellness. Key business trends indicate a significant focus on research and development to enhance the bioavailability and efficacy of isoflavone formulations, leading to novel delivery systems and product innovations. Manufacturers are increasingly investing in sustainable sourcing practices and transparent supply chains to meet consumer demands for ethically produced ingredients. Strategic collaborations between ingredient suppliers and consumer product manufacturers are also becoming prevalent, facilitating the integration of isoflavones into a wider array of end-use applications, particularly in functional foods, dietary supplements, and cosmeceuticals. Moreover, the industry is witnessing a trend towards personalized nutrition, where isoflavones can be tailored to individual health needs based on genetic predispositions and lifestyle factors, further driving product diversification and market penetration.

Regional trends highlight distinct growth patterns and consumption drivers. Asia-Pacific continues to be a dominant force, underpinned by the high consumption of traditional soy-based diets and a strong cultural acceptance of phytoestrogens. This region also acts as a major hub for raw material sourcing and processing, influencing global supply dynamics. North America and Europe are experiencing accelerated growth, driven by an aging demographic seeking natural remedies for age-related health concerns, such as menopause and bone density loss, alongside a growing awareness of cardiovascular benefits. Regulatory landscapes in these Western markets, while sometimes stringent, are gradually adapting to accommodate the inclusion of natural health ingredients, thereby fostering market expansion. Latin America and the Middle East & Africa are emerging as promising markets, characterized by increasing health consciousness, urbanization, and a rising disposable income, leading to greater adoption of functional foods and dietary supplements containing isoflavones. Segment trends reveal that the dietary supplements category holds the largest market share due to its direct health claims and convenience, while the functional foods and beverages segment is poised for the fastest growth, fueled by the demand for everyday products offering added health benefits. The cosmetics and personal care sector is also showing remarkable potential, capitalizing on the antioxidant and anti-aging properties of isoflavones.

AI Impact Analysis on Isoflavones Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize the Isoflavones Market by addressing common user questions related to product discovery, efficacy, and supply chain optimization. Consumers and industry stakeholders frequently inquire about how AI can accelerate the identification of novel isoflavone sources or derivatives with enhanced bioactivity, how it might validate health claims with greater precision, and how it can optimize the entire value chain from raw material sourcing to personalized product delivery. AI's capacity for advanced data analysis can swiftly process vast datasets from genomic research, clinical trials, and epidemiological studies, pinpointing specific isoflavones or their combinations that offer superior therapeutic benefits for targeted health conditions. This leads to a more scientific and evidence-based approach to product development, moving beyond traditional methods and significantly shortening the time-to-market for innovative isoflavone products. Furthermore, AI-driven platforms can analyze consumer health data to create highly personalized nutrition and supplement recommendations, ensuring that individuals receive optimal isoflavone dosages and types tailored to their unique physiological profiles and health goals, thereby increasing product effectiveness and consumer satisfaction.

Beyond product innovation and personalization, AI's influence extends profoundly into operational efficiencies within the Isoflavones Market. The supply chain, often complex and vulnerable to disruptions, can be significantly streamlined through AI-powered predictive analytics, enabling more accurate forecasting of demand and supply, optimizing inventory management, and enhancing logistics. This minimizes waste, reduces costs, and ensures a consistent availability of raw materials. In manufacturing and extraction processes, AI can monitor and control parameters in real-time, leading to improved yield, purity, and consistency of isoflavone extracts, while also identifying potential bottlenecks or quality control issues. This not only elevates product quality but also ensures adherence to stringent regulatory standards. Moreover, AI tools can scour scientific literature and patent databases to identify emerging research, competitive landscapes, and intellectual property opportunities, providing market players with critical insights for strategic decision-making. The ability of AI to simulate molecular interactions and predict the pharmacological effects of different isoflavone compounds also opens new avenues for pharmaceutical applications, offering a powerful tool for drug discovery and development. The collective impact of these AI applications creates a more agile, efficient, and innovative Isoflavones Market, capable of responding swiftly to consumer needs and scientific advancements, ultimately fostering significant growth and development across the industry.

- Enhanced Bioactive Compound Discovery: AI algorithms can rapidly screen vast databases of plant compounds, genetic information, and scientific literature to identify new or underutilized sources of isoflavones with superior bioavailability or specific health benefits, accelerating the discovery phase for novel ingredients.

- Personalized Nutrition and Supplementation: Machine learning models analyze individual genomic data, dietary habits, and health markers to recommend precise isoflavone dosages and types, optimizing their efficacy for specific health conditions like menopause relief, bone density improvement, or cardiovascular support, moving towards highly customized solutions.

- Optimized Supply Chain Management: AI-powered predictive analytics can forecast demand fluctuations, optimize raw material sourcing (e.g., soybean yields), manage inventory levels, and streamline logistics, ensuring consistent supply, reducing waste, and mitigating market volatility, thereby enhancing operational efficiency.

- Improved Extraction and Manufacturing Processes: AI and IoT sensors integrated into manufacturing equipment can monitor and control extraction parameters in real-time, such as temperature, pressure, and solvent ratios, leading to higher purity, yield, and consistency of isoflavone extracts, while minimizing energy consumption and environmental impact.

- Advanced Market Insights and Trend Analysis: AI tools can process extensive market data, consumer reviews, social media trends, and regulatory changes to provide deeper insights into market dynamics, competitive landscapes, and emerging consumer preferences, enabling companies to make more informed strategic decisions and identify new market opportunities.

- Accelerated Clinical Research and Efficacy Validation: AI can analyze results from previous clinical trials and preclinical studies, identify correlations, and even assist in designing new studies, helping to validate the health claims of isoflavones more efficiently and with greater statistical power, bolstering consumer trust and regulatory acceptance.

DRO & Impact Forces Of Isoflavones Market

The Isoflavones Market is significantly shaped by a dynamic interplay of driving forces, restraining factors, and emerging opportunities, all of which are subject to various impact forces. A primary driver is the escalating global health consciousness, as consumers increasingly seek natural and preventive healthcare solutions. The well-documented benefits of isoflavones, particularly in mitigating menopausal symptoms, enhancing bone density, and supporting cardiovascular health, resonate strongly with an aging global population. This demographic shift, coupled with rising chronic disease prevalence, further amplifies the demand for functional ingredients like isoflavones. The growing preference for plant-based diets and sustainable living also acts as a significant catalyst, drawing consumers towards soy-derived and other botanical sources of these beneficial compounds. Scientific advancements in understanding isoflavone mechanisms of action and the development of more bioavailable forms are continuously expanding their application spectrum across diverse industries, from nutraceuticals to cosmetics, thereby fostering market growth.

Despite these robust growth drivers, the Isoflavones Market faces several restraining factors that temper its expansion. Regulatory complexities and varying standards across different geographical regions pose significant hurdles for market players, particularly in terms of product claims and labeling, which can lead to market fragmentation and increased compliance costs. Fluctuations in raw material prices, primarily soybeans and red clover, due to climatic conditions, geopolitical factors, or agricultural policies, directly impact production costs and profit margins. Furthermore, consumer skepticism regarding the efficacy of dietary supplements, sometimes fueled by anecdotal evidence or contradictory studies, can hinder broader market adoption. Potential adverse effects associated with excessive consumption or specific individual sensitivities also necessitate careful dosage recommendations and can contribute to consumer hesitancy. Intense competition from synthetic alternatives and other natural health ingredients also challenges market penetration, requiring continuous innovation and clear differentiation strategies to maintain competitive advantage.

Looking forward, numerous opportunities present themselves for the Isoflavones Market to capitalize on. The burgeoning trend of personalized nutrition offers a fertile ground for developing customized isoflavone formulations based on individual genetic profiles, lifestyle, and specific health needs, promising enhanced efficacy and consumer loyalty. Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, represent untapped markets with rapidly growing middle-class populations, increasing disposable incomes, and evolving dietary preferences, signaling significant potential for market expansion. Novel applications in the pharmaceutical sector, including the exploration of isoflavones as adjunct therapies for hormone-sensitive cancers or in drug delivery systems, could unlock entirely new revenue streams. Moreover, advancements in extraction technologies and encapsulation methods are improving the bioavailability and stability of isoflavones, making them more effective and versatile for product development. Sustainable sourcing initiatives and partnerships with local farmers also offer opportunities to enhance brand image and meet ethical consumer demands, thereby strengthening the market's long-term viability. The convergence of these opportunities with technological advancements and shifting consumer paradigms positions the Isoflavones Market for continued innovation and substantial growth in the coming years.

Segmentation Analysis

The Isoflavones Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and diverse applications. This segmentation enables market participants to identify key growth areas, tailor product development strategies, and target specific consumer demographics more effectively. The primary categories for segmentation include the source of isoflavones, which significantly influences their chemical profile and availability; the specific type of isoflavone, as each compound possesses distinct bioactivity and therapeutic potential; the application areas, reflecting the broad utility of these compounds across industries; and the form in which isoflavones are delivered to end-users, catering to convenience and specific product formulations. Each segment offers unique insights into consumer preferences, technological advancements, and regulatory considerations that collectively shape the market landscape. Understanding these granular divisions is essential for navigating the complexities of the Isoflavones Market and capitalizing on emerging trends within each niche.

By analyzing these segments, stakeholders can discern market hotspots and areas requiring further investment or innovation. For instance, soy-based isoflavones, due to their widespread availability and historical use, continue to dominate the market by source, but red clover and other plant sources are gaining traction as consumers seek diversification and novel benefits. In terms of type, genistein and daidzein consistently lead owing to extensive research validating their health benefits, but other lesser-known isoflavones are being explored for specialized applications. The application segment reveals the dominance of dietary supplements, driven by a growing aging population and increased health awareness, while functional foods and beverages represent a high-growth sector responding to the demand for health-fortified daily consumables. The form segment highlights the preference for powder and capsule forms due to their ease of integration into various products and convenient consumption. This detailed segmentation not only clarifies the current market structure but also provides a roadmap for future growth strategies, emphasizing product differentiation, market expansion, and catering to specific consumer needs within each categorized domain. As research continues to uncover new benefits and applications, these segmentation boundaries may evolve, necessitating continuous market monitoring and adaptive strategies from industry players.

- By Source:

- Soy-based Isoflavones: Derived primarily from soybeans, this category includes prominent compounds like Genistein, Daidzein, and Glycitein. Soy isoflavones are the most widely researched and commercially available, extensively used in dietary supplements for menopausal symptom relief, bone health, and cardiovascular support, leveraging their rich natural abundance and established health profiles.

- Red Clover-based Isoflavones: Sourced from the red clover plant, these isoflavones, primarily Formononetin and Biochanin A, are gaining recognition for their potential in hormone balance and skin health applications. They offer an alternative to soy-based options, catering to consumers seeking diverse plant-derived compounds and specific formulations.

- Other Plant Sources: This segment includes isoflavones derived from other legumes and plants such as Kudzu, Alfalfa, and Chickpeas. While smaller in market share, these sources are increasingly explored for niche applications and unique phytochemical profiles, driven by research into their distinct health benefits and suitability for specialized products.

- By Type:

- Genistein: A well-studied isoflavone known for its potent antioxidant, anti-inflammatory, and estrogenic activities. It is a key ingredient in supplements targeting menopausal support, bone density, and has been a subject of significant oncology research for its potential anti-cancer properties.

- Daidzein: Another major soy isoflavone, notable for its ability to be metabolized into equol in some individuals, a compound associated with enhanced health benefits, particularly in cardiovascular health and menopausal symptom management. It plays a crucial role in promoting gut health and overall metabolic wellness.

- Glycitein: Though present in smaller quantities in soy, Glycitein contributes to the overall health benefits of soy isoflavones, offering distinct biological activities that complement those of Genistein and Daidzein. Research continues to explore its specific contributions to health outcomes.

- Formononetin: Predominantly found in red clover, Formononetin is a phytoestrogen often studied for its role in bone health and cardiovascular support. Its unique structure and metabolic pathways offer specific advantages in certain formulations targeting women's health.

- Biochanin A: Also derived from red clover, Biochanin A is recognized for its potential antioxidant and anti-inflammatory properties. It is often co-formulated with Formononetin to deliver a broader spectrum of health benefits, particularly in cosmetic and anti-aging applications.

- Others (e.g., Equol, Coumestrol): This category includes various other isoflavone derivatives and related compounds being investigated for their therapeutic potential. Equol, a metabolite of daidzein, is particularly noteworthy for its higher estrogenic activity and bioavailability, attracting significant scientific interest.

- By Application:

- Dietary Supplements: The largest application segment, encompassing capsules, tablets, and powders designed to provide targeted health benefits such as menopause relief, bone health support, cardiovascular protection, and antioxidant functions. This segment is driven by an aging population and increasing health awareness.

- Functional Foods & Beverages: Isoflavones are incorporated into foods like fortified yogurts, dairy alternatives, health drinks, energy bars, and breakfast cereals to enhance their nutritional profile and offer specific health benefits. This segment caters to consumers seeking convenient ways to integrate health-promoting ingredients into their daily diet.

- Cosmetics & Personal Care: Utilized in anti-aging creams, serums, lotions, and hair care products due to their antioxidant, anti-inflammatory, and collagen-boosting properties. Isoflavones help to protect the skin from environmental damage, improve elasticity, and promote a youthful appearance.

- Pharmaceuticals: Explored for their potential therapeutic roles in hormone replacement therapies, cancer prevention and treatment research (e.g., breast and prostate cancer), and management of chronic diseases. This application area requires rigorous clinical trials and regulatory approvals.

- Animal Nutrition: A niche but growing application where isoflavones are added to animal feed for their potential benefits in animal health, growth promotion, and reproductive performance, particularly in livestock and aquaculture.

- Others (e.g., Agricultural Chemicals): This includes minor applications where the unique properties of isoflavones are leveraged, potentially in sustainable agriculture as natural pesticides or growth promoters, or in specialized industrial uses.

- By Form:

- Powder: The most common and versatile form, widely used as an ingredient in dietary supplements, functional food formulations, and bulk ingredient sales to manufacturers. Powders offer ease of storage, transportation, and integration into various product matrices.

- Liquid: Used in beverage formulations, tinctures, and specialized supplements where rapid absorption or ease of consumption is desired. Liquid forms often include solubilizers to enhance bioavailability and stability.

- Capsules: A popular dosage form for dietary supplements, offering precise dosing, masking of taste, and protection of ingredients from degradation. Capsules are convenient for consumers and allow for combination with other active ingredients.

- Tablets: Another prevalent solid dosage form for supplements, often preferred for their cost-effectiveness and scalability in manufacturing. Tablets can be coated for delayed release or improved palatability.

- Gels: Emerging in topical cosmetic applications and certain oral delivery systems, gels provide a specific texture and controlled release of isoflavones, particularly beneficial for skin absorption and localized effects.

Value Chain Analysis For Isoflavones Market

The value chain for the Isoflavones Market is a complex and interconnected network, beginning with the meticulous sourcing of raw materials and extending all the way to the final distribution to end-consumers. The upstream segment of the value chain is predominantly centered around agricultural cultivation, primarily involving soybean farming and, to a lesser extent, the cultivation of red clover and other isoflavone-rich plants. Farmers play a critical role in producing high-quality crops, influenced by agricultural practices, climate conditions, and pest management. Following cultivation, the raw plant materials undergo initial processing, which includes harvesting, drying, and preliminary cleaning. This stage is crucial for ensuring the integrity and quality of the isoflavone content before further extraction. Suppliers of these raw materials often need to adhere to specific quality standards and sustainable farming practices to meet the increasing demands from manufacturers for clean-label and ethically sourced ingredients. Investment in advanced agricultural techniques and selective breeding programs can significantly impact the isoflavone yield and quality, thus underpinning the entire subsequent value chain.

Moving downstream, the value chain encompasses the sophisticated processes of extraction, purification, and formulation. Specialized ingredient manufacturers employ various technologies, such as solvent extraction, supercritical fluid extraction, and enzymatic hydrolysis, to isolate and concentrate isoflavones from the raw plant matter. The efficiency and purity of these extraction methods directly affect the quality and market value of the final isoflavone ingredient. Post-extraction, purification processes are critical to remove impurities and unwanted compounds, ensuring that the isoflavones meet stringent industry standards for pharmaceutical, nutraceutical, and cosmetic applications. This often involves chromatography and crystallization techniques. Subsequently, these purified isoflavone ingredients are then formulated into various product types, including powders, liquids, capsules, and tablets, or integrated into complex matrices for functional foods, beverages, and cosmetic products. This formulation stage requires significant R&D investment to enhance bioavailability, stability, and sensory attributes, making the final products appealing and effective for end-users. Contract manufacturers often play a crucial role at this stage, providing specialized services to brands that may not have in-house production capabilities, thus adding another layer of complexity to the value chain.

The distribution channel represents the final critical link in delivering isoflavone-based products to the end-user. This segment involves a combination of direct and indirect channels, each catering to different market needs. Direct distribution typically involves ingredient suppliers selling bulk isoflavone extracts directly to large industrial clients, such as major dietary supplement manufacturers, functional food producers, or cosmetic companies. This B2B model emphasizes technical support, competitive pricing, and long-term supply agreements. Indirect distribution channels are more diverse, encompassing wholesalers, distributors, and various retail outlets that connect finished products to the consumer. This includes pharmacies, health food stores, supermarkets, mass merchandise retailers, and a rapidly expanding e-commerce presence. Online retail platforms have emerged as a particularly powerful channel, offering global reach, convenience, and direct-to-consumer interaction, bypassing traditional intermediaries. The effectiveness of the distribution network is paramount for market penetration and consumer accessibility. Robust logistics, efficient warehousing, and strategic partnerships with retailers are vital for ensuring timely delivery and broad market presence. This intricate flow from cultivation to consumer highlights the collaborative efforts and specialized expertise required at each stage of the Isoflavones Market value chain, with each participant contributing to the ultimate value proposition of these versatile plant compounds.

Isoflavones Market Potential Customers

The Isoflavones Market caters to a diverse and expanding base of potential customers across multiple industries, all seeking the unique health and functional properties these compounds offer. Predominantly, a significant portion of demand originates from the dietary supplement industry, where manufacturers incorporate isoflavones into formulations addressing a wide array of health concerns, including menopausal symptom management, bone health maintenance, and cardiovascular support. These companies target health-conscious consumers, particularly aging populations and women seeking natural alternatives for hormonal balance. Functional food and beverage companies represent another robust segment of potential customers, integrating isoflavones into products like fortified dairy alternatives, health-promoting juices, snack bars, and cereals. Their objective is to appeal to consumers looking for everyday consumables that offer added nutritional benefits, thereby blurring the line between food and medicine. The increasing consumer preference for plant-based and 'clean label' products further drives demand from these sectors, necessitating a consistent supply of high-quality isoflavone ingredients.

Beyond the nutraceutical space, the cosmetics and personal care industry is a rapidly growing customer base for isoflavones. Manufacturers of anti-aging creams, serums, lotions, and hair care products are keen to utilize isoflavones for their potent antioxidant, anti-inflammatory, and collagen-boosting properties. These companies target consumers focused on skin health, anti-aging solutions, and natural beauty products, leveraging the botanical origin and scientifically backed benefits of isoflavones. The pharmaceutical sector also constitutes a key potential customer segment, albeit with more stringent requirements and longer development cycles. Pharmaceutical companies explore isoflavones for their potential in drug discovery, particularly for hormone-sensitive conditions, cancer research, and therapies targeting metabolic disorders. This segment requires highly purified and standardized isoflavone derivatives suitable for clinical trials and eventual drug formulation. Additionally, niche markets such as animal nutrition, where isoflavones are added to feed for improved animal health and performance, and specialized agricultural applications, also represent emerging customer segments. The underlying driver across all these customer groups is the universal desire for natural, effective, and scientifically supported ingredients that contribute to improved health, well-being, and product performance, making isoflavones a versatile and highly sought-after component in various market offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2032 | USD 4.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), Fuji Chemical Industries Co., Ltd., Frutarom (IFF), Indena S.p.A., Givaudan (Naturex), Cargill, Inc., Blue California, DSM, Sabinsa Corporation, SIP Ltd., Kemin Industries, Shanghai Freemen, Jarrow Formulas, Solgar Inc., NOW Foods, The Nature's Bounty Co., Glanbia plc, Gencor, Döhler GmbH, A.H.P. Pharmatec GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isoflavones Market Key Technology Landscape

The Isoflavones Market's growth and innovation are intrinsically linked to advancements in its key technology landscape, which spans from sophisticated extraction methods to novel formulation and analytical techniques. Traditional extraction processes, while effective, are increasingly being refined or replaced by more efficient and environmentally friendly technologies. Supercritical fluid extraction (SFE) using CO2, for instance, offers a solvent-free and residue-free method for isolating isoflavones with high purity and yield, appealing to the growing demand for clean-label ingredients. Enzyme-assisted extraction (EAE) and microwave-assisted extraction (MAE) are also gaining prominence for their ability to enhance extraction efficiency, reduce processing time, and minimize energy consumption, thereby lowering operational costs and improving sustainability. These advanced extraction techniques are pivotal in overcoming the challenges of isolating these complex compounds from their natural matrices, ensuring consistent quality and maximizing their therapeutic potential for various applications across the nutraceutical, cosmetic, and pharmaceutical industries.

Beyond extraction, the technology landscape encompasses critical innovations in enhancing the bioavailability and stability of isoflavones, which are often limited by their poor solubility and susceptibility to degradation. Encapsulation technologies, such as microencapsulation and nanoencapsulation, are vital in protecting isoflavones from environmental factors, improving their absorption rates in the human body, and enabling controlled release for sustained effects. Techniques involving liposomes, solid lipid nanoparticles, and cyclodextrins are being actively researched and implemented to create more effective delivery systems, allowing isoflavones to reach target sites in higher concentrations and with greater stability. Furthermore, fermentation technology is emerging as a promising avenue, not only for converting isoflavone glycosides into more bioavailable aglycones but also for producing novel isoflavone derivatives or even entirely new bioactive compounds. This enzymatic conversion can significantly improve the pharmacological activity and functional properties of isoflavones, opening up new product development opportunities. These formulation advancements are critical for maximizing the therapeutic potential of isoflavones, ensuring their effectiveness in diverse applications, and meeting consumer expectations for high-performance health and wellness products, thereby driving continuous innovation within the market.

The analytical and quality control technologies also form a cornerstone of the Isoflavones Market, ensuring product safety, purity, and compliance with stringent regulatory standards. High-Performance Liquid Chromatography (HPLC) remains the gold standard for quantitative analysis of individual isoflavones, providing precise measurements of their concentration in raw materials and finished products. Mass spectrometry (MS), often coupled with chromatography (LC-MS/MS), offers even greater sensitivity and specificity for identifying and characterizing complex isoflavone profiles, detecting impurities, and verifying product authenticity. Nuclear Magnetic Resonance (NMR) spectroscopy and Fourier-Transform Infrared (FTIR) spectroscopy are also employed for structural elucidation and rapid quality assurance checks. These analytical tools are indispensable for manufacturers to guarantee batch-to-batch consistency, validate health claims, and maintain consumer trust. Furthermore, advancements in genomic and proteomic technologies are facilitating deeper research into the mechanisms of action of isoflavones at a molecular level, providing scientific validation for their health benefits and guiding the development of targeted applications. The continuous evolution and integration of these diverse technologies collectively empower the Isoflavones Market to deliver high-quality, efficacious, and innovative products, fostering both scientific credibility and commercial success.

Regional Highlights

- North America: This region represents a significant market for isoflavones, driven by a high awareness of health and wellness, a proactive approach to preventive healthcare, and a substantial aging population seeking natural solutions for age-related conditions like menopause and bone health. The well-established dietary supplement industry and increasing consumer demand for functional foods and beverages fortified with natural ingredients contribute significantly to market growth. Strong research and development activities and sophisticated regulatory frameworks also characterize the North American market, fostering innovation and product diversification.

- Europe: The European market for isoflavones is robust, supported by a health-conscious consumer base and a growing interest in plant-based and natural ingredients. Strict regulatory standards, particularly from the European Food Safety Authority (EFSA), influence product development and market entry, yet the demand for dietary supplements and functional foods addressing women's health and cardiovascular well-being remains strong. Germany, the UK, and France are key contributors, with rising investments in research to substantiate health claims and explore novel applications.

- Asia Pacific (APAC): The APAC region is a dominant force in the Isoflavones Market, primarily due to the traditional high consumption of soy-based foods, especially in countries like China, Japan, and South Korea, where soy forms a staple part of the diet. This ingrained cultural acceptance, coupled with a large population, rapid urbanization, and rising disposable incomes, fuels significant demand for isoflavone-rich products. The region is also a major producer and exporter of soybeans, making it a critical hub for raw material sourcing and manufacturing. Emerging economies within APAC are also showing accelerated growth as health awareness increases.

- Latin America: The Isoflavones Market in Latin America is experiencing gradual growth, driven by increasing health awareness, a burgeoning middle class, and a growing interest in natural health products. Countries like Brazil and Mexico are leading the way, with expanding dietary supplement and functional food sectors. While still developing compared to other regions, the market benefits from a shift towards healthier lifestyles and a willingness to adopt preventive healthcare measures, creating fertile ground for market expansion.

- Middle East and Africa (MEA): This region currently holds a smaller share but is poised for steady growth in the Isoflavones Market. Factors contributing to this growth include increasing healthcare expenditure, rising prevalence of chronic diseases, and a gradual shift in consumer preferences towards natural and nutritional supplements. Economic development, urbanization, and greater access to global health trends are opening up new opportunities for isoflavone-based products, particularly in the United Arab Emirates, Saudi Arabia, and South Africa, as consumers seek improved well-being solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isoflavones Market.- Archer Daniels Midland (ADM)

- Fuji Chemical Industries Co., Ltd.

- Frutarom (IFF)

- Indena S.p.A.

- Givaudan (Naturex)

- Cargill, Inc.

- Blue California

- DSM

- Sabinsa Corporation

- SIP Ltd.

- Kemin Industries

- Shanghai Freemen

- Jarrow Formulas

- Solgar Inc.

- NOW Foods

- The Nature's Bounty Co.

- Glanbia plc

- Gencor

- Döhler GmbH

- A.H.P. Pharmatec GmbH

Frequently Asked Questions

Analyze common user questions about the Isoflavones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are isoflavones and what are their primary health benefits?

Isoflavones are plant-derived compounds, primarily found in soy and red clover, known for their phytoestrogenic properties. Their primary health benefits include alleviating menopausal symptoms, supporting bone health by reducing bone loss, promoting cardiovascular health through cholesterol regulation, and acting as antioxidants. They are also being researched for potential roles in cancer prevention and hormone balance, contributing significantly to overall wellness and preventive health strategies.

Are isoflavones safe for consumption, and what are the potential side effects?

For most healthy individuals, isoflavones are generally considered safe when consumed as part of a balanced diet or at recommended supplement dosages. However, potential side effects can include mild digestive upset, allergic reactions in sensitive individuals, or interactions with certain medications like hormone therapies or blood thinners. Pregnant or breastfeeding women, individuals with hormone-sensitive cancers, or those with thyroid conditions should consult a healthcare professional before taking isoflavone supplements, ensuring safe and appropriate usage tailored to individual health profiles.

What are the main sources of isoflavones, and how can they be incorporated into a daily diet?

The main sources of isoflavones are soybeans and red clover, which contain prominent compounds like genistein, daidzein, and formononetin. They can be easily incorporated into a daily diet through various soy-based foods such as tofu, tempeh, edamame, soy milk, and miso. Red clover can be consumed as an herbal tea or in supplement form. Additionally, functional foods and beverages fortified with isoflavone extracts offer convenient ways to increase intake, supporting nutritional goals for those seeking natural health benefits.

How do regional consumer preferences influence the Isoflavones Market?

Regional consumer preferences significantly influence the Isoflavones Market by driving demand for specific products and sources. In Asia-Pacific, traditional soy-rich diets foster high acceptance and consumption of isoflavones. In contrast, Western markets like North America and Europe see demand driven by an aging population seeking natural supplements for menopausal support and bone health, alongside a growing interest in plant-based alternatives. These preferences shape product development, marketing strategies, and distribution channels, requiring market players to tailor offerings to local cultural, dietary, and health priorities for effective market penetration.

What technological advancements are impacting the future of the Isoflavones Market?

Several technological advancements are significantly impacting the future of the Isoflavones Market. These include advanced extraction techniques like supercritical fluid extraction and enzyme-assisted extraction for higher purity and yield. Encapsulation technologies, such as micro- and nanoencapsulation, are enhancing bioavailability and stability. Furthermore, fermentation processes are improving isoflavone conversion and creating novel derivatives. These innovations are leading to more effective products, better absorption, reduced production costs, and opening new avenues for applications in personalized nutrition, pharmaceuticals, and cosmetics, thereby driving sustained growth and scientific validation for the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager