IT Telecommunication Wires and Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430025 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

IT Telecommunication Wires and Cables Market Size

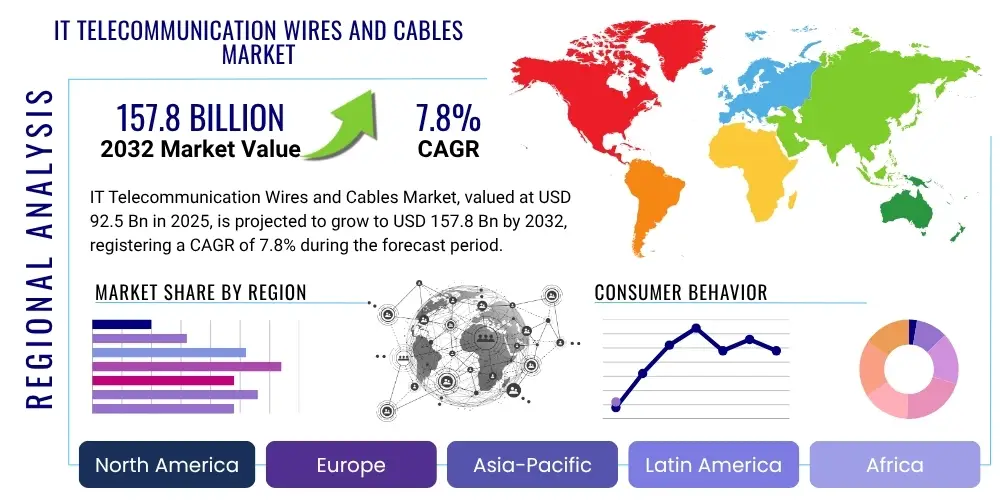

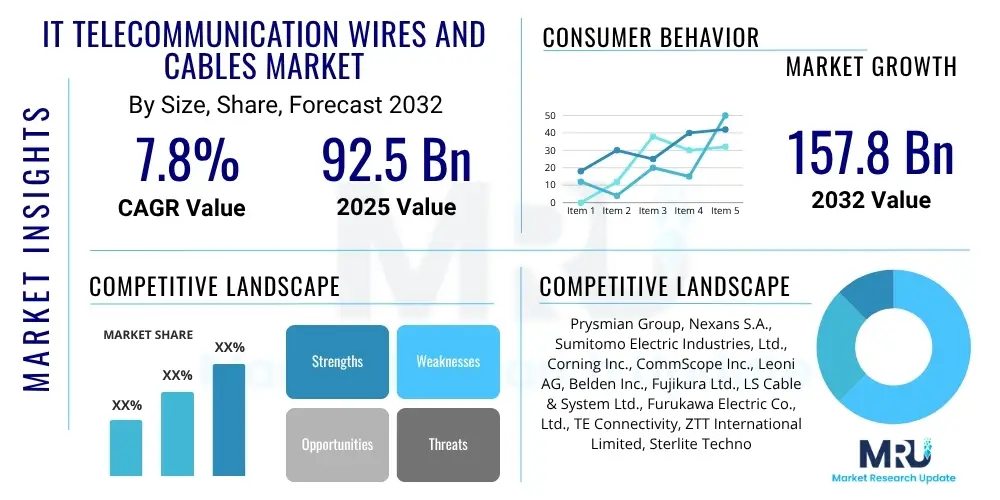

The IT Telecommunication Wires and Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $92.5 Billion in 2025 and is projected to reach $157.8 Billion by the end of the forecast period in 2032.

IT Telecommunication Wires and Cables Market introduction

The IT Telecommunication Wires and Cables Market encompasses the design, manufacturing, and distribution of a wide array of connectivity solutions essential for information technology and telecommunication networks. These products include fiber optic cables, copper cables (such as Ethernet and coaxial), and hybrid cables, all engineered to facilitate high-speed data transmission, voice communication, and video streaming across various infrastructures. These critical components form the backbone of modern digital communication, supporting everything from local area networks (LANs) and wide area networks (WANs) to complex global telecommunications grids. They ensure the reliable and efficient transfer of data, enabling the interconnected world we live in.

Major applications for these wires and cables span across data centers, enterprise networks, telecommunication service provider networks, smart cities, and residential broadband deployments. They are fundamental in connecting servers, switches, routers, and end-user devices, providing the physical conduit for digital traffic. The primary benefits derived from these products include high bandwidth capacity, low latency, enhanced signal integrity, and robust durability, all of which are crucial for maintaining seamless and efficient network operations. The consistent demand for faster and more reliable connectivity underpins the market's sustained growth trajectory, with continuous innovation driving performance improvements.

The market's expansion is significantly driven by global digital transformation initiatives, the rapid rollout of 5G infrastructure, the proliferation of Internet of Things (IoT) devices, and the exponential growth of cloud computing services. Additionally, the increasing demand for data centers, the growing adoption of smart technologies in urban environments, and the persistent need for secure and high-speed enterprise networking contribute to the market's dynamic growth. These factors collectively create a robust demand environment for advanced IT telecommunication wires and cables, pushing manufacturers to innovate and expand their product offerings.

IT Telecommunication Wires and Cables Market Executive Summary

The IT Telecommunication Wires and Cables Market is experiencing significant momentum, propelled by rapid advancements in digital infrastructure and an escalating global demand for connectivity. Key business trends include a heightened focus on fiber optic deployments due to their superior bandwidth capabilities, the continued integration of Power over Ethernet (PoE) solutions for smart building applications, and an increasing emphasis on sustainable manufacturing practices. Market players are also engaging in strategic partnerships and mergers to enhance technological capabilities and expand geographical reach, responding to the growing complexity of network demands and the need for comprehensive end-to-end solutions. This strategic evolution ensures market resilience and adaptability.

Regional trends highlight the Asia Pacific (APAC) as the fastest growing market, driven by massive infrastructure investments in countries like China, India, and Southeast Asian nations for 5G, fiber-to-the-home (FTTH), and smart city projects. North America and Europe, while more mature, exhibit steady demand for upgrades to existing networks, data center expansion, and the ongoing rollout of next-generation cellular technologies. Latin America and the Middle East and Africa (MEA) are emerging as significant growth areas, fueled by increasing internet penetration, government-backed digital initiatives, and investments in new telecommunication backbone infrastructure, presenting lucrative opportunities for market participants.

Segment trends underscore the dominance of fiber optic cables, particularly single-mode fibers, due to their essential role in data centers and long-haul telecommunication networks. Copper cables, including advanced Ethernet categories, maintain strong relevance for last-mile connectivity and local area networks, especially where cost-effectiveness and existing infrastructure leverage are paramount. The market is also witnessing a surge in demand for specialized cables designed for harsh environments, industrial applications, and high-density computing, reflecting a diversification of product needs across various end-use sectors. This segmentation evolution is critical for targeted market strategies and product development.

AI Impact Analysis on IT Telecommunication Wires and Cables Market

User inquiries concerning AI's influence on the IT Telecommunication Wires and Cables Market frequently revolve around how artificial intelligence will drive demand for higher bandwidth and lower latency infrastructure, the integration of AI for predictive maintenance and network optimization, and the potential for new types of smart cabling. There is significant interest in understanding AI's role in processing the massive datasets generated by interconnected devices, thereby necessitating robust and scalable cable networks. Concerns also include the energy consumption of AI-driven data centers and the corresponding need for efficient power and data transmission solutions, along with expectations for AI to enhance the design, manufacturing, and operational efficiency of wire and cable systems.

- Increased demand for high-speed, high-bandwidth fiber optic cables to support AI data processing.

- Development of AI-powered network management tools for predictive maintenance and fault detection in cable infrastructure.

- Optimization of cable routing and resource allocation within data centers using AI algorithms.

- Enhanced manufacturing processes for wires and cables through AI-driven quality control and automation.

- Acceleration of edge computing deployments, requiring robust and low-latency connectivity to local AI inference engines.

- Growth in demand for specialized power cables to meet the high energy requirements of AI-intensive hardware.

- Potential for AI to drive innovation in cable design, leading to more efficient and durable connectivity solutions.

- AI-driven analytics informing strategic network planning and future cable infrastructure investments.

DRO & Impact Forces Of IT Telecommunication Wires and Cables Market

The IT Telecommunication Wires and Cables Market is primarily driven by the relentless global pursuit of digital transformation across industries, the expansive rollout of 5G networks, and the burgeoning ecosystem of Internet of Things (IoT) devices that demand pervasive and high-speed connectivity. The exponential growth of cloud computing services and the subsequent proliferation of hyperscale and enterprise data centers globally create a significant demand for advanced fiber optic and high-grade copper cabling. Additionally, smart city initiatives, emphasizing interconnected urban infrastructure, and the widespread adoption of remote work and education models have further accelerated the need for robust and reliable telecommunication infrastructure, directly impacting cable demand.

However, the market faces several restraints, including the substantial initial capital expenditure required for deploying advanced fiber optic networks, which can be a barrier for smaller service providers or developing regions. Geopolitical trade tensions and a complex global supply chain for raw materials like copper, glass, and polymers pose risks of price volatility and disruptions in production. The intense competition within the market, driven by numerous global and regional players, can also lead to price pressures and compressed profit margins. Furthermore, environmental regulations concerning material sourcing and waste management of obsolete cables introduce additional compliance costs and operational complexities for manufacturers.

Opportunities within this dynamic market are abundant, particularly with the anticipated emergence of 6G networks, which will necessitate even higher bandwidth and lower latency connectivity solutions, pushing the boundaries of current cable technology. The expansion of fiber to the home (FTTH) and fiber to the business (FTTB) in underserved rural and remote areas presents significant growth avenues. Furthermore, major investments in submarine cable projects to connect continents and enhance global internet backbones, alongside the integration of telecommunication cables into smart grid infrastructure for energy management, offer substantial long-term growth prospects. Innovation in sustainable cable solutions and advanced materials also represents a key area for future market development.

Segmentation Analysis

The IT Telecommunication Wires and Cables Market is meticulously segmented across various dimensions to reflect the diverse applications and technological requirements of modern communication infrastructure. This granular segmentation provides a comprehensive understanding of market dynamics, enabling stakeholders to identify specific growth areas and tailor their strategies effectively. The market is typically analyzed by type of cable, application, end-user industry, and installation environment, each revealing unique demand patterns and technological preferences. This detailed breakdown highlights the evolving landscape from traditional copper-based systems to advanced fiber optic networks and specialized hybrid solutions, catering to an ever-increasing demand for data and connectivity.

- By Type

- Fiber Optic Cables

- Single-mode Fiber (SMF)

- Multi-mode Fiber (MMF)

- Copper Cables

- Ethernet Cables (Cat5e, Cat6, Cat6a, Cat7, Cat8)

- Coaxial Cables

- Dataline Cables

- Hybrid Cables

- Fiber Optic Cables

- By Application

- Data Centers

- Enterprise Networks

- Telecom Infrastructure (Access Network, Metro Network, Long-haul Network)

- Residential Connectivity (FTTH, FTTB)

- Industrial Networks

- Security & Surveillance Systems

- Broadcasting & Media

- By End-User

- Telecommunication Service Providers (ISPs, Mobile Operators)

- IT & Network Providers

- Government & Defense

- Manufacturing Sector

- Healthcare Industry

- Education Sector

- Media & Entertainment

- Energy & Utilities

- By Installation

- Indoor (In-building, Riser, Plenum)

- Outdoor (Aerial, Underground, Submarine)

Value Chain Analysis For IT Telecommunication Wires and Cables Market

The value chain for the IT Telecommunication Wires and Cables Market begins with upstream activities involving the sourcing and processing of critical raw materials. This segment includes suppliers of high-purity copper rods, glass preforms for fiber optics, various plastic polymers for insulation and jacketing, and specialized chemical additives. These raw material suppliers form the foundational layer, with their quality, consistency, and pricing directly influencing the manufacturing costs and the ultimate performance characteristics of the finished cables. Relationships with reliable and cost-effective upstream partners are crucial for maintaining competitive pricing and ensuring uninterrupted production schedules, particularly given the global nature of material supply chains.

Moving downstream, the value chain progresses through the manufacturing and assembly stages, where raw materials are transformed into various types of wires and cables. This involves drawing copper wires, fabricating optical fibers, insulating conductors, twisting pairs, stranding multiple elements, and applying protective jackets. Following manufacturing, products are distributed through a combination of direct and indirect channels. Direct sales often involve large-scale projects with major telecommunication companies or data center operators, where manufacturers provide tailored solutions and direct technical support. Indirect channels utilize a network of distributors, wholesalers, and value-added resellers (VARs) who cater to a broader range of smaller enterprises, residential customers, and specialized applications, providing local inventory and installation services.

The final stage of the value chain involves the end-user deployment and integration of these cables into functional networks. This includes professional installers, system integrators, and network operators who design, install, test, and maintain the complex telecommunication infrastructure. The efficiency and expertise at this stage are paramount to ensuring the optimal performance and longevity of the cable systems. Post-installation services, including maintenance, upgrades, and eventual recycling or disposal, also form part of the extended value chain, emphasizing the lifecycle management of these essential IT assets. The entire chain demands close coordination and collaboration among all participants to deliver high-quality, reliable, and cost-effective connectivity solutions.

IT Telecommunication Wires and Cables Market Potential Customers

Potential customers and end-users of IT Telecommunication Wires and Cables represent a broad spectrum of industries and organizations that rely heavily on robust and high-speed digital communication infrastructure. At the forefront are telecommunication service providers, including Internet Service Providers (ISPs) and mobile network operators, who require vast quantities of fiber optic and copper cables for their access, metro, and long-haul networks to deliver broadband internet, mobile data, and voice services to millions of subscribers. These entities are continually investing in network upgrades and expansions to meet the escalating demand for bandwidth driven by streaming, cloud services, and 5G deployment.

Another significant customer segment includes large enterprises and corporate entities across various sectors such as finance, healthcare, manufacturing, and technology. These organizations utilize IT telecommunication cables for building and maintaining their internal data centers, local area networks (LANs), and wide area networks (WANs) to support their mission-critical operations, data storage, and inter-office communication. The push towards digital transformation, the adoption of cloud-based applications, and the implementation of smart building technologies are consistently driving their demand for reliable and high-performance cabling solutions, often requiring specialized fire-rated or armored cables for enhanced security and durability.

Furthermore, government agencies and defense organizations are substantial buyers, necessitating secure and resilient communication infrastructure for national security, public services, and emergency response systems. The growing demand from the construction industry, particularly for new residential and commercial developments that require pre-wired infrastructure, also contributes significantly to the market. Additionally, data center operators, who serve as the backbone for cloud computing and content delivery, represent a rapidly expanding customer base with an insatiable need for high-density, low-latency fiber optic cabling to connect servers, storage arrays, and network equipment within their facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $92.5 Billion |

| Market Forecast in 2032 | $157.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans S.A., Sumitomo Electric Industries, Ltd., Corning Inc., CommScope Inc., Leoni AG, Belden Inc., Fujikura Ltd., LS Cable & System Ltd., Furukawa Electric Co., Ltd., TE Connectivity, ZTT International Limited, Sterlite Technologies Limited (STL), Encore Wire Corporation, Southwire Company, LLC, Hitachi Cable, Ltd., Polycab India Ltd., KEI Industries Ltd., ALFALAK Fiber Optic Co., Hengtong Optic-Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Telecommunication Wires and Cables Market Key Technology Landscape

The IT Telecommunication Wires and Cables Market is characterized by a dynamic technology landscape, constantly evolving to meet the escalating demands for speed, bandwidth, and reliability. Fiber optic technologies continue to dominate high-speed data transmission, with significant advancements in single-mode fiber (SMF) for long-haul and data center interconnects, and multi-mode fiber (MMF) optimized for shorter distances within buildings and campuses. Innovations in fiber manufacturing, such as bend-insensitive fibers and those capable of supporting higher data rates, are extending their applicability and enhancing installation flexibility. The ongoing deployment of Fiber to the X (FTTx) architectures, including Fiber to the Home (FTTH) and Fiber to the Business (FTTB), heavily relies on these sophisticated fiber optic solutions, enabling gigabit and multi-gigabit broadband services.

Parallel to fiber optic developments, copper cable technologies, particularly Ethernet cables, have seen continuous evolution. The progression from Category 5e (Cat5e) to Cat6, Cat6a, Cat7, and now Cat8 cables signifies a consistent push for increased bandwidth and reduced crosstalk over shorter distances. Cat8 cables, designed for 25GBASE-T and 40GBASE-T applications, are increasingly vital for data center environments where short, high-speed links are common, offering a cost-effective alternative to fiber in specific scenarios. Furthermore, Power over Ethernet (PoE) technology is gaining widespread adoption, enabling both data and power delivery over a single Ethernet cable, which is critical for smart building applications, IoT devices, and IP cameras, simplifying infrastructure and reducing installation costs.

Beyond traditional copper and fiber, the market is witnessing the development of hybrid cables that combine optical fibers and copper conductors within a single jacket, providing integrated solutions for both data and power transmission. This is particularly beneficial for remote powering of network equipment and distributed antenna systems (DAS). Research and development also focus on advanced insulation materials that enhance fire safety, reduce smoke emission, and provide better protection against environmental factors. Technologies like advanced polymer composites and fluoropolymers are being integrated to improve cable performance, durability, and compliance with stringent international safety and environmental standards, ensuring a robust and future-proof telecommunication infrastructure.

Regional Highlights

- North America: This region represents a mature yet highly dynamic market, characterized by significant investments in data center expansion and upgrades to support cloud computing and enterprise digitalization. The rapid deployment of 5G networks across the United States and Canada drives substantial demand for fiber optic cables. Additionally, initiatives for smart infrastructure and robust cybersecurity concerns fuel the adoption of high-performance and secure cabling solutions.

- Europe: The European market demonstrates stable growth, driven by stringent regulatory frameworks promoting digital connectivity and substantial investments in fiber-to-the-home (FTTH) and smart city projects. Countries like Germany, France, and the UK are consistently upgrading their telecommunication backbones. There is a strong emphasis on sustainable and environmentally compliant cable manufacturing processes in this region.

- Asia Pacific (APAC): APAC is the fastest-growing region, primarily fueled by massive infrastructure developments in emerging economies such as China, India, and Southeast Asian nations. Extensive 5G rollouts, government-backed digital initiatives, and increasing internet penetration are creating unprecedented demand for both fiber optic and high-grade copper cables. Data center construction boom and smart city initiatives further propel market expansion.

- Latin America: This region is an emerging market with significant growth potential, driven by improving economic conditions and increasing internet penetration. Countries like Brazil, Mexico, and Argentina are investing in expanding their telecommunication networks, particularly in underserved rural areas, leading to a steady demand for fiber optic and last-mile copper solutions. Government support for digital inclusion plays a vital role.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth due to government-led digital transformation agendas, significant investments in smart city projects (e.g., in UAE and Saudi Arabia), and the ongoing expansion of telecommunication infrastructure. The increasing adoption of cloud services and the establishment of new data centers are key drivers for high-bandwidth cable demand in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Telecommunication Wires and Cables Market.- Prysmian Group

- Nexans S.A.

- Sumitomo Electric Industries, Ltd.

- Corning Inc.

- CommScope Inc.

- Leoni AG

- Belden Inc.

- Fujikura Ltd.

- LS Cable & System Ltd.

- Furukawa Electric Co., Ltd.

- TE Connectivity

- ZTT International Limited

- Sterlite Technologies Limited (STL)

- Encore Wire Corporation

- Southwire Company, LLC

- Hitachi Cable, Ltd.

- Polycab India Ltd.

- KEI Industries Ltd.

- ALFALAK Fiber Optic Co.

- Hengtong Optic-Electric

Frequently Asked Questions

What are the primary types of cables used in the IT Telecommunication market?

The primary types include fiber optic cables for high-speed, long-distance data transmission, and copper cables like Ethernet (Cat5e to Cat8) and coaxial cables for shorter distances, local networks, and specific broadband applications.

How is 5G technology influencing the demand for IT Telecommunication wires and cables?

5G technology is significantly boosting demand, particularly for fiber optic cables, as it requires dense network infrastructure, extensive fiber backhaul to cell towers, and high-capacity connectivity to support its low-latency and high-bandwidth capabilities.

Which region is expected to show the highest growth in the IT Telecommunication Wires and Cables Market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth, driven by substantial investments in digital infrastructure, rapid 5G deployment, and extensive smart city initiatives in countries like China, India, and Southeast Asia.

What are the main challenges faced by manufacturers in this market?

Manufacturers face challenges such as high initial deployment costs for advanced networks, supply chain vulnerabilities for raw materials, intense market competition leading to pricing pressures, and increasingly stringent environmental regulations.

What role do data centers play in the demand for IT Telecommunication cables?

Data centers are critical drivers of demand, especially for high-density fiber optic cables, as they require massive bandwidth and low-latency connectivity to interconnect servers, storage, and network equipment within their facilities, supporting cloud computing and data storage needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager