Ka-band Satellite Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427344 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ka-band Satellite Equipment Market Size

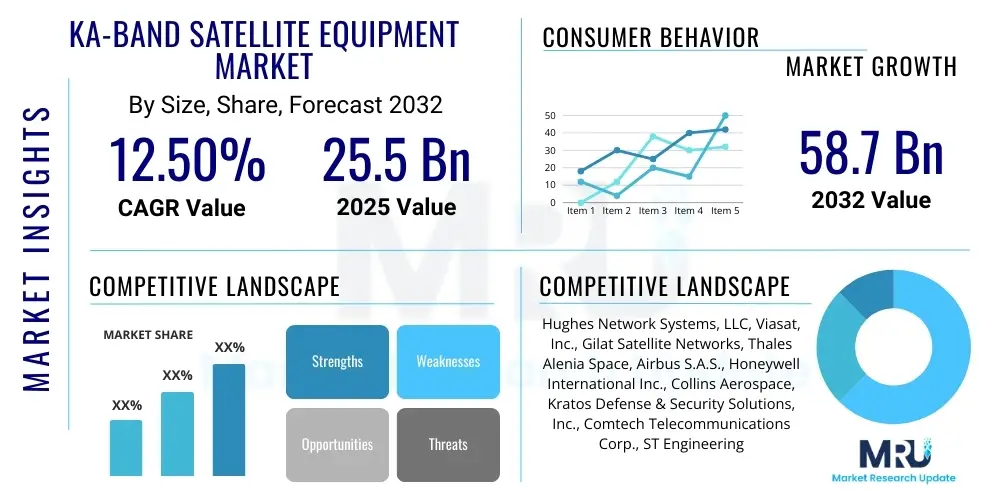

The Ka-band Satellite Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 58.7 Billion by the end of the forecast period in 2032.

Ka-band Satellite Equipment Market introduction

The Ka-band Satellite Equipment Market is at the forefront of the global telecommunications evolution, encapsulating a sophisticated array of hardware and software solutions specifically designed for operation within the Ka-band frequency spectrum, typically ranging from 26.5 to 40 GHz. This high-frequency band is revolutionizing connectivity by offering significantly larger bandwidth and superior data throughput capacities compared to traditional C-band or Ku-band systems. Its inherent ability to facilitate high-speed internet access, robust enterprise networking, and highly secure governmental and military communications positions it as a critical technology for modern digital infrastructure. The ongoing advancements in Ka-band technology, including innovations that allow for smaller antenna footprints and enhanced spectral efficiency, are pivotal drivers behind its rapidly expanding adoption across a multitude of diverse sectors, fostering a vibrant ecosystem of innovation in both geostationary (GEO) and increasingly, non-geostationary orbit (NGSO) satellite constellations.

The primary applications for Ka-band satellite equipment are extensive and vital, addressing pressing global connectivity needs. These include providing high-speed broadband internet services to regions that are unserved or underserved by terrestrial networks, offering essential cellular backhaul solutions for expanding 4G and 5G mobile networks, and ensuring seamless, high-performance connectivity for in-flight and maritime operations. Furthermore, Ka-band is indispensable for secure government communications, disaster recovery efforts, and the establishment of resilient enterprise VSAT (Very Small Aperture Terminal) networks for distributed operations. The benefits derived from Ka-band technology are substantial, encompassing not only dramatically enhanced data rates and significantly reduced latency in next-generation satellite systems but also the robust capability to support demanding applications such as high-definition video streaming, large-scale data transfers, and real-time cloud-based services.

Key driving factors propelling the Ka-band markets impressive expansion include the exponential global demand for ubiquitous, high-speed, and ultra-reliable connectivity across consumer, commercial, and governmental segments. The proliferation of Internet of Things (IoT) devices, requiring consistent and wide-area network access, further underscores the necessity for advanced satellite solutions. Crucially, the continuous development and aggressive deployment of next-generation satellite constellations, particularly those in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO), are fundamentally reliant on Ka-band frequencies to deliver their promised high-throughput, low-latency capabilities, thereby creating a sustained and escalating demand for specialized Ka-band equipment and services globally.

Ka-band Satellite Equipment Market Executive Summary

The Ka-band Satellite Equipment market is currently undergoing a period of dynamic and robust expansion, primarily propelled by the relentless acceleration of global demand for high-throughput satellite (HTS) services and the pervasive adoption of 5G infrastructure, which critically requires highly reliable and extensive backhaul solutions. Prevailing business trends underscore a significant surge in capital expenditure directed towards satellite manufacturing capabilities, innovative launch services, and the strategic formation of partnerships and mergers. These strategic moves are meticulously orchestrated to consolidate market share, foster rapid technological advancements, and enhance operational efficiencies across the value chain. A notable paradigm shift within the industry involves a growing emphasis on software-defined satellites and the virtualization of ground segment infrastructure, which collectively promise enhanced operational flexibility, unprecedented scalability for both satellite operators and service providers, and a reduction in long-term operational costs. Moreover, emerging economies globally are proving to be exceptionally fertile ground for the deployment of new Ka-band solutions, particularly in their concerted efforts to bridge the pervasive digital divide, while more established markets are predominantly focused on upgrading their existing satellite communication infrastructure to meticulously meet the ever-increasing demands for higher bandwidth and superior service quality.

From a regional perspective, North America and Europe consistently maintain their positions as significant revenue generators, largely attributed to their early adoption of advanced satellite technologies, robust technological innovation ecosystems, and sustained investments, especially within the rapidly evolving commercial aviation and maritime sectors. However, the Asia-Pacific region is unequivocally poised for the most substantial and transformative growth, driven by its vast unserved populations, exponentially increasing internet penetration rates, and concerted government initiatives actively promoting digital connectivity across its diverse territories. Developing regions spanning Latin America and Africa are also witnessing a pronounced surge in the adoption of Ka-band for critical communication infrastructure, vital for economic and social development. Analyzing segment trends reveals a particularly strong and consistent demand for sophisticated ground equipment, encompassing advanced user terminals, high-capacity gateways, and complex network management systems. Concurrently, there is robust growth observed in managed services, which offer comprehensive, end-to-end connectivity solutions designed to simplify deployment and operation for clients. The advent and rapid deployment of Low Earth Orbit (LEO) constellations, in particular, are exerting a profound impact, driving intensive innovation in advanced antenna design, signal processing capabilities, and intelligent routing algorithms to effectively support dynamic beam steering, rapid satellite handovers, and ultra-low latency requirements inherent in these next-generation networks.

AI Impact Analysis on Ka-band Satellite Equipment Market

The pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) methodologies is fundamentally transforming and redefining the Ka-band Satellite Equipment market, effectively addressing and proactively answering common user questions pertaining to how these advanced technologies can tangibly enhance operational efficiency, optimize complex network performance, and unlock entirely new frontiers of service capabilities. Users frequently pose critical inquiries regarding the specific mechanisms through which AI can be leveraged to significantly improve satellite resource allocation, accurately predict potential network outages before they occur, and autonomously automate highly complex ground station operations, thereby reducing human intervention and error. The overarching core concern within the industry revolves around the strategic imperative of harnessing AI to effectively manage the escalating complexity inherent in high-throughput and multi-orbit satellite networks, ensuring not only the most reliable and highest quality service delivery possible but also simultaneously minimizing burdensome operational costs. Expectations are notably elevated for AI to facilitate highly intelligent beamforming, dynamic and adaptive bandwidth allocation in real-time, and proactive fault detection systems, all of which are ultimately poised to culminate in the creation of demonstrably more resilient, agile, and cost-effective satellite communication systems.

AI’s transformative influence permeates every layer of the Ka-band satellite ecosystem, extending comprehensively from the initial conceptual design and engineering phase of intricate satellite components to the precise, real-time management of entire vast constellations. This profound impact promises substantial advancements in both data processing capabilities and sophisticated decision-making mechanisms. This significant paradigm shift enables the development of a more responsive and inherently adaptive network infrastructure, a characteristic that is absolutely crucial for effectively handling the massive volumes of data and the incredibly diverse application requirements that are intrinsically associated with the high-capacity Ka-band spectrum. The integration of AI also provides unprecedented opportunities for advanced analytics, offering deep, actionable insights into granular user behavior patterns and precise network utilization metrics. This capability empowers service providers to meticulously tailor their offerings, optimize their infrastructure investments with greater precision, and anticipate future demand more accurately.

The strategic focus is increasingly centered on developing and deploying highly autonomous, self-healing networks that possess the innate ability to adapt dynamically to rapidly changing environmental conditions and evolving user demands with minimal to no human intervention. AI algorithms are instrumental in real-time spectrum management, mitigating interference, and optimizing power usage, which are critical for maximizing the efficiency and longevity of Ka-band satellite assets. Furthermore, advanced AI-driven solutions are enhancing cybersecurity measures for satellite communications, identifying and neutralizing threats with greater speed and accuracy, thereby safeguarding vital data streams. The promise of AI in the Ka-band market is a future where satellite networks are not just connected but intelligently managed, leading to unparalleled reliability, performance, and cost-efficiency for a global user base.

- Enhanced network optimization through dynamic bandwidth allocation and intelligent traffic management.

- Predictive maintenance for satellite components and ground station equipment, reducing downtime.

- Automated fault detection and recovery, improving network resilience and reliability.

- Optimized beamforming and steerable antenna control for efficient resource utilization.

- Real-time processing of massive data streams from high-throughput satellites.

- AI-driven cybersecurity for robust protection against network threats.

- Improved customer experience through personalized services and proactive support.

DRO & Impact Forces Of Ka-band Satellite Equipment Market

The evolutionary trajectory and sustained growth of the Ka-band Satellite Equipment market are intricately shaped by a complex and highly dynamic interplay of inherent drivers, formidable restraints, emergent opportunities, and pervasive external impact forces that collectively dictate its developmental path and overall market direction. Foremost among the key drivers is the escalating and insatiable global demand for high-speed internet connectivity, particularly pronounced in geographically remote and underserved rural and urban fringe areas where terrestrial infrastructure is either non-existent or economically unfeasible. Additionally, the widespread and accelerating rollout of next-generation 5G networks globally critically requires robust, high-capacity, and low-latency backhaul solutions, a role ideally suited for Ka-band satellite technology. The increasing adoption of satellite broadband across diverse applications such as enterprise networking, maritime navigation, and in-flight entertainment further solidifies its market position. Crucially, the continuous and aggressive deployment of advanced High Throughput Satellites (HTS) and innovative new Low Earth Orbit (LEO) constellations, which are inherently designed to leverage Ka-band frequencies for their advanced capabilities, is a monumental factor amplifying market expansion. These synergistic factors collectively push the technological boundaries of satellite communication, firmly establishing it as an indispensable and integral component of the global digital infrastructure, enabling connectivity on an unprecedented scale.

Despite these powerful growth drivers, the Ka-band market concurrently faces a number of significant restraints that temper its expansion. A primary impediment is the substantial initial capital expenditure required for the rigorous research, development, manufacturing, launch, and subsequent deployment of sophisticated satellite systems, as well as the extensive ground segment infrastructure. Such high upfront costs can present a formidable barrier to entry for prospective new market participants and smaller innovators. Furthermore, the market is navigating an increasingly complex landscape of regulatory hurdles and the demanding imperative for intricate spectrum coordination across a myriad of international bodies and national authorities, adding layers of operational complexity and potential delays. A specific technical challenge intrinsic to higher frequency bands like Ka-band is signal attenuation, commonly known as "rain fade," which significantly impacts signal strength during heavy precipitation. Effectively mitigating this phenomenon necessitates the deployment of highly sophisticated and often costly techniques, thereby increasing overall system complexity and operational expenditures.

Conversely, the market is rich with burgeoning opportunities, particularly in bridging the pervasive global digital divide by providing affordable, high-speed internet access to previously unconnected populations. The seamless integration of satellite communication with existing and future terrestrial 5G networks represents a monumental opportunity for hybrid network architectures. Moreover, there is significant potential in developing highly specialized Ka-band solutions tailored for emergent applications such as ubiquitous IoT backhaul, enabling real-time data collection from millions of devices, facilitating secure communications for autonomous vehicles, and establishing resilient communication links for rapid disaster recovery and emergency response scenarios. External impact forces, encompassing rapid and continuous technological advancements in both satellite and ground segment equipment, the evolving geopolitical landscapes that profoundly influence international space policies and regulations, and dynamic global economic conditions that directly affect investment flows and market liquidity, continuously exert pressure and influence on the markets strategic direction and competitive intensity, compelling all stakeholders to constantly innovate, adapt, and strategically position themselves for sustained growth.

Segmentation Analysis

The Ka-band Satellite Equipment Market is meticulously segmented based on a comprehensive understanding of its constituent components, diverse applications, and varied end-users, thereby offering an exceptionally granular and insightful perspective into underlying market dynamics, evolving technological preferences, and prevailing growth opportunities across numerous specialized areas. This multi-faceted segmentation framework is instrumental for conducting detailed analyses of demand patterns, identifying critical technological adoption trends, and discerning strategic investment priorities within distinct industry verticals and operational environments. The component segmentation typically encompasses a broad spectrum of critical hardware and software elements, including advanced transceivers, high-gain antennas, sophisticated modems, powerful amplifiers, and essential processing units that collectively form the backbone of a complete Ka-band communication system. Application segmentation delves into the manifold ways in which Ka-band technology is utilized, ranging from providing ubiquitous consumer broadband connectivity to supporting highly specialized and secure governmental and military operations. Meanwhile, end-user categories meticulously highlight the diverse clientele that actively leverages Ka-band capabilities, extending from major telecommunication operators and internet service providers to global maritime fleets and commercial aviation companies. This detailed market breakdown allows for a precise understanding of where growth is concentrated and how market participants can best tailor their products and services.

- By Component:

- Transceivers

- Antennas (VSAT, Earth Station)

- Modems

- Amplifiers (SSPAs, TWTAs)

- Converters (Up-converters, Down-converters)

- Processors & Baseband Equipment

- By Application:

- Broadband Internet Services

- Cellular Backhaul

- Enterprise & VSAT Networks

- Maritime & Aero Connectivity

- Government & Defense

- Disaster Recovery & Emergency Services

- By End User:

- Telecommunication Operators & ISPs

- Government & Defense Agencies

- Enterprises

- Aviation & Maritime Sectors

- Media & Broadcast

Ka-band Satellite Equipment Market Value Chain Analysis

The intricate value chain associated with the Ka-band Satellite Equipment Market comprises a highly complex and interconnected series of activities, commencing from the fundamental upstream processes of specialized component manufacturing and extending comprehensively through to downstream service delivery and direct end-user engagement, thereby involving a multifaceted ecosystem of diverse stakeholders. The upstream segment is primarily concerned with the rigorous research, development, and precision manufacturing of highly sophisticated satellite components and advanced ground equipment. This includes, but is not limited to, the production of highly specialized radio frequency (RF) chips, cutting-edge RF components, high-performance antennas, and precision-engineered modulators and demodulators. Key players operating within this foundational stage are typically highly specialized technology companies with expertise in aerospace electronics, advanced telecommunications hardware, and innovative material science. Their pioneering innovations directly and profoundly impact the overall performance, reliability, and cost-effectiveness of the entire Ka-band communication system. This crucial foundational stage effectively dictates the technological capabilities, future scalability, and inherent efficiencies of Ka-band networks, influencing critical parameters ranging from achievable data rates and signal integrity to overall spectral efficiency and longevity of the deployed systems.

As the value chain progresses downstream, it seamlessly extends to encompass critical entities such as satellite operators, who are responsible for the ownership, management, and operational oversight of vast satellite constellations, including those in Geostationary Earth Orbit (GEO), Medium Earth Orbit (MEO), and Low Earth Orbit (LEO). This segment also includes ground segment integrators, whose expertise lies in the meticulous deployment, commissioning, and ongoing maintenance of sophisticated earth stations, gateway facilities, and complex network operations centers. Further downstream are the service providers, who are ultimately responsible for delivering comprehensive Ka-band connectivity solutions directly to a diverse base of end-users. The distribution channels employed are notably varied, ranging from direct sales models targeting large-scale telecommunication companies and government entities to more intricate indirect channels facilitated through a network of value-added resellers (VARs) and expert system integrators. These indirect partners often play a crucial role in tailoring bespoke solutions to address the highly specific and nuanced needs of individual customers. The seamless and efficient interaction and strong collaborative partnerships between equipment manufacturers, satellite operators, and service providers are absolutely crucial for ensuring the successful integration of technologies and the efficient, reliable delivery of high-quality Ka-band services. The contemporary evolution of this value chain is increasingly propelled by the adoption of software-defined functionalities and virtualized network architectures, signaling a transformative shift towards more agile, adaptable, and highly responsive service delivery models that can scale rapidly to meet emergent market demands.

Ka-band Satellite Equipment Market Potential Customers

The Ka-band Satellite Equipment Market caters to an exceptionally broad and diverse spectrum of potential customers, all fundamentally united by their critical need for high-speed, ultra-reliable, and geographically ubiquitous connectivity solutions. These wide-ranging end-users and discerning buyers span across myriad sectors, from colossal multinational corporations demanding seamless global communication to individual consumers residing in remote or underserved geographical areas, each keenly seeking to harness the advanced and transformative capabilities offered by state-of-the-art Ka-band technology. Telecommunication operators and prominent Internet Service Providers (ISPs) undeniably constitute a substantial and enduring customer base within this market. They extensively utilize Ka-band for essential cellular backhaul operations, meticulously extending critical broadband services to often neglected rural populations, and strategically offering satellite-based internet as either a primary or a resilient backup connectivity solution. Their persistent demand is overwhelmingly driven by the imperative to dramatically expand network coverage and consistently meet the escalating and ever-increasing data consumption requirements of their burgeoning subscriber bases, particularly for the widespread deployment and optimization of 4G and nascent 5G mobile networks.

A second, equally critical and rapidly expanding segment of the market encompasses various government and defense agencies worldwide. These entities heavily depend on Ka-band satellite solutions for establishing secure, high-bandwidth communications channels, facilitating advanced intelligence gathering operations, enhancing border security, and supporting critical mission-specific operations in geographically challenging regions where conventional terrestrial infrastructure is either non-existent, highly unreliable, or deliberately compromised. The burgeoning maritime and aviation sectors represent swiftly growing customer groups, characterized by their insistent demand for utterly seamless, high-performance, and high-capacity in-flight and at-sea connectivity for both passenger entertainment and vital operational data transfer. Furthermore, a diverse array of enterprises across a multitude of industries, including the demanding energy sector, remote mining operations, and large-scale construction projects, form a substantial and growing customer base. These enterprises require robust and reliable Ka-band VSAT networks to support their geographically dispersed remote sites, enabling efficient data transfer, streamlined operational management, and essential employee communication. The rapidly evolving landscape of the Internet of Things (IoT) and pervasive machine-to-machine (M2M) communications further significantly expands the potential customer base, as these applications increasingly rely on dependable satellite links for global data collection, precision asset tracking, and remote monitoring in challenging and isolated environments, solidifying Ka-bands role as a cornerstone of global digital transformation.

Ka-band Satellite Equipment Market Key Technology Landscape

The Ka-band Satellite Equipment Market is distinguished by a highly dynamic and continuously accelerating technology landscape, profoundly shaped by relentless innovation aimed at dramatically enhancing throughput capacities, significantly reducing communication latency, and vastly improving overall spectral efficiency. High Throughput Satellites (HTS) stand as a pivotal cornerstone of this advanced landscape, expertly leveraging sophisticated multi-spot beam architectures and advanced frequency reuse techniques to deliver an unparalleled increase in capacity compared to traditional satellite systems. This groundbreaking technology facilitates unprecedented data rates and enables the highly cost-effective delivery of robust broadband services across expansive geographical areas, particularly with the advent of Very High Throughput Satellites (VHTS) and Ultra High Throughput Satellites (UHTS), which are consistently pushing the boundaries of achievable capacity further and further. Concurrently, the ground segment is undergoing equally revolutionary transformations, with significant advancements in phased array antennas, electronically steerable antennas (ESAs), and compact flat panel antennas (FPAs) becoming absolutely crucial for next-generation Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations. These innovations enable rapid and precise beam switching, dynamic tracking of fast-moving satellites, and seamless handover capabilities, essential for maintaining continuous connectivity in multi-orbit environments.

Beyond the realm of physical hardware, the profound technological advancements occurring in software-defined satellites and their associated ground systems are proving to be exceptionally pivotal, affording operators vastly greater flexibility and unprecedented reconfigurability of vital network resources. This transformative shift encompasses the application of cutting-edge Software-Defined Networking (SDN) and Network Function Virtualization (NFV) principles directly to satellite ground segments. These technologies empower operators to dynamically and intelligently allocate bandwidth resources in real-time, efficiently manage a diverse portfolio of services, and swiftly implement new features and functionalities with unparalleled agility. Moreover, significant strides in on-board processing and advanced digital payload technologies are fundamentally transforming satellite capabilities, allowing for more intricate data routing, sophisticated error correction algorithms, and even advanced Artificial Intelligence/Machine Learning (AI/ML) inferencing directly on the satellite itself. This reduction in reliance on ground infrastructure not only enhances network resilience but also significantly decreases end-to-end latency. Furthermore, continuous innovations in modem technologies, which incorporate highly adaptive coding and modulation (ACM) techniques and advanced interference mitigation algorithms, are absolutely crucial for maximizing spectral efficiency and ensuring robust link availability even in the most challenging Ka-band environmental conditions, thereby guaranteeing highly reliable and resilient communication links for a remarkably diverse array of mission-critical applications across various sectors globally.

Regional Highlights

- North America: A mature market with high adoption rates, particularly in commercial broadband, aviation, and government/defense sectors. Significant R&D investment and presence of major market players drive innovation.

- Europe: Strong focus on telecom infrastructure, maritime connectivity, and secure government communications. EU initiatives for digital inclusion and space programs foster market growth.

- Asia-Pacific: The fastest-growing region, fueled by increasing internet penetration, rapid economic development, and large unserved populations. China, India, and Southeast Asian countries are key contributors, investing heavily in satellite broadband and cellular backhaul.

- Latin America: Emerging market with growing demand for rural broadband, cellular backhaul, and enterprise connectivity in remote areas. Government programs to bridge the digital divide are significant drivers.

- Middle East & Africa (MEA): Growing importance for essential communication infrastructure, particularly in regions with limited terrestrial connectivity. Investments in oil & gas, defense, and expanding telecommunications drive demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ka-band Satellite Equipment Market.- Hughes Network Systems, LLC (EchoStar Corporation)

- Viasat, Inc.

- Gilat Satellite Networks

- Thales Alenia Space

- Airbus S.A.S.

- Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- Kratos Defense & Security Solutions, Inc.

- Comtech Telecommunications Corp.

- ST Engineering iDirect

Frequently Asked Questions

What are the primary advantages of Ka-band satellite equipment?

Ka-band satellite equipment offers significantly higher data throughput and bandwidth compared to C-band or Ku-band, enabling faster internet speeds, smaller antenna sizes, and more efficient spectral utilization, making it ideal for high-density applications.

How does Ka-band address the digital divide?

Ka-band technology provides high-speed internet access to remote and underserved areas lacking terrestrial infrastructure, facilitating economic development, education, and healthcare access by bridging the global digital divide effectively.

What challenges are associated with Ka-band satellite communication?

Key challenges include higher susceptibility to rain fade (signal attenuation during heavy precipitation), which requires advanced mitigation techniques, and higher initial deployment costs compared to lower frequency bands.

What is the role of Ka-band in 5G cellular backhaul?

Ka-band satellites are crucial for 5G cellular backhaul, providing high-capacity, low-latency links to connect remote 5G base stations to the core network, supporting ubiquitous 5G coverage, especially in areas where fiber is impractical.

How is AI impacting the Ka-band satellite equipment market?

AI is enhancing Ka-band networks through dynamic bandwidth allocation, predictive maintenance, automated fault detection, and intelligent beamforming, leading to improved efficiency, reliability, and service personalization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager