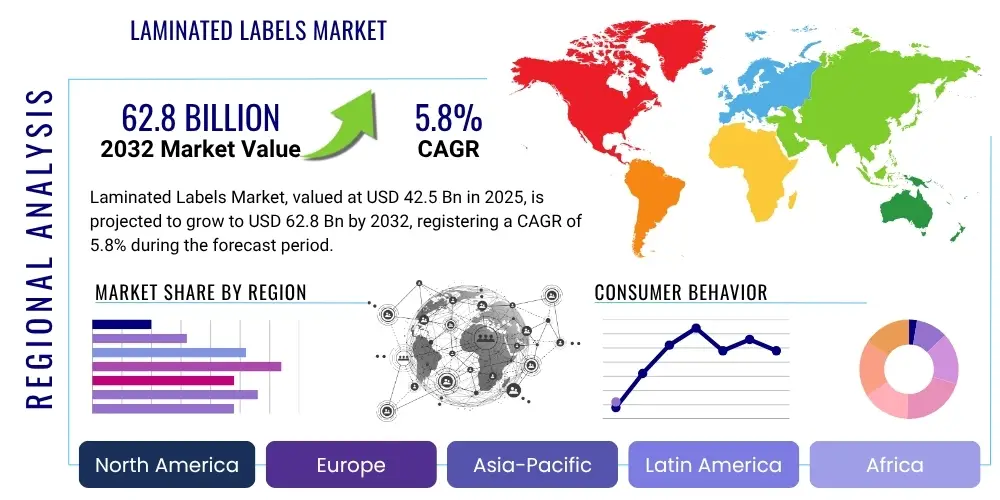

Laminated Labels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431293 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Laminated Labels Market Size

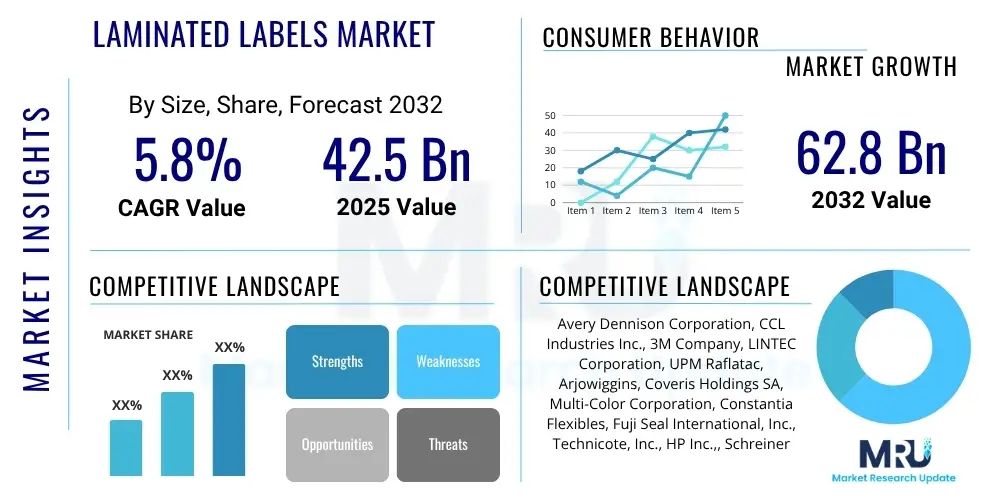

The Laminated Labels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 42.5 Billion in 2025 and is projected to reach USD 62.8 Billion by the end of the forecast period in 2032.

Laminated Labels Market introduction

The laminated labels market is broadly defined by the production and consumption of multi-layered adhesive labels meticulously engineered for superior durability, robust protection, and enhanced aesthetic appeal. These labels are typically constructed from several distinct layers: a printable face stock material (such as paper, plastic film, or foil), a pressure-sensitive adhesive layer for attachment, and critically, a transparent protective laminate film applied over the printed surface. This intricate, multi-layered construction imbues the labels with exceptional resistance to a wide array of environmental stressors, including moisture ingress, exposure to harsh chemicals, abrasive physical wear, and damaging ultraviolet (UV) radiation. Consequently, laminated labels have become indispensable in demanding application environments and for products requiring long-term legibility and integrity in their labeling, safeguarding both product information and brand image throughout their lifecycle.

The major applications for laminated labels are incredibly diverse, spanning across a vast array of industrial and consumer sectors. Prominent among these are the high-volume industries of food and beverages, pharmaceuticals, cosmetics and personal care, automotive, and the rapidly expanding logistics and consumer durables sectors. In the food and beverage industry, for instance, laminated labels are crucial for products exposed to refrigeration, freezing, or high moisture conditions, ensuring nutritional information and branding remain intact. Within the pharmaceutical sector, these labels are paramount for drug packaging, offering critical tamper-evident features, chemical resistance for sterile environments, and ensuring that vital information, batch codes, and expiry dates remain legible and securely affixed, adhering to stringent regulatory compliance. Similarly, in cosmetics, they provide a premium look and withstand exposure to oils and creams, preserving branding and usage instructions.

The inherent benefits of utilizing laminated labels are extensive and strategically significant for brand owners and manufacturers alike. These include significantly extended product life and label integrity, improved readability of essential product information regardless of storage or usage conditions, and greatly enhanced brand image through the vibrancy and protection offered to graphics and colors. Furthermore, many laminated labels incorporate advanced security or tamper-evident features that deter counterfeiting and ensure product authenticity, building consumer trust. Key driving factors propelling the growth of this market include the escalating global demand for robust and visually appealing product identification across a multitude of consumer goods categories. The explosive growth of the e-commerce sector further necessitates packaging and labeling solutions that can withstand the rigors of transit, multiple handling points, and varying environmental conditions during delivery. Moreover, evolving and increasingly stringent regulatory requirements for product traceability, safety standards, and ingredient disclosure across various end-use sectors compel manufacturers to adopt high-quality, reliable labeling solutions that inherently provide the required resilience and longevity, thereby bolstering overall market expansion and technological innovation.

Laminated Labels Market Executive Summary

The Laminated Labels Market is currently demonstrating robust and dynamic growth, underpinned by a confluence of significant business trends that are reshaping global manufacturing and consumer landscapes. These trends include the increasing globalization of supply chains, which amplifies the need for durable and internationally compliant labeling, and a heightened corporate focus on advanced product branding, differentiation, and consumer safety. The proliferation of digital printing technologies, such as advanced inkjet and toner-based systems, is fundamentally revolutionizing the market by enabling unparalleled levels of customization, facilitating much shorter print runs, and significantly accelerating time-to-market for new products and promotional campaigns. This technological shift directly enhances business agility, allowing manufacturers to respond with unprecedented speed and precision to rapidly fluctuating consumer demands and market trends. Furthermore, there is an intensifying global push towards sustainable labeling solutions, prompting manufacturers to make substantial investments in developing eco-friendly materials and optimizing production processes to meet stringent environmental regulations and align with the growing consumer preference for environmentally responsible and recyclable packaging solutions.

Regional trends within the laminated labels market present a clear geographical divergence in growth trajectories and technological adoption. The Asia Pacific (APAC) region stands out as a primary growth engine, experiencing remarkable expansion driven by its rapid pace of industrialization, the continuous expansion of manufacturing bases in economic powerhouses like China and India, and the significant increase in disposable incomes across its vast population. This confluence of factors translates into a substantial and escalating demand for high-quality packaging and labeling solutions across virtually all industrial sectors. In contrast, North America and Europe, while representing more mature markets, are at the forefront of technological innovation, particularly in the adoption of smart labels equipped with RFID and NFC technologies and advanced digital printing capabilities. These regions are also characterized by highly stringent regulatory environments that mandate exceptional quality, durability, and compliance in labeling, pushing the boundaries of material science and application technology. Additionally, a strong consumer preference for premium and aesthetically appealing labels in these regions drives continuous innovation in label design, specialized finishing techniques, and functionality.

In terms of segmented market dynamics, film-based laminated labels, especially those manufactured from highly versatile materials like polypropylene (PP) and polyethylene (PE), continue to command a dominant share of the market. This dominance is attributed to their superior intrinsic properties such as excellent durability, remarkable moisture resistance, and extensive versatility across a broad range of applications, making them indispensable in fast-moving consumer goods (FMCG) and pharmaceutical sectors where protection and longevity are paramount. Concurrently, the demand for variable information printing (VIP) labels is experiencing a significant surge across numerous industries. This growth is primarily driven by the escalating requirements for efficient logistics and supply chain management, intensified anti-counterfeiting efforts necessitating unique serialization, and the rapidly expanding trend towards personalized marketing campaigns that require individualized label content on a mass scale. These trends collectively underscore the critical importance of flexible, adaptable, and technologically advanced labeling solutions capable of accommodating unique product identifiers and highly customized content with speed and precision.

AI Impact Analysis on Laminated Labels Market

Artificial Intelligence (AI) is exerting a profound and transformative influence on the laminated labels market, fundamentally reshaping operational efficiency, significantly improving product quality, and enabling unprecedented advanced customization capabilities. Common user inquiries regarding AI's role frequently revolve around how this technology can meticulously optimize intricate printing processes, ensuring consistent output and reducing material waste. There is a strong emphasis on leveraging AI for stringent quality control through sophisticated automated optical inspection systems that can detect microscopic defects invisible to the human eye, thereby guaranteeing consistently high standards. Furthermore, stakeholders are keenly interested in AI's capacity to streamline complex supply chain management by providing real-time data analysis and predictive insights. This holistic technological integration aims to drastically reduce human error, accelerate production cycles, and deliver consistently high-quality output, addressing some of the most critical manufacturing challenges faced by the industry today.

Beyond process optimization, there is significant industry interest in how AI can facilitate predictive maintenance for advanced printing and lamination machinery, thereby minimizing costly unplanned downtimes and significantly extending equipment lifespan through proactive intervention based on sensor data analysis. Moreover, AI is poised to revolutionize label design, allowing for the rapid generation of personalized label designs tailored to individual consumer preferences or specific market segments. It also plays a crucial role in bolstering anti-counterfeiting measures through advanced data analytics and sophisticated pattern recognition, enabling unique serialization and authentication processes. This leads to smarter, more responsive manufacturing environments and fosters greater consumer engagement through innovative, secure, and highly interactive labeling. The strategic adoption of AI promises to not only significantly reduce material waste and accelerate time-to-market for new products but also provide unprecedented levels of detail and precision in label production, fundamentally transforming the traditional label manufacturing landscape into a highly intelligent and data-driven ecosystem.

Furthermore, AI-powered analytics are capable of processing vast amounts of market data, consumer behavior patterns, and historical sales figures to accurately identify emerging trends, precisely predict consumer preferences, and optimize material selection for specific label applications based on performance requirements and sustainability goals. This proactive and data-informed approach empowers manufacturers to anticipate market demands, develop more relevant and environmentally sustainable label solutions, and adapt their offerings with agility. AI also facilitates the seamless integration of advanced robotics and automation into various stages of label handling, inspection, and packaging, further boosting efficiency and consistency on the production floor. The profound convergence of AI with label manufacturing processes is not merely an incremental improvement; it represents a fundamental paradigm shift towards highly intelligent, adaptive, and exceptionally efficient production systems, setting new industry benchmarks for both quality assurance and market responsiveness.

- Automated quality inspection and defect detection: AI-powered machine vision systems identify imperfections, color inconsistencies, and misregistrations at high speed, significantly reducing rejection rates and improving overall product quality.

- Optimized print settings and color management: AI algorithms analyze print parameters and environmental conditions to suggest optimal settings, ensuring consistent brand identity and color accuracy across all batches and print runs.

- Predictive maintenance for printing equipment: AI analyzes sensor data from machinery to anticipate potential failures, scheduling maintenance proactively and minimizing costly unplanned downtimes and production disruptions.

- Enhanced supply chain visibility and inventory management: AI-driven analytics provide real-time insights into material flow, demand fluctuations, and stock levels, optimizing inventory, reducing waste, and improving logistics efficiency.

- Personalized and variable data printing (VDP) at scale: AI enables the seamless generation and printing of unique codes, custom graphics, and personalized messages on each label, catering to individual consumer preferences and targeted marketing campaigns.

- Improved anti-counterfeiting features through data analytics: AI identifies suspicious patterns in product authentication data, supporting unique serialization, track-and-trace systems, and robust anti-counterfeiting measures.

- Faster design iteration and prototyping: Generative AI tools assist designers by rapidly creating multiple label design variations based on given parameters, accelerating the design cycle and enhancing creative exploration.

- Automated material selection and waste reduction: AI algorithms can recommend optimal material combinations and cutting patterns to minimize scrap, improve resource utilization, and support sustainability goals.

- Demand forecasting and production scheduling optimization: AI analyzes historical data and market trends to provide highly accurate demand forecasts, enabling manufacturers to optimize production schedules and capacity planning efficiently.

- Robotics integration for enhanced production line efficiency: AI guides robotic systems in tasks such as material loading, label application, and packaging, increasing throughput and precision while reducing manual labor requirements.

DRO & Impact Forces Of Laminated Labels Market

The Laminated Labels Market is fundamentally driven by the escalating global demand for exceptionally durable and visually appealing packaging solutions across an increasingly diverse array of industries, particularly within the fast-growing food and beverages, pharmaceuticals, and cosmetics sectors. These industries, operating in highly competitive and regulated environments, necessitate labels that can withstand harsh operational conditions, maintain their visual integrity over extended periods, and effectively communicate vital product information throughout the entire product lifecycle, from manufacturing to point of sale and consumer use. The exponential expansion of global e-commerce platforms has further amplified the critical need for robust and resilient packaging and labeling solutions that can endure the significant rigors of transit, multiple handling points, and varying environmental conditions encountered during complex supply chain logistics. This ensures product information remains perfectly intact and legible until it reaches the end consumer, thereby directly supporting the operational efficiency and consumer satisfaction crucial for the burgeoning online retail ecosystem.

Furthermore, the market's growth is significantly bolstered by the increasingly stringent regulatory standards for product information disclosure, comprehensive traceability requirements, and stringent safety protocols across various industrial sectors. For instance, pharmaceutical serialization mandates, precise food allergen labeling regulations, and chemical hazard warning requirements compel manufacturers to adopt high-quality, reliable, and compliant labeling solutions. Laminated labels, with their inherent protective qualities and ability to secure critical information, often provide the necessary resilience, longevity, and resistance to environmental factors to effectively meet these complex compliance requirements, thereby solidifying their indispensable role in regulated industries. The growing strategic emphasis on brand differentiation and enhancing consumer engagement through premium and innovative label designs also acts as a potent market driver, encouraging substantial investment in advanced lamination technologies, specialized printing techniques, and premium finishing processes to achieve superior visual effects, unique tactile experiences, and sophisticated brand messaging.

However, the laminated labels market faces several notable restraints that pose significant challenges to sustained growth and profitability. Chief among these is the persistent volatility in raw material prices, particularly for key components such as plastic films (e.g., BOPP, PET), specialty adhesives, and various printing inks. Fluctuations in the cost of these essential inputs can directly and substantially impact production costs, subsequently affecting profit margins for manufacturers and potentially leading to price instability for end-users. Environmental concerns regarding the disposal and intrinsic recyclability of multi-layered plastic-based laminated labels also present a substantial and growing challenge. As global environmental consciousness rises and regulatory bodies implement stricter waste management policies, there is immense pressure on the industry to develop and adopt more sustainable alternatives, which often involves complex material science and manufacturing process adjustments, thereby adding to operational complexities and costs. Moreover, the high initial capital investment required for acquiring and implementing advanced printing and lamination machinery, coupled with the ongoing need for highly skilled labor to operate and maintain these sophisticated systems, can act as a significant barrier for new market entrants and smaller players looking to expand their capabilities or compete effectively in a technologically evolving market landscape.

Despite these challenges, substantial opportunities exist within the laminated labels market, particularly in the proactive development and widespread adoption of sustainable and eco-friendly label materials. This includes a growing focus on biodegradable films, significant incorporation of recycled content (such as Post-Consumer Recycled - PCR films), and the innovation of water-based adhesives and inks, all of which align strategically with global environmental initiatives and rapidly evolving consumer preferences for sustainable products. The pervasive integration of smart label technologies, such as Radio-Frequency Identification (RFID), Near Field Communication (NFC), and dynamic QR codes, presents a promising avenue for significant innovation and market expansion. These technologies enable enhanced product traceability throughout complex supply chains, optimized inventory management, and interactive consumer engagement, especially in high-value logistics and sophisticated anti-counterfeiting applications. Furthermore, the burgeoning emerging markets in regions such as Asia Pacific, Latin America, and the Middle East and Africa present considerable untapped growth potential. This is driven by accelerating industrialization, rapid urbanization, and consistently rising consumer spending, thereby creating vast new avenues for market penetration, expansion, and long-term sustainable growth for laminated label manufacturers seeking to capitalize on burgeoning demand.

Segmentation Analysis

The Laminated Labels Market is characterized by an extensive and intricate segmentation, meticulously structured to reflect the diverse applications, myriad materials, and advanced technologies employed across various end-use industries globally. This highly granular segmentation is indispensable as it provides a clear, comprehensive understanding of the nuanced market dynamics, thereby enabling stakeholders to formulate precise, targeted strategies and drive focused product development initiatives. Key segments within this market are meticulously classified based on fundamental criteria, including the specific type of material utilized for the label's construction, the predominant printing technology employed in its intricate production, the designated end-user application for which it is specifically engineered, the critical adhesive properties essential for its performance, and the final aesthetic finish that significantly contributes to its visual appeal and brand messaging.

A thorough understanding of these intricate market segments is absolutely crucial for all stakeholders within the industry to accurately identify lucrative growth pockets, pinpoint emerging trends, and strategically target areas ripe for innovation and investment. For instance, the judicious choice of a specific material directly impacts not only the label's inherent durability, flexibility, and resistance to environmental factors but also its overall cost-effectiveness and sustainability profile. Concurrently, the selection of an appropriate printing technology dictates fundamental aspects such as print quality, production speed, and the extent of customization capabilities that can be offered, directly influencing manufacturing efficiency and market responsiveness. End-use applications, being highly specific, inherently dictate stringent performance requirements, such as exceptional moisture resistance for beverage labels or critical tamper-evidence for pharmaceuticals, profoundly influencing the entire label construction, specific material selection, and precise adhesive formulation to ensure optimal functionality and regulatory compliance.

Furthermore, the market's segmentation by adhesive type allows for the development of highly specialized labeling solutions tailored to diverse surface adhesion needs and specific removal preferences, ranging from aggressively permanent bonds required for long-term product identification to cleanly removable options designed for temporary applications without leaving any residue. The finish segment, encompassing a variety of options such as glossy, matte, semi-gloss, or textured effects, directly caters to specific aesthetic branding requirements, playing a vital role in enhancing shelf appeal and contributing to a distinctive tactile consumer experience. This detailed and multi-faceted segmentation analysis is therefore critically important for comprehending the complex and ever-evolving nature of the laminated labels industry, enabling market participants to effectively navigate its dynamic landscape, identify strategic opportunities, and meet the increasingly complex and highly specific demands of a globalized and discerning market.

- By Material:

- Paper: Utilized for its cost-effectiveness and printability, commonly found in general-purpose, food, and pharmaceutical applications. Includes coated, uncoated, and thermal paper variants, offering different levels of durability and finish.

- Plastic Films: Dominant for high-durability applications due to superior resistance to moisture, chemicals, and tearing.

- Polypropylene (PP): Highly versatile, excellent moisture barrier, cost-effective, widely used in food, beverage, and personal care.

- Polyethylene (PE): Flexible, good for squeezable containers, high moisture resistance, common in personal care and industrial chemicals.

- Polyethylene Terephthalate (PET): Strong, heat-resistant, transparent, ideal for demanding industrial and automotive applications.

- Polyvinyl Chloride (PVC): Durable, chemical-resistant, conformable, used in industrial, outdoor, and medical applications, though facing environmental scrutiny.

- Polystyrene (PS): Rigid, offers good clarity, used for specific food packaging and general purpose labels.

- Bioplastics (PLA, PHA): Emerging sustainable alternative, biodegradable or compostable, addressing environmental concerns, growing in food packaging.

- Foil: Provides a metallic, premium look and enhanced barrier properties. Includes aluminum foil and metallized films for luxury goods and high-end packaging.

- Fabric: Used for specific applications requiring flexibility and a soft feel, such as textile labels, often found in apparel and home goods.

- By Printing Technology:

- Flexography: High-speed and cost-effective for long runs, versatile with various ink types, commonly used for high-volume consumer goods labels due to its efficiency.

- Digital Printing:

- Inkjet: Offers high versatility, good for variable data printing, often used for short to medium runs and personalized labels.

- Toner (Electro-photographic): Provides excellent print quality and color consistency, ideal for premium labels and customized designs.

- Gravure: Known for exceptional print quality, vibrant colors, and consistency over extremely long runs, though with high setup costs, primarily for high-end packaging.

- Offset: Offers fine detail and high resolution, particularly suitable for paper-based labels requiring sophisticated graphics and brand consistency.

- Screen Printing: Produces thick ink layers, resulting in vibrant colors and extreme durability, often used for industrial labels, outdoor applications, and tactile effects.

- By Application:

- Food and Beverages: A major segment, including labels for processed foods, dairy products, beverages (bottles, cans), frozen foods, and fresh produce. Requires moisture, temperature, and chemical resistance.

- Cosmetics and Personal Care: Labels for shampoos, lotions, makeup, perfumes, and soaps. Emphasis on aesthetic appeal, water resistance, and durability against product contents.

- Pharmaceuticals: Critical for drug packaging, medical devices, and health supplements. Demands tamper-evidence, chemical resistance, sterility, and clear, durable display of vital information.

- Automotive: Used for parts identification, warning labels, tire labels, and under-hood applications. Requires extreme temperature, oil, and chemical resistance.

- Consumer Durables: Labels for appliances, electronics, and home goods. Needs long-term durability, scratch resistance, and often serialization for warranty or tracking.

- Logistics and Shipping: Essential for tracking, shipping labels, inventory management, and pallet identification. Demands resistance to abrasion, moisture, and clear barcode readability.

- Retail: Includes price tags, promotional labels, security labels, and product information labels found in various retail environments.

- Chemicals: Labels for industrial chemicals, cleaning products, and agricultural chemicals. Requires high chemical resistance and often compliance with GHS (Globally Harmonized System) standards.

- Electronics: Component labels, circuit board labels, cable marking, and tamper-evident seals for electronic devices. Needs heat resistance and precision.

- Others: Encompasses diverse uses such as horticultural labels, promotional stickers, industrial equipment labels, and stationery, reflecting the broad utility of laminated labels.

- By Adhesive Type:

- Permanent: Forms a strong, long-lasting bond once applied, ideal for labels intended to remain on the product indefinitely, such as brand labels and warning labels.

- Removable: Allows for clean removal of the label without leaving residue or damaging the substrate, useful for temporary labels or those for reusable containers.

- Repositionable: Offers an initial low tack, enabling the label to be lifted and re-applied multiple times before setting, ideal for initial placement adjustments.

- Specialty: Includes formulations like Freezer Grade (for extreme cold), High-Temperature (for industrial processes), Water Soluble (for easily dissolvable applications), and Security Adhesives (void-pattern, destructible).

- By Finish:

- Glossy: Provides a high sheen, enhances color vibrancy and contrast, giving a premium, polished look, popular for cosmetic and luxury food items.

- Matte: Offers a non-reflective, sophisticated, and often tactile finish, preferred for a natural or understated aesthetic, common in specialty foods and craft products.

- Semi-Gloss: An intermediate sheen that balances the vibrancy of gloss with some of the subdued elegance of matte, offering versatility for various applications.

- Textured: Involves embossed, debossed, or specially coated surfaces that provide a tactile feel, adding a premium, sensory dimension to the label.

- Specialty Coatings: Includes UV resistant (for outdoor exposure), chemical resistant, anti-scratch, and soft-touch coatings for enhanced label performance and feel.

- By Form:

- Roll Labels: Supplied on rolls for automated application via labeling machines, highly efficient for high-volume production lines.

- Sheet Labels: Provided in sheets for manual application or desktop printing, suitable for lower volume, specialized, or office-based uses.

Value Chain Analysis For Laminated Labels Market

The value chain for the laminated labels market initiates with the absolutely critical upstream activities, which meticulously encompass the comprehensive procurement of essential raw materials from a diverse array of specialized suppliers. This foundational stage is paramount, involving the sourcing of high-quality face stock materials, which include various grades of paper (coated, uncoated, thermal), a wide range of high-performance plastic films (such as polypropylene (PP), polyethylene (PE), polyethylene terephthalate (PET), and polyvinyl chloride (PVC)), and specialized metallic foils. In addition to these primary substrates, the upstream segment also includes the acquisition of a diverse portfolio of pressure-sensitive adhesives, ranging from acrylic to rubber-based and silicone formulations, each selected for specific bonding characteristics and environmental resistances. Furthermore, the procurement of various printing inks (UV, water-based, solvent-based) and specialized coatings is essential. These raw material providers form the fundamental foundational layer, directly influencing the ultimate quality, cost structure, and overall availability of components that are crucial for the subsequent complex label manufacturing processes. Therefore, maintaining efficient sourcing strategies, fostering strong, collaborative supplier relationships, and ensuring consistent supply chain reliability are absolutely paramount for guaranteeing a continuous flow of high-quality inputs into the market.

Laminated Labels Market Potential Customers

The primary potential customers and end-users of laminated labels encompass an expansive and highly diverse spectrum of industries, all unequivocally united by their critical requirement for robust, aesthetically pleasing, and highly informative product identification and branding solutions that can perform reliably under various conditions. Fast-Moving Consumer Goods (FMCG) companies constitute a particularly significant and high-volume segment, with sub-sectors such as food and beverages extensively utilizing laminated labels for product packaging that demands superior resistance to moisture, varying temperature fluctuations (from refrigeration to ambient storage), and rigorous handling throughout the complex stages of distribution and retail. Similarly, leading cosmetics and personal care brands heavily rely on these labels not only for their premium appearance and tactile quality but also for their exceptional durability, ensuring vital product information remains perfectly legible and visually appealing on bottles, jars, and tubes that are frequently exposed to water, oils, creams, or other chemical agents inherent to product use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 42.5 Billion |

| Market Forecast in 2032 | USD 62.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison Corporation, CCL Industries Inc., 3M Company, LINTEC Corporation, UPM Raflatac, Arjowiggins, Coveris Holdings SA, Multi-Color Corporation, Constantia Flexibles, Fuji Seal International, Inc., Technicote, Inc., HP Inc.,, Schreiner Group GmbH & Co. KG, Macfarlane Group PLC, Bemis Company Inc. (now part of Amcor plc), Essentra PLC, Mondi Group, SMURFIT KAPPA Group, BASF SE, Torraspapel S.A. (part of Lecta Group), SATO Holdings Corporation, Wausau Coated Products Inc., Dow Chemical Company, Arkema S.A., Henkel AG & Co. KGaA, Innovia Films (now part of CCL Industries), Mitsubishi Polyester Film, Xeikon (Flint Group), Eastman Chemical Company, DIC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminated Labels Market Key Technology Landscape

Furthermore, sustainable material innovations are gaining paramount and undeniable importance within the technology landscape, driven by escalating environmental awareness, increasingly stringent regulatory pressures, and a global shift towards circular economy principles. This critical trend includes the active development and widespread adoption of thinner films that significantly reduce overall material consumption, the substantial incorporation of recycled content (particularly Post-Consumer Recycled - PCR films), and the pioneering of truly biodegradable and compostable substrates that offer viable end-of-life solutions for packaging waste. Concurrently, the industry is making concerted efforts towards more eco-friendly manufacturing processes, such as the implementation of solvent-free or advanced water-based adhesive and ink systems, and the adoption of energy-efficient lamination techniques that consume less power and produce fewer emissions. Sophisticated finishing processes like precision varnishing, hot stamping, cold foiling, intricate embossing, and laser die-cutting further add premium tactile and visual effects without compromising environmental integrity, all contributing to a more efficient, high-performance, and ultimately eco-conscious production cycle across the entire laminated label industry, meeting the demands of a responsible global market.

Regional Highlights

- North America: This region consistently represents a mature and highly innovative market within the laminated labels industry, characterized by a leading adoption rate of advanced labeling technologies, including sophisticated smart labels (RFID, NFC) and high-definition digital printing solutions. It operates under exceptionally stringent regulatory frameworks, particularly prevalent in the pharmaceutical, food safety, and healthcare sectors, which necessitate the production of high-quality, durable, and fully compliant labeling solutions. There is a strong consumer preference for premium packaging, a readiness to embrace innovative designs, and a significant, persistent drive towards sustainable and environmentally friendly label options, actively pushing manufacturers towards continuous advancements in material science and process innovations to meet these evolving demands.

- Europe: The European market for laminated labels is profoundly shaped and driven by its exceptionally strict environmental regulations, such as the comprehensive EU Packaging and Packaging Waste Directive, and a pervasive, strong emphasis on corporate sustainability across all industries. This regulatory and societal pressure leads to a proactive and widespread adoption of eco-friendly materials, including recycled content and biodegradable films, and the implementation of greener, more energy-efficient production processes. The region exhibits high and consistent demand from its thriving food and beverage, personal care, and pharmaceutical industries, alongside a persistent cultural focus on sophisticated design, premium aesthetics, and highly functional packaging solutions that not only meet diverse consumer needs but also adhere to stringent quality and safety standards.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally for laminated labels, APAC is powerfully propelled by its rapid and ongoing industrialization, the continuous expansion of colossal manufacturing bases, particularly in economic powerhouses like China, India, Japan, and the dynamic economies of Southeast Asian countries. This growth is further fueled by consistently increasing disposable incomes and a burgeoning middle class across its vast population, resulting in an unprecedented and escalating demand for packaging and labeling solutions across virtually all industrial sectors. The region's market dynamics are characterized by a growing emphasis on both manufacturing efficiency and cost-effectiveness, alongside a rapidly increasing focus on improving product quality and adopting advanced technologies to serve vast and discerning consumer bases effectively.

- Latin America: This region constitutes an emerging and highly promising market, consistently demonstrating steady and robust growth within the laminated labels sector. This expansion is primarily attributable to accelerating industrialization, ongoing urbanization trends, and the significant expansion of its middle-class population, which collectively drive increased consumption of packaged goods. There is a robust and growing demand from the burgeoning food and beverage and personal care sectors, presenting considerable and attractive opportunities for both local manufacturers and international players to introduce innovative labeling solutions that cater to rapidly evolving consumer preferences and developing retail infrastructures across the diverse countries within the region.

- Middle East and Africa (MEA): The MEA region is experiencing notable and sustained growth in the laminated labels market, fueled by ambitious large-scale infrastructure development projects, concerted efforts towards economic diversification away from traditional oil revenues, and a substantial increase in overall consumer goods consumption across various countries. The region presents significant opportunities in the construction, industrial, and food packaging sectors, driven by increasing foreign investment and local manufacturing capabilities. There is a gradual but consistent adoption of modern labeling practices and advanced technologies as economies mature, international trade expands, and local industries seek to enhance product presentation and compliance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminated Labels Market.- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- LINTEC Corporation

- UPM Raflatac

- Arjowiggins

- Coveris Holdings SA

- Multi-Color Corporation

- Constantia Flexibles

- Fuji Seal International, Inc.

- Technicote, Inc.

- HP Inc.

- Schreiner Group GmbH & Co. KG

- Macfarlane Group PLC

- Bemis Company Inc. (now part of Amcor plc)

- Essentra PLC

- Mondi Group

- SMURFIT KAPPA Group

- BASF SE

- Torraspapel S.A. (part of Lecta Group)

- SATO Holdings Corporation

- Wausau Coated Products Inc.

- Dow Chemical Company

- Arkema S.A.

- Henkel AG & Co. KGaA

- Innovia Films (now part of CCL Industries)

- Mitsubishi Polyester Film

- Xeikon (Flint Group)

- Eastman Chemical Company

- DIC Corporation

Frequently Asked Questions

What are laminated labels and what are their primary functional benefits in modern packaging?

Laminated labels are multi-layered adhesive labels featuring a protective film applied over the printed surface, which significantly enhances their durability and aesthetic appeal. Their primary functional benefits in modern packaging include superior resistance to moisture, chemicals, abrasion, and UV radiation, ensuring vital product information remains legible and intact under diverse conditions. Furthermore, they contribute significantly to extended product life, improved brand presentation through vibrant and protected graphics, and often incorporate critical tamper-evident characteristics for enhanced product security and consumer trust across various industries.

Which industrial sectors are the most significant consumers of laminated labels, and why are they preferred?

The most significant industrial consumers of laminated labels include the food and beverage, pharmaceutical, cosmetics and personal care, and automotive sectors. These industries prefer laminated labels due to their stringent requirements for label performance: food and beverage products demand resistance to refrigeration and moisture; pharmaceuticals require chemical resistance and tamper-evidence for regulatory compliance; cosmetics benefit from aesthetic appeal and durability against product contents; and automotive applications need resilience against extreme temperatures, oils, and abrasion, making laminated labels ideal for maintaining integrity and safety.

What key technological advancements are currently shaping the competitive landscape of the laminated labels market?

Key technological advancements profoundly shaping the competitive landscape of the laminated labels market include the widespread adoption of advanced digital printing technologies (such as high-speed inkjet and toner-based systems) for unparalleled customization, variable data printing, and shorter production runs. Additionally, significant innovations in smart label technologies, like integrated RFID and NFC tags, are enhancing product traceability, inventory management, and interactive consumer engagement. The development of advanced adhesive systems providing superior bonding and specialized functionalities, alongside a strong drive towards sustainable material innovations such as thinner films, recycled content, and biodegradable substrates, are all critical to market evolution.

How are growing sustainability concerns and environmental regulations impacting the laminated labels market?

Growing sustainability concerns and increasingly stringent environmental regulations are profoundly impacting the laminated labels market by driving a significant shift towards eco-friendly solutions. Manufacturers are actively investing in the development and adoption of thinner films to reduce material usage, incorporating recycled content (PCR films), and pioneering the use of biodegradable or compostable substrates. Furthermore, there is a strong push towards solvent-free or water-based inks and adhesives, alongside more energy-efficient production processes. These efforts are crucial for meeting global environmental initiatives, complying with evolving regulations, and aligning with escalating consumer preferences for sustainable and circular packaging solutions, thereby reshaping product development and manufacturing strategies across the industry.

What are the primary growth drivers and significant opportunities propelling the expansion of the laminated labels market?

The primary growth drivers for the laminated labels market include the escalating global demand for exceptionally durable and visually appealing product packaging across diverse industries. The rapid and continuous expansion of the e-commerce sector significantly boosts demand for robust labels capable of withstanding transit rigors. Moreover, evolving and increasingly stringent regulatory requirements for product information, traceability, and safety play a crucial role. Significant opportunities include the proactive development and widespread adoption of sustainable and eco-friendly label materials, the pervasive integration of smart label technologies for enhanced functionalities, and the substantial growth potential present in rapidly industrializing emerging markets across Asia Pacific, Latin America, and the Middle East and Africa.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager