Laminated Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427645 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Laminated Tubes Market Size

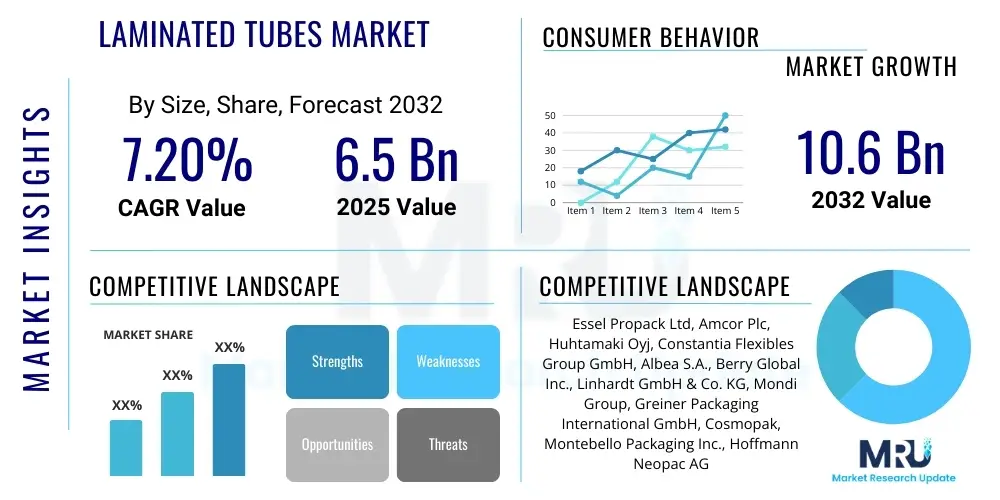

The Laminated Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 6.5 billion in 2025 and is projected to reach USD 10.6 billion by the end of the forecast period in 2032.

Laminated Tubes Market introduction

The laminated tubes market encompasses the global production and consumption of packaging tubes constructed from multiple layers of plastic, aluminum, or a combination thereof, bonded together to form a barrier structure. These tubes offer superior protection against moisture, oxygen, and light, thereby extending the shelf life of sensitive products. Their construction typically involves a co-extruded or laminated web, providing excellent printability, aesthetic appeal, and structural integrity, making them a preferred choice across various industries requiring high-performance packaging solutions.

Products within this market are predominantly used for applications requiring squeezable, hygienic, and convenient dispensing. Key applications span a broad spectrum, including personal care products like toothpaste, creams, and lotions; pharmaceuticals such as ointments and gels; food and beverage items including sauces and condiments; and increasingly, industrial and household chemicals. The versatility in material composition allows for tailored barrier properties, ranging from basic protection to advanced multi-layer structures that prevent chemical migration and preserve product efficacy.

The markets expansion is fundamentally driven by several factors. A significant contributor is the rising global demand for consumer goods, particularly in emerging economies, coupled with an increasing preference for convenient and hygienic packaging formats. Moreover, the shift towards sustainable packaging solutions, including tubes made from post-consumer recycled (PCR) content or bio-based materials, is propelling innovation and adoption. The benefits of laminated tubes, such as their excellent barrier properties, aesthetic versatility, consumer convenience, and robust product protection, further cement their position as a vital packaging solution in a highly competitive market landscape.

Laminated Tubes Market Executive Summary

The laminated tubes market is experiencing robust growth, primarily fueled by the expanding personal care, pharmaceutical, and food and beverage sectors globally. Key business trends indicate a strong emphasis on sustainability, leading to increased investment in recyclable and bio-based laminate materials. Manufacturers are focusing on lightweighting initiatives and incorporating post-consumer recycled (PCR) content to meet evolving consumer and regulatory demands for environmentally friendly packaging. Technological advancements in printing and barrier technologies are also enhancing product appeal and protection capabilities, driving premiumization within the market and expanding applications into more sensitive product categories.

Regional trends highlight Asia Pacific as the fastest-growing market, propelled by rapid urbanization, rising disposable incomes, and the burgeoning manufacturing bases for consumer goods and pharmaceuticals in countries like China and India. North America and Europe, while mature, are characterized by high innovation, stringent regulatory landscapes, and a strong consumer preference for sustainable and premium packaging. These regions are seeing significant adoption of advanced barrier solutions and sophisticated aesthetic designs, particularly in high-end cosmetic and pharmaceutical segments. Latin America, the Middle East, and Africa are showing promising growth driven by increasing industrialization and expanding consumer markets.

From a segmentation perspective, the market is witnessing significant shifts. Plastic Barrier Laminates (PBL) continue to dominate due to their cost-effectiveness and versatility, while Aluminum Barrier Laminates (ABL) are preferred for highly sensitive products requiring maximum protection. The oral care segment remains a cornerstone, with personal care products showing accelerated growth. Pharmaceuticals are also a critical segment due to strict hygiene and barrier requirements. Innovation in cap and closure systems, including tamper-evident and child-resistant options, is further segmenting the market. The emphasis across all segments is on balancing performance, cost-efficiency, and environmental responsibility, dictating future product development and market dynamics.

AI Impact Analysis on Laminated Tubes Market

User questions related to the impact of AI on the Laminated Tubes Market frequently revolve around how artificial intelligence can revolutionize manufacturing efficiency, enhance quality control, and contribute to sustainable practices. Common inquiries explore AIs role in optimizing production lines, predicting maintenance needs, and improving supply chain resilience. There is also significant interest in AIs potential to drive innovation in material science for laminates, personalize packaging designs, and enable smart packaging features that can interact with consumers or provide product authenticity verification. Concerns often touch upon the initial investment costs, data privacy, and the need for skilled labor to manage AI-driven systems within a traditionally mechanical manufacturing environment.

The integration of AI is expected to significantly impact the market by streamlining operational processes and enhancing product quality. AI-powered predictive analytics can forecast demand more accurately, reducing waste and optimizing inventory levels for both raw materials and finished goods. Machine learning algorithms deployed in quality control systems can identify defects in real-time with higher precision than human inspection, ensuring consistent product standards and minimizing recalls. This technological advancement directly contributes to cost savings and improved brand reputation within the competitive packaging industry.

Furthermore, AI holds substantial potential for accelerating sustainable innovations and personalizing consumer experiences. AI can analyze complex data sets to identify optimal material compositions for eco-friendly laminated tubes, such as those with higher PCR content or novel biodegradable layers, without compromising barrier properties. In the realm of smart packaging, AI can enable interactive elements, track product usage, or verify authenticity, adding significant value for brands and consumers. The deployment of AI tools can also lead to more efficient energy consumption in manufacturing plants, aligning with the industrys broader environmental goals and addressing the growing demand for greener packaging solutions.

- AI optimizes production schedules and material utilization, reducing waste and operational costs in laminated tube manufacturing.

- Predictive maintenance driven by AI minimizes downtime on lamination and extrusion lines, enhancing overall equipment effectiveness.

- AI-powered visual inspection systems detect subtle defects in laminate quality and printing, improving product consistency and reducing rejections.

- Advanced analytics can forecast demand accurately, improving inventory management and supply chain efficiency for raw materials and finished tubes.

- AI assists in developing novel sustainable laminate materials by simulating material properties and performance under various conditions.

- Personalized packaging designs can be generated and optimized with AI, catering to niche consumer preferences and market segments.

- Smart packaging features, enabled by AI, can offer enhanced consumer engagement, product traceability, and anti-counterfeiting measures.

- AI facilitates energy consumption optimization in manufacturing processes, supporting the industrys sustainability objectives.

DRO & Impact Forces Of Laminated Tubes Market

The laminated tubes market is profoundly shaped by a confluence of drivers, restraints, opportunities, and external impact forces that dictate its growth trajectory and competitive landscape. Key drivers include the ever-increasing demand for convenient, hygienic, and aesthetically pleasing packaging across diverse end-use industries, particularly personal care, pharmaceuticals, and food. The excellent barrier properties of laminated tubes protect product integrity, extend shelf life, and prevent contamination, which is crucial for sensitive formulations. Furthermore, rising consumer awareness regarding product safety and the need for tamper-evident packaging significantly bolster market growth.

However, the market also faces considerable restraints, primarily stemming from the volatility of raw material prices, particularly for polymers and aluminum, which directly impacts production costs and profit margins. Environmental concerns surrounding plastic waste and stringent regulations on single-use plastics pose challenges, pushing manufacturers to invest in more sustainable, often costlier, alternatives. Competition from alternative packaging formats, such as plastic bottles, jars, and stand-up pouches, also exerts pressure on market share. Moreover, the complex manufacturing process requires significant capital investment in machinery and technology, which can deter new entrants.

Opportunities for growth are abundant, especially in the development and adoption of sustainable laminated tubes made from post-consumer recycled (PCR) content, bio-based polymers, and easily recyclable mono-material structures. Emerging economies present vast untapped potential due to their rapidly growing consumer bases and improving standards of living, driving demand for packaged goods. Innovation in smart packaging, offering features like enhanced traceability, anti-counterfeiting, and consumer interaction, also represents a significant avenue for value creation. Furthermore, the expansion into specialized applications, such as medical devices and industrial chemicals, continues to open new revenue streams.

Impact forces acting on the market are multifaceted, with technological advancements playing a crucial role in improving barrier properties, printability, and manufacturing efficiency. Consumer preferences are shifting towards eco-friendly and personalized packaging, compelling brands to innovate. Regulatory landscapes, particularly those pertaining to environmental protection and product safety, directly influence material choices and production methods. Economic conditions, including global GDP growth and disposable incomes, affect consumer spending on packaged goods. Geopolitical factors and supply chain disruptions can also impact raw material availability and logistics, highlighting the interconnectedness of global trade on this industry.

Segmentation Analysis

The laminated tubes market is intricately segmented across various dimensions, including material type, application, cap type, and region, allowing for a detailed understanding of market dynamics and opportunities. This segmentation helps identify specific growth drivers and challenges within distinct categories, facilitating targeted product development and market strategies. Understanding these segments is crucial for manufacturers to tailor their offerings, for brands to select optimal packaging, and for investors to identify high-growth areas within the broader packaging landscape. The versatility of laminated tubes enables their adoption across a wide array of products, from everyday consumer goods to highly specialized pharmaceutical applications, each with unique requirements that drive specific segment growth.

- By Material Type:

- Plastic Barrier Laminates (PBL): Predominantly used for their excellent aesthetic appeal, squeezability, and cost-effectiveness. Often incorporate EVOH or other plastic barriers.

- Aluminum Barrier Laminates (ABL): Offers superior barrier protection against oxygen, moisture, and light, making them ideal for highly sensitive products like pharmaceuticals and certain food items.

- Recycled Content Laminates: Tubes incorporating post-consumer recycled (PCR) plastics or bio-based materials, addressing sustainability demands.

- Mono-Material Laminates: Designed for enhanced recyclability, these laminates consist of a single type of polymer throughout all layers.

- By Application:

- Oral Care: Includes toothpaste and dental gels, a foundational segment for laminated tubes.

- Cosmetics and Personal Care: Lotions, creams, hair gels, sunscreens, and other beauty products benefiting from aesthetic appeal and barrier properties.

- Pharmaceuticals: Ointments, gels, and creams requiring high levels of hygiene, barrier protection, and tamper-evident features.

- Food and Beverage: Sauces, condiments, processed cheese, and other food items where extended shelf life and hygiene are critical.

- Homecare and Industrial: Adhesives, lubricants, cleaning agents, and other non-food products.

- By Cap Type:

- Stand-up Caps: Common for convenience and shelf display.

- Flip-top Caps: User-friendly for single-hand operation.

- Screw-on Caps: Provide a secure seal, often for products requiring airtight closure.

- Specialty Caps: Include child-resistant, tamper-evident, or dispensing caps.

- By End-Use Industry:

- Consumer Goods: Broad category encompassing personal care, home care, and food.

- Healthcare: Primarily pharmaceuticals and medical device applications.

- Industrial: Adhesives, sealants, lubricants, and other chemical products.

Laminated Tubes Market Value Chain Analysis

The value chain for the laminated tubes market is a complex ecosystem beginning with raw material extraction and extending through manufacturing, distribution, and ultimately to the end-user. Upstream analysis involves the procurement of essential raw materials such as polymers (polyethylene, polypropylene, EVOH), aluminum foil, masterbatches for color, and various inks and lacquers for printing. Key suppliers in this segment play a critical role in determining the quality, cost, and environmental footprint of the final product. Innovations in sustainable materials, like bio-based polymers or high PCR content plastics, are driven by upstream suppliers responding to market demands and regulatory pressures. Ensuring a stable and ethically sourced supply of these materials is paramount for manufacturers to maintain consistent production and competitive pricing.

Midstream activities encompass the core manufacturing processes, where raw materials are transformed into finished laminated tubes. This involves several critical steps: lamination (bonding different layers of plastic and/or aluminum), extrusion (forming the tube body), printing (applying graphics and branding using flexography, gravure, or digital printing), shoulder molding (attaching the cap-receiving part), and capping (applying the final closure). Manufacturers invest heavily in advanced machinery and technology to achieve high-speed production, precision, and customization. Quality control throughout these stages is rigorous to meet industry standards and specific client requirements, especially for pharmaceutical and cosmetic applications where product integrity is paramount.

Downstream analysis focuses on the distribution channels and direct engagement with end-users. Once manufactured, laminated tubes are typically distributed to brand owners and filling companies, which then fill the tubes with their respective products and prepare them for retail. Distribution can be direct, where tube manufacturers supply large clients directly, or indirect, involving packaging distributors and wholesalers who serve smaller businesses or provide integrated packaging solutions. The efficiency of the distribution network, including logistics and warehousing, is crucial for timely delivery and cost management. End-users, encompassing various industries, critically assess the tubes functionality, aesthetics, and sustainability credentials before integration into their product lines, influencing purchasing decisions and future product development.

Laminated Tubes Market Potential Customers

The potential customers for laminated tubes represent a diverse array of industries, primarily driven by the need for effective, hygienic, and aesthetically appealing packaging solutions that protect product integrity and enhance consumer experience. The largest segment of buyers typically includes multinational and regional fast-moving consumer goods (FMCG) companies, particularly those operating in the personal care and oral care sectors. These companies require vast quantities of tubes for products such as toothpaste, face washes, hand creams, and hair conditioners, where squeezability, barrier protection against air and moisture, and attractive branding are essential for market differentiation and consumer convenience. The high volume and recurring nature of these purchases make them foundational customers for tube manufacturers.

Another significant group of potential customers is pharmaceutical manufacturers, who rely on laminated tubes for packaging ointments, gels, and topical creams. For this segment, the critical factors are barrier properties that prevent product degradation, tamper-evident features to ensure safety, and compliance with stringent regulatory standards regarding packaging materials and sterility. Pharmaceutical companies prioritize reliability, consistent quality, and supplier adherence to certifications such as ISO and GMP. The medical and healthcare sector also includes producers of various diagnostic and therapeutic gels and creams, further expanding the customer base requiring specialized and secure packaging.

Beyond personal care and pharmaceuticals, the food and beverage industry represents a growing segment of potential customers, particularly for products like sauces, condiments, processed cheese, and concentrated food pastes. Here, laminated tubes offer benefits such as extended shelf life, portion control, and reduced food waste compared to rigid containers. Industrial and homecare product manufacturers also utilize laminated tubes for items such as adhesives, sealants, lubricants, cleaning gels, and shoe polish. These buyers prioritize robust packaging that can withstand harsh chemicals, provide precise dispensing, and ensure product stability over time. The continuous diversification of applications underscores the broad and expanding customer base for laminated tubes.

Laminated Tubes Market Key Technology Landscape

The laminated tubes market is characterized by a dynamic technology landscape, constantly evolving to meet demands for improved barrier properties, enhanced aesthetics, manufacturing efficiency, and sustainability. A cornerstone of this landscape is advanced lamination technology, which involves bonding multiple layers of different materials—typically plastics like polyethylene or polypropylene, often combined with EVOH (ethylene vinyl alcohol) for oxygen barrier, or aluminum foil for ultimate protection—to create a robust, multi-functional web. Innovations in co-extrusion and adhesive-free lamination techniques are pivotal, allowing for thinner, more effective barrier layers and facilitating the development of mono-material structures for easier recycling, which is a key focus for future packaging design.

Printing technologies represent another critical area of innovation, directly impacting brand appeal and consumer engagement. Traditional methods like flexography and gravure continue to dominate for high-volume production due to their cost-effectiveness and quality. However, digital printing technology is gaining significant traction, offering unparalleled flexibility for shorter runs, personalized designs, and quick turnaround times, which are highly valuable for limited editions, promotional campaigns, and brand customization. Advancements in high-definition printing, metallic inks, and tactile finishes further enable brands to create visually stunning and sensorially engaging packaging, enhancing shelf presence and consumer preference in competitive markets.

Beyond material composition and decoration, the technology landscape also encompasses sophisticated manufacturing automation, cap and closure innovations, and quality control systems. Highly automated production lines improve efficiency, reduce labor costs, and ensure consistent product quality, from tube formation to shoulder molding and capping. Developments in cap and closure design focus on convenience (e.g., flip-top, tamper-evident, child-resistant, or dosage-controlled options), while also integrating sustainability aspects such as tethered caps or those made from recycled materials. Furthermore, the integration of advanced inspection systems, including AI-powered vision systems, ensures that every tube meets stringent quality standards, minimizing defects and enhancing product safety across all end-use applications.

Regional Highlights

The laminated tubes market exhibits distinct growth patterns and characteristics across various global regions, driven by differing economic conditions, consumer preferences, regulatory environments, and industrial development. Each region contributes uniquely to the overall market trajectory, presenting specific opportunities and challenges for manufacturers and brand owners.

- Asia Pacific: This region stands as the dominant and fastest-growing market for laminated tubes, propelled by rapid industrialization, urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asian nations. Increased disposable incomes are driving demand for personal care products, cosmetics, pharmaceuticals, and packaged foods, making it a lucrative market. The region also benefits from a robust manufacturing base, offering cost-effective production and significant export capabilities.

- North America: Characterized by a mature market with high demand for premium and sustainable packaging solutions. Innovation in material science, particularly in post-consumer recycled (PCR) and bio-based laminates, is a key trend. The pharmaceutical and high-end cosmetic sectors are significant drivers, prioritizing advanced barrier properties, brand differentiation, and strict regulatory compliance. Consumer convenience and product safety are paramount.

- Europe: This region is a frontrunner in sustainability initiatives, with stringent regulations on plastic waste driving significant investments in recyclable and mono-material laminated tubes. Germany, France, and the UK are key markets with strong demand from the personal care, cosmetic, and pharmaceutical industries. There is a strong focus on circular economy principles, pushing for innovative designs that facilitate end-of-life recycling.

- Latin America: Experiencing steady growth, particularly in Brazil and Mexico, due to expanding consumer markets and increasing adoption of modern retail formats. The personal care and oral care segments are primary growth engines. Economic stability and rising discretionary spending are contributing to the increased demand for packaged goods, though cost-effectiveness remains a key purchasing factor.

- Middle East & Africa: An emerging market with significant potential, primarily driven by growing urbanization, improving healthcare infrastructure, and rising disposable incomes. Countries in the GCC region and South Africa are leading the growth, with increasing demand for personal care and pharmaceutical products. Investment in local manufacturing capabilities is gradually increasing, reducing reliance on imports.

- Japan: A highly quality-conscious and technologically advanced market. While mature, there is consistent demand for high-performance and aesthetically sophisticated laminated tubes, particularly in the premium cosmetic and pharmaceutical segments. Sustainability, precision, and innovative functionalities are key considerations for packaging manufacturers and brands in this region.

- Oceania: This region, including Australia and New Zealand, follows trends similar to North America and Europe, with a strong emphasis on sustainability and premium product positioning. The demand for eco-friendly packaging solutions and products with natural ingredients drives the market, especially in the personal care and health supplement sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminated Tubes Market.- Essel Propack Ltd (EPL Limited)

- Amcor Plc

- Huhtamaki Oyj

- Constantia Flexibles Group GmbH

- Albea S.A.

- Berry Global Inc.

- Linhardt GmbH & Co. KG

- Mondi Group

- Greiner Packaging International GmbH

- Cosmopak

- Montebello Packaging Inc.

- Hoffmann Neopac AG

Frequently Asked Questions

What are the primary advantages of using laminated tubes over other packaging forms?

Laminated tubes offer superior barrier protection against oxygen, moisture, and light, which significantly extends the shelf life of sensitive products, preventing degradation and maintaining efficacy. Their squeezable nature ensures efficient product dispensing, minimizing waste for consumers. Additionally, they provide excellent printability, allowing for high-quality graphics and branding that enhance product appeal on retail shelves. The combination of these benefits makes them ideal for a wide array of applications in personal care, pharmaceuticals, and food, where product integrity and consumer convenience are paramount.

How is the laminated tubes market addressing sustainability concerns?

The laminated tubes market is actively pursuing various sustainability initiatives. Manufacturers are increasingly incorporating post-consumer recycled (PCR) plastics into their laminate structures, reducing reliance on virgin materials. The development of mono-material tubes, consisting of a single type of polymer, is a significant advancement, as these tubes are easier to recycle within existing recycling streams. Furthermore, theres a growing focus on bio-based plastics derived from renewable resources and lightweighting initiatives to reduce overall material consumption. These efforts are driven by both consumer demand for eco-friendly products and evolving regulatory landscapes aimed at reducing plastic waste.

Which industries are the largest end-users of laminated tubes?

The personal care and oral care industries represent the largest end-users of laminated tubes. This includes products like toothpaste, face creams, lotions, and shampoos, where the tubes aesthetic appeal, squeezability, and barrier properties are highly valued. The pharmaceutical industry is another major consumer, utilizing laminated tubes for ointments, gels, and topical creams due to their critical need for hygiene, product protection, and tamper-evident features. The food and beverage sector is also a growing segment, adopting tubes for sauces, condiments, and processed foods that benefit from extended shelf life and convenient dispensing. Homecare and industrial chemical applications also contribute to the market, seeking durable and protective packaging.

What are the key technological advancements shaping the laminated tubes market?

Key technological advancements include innovations in multi-layer lamination and co-extrusion techniques that enhance barrier properties and facilitate the creation of sustainable mono-material structures. Digital printing technology is revolutionizing customization and small-batch production, offering high-quality graphics and quick turnaround times. Furthermore, advancements in cap and closure systems provide improved functionality, such as tethered caps for easier recycling, child-resistant features, and precise dispensing mechanisms. The integration of automation and AI-powered quality control systems in manufacturing processes is also significantly improving efficiency, reducing waste, and ensuring consistent product quality across the industry.

What impact do raw material price fluctuations have on the laminated tubes market?

Raw material price fluctuations, particularly for polymers (polyethylene, polypropylene) and aluminum foil, have a significant impact on the laminated tubes market. These materials constitute a substantial portion of the overall production cost. Volatility in their prices can lead to increased manufacturing expenses, affecting profit margins for tube producers and potentially leading to higher prices for brand owners. This can also influence material selection decisions, driving manufacturers to seek more cost-effective or alternative sustainable materials when conventional prices are high. Effective supply chain management and long-term contracts are often employed to mitigate these risks and ensure stable pricing for end-products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager