Laser Diode Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430262 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Laser Diode Market Size

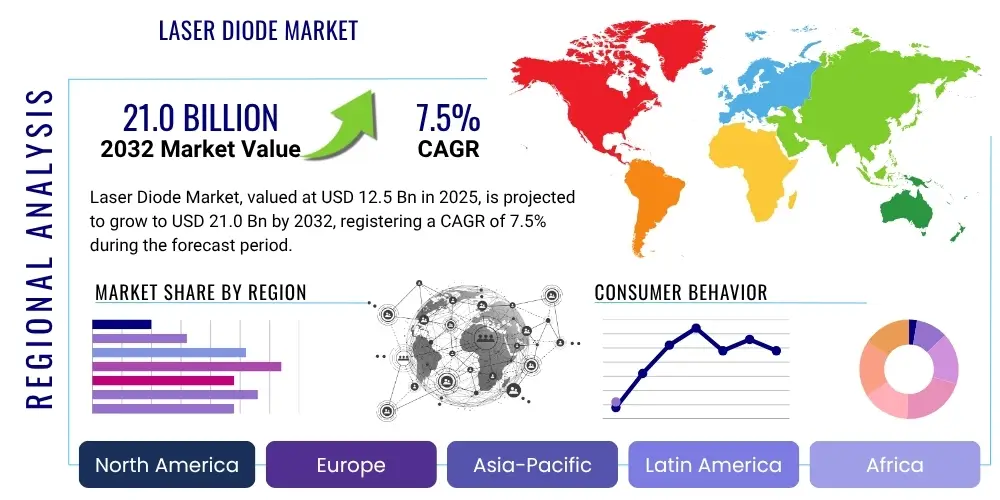

The Laser Diode Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 12.5 billion in 2025 and is projected to reach USD 21.0 billion by the end of the forecast period in 2032.

Laser Diode Market introduction

The Laser Diode Market encompasses the global industry involved in the research, development, manufacturing, and distribution of semiconductor devices that emit coherent light through stimulated emission. These compact and energy-efficient devices convert electrical energy into light, offering unparalleled precision, efficiency, and narrow spectral linewidths compared to traditional light sources. Laser diodes are fundamental components in a myriad of advanced technological applications, ranging from high-speed data transmission in fiber optic networks and precise material processing in industrial settings to intricate medical diagnostics and treatments, as well as crucial sensing capabilities in autonomous vehicles. Their ability to deliver focused, monochromatic light with high power efficiency and a long operational lifespan positions them as indispensable elements in modern innovation. Key benefits include their small footprint, low power consumption, excellent beam quality, and rapid modulation capabilities, which are essential for driving innovation across diverse sectors.

Laser Diode Market Executive Summary

The Laser Diode Market is experiencing robust expansion driven by increasing demand for high-speed data communication, advanced industrial automation, and evolving applications in healthcare and automotive sectors. Business trends highlight significant investments in research and development aimed at improving power output, efficiency, and wavelength diversity, alongside strategic collaborations and mergers to consolidate market positions and expand technological portfolios. Manufacturers are focusing on miniaturization and integration capabilities, which are critical for the proliferation of laser diodes in compact consumer electronics and advanced sensor systems. Regionally, Asia Pacific continues to dominate the market due to its extensive manufacturing base and substantial consumption in consumer electronics and telecommunications, while North America and Europe show strong growth in specialized high-end applications like medical devices, defense, and advanced manufacturing. Segment-wise, telecommunications and data storage remain foundational, yet automotive LiDAR, medical aesthetics, and industrial material processing segments are emerging as significant growth catalysts, propelled by technological advancements and increasing adoption rates. The market is also characterized by a shift towards higher-power and shorter-wavelength diodes, enabling novel applications and enhanced performance.

AI Impact Analysis on Laser Diode Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly influencing the Laser Diode Market, addressing common user questions about enhancing performance, optimizing manufacturing, and enabling new applications. Users are keen to understand how AI can improve the precision and efficiency of laser systems, reduce production costs, and accelerate innovation. AI algorithms are proving instrumental in refining laser diode fabrication processes, performing predictive maintenance on production lines, and ensuring superior quality control through automated inspection, leading to higher yields and reduced waste. Furthermore, AI is enabling advanced applications by enhancing the data processing capabilities of laser-based sensors, such as LiDAR in autonomous vehicles, and by optimizing beam steering and modulation for complex industrial and medical procedures. This synergistic relationship allows for smarter, more adaptive, and highly performant laser diode solutions, unlocking new possibilities across various industries.

- AI-driven optimization of manufacturing processes, leading to increased yield and reduced costs.

- Enhanced quality control and defect detection through AI-powered automated inspection systems.

- Enabling advanced functionality in laser-based applications like LiDAR for autonomous vehicles through intelligent data processing.

- Improved performance and efficiency of laser diodes via AI-guided design and operational parameter tuning.

- Facilitation of complex beam shaping and dynamic modulation in industrial and medical systems using machine learning.

DRO & Impact Forces Of Laser Diode Market

The Laser Diode Market is propelled by several robust drivers, including the insatiable global demand for high-speed internet and data communication, which necessitates advanced fiber optic infrastructure, along with the burgeoning adoption of laser-based technologies in industrial material processing, such as cutting, welding, and marking, due to their precision and efficiency. Further driving factors include rapid advancements in medical diagnostics and therapeutic applications, the integration of LiDAR systems in autonomous vehicles, and the continuous innovation within consumer electronics for applications like 3D sensing and displays. However, the market faces significant restraints, such as the high initial capital expenditure for manufacturing facilities and specialized R&D, stringent thermal management requirements for high-power devices, and susceptibility to electrostatic discharge (ESD) during handling and operation, which can limit broader adoption in certain cost-sensitive sectors. Opportunities for growth are abundant in emerging applications like augmented reality (AR) and virtual reality (VR) systems, quantum computing, free-space optical communication, and the increasing demand for energy-efficient illumination and sensing solutions. The market is also subject to various impact forces, including the pace of technological innovation in material science and semiconductor fabrication, global economic conditions affecting investment in new industries, evolving regulatory standards for safety and environmental impact, and geopolitical dynamics influencing supply chains and trade policies.

Segmentation Analysis

The Laser Diode Market is comprehensively segmented based on various technical and application-oriented criteria to reflect the diverse landscape of its products and their end-use industries. These segmentations provide a detailed understanding of market dynamics, growth drivers, and competitive landscapes within specific niches. Understanding these segments is crucial for stakeholders to identify key growth areas, tailor product development strategies, and penetrate new markets effectively. The market can be broadly categorized by the inherent properties of the laser diodes, their power output, the wavelengths they emit, and critically, the diverse range of applications they serve across commercial, industrial, medical, and technological domains. Each segment exhibits unique demand patterns, technological requirements, and competitive intensity, contributing to the overall complexity and dynamism of the global market. Manufacturers often specialize in specific segments, developing expertise and patented technologies that cater to specialized client needs and performance benchmarks.

- By Type

- Fabry-Perot Laser Diodes: Standard, cost-effective diodes for general applications.

- Distributed Feedback (DFB) Laser Diodes: Highly stable, single-frequency output, essential for telecommunications.

- Distributed Bragg Reflector (DBR) Laser Diodes: Similar to DFB, offers high stability and narrow linewidth.

- Vertical Cavity Surface Emitting Lasers (VCSELs): Low power, high modulation speed, crucial for 3D sensing and short-reach optical interconnects.

- Quantum Cascade Lasers (QCLs): Mid to far-infrared emission, used in gas sensing and spectroscopy.

- External Cavity Laser Diodes (ECLs): Offers wide tunability and extremely narrow linewidths for scientific research.

- By Wavelength

- Infrared Laser Diodes: Dominant for telecommunications, industrial heating, and sensing.

- Red Laser Diodes: Used in barcode scanners, pointers, and some medical applications.

- Blue Laser Diodes: Critical for optical data storage (Blu-ray), projectors, and displays.

- Green Laser Diodes: Found in laser projectors, biomedical instrumentation, and spectroscopy.

- Ultraviolet (UV) Laser Diodes: Emerging for sterilization, curing, and high-resolution printing.

- By Power Rating

- Low-Power Laser Diodes (less than 100 mW): Used in consumer electronics, barcode scanners, and optical storage.

- Medium-Power Laser Diodes (100 mW to 1 W): Applied in medical diagnostics, industrial sensing, and display technologies.

- High-Power Laser Diodes (greater than 1 W): Essential for material processing, high-power pumping, and defense applications.

- By Application

- Telecommunications: Fiber optic communication, data centers, optical switching.

- Industrial: Material processing (cutting, welding, marking), industrial sensing, printing.

- Medical: Surgical procedures, dermatological treatments, diagnostic imaging, dental applications.

- Consumer Electronics: Optical storage (CD/DVD/Blu-ray), 3D sensing (facial recognition), projectors, displays.

- Automotive: LiDAR for autonomous driving, interior lighting, heads-up displays.

- Defense and Security: Target acquisition, range finding, directed energy weapons, night vision.

- By End-User Industry

- Data Centers: For high-speed interconnects and optical transceivers.

- Manufacturing Sector: For precision cutting, welding, drilling, and additive manufacturing processes.

- Healthcare Providers: Hospitals, clinics, and research institutions utilizing medical laser systems.

- Automotive OEMs: Integrating LiDAR and other laser-based sensors into vehicle production.

- Defense Organizations: Procuring laser diodes for various military and security systems.

- Research and Academia: Utilizing advanced laser diodes for scientific experiments and development.

Value Chain Analysis For Laser Diode Market

The value chain for the Laser Diode Market is a complex and highly integrated process, starting from the meticulous sourcing of raw materials and extending to the final deployment in diverse end-user applications. Upstream analysis highlights key players involved in providing specialized semiconductor wafers, such as Gallium Arsenide (GaAs), Indium Phosphide (InP), and Gallium Nitride (GaN), along with high-purity chemicals and gases essential for epitaxial growth processes. These material suppliers form the foundational layer, dictating the quality and performance potential of the eventual laser diode. Midstream activities encompass the intricate fabrication processes, including epitaxy, photolithography, etching, and cleaving, which transform raw wafers into individual laser diode chips, followed by meticulous packaging and testing. This stage involves significant technological expertise and capital investment, where manufacturers integrate advanced chip design with sophisticated manufacturing techniques to ensure optimal performance and reliability. Downstream analysis focuses on the integration of these laser diodes into broader systems by original equipment manufacturers (OEMs) and system integrators across various industries. These integrators design, assemble, and market final products such as fiber optic transceivers, industrial laser machines, medical devices, and automotive LiDAR systems. The distribution channel typically involves a combination of direct sales from large manufacturers to key industrial clients, a network of specialized distributors and value-added resellers for broader market reach, and, increasingly, online platforms for standard components, facilitating both direct and indirect sales channels. The efficiency and optimization of this value chain are critical for cost-effectiveness, quality assurance, and speed-to-market in a rapidly evolving technological landscape.

Laser Diode Market Potential Customers

Potential customers for laser diodes span an extensive array of industries, each seeking the precise, efficient, and versatile light emission capabilities these devices offer for their specific applications. The primary end-users and buyers include major telecommunication companies and data center operators, which require high-speed, reliable optical transceivers for long-haul and short-reach data transmission, forming the backbone of modern digital infrastructure. Industrial manufacturers, particularly in sectors like automotive, aerospace, and electronics, are significant purchasers, utilizing laser diodes for highly precise material processing tasks such as cutting, welding, marking, and drilling, as well as for advanced sensing and quality control systems. The healthcare sector represents another crucial customer base, with medical device manufacturers and research institutions integrating laser diodes into surgical instruments, dermatological treatment systems, diagnostic equipment (like flow cytometry and ophthalmology devices), and advanced imaging technologies. Moreover, the burgeoning automotive industry is increasingly adopting laser diodes for next-generation LiDAR systems in autonomous and semi-autonomous vehicles, alongside interior lighting and projection displays, recognizing their critical role in safety and advanced driver-assistance systems. Consumer electronics companies rely on laser diodes for optical storage devices, 3D sensing in smartphones, augmented reality devices, and pico projectors. Defense and security organizations also represent a vital customer segment, deploying laser diodes in rangefinders, target designators, directed energy applications, and night vision systems, leveraging their accuracy and power. This broad spectrum of end-users underscores the pervasive influence and growing demand for laser diode technology across various critical and innovative applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 billion |

| Market Forecast in 2032 | USD 21.0 billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | II-VI Incorporated (now Coherent Corp.), OSRAM Opto Semiconductors GmbH, Lumentum Holdings Inc., TRUMPF GmbH + Co. KG, IPG Photonics Corporation, Jenoptik AG, Sumitomo Electric Industries, Ltd., Sony Corporation, Hamamatsu Photonics K.K., Sharp Corporation, ROHM Co., Ltd., Panasonic Corporation, Coherent Inc., TOPTICA Photonics AG, SemiLEDs Corporation, Nichia Corporation, Ushio Inc., Lasertel, Inc., Qingdao Bright Laser Technologies Co., Ltd., Lumibird Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Diode Market Key Technology Landscape

The Laser Diode Market is characterized by a dynamic and continually evolving technological landscape, driven by the relentless pursuit of higher efficiency, increased power output, broader wavelength coverage, and enhanced reliability. Core technologies include advanced epitaxial growth techniques such as Metal-Organic Chemical Vapor Deposition (MOCVD) and Molecular Beam Epitaxy (MBE), which are critical for precisely depositing ultrathin layers of semiconductor materials with specific optical and electrical properties on a substrate, thereby forming the active regions of the diode. These processes enable the creation of complex device structures, including quantum wells and quantum dots, that significantly improve light emission efficiency and spectral purity. Following epitaxy, sophisticated wafer processing techniques involving photolithography, etching, and metallization are employed to define the intricate patterns and electrical contacts on the semiconductor chips. High-precision cleaving and dicing technologies separate individual laser diode chips from the wafer. Crucially, advanced packaging technologies play a pivotal role in the overall performance and lifespan of the laser diode, encompassing hermetic sealing, thermal management solutions using innovative heat sinks, and integration with optical components like lenses and fiber pigtails to shape and direct the laser beam. Furthermore, the development of sophisticated thermal management strategies, including micro-channel cooling and thermoelectric coolers, is essential for high-power laser diodes to dissipate heat effectively and prevent performance degradation. Ongoing research focuses on novel material systems, such as GaN-based compounds for blue and UV lasers, and advanced device architectures like vertical-cavity surface-emitting lasers (VCSELs) for high-speed data communications and 3D sensing, alongside distributed feedback (DFB) and distributed Bragg reflector (DBR) lasers for highly stable, single-frequency operation. The landscape is also witnessing significant innovation in beam shaping and beam combining technologies, which allow for the manipulation of laser output for specific industrial and medical applications, maximizing their utility and precision.

Regional Highlights

-

North America

North America is a pivotal region in the Laser Diode Market, distinguished by its strong emphasis on research and development, particularly in advanced applications such as defense, aerospace, medical devices, and autonomous vehicle technology. The United States leads innovation with significant investments in photonics and optoelectronics, fostering a robust ecosystem of startups and established technology giants. Canadian companies also contribute to specialized segments, focusing on industrial applications and sensing technologies. The region benefits from substantial government funding for defense-related laser systems and a thriving venture capital environment supporting emerging laser applications. Demand is particularly high for high-power industrial lasers, sophisticated medical laser systems, and advanced LiDAR solutions for autonomous driving. The presence of leading research institutions and a skilled workforce further solidifies North America's position as a hub for high-value laser diode products and technologies.

- United States: A leader in R&D for defense, medical, and automotive LiDAR applications.

- Canada: Strong focus on industrial lasers, remote sensing, and telecommunications components.

-

Europe

Europe represents a mature and technologically advanced market for laser diodes, driven by its robust industrial manufacturing sector, particularly in countries like Germany, Italy, and France. The region is a significant consumer of laser diodes for precision material processing, additive manufacturing, and advanced machine vision systems. Furthermore, Europe excels in the development and adoption of medical laser technologies, with strong clinical research and a high standard of healthcare facilities. Initiatives to promote Industry 4.0 and smart manufacturing further fuel the demand for high-performance and integrated laser diode solutions. Countries such as the UK and Switzerland also contribute significantly through specialized photonics research and the production of high-precision optical components. Regulatory frameworks for safety and environmental sustainability are also stringent, encouraging innovation in efficient and reliable laser diode designs. Europe's focus on sustainable manufacturing practices and a circular economy also drives demand for energy-efficient laser processing systems.

- Germany: Dominant in industrial lasers, automotive manufacturing, and research.

- United Kingdom: Strong in defense, scientific instrumentation, and optical communications.

- France: Key player in aerospace, defense, and medical laser systems.

-

Asia Pacific (APAC)

The Asia Pacific region stands as the largest and fastest-growing market for laser diodes, primarily due to its expansive manufacturing base, large consumer electronics market, and rapid industrialization. Countries like China, Japan, South Korea, and Taiwan are at the forefront of laser diode production and consumption. China, in particular, is a major manufacturing hub for consumer electronics, telecommunication equipment, and increasingly, high-power industrial lasers. Japan maintains a strong presence in high-precision components, optical storage, and advanced industrial applications, while South Korea excels in displays, mobile technologies, and automotive electronics. The region's substantial investments in 5G infrastructure, data centers, and advanced manufacturing processes like electric vehicle production are fueling unprecedented demand for laser diodes. Furthermore, a growing middle class and expanding disposable incomes contribute to higher adoption rates of consumer devices incorporating laser diode technology. The presence of numerous global electronics manufacturers and strong governmental support for semiconductor industries ensures continued market dominance.

- China: Global manufacturing hub for consumer electronics, telecommunications, and industrial lasers.

- Japan: Leader in optical storage, high-precision industrial, and automotive applications.

- South Korea: Strong market for displays, mobile 3D sensing, and automotive electronics.

- Taiwan: Key contributor to semiconductor manufacturing and optoelectronics.

-

Latin America

Latin America is an emerging market for laser diodes, characterized by increasing industrialization and expanding infrastructure development. Countries like Brazil and Mexico are leading the adoption of laser-based technologies, particularly in industrial material processing for automotive manufacturing, mining, and agricultural machinery. The growing investment in telecommunications infrastructure, including fiber optic network expansion, also contributes to the demand for laser diodes. While smaller in scale compared to other regions, Latin America offers significant growth potential as industrial automation and advanced manufacturing processes become more prevalent. The region's economic growth and efforts to modernize manufacturing sectors are key drivers for the adoption of efficient and precise laser diode solutions. Government initiatives to attract foreign investment and develop local technological capabilities further support market expansion, although challenges such as economic instability and infrastructure limitations persist.

- Brazil: Growing industrial automation and telecommunications infrastructure.

- Mexico: Strong automotive manufacturing sector utilizing laser processing.

-

Middle East and Africa (MEA)

The Middle East and Africa region represents a nascent but steadily growing market for laser diodes, primarily driven by infrastructure development, diversification of economies away from oil, and increasing investments in advanced technologies. Countries in the Middle East, such as UAE and Saudi Arabia, are investing heavily in smart city projects, healthcare infrastructure, and defense capabilities, all of which require sophisticated laser-based systems. Africa is seeing gradual adoption in telecommunications for expanding internet access, as well as in some industrial applications. The demand for security and surveillance technologies is also contributing to the market's growth in the region. Although the market is relatively smaller, the ongoing economic reforms, technological adoption initiatives, and focus on non-oil sectors are expected to create new opportunities for laser diode manufacturers and suppliers. Strategic partnerships with international technology providers are crucial for technology transfer and market penetration in this region.

- UAE: Investments in smart cities, healthcare, and advanced infrastructure.

- Saudi Arabia: Focus on economic diversification and defense technology upgrades.

- South Africa: Emerging demand in telecommunications and industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Diode Market.- II-VI Incorporated (now Coherent Corp.)

- OSRAM Opto Semiconductors GmbH

- Lumentum Holdings Inc.

- TRUMPF GmbH + Co. KG

- IPG Photonics Corporation

- Jenoptik AG

- Sumitomo Electric Industries, Ltd.

- Sony Corporation

- Hamamatsu Photonics K.K.

- Sharp Corporation

- ROHM Co., Ltd.

- Panasonic Corporation

- Coherent Inc.

- TOPTICA Photonics AG

- SemiLEDs Corporation

- Nichia Corporation

- Ushio Inc.

- Lasertel, Inc.

- Qingdao Bright Laser Technologies Co., Ltd.

- Lumibird Group

Frequently Asked Questions

What are the primary applications of laser diodes?

Laser diodes are versatile semiconductor devices with extensive applications across various industries. Their primary uses include high-speed data transmission in telecommunications and data centers, precision material processing such as cutting, welding, and marking in industrial manufacturing, advanced diagnostics and surgical procedures in the medical sector, and sensing technologies like LiDAR for autonomous vehicles. They are also integral to consumer electronics for optical storage, 3D sensing in smartphones, and compact projectors. This broad utility stems from their ability to produce coherent, monochromatic light efficiently and precisely, making them indispensable components in modern technology.

How is AI impacting the laser diode market?

Artificial Intelligence (AI) is significantly transforming the laser diode market by enhancing both production efficiency and application capabilities. In manufacturing, AI optimizes processes, predicts equipment failures, and improves quality control through automated visual inspection, leading to higher yields and reduced operational costs. In terms of applications, AI enables more sophisticated data interpretation for laser-based sensors, such as refining object detection and mapping in autonomous driving LiDAR systems. It also facilitates dynamic beam steering and modulation for complex industrial and medical procedures, allowing for greater precision and adaptability, thereby expanding the potential uses and performance benchmarks of laser diode technology.

What are the key growth drivers for the laser diode market?

The laser diode market is propelled by several robust growth drivers. A fundamental driver is the escalating global demand for high-speed data communication, requiring advanced fiber optic transceivers and data center infrastructure. The increasing adoption of laser diodes in industrial material processing for highly precise and efficient manufacturing tasks also contributes significantly. Furthermore, rapid advancements in medical device technology and therapeutic applications, along with the integration of LiDAR systems into autonomous vehicles for enhanced safety and navigation, are critical drivers. The continuous evolution of consumer electronics, necessitating compact and energy-efficient light sources for 3D sensing and display technologies, further fuels market expansion.

Which regions are dominant in the laser diode market?

The Asia Pacific (APAC) region currently holds the largest share and is the fastest-growing market for laser diodes. This dominance is attributed to its extensive manufacturing capabilities, particularly in China, Japan, and South Korea, which serve as global hubs for consumer electronics and telecommunications equipment production. North America and Europe also represent significant markets, characterized by strong research and development activities and high adoption rates in specialized, high-value applications such as defense, medical devices, and advanced industrial automation. These regions demonstrate consistent demand for cutting-edge laser diode technologies due to their advanced technological infrastructure and innovation ecosystems.

What challenges does the laser diode market face?

The laser diode market encounters several challenges that can impede its growth and widespread adoption. High initial manufacturing costs, particularly for specialized and high-power diodes, can be a significant barrier for some applications and smaller enterprises. Complex thermal management requirements are crucial for maintaining the performance and lifespan of high-power laser diodes, demanding advanced cooling solutions. Additionally, laser diodes are highly susceptible to electrostatic discharge (ESD), necessitating careful handling and protective measures during manufacturing and integration. Intense competition from alternative light sources and the need for continuous innovation to keep pace with evolving technological demands also present ongoing challenges for market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lasers Quantum Dots Market Size Report By Type (Single-Mode Laser Diodes, Multi-Mode Laser Diodes, Distributed Feedback Laser Diode (DFB), Distributed Bragg Reflector Laser Diodes (DBR)), By Application (Biological Imaging, Optoelectronics, Quantum Optics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Laser Diode Market Size Report By Type (Blue Laser Diode, Red Laser Diode, Infrared Laser Diode, Other Laser Diode), By Application (Optical Storage & Display, Telecom & Communication, Industrial Applications, Medical Application, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Visible Laser Diode Market Statistics 2025 Analysis By Application (Pumping, Medical Applications, High-power, Measurement, Other), By Type (Continuous, Pulsed, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Injection Laser Diode Market Statistics 2025 Analysis By Application (Optical Storage & Display, Telecom & Communication, Industrial Applications, Medical Application, Other), By Type (Blue Laser Diode, Red Laser Diode, Infrared Laser Diode, Other Laser Diode), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Multi-Mode Blue Laser Diode Market Statistics 2025 Analysis By Application (Laser Projectors and Scanners, Bio/Medical, Metrology Measurements Application), By Type (Below 1000mw, 1000mw-3000mw, More than 3000mw), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager