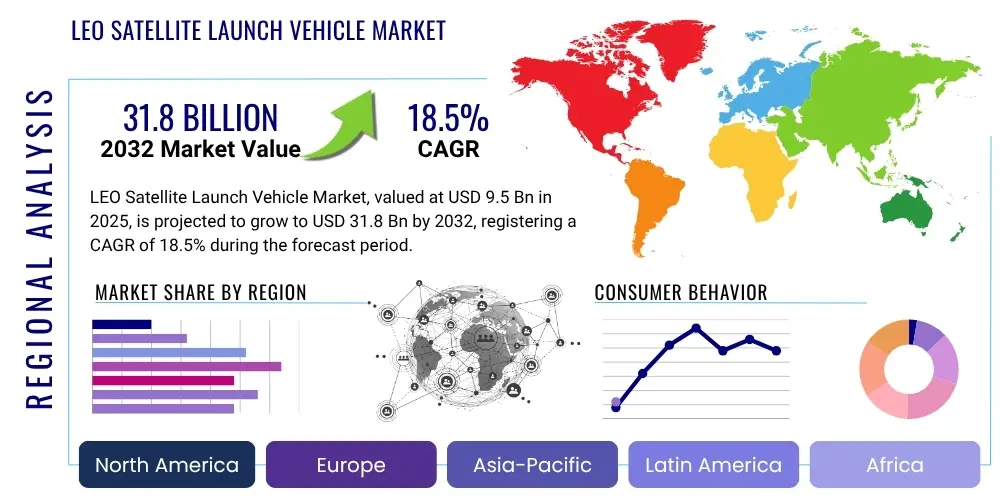

LEO Satellite Launch Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429346 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

LEO Satellite Launch Vehicle Market Size

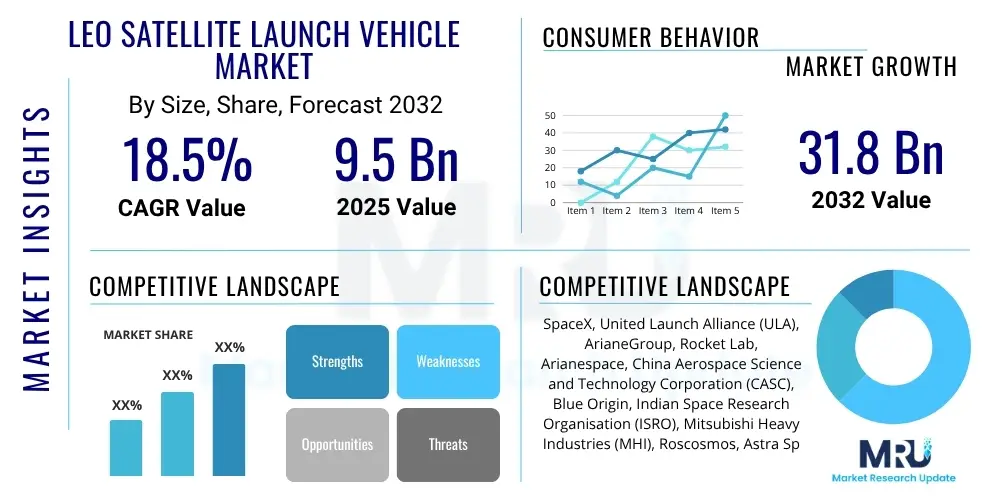

The LEO Satellite Launch Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 9.5 Billion in 2025 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2032.

LEO Satellite Launch Vehicle Market introduction

The LEO Satellite Launch Vehicle market stands as a cornerstone of the burgeoning global space economy, dedicated to the precise and efficient deployment of various payloads into Low Earth Orbit. LEO, typically defined by altitudes ranging from 160 km to 2,000 km, is a preferred operational zone for satellites requiring minimal latency for communication, high-resolution imaging for Earth observation, and reduced power consumption compared to higher orbits. The market's primary offering comprises a sophisticated array of launch systems, from dedicated small launchers catering to micro- and nano-satellites, to powerful heavy-lift rockets designed for deploying extensive satellite constellations. These vehicles are engineered with a strong emphasis on reliability, cost-effectiveness, and increasingly, reusability, aiming to democratize access to space by significantly lowering per-launch expenses.

The major applications driving demand for LEO satellite launch vehicles are diverse and strategically important. Global internet connectivity initiatives, spearheaded by projects like Starlink, OneWeb, and Amazon Kuiper, represent a significant portion of the market, necessitating frequent and high-volume launches to establish and maintain vast satellite constellations. Beyond communication, LEO satellites are critical for advanced Earth observation and remote sensing, enabling detailed environmental monitoring, agricultural management, and urban planning. Defense and intelligence agencies worldwide rely on LEO assets for surveillance, reconnaissance, and secure communication, while scientific research institutions utilize these orbits for a multitude of experiments and astronomical observations. Emerging applications in the Internet of Things (IoT), facilitating global asset tracking and remote data collection, further broaden the market's scope.

The inherent benefits of LEO satellite deployment, such as enhanced global coverage, ultra-low latency data transmission, and the ability to rapidly refresh in-orbit technology, are pivotal in fostering market growth. These advantages make LEO constellations highly attractive for a wide array of commercial and governmental applications, providing resilient and high-capacity services. The market's expansion is fundamentally driven by several key factors: the escalating global demand for ubiquitous satellite internet, continuous advancements in satellite miniaturization that allow for more payloads per launch, substantial governmental and private sector investments in space exploration and commercialization, and significant technological breakthroughs in launch vehicle design, particularly the increasing maturity and reliability of reusable rocket systems, which are dramatically reshaping the economics of space access.

LEO Satellite Launch Vehicle Market Executive Summary

The LEO Satellite Launch Vehicle market is characterized by profound business trends, including a transformative shift towards private sector dominance and unprecedented levels of investment from venture capital and corporate entities. This has ignited intense competition, with traditional aerospace giants contending alongside agile new space startups, all vying for market share by prioritizing innovations in cost reduction, rapid launch cadence, and technological reusability. The strategic deployment of large-scale satellite constellations for global broadband internet is a defining trend, reshaping demand for launch services and fostering a supply chain focused on efficiency and high-volume operations. Furthermore, the market is experiencing an increase in strategic partnerships and consolidations as companies seek to pool resources, leverage specialized expertise, and expand their global footprint, navigating an evolving regulatory landscape that aims to balance rapid innovation with concerns around space traffic management and debris mitigation.

Geographically, the market exhibits distinct regional dynamics. North America and Europe maintain their stronghold as mature and leading markets, underpinned by well-established government space programs, advanced industrial infrastructure, and a robust ecosystem of both legacy aerospace corporations and disruptive new entrants. These regions benefit from significant research and development capabilities and consistent demand from defense and commercial sectors. The Asia Pacific (APAC) region, however, is emerging as the most dynamic growth frontier, driven by ambitious national space programs in countries like China, India, and Japan, coupled with rapidly expanding domestic demand for satellite communication, Earth observation, and navigation services. This growth is further fueled by substantial government backing and increasing private sector participation, leading to the development of indigenous launch capabilities. Latin America and the Middle East & Africa (MEA) represent nascent but promising markets, marked by strategic investments in space infrastructure and increasing reliance on international collaboration to build out their own space access capabilities, often prioritizing national security and economic diversification.

Segmentation trends within the LEO Satellite Launch Vehicle market highlight a pronounced emphasis on smaller payload capacities, primarily driven by the proliferation of CubeSats, nano-satellites, and micro-satellites for diverse commercial, scientific, and defense applications. This trend has spurred the development of dedicated small satellite launchers and increased the availability and attractiveness of rideshare opportunities, which offer cost-effective access to space for smaller payloads. In terms of launch types, while dedicated missions provide unparalleled flexibility and control for primary payloads, rideshare services are gaining substantial traction due to their economic advantages for secondary payloads and constellation deployments. Propulsion technologies are continuously evolving, with liquid propulsion remaining a dominant choice for its efficiency and thrust, complemented by ongoing advancements in solid and hybrid propulsion systems tailored for specific mission requirements. The end-user landscape is predominantly shaped by commercial satellite operators and government/defense entities, with academic and research institutions contributing a steady, albeit smaller, demand for experimental and scientific missions, collectively driving innovation and investment across all market segments.

AI Impact Analysis on LEO Satellite Launch Vehicle Market

Users frequently inquire about how Artificial Intelligence (AI) is fundamentally transforming the LEO Satellite Launch Vehicle market, with a strong focus on its capabilities to significantly enhance operational efficiency, reduce costs, and improve the overall reliability and success rates of complex space missions. Key themes in user questions revolve around the practical applications of AI in optimizing launch vehicle design and manufacturing processes, enabling increasingly autonomous launch and in-orbit operations, and providing sophisticated predictive maintenance for intricate rocket systems. There is considerable interest in how AI can make launch systems more intelligent, adaptive, and resilient against unforeseen challenges, alongside concerns regarding the trustworthiness and ethical implications of AI-driven decision-making in high-stakes space endeavors. Users also seek clarity on the timelines for widespread AI adoption in the space industry and the specialized skill sets required to fully harness AI's potential in this domain.

The integration of AI and machine learning technologies across the entire lifecycle of a LEO satellite launch vehicle promises revolutionary advancements. In the initial design and engineering phase, AI algorithms are leveraged to optimize complex aerodynamic profiles, enhance structural integrity, and maximize the efficiency of propulsion systems. This leads to the creation of lighter, more capable, and ultimately more cost-effective rockets, reducing development cycles. During the manufacturing and assembly stages, AI-powered robotics, coupled with advanced computer vision systems, ensure unparalleled precision, identify defects in real-time, and streamline production processes, thereby accelerating build times and minimizing human error. For pre-launch operations, AI significantly improves ground system diagnostics, conducting sophisticated anomaly detection and real-time health monitoring of the vehicle, ensuring optimal readiness. Furthermore, AI is crucial for dynamic launch window optimization, processing vast meteorological data and space traffic information to identify the most opportune and safest launch slots, thereby maximizing mission opportunities.

Following launch, AI's influence extends to critical in-flight and post-flight operations. Advanced AI-driven autonomous flight control systems enable rockets to self-correct trajectories, adapt to unexpected atmospheric conditions or system anomalies, and precisely deploy satellites into their designated orbits with minimal human intervention. For the rapidly expanding segment of reusable launch vehicles, AI-powered predictive maintenance algorithms analyze continuous streams of sensor data from rocket components to anticipate potential failures, optimize maintenance schedules, and extend the operational lifespan of high-value assets such as engines and structures. This directly translates to substantial reductions in operational costs and increased vehicle availability. Moreover, AI facilitates an iterative design process by analyzing massive datasets from test flights and operational missions, providing invaluable insights that inform and accelerate the development of future, more advanced launch vehicle generations, solidifying its role as an indispensable technology in achieving safe, efficient, and sustainable access to LEO.

- Enhanced trajectory optimization and autonomous navigation for precision orbital insertion.

- Predictive maintenance and real-time anomaly detection for critical launch vehicle components.

- Automated manufacturing, assembly, and quality control processes to reduce production time and costs.

- Real-time telemetry analysis and adaptive decision-making during dynamic launch sequences.

- Intelligent payload deployment strategies for complex, multi-satellite constellation architectures.

- Optimized mission planning and scheduling, factoring in dynamic weather conditions and space traffic.

- Autonomous flight control systems enabling adaptive and resilient operations in challenging environments.

- AI-driven sensor data processing for comprehensive pre-flight diagnostics and post-flight performance analysis.

DRO & Impact Forces Of LEO Satellite Launch Vehicle Market

The LEO Satellite Launch Vehicle market is profoundly shaped by a powerful combination of driving forces, significant restraints, and promising opportunities. Key drivers propelling market expansion include the exponential and unwavering demand for global broadband internet connectivity, fueled by massive satellite constellation initiatives from commercial giants like SpaceX and OneWeb. This is further amplified by the increasing adoption of LEO satellites for critical applications in Earth observation, advanced Internet of Things (IoT) services, and defense and intelligence gathering across various sectors. The continuous trend of satellite miniaturization has reduced the mass of individual payloads, making space access more economically viable for a broader array of entities. Moreover, substantial governmental investments in national space programs worldwide and the accelerating commercialization of space, which incentivizes private sector innovation and competition, are pivotal in expanding both market demand and technological capabilities, particularly in the realm of advanced reusable rocket technologies that dramatically reduce the cost of access to space.

Conversely, the market faces several formidable restraints that temper its growth trajectory. The inherently high initial capital investment required for the research, development, and operational deployment of sophisticated launch vehicles, coupled with lengthy development cycles and certification processes, poses a significant barrier to entry for new players. The highly stringent and complex regulatory environment, encompassing international space treaties, national launch regulations, and orbital debris mitigation guidelines, adds layers of compliance and can slow down the pace of innovation and market entry. The ever-present risk of launch failures represents not only substantial financial losses but also reputational damage for launch service providers, potentially impacting future contracts. Furthermore, the escalating concern over space debris in LEO and the environmental impact of rocket launches, including greenhouse gas emissions, are leading to increased scrutiny and calls for sustainable practices, which may impose additional costs and technical challenges on market participants. The limited availability of suitable launch sites globally also presents logistical and geopolitical challenges, affecting launch cadences and market access for some operators.

Despite these challenges, numerous opportunities are poised to significantly accelerate market expansion and foster long-term sustainability. The emergence of new markets for satellite-based services in developing economies, particularly for rural broadband, remote monitoring, and disaster management, presents untapped revenue streams and expands the global customer base. The continuous proliferation of nano- and micro-satellites for diverse applications will sustain a robust demand for flexible and cost-effective launch solutions, including dedicated small satellite launchers and dynamic rideshare options. Longer-term opportunities lie in pioneering ventures such as space tourism, asteroid mining, and in-orbit servicing and manufacturing, which will necessitate the development of next-generation launch vehicles and supporting infrastructure. Moreover, cross-industry collaborations between space companies and sectors such as telecommunications, agriculture, logistics, and renewable energy are opening up innovative application areas and novel business models, fostering a more integrated and diversified space economy. The relentless pursuit of advanced materials, novel propulsion systems, and artificial intelligence-driven technologies continues to unlock new possibilities for highly efficient, reliable, and sustainable access to LEO.

Segmentation Analysis

The LEO Satellite Launch Vehicle market is meticulously segmented to provide a granular understanding of its complex dynamics, competitive landscape, and future growth trajectories across various operational and technological dimensions. This segmentation is crucial for stakeholders to identify specific market niches, tailor their offerings to precise customer requirements, and strategically position themselves within the evolving space industry. The market is primarily analyzed based on factors such as payload capacity, which defines the maximum weight and volume a launch vehicle can deliver to orbit, and launch type, distinguishing between missions solely dedicated to a single client's payload and more economical rideshare opportunities where multiple satellites share a single launch. Further segmentation by propulsion type examines the diverse engine technologies employed, while the end-user category identifies the key customer groups driving the demand for LEO launch services across commercial, governmental, and academic sectors. Each segment contributes uniquely to the market's overall structure, influenced by specific technical needs, economic considerations, and strategic objectives of both providers and consumers of space launch services.

- By Payload Capacity: This segment categorizes launch vehicles based on the mass of the payload they are designed to carry into LEO, impacting their target market and mission profiles.

- Small (50-500 kg): Primarily targets CubeSats, nano-satellites, and micro-satellites for scientific, educational, and commercial applications.

- Medium (501-2500 kg): Caters to larger micro-satellites, mini-satellites, and smaller traditional satellites, often for Earth observation and communication.

- Heavy (above 2500 kg): Designed for deploying large, multi-satellite constellations or substantial individual payloads, critical for global broadband networks.

- By Launch Type: Differentiates how satellites are deployed, affecting cost, flexibility, and mission control.

- Dedicated: A single customer's payload occupies the entire launch vehicle, offering maximum flexibility in orbit, launch window, and trajectory.

- Rideshare: Multiple payloads from different customers share a single launch, significantly reducing individual costs but offering less control over specific orbital parameters and launch timelines.

- By Propulsion Type: Focuses on the type of fuel and oxidizer used in rocket engines, influencing performance, reusability, and environmental impact.

- Liquid Propulsion: Utilizes liquid propellants (e.g., kerosene, methane, hydrogen with liquid oxygen) for high thrust, controlled shutdown, and restart capabilities, essential for reusable stages.

- Solid Propulsion: Employs solid propellant mixtures, offering high thrust-to-weight ratio and simplicity, often used as boosters or for smaller, simpler rockets.

- Hybrid Propulsion: Combines solid fuel with a liquid oxidizer, aiming to offer the safety and throttleability of liquid systems with the simplicity of solid rockets.

- By End-User: Identifies the primary customers driving demand for LEO launch services, reflecting diverse strategic and operational needs.

- Commercial: Includes satellite communication providers, Earth observation companies, and IoT service providers deploying large-scale constellations for business purposes.

- Government/Defense: Comprises national space agencies, defense ministries, and intelligence organizations using LEO satellites for security, scientific research, and national infrastructure.

- Academic/Research: Universities and research institutions utilizing LEO launches for experimental payloads, technology demonstrations, and scientific investigations, often with CubeSats.

Value Chain Analysis For LEO Satellite Launch Vehicle Market

The value chain for the LEO Satellite Launch Vehicle market is highly complex and interdependent, involving numerous specialized stages from foundational research and raw material sourcing to the ultimate deployment and operational support of satellites. The upstream segment of this value chain is foundational, encompassing extensive research and development (R&D) efforts that drive innovation in propulsion systems, materials science, and structural engineering. This segment includes suppliers of highly specialized raw materials such as advanced aerospace-grade alloys (e.g., aluminum-lithium, titanium), high-performance carbon composites, and chemical propellants (e.g., liquid oxygen, liquid hydrogen, refined kerosene, methane). Critical component manufacturers also reside upstream, producing sophisticated rocket engines, precise avionics systems, robust guidance, navigation, and control (GNC) units, and intricate structural elements. The intellectual capital in R&D and precision manufacturing at this stage is paramount, dictating the performance, reliability, and cost-effectiveness of the final launch vehicle.

Progressing downstream, the value chain encompasses the meticulous integration and assembly of these components into a complete, flight-ready launch vehicle, followed by the rigorous process of launch service provision and, eventually, the sustained operational phase of the deployed satellites. Launch service providers are responsible for orchestrating the entire launch campaign, which includes vehicle assembly at dedicated facilities, extensive ground testing and validation, managing complex ground support infrastructure, and the precise execution of launches from specialized spaceports. Post-launch, the value chain extends to satellite operators who manage their constellations in orbit, ensuring optimal performance and longevity. This also involves the extensive network of ground stations responsible for telemetry, tracking, and command (TT&C), as well as data processing and analytics companies that extract valuable insights from the vast amounts of information transmitted by LEO satellites. The seamless coordination and robust technological capabilities across these stages are vital for ensuring mission success and maximizing the return on investment for all stakeholders.

Distribution channels within the LEO Satellite Launch Vehicle market are predominantly characterized by direct, high-value contracts between launch service providers and their clients. For large-scale, dedicated missions, clients such as national space agencies, defense departments, and major commercial satellite operators typically engage directly with providers through long-term procurement agreements. These direct engagements allow for bespoke mission planning, tailored orbital insertion parameters, and stringent security protocols. However, with the rapid proliferation of smaller satellites, indirect distribution channels are gaining significant prominence and market share. This model often involves launch brokers or aggregators who consolidate multiple smaller payloads from various clients onto a single launch vehicle, offering cost-effective rideshare opportunities. These aggregators democratize access to space for academic institutions, startups, and smaller commercial entities that might not require a dedicated launch. Both direct and indirect channels are critical for serving the diverse needs of the LEO satellite market, balancing the demand for mission-specific flexibility with the growing imperative for economical and frequent access to orbit, ensuring a dynamic and accessible space ecosystem.

LEO Satellite Launch Vehicle Market Potential Customers

The potential customer base for LEO Satellite Launch Vehicles is expansive and rapidly diversifying, reflecting the growing utility and accessibility of Low Earth Orbit across various industries and governmental sectors. A significant portion of this customer base comprises commercial satellite communication providers, exemplified by ambitious projects such as SpaceX's Starlink, OneWeb, and Amazon's Project Kuiper. These entities are engaged in the large-scale deployment of extensive satellite constellations designed to provide global broadband internet services, necessitating frequent, high-cadence, and exceptionally cost-effective launch services to establish and continuously replenish their vast in-orbit networks. Concurrently, Earth observation and remote sensing companies constitute another critical customer segment, leveraging LEO satellites for highly detailed environmental monitoring, precision agriculture, urban development planning, resource management, and disaster response. These customers require precise orbital insertion capabilities to ensure optimal sensor performance and data collection accuracy.

Government and defense agencies worldwide represent a foundational and consistently robust segment of demand for LEO launch capabilities. These institutions utilize LEO satellites for an array of critical national security applications, including intelligence gathering, surveillance, and reconnaissance (ISR), secure military communications, enhanced navigation systems, and advanced meteorological forecasting. Furthermore, national space agencies such as NASA (USA), ESA (Europe), JAXA (Japan), and ISRO (India) consistently invest in LEO missions for scientific research, technological demonstration, and deep space exploration precursor missions, providing a stable stream of demand for specialized launch services. The long-term nature and strategic importance of government contracts often provide a crucial bedrock of revenue for many launch service providers, fostering continuous technological development and ensuring operational stability within the market.

Beyond these major stakeholders, the market is increasingly catering to a growing number of specialized and emerging end-users. Internet of Things (IoT) service providers are deploying dedicated LEO constellations to offer global asset tracking and data connectivity for remote devices across diverse sectors like logistics, utilities, smart infrastructure, and environmental monitoring, addressing connectivity gaps in terrestrial networks. Academic and research institutions frequently utilize LEO launches for a wide variety of scientific experiments, technology validation, and educational initiatives, often leveraging small, cost-effective payloads like CubeSats. Furthermore, nascent but rapidly developing sectors such as commercial space tourism, asteroid mining, and future in-orbit manufacturing or servicing companies are poised to become significant customers, driving demand for both human-rated and cargo-carrying LEO launch vehicles. These emerging segments will necessitate highly adaptable, reliable, and frequent access to space for specialized missions, further broadening the market's potential client base and fostering innovation in launch solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 31.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SpaceX, United Launch Alliance (ULA), ArianeGroup, Rocket Lab, Arianespace, China Aerospace Science and Technology Corporation (CASC), Blue Origin, Indian Space Research Organisation (ISRO), Mitsubishi Heavy Industries (MHI), Roscosmos, Astra Space, Relativity Space, Firefly Aerospace, ExPace, Skyroot Aerospace, ISAR Aerospace, PLD Space, LinkSpace, Vector Launch Inc., BlackSky, Stratolaunch, Ursa Major Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LEO Satellite Launch Vehicle Market Key Technology Landscape

The LEO Satellite Launch Vehicle market is undergoing a profound and rapid technological transformation, primarily driven by an unyielding pursuit of significantly lower launch costs, enhanced reliability, and accelerated deployment capabilities. A cornerstone of this technological evolution is the pioneering development and increasingly widespread adoption of reusable rocket technology, notably championed by industry leaders like SpaceX. This innovative approach involves sophisticated landing systems for first-stage boosters, often incorporating advanced guidance, navigation, and control (GNC) systems, coupled with robust engine restart capabilities for precision landings. The ability to recover and reuse expensive rocket components dramatically reduces the per-launch cost, making access to space considerably more economically viable for a broader spectrum of commercial and governmental entities. Continued innovation in this area, including the development of fully reusable two-stage-to-orbit systems, is expected to further disrupt existing market paradigms and accelerate future growth.

Beyond reusability, advancements in propulsion systems represent another critical area of technological focus and investment. While conventional liquid and solid propulsion systems remain prevalent and continuously refined, there has been a significant surge in the development and testing of new-generation engines such as methalox (methane-liquid oxygen) engines. These engines are favored for their higher performance characteristics, inherent reusability potential due to reduced coking, and a cleaner burn compared to traditional kerosene-based propellants. While not typically used for primary launch thrust, electric propulsion systems are also gaining traction for highly efficient in-space maneuvering, orbital adjustments, and deorbiting capabilities of satellites. Furthermore, substantial progress is being made in the application of advanced manufacturing techniques, particularly additive manufacturing (3D printing), for producing complex rocket components. This enables rapid prototyping, significantly reduces part count, creates intricate geometries that enhance engine efficiency and structural integrity, and ultimately leads to faster production cycles and lower overall manufacturing costs.

The technological landscape of LEO satellite launch vehicles is also profoundly shaped by advancements in software, avionics, and materials science. Miniaturized and increasingly powerful avionics systems are enhancing flight autonomy, improving real-time decision-making, and bolstering overall mission reliability, thereby reducing the reliance on extensive ground control infrastructure. The integration of Artificial Intelligence and Machine Learning (AI/ML) is becoming vital across various operational phases, from optimizing mission parameters and trajectory planning to enabling predictive maintenance for critical components, real-time anomaly detection during launch, and developing fully autonomous flight control systems. Moreover, the continuous development of advanced materials, including lightweight, high-strength carbon composites and high-temperature resistant ceramics, is essential for constructing lighter, stronger, and more resilient vehicle structures. These material innovations enable higher payload capacities, improve reusability thresholds, and enhance the overall safety and performance of next-generation LEO launch vehicles, collectively driving a more dynamic, accessible, and sustainable future for space access.

Regional Highlights

- North America: This region maintains a dominant position in the LEO Satellite Launch Vehicle market, primarily driven by the pioneering efforts of private companies like SpaceX, the established capabilities of United Launch Alliance (ULA), and the innovative solutions from Rocket Lab. It benefits from substantial governmental investment through agencies like NASA and the Department of Defense (DoD), fostering a robust private space industry and a dynamic ecosystem of startups focused on developing cutting-edge launch technologies and deploying extensive satellite constellations. The region's strong R&D infrastructure and consistent demand for advanced satellite-based services underscore its market leadership and ongoing innovation.

- Europe: Europe stands as a significant global player, strongly supported by the European Space Agency (ESA) and key industrial entities such as ArianeGroup and Arianespace. The region's strategic focus is on ensuring independent access to space, with increasing private sector involvement and the emergence of promising new launch providers like ISAR Aerospace and PLD Space, which are actively targeting the rapidly growing small satellite launch market. Collaborative initiatives across member states are crucial for driving technological advancements and ensuring competitive prowess in the global space arena, with initiatives like the European Union's IRIS2 constellation further stimulating demand.

- Asia Pacific (APAC): This region is rapidly emerging as a primary engine of growth and innovation in the LEO Satellite Launch Vehicle market. It is propelled by the ambitious national space programs of countries such as China (e.g., CASC, ExPace) and India (ISRO), alongside significant contributions from Japan (Mitsubishi Heavy Industries) and South Korea. The APAC market is characterized by a surging domestic demand for satellite communication, Earth observation, and navigation services, supported by substantial government funding for indigenous space capabilities and a burgeoning private space sector. Rapid industrialization, technological advancements, and increasing geopolitical interests in space are key drivers for this region's expansion.

- Latin America: Currently representing a nascent market, Latin America largely depends on international launch providers for its satellite deployment requirements. However, there is a discernible trend of increasing interest and strategic investment in developing indigenous space capabilities across the region. Countries such as Brazil and Argentina are at the forefront of these efforts, focusing on research, infrastructure development, and partnerships, indicating a strong potential for future growth in regional demand for tailored launch services and localized space access solutions, driven by national security and economic development goals.

- Middle East and Africa (MEA): This region is making strategic and substantial investments in its space infrastructure and advanced satellite technologies, driven by objectives related to national security, economic diversification away from traditional industries, and the critical need for improved communication services. Countries such as the UAE and Saudi Arabia are leading these initiatives, often through impactful international partnerships and technology transfer agreements. These efforts are gradually fostering a domestic demand for LEO launch capabilities and a developing ecosystem for space services, positioning MEA as a region with significant long-term growth potential in space access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LEO Satellite Launch Vehicle Market.- SpaceX

- United Launch Alliance (ULA)

- ArianeGroup

- Rocket Lab

- Arianespace

- China Aerospace Science and Technology Corporation (CASC)

- Blue Origin

- Indian Space Research Organisation (ISRO)

- Mitsubishi Heavy Industries (MHI)

- Roscosmos

- Astra Space

- Relativity Space

- Firefly Aerospace

- ExPace

- Skyroot Aerospace

- ISAR Aerospace

- PLD Space

- LinkSpace

- Vector Launch Inc.

- BlackSky

- Stratolaunch

- Ursa Major Technologies

Frequently Asked Questions

What are LEO satellite launch vehicles?

LEO satellite launch vehicles are sophisticated rocket systems specifically engineered to transport satellites and other payloads into Low Earth Orbit (LEO), which typically ranges from altitudes of 160 km to 2,000 km above Earth. These vehicles are instrumental for deploying extensive constellations used in global internet provision, detailed Earth observation, advanced scientific research, and defense applications. They incorporate cutting-edge propulsion and guidance technologies, with a rapidly increasing emphasis on reusability and cost-efficiency to make space access more sustainable.

Why is the LEO satellite market growing significantly?

The LEO satellite market is experiencing substantial growth driven by several interconnected factors. These include the surging global demand for ubiquitous satellite internet services, the continued miniaturization of satellite technology which enables more numerous and cost-effective deployments, heightened governmental and private sector investments in space programs worldwide, and revolutionary technological advancements. Specifically, the increasing reliability and economic benefits of reusable rocket systems are making access to space more affordable and frequent for a diverse range of commercial and scientific missions, accelerating market expansion.

What are the primary challenges faced by the LEO Satellite Launch Vehicle market?

The LEO Satellite Launch Vehicle market confronts several significant challenges. These include the exceptionally high initial capital investment required for research, development, and operational infrastructure, coupled with stringent and complex regulatory frameworks that govern space activities. Furthermore, the inherent risks associated with launch failures, which can result in substantial financial and reputational losses, remain a constant concern. The escalating problem of space debris in LEO and growing environmental concerns related to rocket emissions also necessitate costly mitigation strategies and sustainable operational practices, adding further layers of complexity to market operations.

How does reusability impact LEO satellite launch costs?

Reusability dramatically impacts LEO satellite launch costs by enabling the recovery and subsequent reflown of expensive components, most notably the first-stage boosters and potentially other vehicle elements. This innovation eliminates the need to manufacture entirely new rockets for each mission, leading to substantial reductions in manufacturing expenses, operational overheads, and overall capital expenditure per launch. Consequently, reusability makes access to space significantly more affordable, increases launch cadence, and opens up the LEO market to a broader spectrum of commercial and governmental clients, fundamentally transforming the economics of space transportation.

What role does AI play in optimizing LEO satellite launches?

Artificial Intelligence (AI) plays a transformative and increasingly critical role in optimizing LEO satellite launches across various stages. AI algorithms are employed to enhance trajectory optimization for precise orbital insertion, implement sophisticated predictive maintenance for vital rocket components, automate complex manufacturing and assembly processes, and facilitate real-time anomaly detection during dynamic flight sequences. Moreover, AI aids in intelligent mission planning, optimizing launch windows, and developing autonomous flight control systems that adapt to unexpected conditions. This comprehensive application of AI contributes to significant improvements in launch safety, operational efficiency, cost-effectiveness, and overall mission reliability for LEO satellite deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager