Life & Non-Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430324 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Life & Non-Life Insurance Market Size

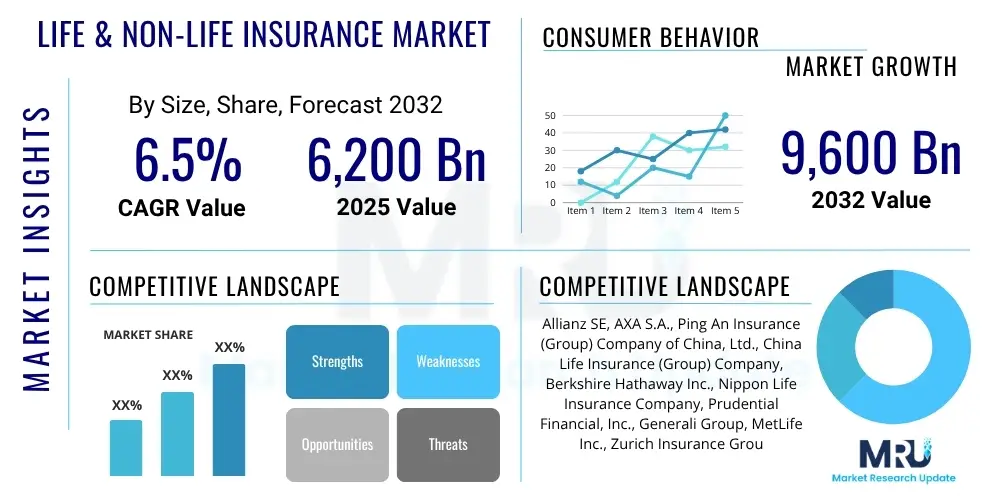

The Life & Non-Life Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $6,200 Billion in 2025 and is projected to reach $9,600 Billion by the end of the forecast period in 2032.

Life & Non-Life Insurance Market introduction

The Life & Non-Life Insurance Market forms a critical pillar of the global financial services landscape, offering essential protection against a multitude of risks. Life insurance products, including term, whole, and universal life policies, provide financial security for beneficiaries upon the policyholder's demise, often incorporating savings or investment components. Non-life insurance, encompassing property, casualty, health, motor, and liability coverages, safeguards individuals and businesses from losses arising from unforeseen events, ensuring continuity and stability in the face of adversity. These diverse product offerings are fundamental to both personal financial planning and robust corporate risk management strategies.

Major applications of insurance span individual protection, wealth accumulation, and business operational continuity. Individuals leverage life insurance for family financial stability and retirement planning, while non-life policies protect assets like homes, vehicles, and health. For businesses, insurance is indispensable for mitigating operational risks, protecting against property damage, legal liabilities, employee health issues, and cyber threats. The inherent benefits include unparalleled financial security, peace of mind, and the facilitation of economic growth by enabling risk-taking and innovation, as businesses and individuals can transfer potential losses to insurers, thereby stabilizing financial outcomes.

Driving factors propelling this market include a burgeoning global population, increasing awareness of risk management among both consumers and enterprises, and a rise in disposable incomes. Furthermore, evolving regulatory landscapes that mandate certain types of insurance, coupled with the increasing frequency and severity of natural disasters, underscore the necessity of robust insurance coverage. Technological advancements, particularly in digitalization and data analytics, are also catalyzing market expansion by enhancing product accessibility, personalization, and operational efficiency, making insurance more relevant and reachable to a wider demographic.

Life & Non-Life Insurance Market Executive Summary

The Life & Non-Life Insurance market is experiencing dynamic shifts characterized by digitalization, a heightened focus on customer-centricity, and strategic responses to global challenges. Business trends indicate a strong move towards integrating advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain to streamline underwriting, claims processing, and customer service. There is also an observable increase in mergers and acquisitions as companies seek to expand market share, diversify product portfolios, and achieve economies of scale. Furthermore, environmental, social, and governance (ESG) considerations are increasingly influencing investment strategies and product development, pushing insurers towards sustainable practices and offerings.

Regional trends reveal varied growth trajectories and market maturities. North America and Europe, while mature, are characterized by high digital adoption, intense competition, and a focus on personalized and specialty insurance products. The Asia Pacific region stands out as a primary growth engine, driven by a rapidly expanding middle class, increasing disposable incomes, and improving insurance literacy in countries like China and India. Latin America and the Middle East & Africa present significant untapped potential, with governments and private entities working to enhance insurance penetration through regulatory reforms and innovative distribution models. These regional disparities necessitate tailored market entry and growth strategies.

Segment trends highlight a strong demand for customized insurance solutions that address specific needs and evolving risk profiles. In life insurance, there is a growing interest in policies linked to wellness programs and those offering flexible investment options. The non-life segment is witnessing robust growth in niche areas such as cyber insurance, reflecting the increasing digital risks faced by businesses and individuals. Parametric insurance, which pays out based on predetermined triggers rather than actual loss assessment, is gaining traction, particularly in catastrophe-prone regions. Additionally, embedded insurance, where coverage is seamlessly integrated into the purchase of other products or services, is emerging as a significant distribution innovation across both life and non-life categories, improving convenience and accessibility for consumers.

AI Impact Analysis on Life & Non-Life Insurance Market

Users frequently inquire about the transformative capabilities of AI within the Life & Non-Life Insurance Market, focusing on how it is revolutionizing core operations, enhancing customer interactions, and enabling more precise risk management. Key themes revolve around the potential for automated underwriting, accelerated claims processing, and the development of highly personalized insurance products. There are also notable concerns regarding data privacy, the potential for algorithmic bias in risk assessment, and the impact of automation on workforce dynamics. Stakeholders seek to understand how AI can drive efficiency and innovation while mitigating associated ethical and operational challenges, aiming for a future where insurance is more accessible, affordable, and tailored to individual needs.

- Automated underwriting and dynamic risk assessment capabilities, leading to faster policy issuance.

- Expedited claims processing through intelligent automation, reducing settlement times and improving customer satisfaction.

- Development of highly personalized product offerings and pricing based on granular customer data and behavioral analytics.

- Enhanced fraud detection through advanced pattern recognition and anomaly detection algorithms.

- Predictive analytics for more accurate actuarial modeling, policy pricing, and solvency management.

- Improved customer service and engagement via AI-powered chatbots and virtual assistants available 24/7.

- Significant operational efficiency gains across the entire insurance value chain.

- Facilitation of new product development, such as usage-based insurance and proactive risk mitigation services.

- Better allocation of capital by understanding and forecasting market trends and risks more effectively.

- Streamlined regulatory compliance through automated data monitoring and reporting.

DRO & Impact Forces Of Life & Non-Life Insurance Market

The Life & Non-Life Insurance Market is influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces shaping its trajectory. Key drivers include a rising global population, increasing urbanization, and a heightened awareness of diverse risks, ranging from health crises to natural catastrophes and cyber threats. Economic growth in emerging markets further fuels demand, as does the expansion of digital infrastructure making insurance more accessible. Conversely, significant restraints include economic slowdowns, which can reduce discretionary spending on insurance, coupled with intense market competition that squeezes profit margins. The high costs associated with regulatory compliance and low insurance literacy in certain demographics also pose considerable challenges to market expansion and operational efficiency.

Opportunities within the market are vast and primarily driven by technological innovation and evolving societal needs. The proliferation of InsurTech startups and partnerships with traditional insurers is fostering a landscape of innovative products and services, including microinsurance for underserved populations and embedded insurance solutions. The increasing impact of climate change creates new demand for specialized catastrophe and parametric insurance products. Furthermore, advancements in data analytics allow for hyper-personalization of policies, catering precisely to individual risk profiles and preferences. The expansion into untapped emerging markets, particularly in Asia Pacific and Africa, represents substantial growth potential as these regions experience economic development and increased risk exposure.

Impact forces acting on the market are multifaceted, stemming from technological advancements, demographic shifts, global economic volatility, and environmental concerns. The rapid evolution of Artificial Intelligence, blockchain, and the Internet of Things (IoT) is fundamentally reshaping how insurance products are designed, priced, and delivered, leading to more efficient and responsive services. Demographic changes, such as aging populations in developed countries, necessitate new life and health insurance products, while a growing youth demographic in emerging markets drives demand for digital-first solutions. Geopolitical tensions, trade disputes, and economic recessions introduce volatility, affecting investment returns and claims frequency. Climate change increasingly impacts non-life segments through more frequent and severe weather events, prompting insurers to reassess risk models and product offerings, emphasizing resilience and sustainability in their core strategies.

Segmentation Analysis

The Life & Non-Life Insurance market is comprehensively segmented to provide granular insights into its diverse components and consumer bases. This segmentation typically includes breakdowns by insurance type (life and non-life), distribution channel, and end-user, reflecting the varied mechanisms through which insurance products are offered and consumed globally. Each segment is characterized by unique market dynamics, competitive landscapes, and growth drivers, necessitating distinct strategic approaches for market players. Understanding these segments is crucial for identifying specific opportunities, tailoring product development, and optimizing market penetration strategies across different regions and customer demographics.

- By Type:

- Life Insurance

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Endowment Policies

- Annuities

- Non-Life Insurance

- Property Insurance (Homeowners, Commercial Property)

- Casualty Insurance (General Liability, Professional Liability)

- Health Insurance (Individual, Group, Critical Illness)

- Motor Insurance (Auto, Commercial Vehicle)

- Marine Insurance (Cargo, Hull)

- Aviation Insurance

- Cyber Insurance

- Travel Insurance

- Workers' Compensation Insurance

- Other Specialty Lines

- Life Insurance

- By Distribution Channel:

- Agents & Brokers

- Bancassurance

- Direct Sales (Online & Offline)

- Digital & Online Platforms

- Aggregators

- Embedded Insurance

- By End-User:

- Individual

- Corporate/Commercial

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Government & Public Sector

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Life & Non-Life Insurance Market

The value chain for the Life & Non-Life Insurance market encompasses a series of interconnected stages, from initial risk assessment and product development to underwriting, claims processing, and ultimate policyholder servicing. This chain begins with upstream activities involving data collection, actuarial analysis, and technology providers who supply the foundational tools for risk modeling and policy administration. As products move downstream, they are distributed through a diverse ecosystem of channels, reaching end-users directly or indirectly, before the cycle culminates in claims management and ongoing customer relationship management. Efficient coordination across these stages is crucial for profitability and customer satisfaction, constantly evolving with technological advancements and market demands.

Upstream activities are critical for defining the scope and pricing of insurance products. This involves leveraging vast amounts of data from various sources, including health records, IoT devices (for telematics in auto insurance or smart home sensors), and demographic information, often facilitated by data analytics vendors and actuarial consultants. Technology providers play a pivotal role, offering platforms for policy management, customer relationship management (CRM), and advanced analytics that enable insurers to accurately assess risks and develop competitive products. Reinsurers also sit upstream, providing capital and risk transfer mechanisms that allow primary insurers to underwrite larger or more complex risks, thereby stabilizing their portfolios and expanding their capacity to serve the market.

The core of the value chain involves product design, underwriting, policy administration, and claims management. Product design teams develop new insurance offerings tailored to market needs, while underwriters assess individual and corporate risks to determine coverage terms and premiums. Policy administration involves managing policy lifecycles, from issuance to renewals and modifications. Distribution channels form a vital link, ranging from traditional agents and brokers offering personalized advice to bancassurance partnerships, direct sales online, and innovative digital aggregators. The downstream segment primarily focuses on policyholders, encompassing individuals and businesses who are the ultimate buyers of insurance products. Post-sales services, particularly claims processing, are critical touchpoints, impacting customer loyalty and an insurer's reputation. The integration of digital tools and automation throughout these downstream processes is enhancing efficiency and improving the customer experience, leading to quicker resolutions and greater transparency.

Life & Non-Life Insurance Market Potential Customers

The Life & Non-Life Insurance market caters to an exceptionally broad spectrum of potential customers, spanning individual consumers to multinational corporations, each with distinct needs for protection against various life and property risks. These end-users are primarily driven by the desire for financial security, wealth preservation, and operational continuity, making insurance an indispensable component of their personal and business strategies. The diversity of customer profiles necessitates a highly segmented approach to product development, marketing, and distribution, ensuring that specific risk exposures and preferences are adequately addressed. Understanding these varied customer segments is paramount for insurers seeking to effectively penetrate the market and deliver relevant value propositions.

Individual consumers represent a foundational segment, seeking protection for their lives, health, assets, and liabilities. This includes young professionals looking for basic life and health coverage, families requiring comprehensive plans for dependents and property, and retirees seeking annuities and long-term care solutions. Common purchases include term life insurance for income replacement, whole life for wealth accumulation, health insurance to cover medical expenses, auto insurance for vehicle protection, and homeowners or renters insurance for property safeguards. As demographics shift and disposable incomes rise, the demand for personalized and comprehensive individual insurance solutions continues to expand, often influenced by digital convenience and personalized advice.

The corporate and commercial segment constitutes another major customer base, ranging from small and medium-sized enterprises (SMEs) to large global enterprises. SMEs typically require essential covers like property insurance, general liability, business interruption, and employee benefits to protect their operations and workforce. Large corporations, with more complex and diverse risk profiles, demand sophisticated and often bespoke solutions, including specialized property and casualty policies, professional liability, directors and officers (D&O) liability, marine, aviation, and increasingly, comprehensive cyber insurance. These businesses often work with brokers to navigate complex risks and secure tailored packages that ensure business resilience and compliance. Governments and public sector entities also act as significant buyers, procuring insurance for public assets, infrastructure projects, and their employees, highlighting the pervasive need for risk transfer across all economic sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $6,200 Billion |

| Market Forecast in 2032 | $9,600 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AXA S.A., Ping An Insurance (Group) Company of China, Ltd., China Life Insurance (Group) Company, Berkshire Hathaway Inc., Nippon Life Insurance Company, Prudential Financial, Inc., Generali Group, MetLife Inc., Zurich Insurance Group Ltd, Chubb Limited, The Travelers Companies, Inc., Munich Re, Swiss Re, American International Group, Inc. (AIG), Tokio Marine Holdings, Inc., Manulife Financial Corporation, Standard Life Aberdeen (Phoenix Group), Legal & General Group Plc, Taiping Life Insurance Co. Ltd., Sompo Holdings, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Life & Non-Life Insurance Market Key Technology Landscape

The Life & Non-Life Insurance market is undergoing a profound technological transformation, leveraging advanced solutions to enhance efficiency, refine risk assessment, and improve customer engagement. Insurers are increasingly adopting Artificial Intelligence (AI) and Machine Learning (ML) to automate complex tasks, from intelligent underwriting and fraud detection to personalized policy recommendations. These technologies enable a data-driven approach, allowing for more precise risk modeling and dynamic pricing, moving away from traditional, static actuarial methods. The integration of predictive analytics further empowers insurers to forecast trends, identify potential claims, and proactively manage their portfolios, optimizing operational performance and enhancing profitability.

Beyond AI/ML, other emerging technologies are playing a pivotal role in reshaping the insurance landscape. Blockchain technology is being explored for its potential to create secure, transparent, and immutable records for policy administration and claims processing, facilitating smart contracts that can automate payouts based on predefined conditions. The Internet of Things (IoT) is revolutionizing non-life insurance, particularly in sectors like automotive (telematics for usage-based insurance), health (wearable devices for wellness programs), and property (smart home sensors for risk mitigation), enabling real-time data collection and proactive risk management. This connectivity allows for more granular understanding of risk, driving product innovation and fostering a more preventative approach to insurance.

Cloud computing forms the backbone for much of this digital transformation, providing scalable infrastructure for data storage, processing, and application deployment, crucial for handling the massive datasets generated by modern insurance operations. Robotic Process Automation (RPA) is widely used to automate repetitive administrative tasks, freeing up human capital for more strategic functions. Furthermore, Application Programming Interfaces (APIs) are essential for fostering an interconnected ecosystem, allowing seamless integration between insurers, InsurTech startups, and other third-party service providers. This facilitates the development of embedded insurance solutions and enhances data exchange, contributing to a more agile, responsive, and customer-centric insurance market capable of innovating at an accelerated pace.

Regional Highlights

- North America: A highly mature and competitive market characterized by high insurance penetration, significant technological adoption (especially in AI and big data analytics), and sophisticated regulatory frameworks. The region leads in InsurTech investment and innovation, with a strong focus on personalized products and digital distribution. The U.S. and Canada remain dominant, driving advancements in specialty lines and integrated risk management solutions.

- Europe: A diverse market with varying regulatory landscapes and cultural preferences. Western Europe boasts high penetration, an aging population driving demand for specific life and health products, and a growing emphasis on ESG (Environmental, Social, Governance) factors. Eastern Europe presents growth opportunities as economies develop and insurance awareness increases. Digital transformation and consolidation are key trends across the continent, alongside a focus on cyber and climate-related non-life insurance.

- Asia Pacific (APAC): The fastest-growing region, fueled by burgeoning middle classes, rapid urbanization, increasing disposable incomes, and relatively low insurance penetration rates in many countries. China and India are major growth engines, driven by digital adoption, government initiatives to expand coverage, and a rising awareness of health and financial security. Japan, Australia, and South Korea represent mature markets with high digital sophistication and product innovation.

- Latin America: A region with moderate growth potential, influenced by economic volatility and evolving regulatory environments. Increasing insurance awareness, coupled with the expansion of digital infrastructure, is fostering market development. Countries like Brazil, Mexico, and Argentina are witnessing efforts to boost penetration, particularly in the microinsurance and mobile-first segments.

- Middle East & Africa (MEA): Offers significant untapped potential, especially in countries undergoing rapid economic development and infrastructure expansion. The region is characterized by diverse regulatory landscapes, the prominence of Islamic insurance (Takaful), and a growing need for protection against both traditional and emerging risks. Digitalization initiatives are crucial for improving accessibility and driving market growth, particularly in health and property insurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Life & Non-Life Insurance Market.- Allianz SE

- AXA S.A.

- Ping An Insurance (Group) Company of China, Ltd.

- China Life Insurance (Group) Company

- Berkshire Hathaway Inc.

- Nippon Life Insurance Company

- Prudential Financial, Inc.

- Generali Group

- MetLife Inc.

- Zurich Insurance Group Ltd

- Chubb Limited

- The Travelers Companies, Inc.

- Munich Re

- Swiss Re

- American International Group, Inc. (AIG)

- Tokio Marine Holdings, Inc.

- Manulife Financial Corporation

- Standard Life Aberdeen (Phoenix Group)

- Legal & General Group Plc

- Sompo Holdings, Inc.

Frequently Asked Questions

How is the Life & Non-Life Insurance market performing globally?

The global Life & Non-Life Insurance market is experiencing robust growth, driven by increasing risk awareness, digitalization, and expanding economies in emerging regions. It is projected to grow at a CAGR of 6.5% between 2025 and 2032, reaching $9,600 Billion by 2032.

What are the primary drivers of growth in this market?

Key growth drivers include rising global population, increasing urbanization, greater awareness of diverse risks (e.g., health, natural disasters, cyber), economic growth in developing regions, and supportive regulatory environments.

How is technology, particularly AI, transforming the insurance sector?

AI is revolutionizing the sector by enabling automated underwriting, accelerating claims processing, facilitating personalized product development, enhancing fraud detection, and improving overall operational efficiency and customer service.

What are the main challenges faced by the Life & Non-Life Insurance market?

Major challenges include economic slowdowns, intense market competition, stringent regulatory compliance costs, low insurance literacy in certain areas, and managing data security and privacy concerns in a digital age.

Which regions offer the most significant growth opportunities?

The Asia Pacific region, particularly China and India, along with Latin America and parts of Africa, are identified as key growth opportunities due to their expanding economies, rising disposable incomes, and relatively low insurance penetration rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager