Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427219 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Light Tower Market Size

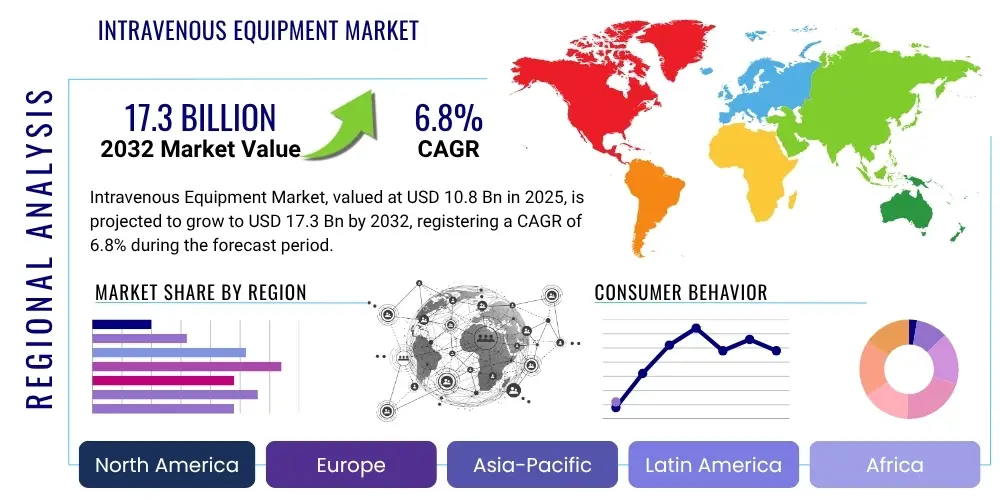

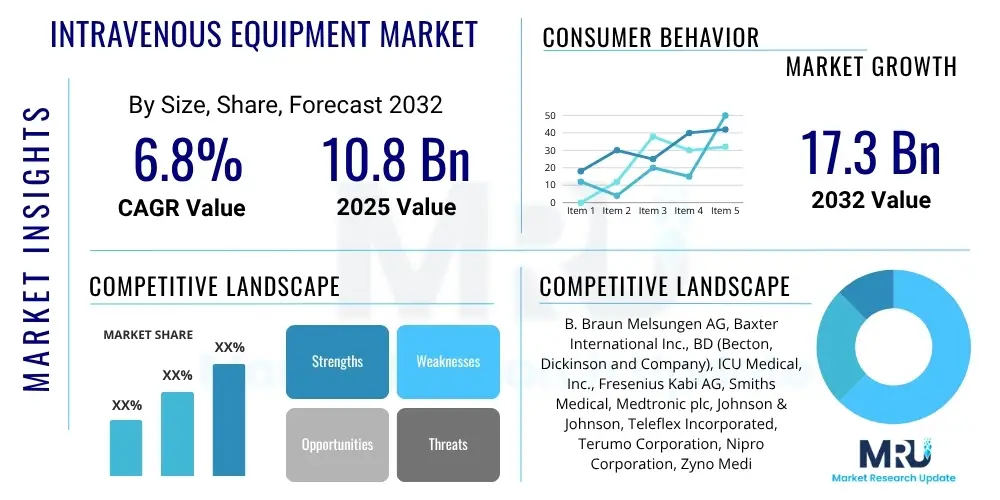

The Light Tower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by the end of the forecast period in 2032. This growth trajectory is underpinned by escalating global infrastructure development, increasing demand for robust and reliable mobile illumination solutions across diverse industries, and stringent safety regulations that mandate adequate lighting in various operational environments. The expansion is further fueled by technological advancements leading to more efficient, eco-friendly, and versatile light tower designs, catering to evolving market needs and operational complexities.

The increasing adoption of LED light towers, hybrid models integrating solar and battery power, and advanced telematics systems is significantly contributing to market expansion. These innovations address key industry demands for reduced operational costs, lower environmental impact, and enhanced remote management capabilities. Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing substantial investments in construction, mining, and public infrastructure projects, thereby generating considerable demand for light towers. The rental sector also plays a pivotal role, offering flexible and cost-effective access to state-of-the-art lighting solutions for short-term projects and peak operational periods.

Light Tower Market introduction

The Light Tower Market encompasses the manufacturing, distribution, and rental of portable lighting solutions designed to provide intense illumination over large areas, primarily in outdoor and low-light conditions. These robust units typically consist of a generator or battery pack, a telescopic mast, and multiple high-output lamps, such as LED, halogen, or metal halide, mounted on a mobile trailer. Originally developed for demanding applications like construction sites and mining operations, their utility has expanded significantly due to their versatility and ability to provide crucial visibility for safety and productivity in environments lacking permanent power infrastructure or sufficient natural light. The fundamental purpose of a light tower is to extend operational hours and enhance safety margins, thereby enabling continuous work regardless of daylight availability.

Major applications for light towers span across a multitude of industries, including heavy construction for roads, bridges, and commercial buildings; mining and quarrying for continuous operations; oil and gas exploration and production sites; outdoor events and entertainment; emergency and disaster relief operations; and public works such as road maintenance and utility repairs. The primary benefits derived from deploying light towers include enhanced worker safety by illuminating hazardous areas, increased productivity through extended operational windows, improved site security, and the flexibility of mobile, self-contained lighting. Driving factors for this market include rapid urbanization and infrastructure development globally, escalating safety regulations, and a growing demand for reliable temporary lighting solutions in remote or off-grid locations. Furthermore, the market is increasingly influenced by the shift towards energy-efficient and environmentally sustainable lighting technologies.

Light Tower Market Executive Summary

The Light Tower Market is experiencing dynamic growth, propelled by several key business, regional, and segment trends. Business trends highlight a significant shift towards more sustainable and technologically advanced solutions, with manufacturers increasingly focusing on hybrid, solar-powered, and fully electric light towers to meet environmental regulations and reduce fuel consumption. This evolution is also fostering innovation in smart features, including telematics for remote monitoring, GPS tracking, and advanced energy management systems that optimize performance and minimize operational costs. The rental market continues to be a dominant force, offering flexible procurement options for businesses seeking to manage capital expenditure and adapt to fluctuating project demands, thereby driving substantial demand for new, efficient models.

Regionally, Asia-Pacific emerges as a high-growth area due to rapid urbanization, massive infrastructure projects, and expanding industrial activities in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, are experiencing demand driven by the replacement of older fleets with more energy-efficient and compliant models, alongside ongoing construction and maintenance activities. Latin America and the Middle East & Africa are also showing robust growth, fueled by investments in mining, oil and gas, and public infrastructure. Segment trends are characterized by the increasing dominance of LED light towers, which offer superior energy efficiency, longer lifespan, and better illumination quality compared to traditional halogen or metal halide lamps. The power source segment is witnessing a strong uptake of hybrid and solar solutions, signaling a clear industry movement towards eco-friendlier alternatives, while the application segment for events and emergency services shows steady expansion.

AI Impact Analysis on Light Tower Market

User inquiries concerning the impact of Artificial Intelligence on the Light Tower Market frequently revolve around themes of operational efficiency, cost reduction, predictive maintenance, and autonomous capabilities. Common questions explore how AI can optimize energy consumption in light towers, whether AI integration can lead to fully autonomous lighting solutions, and the potential for AI to enhance safety and security on job sites. There is a clear expectation that AI will transform light towers from simple illumination tools into intelligent, self-optimizing assets, capable of making data-driven decisions to improve performance and reduce human intervention. The primary concerns often relate to the complexity of integration, data privacy, and the initial investment required for such advanced systems, alongside questions about the tangible return on investment.

The integration of AI into light tower technology is poised to revolutionize their operation and maintenance, ushering in an era of unprecedented efficiency and autonomy. By leveraging AI algorithms, light towers can autonomously adjust their brightness based on ambient light conditions, optimize power consumption by intelligently managing energy sources (e.g., switching between solar, battery, and diesel), and predict maintenance needs before failures occur. This predictive capability significantly reduces downtime and operational costs, transitioning from reactive repairs to proactive management. Furthermore, AI can enhance site safety by integrating with surveillance systems, detecting unauthorized access, or monitoring equipment movement, triggering appropriate lighting responses or alerts. This intelligent functionality transforms light towers into sophisticated, interconnected assets within a broader smart construction or smart city ecosystem.

- Enhanced Energy Management: AI optimizes power source utilization, balancing diesel, battery, and solar input based on demand and availability.

- Predictive Maintenance: AI algorithms analyze operational data to forecast equipment failures, enabling proactive repairs and minimizing downtime.

- Autonomous Brightness Control: AI adjusts illumination levels automatically in response to ambient light and operational requirements, saving energy.

- Remote Monitoring and Control: AI-powered telematics allows for advanced remote diagnostics, performance tracking, and control, improving operational efficiency.

- Improved Site Security: AI can integrate with motion sensors and cameras, intelligently adjusting lighting for enhanced surveillance and threat detection.

- Optimized Fuel Consumption: AI-driven insights and control reduce unnecessary engine run times, leading to significant fuel savings and lower emissions.

- Data-Driven Decision Making: Collection and analysis of operational data by AI provide valuable insights for fleet management and future equipment design.

DRO & Impact Forces Of Light Tower Market

The Light Tower Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. Key drivers include the global surge in infrastructure development projects, necessitating extensive temporary lighting for construction sites, roadworks, and public utilities. The increasing emphasis on occupational safety and health regulations across industries also mandates adequate illumination in various work environments, thereby boosting demand for reliable light towers. Furthermore, the burgeoning event management industry, alongside the frequent occurrence of natural disasters and subsequent relief efforts, consistently generates a need for robust, portable lighting solutions. These factors create a strong foundational demand, compelling businesses to invest in or rent light towers for operational continuity and safety compliance.

Conversely, the market faces significant restraints. The high initial capital investment required for purchasing modern, technologically advanced light towers can be a barrier for smaller enterprises. Volatility in fuel prices directly impacts the operational costs of traditional diesel-powered units, affecting profitability and budget planning. Environmental concerns regarding noise pollution and carbon emissions from conventional diesel generators pose regulatory challenges and drive a push towards more expensive, but eco-friendly, alternatives. However, these restraints concurrently present opportunities for market innovation. The development of hybrid, solar, and electric light towers addresses environmental concerns and reduces reliance on fossil fuels, opening new avenues for growth and market penetration. Furthermore, the expansion of the light tower rental market provides a cost-effective solution for end-users, mitigating the high upfront investment barrier and fostering broader adoption of advanced lighting technologies.

Impact forces on the Light Tower Market are diverse and continually evolving. Technological advancements are profoundly reshaping the industry, with the rapid proliferation of LED technology, smart features, and integrated power management systems enhancing efficiency and performance. Environmental regulations, particularly those aimed at reducing emissions and noise, are compelling manufacturers to innovate and develop greener solutions, creating a competitive landscape focused on sustainability. Economic development, particularly in emerging markets, fuels construction and industrial activities, directly translating into increased demand for light towers. The global supply chain dynamics, including raw material costs and component availability, also exert a significant influence on manufacturing costs and market pricing. Lastly, shifts in consumer preferences towards more automated, reliable, and energy-efficient equipment are driving market innovation and product diversification.

Segmentation Analysis

The Light Tower Market is comprehensively segmented based on various critical parameters, providing a detailed understanding of its diverse landscape and operational dynamics. These segmentations allow for a granular analysis of market trends, consumer preferences, and growth opportunities across different product types, power sources, applications, and end-user categories. The ability to differentiate market demand based on these segments is crucial for manufacturers to tailor their product offerings, for distributors to optimize their inventory, and for rental companies to manage their fleets effectively, ensuring that specific industry needs and environmental considerations are met with precision and efficiency. Understanding these divisions helps in strategic planning and market penetration.

The markets segmentation highlights the ongoing evolution towards more specialized and sustainable lighting solutions. For instance, the transition from traditional light sources to LED technology reflects a broader industry shift towards energy efficiency and extended product lifespan. Similarly, the growing popularity of hybrid and solar-powered light towers underscores the increasing emphasis on environmental sustainability and reduced operational costs. Analyzing these segments reveals that while traditional applications like construction and mining remain strongholds, newer segments such as events and emergency relief are rapidly expanding, signaling diversified demand patterns and new areas for market growth. This comprehensive breakdown facilitates a nuanced view of the competitive landscape and aids in identifying untapped market potential.

- By Light Source Type:

- LED Light Towers: Dominant due to energy efficiency, long lifespan, and superior illumination.

- Halogen Light Towers: Traditional, cost-effective but less efficient.

- Metal Halide Light Towers: Offer bright, wide area illumination but with higher energy consumption and warm-up times.

- By Power Source:

- Diesel Light Towers: Most common, robust for heavy-duty applications.

- Electric Light Towers: Quieter, zero emissions, ideal for indoor or sensitive environments.

- Solar/Hybrid Light Towers: Eco-friendly, fuel-efficient, ideal for remote or long-term sites.

- By Application:

- Construction: Roads, bridges, commercial and residential buildings.

- Mining: Surface and underground operations, quarries.

- Oil & Gas: Exploration, drilling, and production sites.

- Events & Entertainment: Concerts, festivals, sports events.

- Road & Bridge Construction: Maintenance, repair, and new infrastructure.

- Emergency & Disaster Relief: Search and rescue, temporary shelters.

- Others: Municipal works, military, agriculture.

- By End-Use:

- Rental Companies: Major buyers for their diversified client base.

- End-Users (Direct Purchase): Large construction firms, mining companies, government agencies.

Light Tower Market Value Chain Analysis

The value chain for the Light Tower Market commences with upstream activities involving the sourcing of raw materials and the manufacturing of essential components. This initial phase includes suppliers of steel for chassis and masts, engine and generator manufacturers, battery producers for electric and hybrid models, lighting component suppliers (LED chips, lenses, fixtures), and control panel manufacturers. These upstream partners are crucial for providing the foundational elements that determine the quality, performance, and durability of the final product. Effective supply chain management at this stage is vital to ensure cost-effectiveness, timely delivery, and compliance with quality standards, laying the groundwork for the entire manufacturing process.

Further along the value chain, the components are assembled by light tower manufacturers, who integrate various systems such as power generation, lighting, and mobility into a complete, functional unit. Following manufacturing, the products move into distribution channels, which are typically bifurcated into direct and indirect routes. Direct distribution involves manufacturers selling directly to large end-users, such as major construction companies or government agencies, often facilitated by dedicated sales teams. Indirect distribution, which forms a significant portion of the market, relies on dealer networks and, most notably, rental companies. These rental companies serve as a crucial intermediary, purchasing large fleets of light towers and then leasing them to a diverse range of end-users for various project durations, effectively broadening market access and reducing the upfront capital burden for clients.

Downstream activities involve the delivery, deployment, operation, and maintenance of light towers by the end-users. This phase encompasses the logistical aspects of transporting light towers to job sites, setting them up, and ensuring their efficient operation throughout the project lifecycle. Post-sales services, including maintenance, repairs, and spare parts supply, also constitute a vital part of the downstream segment, contributing to customer satisfaction and product longevity. The interplay between manufacturers, distributors, rental companies, and end-users defines the markets efficiency and responsiveness, with each link adding value through specialized functions from product conceptualization to final deployment and ongoing support.

Light Tower Market Potential Customers

Potential customers for light towers represent a broad spectrum of industries and organizations that require robust and mobile illumination solutions for various operational needs, often in environments lacking permanent power infrastructure or during periods of low natural light. The primary demographic includes entities involved in large-scale outdoor projects, emergency response, and public gatherings. These buyers seek reliable equipment that can withstand challenging conditions, provide consistent illumination, and contribute to both safety and productivity. The decision-making process for these customers is typically driven by factors such as the scale of their operations, project duration, budgetary constraints, and specific regulatory compliance requirements for lighting and environmental impact.

Key end-user segments include construction companies, which extensively utilize light towers for nighttime work on roads, bridges, commercial buildings, and housing developments to extend working hours and ensure worker safety. The mining and quarrying sector is another significant consumer, relying on these units for continuous operations in often remote and harsh environments. Oil and gas exploration and production sites also demand high-intensity, durable lighting for safety and efficiency. Beyond heavy industry, event management companies are increasingly dependent on light towers for illuminating outdoor concerts, festivals, and sporting events. Furthermore, municipal public works departments use them for road maintenance, utility repairs, and other infrastructure projects, while emergency services and disaster relief organizations deploy them for search and rescue operations, temporary shelters, and incident management.

The light tower rental market itself constitutes a major customer segment, as rental companies acquire substantial fleets of light towers to serve a diverse array of clients who prefer leasing over outright purchase due to project-specific needs, financial flexibility, or maintenance considerations. This rental model allows smaller businesses and organizations with fluctuating demands to access high-quality equipment without significant capital outlay. Government agencies, including military and public safety bodies, also represent a consistent customer base, procuring light towers for various operational, security, and humanitarian missions. Understanding these diverse customer needs and their operational contexts is crucial for manufacturers and service providers to effectively target and serve the market.

Light Tower Market Key Technology Landscape

The Light Tower Market is undergoing a rapid technological transformation, moving beyond basic illumination to integrate advanced systems that enhance efficiency, sustainability, and operational intelligence. At the forefront of this evolution is the widespread adoption of LED (Light Emitting Diode) lighting technology. LEDs offer superior energy efficiency, significantly longer lifespans, reduced heat output, and instant-on capabilities compared to traditional halogen or metal halide lamps. This transition to LED not only lowers operational costs through reduced fuel consumption and maintenance but also provides brighter, more uniform light distribution, improving visibility and safety on job sites. The robust nature of LEDs also makes them highly suitable for the demanding environments where light towers are typically deployed, resisting vibrations and impacts more effectively.

Another pivotal technological advancement lies in the development and integration of advanced power sources. Hybrid power systems, combining diesel generators with battery banks and solar panels, are gaining substantial traction. These systems intelligently manage power generation, often allowing for silent, zero-emission operation during off-peak hours or in noise-sensitive areas, while leveraging solar energy to reduce diesel consumption and refuelling frequency. This focus on sustainable power solutions not only addresses environmental concerns and complies with stricter emission regulations but also provides significant fuel cost savings for operators. Furthermore, fully electric light towers, powered entirely by large battery banks, are emerging for specific applications requiring absolute zero emissions and minimal noise.

The rise of the Internet of Things (IoT) and telematics is profoundly impacting the light tower market, enabling remote monitoring, control, and predictive maintenance capabilities. Integrated sensors and communication modules allow operators to track light tower location, fuel levels, battery status, engine performance, and lighting functionality from a central hub or mobile device. This connectivity facilitates proactive maintenance scheduling, optimizes deployment, and enhances operational efficiency by minimizing downtime and reducing the need for on-site inspections. Automation features, such as automatic start/stop based on light sensors or programmable timers, further streamline operations. These technological advancements collectively contribute to more intelligent, cost-effective, and environmentally responsible light tower solutions, catering to the evolving demands of modern industries.

Regional Highlights

Regional dynamics play a crucial role in shaping the Light Tower Market, with each geographic area presenting unique drivers, demands, and regulatory landscapes. North America, characterized by its robust construction industry, extensive oil and gas operations, and a strong emphasis on worker safety regulations, remains a significant market. The demand here is often driven by large-scale infrastructure projects, including road and bridge construction, and a well-established rental sector that facilitates widespread access to advanced light tower technologies. Manufacturers in this region often focus on rugged, durable equipment designed for demanding conditions, alongside increasingly sophisticated hybrid and smart solutions to meet efficiency and environmental goals.

Europe represents a mature but progressive market, driven by stringent environmental regulations and a strong push towards sustainability and efficiency. The demand for low-emission, quiet, and fuel-efficient light towers, particularly hybrid and electric models, is pronounced. Investment in urban infrastructure, public works, and a thriving events sector further contributes to market growth. European companies are often at the forefront of developing advanced power management systems and telematics for enhanced performance and reduced environmental impact, reflecting the regions commitment to eco-friendly industrial practices. The strong rental culture in Europe also significantly influences procurement patterns and fleet modernization.

Asia-Pacific is poised as the fastest-growing market, propelled by rapid urbanization, massive infrastructure development initiatives (such as Chinas Belt and Road Initiative, and extensive construction in India and Southeast Asian nations), and burgeoning mining and industrial sectors. The sheer scale of development projects in this region necessitates a substantial volume of light towers for extended operational hours and safety. While cost-effectiveness remains a key consideration, there is a growing adoption of more advanced and efficient models as environmental awareness and regulatory standards begin to rise. The Middle East & Africa region shows strong demand primarily from large-scale construction projects, including mega-cities and commercial developments, alongside significant oil and gas exploration activities, where reliable and powerful illumination is critical. Latin America also contributes to market growth through developing infrastructure projects and extensive mining operations, although economic fluctuations can impact demand.

- North America: Strong demand from construction, oil and gas, and a mature rental market, with a growing focus on efficiency and smart technologies.

- Europe: Driven by stringent environmental regulations, sustainability goals, and demand from urban infrastructure and events; high adoption of hybrid and electric models.

- Asia-Pacific: Fastest-growing market due to rapid urbanization, massive infrastructure projects, and expanding industrial and mining sectors, particularly in China and India.

- Middle East & Africa: Significant growth from large-scale construction projects and extensive oil and gas exploration and production activities.

- Latin America: Demand fueled by developing infrastructure, robust mining operations, and a growing construction sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Light Tower Market.- Generac Holdings Inc.

- Terex Corporation (Genie)

- Wacker Neuson SE

- Atlas Copco

- Doosan Portable Power

- United Rentals

- Herc Rentals

- Ashtead Group plc (Sunbelt Rentals)

- Multiquip Inc.

- XCMG

- JCB

- Komatsu Ltd.

- Caterpillar Inc.

- VT-Lift

- Allmand Bros. Inc.

- FTG Equipment Solutions Inc.

- Chicago Pneumatic (Atlas Copco Group)

- AIRMAN (Hokuetsu Industries Co., Ltd.)

- Kubota Corporation

- Wanco Inc.

Frequently Asked Questions

What are the primary benefits of using LED light towers?

LED light towers offer significantly higher energy efficiency, leading to substantial fuel savings and reduced operational costs compared to traditional lighting types. They boast a much longer lifespan, minimizing maintenance and replacement frequencies. Additionally, LEDs provide instant-on functionality, superior light quality with better color rendering, and are more durable, making them ideal for harsh environmental conditions commonly found on construction or mining sites.

How do hybrid light towers contribute to sustainability?

Hybrid light towers enhance sustainability by combining diesel generators with renewable energy sources like solar panels and battery storage. This configuration drastically reduces reliance on fossil fuels, cutting down on fuel consumption, carbon emissions, and noise pollution. They optimize power generation, often operating silently on battery power during low demand, thereby minimizing their environmental footprint and supporting eco-friendly operational practices.

What industries are the largest consumers of light towers?

The largest consumers of light towers primarily include the construction industry, encompassing civil engineering, road building, and commercial and residential development. The mining and quarrying sector also represents a substantial market share, utilizing light towers for continuous operations. Furthermore, the oil and gas industry, event management companies, and municipal public works departments are significant end-users due requiring robust, portable illumination for safety and extended working hours.

What future technological advancements are expected in the light tower market?

Future technological advancements in the light tower market are expected to focus on enhanced automation through AI and IoT integration for remote monitoring, predictive maintenance, and autonomous operation. We anticipate further development in fully electric light towers with advanced battery technologies, greater integration of renewable energy sources, and more sophisticated telematics for real-time data analysis. Improved energy management systems and potentially even drone-mounted lighting solutions are also on the horizon.

How does the rental market influence light tower sales?

The rental market significantly influences light tower sales by acting as a primary channel for distribution and adoption, particularly for smaller businesses or projects with variable durations. Rental companies purchase large volumes of light towers, driving demand for new and technologically advanced units. This model allows end-users to access equipment without high upfront capital investment, reducing financial barriers and enabling broader market penetration for manufacturers. It also accelerates the adoption of newer, more efficient models as rental fleets are regularly updated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- LED Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Diesel Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Metal Halide Mobile Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Hydraulic Lifting Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Solar Light Tower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager