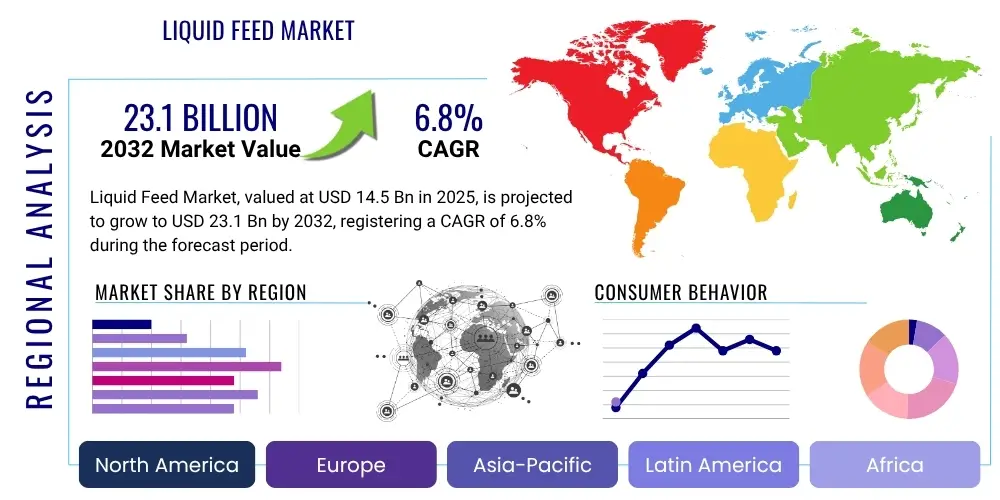

Liquid Feed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431219 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Liquid Feed Market Size

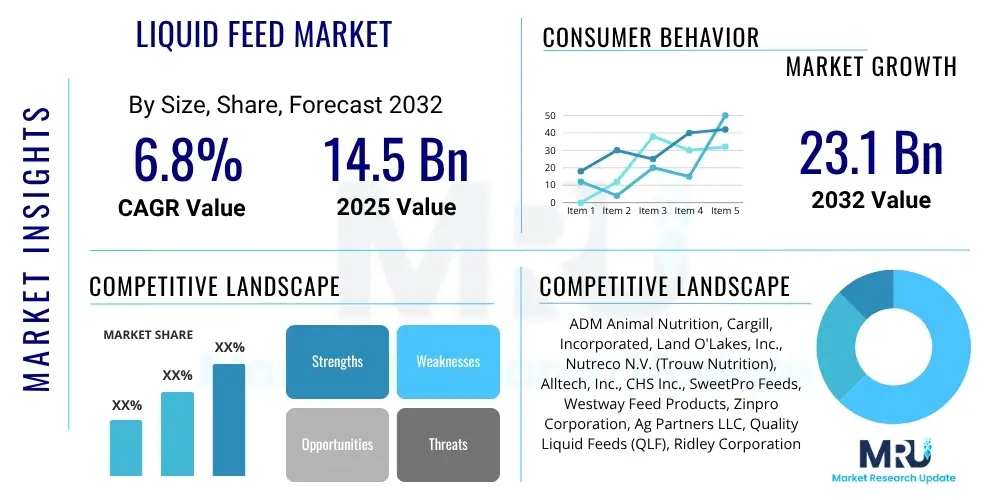

The Liquid Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $14.5 billion in 2025 and is projected to reach $23.1 billion by the end of the forecast period in 2032.

Liquid Feed Market introduction

The liquid feed market represents a dynamic and increasingly vital segment within the global animal nutrition industry, providing specialized dietary supplements for various livestock. These products are formulated to deliver essential nutrients, including proteins, energy, vitamins, and minerals, in a highly palatable and easily digestible liquid form. This innovative approach to animal feeding offers significant advantages over traditional dry feed methods, driving its adoption across modern agricultural practices worldwide. The core objective of liquid feed is to optimize animal health, enhance productivity, and improve feed conversion efficiency, ultimately contributing to more sustainable and profitable livestock operations.

Liquid feeds are typically comprised of a blend of ingredients such as molasses, urea, essential amino acids, fats, minerals, and vitamins, all carefully balanced to meet specific nutritional requirements of different animal species and physiological stages. They are widely recognized for their ability to ensure uniform nutrient distribution, which can be challenging to achieve with conventional dry feed mixes, thereby providing a consistent and reliable source of nutrition. Major applications span across ruminant animals like beef cattle, dairy cattle, and sheep, where they are crucial for improving forage utilization, supporting reproductive cycles, and boosting milk or meat production. Beyond ruminants, their application is expanding into poultry, swine, and aquaculture sectors, albeit with tailored formulations to suit distinct digestive systems and growth objectives.

The myriad benefits of liquid feed contribute significantly to its market expansion. These include enhanced feed intake dueability to high palatability, reduced feed waste, and substantial labor savings due to ease of handling, storage, and automated dispensing compared to bagged or bulk dry feeds. From an animal health perspective, liquid feeds often lead to improved digestive function, stronger immune systems, and better overall resilience, which translates into higher productivity and reduced veterinary costs. Key driving factors underpinning the market's growth include the escalating global demand for high-quality animal protein, a rising emphasis on scientific and precision animal nutrition, the need for cost-effective and efficient feed delivery systems, and continuous advancements in feed formulation technologies. These combined forces are propelling the liquid feed market towards sustained growth and innovation.

Liquid Feed Market Executive Summary

The liquid feed market is experiencing robust growth, propelled by evolving business trends focused on sustainability, digitalization, and specialized nutrition. Companies are increasingly investing in research and development to produce innovative formulations that not only meet the precise dietary needs of various livestock but also align with growing consumer demand for responsibly raised animals. Strategic partnerships, mergers, and acquisitions are common business trends, aimed at consolidating market share, expanding geographic reach, and integrating new technologies into product lines and distribution networks. There is a palpable shift towards data-driven feeding solutions, where real-time animal performance metrics inform feed adjustments, optimizing resource utilization and minimizing environmental impact. Furthermore, a focus on traceability and transparent sourcing of ingredients is becoming paramount, reflecting broader industry trends towards enhanced supply chain integrity and consumer trust.

Regionally, the market exhibits diverse growth patterns and maturity levels. North America and Europe currently lead the market, characterized by advanced livestock farming practices, significant investments in animal health and nutrition, and a high per capita consumption of animal protein. These regions demonstrate a strong inclination towards adopting precision feeding technologies and high-value liquid feed products. The Asia Pacific region is poised for the most rapid expansion, driven by its burgeoning population, increasing disposable incomes, and the subsequent rise in demand for meat and dairy products. Countries such as China, India, and Southeast Asian nations are modernizing their agricultural infrastructure, creating fertile ground for the adoption of efficient liquid feed solutions. Latin America, with its vast agricultural resources, particularly in Brazil and Argentina, also presents substantial growth opportunities as its livestock sectors continue to professionalize and scale up operations, seeking improved productivity and economic efficiencies.

Segmentation trends within the liquid feed market reveal a strong emphasis on tailored solutions. The ruminant livestock segment remains the largest end-user, given the proven benefits of liquid supplements in optimizing their complex digestive systems for forage utilization and overall health. Within product types, protein-based and energy-based liquid feeds are witnessing significant demand due to their direct impact on growth rates and production yields, particularly in dairy and beef operations. The market is also seeing increased development of mineral and vitamin-based liquid feeds designed to address specific deficiencies and enhance immune function. Distribution channels are diversifying, with both direct sales to large commercial farms and indirect sales through extensive distributor networks playing crucial roles in market penetration. The continuous innovation in ingredient sourcing, formulation science, and delivery systems is expected to further refine and expand these segmentations, catering to an ever more sophisticated agricultural landscape.

AI Impact Analysis on Liquid Feed Market

User inquiries regarding Artificial Intelligence's influence on the liquid feed market predominantly center on its potential to revolutionize precision nutrition, optimize operational efficiencies, and enhance sustainability. Common questions explore how AI can personalize feed formulations based on individual animal needs, predict health issues before they manifest, streamline supply chain logistics, and automate complex feeding regimes. There are clear expectations that AI will lead to significant improvements in feed conversion rates, substantial reductions in feed waste, and ultimately, a boost in farm profitability. Concerns frequently raised include the initial investment required for AI infrastructure, the complexities of data integration across various farm systems, and the need for a skilled workforce capable of deploying and managing these advanced technologies. Despite these challenges, the prevailing sentiment is one of optimistic anticipation for AI's transformative capabilities in animal agriculture.

Artificial Intelligence is set to profoundly reshape the liquid feed market by enabling unprecedented levels of customization and operational intelligence. Through sophisticated data analysis, AI algorithms can process vast amounts of information pertaining to animal genetics, physiological status, environmental conditions, and feed intake patterns to formulate liquid feeds with pinpoint accuracy. This capability moves beyond generic nutritional guidelines, allowing for dynamic adjustments that cater to the real-time requirements of individual animals or specific groups, thereby maximizing their health, growth, and productive output. Such precision minimizes the over-provisioning of nutrients, which in turn reduces feed costs and mitigates environmental impacts associated with nutrient runoff.

Beyond formulation, AI's impact extends across the entire value chain, from raw material sourcing to feed delivery. It facilitates predictive analytics for market demand and ingredient availability, optimizing inventory management and procurement strategies, thus enhancing supply chain resilience and cost-efficiency. On the farm, AI-powered sensors and automated dispensing systems can monitor liquid feed consumption and animal behavior, identifying subtle deviations that might indicate health problems or stress, allowing for proactive interventions. This shift towards intelligent, data-driven farming practices promises to elevate animal welfare standards, improve resource management, and drive significant economic benefits for livestock producers, positioning AI as a critical catalyst for innovation and sustainable growth in the liquid feed sector.

- Precision Feed Formulation: AI analyzes animal data, genetics, and environmental factors to optimize liquid feed composition for individual animals or groups, reducing waste and improving nutrient utilization.

- Predictive Health Monitoring: AI algorithms monitor animal behavior and feed intake patterns to predict health issues or disease outbreaks, enabling proactive intervention and adjustment of liquid feed supplements.

- Supply Chain Optimization: AI enhances logistics, inventory management, and demand forecasting for liquid feed ingredients and finished products, leading to reduced costs and improved efficiency.

- Automated Delivery Systems: Integration of AI with smart dispensing units automates and personalizes liquid feed delivery, ensuring consistent and precise nutrition based on real-time needs and consumption.

- Enhanced Research and Development: AI accelerates the discovery of novel feed ingredients and optimized formulations by simulating their effects and identifying optimal combinations, shortening product development cycles.

- Farm Management Integration: AI platforms consolidate data from various farm systems, including liquid feed consumption, health records, and environmental sensors, enabling holistic performance monitoring and strategic decision-making.

- Sustainability Improvements: By optimizing nutrient delivery, reducing feed waste, and improving animal health, AI contributes to more environmentally friendly livestock production practices, lowering the overall carbon footprint of feed.

- Market Trend Analysis: AI assists in analyzing market trends, consumer preferences, and competitive landscapes to guide product development and marketing strategies for liquid feed manufacturers.

DRO & Impact Forces Of Liquid Feed Market

The liquid feed market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the escalating global demand for animal protein, fueled by a growing population and rising disposable incomes in emerging economies, which necessitates more efficient and productive livestock farming. Farmers are increasingly adopting liquid feed solutions due to their demonstrated efficacy in improving animal health and growth, enhanced palatability leading to better feed intake, and the logistical advantages of easier handling and storage compared to traditional dry feeds. The increasing awareness among livestock producers about the importance of scientific animal nutrition and its direct correlation with higher yields and profitability further propels market expansion, as does the global push towards sustainable and resource-efficient agricultural practices.

Despite these strong drivers, the market faces several notable restraints. The relatively higher initial capital investment required for liquid feed infrastructure, including specialized storage tanks, pumps, and automated dispensing equipment, can be a deterrent, especially for smaller farms with limited budgets. Regulatory complexities surrounding feed ingredient approval, animal health standards, and environmental compliance vary significantly across different regions, creating hurdles for market entry and product commercialization. Furthermore, the inherent logistical challenges associated with transporting and storing liquid products, coupled with the potential for spoilage if not managed meticulously, add to operational costs and can limit market accessibility in remote areas, posing an ongoing challenge for producers and distributors alike.

However, substantial opportunities exist for market growth and innovation. The global trend towards precision livestock farming, leveraging technologies like IoT, sensors, and data analytics for individualized animal care, creates a strong demand for sophisticated liquid feed delivery systems. Expanding dairy and beef industries in developing economies, coupled with increasing governmental support for agricultural modernization, offer fertile grounds for market penetration and expansion. The continuous development of novel liquid feed formulations tailored to specific animal health objectives, such as immune system enhancement, gut microbiome modulation, or stress reduction, along with the rising consumer preference for organic and sustainably produced animal products, opens new market segments and premiumization strategies. These opportunities promise to drive significant innovation and investment in the sector, fostering long-term growth.

The market is also subject to various external impact forces that shape its trajectory. Fluctuations in the prices of key raw materials, particularly molasses, urea, and protein supplements, can directly affect production costs, profit margins, and the overall pricing strategies of liquid feed manufacturers. Environmental regulations, particularly those concerning nutrient runoff and greenhouse gas emissions from livestock, are increasingly influencing feed formulation and ingredient sourcing, pushing for more eco-friendly solutions. Technological advancements in feed processing, ingredient functionalization, and automated feeding systems are constantly reshaping the competitive landscape and driving product differentiation. Lastly, unforeseen factors such as global disease outbreaks among livestock (e.g., Avian Influenza, African Swine Fever) can severely disrupt supply chains, impact demand, and necessitate rapid adaptation in feed production and distribution, underscoring the need for market resilience and agile response strategies.

Segmentation Analysis

The liquid feed market is comprehensively segmented to cater to the diverse and specific nutritional needs of various animal species and farming operations globally. This multi-faceted segmentation allows manufacturers to develop highly targeted products, optimizing efficacy and ensuring that each segment receives a tailored nutritional solution. The primary segmentation criteria typically include the type of feed product, the specific livestock species it is intended for, the source of its main ingredients, and the channels through which these products are distributed to the end-users. Understanding these segments is crucial for market participants to identify growth opportunities, develop competitive strategies, and address the evolving demands of the animal agriculture sector.

Each segment within the liquid feed market presents unique dynamics influenced by factors such as farming practices, regional dietary requirements, and economic considerations. For instance, the type-based segmentation highlights the distinct functional roles of protein, energy, mineral, and vitamin supplements, reflecting the targeted nutritional objectives producers aim to achieve. Similarly, segmenting by livestock type underscores the physiological differences and specific growth stages of ruminants, poultry, swine, and aquaculture species, each requiring a specialized approach to liquid nutrition. Furthermore, the source of ingredients and the chosen distribution channels significantly impact the cost, availability, and market reach of liquid feed products, illustrating the complex interplay of factors that define the market's structure and competitive landscape. Continuous innovation within these segments is driven by ongoing research into animal nutrition and the adoption of advanced agricultural technologies.

- By Type:

- Protein Based Liquid Feed

- Energy Based Liquid Feed

- Mineral Based Liquid Feed

- Vitamin Based Liquid Feed

- Other Additives (e.g., enzymes, probiotics, amino acids)

- By Livestock:

- Ruminants

- Cattle (Beef)

- Cattle (Dairy)

- Sheep

- Goats

- Poultry

- Broilers

- Layers

- Turkeys

- Swine (Pigs)

- Aquaculture

- Fish

- Shrimp

- Other Aquatic Species

- Other Livestock (e.g., Horses)

- Ruminants

- By Source:

- Molasses

- Urea

- Vegetable Oils

- Industrial Co-products

- Other Ingredients

- By Distribution Channel:

- Direct Sales

- Distributors/Retailers

- Online Sales

Value Chain Analysis For Liquid Feed Market

The value chain for the liquid feed market is a complex network of activities that transforms raw materials into finished products and delivers them to the end-users. It begins with the upstream procurement of diverse ingredients, which are critical for the nutritional efficacy and cost-effectiveness of the final product. Key upstream components include agricultural commodities like molasses, derived from sugar processing, and industrial by-products such as urea, a nitrogen source. Additionally, essential minerals (e.g., calcium, phosphorus, trace minerals), vitamins, amino acids, and specialized feed additives are sourced from various chemical, pharmaceutical, and nutritional ingredient suppliers. Ensuring consistent quality, availability, and stable pricing of these raw materials is paramount for manufacturers, as fluctuations directly impact production costs and product stability. Relationships with reliable suppliers are thus a cornerstone of a robust upstream value chain, involving negotiation, quality control, and logistics for ingredient delivery to manufacturing facilities.

Midstream activities encompass the manufacturing, formulation, and quality assurance processes. This stage involves the precise blending, mixing, and often heating or treating of various raw materials to produce homogeneous liquid feed supplements. Manufacturers leverage advanced processing technologies to ensure optimal nutrient dispersion, product stability, and shelf-life, preventing ingredient separation or degradation. Research and development play a significant role here, with companies continually innovating to create new formulations that address specific animal health challenges, improve feed conversion ratios, or incorporate sustainable ingredients. Strict quality control measures are implemented at every stage of production to comply with animal feed safety regulations and maintain product integrity, ensuring that the liquid feeds meet their intended nutritional specifications before moving to the next stage.

The downstream segment of the value chain focuses on the distribution, sales, and delivery of finished liquid feed products to end-users. Distribution channels are varied, often involving both direct and indirect sales approaches. Large commercial livestock operations and integrated farming enterprises may engage in direct procurement from manufacturers, benefiting from bulk deliveries, tailored support, and potentially customized formulations. Indirect distribution involves a network of distributors, wholesalers, agricultural cooperatives, and local retailers who serve a broader base of small and medium-sized farms. This extensive network is crucial for market penetration, ensuring wider accessibility of liquid feed products across diverse geographical regions. Logistics, including specialized transportation and storage solutions, are vital in this stage to maintain product quality and deliver efficiency, ultimately connecting the product to the livestock farmers who are the ultimate beneficiaries and drivers of demand in the market.

Liquid Feed Market Potential Customers

The primary potential customers and end-users of liquid feed products are diverse entities within the animal agriculture sector, fundamentally driven by the need to optimize livestock health, growth, and productivity. The largest segment of buyers comprises livestock farmers and integrated farming operations that manage ruminant animals, specifically beef cattle, dairy cattle, sheep, and goats. These producers utilize liquid feeds extensively to supplement pasture-based diets, enhance forage digestibility, and provide a consistent supply of essential nutrients during critical physiological stages such as breeding, lactation, or intensive growth periods. The ease of administration and the ability to ensure uniform nutrient intake make liquid feeds an attractive option for large-scale ruminant operations seeking efficiency and consistency in their feeding programs.

Beyond ruminants, the market for liquid feed is expanding to include poultry, swine, and aquaculture industries. Poultry farmers are increasingly adopting liquid supplements for improved hydration, precise delivery of vitamins and minerals, and the administration of medications, particularly during periods of stress or disease challenge. In the swine industry, liquid feeds are valued for their ability to improve palatability, reduce feed waste, and enhance nutrient absorption, contributing to faster growth rates and better feed conversion ratios in pigs. For aquaculture, liquid supplements provide a means to deliver specialized nutrients, probiotics, and immune boosters to fish and shrimp, supporting healthy growth and disease resistance in aquatic farming environments. These sectors represent growing customer bases seeking tailored nutritional solutions to maximize their operational efficiencies and yields.

Essentially, any commercial animal farming enterprise that aims to implement a precision nutrition strategy, enhance animal welfare, reduce feed-related labor costs, and achieve higher economic returns on their livestock investments is a potential customer for liquid feed products. This includes independent farmers, large corporate agribusinesses, feedlots, and even specialized niche farms focused on organic or sustainable livestock production. The market also extends to veterinary practices that recommend nutritional solutions and academic or research institutions involved in animal nutrition studies. The common thread among all these potential customers is their shared objective of achieving optimal animal performance through scientifically formulated, efficiently delivered, and consistently available nutritional support, making liquid feeds an indispensable component of modern animal husbandry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $14.5 billion |

| Market Forecast in 2032 | $23.1 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADM Animal Nutrition, Cargill, Incorporated, Land O'Lakes, Inc., Nutreco N.V. (Trouw Nutrition), Alltech, Inc., CHS Inc., SweetPro Feeds, Westway Feed Products, Zinpro Corporation, Ag Partners LLC, Quality Liquid Feeds (QLF), Ridley Corporation Limited, Global Animal Products, Kent Nutrition Group, Midwest Liquid Feeds, DSM Nutritional Products, Kemin Industries, Inc., Provimi (Cargill), Phibro Animal Health Corporation, Novus International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Feed Market Key Technology Landscape

The liquid feed market is characterized by a rapidly evolving technology landscape, driven by continuous innovation aimed at enhancing nutritional precision, operational efficiency, and overall sustainability in animal agriculture. At the core of this landscape are advanced formulation and blending technologies. Modern manufacturing facilities employ sophisticated mixing systems capable of handling ingredients with varying viscosities and specific gravities, ensuring the production of highly stable, homogeneous liquid feeds. These systems often incorporate real-time sensor technologies to monitor ingredient flow and blend consistency, guaranteeing that each batch meets precise nutritional specifications and maintains its integrity throughout its shelf life, preventing ingredient stratification or separation. This precision in formulation is critical for delivering consistent and effective nutritional benefits to livestock.

Further technological advancements are evident in the development and adoption of automated dispensing and monitoring systems. These cutting-edge systems leverage Internet of Things (IoT) devices, smart sensors, and remote connectivity to enable precise, controlled delivery of liquid feeds to individual animals or groups. Automated feeders can adjust feed volumes and timings based on pre-programmed schedules, real-time consumption data, or even physiological indicators of the animals. This level of automation significantly reduces labor requirements, minimizes human error, and ensures that animals receive their exact nutritional requirements, leading to improved feed conversion ratios and reduced waste. The integration of data analytics with these systems allows farmers to monitor feed intake patterns, identify potential health issues early, and make data-driven decisions to optimize animal performance and resource management.

Moreover, the integration of Artificial Intelligence (AI) and machine learning (ML) is emerging as a transformative technology within the liquid feed sector. AI algorithms can process vast datasets, including animal genetics, environmental conditions, feed ingredient profiles, and historical performance data, to dynamically optimize liquid feed formulations. This allows for truly personalized nutrition, adapting feed composition to changing animal needs or environmental stressors, thereby maximizing animal health and productivity while minimizing overfeeding and its associated environmental footprint. Additionally, advancements in ingredient processing technologies, such as micro-encapsulation and targeted delivery systems for delicate nutrients, contribute to enhanced bioavailability and stability of active compounds within liquid feeds. These technologies collectively underscore the industry's commitment to leveraging innovation for superior animal nutrition and more sustainable agricultural practices.

Regional Highlights

- North America: This region holds a significant share in the liquid feed market, driven by its large-scale commercial livestock operations, particularly in beef and dairy cattle. The adoption of advanced farming technologies, high demand for animal protein, and a strong emphasis on precision nutrition and feed efficiency contribute to its market dominance. Strategic investments in research and development for innovative feed formulations are also prominent.

- Europe: A mature market characterized by stringent regulations on animal welfare, feed safety, and environmental protection. European countries focus on high-quality dairy and meat production with a growing emphasis on sustainable practices and organic farming. The region shows increasing adoption of liquid feeds to enhance animal performance and reduce ecological impact.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC's market expansion is fueled by its burgeoning population, increasing disposable incomes, and the subsequent surge in demand for animal protein. Countries like China, India, and Southeast Asian nations are modernizing their agricultural infrastructure, leading to greater adoption of efficient liquid feed solutions to support expanding livestock populations and improve productivity.

- Latin America: This region offers substantial growth potential, particularly in key agricultural economies such as Brazil and Argentina. Abundant agricultural resources, a rapidly expanding beef and dairy industry, and the increasing adoption of modern farming techniques drive the demand for liquid feeds. The focus is on optimizing feed conversion and improving livestock health to meet both domestic and international market demands.

- Middle East and Africa (MEA): An emerging market with increasing investments in agricultural infrastructure and national efforts to enhance food security. The demand for liquid feeds in MEA is primarily driven by the growth of its livestock industries, particularly in poultry and dairy, and the need for efficient feeding solutions in challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Feed Market.- ADM Animal Nutrition (Archer Daniels Midland Company)

- Cargill, Incorporated

- Land O'Lakes, Inc.

- Nutreco N.V. (Trouw Nutrition)

- Alltech, Inc.

- CHS Inc.

- SweetPro Feeds

- Westway Feed Products

- Zinpro Corporation

- Ag Partners LLC

- Quality Liquid Feeds (QLF)

- Ridley Corporation Limited

- Global Animal Products

- Kent Nutrition Group

- Midwest Liquid Feeds

- DSM Nutritional Products

- Kemin Industries, Inc.

- Provimi (Cargill)

- Phibro Animal Health Corporation

- Novus International

Frequently Asked Questions

What are the primary benefits of using liquid feed for livestock?

Liquid feeds offer several key benefits, including improved nutrient intake due to enhanced palatability, significant reduction in feed waste, labor savings from easier handling and storage, and consistent, uniform delivery of nutrients, all contributing to superior animal health and overall productivity.

Which types of livestock most commonly benefit from liquid feed?

Ruminants, such as beef cattle, dairy cattle, sheep, and goats, are the primary beneficiaries of liquid feeds. These feeds are highly effective in optimizing their complex digestive systems, improving forage utilization, and providing essential supplemental nutrition during critical growth and production phases.

How does liquid feed contribute to precision livestock farming?

Liquid feeds are integral to precision livestock farming by enabling highly specific and tailored nutrient delivery. When integrated with automated systems, sensors, and data analytics, liquid feeds can be precisely adjusted and dispensed based on individual animal needs or group requirements, optimizing health, performance, and resource efficiency with minimal waste.

What are the key raw materials typically used in liquid feed production?

Key raw materials commonly used in liquid feed production include molasses, primarily for energy and palatability; urea, as a non-protein nitrogen source; various essential minerals such as calcium, phosphorus, and trace elements; a range of vitamins; and other specialized additives like amino acids, enzymes, or probiotics to enhance specific functional benefits.

What growth trends are expected for the liquid feed market in the Asia Pacific region?

The Asia Pacific region is anticipated to exhibit rapid and substantial growth in the liquid feed market. This growth is driven by expanding livestock populations, increasing disposable incomes leading to higher demand for animal protein, and the ongoing modernization of agricultural practices across key countries like China, India, and various Southeast Asian nations, fostering greater adoption of advanced feeding solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Compound Feed and Additive Market Statistics 2025 Analysis By Application (Poultry, Pig, Ruminant, Othes), By Type (Pellets Feed and Additives, Powder Feed and Additives, Liquid Feed and Additives, Othes), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Liquid Feed Supplements Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Molassed Based Liquid Feed Supplements, Urea Based Liquid Feed Supplements, Magnesium Liquid Feeds), By Application (Feedlot, Dairy, Beef, Sheep, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Liquid Feed Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Phosphoric Acid, Trace Minerals, Vitamins, Urea, Fats, Others), By Application (Ruminant, Swine, Poultry, Aquaculture, Other Animals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager