Liquid Pouch Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430738 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Liquid Pouch Packaging Market Size

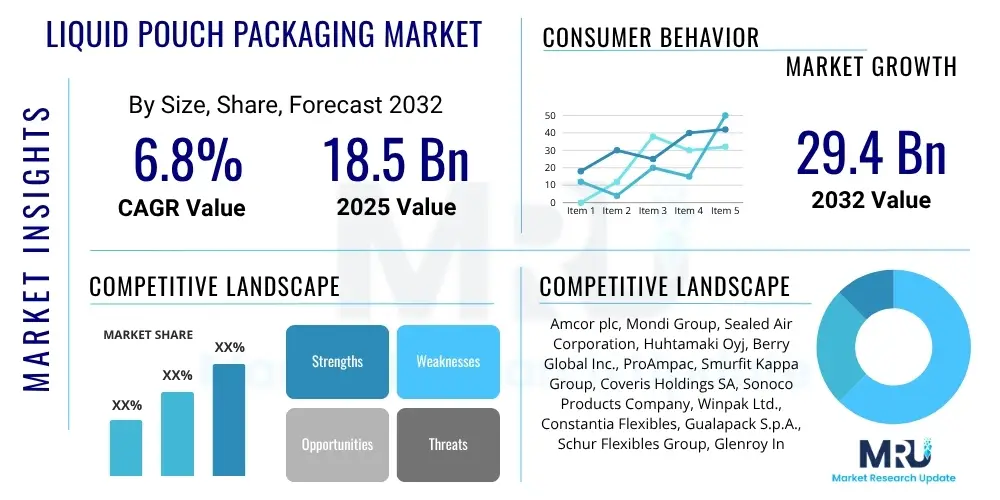

The Liquid Pouch Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $29.4 Billion by the end of the forecast period in 2032.

Liquid Pouch Packaging Market introduction

The Liquid Pouch Packaging Market encompasses flexible packaging solutions designed specifically for liquid and semi-liquid products across various industries. These innovative packaging formats, including stand-up pouches, spouted pouches, and flat pouches, are crafted from advanced flexible materials such as plastic films, aluminum foil, and paper laminates, offering superior barrier properties and structural integrity. They serve as a modern alternative to traditional rigid packaging like bottles, cans, and cartons, providing significant advantages in terms of material efficiency, reduced transportation costs, and enhanced consumer convenience.

Products within this market are widely utilized for a diverse range of applications, predominantly within the food and beverage sector for items such as juices, sauces, dairy products, and pet food. Beyond consumables, liquid pouches are increasingly adopted in personal care for shampoos, lotions, and soaps, as well as in home care for detergents and cleaning solutions. The pharmaceutical and industrial sectors also leverage liquid pouch packaging for specific formulations requiring precise dispensing and robust protection against contamination or degradation.

Key benefits driving the market's growth include their lightweight nature, which contributes to lower carbon footprints and reduced shipping expenses, and their ability to extend product shelf life through effective barrier technologies. Furthermore, the inherent design flexibility allows for eye-catching graphics and user-friendly features like spouts and resealable closures, enhancing brand appeal and consumer experience. These factors, coupled with growing environmental concerns favoring lighter, more resource-efficient packaging and robust demand for convenient, on-the-go product formats, are significant drivers propelling the expansion of the liquid pouch packaging market globally.

Liquid Pouch Packaging Market Executive Summary

The Liquid Pouch Packaging Market is experiencing robust growth fueled by shifting consumer preferences towards convenience, sustainability, and cost-effectiveness. Key business trends indicate a significant pivot towards advanced barrier films and multi-layer structures that enhance product preservation and extend shelf life, catering to demanding applications in food, beverage, personal care, and pharmaceuticals. There is also a strong emphasis on developing eco-friendly materials, including recyclable and biodegradable polymers, as companies strive to meet stringent environmental regulations and consumer expectations for sustainable packaging solutions. Automation in manufacturing and filling processes is becoming paramount to improve operational efficiencies and reduce production costs across the value chain, driving innovation in equipment and technology adoption.

Regional trends reveal Asia Pacific as a primary growth engine, characterized by rapidly expanding economies, increasing disposable incomes, and the burgeoning organized retail sector which drives demand for packaged liquid products. North America and Europe maintain substantial market shares, with a strong focus on premiumization, sophisticated design, and advanced functional pouches, particularly spouted and retort-capable varieties for baby food, ready-to-drink beverages, and gourmet sauces. Latin America and the Middle East and Africa regions are showing promising growth trajectories, supported by urbanization and evolving retail landscapes, albeit with varying levels of technological adoption and infrastructure development for recycling. These regions present significant opportunities for market penetration by key players.

Segmentation trends highlight the dominance of stand-up pouches due to their aesthetic appeal and shelf stability, while spouted pouches are gaining traction for single-serve and viscous product applications, offering superior dispensing control and convenience. The food and beverage sector remains the largest application segment, with specific sub-segments like dairy, juices, and pet food exhibiting high demand. Material advancements are critical, with plastic films continuing to lead, but a noticeable shift towards sustainable alternatives and enhanced barrier materials like EVOH and nylon to improve product protection against oxygen and moisture. The small to medium capacity pouch segment is particularly dynamic, aligning with on-the-go consumption patterns and portion control requirements, further fragmenting the market with specialized solutions tailored to diverse consumer needs.

AI Impact Analysis on Liquid Pouch Packaging Market

User questions regarding AI's impact on the Liquid Pouch Packaging Market frequently revolve around optimizing production efficiency, enhancing quality control, and improving supply chain management. Consumers and industry stakeholders are keen to understand how AI can reduce material waste, accelerate design processes, and personalize packaging solutions, while also addressing concerns about data security and the initial investment required for AI integration. The overarching theme is an expectation for AI to drive smarter, more sustainable, and highly responsive packaging operations, ranging from predictive maintenance for machinery to intelligent inventory management and real-time quality assurance for sensitive liquid products. Users are particularly interested in AI's role in creating 'smart pouches' with enhanced traceability and consumer engagement features.

- AI-driven predictive maintenance optimizes machinery uptime, reducing production stoppages and costs in packaging plants.

- Automated quality inspection systems using AI vision ensure consistent product integrity and seal strength, minimizing defects.

- Supply chain optimization through AI algorithms improves inventory management, demand forecasting, and logistics for raw materials and finished goods.

- AI assists in designing more efficient and sustainable pouch structures by simulating material performance and reducing material usage.

- Enhanced traceability and anti-counterfeiting measures via AI-powered serialization and QR code analytics on pouches.

- Personalized packaging insights and consumer engagement opportunities through data analysis from smart packaging features.

- Robotics and AI collaborate to automate filling, sealing, and palletizing processes, increasing throughput and precision.

- Energy consumption optimization in manufacturing facilities by AI monitoring and controlling operational parameters.

DRO & Impact Forces Of Liquid Pouch Packaging Market

The Liquid Pouch Packaging Market is profoundly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its trajectory and competitive landscape. A primary driver is the increasing consumer demand for convenient, lightweight, and portable packaging solutions, particularly for on-the-go consumption of food, beverages, and personal care products. The enhanced sustainability profile of pouches, which typically use less material and generate less waste compared to rigid alternatives, aligns well with global environmental initiatives and growing consumer preference for eco-friendly products, further boosting adoption. Additionally, cost-effectiveness in production and transportation, coupled with the ability of flexible materials to provide excellent barrier properties for extended shelf life, makes pouches an attractive option for manufacturers seeking to optimize operational expenses and product quality. The aesthetic versatility and printable surface area of pouches also provide significant branding and differentiation opportunities, allowing companies to capture consumer attention effectively on retail shelves.

Despite robust growth, the market faces several restraints that could impede its full potential. A significant challenge is the complexity and cost associated with establishing adequate recycling infrastructure for multi-layer flexible pouches, which are often difficult to separate into their constituent materials for reprocessing. This leads to lower recycling rates compared to rigid plastics or metals and raises environmental concerns among some stakeholders. Material compatibility issues for certain highly acidic or alkaline liquid products, which may require specialized and more expensive barrier films, also present a technical and economic hurdle. Furthermore, the initial capital investment required for specialized pouch manufacturing and high-speed filling machinery can be substantial, particularly for smaller and medium-sized enterprises, thus posing an entry barrier for new market participants and potentially slowing adoption in developing regions.

Opportunities for growth are abundant, especially in emerging markets where urbanization and rising disposable incomes are driving increased consumption of packaged goods, opening new avenues for pouch applications. Technological advancements in barrier film materials, such as bio-based polymers and enhanced recyclable laminates, offer pathways to address sustainability concerns and meet evolving regulatory standards. The integration of smart packaging technologies, including QR codes, NFC tags, and time-temperature indicators, can provide consumers with enhanced product information, traceability, and interactive experiences, adding significant value. Moreover, the expansion into specialized applications, such as pharmaceutical liquids, industrial lubricants, and bulk institutional packaging, represents untapped potential for market diversification. These opportunities, combined with ongoing innovation in manufacturing processes and material science, suggest a dynamic future for the liquid pouch packaging market, allowing it to overcome existing challenges and capitalize on emerging trends for sustained expansion.

Segmentation Analysis

The Liquid Pouch Packaging Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. This segmentation helps in identifying key market drivers, niche opportunities, and competitive landscapes across various product types, materials, applications, and capacities. The intricate interplay of these segments underscores the market's adaptability and responsiveness to specific industry needs and consumer demands, from lightweight, single-serve portions to bulk industrial liquid containers. Analyzing these segments facilitates strategic planning for manufacturers, material suppliers, and end-users, ensuring optimal resource allocation and market penetration strategies, as the market continues to evolve with technological advancements and shifting consumer behaviors across different geographies.

- By Type

- Stand-up Pouches: Versatile, self-standing packaging with a bottom gusset, widely used for food, beverages, and personal care.

- Spouted Pouches: Equipped with a spout and cap for easy pouring and re-sealing, popular for baby food, sauces, and detergents.

- Flat/Lay-flat Pouches: Simple, cost-effective pouches, often used for single-serve portions or product samples.

- Pillow Pouches: Basic, low-cost flexible bags formed from a single roll of film, commonly seen for snacks or small liquid volumes.

- Retort Pouches: Designed to withstand high-temperature sterilization, suitable for shelf-stable foods like ready meals and pet food.

- Bag-in-Box: Large flexible pouches housed within a rigid outer box, typically for bulk liquids like wine, juices, or industrial chemicals.

- By Material

- Plastic Films:

- Polyethylene (PE): Commonly used for outer layers due to flexibility, moisture barrier, and heat sealability.

- Polypropylene (PP): Offers good clarity, heat resistance, and barrier properties against moisture.

- Polyethylene Terephthalate (PET): Provides excellent strength, stiffness, and oxygen barrier, often used for transparent layers.

- Nylon (Polyamide): Known for high strength, puncture resistance, and good oxygen barrier, especially for retort applications.

- Ethylene Vinyl Alcohol (EVOH): Offers superior oxygen barrier properties, crucial for sensitive food products.

- Other Plastics: Including PVC, PVDC, etc., used for specific barrier or structural requirements.

- Aluminum Foil: Provides an excellent barrier against light, oxygen, moisture, and odors, often used in multi-layer laminates.

- Paper: Used for structural support or aesthetic appeal, typically laminated with plastic films for liquid containment.

- Bioplastics: Emerging sustainable materials like PLA (Polylactic Acid) or PHA (Polyhydroxyalkanoates) offering biodegradable or compostable options.

- Plastic Films:

- By Application

- Food and Beverage:

- Dairy Products: Milk, yogurt, cream, cheese sauces.

- Juices and Beverages: Fruit juices, energy drinks, alcoholic beverages.

- Sauces and Condiments: Ketchup, mayonnaise, salad dressings, cooking sauces.

- Soups and Broths: Ready-to-eat soups, concentrated broths.

- Edible Oils: Cooking oils, olive oil.

- Pet Food: Wet pet food, pet treats.

- Baby Food: Purees, squeezable pouches.

- Other Food: Pureed fruits/vegetables, liquid eggs, nutritional supplements.

- Personal Care: Shampoo, conditioner, liquid soaps, lotions, creams, hand sanitizers, cosmetics.

- Home Care: Liquid detergents, fabric softeners, household cleaners, dishwashing liquids.

- Pharmaceuticals: Liquid medicines, cough syrups, antiseptic solutions, medical nutrition.

- Industrial: Lubricants, chemicals, paints, adhesives, automotive fluids.

- Food and Beverage:

- By Capacity

- Small (Under 200 ml): Single-serve, sample sizes, on-the-go products.

- Medium (200 ml to 1000 ml): Standard consumer sizes, family packs.

- Large (Over 1000 ml): Bulk packaging, institutional use, bag-in-box applications.

Value Chain Analysis For Liquid Pouch Packaging Market

The value chain for the Liquid Pouch Packaging Market is a complex network involving several interdependent stages, beginning with the procurement of raw materials and extending to the end-users. Upstream activities primarily focus on the sourcing and processing of base materials crucial for flexible packaging. This involves chemical companies producing polymer resins (such as PE, PP, PET, nylon, EVOH) and aluminum suppliers providing foil. These raw materials are then processed by film manufacturers into various types of flexible films, including mono-films and multi-layer laminates, which are engineered for specific barrier properties, strength, and printability, forming the foundational components of pouches. This initial stage is capital-intensive and requires advanced chemical engineering and material science expertise, heavily impacting the overall cost and performance of the final packaging solution.

Midstream activities in the value chain involve the conversion of these flexible films into finished pouches. Packaging converters and manufacturers take the raw films, often incorporating printing, lamination, and pouch-making processes (such as forming, filling, and sealing). This stage is characterized by high levels of automation and precision machinery, enabling the creation of diverse pouch formats like stand-up, spouted, or flat pouches, customized to client specifications regarding size, shape, and graphic design. These manufacturers also develop and integrate dispensing mechanisms like spouts and caps. The efficiency and technological sophistication at this stage directly influence the cost, quality, and speed of product delivery to the market, playing a critical role in meeting the dynamic demands of various industries requiring liquid packaging.

Downstream, the completed liquid pouches are distributed through various channels to the end-users. The distribution channel primarily involves direct sales from large packaging manufacturers to major fast-moving consumer goods (FMCG) companies, pharmaceutical giants, or industrial clients. Alternatively, indirect channels utilize packaging distributors and wholesalers who cater to a broader range of smaller and medium-sized enterprises, offering a consolidated supply of various packaging types. These end-users then fill the pouches with their respective liquid or semi-liquid products using specialized filling and sealing equipment, often integrated directly into their production lines. The effectiveness of the distribution network ensures timely delivery and availability of packaging, minimizing supply chain disruptions for end-user industries that rely heavily on consistent packaging supply to bring their liquid products to market efficiently and securely.

Liquid Pouch Packaging Market Potential Customers

The primary potential customers and end-users of liquid pouch packaging span across a wide array of industries, each with unique requirements for product protection, consumer convenience, and brand presentation. Fast-Moving Consumer Goods (FMCG) companies constitute the largest segment of buyers, particularly those in the food and beverage sector. This includes manufacturers of juices, dairy products like milk and yogurt, various sauces, edible oils, and alcoholic beverages. These customers prioritize packaging that extends shelf life, withstands transportation, offers appealing aesthetics, and provides user-friendly dispensing, aligning perfectly with the benefits of flexible liquid pouches, especially spouted and stand-up varieties for on-the-go consumption and kitchen convenience.

Beyond food and beverage, the personal care and home care industries represent significant end-user segments. Personal care brands, producing items such as shampoos, conditioners, liquid soaps, lotions, and hand sanitizers, are increasingly adopting pouches for their lightweight nature, reduced plastic content, and refill economy packs, which resonate with environmentally conscious consumers. Similarly, home care product manufacturers for detergents, fabric softeners, and household cleaners utilize large-capacity pouches, often in bag-in-box formats, for bulk purchasing and efficient storage, reflecting a growing trend towards sustainable and cost-effective packaging solutions in these sectors.

Furthermore, the pharmaceutical and industrial sectors are critical, albeit more specialized, customer bases for liquid pouch packaging. Pharmaceutical companies use pouches for liquid medicines, syrups, and medical nutrition, where sterility, precise dosing, and tamper-evident features are paramount, often requiring advanced barrier films and aseptic filling processes. Industrial applications include packaging for lubricants, automotive fluids, chemicals, and paints, where durability, chemical resistance, and efficient dispensing are key considerations. These diverse end-user segments underscore the versatility and broad applicability of liquid pouch packaging, demonstrating its capacity to meet stringent industry standards and consumer expectations across a global marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $29.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Mondi Group, Sealed Air Corporation, Huhtamaki Oyj, Berry Global Inc., ProAmpac, Smurfit Kappa Group, Coveris Holdings SA, Sonoco Products Company, Winpak Ltd., Constantia Flexibles, Gualapack S.p.A., Schur Flexibles Group, Glenroy Inc., Goglio S.p.A., Bryce Corporation, Flexpak Inc., Pouch Partners AG, Flair Flexible Packaging, Tekni-Plex, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Pouch Packaging Market Key Technology Landscape

The Liquid Pouch Packaging Market is continually evolving through advancements in packaging technologies that enhance product protection, extend shelf life, and improve consumer interaction. One critical area of innovation is in advanced barrier film technology, which utilizes multi-layer co-extrusion and lamination techniques to combine different polymers like EVOH (Ethylene Vinyl Alcohol), Nylon, and metallized films. These high-performance films provide superior protection against oxygen, moisture, UV light, and odors, which are essential for preserving the freshness and nutritional value of sensitive liquid products, particularly in the food, beverage, and pharmaceutical sectors. The development of thinner yet stronger films also contributes to material reduction, aligning with sustainability goals.

Aseptic and retort processing technologies are also pivotal, enabling the packaging of shelf-stable liquid products without refrigeration or preservatives for extended periods. Aseptic packaging involves sterilizing the product and packaging separately before filling in a sterile environment, while retort packaging processes the filled and sealed pouch under high heat and pressure to achieve commercial sterility. These technologies significantly expand the market for liquid pouches, allowing for the safe distribution of products like dairy, juices, soups, and baby food across diverse geographical regions, including those with limited cold chain infrastructure. Continuous innovation in retortable materials ensures pouches maintain integrity and barrier properties under extreme processing conditions, enhancing product safety and quality.

Furthermore, the integration of smart packaging technologies and automation in manufacturing processes is transforming the liquid pouch landscape. Smart packaging incorporates features like QR codes, NFC tags, and RFID for enhanced traceability, anti-counterfeiting measures, and consumer engagement, providing real-time data on product origin, ingredients, and usage. Automated filling and sealing lines, equipped with precision dosing systems and vision inspection technology, improve production efficiency, reduce labor costs, and ensure consistent product quality and pouch integrity. The development of sustainable manufacturing processes, including solvent-free lamination and energy-efficient machinery, further underscores the industry's commitment to both operational excellence and environmental stewardship, driving the market towards more eco-conscious and technologically advanced solutions.

Regional Highlights

- North America: Characterized by strong demand for convenient and premium liquid pouch solutions, particularly in the ready-to-drink beverages, dairy, and personal care sectors. High adoption of spouted and stand-up pouches due to busy consumer lifestyles and a focus on product differentiation.

- Europe: Driven by stringent sustainability regulations and a mature consumer base that values eco-friendly packaging. Strong emphasis on recyclable and compostable pouch materials, alongside a growing market for specialized applications like baby food and pharmaceutical liquids.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and the expansion of modern retail channels. High demand for cost-effective and convenient liquid pouch packaging across food, beverage, and home care segments, especially in emerging economies like India and China.

- Latin America: Experiencing significant growth due to improving economic conditions, a growing middle class, and increasing preference for packaged food and beverage products. Pouch packaging offers a cost-effective solution for widespread distribution in developing infrastructure.

- Middle East and Africa (MEA): Showing nascent but promising growth, driven by population growth, rising consumer awareness of packaged goods, and investments in food processing and manufacturing capabilities. Opportunities exist for basic to mid-range pouch solutions for essential liquid products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Pouch Packaging Market.- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Huhtamaki Oyj

- Berry Global Inc.

- ProAmpac

- Smurfit Kappa Group

- Coveris Holdings SA

- Sonoco Products Company

- Winpak Ltd.

- Constantia Flexibles

- Gualapack S.p.A.

- Schur Flexibles Group

- Glenroy Inc.

- Goglio S.p.A.

- Bryce Corporation

- Flexpak Inc.

- Pouch Partners AG

- Flair Flexible Packaging

- Tekni-Plex, Inc.

Frequently Asked Questions

What is liquid pouch packaging?

Liquid pouch packaging refers to flexible containers made from plastic films, aluminum foil, or paper laminates, specifically designed to hold and dispense liquid or semi-liquid products. Common types include stand-up pouches, spouted pouches, and flat pouches, widely used for food, beverages, personal care, and home care items.

What are the main benefits of using liquid pouches over rigid packaging?

Liquid pouches offer several key benefits including reduced material consumption, lower transportation costs due to lighter weight, extended shelf life through superior barrier properties, enhanced consumer convenience with features like spouts and resealable closures, and improved branding opportunities due to versatile printing surfaces. They also have a better product-to-package ratio.

Which industries are the primary users of liquid pouch packaging?

The primary industries utilizing liquid pouch packaging are Food and Beverage (e.g., juices, dairy, sauces, pet food), Personal Care (e.g., shampoos, lotions), Home Care (e.g., detergents, cleaners), and to a lesser extent, Pharmaceuticals (e.g., liquid medicines) and Industrial applications (e.g., lubricants).

What are the key challenges facing the liquid pouch packaging market?

Key challenges include the complexity and cost of recycling multi-layer flexible pouches, which hinders widespread circularity. Other challenges involve material compatibility for highly aggressive liquid products, requiring specialized barrier films, and the substantial initial capital investment needed for advanced manufacturing and filling machinery.

How is sustainability impacting the liquid pouch packaging market?

Sustainability is a major driver, pushing the market towards developing recyclable, compostable, and bio-based materials. Consumers and regulations demand reduced plastic waste and lower carbon footprints, leading to innovations in mono-material pouches, lightweighting, and improved end-of-life solutions for flexible packaging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager