LNG Bunkering Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430134 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

LNG Bunkering Market Size

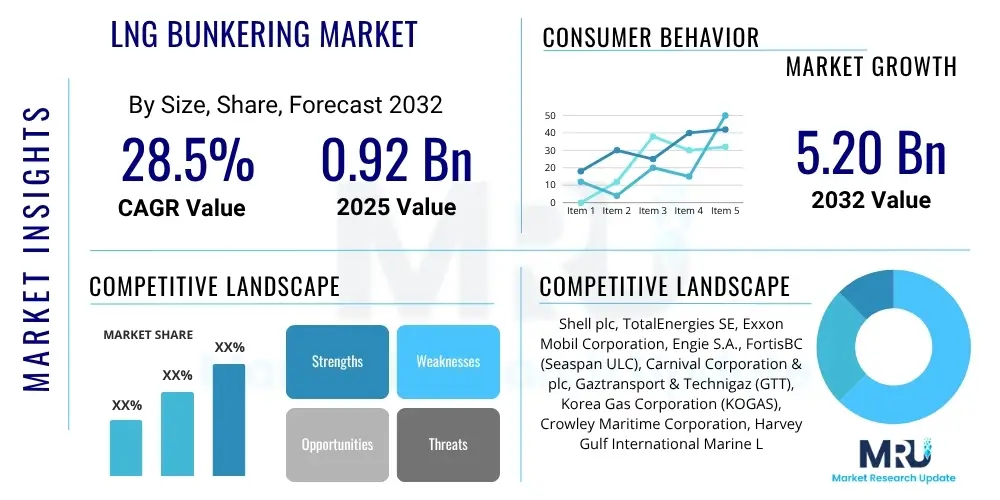

The LNG Bunkering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 0.92 Billion in 2025 and is projected to reach USD 5.20 Billion by the end of the forecast period in 2032.

LNG Bunkering Market introduction

The LNG bunkering market represents a critical and rapidly expanding sector within the global maritime industry, focused on the provision and utilization of Liquefied Natural Gas as a primary marine fuel. This sophisticated process involves the safe, efficient, and environmentally compliant transfer of LNG from a supply source, such as a dedicated bunker vessel or a shore-based facility, to a receiving ship's fuel tanks. The inherent characteristics of LNG, notably its significantly lower carbon footprint compared to conventional heavy fuel oils and marine diesel, position it as an indispensable solution for achieving global decarbonization targets and adhering to increasingly stringent international environmental regulations. The transition to LNG-fueled vessels is a cornerstone of the shipping industry's strategy to enhance sustainability and ensure long-term operational viability in a climate-conscious world.

The product, LNG, functions as a highly efficient and clean-burning marine fuel, substantially reducing emissions of sulfur oxides (SOx) by nearly 100%, nitrogen oxides (NOx) by up to 85%, and particulate matter (PM) by 99%, while also cutting carbon dioxide (CO2) emissions by approximately 20-25% compared to traditional fossil fuels. These environmental benefits are paramount in light of the International Maritime Organization (IMO) 2020 sulfur cap and forthcoming regulations aimed at reducing greenhouse gas emissions. Major applications for LNG bunkering span a broad spectrum of vessel types, including large intercontinental container ships, crude oil and chemical tankers, dry bulk carriers, passenger cruise liners, and regional ferries. The adaptability of LNG as a fuel makes it suitable for both newbuild vessels designed for LNG propulsion and existing ships undergoing retrofitting processes, thereby addressing diverse operational profiles across the global fleet.

Beyond environmental compliance, the adoption of LNG offers several compelling operational and economic benefits, such as potential long-term fuel cost stability, extended engine lifespan due to cleaner combustion, and reduced maintenance requirements. These advantages contribute to a stronger return on investment for shipping companies. The market's accelerated growth is directly attributable to several driving factors, including the global imperative for cleaner energy sources in maritime transport, significant investments in the expansion of LNG bunkering infrastructure across strategic ports and shipping routes, and technological advancements in marine engine design that enhance efficiency and safety. Furthermore, the increasing availability of LNG as a commodity and the establishment of robust supply chains play a crucial role in fostering broader market acceptance and integration, solidifying LNG's position as a future-proof marine fuel solution.

LNG Bunkering Market Executive Summary

The LNG Bunkering Market is currently undergoing a period of dynamic transformation and significant growth, primarily propelled by overarching business trends focused on global decarbonization mandates and the shipping industry's proactive shift towards more sustainable and environmentally responsible operational practices. This evolving landscape is characterized by an uptick in strategic alliances and collaborative ventures between major energy suppliers, influential port authorities, and leading shipping companies, all working in concert to accelerate the development and deployment of essential bunkering infrastructure. Furthermore, continuous technological advancements in specialized bunkering vessels, advanced cryogenic transfer systems, and sophisticated safety protocols are consistently enhancing the overall efficiency and security of LNG fuel delivery operations. The market is further defined by substantial capital investments channeled into the establishment of new, state-of-the-art bunkering facilities worldwide, coupled with a notable surge in orders for LNG-fueled vessels, collectively signaling a robust and enduring growth trajectory for the sector throughout the forecast period. This vibrant and competitive environment actively fosters innovation, with a strategic emphasis on the development of integrated logistics solutions and the diversification of supply chains to effectively meet the escalating global demand for LNG as a marine fuel.

From a regional perspective, Europe continues to exert its leadership in the LNG bunkering market, a position solidified by its progressive regulatory frameworks, such as those implemented by the European Union and national maritime authorities, and a highly advanced and well-established network of LNG bunkering ports, particularly prevalent across the strategically vital North Sea and Baltic Sea regions. Simultaneously, the Asia Pacific region is rapidly ascending as a pivotal growth powerhouse, driven by its burgeoning trade volumes, extensive governmental backing for cleaner maritime fuels in key economies like China, Singapore, and South Korea, and substantial investments in modernizing port infrastructure to accommodate LNG bunkering. North America is also witnessing considerable market expansion, propelled by the increasing adoption of LNG in its domestic waterways and coastal shipping routes, complemented by supportive regulatory incentives aimed at encouraging fleet conversions. These distinctive regional trends collectively underscore a profound global commitment to environmental stewardship and a fundamental energy transition within the maritime sector, fostering the development of a sophisticated, distributed, yet intricately interconnected global LNG bunkering network that is resilient and responsive to evolving market demands.

An in-depth analysis of segmentation trends reveals a strong and consistent uptake of LNG across a broad array of diverse vessel types. Early and significant adopters predominantly include large container ships and various classes of tankers, which benefit immensely from LNG due to their extensive fuel consumption profiles and global operational routes. The ship-to-ship (STS) bunkering method remains the prevailing mode of fuel delivery, celebrated for its unparalleled flexibility and operational efficiency, allowing vessels to refuel while at anchor or underway in certain designated areas. Nevertheless, port-to-ship (PTS) and truck-to-ship (TTS) methods continue to hold critical importance, especially for smaller ports lacking extensive infrastructure or for specific vessel requirements that demand tailored bunkering solutions. This comprehensive segmentation highlights the remarkable versatility of LNG as a marine fuel and the adaptive, multi-faceted nature of its associated supply chain, which is meticulously designed to cater to a broad spectrum of unique operational needs and logistical challenges encountered within the expansive global shipping fleet. The discernible shift towards greater adoption of Type C storage tanks aboard LNG-fueled vessels also indicates a growing preference for standardized, robust, and economically efficient solutions in contemporary marine engineering and vessel design.

AI Impact Analysis on LNG Bunkering Market

User inquiries into the transformative impact of Artificial Intelligence on the LNG Bunkering Market frequently coalesce around key themes such as the optimization of complex logistical operations, the enhancement of stringent safety protocols, and the accurate prediction of intricate demand and supply fluctuations. Stakeholders across the maritime value chain are increasingly interested in understanding precisely how AI technologies can be leveraged to streamline the inherently complex supply chain of LNG, encompassing everything from its initial production and liquefaction to its final delivery to the receiving vessel. The overarching goal is to concurrently achieve substantial reductions in operational costs and effectively mitigate potential environmental risks associated with fuel transfer. There is a palpable and growing expectation regarding AI's multifaceted role in enabling sophisticated predictive maintenance regimes for critical bunkering equipment, facilitating dynamic route optimization for LNG bunker vessels, and providing real-time, granular monitoring of fuel transfer processes to proactively prevent spills, detect anomalies, and rectify inefficiencies before they escalate. Moreover, users anticipate that AI will make significant contributions to smarter inventory management systems and more accurate, data-driven forecasting of LNG prices, thereby substantially improving the overall economic viability and long-term stability of the entire bunkering ecosystem. Furthermore, the immense potential for AI to seamlessly integrate diverse data streams for robust regulatory compliance, enhanced operational transparency, and superior strategic decision-making represents a consistently recurring and highly valued theme among industry participants.

- AI-powered predictive maintenance for critical bunkering infrastructure and equipment, ensuring maximum operational reliability, extending asset lifespan, and significantly reducing unscheduled downtime and costly repairs.

- Advanced optimization of logistics and dynamic route planning algorithms for LNG bunker vessels, meticulously minimizing fuel consumption during transit, reducing operational costs, and optimizing delivery schedules for enhanced efficiency.

- Comprehensive real-time monitoring, intelligent anomaly detection, and automated alert systems during intricate fuel transfer operations, drastically enhancing safety protocols, proactively preventing accidental spills, and ensuring regulatory compliance.

- Sophisticated demand forecasting models and intelligent inventory management systems for LNG suppliers and port operators, precisely reducing fuel waste, optimizing storage capacity utilization, and guaranteeing timely fuel availability for shipping clients.

- Automated compliance checks, digital record-keeping, and streamlined data reporting mechanisms for complex international and local environmental regulations, significantly reducing administrative burdens and ensuring consistent adherence to standards.

- Immersive virtual reality (VR) and augmented reality (AR) enhanced training simulations for bunkering personnel, fostering advanced skill acquisition, enhancing situational awareness, and significantly improving overall safety consciousness and emergency response capabilities.

- Advanced data analytics platforms for continuous performance optimization of LNG-fueled vessels, meticulously analyzing operational parameters to achieve greater fuel efficiency, reduce emissions, and extend engine life through informed adjustments.

- Intelligent smart port integration systems for seamless, automated coordination of bunkering operations with overall port logistics, minimizing vessel waiting times, optimizing berth utilization, and enhancing port efficiency.

DRO & Impact Forces Of LNG Bunkering Market

The LNG Bunkering Market is primarily propelled by a confluence of powerful drivers, most notably the escalating global imperative for cleaner marine fuels, an urgency largely dictated by increasingly stringent environmental regulations promulgated by influential international bodies such as the International Maritime Organization (IMO) and various proactive regional authorities. The foundational IMO 2020 sulfur cap, which drastically limits sulfur content in marine fuels, alongside forthcoming ambitious greenhouse gas emission reduction targets (e.g., IMO's 2050 decarbonization strategy), collectively necessitate a swift and decisive transition away from high-sulfur fuel oils. Beyond regulatory compliance, the compelling economic benefits of LNG serve as significant incentives for shipping companies. These include the potential for lower long-term fuel costs compared to compliant very low sulfur fuel oil (VLSFO) or marine gas oil (MGO), reduced engine maintenance requirements attributable to cleaner combustion, and the avoidance of expensive exhaust gas cleaning systems (scrubbers). The rapidly expanding network of LNG supply infrastructure and a burgeoning orderbook for LNG-fueled vessels globally also act as powerful market accelerators, creating a self-reinforcing cycle of demand and supply within the maritime industry.

Despite these robust drivers, the market faces considerable and multifaceted restraints. Predominantly, these include the substantial initial capital investment required for both the construction or conversion of LNG-fueled vessels and the extensive development of dedicated LNG bunkering infrastructure, which encompasses terminals, specialized bunker vessels, and cryogenic storage facilities. Such significant upfront costs can pose a formidable barrier to entry, particularly for smaller shipping lines or emerging ports with limited financial resources. Furthermore, while largely mitigated by advanced engineering and rigorous operational protocols, perceived safety concerns associated with the handling, storage, and transfer of highly cryogenic LNG can still represent a psychological barrier for some stakeholders, necessitating continuous education and demonstration of robust safety records. Additionally, the complex and sometimes disparate regulatory landscape, although a key driver, can paradoxically act as a restraint due to varying local interpretations of international guidelines, creating a degree of uncertainty for investors and operators navigating diverse jurisdictions. The inherent volatility of global natural gas prices relative to crude oil also introduces economic uncertainties, impacting long-term financial planning for vessel operators.

Significant opportunities abound within the LNG bunkering market, particularly in the strategic expansion of small-scale LNG infrastructure. This development aims to serve a broader range of ports and vessel types, including those in emerging markets and inland waterways, thereby enhancing accessibility and flexibility. Technological advancements in bunkering equipment, such as more efficient and automated transfer systems, innovative modular bunkering solutions, and highly adaptable floating storage and regasification units (FSRUs), offer crucial avenues for cost reduction, increased operational flexibility, and accelerated deployment. Moreover, the long-term growth prospects are bolstered by the potential for integrating LNG bunkering with broader decarbonization strategies, including the future adoption of bio-LNG (from sustainable biomass) and synthetic LNG (produced using renewable energy), which promise near-zero lifecycle emissions. The increasing global demand for sustainable tourism and environmentally responsible cargo transport also drives considerable opportunities for cruise and ferry operators to proactively adopt cleaner fuel solutions, enhancing their corporate social responsibility profile. The overarching impact forces shaping this market include unrelenting regulatory pressure for steep emissions reduction targets, continuous and rapid technological innovation in marine propulsion systems and fuel handling technologies, evolving geopolitical energy policies influencing supply and pricing, and the dynamic interplay of global trade patterns and the imperative for resilient, sustainable supply chains, all contributing to a transformative shift in maritime energy consumption.

Segmentation Analysis

The LNG Bunkering Market is meticulously segmented across various critical dimensions to provide an exhaustive and granular understanding of its operational intricacies, growth trajectories, and competitive dynamics. This comprehensive segmentation framework is instrumental for stakeholders, including market analysts, investors, policymakers, and industry participants, to precisely identify nascent market niches, accurately assess the evolving competitive landscapes, and formulate highly targeted and effective growth strategies. A detailed breakdown across end-use vessel types, bunkering methodologies, and storage tank technologies offers unparalleled insights into the diverse demands emanating from different maritime sectors and the preferred operational approaches for fuel delivery and onboard storage. Such an in-depth analytical approach is indispensable for accurately forecasting future market trends, efficiently allocating strategic resources across the extensive LNG bunkering value chain, and ultimately driving informed decision-making within this rapidly evolving industry. Understanding these segmented dynamics ensures that market participants can adapt to specific regional demands and technological preferences, fostering innovation and sustainable expansion.

- By End-Use Vessel: This segment categorizes the market based on the types of ships that utilize LNG as a marine fuel, reflecting their varied operational profiles and fuel consumption needs.

- Container Vessels: Large cargo ships primarily engaged in international trade, known for their high fuel consumption and long-haul routes. Their adoption of LNG is driven by scale and global environmental compliance.

- Tankers: Vessels designed for transporting bulk liquids or gases, including crude oil, refined petroleum products, chemicals, and specialized gases. Environmental mandates and long operational periods make LNG an attractive option.

- Bulk Carriers: Ships that carry unpackaged dry cargo such as grain, coal, iron ore, and cement. Their global operations and need for cost-effective, compliant fuel solutions drive LNG adoption.

- Cruise Ships: Large passenger vessels focused on leisure voyages, highly sensitive to environmental impact and public perception, particularly in sensitive coastal and port areas. LNG provides significant emission reductions.

- Ferries: Vessels for passenger and vehicle transport over shorter distances, often with frequent port calls. Their regular routes make fixed LNG bunkering infrastructure highly efficient.

- Others: This broad category includes specialized vessels such as offshore support vessels (OSVs), tugboats, car carriers (PCC/PCTC), governmental vessels (e.g., coast guard), and research vessels, all seeking cleaner fuel alternatives for specific operational requirements.

- By Bunkering Method: This segment differentiates the market based on the logistical approach used for delivering LNG fuel to the receiving vessel, highlighting variations in infrastructure requirements, flexibility, and operational efficiency.

- Ship-to-Ship (STS): The most flexible and widely adopted method, involving the direct transfer of LNG from a specialized bunker vessel to the receiving ship, often while at anchor, alongside, or even underway in designated areas. Offers high transfer rates and avoids port congestion.

- Port-to-Ship (PTS): Involves the transfer of LNG from fixed shore-based facilities, such as jetties, terminals, or dedicated quays, directly to a vessel docked at berth. Ideal for ports with dedicated LNG infrastructure and regular vessel traffic.

- Truck-to-Ship (TTS): LNG is delivered via cryogenic road tankers to a ship while it is berthed at a port. This method is highly flexible for ports with less developed infrastructure, smaller vessel volumes, or for initial adoption phases, offering scalability.

- Others: Encompasses alternative or niche solutions such as container-to-ship (where LNG is stored in ISO tanks and transferred) and train-to-ship, often employed for specific logistical challenges, remote locations, or experimental deployments, catering to specialized operational contexts.

- By Storage Tank Type: This segment classifies the market based on the design and structural characteristics of the onboard LNG storage tanks utilized by LNG-fueled vessels, impacting safety, capacity, and vessel design.

- Type C: These are robust, cylindrical or bi-lobe pressure vessels suitable for storing both LPG and LNG, commonly used for smaller to medium-sized vessels due to their high structural integrity and flexibility in installation. They are self-supporting and designed to withstand high internal pressures.

- Membrane: Non-self-supporting tanks that are an integral part of the ship's hull structure, maximizing cargo volume by conforming to the shape of the hull. Primarily used for large LNG carriers and increasingly for larger LNG-fueled vessels, offering extensive capacity.

- IMO Type A: Prismatic tanks that are self-supporting and typically designed for larger storage capacities at lower pressures. They require independent structural support within the hull and are often used in combination with secondary barriers.

- IMO Type B: Self-supporting tanks, often spherical (Moss type) or cylindrical (bilobe), offering superior structural integrity and fatigue life. These designs minimize sloshing effects and provide inherent safety features, suitable for various vessel sizes and operational conditions.

- By Region: This segment analyzes the geographical distribution of the LNG bunkering market, reflecting regional differences in regulatory environments, infrastructure development, maritime traffic, and economic conditions.

- North America: Includes the United States, Canada, and Mexico, with growth driven by coastal shipping, Great Lakes traffic, and proximity to abundant natural gas resources, alongside increasing regulatory compliance.

- Europe: Encompasses Germany, United Kingdom, France, Italy, Spain, the Nordic Countries (Norway, Sweden, Finland, Denmark), and the Rest of Europe. This region is a pioneer, characterized by mature infrastructure, stringent environmental regulations, and significant governmental support.

- Asia Pacific: Comprises China, Japan, South Korea, India, Southeast Asia (e.g., Singapore, Malaysia, Indonesia), and Australia, along with the Rest of Asia Pacific. It is a high-growth region driven by massive trade volumes, new port developments, and strong governmental initiatives for cleaner fuels.

- Latin America: Includes Brazil, Argentina, and the Rest of Latin America. An emerging market with developing infrastructure, primarily focused on domestic coastal trade and exploiting regional natural gas reserves.

- Middle East and Africa (MEA): Covers Saudi Arabia, UAE, South Africa, and the Rest of MEA. This region holds strategic importance due to major shipping lanes and significant gas production, with nascent but promising bunkering developments.

Value Chain Analysis For LNG Bunkering Market

The intricate value chain of the LNG Bunkering Market commences with comprehensive upstream activities, which encompass the entire lifecycle from the initial exploration and extraction of natural gas to its subsequent liquefaction. This foundational segment is predominantly controlled by major international energy corporations, national oil companies, and specialized gas producers that possess extensive expertise, substantial capital, and the sophisticated infrastructure required for large-scale gas production. Following extraction, natural gas is transported to highly advanced liquefaction plants, where it is chilled to approximately -162 degrees Celsius, transforming it into its cryogenic liquid form, known as LNG, which is significantly reduced in volume (by about 600 times) compared to its gaseous state, making it economically viable for long-distance maritime transport. The efficiency, technological sophistication, and cost-effectiveness achieved at this upstream stage are paramount, as they directly influence the ultimate price, consistent availability, and overall competitiveness of LNG destined for bunkering purposes. Strategic investments in expanding new liquefaction capacity, alongside the continuous optimization and modernization of existing facilities, are critical components of the upstream segment, ensuring a stable, scalable, and steadily growing supply to adequately meet the escalating global demand from the maritime sector.

Progressing further, the midstream and downstream segments of the value chain encompass the crucial stages of LNG storage, long-haul transportation, and the intricate last-mile bunkering operations. Once liquefied, LNG is transported across oceans by specialized large-scale LNG carriers to regional import terminals strategically located near major shipping lanes or consumption centers. From these large terminals, the fuel is often distributed further through various means, including pipelines, smaller coastal LNG tankers, or even cryogenic road tankers, to reach dedicated bunkering hubs or specific port facilities. The actual bunkering operation itself can be executed through several specialized methods: ship-to-ship (STS) transfer utilizing purpose-built LNG bunker vessels; port-to-ship (PTS) transfer from fixed shore-based terminals or jetties; or truck-to-ship (TTS) transfer, particularly for smaller volumes or at less-developed ports. Each of these bunkering methodologies demands specific infrastructure, rigorous safety protocols, and highly trained personnel to ensure safe, efficient, and timely delivery of LNG to the receiving vessel. The downstream segment is characterized by a complex interplay of specialized logistics providers, proactive port authorities, dedicated bunkering service companies, and regulatory bodies, all working in concert to optimize delivery schedules, minimize vessel turnaround times, and maintain the highest standards of operational safety.

Distribution channels within the dynamic LNG bunkering market can broadly be categorized into direct and indirect models, each with distinct operational advantages and stakeholder involvement. Direct channels typically involve integrated energy companies that strategically manage the entire LNG value chain, from initial gas production and liquefaction to transportation, storage, and the final bunkering service. This integrated approach offers a seamless, highly controlled, and potentially more cost-efficient supply chain, often preferred by major global players seeking end-to-end control and assured supply for their own fleets or captive markets. In contrast, indirect channels rely on a network of third-party bunkering service providers. These providers procure LNG from various upstream suppliers, often on a contractual or spot basis, and then manage the distribution and bunkering operations for a diverse range of shipping clients. The selection of a specific distribution channel often hinges on several factors, including the scale and geographical reach of operations, the prevailing regulatory environment, and the nature of strategic partnerships forged within the industry. The development of robust, resilient distribution networks and the establishment of highly efficient logistical coordination mechanisms are absolutely paramount for ensuring the reliable, timely, and secure supply of LNG to a growing global maritime fleet, making the distribution channel a pivotal link in effectively delivering tangible value to the ultimate end-user in the shipping industry, thereby fostering sustained market growth and adoption.

LNG Bunkering Market Potential Customers

The primary potential customers and ultimate end-users within the burgeoning LNG Bunkering Market encompass a diverse array of stakeholders spanning the global maritime industry. These entities are unified by a common objective: to meticulously comply with increasingly stringent international environmental regulations, strategically reduce their operational expenditures, and significantly enhance their corporate sustainability profiles. At the forefront of this customer base are major international shipping companies, which operate vast and complex fleets of container ships, crude oil and product tankers, and dry bulk carriers that tirelessly traverse global trade routes. These large-scale operators are increasingly committing substantial capital to either construct new LNG-fueled vessels or embark on ambitious retrofitting projects for their existing fleets, driven by the imperative to meet the IMO’s stringent sulfur cap, nitrogen oxide limits, and ambitious decarbonization targets. Their demand for LNG as a marine fuel is fundamentally driven by the immense volumes of fuel consumed across extensive operational periods and the compelling long-term economic, environmental, and reputational advantages that LNG offers, particularly crucial for large-scale, globally operating maritime businesses.

Beyond the extensive domain of cargo shipping, the passenger shipping sector constitutes another exceptionally significant and rapidly expanding customer segment. This includes prominent cruise lines and numerous ferry operators worldwide. Companies within this segment are acutely sensitive to both public perception and their environmental impact, especially given their frequent operations in ecologically sensitive coastal areas, pristine marine environments, or in close proximity to densely populated urban coastlines. The proactive adoption of LNG as a marine fuel enables these operators to achieve substantial reductions in their emissions footprint, thereby significantly enhancing their brand image, bolstering customer loyalty, and ensuring unwavering compliance with a myriad of local and regional emission control zones and air quality regulations. For ferry operators, the inherent predictability of their routes and the high frequency of their port calls render shore-side LNG bunkering infrastructure particularly attractive, as it offers a consistent, highly reliable, and operationally efficient refueling solution that seamlessly integrates into their tight schedules, optimizing turnaround times and overall operational flow.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 0.92 Billion |

| Market Forecast in 2032 | USD 5.20 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell plc, TotalEnergies SE, Exxon Mobil Corporation, Engie S.A., FortisBC (Seaspan ULC), Carnival Corporation & plc, Gaztransport & Technigaz (GTT), Korea Gas Corporation (KOGAS), Crowley Maritime Corporation, Harvey Gulf International Marine LLC, Polaris LNG, Qatargas Operating Company Limited, China National Offshore Oil Corporation (CNOOC), Petronet LNG Limited, Cheniere Energy, Sempra LNG, Osaka Gas Co. Ltd., Mitsubishi Corporation, NYK Line, CMA CGM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LNG Bunkering Market Key Technology Landscape

The profound impact of digitalization and smart technologies is rapidly transforming the operational paradigms of LNG bunkering. This includes the extensive deployment of real-time monitoring sensors and sophisticated telemetry systems for continuous detection of gas leaks, precise management of pressure and temperature parameters, and comprehensive oversight of the entire fuel transfer process. These digital solutions dramatically enhance safety protocols and provide unparalleled operational visibility. Predictive analytics, increasingly powered by advanced artificial intelligence algorithms, are being meticulously applied to optimize complex bunkering schedules, generate highly accurate demand forecasts, and manage LNG inventory levels with unprecedented effectiveness, leading to substantial improvements in logistical efficiency, significant cost savings, and enhanced supply chain resilience. Moreover, distributed ledger technologies, such as blockchain, are actively being explored for their potential to enable transparent, immutable, and secure tracking of LNG fuel transactions and supply chain verification. This innovation promises to bolster regulatory compliance, enhance accountability, and build greater trust among all stakeholders. Collectively, these technological advancements are making LNG bunkering not only a safer and more efficient choice but also an economically compelling and future-proof option for the global shipping industry's journey towards sustainable maritime transport.

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region is rapidly ascending to become a dominant growth engine within the global LNG bunkering market. This surge is profoundly influenced by its burgeoning trade volumes, immense investments in port development, and unequivocal governmental support for cleaner shipping fuels across its key economies. Major maritime hubs, such as Singapore, which holds the distinction of being the world's largest bunkering port, are strategically dedicating substantial resources to develop cutting-edge LNG bunkering capabilities. Countries including China, Japan, and South Korea are pivotal players, characterized by significant investments in both LNG-fueled newbuild vessels and the necessary associated infrastructure, reflecting a comprehensive long-term vision. The region benefits immensely from possessing a large and continuously expanding shipping fleet, coupled with a growing environmental consciousness among its populace and proactive national policies that actively promote LNG as a preferred marine fuel, especially along the region's densely trafficked major shipping lanes and within its bustling port areas.

- North America: North America is experiencing steady and promising growth in its LNG bunkering capabilities, primarily driven by increasing regulatory pressures for emissions reduction in its sensitive coastal areas, the Great Lakes region, and inland waterways. This impetus is complemented by a rising number of LNG-fueled vessels operating on both domestic and international routes calling at North American ports. The U.S. Gulf Coast, with key ports like Port Fourchon, Port Canaveral, and Jacksonville, is aggressively developing robust LNG bunkering facilities, capitalizing on its advantageous proximity to abundant natural gas reserves and existing, expanding LNG export terminals. Canada is similarly expanding its bunkering infrastructure, notably on its west coast to serve trans-Pacific trade and its eastern ports. The region’s market expansion is characterized by a strategic mix of truck-to-ship, port-to-ship, and ship-to-ship operations, adeptly catering to a diverse spectrum of vessels ranging from offshore support vessels to large container ships, reflecting an adaptable and demand-responsive growth strategy.

- Latin America: Latin America represents an emerging market with substantial untapped potential within the LNG bunkering sector, particularly in nations endowed with abundant natural gas resources or those strategically positioned along critical global maritime corridors. Brazil and Argentina are at the forefront of nascent development, primarily focusing on domestic coastal shipping and catering to specific industrial applications within their territorial waters. The region currently faces considerable challenges predominantly related to securing significant infrastructure investments and establishing comprehensive, harmonized regulatory frameworks to support widespread adoption. Despite these hurdles, Latin America presents compelling long-term opportunities as global shipping routes continue to diversify and as local demand for cleaner energy solutions in maritime transport progressively increases. Future market development is anticipated to be strategically concentrated around its key trading ports and established energy production zones, gradually integrating into the global LNG bunkering network.

- Middle East and Africa (MEA): The Middle East and Africa region is strategically positioned for future growth within the LNG bunkering market, largely attributable to its pivotal geographical location along major global shipping lanes and its significant natural gas reserves. Key players in the region, such as Qatar and the United Arab Emirates, are actively exploring and investing in developing LNG bunkering capabilities to strategically leverage their established positions as global energy hubs and critical maritime transit points. While the development of dedicated LNG bunkering infrastructure is currently in nascent stages compared to the more mature markets of Europe or Asia Pacific, the region harbors substantial long-term potential for evolving into a key bunkering zone. This anticipated growth will be fundamentally driven by increasing regional trade, the continuous evolution of global shipping patterns that demand greater fuel flexibility, and a growing awareness of environmental sustainability within the maritime industry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Bunkering Market.- Shell plc

- TotalEnergies SE

- Exxon Mobil Corporation

- Engie S.A.

- FortisBC (Seaspan ULC)

- Carnival Corporation & plc

- Gaztransport & Technigaz (GTT)

- Korea Gas Corporation (KOGAS)

- Crowley Maritime Corporation

- Harvey Gulf International Marine LLC

- Polaris LNG

- Qatargas Operating Company Limited

- China National Offshore Oil Corporation (CNOOC)

- Petronet LNG Limited

- Cheniere Energy

- Sempra LNG

- Osaka Gas Co. Ltd.

- Mitsubishi Corporation

- NYK Line

- CMA CGM

Frequently Asked Questions

What is LNG bunkering and why is it important for the maritime industry?

LNG bunkering refers to the process of supplying Liquefied Natural Gas (LNG) as fuel to marine vessels. It is of paramount importance for the maritime industry because LNG serves as a significantly cleaner alternative to conventional heavy fuel oils and marine diesel. Its adoption drastically reduces harmful emissions, including sulfur oxides (SOx) by nearly 100%, nitrogen oxides (NOx) by up to 85%, and particulate matter (PM) by 99%, while also cutting carbon dioxide (CO2) emissions by 20-25%. This helps shipping companies not only comply with stringent international environmental regulations, such as the IMO 2020 sulfur cap and forthcoming decarbonization targets, but also demonstrates a strong commitment to environmental stewardship and sustainable shipping practices globally.

What are the primary drivers for the accelerated growth of the LNG Bunkering Market?

The accelerated growth of the LNG Bunkering Market is primarily fueled by several powerful drivers. Firstly, increasingly stringent international environmental regulations from bodies like the International Maritime Organization (IMO) necessitate a shift to cleaner fuels. Secondly, there is a growing global demand for cleaner marine energy solutions driven by environmental consciousness and corporate sustainability goals. Thirdly, the inherent economic benefits associated with LNG, such as potential long-term fuel cost stability, reduced engine maintenance due and the avoidance of expensive exhaust gas cleaning systems, make it an attractive option. Additionally, the rapid expansion of global LNG supply infrastructure and continuous technological advancements in bunkering operations and LNG-fueled vessel designs are crucial factors propelling this market forward, ensuring its viability and scalability for the future.

What are the main challenges and restraints faced by the LNG Bunkering Market?

The LNG Bunkering Market faces several significant challenges and restraints that can impede its wider adoption. A major hurdle is the substantial initial capital investment required for both the construction or conversion of LNG-fueled vessels and the development of extensive, specialized bunkering infrastructure, including terminals and bunker vessels. These high upfront costs can be prohibitive for smaller operators. Furthermore, while rigorously addressed through advanced safety protocols, perceived safety concerns associated with handling and storing cryogenic LNG can still be a psychological barrier. The complexity and occasional inconsistency of global and regional regulatory frameworks also create uncertainty, alongside the inherent volatility of natural gas prices, which can impact long-term financial planning and investment decisions within the shipping sector.

Which regions are currently leading the adoption and infrastructure development in LNG bunkering?

Globally, Europe currently leads the adoption and infrastructure development in LNG bunkering, particularly within the North Sea and Baltic Sea regions. This leadership is attributed to pioneering regulatory environments, robust governmental support, and well-established bunkering networks. The Asia Pacific region is rapidly emerging as a significant growth hub, driven by massive trade volumes, substantial port investments, and strong governmental initiatives in countries like Singapore, China, Japan, and South Korea. North America is also experiencing considerable growth, propelled by increasing regulatory pressures for emissions reduction in coastal areas and expanding LNG-fueled fleets in domestic and international routes, reflecting a global commitment to cleaner maritime transport solutions.

How does Artificial Intelligence (AI) impact the efficiency, safety, and operational aspects of LNG bunkering?

Artificial Intelligence (AI) is set to profoundly impact the efficiency, safety, and operational aspects of LNG bunkering. In terms of efficiency, AI optimizes logistics through sophisticated route planning for bunker vessels and intelligent inventory management for LNG suppliers, leading to reduced transit times and cost savings. For safety, AI enhances operations via real-time monitoring sensors for leak detection, anomaly identification during fuel transfer, and predictive maintenance for critical equipment, significantly minimizing risks and ensuring operational reliability. Furthermore, AI streamlines administrative processes through automated compliance checks and data reporting, while improving strategic decision-making through advanced data analytics and fostering more integrated, smart port operations for seamless fuel delivery and improved overall maritime logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- LNG Bunkering Market Statistics 2025 Analysis By Application (Container Vessels, Tanker Vessels, Bulk & General Cargo Vessels, Ferries & OSV), By Type (Truck-to-Ship, Ship-to-Ship, Port-to-Ship), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- LNG bunkering equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Portable Tanks, Ship-to-Ship, Port-to-Ship, Truck-to-Ship), By Application (Tankers, Container Ships, Bulk & General Cargo Vessels, Ferries & Offshore Support Vessels), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager