Location-Based Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429447 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Location-Based Services Market Size

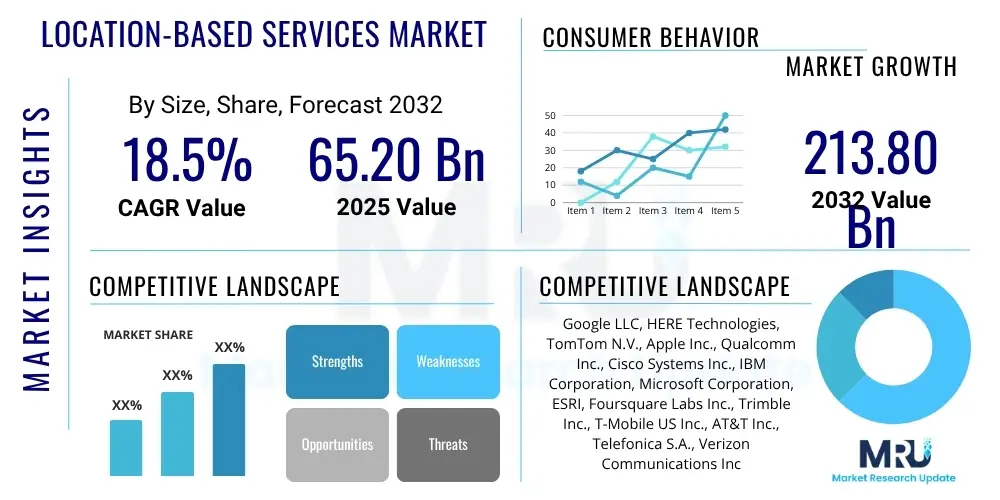

The Location-Based Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $65.20 Billion in 2025 and is projected to reach $213.80 Billion by the end of the forecast period in 2032.

Location-Based Services Market introduction

The Location-Based Services (LBS) Market encompasses a broad spectrum of technologies and applications that leverage real-time geographic data to provide relevant information, entertainment, or security services to users. These services rely on positioning technologies such as GPS, Wi-Fi, cellular networks, and increasingly, indoor positioning systems, to pinpoint the location of a device or individual. The core product of LBS is the intelligent delivery of contextual information or functionality based on a user's physical presence, transforming how individuals interact with their environment and how businesses engage with their customers. From facilitating seamless navigation to enabling hyper-targeted marketing campaigns, LBS solutions are integrated into daily life, offering convenience and efficiency.

Major applications of Location-Based Services span across numerous industries, demonstrating their versatility and indispensable nature in the modern digital landscape. These applications include detailed outdoor and indoor navigation systems, crucial for logistics, personal travel, and emergency services. Furthermore, LBS drives asset tracking and fleet management, optimizing supply chain operations and improving delivery efficiencies. Social networking platforms heavily utilize LBS to connect users based on proximity, while targeted advertising and retail analytics benefit from precise location data to deliver personalized consumer experiences. The pervasive nature of smartphones and the continuous advancements in sensor technologies have significantly broadened the scope and capabilities of LBS, making them a foundational element for many digital ecosystems.

The benefits derived from the widespread adoption of Location-Based Services are substantial, impacting both individuals and enterprises. For consumers, LBS offers unparalleled convenience through real-time navigation, localized content, and enhanced safety features such as emergency assistance. Businesses leverage LBS to gain competitive advantages by improving operational efficiencies, optimizing resource allocation, and fostering deeper customer engagement through personalized interactions and timely promotions. Key driving factors propelling the growth of this market include the increasing penetration of smartphones globally, the proliferation of Internet of Things (IoT) devices that integrate location tracking, the rollout of advanced network infrastructures like 5G, and the surging demand for highly personalized and contextually relevant services across various sectors. The continuous innovation in positioning accuracy and data analytics further fuels this growth, creating new opportunities for market expansion and application development.

Location-Based Services Market Executive Summary

The Location-Based Services (LBS) market is undergoing a transformative period, characterized by dynamic business trends that are reshaping competitive landscapes and opening new avenues for innovation. A prominent trend is the increasing demand for hyper-personalization, where businesses leverage precise location data to deliver highly customized content, advertisements, and services, moving beyond generic campaigns to context-aware interactions. This is particularly evident in retail, hospitality, and entertainment sectors seeking to enhance customer engagement and drive conversions. Furthermore, the integration of LBS with advanced analytics and big data platforms is enabling businesses to derive deeper insights into consumer behavior, operational efficiencies, and market trends, facilitating data-driven decision-making. The market also observes a strong trend towards indoor positioning solutions, addressing the growing need for precise location data within complex urban environments and large commercial spaces, a challenge traditional GPS often cannot meet.

Regional trends significantly influence the LBS market's growth trajectory, with varying levels of adoption and technological maturity across different geographies. North America and Europe currently represent mature markets, characterized by high smartphone penetration, robust technological infrastructure, and a strong emphasis on enterprise-grade LBS solutions for logistics, public safety, and smart city initiatives. These regions are also at the forefront of privacy regulations, such as GDPR, which shape how location data is collected and utilized, driving innovation in privacy-preserving LBS technologies. In contrast, the Asia Pacific (APAC) region is experiencing the most rapid expansion, fueled by a burgeoning young population, increasing internet and smartphone penetration, rapid urbanization, and significant government investments in smart infrastructure projects. Countries like China and India are leading in mobile-first LBS applications, particularly in navigation, social media, and mobile commerce, showcasing immense potential for continued growth and diversification.

Segmentation trends within the LBS market reveal key areas of expansion and technological focus. The component segment shows strong growth in software and services, driven by the increasing complexity of LBS platforms that require sophisticated analytics, integration capabilities, and ongoing support. While hardware remains essential for data capture, the value is increasingly shifting towards the intelligence derived from location data. By technology, the market is diversifying beyond traditional GPS, with significant advancements in Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), and cellular-based positioning, particularly for indoor accuracy and low-power applications. The application segment highlights navigation and tracking as perennial leaders, but emerging areas like location-based advertising, workforce management, and emergency services are demonstrating accelerated adoption. End-user industries such as retail, transportation & logistics, and healthcare are consistently investing in LBS to optimize operations, enhance customer experiences, and improve safety, indicating a broad and sustained demand across diverse economic sectors.

AI Impact Analysis on Location-Based Services Market

User inquiries about AI's impact on the Location-Based Services market frequently revolve around its potential to enhance accuracy, enable predictive analytics, personalize user experiences, and automate complex tasks. There is significant interest in how AI can overcome the inherent limitations of traditional LBS, such as poor indoor positioning accuracy or privacy concerns. Users also express curiosity about new applications AI could unlock, from autonomous navigation to highly granular behavioral insights. Concerns often touch upon data privacy, the ethical implications of pervasive tracking, and the potential for AI-driven LBS to create "filter bubbles" or exacerbate existing societal biases. Overall, the prevailing sentiment is one of cautious optimism, acknowledging AI's transformative power while emphasizing the need for robust ethical frameworks and transparent data practices to ensure responsible innovation in the LBS domain.

- Enhanced Accuracy and Precision: AI algorithms improve positioning accuracy by filtering noise from sensor data, fusing data from multiple sources (GPS, Wi-Fi, BLE, inertial sensors), and correcting for environmental interferences, particularly in challenging indoor or urban canyon environments.

- Predictive Location Analytics: AI enables LBS to move beyond real-time tracking to anticipate future movements and behaviors. Machine learning models analyze historical location patterns to predict traffic congestion, estimate arrival times more accurately, or anticipate demand for services in specific areas.

- Hyper-Personalized Experiences: AI allows LBS applications to deliver highly relevant and dynamic content, recommendations, and advertisements based on a user's real-time location, past behavior, and declared preferences, creating truly individualized experiences.

- Automated Contextual Awareness: AI automates the interpretation of location data, allowing systems to understand the context of a user's presence (e.g., at home, at work, commuting, shopping) and automatically trigger actions or provide pertinent information without explicit user input.

- New Application Development: AI facilitates the creation of advanced LBS applications in areas like autonomous vehicles (localization and path planning), smart city management (traffic flow optimization, waste management), augmented reality (precise content overlay), and advanced security and surveillance systems.

- Optimized Resource Management: AI-driven LBS optimizes routing for logistics, allocates field service personnel efficiently, and manages assets more effectively by providing intelligent insights into their real-time location and operational status.

DRO & Impact Forces Of Location-Based Services Market

The Location-Based Services (LBS) market is profoundly shaped by a confluence of powerful drivers, inherent restraints, burgeoning opportunities, and external impact forces. A primary driver is the pervasive adoption of smartphones and other mobile devices, which act as ubiquitous sensors and platforms for LBS applications, making location data readily available to a vast user base. Complementing this is the rapid rollout of 5G networks, offering unprecedented speeds and low latency, which significantly enhances the real-time capabilities and responsiveness of LBS. Furthermore, the exponential growth of the Internet of Things (IoT) ecosystem, with billions of connected devices generating vast amounts of location-specific data, provides a rich tapestry for LBS integration, enabling intelligent asset tracking, smart home applications, and connected vehicle solutions. The escalating demand for hyper-personalization across consumer and enterprise sectors, where context-aware services deliver superior experiences and operational efficiencies, also acts as a robust catalyst for market expansion. Businesses are increasingly recognizing the strategic value of location intelligence for improving customer engagement, optimizing logistics, and enhancing safety and security, further fueling investment and innovation in the LBS domain.

Despite the strong growth drivers, the LBS market faces significant restraints that necessitate careful navigation. Paramount among these is the escalating concern over data privacy and security. As location data is highly personal and sensitive, regulatory frameworks like GDPR and CCPA impose stringent requirements on data collection, storage, and usage, creating compliance challenges for LBS providers. Public apprehension regarding constant surveillance and the potential for misuse of location data can also impede user adoption and trust. Another significant restraint is the technical challenge of achieving high accuracy and reliability in all environments, particularly indoors or in dense urban areas where GPS signals are weak or unavailable. The complexity and cost associated with deploying and maintaining robust indoor positioning infrastructure, such as Wi-Fi access points or Bluetooth beacons, can be prohibitive for many organizations. Furthermore, the interoperability issues among diverse positioning technologies and platforms often lead to fragmented solutions, hindering seamless integration and universal accessibility of LBS.

However, these challenges are counterbalanced by a wealth of compelling opportunities that promise to propel the LBS market forward. The development of advanced indoor positioning technologies, including UWB, LiDAR, and AI-powered vision-based systems, presents a massive opportunity to unlock value in sectors like retail, healthcare, and manufacturing, where precise indoor location data can revolutionize operations and customer experiences. The emergence of smart cities and intelligent transportation systems offers fertile ground for LBS integration, optimizing urban planning, public transit, and emergency response services. The convergence of LBS with augmented reality (AR) and virtual reality (VR) technologies holds immense potential for immersive navigation, interactive advertising, and location-aware gaming. Moreover, the increasing adoption of LBS for autonomous vehicles, drones, and robotics, where precise and reliable positioning is critical for safe and efficient operation, represents a long-term growth frontier. The exploration of new monetization models beyond traditional advertising, such as subscription-based premium LBS, data-as-a-service offerings, and specialized enterprise solutions, further broadens the market's commercial viability. These opportunities, coupled with ongoing technological innovation, are expected to significantly mitigate existing restraints and drive sustained market expansion.

Segmentation Analysis

The Location-Based Services market is intricately segmented to provide a granular understanding of its diverse components, technologies, applications, and end-user adoption patterns. This comprehensive segmentation allows market participants to identify niche opportunities, tailor product offerings, and develop targeted marketing strategies. Analyzing the market across these dimensions reveals the evolving preferences of consumers and businesses, the impact of technological advancements, and the specific demands of various industry verticals. Understanding these segments is crucial for strategic planning, resource allocation, and forecasting future growth trajectories within the dynamic LBS ecosystem, ensuring that solutions are precisely aligned with market needs and technological capabilities.

- By Component

- Hardware (e.g., GPS modules, RFID tags, Beacons, IoT sensors)

- Software (e.g., Geospatial platforms, Analytics software, Mapping software, Application Programming Interfaces (APIs))

- Services (e.g., Consulting, System Integration, Managed Services, Professional Services)

- By Technology

- Global Positioning System (GPS)

- Wi-Fi

- Bluetooth Low Energy (BLE)

- Radio Frequency Identification (RFID)

- Ultra-Wideband (UWB)

- Cellular Positioning (e.g., Cell ID, A-GPS, E-OTD)

- Geofencing

- Assisted GPS (A-GPS)

- Near Field Communication (NFC)

- Magnetic Positioning

- Hybrid Positioning Systems

- By Application

- Navigation & Mapping (e.g., Turn-by-turn navigation, Public transit navigation)

- Tracking & Monitoring (e.g., Asset tracking, Fleet management, Personal tracking)

- Location-Based Advertising & Marketing (e.g., Proximity marketing, Geo-targeted ads)

- Social Networking & Entertainment (e.g., Geo-tagging, Location-based gaming)

- Emergency Services (e.g., E911, Emergency response coordination)

- Infotainment (e.g., Location-based content delivery)

- Workforce Management (e.g., Field service optimization, Employee tracking)

- Business Intelligence & Analytics

- Security & Safety

- Augmented Reality (AR) & Virtual Reality (VR)

- By End-User Industry

- Retail & E-commerce

- Transportation & Logistics

- Healthcare

- Government & Public Safety

- Media & Entertainment

- Tourism & Hospitality

- Automotive

- Manufacturing

- BFSI (Banking, Financial Services, and Insurance)

- Education

- Real Estate

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Location-Based Services Market

The value chain of the Location-Based Services market is complex and multi-faceted, involving several interdependent stages from foundational technology providers to end-users, each contributing unique value. At the upstream end, the value chain begins with core technology providers, including chipset manufacturers that develop GPS modules, Wi-Fi and Bluetooth chips, and UWB transceivers, which are essential for location data acquisition. This segment also includes network infrastructure providers such as telecom companies offering cellular triangulation capabilities and Wi-Fi network operators. Additionally, raw data providers, including satellite operators and geospatial data mapping companies, supply the foundational geographical information that LBS solutions build upon. These upstream entities are critical as their innovations in accuracy, speed, and cost-efficiency directly impact the performance and accessibility of LBS further down the chain, necessitating significant R&D investment and a focus on open standards and interoperability.

Moving downstream, the value chain extends to solution developers, platform providers, and service integrators who transform raw location data and underlying technologies into actionable LBS applications. This includes geospatial platform developers offering APIs and SDKs for building LBS, application developers creating consumer-facing apps for navigation, social networking, or gaming, and enterprise solution providers crafting specialized LBS for asset tracking, fleet management, or workforce optimization. System integrators play a crucial role in customizing and deploying these solutions for specific business needs, often integrating LBS with existing enterprise systems like ERP or CRM. The distribution channels for LBS are diverse, ranging from direct sales models for enterprise solutions, often involving bespoke contracts and direct customer relationships, to indirect channels such as mobile app stores (Google Play, Apple App Store) for consumer applications, and partnerships with telecommunication providers or IoT platforms for broader market reach. These channels facilitate the delivery and accessibility of LBS products and services to a wide array of end-users.

Ultimately, the value delivered by Location-Based Services culminates with the end-users and buyers of the product across various industries and consumer segments. This includes individual consumers leveraging LBS for personal navigation, local search, and social connectivity; businesses employing LBS for operational efficiency, customer engagement, and supply chain optimization; and government agencies utilizing LBS for public safety, urban planning, and emergency response. The direct impact on end-users is manifested through enhanced convenience, improved safety, greater personalization, and increased productivity. The feedback loop from end-users back to developers and technology providers is vital for continuous improvement and innovation, driving demand for more accurate, secure, and privacy-conscious LBS solutions. The ability of the entire value chain to seamlessly integrate, share data securely, and adapt to evolving technological and regulatory landscapes is paramount for sustained growth and value creation in the Location-Based Services market.

Location-Based Services Market Potential Customers

The Location-Based Services market caters to a vast and diverse array of potential customers, spanning individual consumers to large multinational corporations and governmental entities. At the consumer level, almost every smartphone user is a potential customer, leveraging LBS for daily activities such as navigation, local search for restaurants or businesses, social media geotagging, and entertainment applications like location-based games. This segment values convenience, real-time information, and personalized experiences that enhance their daily lives and connectivity. As technology advances, consumers are increasingly seeking sophisticated LBS features, including indoor navigation within malls or airports, and advanced safety functionalities that can pinpoint their location during emergencies, demonstrating a continuous appetite for innovative and reliable location-aware services.

For businesses, the potential customer base for Location-Based Services is incredibly broad, encompassing nearly every industry seeking to improve operational efficiency, enhance customer engagement, or gain competitive intelligence. In the retail sector, LBS is crucial for proximity marketing, foot traffic analysis, and personalized in-store experiences. The transportation and logistics industry relies heavily on LBS for fleet management, route optimization, asset tracking, and supply chain visibility, directly impacting profitability and delivery times. Healthcare providers use LBS for tracking medical equipment, patient monitoring within facilities, and optimizing emergency response. The automotive sector integrates LBS for in-car navigation, telematics, and emerging autonomous driving capabilities, while the media and entertainment industry utilizes it for targeted advertising and location-aware content delivery. These enterprise customers are primarily driven by the need for cost reduction, revenue generation, data-driven insights, and improved safety and compliance, viewing LBS as an indispensable tool for modern business operations.

Government agencies and public sector organizations also represent significant potential customers for Location-Based Services, driven by mandates for public safety, infrastructure management, and smart city initiatives. Law enforcement and emergency services utilize LBS for dispatching first responders, managing large-scale events, and enhancing citizen safety through precise location information during emergencies. Urban planners and municipal authorities leverage LBS for traffic management, waste collection optimization, public asset monitoring, and developing smart city solutions that improve quality of life for residents. Defense and intelligence agencies employ highly sophisticated LBS for surveillance, navigation, and strategic operations. These public sector buyers prioritize reliability, security, scalability, and adherence to regulatory standards, recognizing LBS as a foundational technology for effective governance, public service delivery, and national security. The multifaceted utility of LBS ensures a perpetually expanding customer base across all tiers of society and commerce.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $65.20 Billion |

| Market Forecast in 2032 | $213.80 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, HERE Technologies, TomTom N.V., Apple Inc., Qualcomm Inc., Cisco Systems Inc., IBM Corporation, Microsoft Corporation, ESRI, Foursquare Labs Inc., Trimble Inc., T-Mobile US Inc., AT&T Inc., Telefonica S.A., Verizon Communications Inc., SAP SE, Bosch IoT GmbH, Zebra Technologies Corporation, IndoorAtlas Ltd., Ubisense Group plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Location-Based Services Market Key Technology Landscape

The technological landscape of the Location-Based Services market is dynamic and multifaceted, characterized by a convergence of various positioning, data processing, and connectivity innovations. At its foundation are global navigation satellite systems (GNSS) like GPS, GLONASS, Galileo, and BeiDou, which provide ubiquitous outdoor positioning capabilities. However, for enhanced accuracy, especially in urban canyons or indoors, these systems are often augmented by Wi-Fi triangulation, which estimates location based on the signal strength from nearby access points, and Bluetooth Low Energy (BLE) beacons, which emit signals detectable by mobile devices to provide precise proximity and indoor positioning data. The integration of these disparate technologies creates hybrid positioning systems that overcome the limitations of any single method, delivering more robust and seamless location experiences across diverse environments, from open fields to multi-story buildings.

Beyond traditional radio-frequency based methods, emerging and advanced technologies are significantly shaping the LBS market. Ultra-Wideband (UWB) technology is gaining traction for its exceptional precision and reliability in indoor environments, enabling centimeter-level accuracy for applications like asset tracking, access control, and augmented reality. Cellular positioning, ranging from simple Cell ID to more sophisticated E-OTD (Enhanced Observed Time Difference) and A-GPS (Assisted GPS), provides a broad coverage layer, particularly useful in areas where other signals are weak or unavailable, serving as a fallback or complementary system. Geofencing, a software-defined perimeter, leverages these positioning technologies to trigger actions or alerts when a device enters or exits a virtual boundary, finding extensive use in marketing, security, and workforce management applications. These technologies, when combined, create a rich tapestry of capabilities that allow LBS providers to tailor solutions to specific accuracy, power consumption, and environmental requirements.

The intelligence layer of the LBS technology landscape is increasingly dominated by Internet of Things (IoT) sensors and Artificial Intelligence (AI) and Machine Learning (ML) algorithms. IoT sensors, embedded in vehicles, smart devices, and infrastructure, generate a continuous stream of location-relevant data, feeding into LBS platforms. AI and ML play a critical role in processing this vast amount of data, enhancing positioning accuracy through advanced signal filtering and fusion techniques, enabling predictive location analytics by identifying patterns and forecasting movements, and powering context-aware services that adapt to user behavior and environmental conditions. Furthermore, advancements in cloud computing provide the scalable infrastructure necessary to store, process, and analyze massive datasets generated by LBS, while robust cybersecurity measures are paramount to protect the sensitive nature of location information. The continuous evolution and integration of these diverse technologies are fundamental to the ongoing innovation and expansion of the Location-Based Services market.

Regional Highlights

- North America: This region stands as a mature yet highly innovative market for Location-Based Services, driven by early adoption of mobile technologies, significant investments in research and development, and a strong presence of key technology players. The United States leads in enterprise LBS solutions, particularly in fleet management, asset tracking, and public safety, fueled by a robust telecommunications infrastructure and a high penetration of smartphones. Canada also contributes significantly, especially in government and emergency services LBS. The regional market is characterized by a strong emphasis on data security and privacy compliance, alongside continuous advancements in indoor positioning and predictive analytics for retail and healthcare sectors.

- Europe: The European LBS market is distinguished by stringent data privacy regulations, such as GDPR, which significantly influence the development and deployment of location-based solutions. Despite regulatory hurdles, Europe demonstrates strong growth, particularly in smart city initiatives, intelligent transportation systems, and advanced navigation services. Countries like Germany, the UK, and France are at the forefront of adopting LBS for logistics optimization, retail personalization, and tourism applications. There is a growing focus on integrating LBS with IoT for industrial applications and enhancing public safety and emergency response systems across the continent.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market for LBS, propelled by rapid urbanization, massive smartphone penetration, and substantial government investments in digital infrastructure. Countries such as China, India, Japan, and South Korea are key drivers, with extensive adoption of LBS in consumer-centric applications like mobile gaming, social networking, and ride-hailing services. The region also sees significant growth in enterprise LBS for logistics, retail analytics, and smart city projects, particularly in emerging economies where new infrastructure is being built with LBS capabilities embedded from the outset.

- Latin America: The LBS market in Latin America is an emerging yet promising region, characterized by increasing smartphone adoption and a growing demand for operational efficiency across various industries. Brazil and Mexico are leading the adoption, primarily in fleet management, logistics, and mobile advertising. The region faces challenges related to infrastructure development and economic stability, but the expanding e-commerce sector and the need for improved public safety are creating strong incentives for LBS integration. Opportunities lie in solutions that address localized needs and are adaptable to diverse infrastructural conditions.

- Middle East & Africa (MEA): This region is experiencing considerable growth in the LBS market, driven by ambitious smart city projects, significant tourism investments, and an increasing focus on public safety and security. Countries like UAE (Dubai, Abu Dhabi) and Saudi Arabia are investing heavily in advanced LBS for urban planning, transportation, and hospitality sectors. Africa, while still nascent, shows potential in mobile-first LBS applications, especially for financial services and logistics, as mobile phone penetration continues to rise and digital transformation initiatives gain momentum.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Location-Based Services Market.- Google LLC

- HERE Technologies

- TomTom N.V.

- Apple Inc.

- Qualcomm Inc.

- Cisco Systems Inc.

- IBM Corporation

- Microsoft Corporation

- ESRI

- Foursquare Labs Inc.

- Trimble Inc.

- T-Mobile US Inc.

- AT&T Inc.

- Telefonica S.A.

- Verizon Communications Inc.

- SAP SE

- Bosch IoT GmbH

- Zebra Technologies Corporation

- IndoorAtlas Ltd.

- Ubisense Group plc

Frequently Asked Questions

What are Location-Based Services (LBS)?

Location-Based Services (LBS) are software and hardware functionalities that provide information, entertainment, or security services based on the real-time geographical position of a mobile device or person. They leverage various positioning technologies, such as GPS, Wi-Fi, Bluetooth, and cellular networks, to deliver contextually relevant data or actions. LBS enhance user experience by offering personalized and localized content, making daily activities more efficient and convenient.

These services are integral to many modern applications, ranging from navigation and asset tracking to targeted advertising and emergency response. The core concept revolves around utilizing location intelligence to offer value, whether it's guiding a user to a nearby coffee shop, optimizing delivery routes for a logistics company, or alerting authorities to a distress signal from a specific location. The evolution of LBS is closely tied to advancements in mobile technology, sensor miniaturization, and data analytics.

How do Location-Based Services work?

LBS typically work by determining the geographical coordinates of a user's device through a combination of positioning technologies. Outdoors, Global Positioning Systems (GPS) are the primary method, using signals from satellites to calculate precise latitude and longitude. Indoors or in areas with poor GPS reception, LBS often switch to alternative methods such as Wi-Fi triangulation, which estimates location based on the strength of signals from known Wi-Fi hotspots, or Bluetooth Low Energy (BLE) beacons, which broadcast identifiers that mobile devices detect to pinpoint proximity and indoor position.

Once the location data is acquired, it is processed and transmitted to a server, often augmented with mapping data, points of interest, and user preferences. Advanced LBS may employ Artificial Intelligence and Machine Learning to refine accuracy, predict user movements, and personalize the delivered services. The resulting information or action is then sent back to the user's device, enabling features like turn-by-turn directions, localized weather updates, or proximity-based notifications, all seamlessly integrating location intelligence into the user experience.

What are the main applications of Location-Based Services?

The main applications of Location-Based Services are highly diverse and span across numerous industries and consumer needs. Prominent applications include navigation and mapping, which provides directions, traffic updates, and public transport information for both personal travel and commercial logistics. Tracking and monitoring solutions are vital for fleet management, asset tracking in supply chains, and personal safety through devices that monitor the location of children or elderly individuals.

Furthermore, LBS plays a crucial role in location-based advertising and marketing, enabling businesses to deliver geo-targeted promotions and personalized offers to consumers based on their proximity to stores or specific events. Social networking and entertainment apps leverage LBS for geo-tagging photos, connecting with nearby friends, and creating immersive location-based games. Emergency services rely on LBS to accurately locate callers in distress, significantly reducing response times. Other key applications include workforce management, business intelligence, and enhancing security and safety protocols across various sectors.

What are the primary challenges in the LBS market?

The Location-Based Services market faces several primary challenges that influence its growth and adoption. One significant challenge is data privacy and security, as location data is highly sensitive and its collection and usage are subject to stringent regulations like GDPR. Ensuring transparent data practices, obtaining explicit user consent, and safeguarding against data breaches are critical for maintaining user trust and avoiding legal repercussions.

Another major hurdle is achieving consistent accuracy and reliability across all environments, particularly indoors or in dense urban areas where traditional GPS signals are often weak or unavailable. The deployment and maintenance of alternative indoor positioning infrastructures, such as Wi-Fi access points or Bluetooth beacons, can be costly and complex. Additionally, interoperability issues between various positioning technologies and platforms can lead to fragmented solutions, hindering seamless user experiences and broader integration within existing systems. Market players must continuously innovate to overcome these technical and regulatory obstacles.

How is AI transforming Location-Based Services?

Artificial Intelligence (AI) is profoundly transforming Location-Based Services by significantly enhancing their capabilities, accuracy, and intelligence. AI algorithms improve positioning precision by fusing data from multiple sensors, filtering out noise, and predicting environmental interferences, thereby enabling more reliable indoor and outdoor localization. This leads to more accurate navigation, asset tracking, and precise delivery of location-based information.

Moreover, AI powers predictive analytics within LBS, allowing systems to analyze historical location data and user patterns to anticipate future movements, predict traffic congestion, or forecast demand for services in specific areas. This transforms LBS from reactive tracking to proactive intelligence. AI also facilitates hyper-personalization, enabling LBS applications to deliver highly relevant and dynamic content, recommendations, and advertisements tailored to an individual's real-time context and historical preferences, creating a far more engaging and intuitive user experience across various applications like retail, smart cities, and autonomous systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Gnss Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (GPS, Glonass, Galileo, BDS), By Application (Location-Based Services (LBS), Road, Aviation, Rail, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Location-Based Services (LBS) and Real Time Location Systems (RTLS) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Platform, Hardware, Services), By Application (Transportation and Logistics, Retail, Government, Tourism and Hospitality, Manufacturing, Healthcare and Life Sciences, Media and Entertainment, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager