Long-Term Evolution Base Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429646 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Long-Term Evolution Base Station Market Size

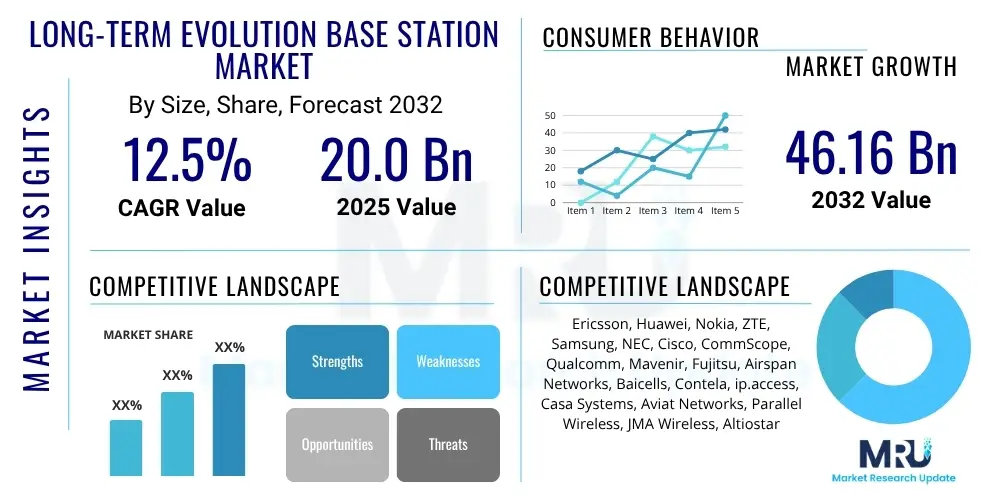

The Long-Term Evolution Base Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at $20.0 billion in 2025 and is projected to reach $46.16 billion by the end of the forecast period in 2032.

Long-Term Evolution Base Station Market introduction

The Long-Term Evolution (LTE) Base Station Market encompasses the infrastructure essential for delivering high-speed 4G mobile broadband connectivity. An LTE base station, commonly known as an eNodeB or eNB, serves as the core element of the Radio Access Network (RAN), facilitating wireless communication between user equipment (like smartphones, tablets, and IoT devices) and the core network. These stations are critical for voice (VoLTE) and data services, forming the backbone of modern cellular networks and providing the high bandwidth and low latency required by contemporary digital applications. Their role is continuously evolving, even with the advent of 5G, as they often coexist and complement newer technologies to provide seamless coverage and capacity.

LTE base stations are comprised of sophisticated hardware and software components, including antennas, radio units, digital baseband processing units, and robust power supply systems. They are responsible for radio resource management, mobility management, and robust security protocols, ensuring efficient and reliable data transmission. Major applications span from enhancing mobile broadband experience for millions of subscribers to enabling advanced IoT connectivity across various industries, supporting smart city initiatives, and establishing dedicated private networks for enterprises and public safety organizations. The primary benefits derived from these stations include significantly higher data rates compared to previous generations, improved spectral efficiency allowing more users and data over limited spectrum, reduced latency for real-time applications, and widespread geographical coverage, fostering digital inclusion.

The market is primarily driven by the exponential growth in global mobile data traffic, fueled by increasing smartphone adoption, the proliferation of video streaming, and the continuous expansion of connected devices within the Internet of Things (IoT) ecosystem. Furthermore, ongoing government initiatives to promote digital connectivity, especially in rural and underserved areas, and the strategic coexistence with 5G networks, where LTE often provides foundational coverage or supplementary capacity, further propel market expansion. Operators are continuously investing in upgrading and densifying their LTE networks to handle burgeoning demand and prepare for future technological transitions, ensuring robust and scalable communication infrastructures.

Long-Term Evolution Base Station Market Executive Summary

The Long-Term Evolution Base Station Market is experiencing robust growth driven by persistent demand for mobile data and the ongoing densification of 4G networks globally. Business trends indicate a strong move towards network virtualization and cloud-native architectures, with operators exploring Open RAN solutions to reduce vendor lock-in and operational costs. Strategic partnerships between traditional telecom equipment providers and software specialists are becoming more common, fostering innovation in network management and optimization. Energy efficiency and sustainability are also key business considerations, prompting the development of more power-efficient base station components and intelligent network management systems to reduce carbon footprint.

Regional trends highlight Asia Pacific as the leading market, characterized by massive subscriber bases, aggressive network expansions, and significant investments in both 4G and nascent 5G infrastructure, particularly in countries like China, India, and Japan. North America and Europe, while having more mature LTE markets, are focusing on network modernization, small cell deployments for enhanced capacity, and the rollout of private LTE networks for industrial applications. Latin America and the Middle East and Africa regions are showing promising growth, spurred by increasing mobile penetration, governmental push for digital inclusion, and the foundational role of LTE in bridging the digital divide before widespread 5G adoption.

Segment trends reveal continued investment in macrocell base stations for foundational coverage, complemented by an accelerated deployment of small cells to enhance capacity in dense urban areas and indoor environments. The software segment, particularly related to network management, optimization, and security solutions, is witnessing significant growth as operators seek to maximize efficiency and flexibly manage their networks. The transition towards software-defined radio (SDR) and network function virtualization (NFV) is reshaping the hardware-software interface, enabling more agile and cost-effective network deployments and upgrades, supporting the market's long-term evolution and scalability requirements.

AI Impact Analysis on Long-Term Evolution Base Station Market

Users frequently inquire about how Artificial Intelligence can revolutionize the operational efficiency, performance, and maintenance of Long-Term Evolution Base Stations. Key themes revolve around leveraging AI for network optimization, predicting and preventing outages, enhancing energy efficiency, and automating complex network management tasks. There is also significant interest in AI's role in improving cybersecurity posture within LTE networks and its potential implications for the workforce, driving a demand for skills in AI-driven network solutions. Overall, users expect AI to enable more intelligent, self-optimizing, and resilient LTE infrastructures.

- Enhanced Network Optimization: AI algorithms can dynamically adjust network parameters, traffic routing, and resource allocation in real-time to optimize capacity, throughput, and user experience.

- Predictive Maintenance: AI-driven analytics can monitor base station performance and component health, predicting potential failures before they occur, thus minimizing downtime and operational costs.

- Improved Energy Efficiency: AI can intelligently manage power consumption by optimizing radio resource usage, switching off inactive components, and adapting to traffic patterns, leading to significant energy savings.

- Automated Fault Detection and Resolution: AI systems can rapidly identify network anomalies, diagnose issues, and even autonomously initiate corrective actions, reducing the need for manual intervention.

- Advanced Security Capabilities: AI can detect unusual patterns or malicious activities within the network, enhancing threat detection and response mechanisms to safeguard base station infrastructure.

- Dynamic Spectrum Management: AI can optimize spectrum utilization by intelligently allocating frequencies, managing interference, and adapting to varying radio environments for better performance.

- Optimized Small Cell Deployment: AI can analyze geographical data and traffic patterns to determine optimal locations for small cell deployments, maximizing coverage and capacity with minimal overhead.

DRO & Impact Forces Of Long-Term Evolution Base Station Market

The Long-Term Evolution Base Station Market is shaped by a complex interplay of various drivers, restraints, and opportunities, all subject to significant impact forces. A primary driver is the insatiable global demand for mobile data, propelled by ubiquitous smartphone usage, the rise of bandwidth-intensive applications like video streaming and online gaming, and the proliferation of connected devices in the Internet of Things (IoT) ecosystem. This continuous surge in data consumption necessitates constant network densification and capacity upgrades, thereby fueling the demand for new LTE base stations and related infrastructure. Government initiatives aimed at improving digital connectivity, especially in remote and rural areas, further stimulate market growth by incentivizing network expansions and upgrades to bridge the digital divide.

Despite these strong drivers, the market faces notable restraints. The substantial initial capital expenditure required for deploying and upgrading LTE base station infrastructure presents a significant barrier, particularly for operators in developing economies. Furthermore, the complexity involved in network planning, deployment, and ongoing maintenance, coupled with challenges related to spectrum availability and regulatory approvals, can slow down market expansion. Concerns around cybersecurity and the physical security of remote base stations also add to operational complexities and costs, requiring continuous investment in protective measures. The ongoing transition to 5G also presents a dual challenge and opportunity, as operators balance investments in maintaining and evolving 4G while simultaneously deploying 5G networks.

Opportunities within the market include the growing adoption of private LTE networks by enterprises and industries for mission-critical applications, offering enhanced security, reliability, and control over their connectivity. The expansion of fixed wireless access (FWA) services, utilizing LTE base stations to provide broadband internet in areas underserved by fiber, represents another significant growth avenue. Moreover, the evolution towards Open RAN (Radio Access Network) architectures offers new possibilities for diversification of vendors, reduced costs, and increased innovation, promising to reshape the supply chain dynamics. Technological advancements such as Massive MIMO, carrier aggregation, and intelligent network management systems continually enhance the capabilities and efficiency of LTE base stations, ensuring their continued relevance and market viability. These forces collectively define the strategic landscape and future trajectory of the Long-Term Evolution Base Station Market.

Segmentation Analysis

The Long-Term Evolution Base Station Market is meticulously segmented to provide a granular understanding of its diverse components, technologies, and applications. This segmentation allows for a detailed analysis of market dynamics across various dimensions, including the physical and logical infrastructure elements, the scale of deployment, and the end-use scenarios that drive demand. Understanding these segments is crucial for stakeholders to identify growth areas, tailor strategies, and assess competitive landscapes within this evolving telecommunications infrastructure domain.

The segmentation primarily breaks down the market based on the intrinsic nature of the base station components, the functional categories of the stations themselves, and the distinct applications they serve. This multi-faceted approach ensures that both the supply and demand sides of the market are thoroughly explored, reflecting technological advancements and evolving user requirements. By segmenting the market, analysts can precisely track market shares, forecast future trends, and delineate the unique growth trajectories inherent in each sub-market, offering valuable insights for business development and investment decisions.

- By Component:

- Hardware: (Antennas, Radio Units, Baseband Units, Power Amplifiers, Routers, Switches)

- Software: (Network Management Systems, Operating Systems, Security Software, Analytics Software)

- Services: (Deployment and Integration, Maintenance and Support, Consulting, Network Optimization)

- By Type:

- Macrocell: (High power, wide coverage for general outdoor areas)

- Small Cell:

- Femtocell: (Very low power, for residential or small office use)

- Picocell: (Low power, for larger indoor spaces like malls or enterprises)

- Microcell: (Medium power, for urban hotspots or specific outdoor coverage gaps)

- By Application:

- Mobile Broadband: (Consumer internet access for smartphones, tablets)

- Fixed Wireless Access (FWA): (Broadband internet to homes/businesses via wireless link)

- IoT Connectivity: (Enabling communication for various IoT devices)

- Public Safety: (Dedicated networks for emergency services and government agencies)

- Enterprise and Private Networks: (Customized networks for industries, campuses, etc.)

Value Chain Analysis For Long-Term Evolution Base Station Market

The value chain for the Long-Term Evolution Base Station Market is a complex ecosystem involving multiple stages, from raw material sourcing and component manufacturing to final deployment and ongoing maintenance. The upstream segment of the value chain is critical, encompassing suppliers of essential raw materials such as semiconductors, specialized metals, and plastics, which form the foundational elements of base station components. Further upstream are the manufacturers of sophisticated components like antennas, power amplifiers, RF transceivers, and digital signal processors, along with software developers providing operating systems and specialized network functions. These suppliers form the technological bedrock upon which the entire base station infrastructure is built, driving innovation in performance and efficiency.

Moving downstream, the value chain extends to the assembly and integration of these components into complete base station units, performed by major telecom equipment vendors. These vendors then engage in direct sales to large mobile network operators (MNOs) and telecommunication service providers, often involving complex contracts for large-scale network rollouts and upgrades. For smaller deployments or niche applications, the distribution channel may involve indirect sales through a network of channel partners, including value-added resellers (VARs), system integrators, and local distributors who provide localized expertise and support. The distribution strategy depends heavily on the scale and geographical reach of the end-user requirements, balancing direct engagement with broad market penetration.

The direct distribution model is typically favored for major contracts with global or national MNOs, where vendors provide end-to-end solutions, including deployment, integration, and ongoing managed services. This direct approach allows for close collaboration, customization, and long-term partnerships. Conversely, the indirect distribution channel leverages regional distributors and system integrators to reach a wider array of customers, including smaller service providers, enterprises for private LTE networks, and public safety organizations. These indirect partners often add value through localized installation, maintenance, and support services, extending the market reach of the primary equipment manufacturers and ensuring comprehensive coverage across diverse customer segments.

Long-Term Evolution Base Station Market Potential Customers

The primary potential customers and end-users in the Long-Term Evolution Base Station Market are diverse, reflecting the broad utility and critical role of these technologies in modern communication infrastructure. At the forefront are Mobile Network Operators (MNOs), which include global giants such as AT&T, Verizon, Vodafone, China Mobile, T-Mobile, Orange, and NTT Docomo. These operators represent the largest segment of buyers, constantly investing in new LTE base stations for network expansion, densification, and capacity upgrades to meet the escalating demand for mobile voice and data services. Their continuous need for robust and scalable infrastructure to support billions of subscribers worldwide makes them central to the market's sustained growth.

Beyond traditional MNOs, a significant and growing customer base includes Telecommunication Service Providers and Internet Service Providers (ISPs) who utilize LTE base stations to offer Fixed Wireless Access (FWA) services. FWA enables the delivery of broadband internet to residential and business customers in areas where wired infrastructure is either unavailable, economically unfeasible, or slower than wireless alternatives. This segment is particularly vital in emerging markets and rural regions, where LTE technology provides a cost-effective and rapid deployment solution for bridging the digital divide, making these providers key purchasers of LTE base station equipment.

Furthermore, enterprises and large industrial entities are increasingly becoming important customers for private LTE networks. Industries such as manufacturing, mining, logistics, and utilities are deploying dedicated LTE networks to ensure secure, reliable, and high-performance connectivity for their mission-critical operations, IoT devices, and internal communications. Government and Public Safety agencies also represent a crucial customer segment, as they require dedicated and resilient LTE networks for emergency services, national security, and critical infrastructure management, ensuring reliable communication during crises. These diverse end-users collectively drive the demand for LTE base station technology, highlighting its foundational role across various sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $20.0 billion |

| Market Forecast in 2032 | $46.16 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ericsson, Huawei, Nokia, ZTE, Samsung, NEC, Cisco, CommScope, Qualcomm, Mavenir, Fujitsu, Airspan Networks, Baicells, Contela, ip.access, Casa Systems, Aviat Networks, Parallel Wireless, JMA Wireless, Altiostar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Long-Term Evolution Base Station Market Key Technology Landscape

The Long-Term Evolution Base Station Market is characterized by a dynamic and continuously evolving technology landscape, driven by the relentless pursuit of higher data speeds, lower latency, increased capacity, and improved network efficiency. One of the most significant technologies enabling these advancements is Massive MIMO (Multiple Input, Multiple Output), which employs a large number of antennas at the base station to serve multiple users simultaneously with enhanced spatial multiplexing, significantly boosting spectral efficiency and overall network capacity. This technology is crucial for managing the exponential growth in mobile data traffic and enhancing coverage in dense urban environments, thereby optimizing the utilization of available spectrum resources.

Another pivotal technology is Carrier Aggregation, which allows operators to combine multiple discrete spectrum channels into a single, wider virtual channel. This effectively increases the instantaneous bandwidth available to users, leading to higher peak data rates and a more robust user experience. The deployment of various types of Small Cells, including femtocells, picocells, and microcells, is also a critical technological trend. These smaller, lower-power base stations are strategically deployed in dense urban areas, indoor environments, and specific coverage gaps to offload traffic from macrocells, enhance capacity, and improve coverage in hard-to-reach locations, forming an integral part of network densification strategies. Their compact size and flexible deployment options make them ideal for targeted capacity enhancement.

Furthermore, the market is increasingly embracing virtualized and software-centric architectures such as Cloud-RAN (C-RAN) and Network Function Virtualization (NFV). C-RAN centralizes baseband processing units into a data center, allowing for resource pooling, collaborative radio processing, and dynamic allocation of resources, which improves operational efficiency and reduces CapEx and OpEx. NFV decouples network functions from proprietary hardware, enabling them to run as software on standard servers, thereby offering greater flexibility, scalability, and agility in network deployment and management. Technologies like Software Defined Radio (SDR) and Self-Organizing Networks (SON) further automate network configuration, optimization, and fault management, minimizing manual intervention and enabling more resilient and adaptive LTE networks. These innovations collectively underpin the ongoing evolution and performance enhancements within the LTE base station ecosystem.

Regional Highlights

- North America: This region is characterized by early adoption of advanced LTE technologies, significant investment in network densification, and rapid deployment of private LTE networks for industrial applications. The market here is mature, with a strong focus on capacity upgrades, VoLTE expansion, and laying the groundwork for seamless coexistence with 5G infrastructure. High smartphone penetration and demand for high-quality mobile broadband services continue to drive steady growth.

- Europe: European markets are focused on network modernization, improving rural coverage, and increasingly exploring Open RAN initiatives to foster innovation and reduce costs. Regulatory frameworks often push for widespread connectivity and infrastructure sharing, shaping investment patterns. The region sees continuous upgrades to enhance spectral efficiency and prepare for a smooth transition to next-generation technologies.

- Asia Pacific (APAC): As the largest and fastest-growing market, APAC is distinguished by its vast subscriber base, aggressive network expansion, and substantial government and private sector investments in both 4G and 5G infrastructure. Countries like China, India, Japan, and South Korea are at the forefront of deploying new base stations and advanced features, driven by immense mobile data demand and the rapid adoption of IoT devices, making it a critical region for market growth.

- Latin America: This region is a developing market experiencing significant infrastructure development and increasing mobile penetration rates. Governments and operators are investing in LTE base stations to improve connectivity, particularly in underserved areas, and to support economic development through digital inclusion. The focus is on expanding coverage and enhancing network capacity to cater to a growing base of mobile users.

- Middle East and Africa (MEA): MEA represents an emerging market with expanding mobile connectivity and increasing urbanization. The deployment of LTE base stations is crucial for bridging the digital divide, facilitating smart city projects, and supporting nascent digital economies. The region is witnessing substantial investments in mobile infrastructure to provide foundational connectivity and drive socioeconomic growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Long-Term Evolution Base Station Market.- Ericsson

- Huawei

- Nokia

- ZTE

- Samsung

- NEC

- Cisco

- CommScope

- Qualcomm

- Mavenir

- Fujitsu

- Airspan Networks

- Baicells

- Contela

- ip.access

- Casa Systems

- Aviat Networks

- Parallel Wireless

- JMA Wireless

- Altiostar

Frequently Asked Questions

What is an LTE base station?

An LTE base station, also known as an eNodeB or eNB, is a critical component of a 4G mobile network's radio access network. It facilitates wireless communication between mobile devices (user equipment) and the core network, enabling high-speed data and voice services (VoLTE).

How does 5G affect the LTE base station market?

5G does not replace LTE entirely; instead, they often coexist. LTE base stations continue to provide foundational coverage, especially in less dense areas, and complement 5G deployments by offloading traffic and ensuring seamless handover, thus maintaining their relevance and requiring ongoing upgrades.

What are the key components of an LTE base station?

Key components typically include antennas for transmitting and receiving radio signals, radio units (RRUs) that convert digital signals to radio frequencies, baseband units (BBUs) for digital signal processing, and robust power supply systems along with specialized software for network management and control.

What is the role of small cells in LTE networks?

Small cells (femtocells, picocells, microcells) are compact, low-power base stations deployed to enhance network capacity and coverage in densely populated urban areas, indoor environments, and specific hotspots. They offload traffic from larger macrocells, improving user experience and overall network performance.

How does AI enhance LTE base station performance?

AI enhances LTE base station performance by enabling real-time network optimization, predictive maintenance to prevent outages, intelligent energy management for reduced power consumption, automated fault detection, and dynamic resource allocation, leading to a more efficient and resilient network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager