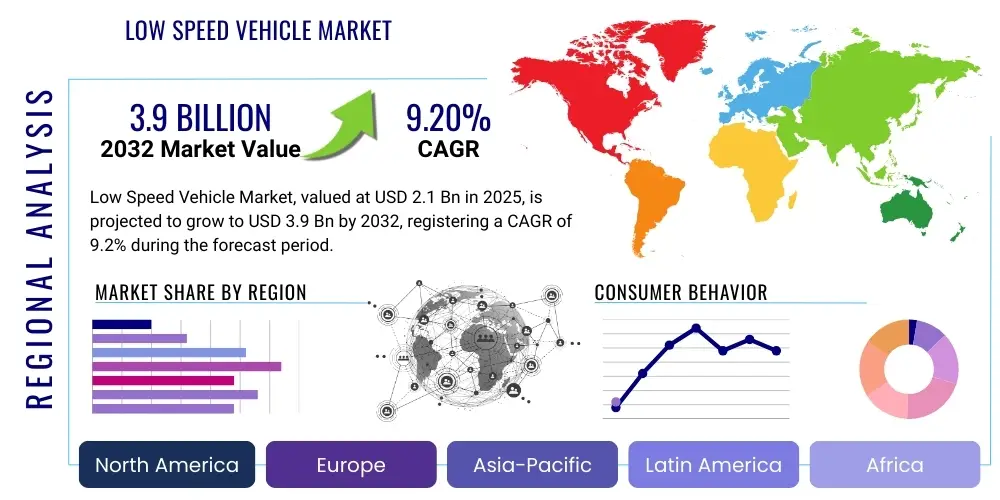

Low Speed Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427463 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Low Speed Vehicle Market Size

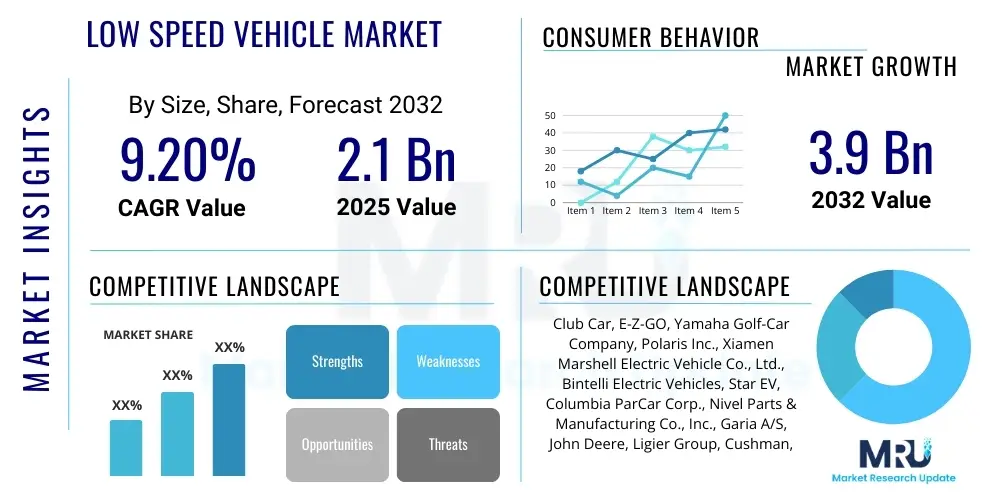

The Low Speed Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2032. The market is estimated at $2.1 billion in 2025 and is projected to reach $3.9 billion by the end of the forecast period in 2032.

Low Speed Vehicle Market introduction

The Low Speed Vehicle (LSV) market encompasses a diverse range of compact electric or gasoline-powered vehicles designed for short-distance transportation at reduced speeds, typically under 25 miles per hour (40 km/h). These vehicles are characterized by their small footprint, low operating costs, and enhanced maneuverability, making them ideal for specific environments where full-sized automobiles are impractical or unnecessary. LSVs serve a critical role in addressing evolving transportation needs, particularly in controlled environments and for last-mile logistics, thereby contributing to sustainable urban mobility and operational efficiency across various sectors.

Product descriptions within the LSV category include golf carts, which are foundational to the market, utility vehicles used for maintenance and material handling, and Neighborhood Electric Vehicles (NEVs) that offer street-legal transportation in certain areas. Major applications span golf courses, large residential communities, industrial complexes, airports, resorts, and increasingly, urban last-mile delivery services. These applications highlight the versatility of LSVs in fulfilling specialized transport requirements efficiently and economically, optimizing movement in spaces not traditionally served by conventional vehicles.

The benefits of Low Speed Vehicles are multifaceted, including reduced environmental impact due to their often-electric powertrains, lower operational and maintenance costs compared to standard automobiles, and decreased traffic congestion in confined areas. Driving factors for market expansion include the global shift towards electric mobility, growing environmental consciousness among consumers and businesses, the expansion of planned communities and recreational facilities, and the increasing demand for efficient, localized logistics solutions. These elements collectively propel the LSV market forward, positioning it as a significant component of future transportation ecosystems.

Low Speed Vehicle Market Executive Summary

The Low Speed Vehicle market is experiencing robust growth, driven by key business trends such as the pervasive adoption of electric powertrains, the integration of advanced connectivity and telematics, and the emergence of shared mobility models catering to short-distance travel needs. Manufacturers are increasingly focusing on customization and modular designs to meet diverse application requirements, from specialized utility tasks in industrial settings to personalized transport in residential enclaves. Furthermore, the market is witnessing a strategic shift towards enhanced safety features and more sophisticated battery technologies, which are critical for broadening the appeal and functionality of LSVs across various user groups and operational environments.

Regional trends significantly influence the market landscape, with North America leading in terms of golf cart sales and the adoption of NEVs within large retirement communities and sprawling residential developments. Europe is observing substantial growth in urban logistics applications and tourism sectors, leveraging LSVs for eco-friendly city exploration and intra-city cargo transport, particularly in densely populated historical centers. The Asia-Pacific region stands out for its rapid urbanization, industrial expansion, and burgeoning e-commerce, which fuels demand for LSVs in factory logistics, last-mile delivery, and campus transportation, positioning it as the fastest-growing market due to the sheer volume of operational needs and governmental support for green mobility solutions.

Segmentation trends indicate a strong move towards electric LSVs over gasoline-powered variants, primarily due to environmental regulations and decreasing battery costs. The utility vehicle segment is expanding rapidly, propelled by demand from industrial parks, airports, and universities seeking efficient material handling and personnel transport. Concurrently, the personal transport vehicle segment, encompassing NEVs, is gaining traction as an alternative to traditional cars for local commutes, particularly in areas with supportive legal frameworks. The increasing diversification of end-use applications beyond traditional golf courses, into areas such as smart city infrastructure, leisure, and public service, underscores the markets evolving dynamism and potential for sustained expansion.

AI Impact Analysis on Low Speed Vehicle Market

The integration of Artificial Intelligence (AI) is set to profoundly transform the Low Speed Vehicle market by enhancing operational efficiency, safety, and user experience. Users frequently inquire about how AI can make LSVs safer, the extent to which AI will enable autonomous capabilities, and its specific applications in optimizing logistics and fleet management. There is also considerable interest in how AI might influence the cost-effectiveness and accessibility of these vehicles, alongside concerns regarding data privacy and the complexity of AI system implementation. These questions highlight a clear expectation that AI will deliver tangible benefits across the LSV ecosystem, driving innovation and expanding the potential applications for these specialized vehicles.

AIs influence extends to enabling more sophisticated Advanced Driver-Assistance Systems (ADAS) within LSVs, moving beyond basic collision warnings to predictive analytics that can anticipate hazards and suggest safer routes in real-time. This capability is particularly vital in environments with mixed pedestrian and vehicle traffic, such as university campuses or resort areas, where enhanced situational awareness is paramount. Furthermore, AI algorithms are crucial for developing robust autonomous LSVs capable of navigating complex urban or industrial landscapes without human intervention. These systems rely on advanced sensor fusion, object recognition, and path planning, all powered by AI, to ensure reliable and safe autonomous operation, addressing a key user expectation for future LSV functionality and market growth.

Beyond direct operational improvements, AI also significantly impacts the backend management and maintenance of LSV fleets. Predictive maintenance, powered by AI, analyzes vehicle performance data to identify potential component failures before they occur, reducing downtime and extending vehicle lifespan. Moreover, AI-driven route optimization algorithms can significantly enhance the efficiency of last-mile delivery and utility services, minimizing travel times, energy consumption, and operational costs. These advancements not only make LSVs more economical and reliable for businesses but also contribute to a more sustainable and responsive transport infrastructure, directly addressing user demands for greater efficiency and reliability in LSV applications.

- Enhanced Autonomous Navigation: AI enables precise localization, obstacle detection, and path planning for self-driving LSVs, improving safety and operational efficiency.

- Predictive Maintenance: AI algorithms analyze vehicle data to forecast potential failures, optimizing maintenance schedules and reducing downtime for LSV fleets.

- Optimized Fleet Management: AI-driven systems provide real-time tracking, route optimization, and dynamic scheduling for LSV fleets, particularly for last-mile delivery and campus transport.

- Advanced Driver-Assistance Systems (ADAS): AI powers features like collision avoidance, intelligent braking, and adaptive cruise control, significantly boosting LSV safety.

- Personalized User Experience: AI can tailor vehicle settings, entertainment, and information based on user preferences and historical data for individual LSV users.

- Energy Management: AI optimizes battery usage and charging cycles in electric LSVs, extending range and battery life while reducing energy consumption.

DRO & Impact Forces Of Low Speed Vehicle Market

The Low Speed Vehicle market is propelled by several robust drivers, primarily including increasing urbanization, which necessitates compact and efficient transport solutions for congested city centers and planned communities. A growing global emphasis on environmental sustainability further boosts the demand for electric LSVs, aligning with governmental regulations and consumer preferences for reduced carbon footprints. The escalating demand for efficient last-mile delivery services, particularly from the e-commerce sector, heavily relies on the maneuverability and cost-effectiveness of LSVs. Furthermore, the expansion of recreational facilities, large corporate campuses, and tourism sectors continuously drives the need for convenient and eco-friendly internal transportation, solidifying the market’s growth trajectory.

However, the market also faces significant restraints. Regulatory hurdles vary widely by region and country, often limiting where LSVs can be operated on public roads, thereby restricting their broader adoption. Concerns regarding safety, especially when LSVs share infrastructure with higher-speed vehicles, pose a challenge, leading to demand for more advanced safety features and dedicated pathways. The limited speed and range of LSVs inherently confine their utility to specific short-distance applications, preventing them from competing with conventional vehicles for long-range travel. Additionally, the initial capital expenditure for advanced electric LSVs with integrated technologies can be a barrier for some buyers, particularly smaller businesses or individuals.

Despite these challenges, substantial opportunities exist for market expansion. The integration of LSVs into smart city initiatives, where they can serve as autonomous shuttles or part of intelligent public transport networks, presents a significant growth avenue. Advancements in battery technology, leading to increased range and faster charging capabilities, will enhance the practicality and appeal of electric LSVs. The development of autonomous LSV technology promises to revolutionize various sectors, from logistics to personal mobility, opening up new application areas and reducing operational costs. Furthermore, the exploration of new business models, such as subscription services and on-demand rentals for LSVs, can broaden accessibility and adoption, catering to evolving consumer preferences for flexible mobility solutions. The collective impact of these forces shapes the competitive dynamics and future potential of the Low Speed Vehicle market.

Segmentation Analysis

The Low Speed Vehicle market is comprehensively segmented to address the diverse needs and applications across various industries and consumer groups. This segmentation helps in understanding the specific demands within different niches and allows manufacturers to tailor products and services more effectively. Key dimensions for market segmentation include the vehicle type, power source, application area, and end-use, each revealing distinct market dynamics and growth patterns. Analyzing these segments provides a clear overview of the markets structure and highlights opportunities for innovation and targeted market penetration, allowing stakeholders to identify high-growth areas and develop strategic initiatives to capture market share.

Segmentation by vehicle type, for instance, distinguishes between traditional golf carts, versatile utility vehicles designed for commercial tasks, personal transport vehicles for daily use in confined communities, and industrial vehicles tailored for demanding logistical operations within factories and warehouses. Each type serves a unique purpose and is characterized by specific design features, performance capabilities, and regulatory considerations. Understanding these distinctions is crucial for manufacturers in designing appropriate products and for end-users in selecting vehicles that best suit their operational requirements, ultimately driving efficiency and user satisfaction across the diverse spectrum of LSV applications.

Further segmentation by power source, primarily electric versus gasoline or hybrid, reflects the ongoing transition towards sustainable mobility solutions, with electric LSVs gaining significant traction due to environmental concerns and operational cost advantages. Application-based segmentation delves into specific use cases such as golf courses, gated communities, industrial facilities, last-mile delivery, and tourism, each presenting unique demands for vehicle features and performance. Finally, end-use segmentation differentiates between commercial and personal applications, influencing purchasing decisions, fleet management strategies, and marketing approaches. This multifaceted segmentation approach provides a granular view of the market, essential for strategic planning and product development.

- By Vehicle Type:

- Golf Carts

- Utility Vehicles

- Personal Transport Vehicles (NEVs)

- Industrial Vehicles

- By Power Source:

- Electric

- Gasoline

- Hybrid

- By Application:

- Golf Courses

- Gated Communities and Resorts

- Industrial Facilities and Warehouses

- Last-Mile Delivery and Urban Logistics

- Tourism and Sightseeing

- Campus Transport (Educational and Corporate)

- By End-Use:

- Commercial

- Personal

Low Speed Vehicle Market Value Chain Analysis

The Low Speed Vehicle markets value chain commences with the upstream analysis, which involves the sourcing of essential raw materials and components critical for LSV manufacturing. This segment includes suppliers of metals such as aluminum and steel for chassis construction, plastics for body panels and interior components, and specialized materials for seating and dashboards. Crucially, the upstream also encompasses manufacturers of powertrain components, including electric motors, gasoline engines, intricate battery packs (for electric variants), and sophisticated control units. The quality and availability of these foundational elements directly impact the production cost, performance, and reliability of the final LSV product, necessitating strong supplier relationships and effective supply chain management to mitigate risks and ensure consistent quality.

Moving downstream, the value chain encompasses the manufacturing and assembly processes where these various components are integrated into finished Low Speed Vehicles. This stage involves complex engineering, design, and fabrication to produce diverse LSV types, from basic golf carts to advanced utility vehicles and neighborhood electric vehicles. Following manufacturing, the distribution channels play a pivotal role in bringing products to end-users. These channels can be direct, where manufacturers sell directly to large fleet operators, industrial clients, or government entities, often for bulk purchases. Indirect channels, on the other hand, involve a network of dealerships, authorized distributors, and rental companies that serve individual consumers, small businesses, and a broader range of commercial clients, providing sales, service, and aftermarket support.

The distribution networks efficiency is crucial for market reach and customer satisfaction. Direct channels offer greater control over customer relationships and pricing, often facilitating customization for specific client needs. Indirect channels, conversely, provide wider market penetration through established dealer networks, offering local accessibility and diversified product offerings, including used LSV sales and maintenance services. This dual-channel approach ensures that the Low Speed Vehicle market effectively reaches its varied customer base, from institutional purchasers requiring specialized fleets to individual consumers seeking personal mobility solutions. The interplay between upstream supply, manufacturing innovation, and robust distribution strategies defines the competitive landscape and overall health of the LSV market, continuously adapting to technological advancements and evolving consumer demands.

Low Speed Vehicle Market Potential Customers

The Low Speed Vehicle market serves a broad and expanding array of potential customers, spanning both commercial and personal end-users who benefit from the unique attributes of these vehicles. Commercial buyers represent a significant segment, including operators of golf courses and country clubs, which remain foundational to the LSV market, utilizing fleets for player transport and course maintenance. Furthermore, the hospitality sector, encompassing resorts, hotels, and theme parks, heavily relies on LSVs for guest transportation, luggage handling, and internal operational logistics, seeking efficiency and convenience in large, sprawling properties. These commercial entities often prioritize durability, low maintenance, and customization options tailored to their specific operational needs, driving demand for robust and reliable LSV solutions that enhance customer experience and streamline services.

Beyond traditional recreational and hospitality applications, industrial parks, manufacturing facilities, and large corporate campuses are increasingly adopting LSVs as essential tools for internal transport of personnel, materials, and equipment. Their maneuverability in confined spaces, combined with often electric powertrains, makes them ideal for reducing operational costs and improving environmental performance within these controlled environments. Moreover, the burgeoning e-commerce sector and its associated last-mile delivery services represent a rapidly growing customer base for LSVs. These businesses utilize compact electric vehicles to navigate urban congestion, access restricted areas, and deliver goods efficiently and sustainably over short distances, responding to the escalating demand for quick and eco-friendly parcel delivery in metropolitan areas.

On the personal end-user side, residents of gated communities, retirement villages, and suburban neighborhoods constitute a substantial market for Neighborhood Electric Vehicles (NEVs) and personal transport carts. These individuals seek convenient, cost-effective, and environmentally friendly alternatives to traditional cars for local errands, community activities, and short commutes, particularly in areas with supportive regulations for street-legal LSV use. Additionally, educational institutions, such as university campuses, deploy LSVs for student and staff transport, maintenance, and security operations, appreciating their ability to navigate pedestrian-heavy environments safely and quietly. The diverse needs of these end-users drive innovation within the LSV market, pushing manufacturers to develop more versatile, technologically advanced, and user-friendly vehicles to cater to this expanding customer base.

Low Speed Vehicle Market Key Technology Landscape

The Low Speed Vehicle market is undergoing a significant technological evolution, driven by advancements aimed at enhancing performance, safety, efficiency, and user experience. A foundational aspect of this landscape is the continuous improvement in electric powertrains, particularly in battery technology. Lithium-ion batteries are increasingly replacing traditional lead-acid batteries, offering greater energy density, faster charging times, longer lifespans, and reduced weight. These advancements significantly extend the range and utility of electric LSVs, making them more appealing for a wider array of applications. Complementary to this, efficient electric motors and sophisticated Battery Management Systems (BMS) optimize energy consumption and ensure battery longevity, contributing to the overall reliability and cost-effectiveness of electric LSV fleets, thereby attracting a larger customer base seeking sustainable and economically viable transport solutions.

Another pivotal area of technological innovation is the integration of advanced connectivity and telematics. GPS navigation, real-time tracking, and geofencing capabilities are becoming standard features, enabling efficient fleet management, asset protection, and optimized route planning for commercial operators. Telematics systems collect vital operational data, providing insights into vehicle performance, usage patterns, and predictive maintenance needs, allowing businesses to maximize uptime and reduce operational costs. Furthermore, the incorporation of advanced sensor technologies, including cameras, radar, and lidar, is laying the groundwork for more sophisticated Advanced Driver-Assistance Systems (ADAS) and eventually, autonomous driving functionalities. These technologies are crucial for improving safety in environments with mixed traffic and enhancing the overall operational intelligence of LSVs, addressing growing demands for automated and safer transport options.

Material science also plays a crucial role, with manufacturers increasingly utilizing lightweight composites, high-strength steels, and durable plastics to reduce vehicle weight, which in turn improves energy efficiency and extends battery range for electric models. The development of modular platforms allows for greater customization and easier adaptation of LSVs for various applications, from passenger transport to specialized utility tasks. Additionally, the digital user interface and infotainment systems are becoming more refined, offering enhanced connectivity for personal devices, intuitive controls, and diagnostic information directly to the driver. These technological advancements collectively elevate the capabilities of Low Speed Vehicles, making them more competitive, versatile, and attractive for diverse commercial and personal use cases, solidifying their position as a key component of modern mobility ecosystems.

Regional Highlights

- North America: This region holds a significant share of the global Low Speed Vehicle market, largely driven by the extensive presence of golf courses, large residential communities, and retirement villages. The adoption of Neighborhood Electric Vehicles (NEVs) is prominent, supported by a favorable regulatory environment in many states allowing their use on local roads. The market here is mature, with a strong focus on recreational use, personal transport, and utility applications in controlled environments.

- Europe: The European market for LSVs is experiencing rapid growth, primarily fueled by urban logistics, tourism, and increasing environmental awareness. Countries like Germany, France, and the UK are seeing greater adoption of electric LSVs for last-mile delivery in city centers and for tourist transport in historical areas. Strict emission regulations and smart city initiatives further propel the demand for eco-friendly and compact transport solutions.

- Asia-Pacific: Positioned as the fastest-growing market, the Asia-Pacific region is characterized by rapid urbanization, industrial expansion, and burgeoning e-commerce. Countries such as China, India, and Japan are witnessing substantial demand for LSVs in industrial facilities, warehouses, and for last-mile delivery services. Government support for electric mobility and the need for efficient campus transportation in large educational and corporate setups also contribute significantly to market expansion.

- Latin America: This region presents emerging opportunities for the Low Speed Vehicle market, particularly in the tourism sector and specific industrial applications. Countries with strong tourism industries, like Mexico and Brazil, utilize LSVs in resorts and recreational areas. The adoption in large agricultural or mining operations for utility purposes also contributes to steady, albeit localized, growth.

- Middle East & Africa: The market in the Middle East & Africa is niche but growing, primarily driven by tourism, luxury resorts, and large private estates. Countries in the Gulf Cooperation Council (GCC) states are investing in infrastructure development that includes the use of LSVs for internal transport and utility. Demand in Africa is emerging, particularly in specific industrial zones and developing urban centers where cost-effective and maneuverable transport is needed.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Speed Vehicle Market.- Club Car (Platinum Equity)

- E-Z-GO (Textron Inc.)

- Yamaha Golf-Car Company

- Polaris Inc.

- Xiamen Marshell Electric Vehicle Co., Ltd.

- Bintelli Electric Vehicles

- Star EV (Star Electric Vehicles)

- Columbia ParCar Corp.

- Nivel Parts & Manufacturing Co., Inc.

- Garia A/S

- John Deere (Deere & Company)

- Ligier Group

- Cushman (Textron Inc.)

- Streetrod Golf Cars

- Voyage Golf Car

- Dongfeng Motor Corporation (partially through subsidiaries)

- BYD Company Ltd. (potentially through specific light vehicle divisions)

Frequently Asked Questions

What are Low Speed Vehicles (LSVs)?

Low Speed Vehicles are compact, often electric, vehicles designed for short-distance travel at speeds typically under 25 mph (40 km/h). They are commonly used in controlled environments like golf courses, gated communities, and industrial facilities, and sometimes permitted on public roads with specific speed limits and regulations.

Can LSVs be driven on public roads?

Whether LSVs can be driven on public roads depends on local and national regulations. Many jurisdictions permit them on roads with posted speed limits of 35 mph (56 km/h) or less, provided they meet specific safety requirements such as headlights, tail lights, turn signals, seat belts, and mirrors. Always check local laws before operating an LSV on public roads.

What are the primary benefits of using LSVs?

The primary benefits of using LSVs include their environmental friendliness, especially electric models, due to zero emissions. They offer lower operating and maintenance costs, enhanced maneuverability in confined spaces, and contribute to reduced traffic congestion in specific areas. LSVs are also quieter and often more accessible than traditional automobiles for short-distance personal and commercial transport.

How is AI impacting the Low Speed Vehicle market?

AI is significantly impacting the LSV market by enabling advanced features like autonomous navigation, predictive maintenance, and optimized fleet management. It enhances safety through ADAS, improves energy efficiency, and provides personalized user experiences. AI is crucial for developing smarter, safer, and more efficient LSVs for diverse applications, driving future innovation in the sector.

What is the typical range of an electric LSV?

The typical range of an electric LSV varies significantly based on battery type, capacity, terrain, and driving conditions. Most modern electric LSVs equipped with lithium-ion batteries can offer a range between 30 to 60 miles (50 to 100 kilometers) on a single charge. Advanced models may exceed this range, providing greater utility for extended operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager