Lubricant Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429164 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Lubricant Packaging Market Size

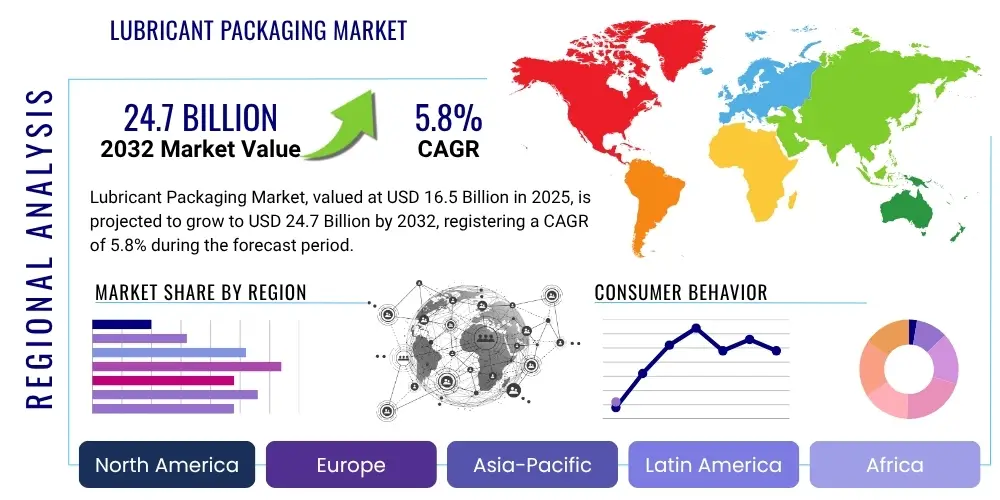

The Lubricant Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 16.5 billion in 2025 and is projected to reach USD 24.7 billion by the end of the forecast period in 2032.

Lubricant Packaging Market introduction

The lubricant packaging market, vital for industrial and automotive sectors, encompasses diverse containers engineered for safe storage, transportation, and application of various lubricants. This market addresses critical needs: resisting chemical properties of oils and greases, preventing contamination, and enduring varied environmental conditions. Demand for robust, reliable, and specialized packaging directly correlates with lubricant consumption across numerous global end-use industries.

Product offerings span from small, consumer-friendly plastic bottles and flexible pouches for automotive aftermarket use to large industrial pails, drums, and Intermediate Bulk Containers (IBCs) made from metals or rigid plastics for bulk commercial and industrial applications. Key materials include High-Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), steel, and aluminum, chosen based on chemical compatibility, strength, shelf-life, cost-effectiveness, and sustainability. These solutions offer benefits like enhanced product integrity, precise dispensing, tamper-evident security, and serve as crucial platforms for brand differentiation and consumer information through effective labeling.

Major applications concentrate in the automotive industry, where engine oils, transmission fluids, and brake fluids require specialized packaging for both OEMs and the aftermarket. Concurrently, the expansive industrial sector, including manufacturing, power generation, metalworking, construction, and mining, generates substantial demand for hydraulic oils, gear oils, and greases. Driving factors for market expansion include sustained growth of the global vehicle fleet, accelerated industrialization in developing regions, and increased focus on machinery maintenance. Furthermore, the persistent drive for environmental sustainability catalyzes innovation in recyclable, refillable, and lightweight packaging solutions, aligning with evolving regulations and consumer preferences, profoundly shaping market dynamics.

Lubricant Packaging Market Executive Summary

The global lubricant packaging market is positioned for significant growth, influenced by dynamic shifts in industrial output and evolving consumer demands. Business trends highlight a strong pivot towards sustainable and functional packaging solutions, incorporating recycled plastics (rHDPE, rPET), bio-based materials, and lightweight designs to minimize environmental impact and meet regulations. Manufacturers also invest in advanced barrier technologies and smart packaging features, such as anti-counterfeiting and digital traceability, to enhance product security and supply chain transparency.

Regionally, Asia Pacific leads the market with unparalleled growth, driven by aggressive industrialization, expanding automotive manufacturing, and a vast consumer base in China and India. North America and Europe, while mature, emphasize premiumization, technological innovation, and robust commitment to sustainable practices, leading advancements in eco-friendly packaging and intelligent solutions. Emerging markets in Latin America and MEA show strong potential, spurred by infrastructural development and increasing industrial activities, resulting in rising lubricant consumption and subsequent packaging demand.

Segmentation trends reveal plastic packaging, particularly HDPE bottles, maintaining dominance due to versatility and cost-effectiveness. Metal packaging, especially drums and pails, remains critical for heavy-duty industrial bulk applications, valued for strength. A notable trend is increasing consumer preference for smaller capacity packs (e.g., 1-liter bottles, pouches) in the retail automotive aftermarket for convenience. Concurrently, larger Intermediate Bulk Containers (IBCs) continue to grow in industrial and commercial sectors, driven by efficiencies in bulk handling and storage, reflecting market adaptation to diverse logistical and user requirements.

AI Impact Analysis on Lubricant Packaging Market

User inquiries concerning Artificial Intelligence's impact on lubricant packaging frequently address how AI can enhance efficiency, reduce costs, and improve sustainability across the packaging lifecycle. Key themes include AI's role in optimizing manufacturing, predicting demand, enhancing supply chain visibility, and enabling intelligent inventory management. Significant interest also lies in AI's capabilities for quality control, automated defect detection, and the development of 'smart' packaging that provides real-time product data, alongside its potential to accelerate sustainable packaging design.

AI’s integration is set to revolutionize the lubricant packaging market by fostering operational efficiencies and data-driven decision-making. Leveraging machine learning algorithms, manufacturers can predict equipment failures, optimize production line speeds, and minimize material waste, leading to substantial cost savings and improved throughput. Furthermore, AI-powered analytics process vast datasets on market trends and customer behavior to generate highly accurate demand forecasts, enabling lubricant producers to manage packaging inventory more effectively and respond dynamically to market shifts, reducing both overstocking and stockouts.

Beyond manufacturing, AI enhances product development and market responsiveness. AI-driven design tools rapidly iterate packaging prototypes, simulating performance to identify optimal material compositions for durability and sustainability, accelerating time-to-market. AI also contributes to quality assurance, with computer vision systems inspecting packaging at high speeds for micro-defects, ensuring consistent quality, protecting brand reputation, and preventing costly recalls, solidifying AI's transformative role across the value chain.

- Supply Chain Optimization: AI predicts optimal routes, monitors shipping, and manages inventory, reducing logistics costs and improving delivery for packaging materials and products.

- Predictive Maintenance: AI-driven sensors anticipate maintenance needs, minimizing downtime and extending equipment lifespan in packaging production.

- Quality Control: AI-powered computer vision systems rapidly identify packaging defects, ensuring consistent product quality and reducing waste.

- Demand Forecasting: AI analytics predict future packaging demand based on historical data and market trends, optimizing production and inventory.

- Smart Packaging: AI facilitates intelligent packaging design with embedded sensors for real-time monitoring of lubricant conditions, enhancing security and value.

- Material Optimization: AI identifies optimal material combinations for lightweight, robust, and sustainable packaging, reducing environmental impact.

- Automation & Robotics: AI enhances robotic systems for automated packaging, filling, and palletizing, improving speed, precision, and safety.

DRO & Impact Forces Of Lubricant Packaging Market

The lubricant packaging market is shaped by a complex interplay of drivers, restraints, opportunities, and impact forces. Primary drivers include robust growth of the global automotive industry, continuously requiring diverse lubricant products for maintenance and manufacturing. Additionally, expansion of industrial sectors like manufacturing, construction, and mining, particularly in emerging economies, fuels substantial demand for industrial lubricants and their packaging. Increasing consumer preference for convenient, smaller-sized packaging for retail automotive products also acts as a significant market driver, promoting innovative solutions.

However, the market faces notable restraints. Volatility in raw material prices, including crude oil derivatives for plastics and metals like steel and aluminum, directly impacts production costs and profit margins. Furthermore, stringent environmental regulations concerning plastic waste and the push for a circular economy pose challenges, compelling investments in sustainable, yet potentially costlier, materials and recycling infrastructure. Designing packaging that withstands harsh chemical properties of lubricants while being eco-friendly remains a significant hurdle.

Opportunities within the market largely center on development and adoption of sustainable packaging solutions, including bio-based plastics, recycled content, and refillable systems, aligning with global environmental goals and consumer demand. Integration of smart packaging technologies, such as RFID tags and QR codes for enhanced traceability and anti-counterfeiting, offers new avenues for growth. Moreover, exploring untapped markets in regions undergoing rapid industrialization provides substantial potential. Key impact forces include significant bargaining power of lubricant manufacturers, raw material suppliers influencing production costs, a moderate threat of substitutes, and intense competitive rivalry driving continuous innovation among packaging providers.

Segmentation Analysis

The lubricant packaging market is comprehensively segmented to provide a detailed understanding of its diverse components and consumer bases. These segments are typically categorized by material type, packaging type, volumetric capacity, and end-user industry, reflecting varied requirements of lubricant producers and their customers across different applications. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory shifts, and evolving market preferences.

Segmentation by material highlights foundational choices, with plastic and metal predominant, each offering distinct advantages in cost, durability, and chemical resistance. Packaging type delves into physical forms from small bottles to large drums, addressing different dispensing and logistical needs. Capacity-based segmentation covers a wide range of lubricant volumes, from individual consumer use to large industrial operations. Finally, end-user segmentation provides insights into primary industries driving demand, illustrating how automotive, industrial, marine, and aerospace sectors have specialized requirements for lubricant containment, influencing market demand and product development strategies.

- By Material:

- Plastic: HDPE, PET, PP, Others (chemical resistance, transparency, heat resistance).

- Metal: Steel, Aluminum (strength, protection, lightweight).

- Others: Composite materials (enhanced barriers), Bag-in-Box (flexible liner).

- By Type:

- Bottles: Plastic, small to several liters, automotive/light industrial.

- Pails: 5-20 liter plastic/metal, industrial lubricants.

- Drums: Large metal/plastic (e.g., 200-liter), bulk industrial storage.

- Cans: Smaller metal, specialty lubricants.

- Pouches: Flexible, lightweight, smaller volumes, automotive aftermarket.

- Greases Tubes: Small tubes for grease dispensing.

- Intermediate Bulk Containers (IBCs): Large reusable (1000+ liters), bulk liquid handling.

- By Capacity:

- Less than 1 Liter: Retail-oriented, individual use.

- 1-5 Liters: Automotive aftermarket multi-packs, smaller industrial.

- 5-10 Liters: Medium industrial volumes, larger retail packs.

- 10-20 Liters: Standard for industrial pails, mid-range commercial.

- 20-50 Liters: Medium industrial needs.

- Above 50 Liters: Drums, IBCs for bulk industrial/commercial supply.

- By End-User:

- Automotive: Passenger Vehicles, Commercial Vehicles, Motorcycles (engine oils, fluids).

- Industrial: Manufacturing, Power Generation, Metalworking, Mining, Construction, Food and Beverages, Agriculture (hydraulic, gear, compressor oils, greases).

- Marine: Specialized engine oils and greases.

- Aerospace: High-performance lubricant packaging.

- Others: Niche applications (textiles, medical, consumer goods).

Value Chain Analysis For Lubricant Packaging Market

The lubricant packaging market's value chain is a comprehensive network delivering packaged lubricant products to end-users. It begins upstream with raw material procurement, involving suppliers of plastic resins (HDPE, PET, PP) and metals (steel, aluminum), plus additives and coatings. Establishing strategic relationships with these suppliers is crucial for packaging manufacturers, influencing product quality, costs, supply chain resilience, and sustainability.

Downstream, the value chain proceeds through manufacturing by specialized packaging companies, transforming raw materials into various formats using techniques like blow molding, injection molding, and metal fabrication. This stage requires significant capital investment and skilled labor. Once produced, packaging is delivered to lubricant producers for filling, sealing, and labeling. Distribution can be direct (packaging manufacturers to large lubricant brands) or indirect (through distributors/wholesalers serving smaller producers). Efficient distribution is vital for timely delivery and cost management.

Final stages involve lubricant producers distributing filled products to diverse end-users: direct sales to large industrial clients, automotive OEMs, and bulk commercial buyers; and indirect channels like retail, automotive parts stores, repair shops, and e-commerce. Effective distribution impacts market reach and sales volume. Post-consumption, the value chain extends to recycling, waste management, and potential reuse (e.g., IBCs). This aspect gains prominence due to environmental concerns, fostering a circular economy where materials are recovered and reintegrated, minimizing waste.

Lubricant Packaging Market Potential Customers

The lubricant packaging market serves a broad, diverse clientele, primarily entities involved in the entire lifecycle of lubricant products, from manufacturing to ultimate consumption. These potential customers are end-users and buyers of packaging solutions, whose demand links to product formulations, target markets, logistics, and brand strategies. Scope ranges from global oil and gas supermajors to specialized lubricant blenders, independent distributors, and large-scale industrial consumers. Their packaging needs differentiate by lubricant volume, product aggressiveness, and desired shelf appeal.

Key segments include automotive lubricant manufacturers (engine oils, transmission fluids, coolants for passenger, commercial vehicles, motorcycles), catering to both OEM and aftermarket. Another significant group is industrial lubricant producers, supplying specialized lubricants for manufacturing, construction, mining, power generation, and metalworking. These customers require robust, often high-capacity, packaging for hydraulic oils, gear oils, compressor lubricants, and greases, designed to withstand demanding industrial environments and facilitate bulk handling. Specialized industries like marine and aerospace also represent critical buyers for high-performance lubricant packaging tailored to extreme conditions.

Beyond direct manufacturers, influential indirect customers include large-scale lubricant distributors, wholesalers, and retail chains. Their packaging preferences are guided by logistical efficiency, shelf appeal, and ease of handling. The burgeoning e-commerce sector introduces demands for packaging resilient to shipping, stackable, and designed to minimize transit damage. Ultimately, any organization requiring secure, efficient, compliant, and branded containment for liquid or semi-solid lubricants, whether for internal use or onward sale, represents a potential customer within this dynamic market segment. Their diverse needs drive innovation in materials, design, and functionality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 16.5 Billion |

| Market Forecast in 2032 | USD 24.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor Plc, Berry Global Inc., Mauser Packaging Solutions, Greif Inc., SCHÜTZ GmbH & Co. KGaA, Universal Can Corporation, Mold-Tek Packaging Ltd., Time Technoplast Ltd., DS Smith Plc, Orora Limited, Sonoco Products Company, Mondi Group, ALPLA Group, Silgan Holdings Inc., Ball Corporation, Crown Holdings Inc., Constantia Flexibles, Winpak Ltd., Sealed Air Corporation, Plastipak Holdings, Inc., O. Berk Company, Bemis Company Inc., PACCOR GmbH, Bericap GmbH & Co. KG, Rieke Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lubricant Packaging Market Key Technology Landscape

The lubricant packaging market is continually reshaped by advancements in materials science, manufacturing processes, and digital integration. Innovations are driven by enhanced product protection (extending shelf-life, preventing contamination), improved user convenience, cost reduction, and environmental sustainability. This includes developing multi-layer barrier films and specialized coatings for superior chemical resistance and lubricant degradation prevention, ensuring product integrity under varied storage conditions.

A significant trend is the pursuit of lightweight and sustainable packaging materials, encompassing recycled plastics (rHDPE, rPET), bio-based polymers, and lightweight metals. These aim to reduce carbon footprint and comply with circular economy principles. Advanced manufacturing techniques like co-extrusion blow molding and advanced injection molding enable complex shapes and integrated features (ergonomic handles, precise dispensing spouts), enhancing usability and material efficiency.

The burgeoning integration of smart packaging technologies is also gaining traction, including RFID tags, NFC chips, and embedded sensors. These facilitate enhanced traceability, offer robust anti-counterfeiting measures, and can monitor lubricant condition (temperature, fill level). This real-time data provides invaluable insights for optimizing inventory management and quality assurance. These advancements collectively contribute to a more efficient, sustainable, secure, and consumer-friendly lubricant packaging ecosystem.

Regional Highlights

- North America: Characterized by a mature automotive market, significant industrial activity, and strong focus on innovation and sustainable practices. Demand for high-performance lubricants, coupled with stringent environmental regulations, drives advanced and eco-friendly packaging adoption. Emphasis on convenience and premiumization influences packaging design.

- Europe: A leader in sustainable packaging initiatives, with robust regulations promoting recycling, recycled content, and waste reduction. This propels manufacturers to innovate with bio-based materials, refillable systems, and lightweight designs. Its automotive and industrial sectors maintain steady demand, with a clear trend towards resource-efficient solutions.

- Asia Pacific (APAC): Represents the largest and fastest-growing market, primarily driven by rapid industrialization, burgeoning automotive production, and increasing disposable incomes in China, India, Japan, and South Korea. The sheer volume of lubricant consumption fuels immense demand for all packaging types, with growing awareness for cost-effectiveness and efficiency.

- Latin America: Shows significant growth potential, attributed to expanding industrial bases and a growing automotive fleet. Economic development and infrastructure projects increase lubricant demand, boosting packaging needs. While cost-effectiveness remains key, there's a gradual shift towards improved quality and more convenient packaging formats.

- Middle East and Africa (MEA): Experiencing growth driven by investments in infrastructure, oil and gas, and mining sectors, leading to increased lubricant consumption. Expanding industrial activities and a growing vehicle parc contribute to packaging demand. Local manufacturing develops, with a rising trend towards adopting international standards and technologies, balanced with economic viability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lubricant Packaging Market.- Amcor Plc

- Berry Global Inc.

- Mauser Packaging Solutions

- Greif Inc.

- SCHÜTZ GmbH & Co. KGaA

- Universal Can Corporation

- Mold-Tek Packaging Ltd.

- Time Technoplast Ltd.

- DS Smith Plc

- Orora Limited

- Sonoco Products Company

- Mondi Group

- ALPLA Group

- Silgan Holdings Inc.

- Ball Corporation

- Crown Holdings Inc.

- Constantia Flexibles

- Winpak Ltd.

- Sealed Air Corporation

- Plastipak Holdings, Inc.

- O. Berk Company

- Bemis Company Inc.

- PACCOR GmbH

- Bericap GmbH & Co. KG

- Rieke Corporation

Frequently Asked Questions

What is the primary function of lubricant packaging?

The primary function of lubricant packaging is to safely contain and protect lubricants from contamination, degradation, and leakage. It also facilitates convenient storage, transport, and precise dispensing, preserving chemical integrity and performance properties until use.

What are the key materials used in lubricant packaging?

Key materials include plastics like High-Density Polyethylene (HDPE) and Polyethylene Terephthalate (PET) for bottles and pouches, and metals like steel and aluminum for drums, cans, and pails. Composite materials and bag-in-box solutions are increasingly utilized for specific applications.

Which factors are driving the growth of the lubricant packaging market?

Market growth is driven by the expanding global automotive industry, increasing industrialization across emerging economies, and rising demand for high-performance lubricants. Consumer preference for convenient, smaller-sized packaging and advancements in sustainable materials also contribute significantly.

How do environmental regulations impact lubricant packaging?

Environmental regulations significantly impact lubricant packaging by driving demand for sustainable solutions. This includes promoting recycled content, encouraging development of lightweight and bio-based materials, and fostering designs that enhance recyclability and reduce waste, aligning with circular economy objectives.

What role does advanced technology play in modern lubricant packaging?

Technology plays a crucial role through advanced barrier materials for enhanced protection, lightweighting for sustainability, and smart packaging features like RFID and QR codes for improved traceability and anti-counterfeiting. Automation and AI also optimize manufacturing processes and supply chain efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager