M-RAM Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428007 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

M-RAM Market Size

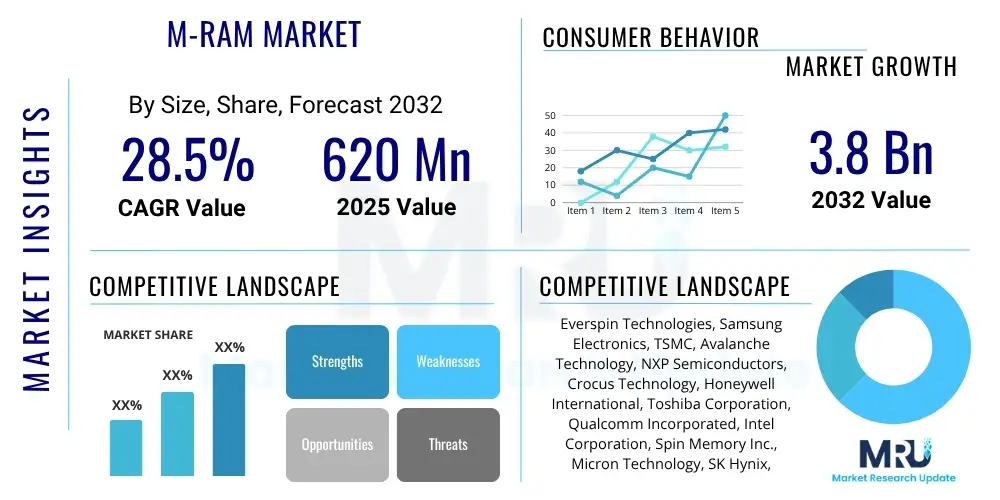

The M-RAM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at $620 Million in 2025 and is projected to reach $3.8 Billion by the end of the forecast period in 2032.

M-RAM Market introduction

The M-RAM (Magnetoresistive Random-Access Memory) market is at the forefront of advanced memory technology, offering a unique blend of non-volatility, high-speed operation, and exceptional endurance. M-RAM is a type of non-volatile RAM that stores data in magnetic domains, utilizing spintronics to achieve its distinctive characteristics. Unlike conventional memory technologies like DRAM or NAND flash, M-RAM retains data even when power is removed, making it ideal for applications requiring persistent data storage and instant-on capabilities. Its product description highlights its ability to combine the speed of SRAM, the non-volatility of Flash, and the endurance of DRAM, positioning it as a universal memory solution. Major applications span a wide array of sectors including enterprise storage, automotive electronics, industrial IoT, artificial intelligence (AI), edge computing, and consumer devices, where high performance, reliability, and power efficiency are paramount. The benefits of M-RAM are multifaceted, encompassing low power consumption, high endurance for frequent write cycles, fast read/write speeds, and robustness in harsh environments. These attributes are driving factors for its increasing adoption, particularly in areas demanding reliable persistent memory, such as advanced driver-assistance systems (ADAS), data centers, and the burgeoning landscape of AI and machine learning workloads.

M-RAM Market Executive Summary

The M-RAM market is experiencing robust growth fueled by several key business, regional, and segment trends that underscore its potential as a transformative memory technology. Business trends reveal a landscape characterized by strategic partnerships between M-RAM developers and semiconductor foundries, aimed at accelerating production scale and embedding M-RAM into a broader range of SoCs. Significant investments in research and development are driving advancements in density, speed, and manufacturing processes, particularly for next-generation STT-MRAM and SOT-MRAM technologies. Consolidation activities and intellectual property licensing are also becoming prevalent as companies strive to gain a competitive edge and expand their market reach, focusing on addressing the limitations of existing memory solutions. Regionally, Asia-Pacific dominates the M-RAM market, primarily due to its robust semiconductor manufacturing infrastructure, high concentration of consumer electronics production, and rapid adoption of advanced technologies in countries like South Korea, Japan, China, and Taiwan. North America and Europe are significant contributors, leading in R&D, data center investments, and automotive applications, with a strong emphasis on high-performance computing and industrial IoT. Segment trends indicate a strong shift towards embedded M-RAM, which offers significant advantages in power efficiency and performance for microcontrollers and system-on-chips (SoCs). While standalone M-RAM solutions are gaining traction in enterprise storage and specialized industrial applications, the integration of M-RAM directly into chip designs for edge AI devices, automotive safety systems, and industrial automation is poised for exponential growth, reflecting a broader industry demand for persistent, high-speed, and low-power memory solutions at every layer of the computing stack.

AI Impact Analysis on M-RAM Market

The convergence of Artificial Intelligence (AI) and the M-RAM market is poised to be a symbiotic relationship, with AI workloads demanding new memory paradigms that M-RAM is uniquely positioned to address. Users frequently inquire about M-RAM's role in accelerating AI training and inference, especially at the edge, and its potential to alleviate the "memory wall" bottleneck. There is significant interest in how M-RAM contributes to energy efficiency in AI systems, how it supports neuromorphic computing architectures, and its overall impact on persistent storage for large AI models and datasets. The analysis indicates that AI's relentless pursuit of faster data processing, lower latency, and reduced power consumption across the entire computing spectrum, from cloud data centers to tiny edge devices, directly aligns with M-RAM's core capabilities. M-RAM offers a compelling solution for storing AI model parameters and intermediate results persistently, enabling instant-on operation and significantly reducing boot times and power drain in edge AI devices. Its high endurance supports the frequent write cycles typical in machine learning algorithms, while its non-volatility ensures data integrity even during power interruptions, critical for robust AI deployments in mission-critical applications. Furthermore, M-RAM's potential for in-memory computing architectures could revolutionize AI inference by enabling data processing directly within the memory, thus bypassing the traditional data transfer bottlenecks that limit performance.

- Edge AI Acceleration: M-RAM provides high-speed, non-volatile memory for AI inference at the edge, enabling instant-on capabilities and reducing power consumption in battery-constrained devices. It allows AI models to be stored persistently and accessed rapidly, critical for real-time decision-making in IoT and autonomous systems.

- In-Memory Computing: The magnetic nature of M-RAM facilitates the development of novel in-memory computing paradigms, where processing occurs directly within the memory array. This significantly reduces data movement between CPU and memory, a major bottleneck for AI workloads, leading to faster computations and higher energy efficiency for neural network operations.

- Neuromorphic Chips: M-RAM's analog storage capabilities and high endurance make it an attractive candidate for implementing synapses in neuromorphic computing architectures. Its ability to store multiple resistance states can simulate synaptic weights, offering a path towards more biologically inspired, energy-efficient AI hardware that mimics the brain's parallel processing.

- Persistent Storage for AI Models: Large AI models require robust and fast persistent storage. M-RAM offers non-volatility combined with speeds approaching SRAM, making it ideal for storing frequently accessed AI model parameters, lookup tables, and inference results, ensuring data integrity and rapid retrieval even after power cycles.

- Low Power for AI Devices: The intrinsic low-power characteristics of M-RAM, especially in its static state where it consumes no power to retain data, are crucial for extending battery life in mobile and IoT AI applications. This enables continuous, always-on AI functionalities without significant energy overhead, which is vital for widespread AI adoption.

- Enhanced Data Center Performance: In data centers, M-RAM can serve as a high-speed cache or buffer for AI training datasets, improving throughput and reducing latency between main memory and processing units. This helps alleviate the "memory wall" issue, allowing GPUs and specialized AI accelerators to operate more efficiently.

DRO & Impact Forces Of M-RAM Market

The M-RAM market is shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the escalating demand for high-speed, non-volatile memory solutions across diverse industries, particularly in data centers and enterprise storage where data integrity and quick access are paramount. The pervasive growth of the Internet of Things (IoT) and artificial intelligence (AI) further fuels adoption, as these applications require energy-efficient, persistent memory for edge computing and real-time processing. Additionally, the automotive industry's shift towards autonomous driving and advanced driver-assistance systems (ADAS) necessitates robust, reliable, and high-endurance memory, perfectly aligning with M-RAM's capabilities. However, several restraints temper the market's growth. High manufacturing costs associated with M-RAM production, often involving specialized fabrication processes and materials, pose a significant barrier, particularly when competing with mature and cost-optimized technologies like DRAM and NAND flash. Moreover, challenges related to scalability, achieving higher densities comparable to NAND flash, and establishing comprehensive industry standards remain areas of concern that can hinder broader market penetration. Despite these challenges, vast opportunities exist, especially in the embedded memory market where M-RAM can replace eFlash and other on-chip memories, offering superior performance and integration benefits. The emergence of new applications in neuromorphic computing, quantum computing, and high-performance industrial controllers further expands M-RAM's addressable market. The broader impact forces, such as rapid technological advancements in spintronics and material science, intense market competition from other emerging memory technologies like ReRAM and PCM, and the evolving regulatory landscape concerning data storage and security, all significantly influence the M-RAM market's trajectory and competitive dynamics, pushing for continuous innovation and strategic collaborations.

Segmentation Analysis

The M-RAM market is meticulously segmented across various dimensions to provide a granular understanding of its diverse applications, technological variations, and target end-users. These segmentations are critical for stakeholders to identify lucrative niches, develop targeted strategies, and understand the competitive landscape. The market can be broadly categorized by Type, encompassing the different architectural approaches to M-RAM; by Application, reflecting its varied uses across industries; by End-use Industry, identifying the primary sectors driving demand; and by Form Factor, differentiating between integrated and standalone solutions. Each segment exhibits unique growth trajectories and adoption rates, influenced by specific technological requirements, cost considerations, and performance demands of the respective market verticals. Analyzing these segments provides invaluable insights into the evolving landscape of persistent memory, highlighting areas of high potential and those requiring further technological maturation or market education.

- Type:

- Toggle M-RAM: Early generation, suitable for niche applications requiring high endurance.

- STT-MRAM (Spin-Transfer Torque M-RAM): Dominant type, offers higher density and lower power, widely adopted.

- SOT-MRAM (Spin-Orbit Torque M-RAM): Next-generation, promising even faster write speeds and lower power consumption.

- Hybrid M-RAM: Combinations leveraging benefits of different M-RAM technologies or integration with other memory types.

- Application:

- Enterprise Storage: Non-volatile cache, database acceleration, persistent memory modules.

- Consumer Electronics: Wearables, smartphones, IoT devices, smart home appliances.

- Automotive: ADAS, infotainment systems, in-vehicle networking, engine control units (ECUs).

- Robotics: Industrial robots, collaborative robots, autonomous mobile robots requiring persistent memory for AI.

- Industrial: PLCs (Programmable Logic Controllers), factory automation, industrial IoT gateways, smart meters.

- IoT Devices: Edge computing, sensors, smart security systems, low-power connected devices.

- Aerospace & Defense: High-reliability systems, radiation-hardened memory, mission-critical avionics.

- Data Centers: Persistent memory, storage class memory, high-speed caching for cloud infrastructure.

- AI/ML: On-chip memory for AI accelerators, persistent storage for neural network models at the edge.

- Medical Devices: Portable medical equipment, implantable devices, diagnostic tools requiring robust, low-power memory.

- End-use Industry:

- IT & Telecommunications: Data centers, networking equipment, cloud infrastructure.

- Automotive: Electric vehicles, autonomous vehicles, traditional combustion engine vehicles.

- Industrial: Manufacturing, energy, utilities, logistics.

- Consumer Electronics: Mobile devices, home entertainment, smart personal devices.

- Medical: Healthcare equipment, patient monitoring, diagnostic imaging.

- Aerospace & Defense: Military applications, commercial aviation, space exploration.

- Others: Research & Development, academic institutions, niche specialized applications.

- Form Factor:

- Embedded M-RAM: Integrated directly into SoCs, microcontrollers, and processors.

- Standalone M-RAM: Discrete memory chips, DIMMs, or other modules.

Value Chain Analysis For M-RAM Market

A comprehensive value chain analysis of the M-RAM market reveals a complex ecosystem involving multiple stages, from raw material sourcing to end-user consumption. The upstream segment of the value chain is critical, focusing on the supply of specialized raw materials essential for M-RAM fabrication. This includes high-purity magnetic materials, such as ferromagnetic alloys like CoFeB (Cobalt-Iron-Boron) and rare-earth elements, which are vital for creating the magnetic tunnel junctions (MTJs) that form the core of M-RAM cells. Semiconductor-grade wafers, epitaxy services, and various specialty chemicals and gases are also procured in this stage. Equipment manufacturers play a pivotal role here, providing advanced deposition tools for magnetic layers, lithography systems for patterning, and etching equipment tailored for the nanoscale precision required in M-RAM production. These upstream activities demand significant R&D investment and a high degree of technical expertise to ensure material quality and manufacturing process efficiency, directly impacting the performance and reliability of the final M-RAM product.

Moving further downstream, the value chain encompasses the M-RAM manufacturing process, which involves sophisticated semiconductor foundries and integrated device manufacturers (IDMs). These entities handle the complex fabrication steps, including cleanroom operations, precise material layering, annealing, and testing. After manufacturing, the M-RAM components are integrated into larger systems by original equipment manufacturers (OEMs). These OEMs operate across various sectors such as automotive, industrial, consumer electronics, and enterprise storage, where they design and assemble final products like ADAS modules, IoT gateways, smart devices, and solid-state drives (SSDs) that leverage M-RAM. System integrators also play a crucial role by combining M-RAM components with other hardware and software to create complete solutions for specific applications, particularly in data centers and high-performance computing environments. Their ability to integrate M-RAM effectively into existing architectures is key to unlocking its full potential and driving market adoption.

The distribution channel for M-RAM products varies depending on the form factor and target market. For embedded M-RAM, the primary distribution channel is direct sales from semiconductor manufacturers to large-volume OEM customers who incorporate the memory directly into their chip designs or boards. This often involves close collaboration and custom integration services. For standalone M-RAM chips or modules, the distribution network typically includes a mix of direct sales to major enterprise clients and indirect channels through specialized electronics distributors. These distributors cater to a broader range of smaller and medium-sized enterprises, offering product warehousing, logistics, technical support, and value-added services. The direct channel allows for closer customer relationships and tailored solutions, while the indirect channel provides wider market reach and efficient access for diverse end-users. Both channels are essential for ensuring that M-RAM technology reaches its intended markets effectively, navigating the complexities of global supply chains and diverse customer needs.

M-RAM Market Potential Customers

The M-RAM market targets a broad spectrum of end-users and buyers who require advanced memory solutions that surpass the capabilities of traditional DRAM and NAND flash in specific applications. These potential customers are typically found in industries demanding high performance, robust data integrity, low power consumption, and extended endurance, making M-RAM an attractive alternative. Data center operators and cloud service providers represent a significant customer base, driven by the need for persistent memory for caching, journal logging, and accelerating database operations. M-RAM’s ability to offer near-DRAM speeds with non-volatility provides a critical advantage in reducing latency and improving the overall efficiency and reliability of enterprise storage systems. This group seeks to enhance the performance of their critical infrastructure, minimize data loss during power outages, and optimize total cost of ownership through energy savings and extended component life.

Automotive manufacturers are another key demographic, especially with the rapid evolution of autonomous vehicles and advanced driver-assistance systems (ADAS). Modern cars are essentially sophisticated computers on wheels, requiring robust memory for real-time sensor data processing, AI algorithms, and critical safety features. M-RAM’s high endurance, reliability in extreme temperature environments, and instant-on capabilities make it ideal for storing firmware, mapping data, and critical control parameters that must remain intact regardless of power status. Industrial automation and IoT device manufacturers also represent a substantial customer segment. In industrial settings, PLCs, robotic systems, and smart factory equipment demand memory that can withstand harsh operating conditions, perform frequent write cycles without degradation, and retain data persistently to ensure operational continuity. For IoT devices, M-RAM offers crucial benefits in terms of low power consumption and the ability to enable instant boot-up and data logging in remote or battery-powered applications, extending device lifespan and functionality.

Furthermore, consumer electronics brands are increasingly exploring M-RAM for high-end wearables, smartphones, and other portable devices where power efficiency and instant responsiveness are premium features. The ability to quickly power on and off devices without losing state, coupled with prolonged battery life, provides a competitive edge. The aerospace and defense sector also stands as a significant potential customer, requiring memory solutions that are radiation-hardened, extremely reliable, and capable of operating in demanding environments for mission-critical applications. As M-RAM technology matures and its cost-effectiveness improves, its adoption is expected to broaden across these and other niche markets, including medical devices for portable and implantable electronics, where data integrity and energy efficiency are non-negotiable requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $620 Million |

| Market Forecast in 2032 | $3.8 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Everspin Technologies, Samsung Electronics, TSMC, Avalanche Technology, NXP Semiconductors, Crocus Technology, Honeywell International, Toshiba Corporation, Qualcomm Incorporated, Intel Corporation, Spin Memory Inc., Micron Technology, SK Hynix, IBM, Fujitsu, Renesas Electronics Corporation, GlobalFoundries, Analog Devices, STMicroelectronics, Applied Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

M-RAM Market Key Technology Landscape

The M-RAM market is characterized by a sophisticated and rapidly evolving technology landscape, where continuous innovation in material science, device physics, and manufacturing processes is paramount. At the core of M-RAM technology lies the magnetic tunnel junction (MTJ), a fundamental component whose performance dictates the memory cell's characteristics. Advancements in MTJ design, particularly the development of perpendicular magnetic anisotropy (PMA), have been crucial in enabling higher density, improved thermal stability, and reduced switching currents. PMA allows for a more compact cell structure compared to in-plane anisotropy, directly contributing to increased bit density and scalability, which are critical for M-RAM to compete with other mainstream memory technologies. Furthermore, research into novel magnetic materials, such as different ferromagnetic alloys and barrier oxides (e.g., MgO), continues to enhance MTJ performance, improving spin-transfer efficiency and reducing variability in device characteristics.

Beyond the fundamental MTJ structure, the M-RAM technology landscape is significantly shaped by the various switching mechanisms employed to write data. Spin-Transfer Torque M-RAM (STT-MRAM) has emerged as the dominant technology, utilizing the spin angular momentum of electrons to switch the magnetic orientation of the free layer in the MTJ. This method offers high speed, low power consumption, and good scalability, making it suitable for both embedded and standalone applications. However, STT-MRAM still faces challenges regarding write latency and endurance at very high densities. To address these limitations, Spin-Orbit Torque M-RAM (SOT-MRAM) is gaining considerable attention as a next-generation technology. SOT-MRAM separates the read and write paths, using a spin-Hall effect in a heavy metal layer to generate a spin current that switches the MTJ. This promises even faster write speeds, significantly improved endurance, and reduced power consumption, positioning SOT-MRAM for high-performance computing, AI accelerators, and high-frequency applications. The continued refinement of these switching mechanisms is vital for M-RAM's competitive edge.

Fabrication technologies and integration techniques are also central to the M-RAM market's technological evolution. The ability to integrate M-RAM seamlessly into existing CMOS (Complementary Metal-Oxide-Semiconductor) manufacturing processes is a key enabler for widespread adoption, especially for embedded M-RAM. Foundries like TSMC, Samsung, and GlobalFoundries are investing heavily in developing advanced process nodes (e.g., 28nm, 22nm, 14nm) that support M-RAM integration, often leveraging techniques like back-end-of-line (BEOL) processing to stack M-RAM layers above existing logic circuits. This co-integration reduces latency, power, and area, making M-RAM an attractive option for System-on-Chip (SoC) designs. Further advancements in lithography, etching, and annealing processes are continuously sought to improve yield, reduce defect rates, and scale M-RAM to even smaller feature sizes. The interplay between material science, device physics, and advanced manufacturing capabilities defines the current and future potential of the M-RAM market, promising increasingly robust, higher-density, and more energy-efficient non-volatile memory solutions for a wide range of applications.

Regional Highlights

- North America: This region stands as a significant hub for M-RAM innovation and adoption, driven by robust investments in research and development, particularly in data center technologies, high-performance computing, and aerospace and defense sectors. The presence of major semiconductor companies and strong demand for persistent memory in AI and cloud computing applications fuel market growth. Early adoption in automotive electronics and specialized industrial solutions also contributes to its market share.

- Europe: Europe showcases strong potential, especially in the automotive, industrial automation, and medical device sectors. Countries like Germany, France, and the UK are leading in advanced manufacturing and smart factory initiatives, where M-RAM's robustness and non-volatility are highly valued. European research institutions are actively contributing to M-RAM advancements, fostering innovation in niche high-reliability applications.

- Asia Pacific (APAC): APAC is the dominant force in the global M-RAM market, primarily due to its extensive semiconductor manufacturing capabilities and the high concentration of consumer electronics, automotive, and industrial IoT production hubs. Countries such as South Korea, Japan, China, and Taiwan are at the forefront of M-RAM production and adoption, driven by large domestic markets and strong export-oriented industries. The region also sees significant demand from burgeoning data centers and burgeoning AI development.

- Latin America: While currently a smaller market, Latin America is an emerging region with growing industrialization and increasing investment in IT infrastructure and telecommunications. As local manufacturing capabilities expand and digital transformation initiatives gain momentum, the demand for advanced, reliable memory solutions like M-RAM is expected to grow, particularly in sectors such as automotive assembly and industrial IoT.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the M-RAM market, largely influenced by rising investments in smart city projects, digitalization efforts, and the expansion of data centers and cloud services. As countries diversify their economies and enhance their technological infrastructure, the need for robust and efficient memory solutions in industrial, telecommunications, and emerging AI applications will drive M-RAM adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the M-RAM Market.- Everspin Technologies

- Samsung Electronics

- TSMC

- Avalanche Technology

- NXP Semiconductors

- Crocus Technology

- Honeywell International

- Toshiba Corporation

- Qualcomm Incorporated

- Intel Corporation

- Spin Memory Inc.

- Micron Technology

- SK Hynix

- IBM

- Fujitsu

- Renesas Electronics Corporation

- GlobalFoundries

- Analog Devices

- STMicroelectronics

- Applied Materials

Frequently Asked Questions

What is M-RAM and how does it work?

M-RAM (Magnetoresistive Random-Access Memory) is a type of non-volatile RAM that stores data using magnetic elements instead of electric charges. It works by detecting changes in the electrical resistance of a magnetic tunnel junction (MTJ), which varies depending on the magnetic orientation of two ferromagnetic layers. This allows M-RAM to retain data even when power is turned off, offering persistent storage with high speed.

What are the key advantages of M-RAM over other memory technologies?

M-RAM offers several significant advantages: it is non-volatile, meaning it retains data without continuous power; it provides high read/write speeds comparable to SRAM; it boasts exceptional endurance, supporting a virtually unlimited number of write cycles unlike NAND flash; and it consumes very low power, especially in standby mode. These attributes make it ideal for applications demanding reliability, speed, and energy efficiency.

Where is M-RAM primarily used today?

Today, M-RAM finds primary applications in enterprise storage (e.g., non-volatile cache), industrial automation (e.g., PLCs), automotive electronics (e.g., ADAS, infotainment), and a growing number of IoT devices requiring persistent and low-power memory. Its robust nature also makes it suitable for aerospace and defense, and it is increasingly being embedded into microcontrollers for various high-performance, low-power systems.

What are the future prospects for M-RAM?

The future prospects for M-RAM are very strong, driven by its potential to become a universal memory. Expected advancements include higher densities, reduced manufacturing costs, and faster switching mechanisms (like SOT-MRAM). It is poised for broader adoption in AI and machine learning, neuromorphic computing, and as a storage-class memory, bridging the performance gap between DRAM and NAND flash. Continued integration into SoCs will also expand its market reach.

How does M-RAM address challenges in AI and edge computing?

In AI and edge computing, M-RAM addresses critical challenges by providing fast, non-volatile, and low-power memory. It enables instant-on functionality for edge AI devices, stores large AI models persistently, and supports high-endurance write operations crucial for frequent model updates. Furthermore, its potential for in-memory computing can significantly reduce data transfer bottlenecks, enhancing the speed and energy efficiency of AI inference directly at the device level.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager