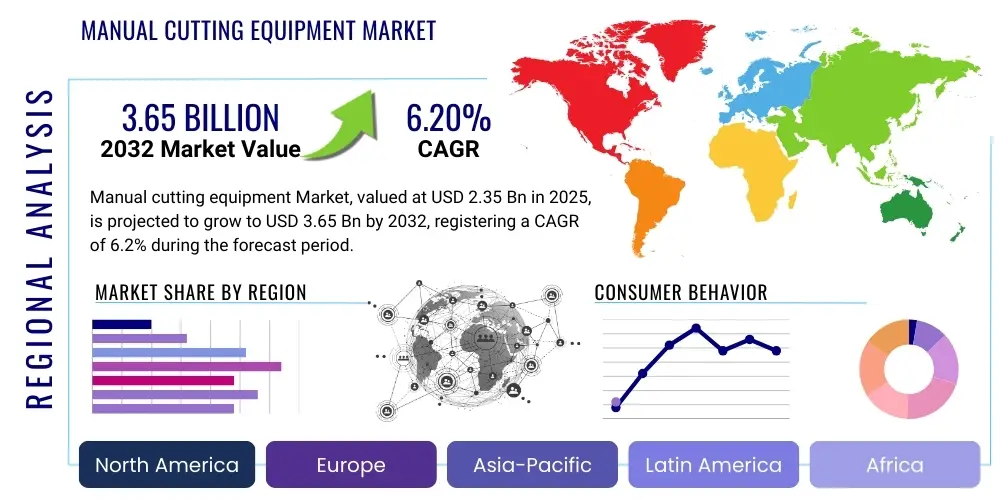

Manual cutting equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427797 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Manual cutting equipment Market Size

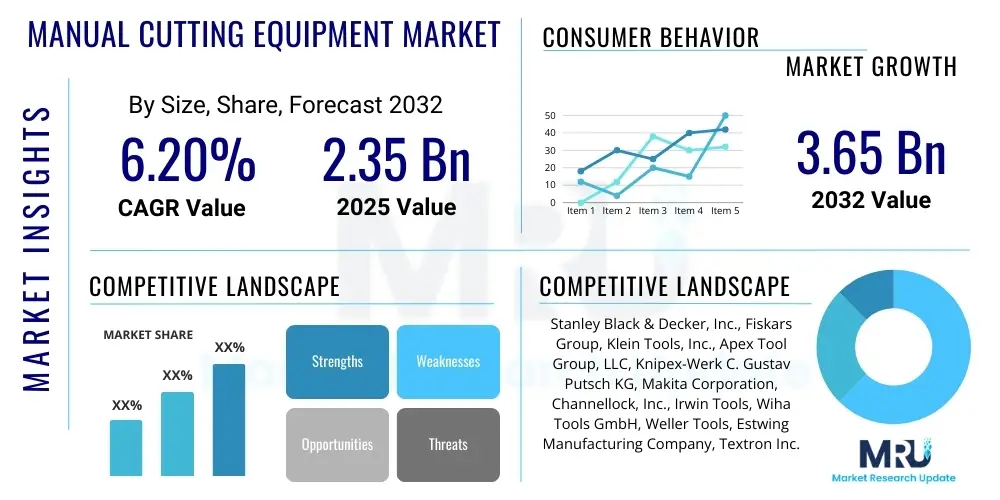

The Manual cutting equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 2.35 Billion in 2025 and is projected to reach USD 3.65 Billion by the end of the forecast period in 2032.

Manual cutting equipment Market introduction

The manual cutting equipment market encompasses a broad range of hand-held tools designed for precise material severance across various industries and consumer applications. These essential tools facilitate tasks requiring accuracy, portability, and independence from power sources, making them indispensable in scenarios ranging from intricate craftwork to heavy-duty construction. The market is characterized by a diverse product portfolio, including scissors, knives, shears, and specialized cutters, each engineered for specific materials and cutting requirements.

The core product description revolves around unpowered, hand-operated devices utilizing sharp blades or cutting edges to separate materials. Major applications span industrial manufacturing, construction, automotive repair, textile production, packaging, and an expansive DIY and craft segment. The primary benefits of manual cutting equipment include cost-effectiveness, ease of use, high portability, and the ability to perform fine, controlled cuts where automated machinery may be impractical or overkill. Driving factors for market growth include the global expansion of construction and infrastructure projects, increasing participation in DIY and craft activities, and the persistent demand for specialized tools in professional trades.

Manual cutting equipment Market Executive Summary

The manual cutting equipment market is experiencing steady growth, driven by sustained demand across industrial, construction, and consumer sectors. Key business trends indicate a focus on ergonomic design, enhanced material durability, and the development of specialized tools to meet niche application requirements. Companies are investing in research and development to improve user comfort, cutting efficiency, and safety features, thereby extending the utility and appeal of their product lines. Strategic partnerships and targeted marketing efforts are also prevalent, aiming to capture market share in both professional and DIY segments.

Regional trends highlight robust growth in emerging economies, particularly in Asia Pacific, propelled by rapid industrialization, urbanization, and expanding manufacturing bases. Established markets in North America and Europe demonstrate stable demand, characterized by a preference for high-quality, professional-grade tools and a thriving DIY culture. Segment trends indicate a rising demand for specialized cutting tools tailored for new materials and complex tasks, alongside continued strong performance from general-purpose equipment. The market also observes an increasing penetration of online retail channels, offering consumers broader access to diverse product offerings and competitive pricing.

AI Impact Analysis on Manual cutting equipment Market

User questions regarding AIs impact on manual cutting equipment often center on potential displacement by automation, enhancements to tool design, and improvements in related processes. While AI is unlikely to directly operate or replace manual cutting tools in the traditional sense, its influence is significant in optimizing upstream and downstream activities. Users are keen to understand how AI can lead to smarter material usage, more precise cutting guidelines, and ultimately, better outcomes when manual tools are employed. The prevailing sentiment is that AI will augment, rather than diminish, the utility of manual cutting equipment, particularly by improving efficiency, training, and design.

The integration of AI technologies will primarily manifest through indirect mechanisms that enhance the value proposition of manual cutting. This includes AI-driven analytics for predicting demand, optimizing supply chains, and improving manufacturing processes of the tools themselves. Furthermore, AI can contribute to the development of more ergonomic and performance-optimized tool designs, using simulations and data analysis to refine blade geometries and handle ergonomics. For end-users, AI-powered design software can offer optimized cutting patterns to minimize material waste, or provide augmented reality guidance for precise manual cuts, making complex tasks more accessible and accurate.

- AI optimizes manufacturing processes for manual tools, improving production efficiency and quality control.

- AI-driven design software enhances tool ergonomics and blade geometry, leading to more efficient and comfortable manual cutting.

- AI analytics facilitate demand forecasting and supply chain optimization, ensuring better product availability and inventory management.

- AI-powered vision systems can guide users for precision cutting, augmenting the accuracy of manual operations.

- AI assists in developing smart training modules for manual cutting techniques, enhancing user skill and safety.

- AI-driven material optimization algorithms reduce waste by providing optimal cutting layouts for manual execution.

DRO & Impact Forces Of Manual cutting equipment Market

The manual cutting equipment market is shaped by a complex interplay of drivers, restraints, opportunities, and competitive forces. Key drivers include the sustained growth in global construction and infrastructure development, which necessitates a wide array of cutting tools for various materials and tasks. The burgeoning DIY and home improvement sectors, coupled with the expansion of craft and hobby industries, also significantly bolster demand. Furthermore, the inherent cost-effectiveness, portability, and independence from power sources make manual cutting equipment a preferred choice for many applications, especially in remote areas or for intricate work where precision is paramount.

However, the market faces several restraints, most notably the increasing adoption of automated cutting solutions such as laser cutters, CNC machines, and robotic arms in large-scale industrial settings. These advanced technologies offer higher precision, speed, and consistency, potentially reducing the demand for manual tools in specific manufacturing processes. Safety concerns associated with sharp tools and the physical exertion required for prolonged manual cutting tasks also act as deterrents. Opportunities abound in product innovation, focusing on ergonomic designs, durable materials, and specialized tools for emerging applications. Advancements in material science for blade composition and handle manufacturing can significantly enhance product performance and user safety, opening new market avenues. Additionally, expanding into underserved regional markets and developing tools for sustainable practices present significant growth prospects.

The impact forces within the market are characterized by moderate buyer bargaining power, as numerous suppliers offer a wide range of products across different price points, allowing buyers to select based on quality, cost, and brand reputation. Supplier bargaining power is relatively low due to the availability of raw materials and component manufacturers. The threat of new entrants is moderate, with barriers including brand loyalty, established distribution networks, and the need for manufacturing expertise. The threat of substitutes, primarily from automated cutting technologies, is high in industrial contexts but lower in consumer and craft segments. Competitive rivalry among existing players is intense, driving continuous innovation and aggressive marketing strategies.

Segmentation Analysis

The manual cutting equipment market is highly diverse, categorized into several key segments based on product type, material cut, application or end-user, and distribution channel. This segmentation allows for a granular understanding of market dynamics, consumer preferences, and specialized industrial requirements, facilitating targeted product development and marketing strategies. The breadth of manual cutting tools, from simple household scissors to highly specialized industrial shears, underscores the importance of a detailed segmentation analysis to capture the varied demand drivers within the market.

Understanding these segments is crucial for manufacturers to identify lucrative niches and for distributors to optimize their product portfolios. For instance, the professional segment demands tools with superior durability and precision, while the DIY segment prioritizes ease of use and affordability. Similarly, different materials require distinct blade designs and leverage mechanisms, leading to a proliferation of specialized tools. The rise of e-commerce has also significantly impacted distribution, creating new opportunities for direct-to-consumer sales and expanding market reach for specialized products.

- By Product Type: Knives (utility knives, craft knives, precision knives), Shears (household shears, industrial shears, textile shears), Scissors (general purpose, craft, office), Snips (tin snips, aviation snips), Saws (hand saws, coping saws), Wire Cutters, Bolt Cutters, Pipe Cutters, Glass Cutters, Specialized Cutters (e.g., for plastic, rubber).

- By Material Cut: Paper and Cardboard, Fabric and Textiles, Plastics and Composites, Metals (sheet metal, wire, pipes), Wood, Rubber, Leather, Foam.

- By Application/End-User: Industrial (manufacturing, automotive, aerospace), Construction and Trades (plumbers, electricians, carpenters), DIY and Home Improvement, Arts and Crafts, Packaging, Healthcare, Office and Stationery.

- By Distribution Channel: Retail Stores (hardware stores, department stores, craft stores), Online Retailers (e-commerce platforms, brand websites), Wholesalers and Distributors, Direct Sales to Businesses.

Manual cutting equipment Market Value Chain Analysis

The value chain for manual cutting equipment begins with comprehensive upstream analysis, encompassing the procurement of essential raw materials and specialized components. This stage involves suppliers of high-grade steel (e.g., carbon steel, stainless steel, alloy steel) for blades, various plastics and rubbers for handles, and other materials like ceramics or composites for advanced applications. Key activities include material sourcing, quality control, and initial processing of these raw components. Efficient supplier relationships and robust raw material quality are critical for the durability and performance of the final products. Component manufacturers provide specialized parts such as springs, rivets, and locking mechanisms, which are integral to the tools functionality.

The manufacturing phase is central to the value chain, where raw materials are transformed into finished cutting equipment through processes such as forging, stamping, grinding, heat treatment, and precision assembly. This stage demands specialized machinery, skilled labor, and stringent quality assurance to ensure product consistency, blade sharpness, and ergonomic design. Manufacturers focus on optimizing production efficiency, minimizing waste, and adhering to safety standards. Branding, packaging, and product testing are also vital parts of this phase to prepare products for market distribution. Innovation in manufacturing techniques, such as laser-hardening or advanced coating applications, contributes significantly to product differentiation and competitive advantage.

Downstream analysis covers the distribution channels and subsequent sales to end-users. This involves a complex network of wholesalers, retailers, and e-commerce platforms that facilitate the movement of products from manufacturers to consumers. Distribution channels can be broadly categorized into direct and indirect methods. Direct channels involve manufacturers selling directly to large industrial clients, professional trade organizations, or via their own brand websites. Indirect channels, which form the bulk of the market, include sales through hardware stores, home improvement centers, specialized craft stores, general merchandise retailers, and a rapidly expanding array of online marketplaces. Effective logistics, inventory management, and robust marketing strategies are paramount at this stage to ensure product availability, visibility, and market penetration, ultimately connecting the product with its diverse range of end-users.

Manual cutting equipment Market Potential Customers

The manual cutting equipment market serves a vast and varied customer base, spanning across professional trades, industrial sectors, and consumer segments. Understanding these diverse end-users and buyers is crucial for manufacturers and distributors to tailor their product offerings and marketing efforts effectively. Potential customers are individuals and organizations requiring precision, portability, and reliability in their cutting tasks, often preferring the control and flexibility that manual tools provide over automated solutions in specific contexts. This broad appeal ensures a consistent demand across multiple economic sectors.

Key segments of potential customers include skilled tradespeople such as electricians, plumbers, carpenters, and mechanics who rely on specialized manual cutters for daily tasks in construction, installation, and repair. Industrial manufacturers, particularly in automotive, aerospace, and electronics, utilize manual tools for prototyping, finishing, and precise assembly operations. The expanding DIY and home improvement community represents a significant consumer segment, alongside a robust market of artists, crafters, and hobbyists who require detailed and versatile cutting instruments for their creative endeavors. Moreover, offices, educational institutions, and healthcare facilities frequently use general-purpose manual cutting equipment for administrative and operational needs, highlighting the ubiquitous presence of these tools across virtually all facets of modern life.

Manual cutting equipment Market Key Technology Landscape

The key technology landscape within the manual cutting equipment market is continuously evolving, driven by advancements in material science, ergonomic design principles, and precision manufacturing techniques. While fundamentally simple, the effectiveness and user experience of manual cutting tools are profoundly influenced by the sophistication of the materials used for blades and handles, as well as the engineering behind their mechanical operation. Manufacturers are increasingly leveraging cutting-edge technologies to enhance durability, sharpness retention, safety, and user comfort, ensuring that manual tools remain competitive and efficient in various applications. This focus on technological refinement allows for the development of highly specialized tools capable of handling modern materials and demanding tasks.

Material science plays a pivotal role, with innovations in blade composition being a primary area of development. This includes the use of high-carbon stainless steels, tool steels, ceramic composites, and carbide inserts, often enhanced with advanced coatings like titanium nitride or diamond-like carbon (DLC) for superior hardness, corrosion resistance, and extended edge retention. For handles, ergonomic design is paramount, integrating advanced polymers, rubberized grips, and sometimes composite materials to provide comfortable, anti-slip, and fatigue-reducing user interfaces. Mechanical technologies focus on leverage systems, spring-loaded mechanisms, and robust locking systems to improve cutting power, ease of use, and operational safety, particularly for heavier-duty tools.

Precision manufacturing techniques, such as CNC grinding, laser hardening, and advanced casting methods, are essential for achieving the tight tolerances required for optimal blade geometry, consistent sharpness, and reliable tool assembly. These technologies ensure that blades are perfectly aligned and sharpened to exact specifications, contributing directly to cutting efficiency and accuracy. Furthermore, ongoing research into material fatigue and stress analysis informs design improvements that extend the lifespan of tools. The integration of advanced safety features, like retractable blades, secure locking mechanisms, and blade guards, also reflects a technological commitment to user protection, making modern manual cutting equipment not only more effective but also safer to operate.

Regional Highlights

- North America: A mature market characterized by high consumer spending on DIY and home improvement projects, alongside robust demand from construction and industrial sectors. Key countries like the United States and Canada exhibit a strong preference for durable, high-quality, and ergonomically designed tools, with significant penetration of established international brands and a growing e-commerce presence.

- Europe: A stable and sophisticated market, with Germany, the UK, and France leading in demand for professional-grade and specialized manual cutting equipment. The regions emphasis on stringent safety standards and high-quality craftsmanship drives innovation in material science and ergonomic design. A strong heritage in various trades ensures consistent demand from professional users.

- Asia Pacific: The fastest-growing regional market, propelled by rapid industrialization, burgeoning construction activities, and increasing disposable incomes in countries such as China, India, Japan, and South Korea. This region is a major manufacturing hub for manual cutting equipment and also a significant consumer, driven by both professional and rapidly expanding DIY segments. Infrastructure development and urbanization are key drivers.

- Latin America: An emerging market with significant growth potential, driven by expanding construction sectors and increasing industrial activity in Brazil, Mexico, and Argentina. The demand is characterized by a mix of affordability and growing preference for quality tools, as economic conditions improve and local manufacturing capabilities develop.

- Middle East & Africa: These regions represent developing markets for manual cutting equipment, primarily driven by investments in infrastructure projects, real estate development, and a nascent but growing industrial base. Countries like Saudi Arabia, UAE, and South Africa are key markets, with demand influenced by both local construction booms and international trade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual cutting equipment Market.- Stanley Black & Decker, Inc.

- Fiskars Group

- Klein Tools, Inc.

- Apex Tool Group, LLC

- Knipex-Werk C. Gustav Putsch KG

- Makita Corporation

- Channellock, Inc.

- Irwin Tools (S.P. Richards Company)

- Wiha Tools GmbH

- Weller Tools (Apex Tool Group)

- Estwing Manufacturing Company

- Textron Inc. (Greenlee Textron)

- L.S. Starrett Company

Frequently Asked Questions

What are the primary applications of manual cutting equipment?

Manual cutting equipment finds primary applications across diverse sectors including construction, industrial manufacturing (e.g., prototyping, finishing), automotive repair, textile production, and packaging. Additionally, it is extensively used in household tasks, DIY projects, and various arts and crafts activities, offering precision and portability for a wide array of materials.

How is the manual cutting equipment market growing?

The manual cutting equipment market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. This growth is driven by sustained demand from construction and industrial sectors, the increasing popularity of DIY activities, and innovations in tool design focusing on ergonomics and material durability.

What factors are driving the demand for manual cutting tools?

Key drivers include global growth in construction and infrastructure development, the expanding popularity of DIY and craft activities, the inherent cost-effectiveness and portability of manual tools, and the continued need for precision in various professional trades and industrial applications where automated solutions are not feasible.

How does AI impact the manual cutting equipment industry?

AI indirectly impacts the manual cutting equipment industry by optimizing manufacturing processes, enhancing tool design through data analysis, and improving supply chain efficiency. While AI does not operate manual tools, it can provide augmented guidance for users, optimize material usage patterns, and improve training for precise manual cutting techniques.

What are the key types of manual cutting tools?

The key types of manual cutting tools include knives (utility, craft, precision), shears (household, industrial, textile), scissors, snips (tin, aviation), saws (hand, coping), wire cutters, bolt cutters, pipe cutters, and glass cutters. These tools are specialized for cutting various materials such as paper, fabric, plastic, metal, wood, and rubber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager