Marine Steering System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427912 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Marine Steering System Market Size

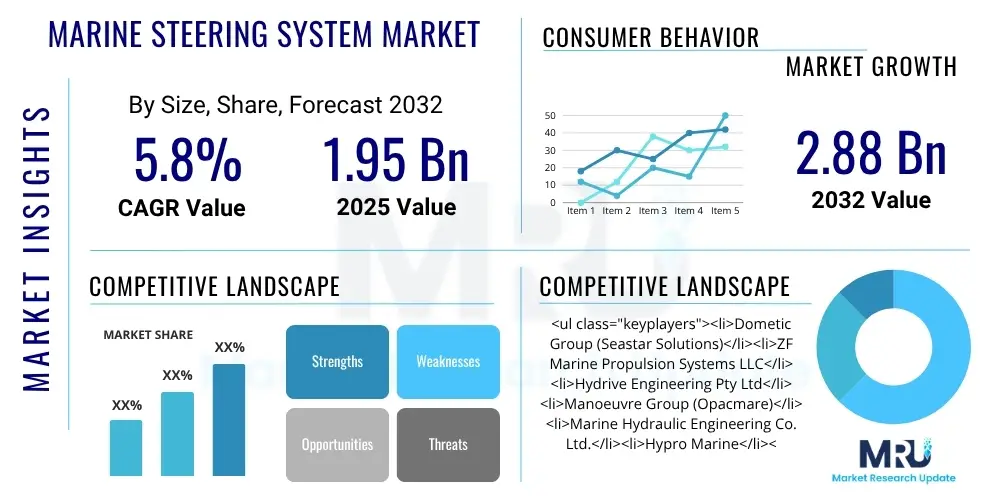

The Marine Steering System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.95 Billion in 2025 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2032.

Marine Steering System Market introduction

The marine steering system market encompasses a wide array of products and technologies crucial for the precise navigation and control of vessels across various applications. These systems are fundamental components ensuring the safety, efficiency, and maneuverability of marine craft, ranging from small recreational boats to massive commercial ships and sophisticated naval vessels. The core function of a marine steering system is to transmit the operator's input from the helm to the rudder or propulsion units, enabling directional changes. This market is driven by continuous innovation aimed at enhancing responsiveness, reducing operator fatigue, and improving overall vessel performance, alongside stringent maritime safety regulations that necessitate reliable and advanced steering solutions. As global maritime trade expands and recreational boating activities increase, the demand for robust and technologically advanced steering systems continues to escalate, pushing manufacturers to develop more integrated and intelligent offerings.

Products within this market segment are diverse, spanning mechanical cable steering, hydraulic steering, electro-hydraulic steering, and fully electric steering systems. Mechanical systems, typically found in smaller boats, rely on cables and pulleys, offering simplicity and cost-effectiveness. Hydraulic systems, dominant in a broad range of vessels, utilize fluid pressure for power assistance, significantly reducing steering effort. Electro-hydraulic systems integrate electronic controls with hydraulic power, providing enhanced precision and control, often with features like auto-pilot integration. The most advanced, fully electric steering systems, are gaining traction for their efficiency, reduced maintenance, and seamless integration with modern vessel management systems, offering a cleaner and quieter operation. These systems are designed to withstand harsh marine environments, ensuring durability and consistent performance under extreme conditions, which is paramount for maritime safety and operational continuity.

Major applications for marine steering systems are found across commercial shipping, recreational boating, and naval defense sectors. In commercial shipping, these systems are vital for tankers, cargo ships, and container vessels, where precise navigation and reliable control are critical for docking, navigating congested waterways, and long-distance voyages. For recreational boating, steering systems contribute significantly to the user experience, offering ease of handling and comfort for yachts, sportfishing boats, and personal watercraft. Naval vessels demand highly reliable, often redundant, and responsive steering systems for mission-critical operations, tactical maneuvers, and enhanced survivability. The benefits derived from these systems are manifold: enhanced maneuverability, significant reduction in operator fatigue, improved safety through responsive control, and optimized fuel consumption due to more precise course keeping. Driving factors include the increasing global seaborne trade, growth in recreational water sports, rising defense budgets, and the continuous push for automation and smart vessel technologies, all contributing to a vibrant and expanding market.

Marine Steering System Market Executive Summary

The Marine Steering System Market is experiencing dynamic shifts, characterized by evolving business trends, distinct regional growth patterns, and technological advancements across various segments. From a business perspective, the market is witnessing a strong emphasis on integration and digitalization. Manufacturers are increasingly focusing on developing holistic solutions that seamlessly integrate steering systems with other vessel control and navigation technologies, such as autopilots, dynamic positioning systems, and engine management units. There is a growing demand for 'plug-and-play' solutions that simplify installation and maintenance, coupled with a push towards modular designs that allow for easier customization and upgrades. Furthermore, after-sales services, including maintenance, repair, and spare parts supply, are becoming crucial differentiators, driving revenue growth for key players. The competitive landscape is marked by both established giants leveraging their extensive portfolios and emerging innovators introducing disruptive technologies, particularly in electric and smart steering solutions. Investment in research and development remains a cornerstone, aimed at enhancing system reliability, energy efficiency, and operational safety, aligning with the industry's broader goals of sustainability and autonomy.

Regional trends significantly influence the market's trajectory, with Asia Pacific emerging as the largest and fastest-growing region, primarily due to its robust shipbuilding industry. Countries like China, South Korea, and Japan are global leaders in commercial vessel construction, generating substantial demand for marine steering systems. This region is also seeing increasing investment in naval modernization programs and a burgeoning recreational boating market, further fueling growth. Europe, while a mature market, remains a hub for technological innovation, especially in advanced electro-hydraulic and electric steering systems, driven by stringent environmental regulations and a strong luxury yacht segment. North America demonstrates consistent demand, largely propelled by its extensive recreational boating culture and a stable commercial shipping sector. Latin America, the Middle East, and Africa represent emerging markets with significant potential, driven by infrastructure development, expanding oil and gas exploration activities, and increasing maritime trade, though growth in these regions can be more volatile due to economic and political factors.

Segment trends highlight a clear progression towards more advanced and automated steering solutions. While traditional hydraulic steering systems still dominate due to their proven reliability and cost-effectiveness, the electro-hydraulic and fully electric segments are experiencing accelerated growth. This shift is driven by the desire for improved fuel efficiency, reduced emissions, lower noise levels, and enhanced integration capabilities with advanced navigation electronics. The commercial shipping application segment continues to represent the largest market share, but the recreational boating segment is showing significant dynamism, with increased demand for comfort, ease of use, and premium features. Within components, power packs, helm pumps, and cylinders remain critical, but the increasing sophistication of electronic control units and sensors reflects the broader trend towards smarter, more autonomous vessel operations. Manufacturers are adapting their portfolios to cater to these evolving preferences, offering a spectrum of solutions that balance performance, cost, and technological sophistication, ensuring comprehensive market coverage.

AI Impact Analysis on Marine Steering System Market

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in the marine steering system market, particularly concerning enhanced precision, automation, predictive capabilities, and overall safety. There is a pervasive expectation that AI will usher in a new era of smarter, more responsive, and more autonomous vessel navigation, fundamentally altering how ships are controlled. Common questions revolve around how AI can optimize steering maneuvers for fuel efficiency, its role in enabling fully autonomous vessels, the accuracy of AI-driven predictive maintenance for steering components, and the potential for AI to mitigate human error in challenging maritime conditions. Concerns often accompany these questions, focusing on cybersecurity vulnerabilities in AI-integrated systems, the reliability of AI algorithms in unforeseen scenarios, the regulatory frameworks required for AI-driven maritime operations, and the ethical implications of delegating critical control functions to machines. These discussions underscore a clear demand for robust, secure, and transparent AI solutions that deliver tangible operational benefits while addressing inherent risks, showcasing a blend of optimism and cautious inquiry from industry stakeholders.

AI's influence on marine steering systems is poised to be profound, particularly through the advent of adaptive steering algorithms. These algorithms can learn from environmental conditions, vessel dynamics, and historical data to continuously optimize rudder movements, leading to significant improvements in course-keeping accuracy and fuel efficiency. By dynamically adjusting steering parameters in real-time, AI can minimize unnecessary rudder actions, reducing drag and thereby lowering fuel consumption and greenhouse gas emissions. This capability is especially critical for long voyages and in varying sea states, where traditional systems might struggle to maintain optimal performance. Beyond adaptive control, AI is also instrumental in enabling advanced decision support systems for human operators, providing proactive recommendations for steering adjustments, route optimization, and collision avoidance based on complex data analysis. Such systems empower crews with enhanced situational awareness and predictive insights, significantly contributing to safer and more efficient maritime operations, bridging the gap between human expertise and computational power.

Furthermore, AI is rapidly advancing the field of predictive maintenance for marine steering systems. By continuously monitoring a multitude of operational parameters, such as hydraulic pressure, motor current, temperature, and vibration levels, AI-driven analytics can detect subtle anomalies and predict potential component failures long before they manifest as critical issues. This proactive approach allows for scheduled maintenance interventions during planned downtimes, avoiding costly unplanned repairs, reducing vessel downtime, and extending the operational lifespan of steering equipment. In the realm of autonomous navigation, AI serves as the brain of self-steering systems, interpreting sensor data from radar, LiDAR, cameras, and GPS to perceive the vessel's surroundings, plan optimal trajectories, and execute precise steering commands without human intervention. This foundational role in autonomous vessels promises to revolutionize maritime transport by enhancing safety, efficiency, and potentially opening new avenues for unmanned shipping, although significant regulatory and technological hurdles remain. The integration of AI also bolsters cybersecurity measures by identifying and responding to potential threats within the steering control network, ensuring the integrity and security of critical navigation systems.

- AI-driven adaptive steering for enhanced fuel efficiency and course accuracy.

- Predictive maintenance through machine learning to prevent system failures and reduce downtime.

- Enabling capabilities for autonomous and semi-autonomous vessel navigation.

- Improved decision support systems for human operators, enhancing situational awareness.

- Optimized route planning and collision avoidance through advanced data analysis.

- Enhanced safety through reduced human error and proactive risk assessment.

- Integration with vessel management systems for holistic operational control.

- Development of self-calibrating and self-diagnosing steering components.

- Potential for energy regeneration in electric steering systems using AI.

- Facilitation of remote control and monitoring capabilities with intelligent algorithms.

DRO & Impact Forces Of Marine Steering System Market

The Marine Steering System Market is profoundly shaped by a confluence of drivers, restraints, and opportunities, alongside significant impact forces that dictate its growth trajectory and competitive landscape. Key drivers propelling market expansion include the consistent growth in global seaborne trade, which necessitates an increasing number of commercial vessels, each requiring reliable and efficient steering mechanisms. Simultaneously, the expanding global leisure and recreational boating industry fuels demand for comfortable and easy-to-operate steering systems in yachts, motorboats, and personal watercraft. Technological advancements, particularly in automation, digitalization, and electric propulsion systems, are creating a strong impetus for upgrading existing fleets and equipping new vessels with more sophisticated, integrated, and energy-efficient steering solutions. Furthermore, stringent international maritime regulations concerning safety, emissions, and operational efficiency compel vessel operators to invest in modern steering technologies that comply with these standards, thereby reducing environmental impact and enhancing crew safety. The increasing focus on autonomous shipping initiatives also represents a significant long-term driver, requiring highly advanced and fail-safe steering systems capable of operating without human intervention.

Despite these robust drivers, the market faces several significant restraints. The high initial cost associated with advanced marine steering systems, especially electro-hydraulic and fully electric variants, can be a barrier to adoption for smaller vessel owners or those with limited capital budgets. The complexity of integrating these advanced systems with existing vessel infrastructure and other navigation electronics can also pose a challenge, requiring specialized expertise and significant installation time. Moreover, regulatory hurdles, particularly concerning the certification and acceptance of new, highly automated or autonomous steering technologies, can slow down market penetration as authorities cautiously evaluate their safety and reliability. Cybersecurity concerns are another emerging restraint; as steering systems become more connected and digitized, they become potential targets for cyberattacks, which could have catastrophic consequences. The availability of skilled technicians for the installation, maintenance, and repair of sophisticated steering systems is also a limiting factor, particularly in developing regions, impacting widespread adoption and efficient operation.

Opportunities within the marine steering system market are substantial and multifaceted. The vast existing global fleet presents a significant opportunity for retrofitting, where older mechanical or basic hydraulic systems can be upgraded to more modern, efficient, and technologically advanced steering solutions, enhancing performance and regulatory compliance. Emerging markets in Asia Pacific, Latin America, and Africa, characterized by expanding maritime trade routes, growing shipbuilding industries, and increasing disposable incomes for recreational activities, offer fertile ground for market expansion. The development of eco-friendly and energy-efficient steering systems, such as those integrated with electric propulsion and smart energy management, aligns with global sustainability goals and presents a strong growth avenue. Furthermore, the burgeoning segment of autonomous and remotely operated vessels opens up completely new possibilities for steering system manufacturers to innovate and provide cutting-edge solutions tailored to these future-forward applications. Collaborations between technology providers, shipyards, and marine electronics companies to develop integrated smart vessel platforms also represent a significant opportunity to drive innovation and create comprehensive solutions. The continuous evolution of sensor technology and data analytics also provides avenues for more precise control and predictive maintenance features.

Segmentation Analysis

The marine steering system market is extensively segmented based on various critical attributes, including type, application, component, and vessel type. This detailed segmentation provides a comprehensive view of the diverse needs and technological preferences across the global maritime industry. Each segment represents distinct market dynamics, driven by specific operational requirements, regulatory environments, and economic considerations. Understanding these segments is crucial for market participants to tailor their product offerings, develop targeted marketing strategies, and identify niche growth opportunities. The market's complexity arises from the wide range of vessel sizes, operational environments, and technological sophistication demanded by different end-users, necessitating a broad portfolio of steering solutions that can cater to both basic and advanced control needs. This multi-dimensional segmentation allows for a granular analysis of market trends and forecasts, highlighting areas of high growth and potential stagnation.

By dissecting the market along these lines, it becomes evident that certain segments exhibit higher growth potential due to prevailing industry trends. For instance, the shift towards larger, more efficient commercial vessels and the increasing adoption of luxury yachts drives demand for sophisticated electro-hydraulic and electric steering systems. Similarly, the growing emphasis on environmental sustainability and fuel efficiency across all vessel types is accelerating the adoption of advanced systems that offer precise control and reduced energy consumption. The aftermarket for components also represents a significant segment, driven by the need for maintenance, repairs, and upgrades of existing steering systems throughout their operational lifespan. Moreover, the integration of steering systems with broader vessel automation and navigation suites is a growing trend, impacting the component segment with increased demand for sophisticated electronic control units and sensors that facilitate seamless communication and data exchange across various onboard systems.

- Type

- Manual Steering System

- Hydraulic Steering System

- Electro-Hydraulic Steering System

- Electric Steering System

- Application

- Commercial Vessels

- Recreational Vessels

- Naval Vessels

- Specialized Vessels (e.g., Offshore Support, Research)

- Component

- Helm Pumps

- Steering Cylinders

- Steering Wheels/Levers

- Power Steering Units (PSUs)

- Electronic Control Units (ECUs)

- Sensors and Actuators

- Hoses and Fittings

- Reservoirs and Fluid

- Vessel Type

- Small Vessels (up to 25 ft)

- Medium Vessels (25-80 ft)

- Large Vessels (over 80 ft)

- Specialty Vessels (e.g., Fishing Trawlers, Tugboats, Ferries)

Value Chain Analysis For Marine Steering System Market

The value chain for the marine steering system market begins with the upstream activities involving raw material suppliers and component manufacturers. This phase is critical, as the quality and availability of materials such as specialized steels, aluminum alloys, corrosion-resistant plastics, hydraulic fluids, and advanced electronic components directly impact the performance and durability of the final steering systems. Upstream suppliers include metal foundries, plastic resin producers, electronics manufacturers, and specialized hydraulic component suppliers (e.g., pump and valve manufacturers). These suppliers often operate under strict quality control standards and certifications to meet the demanding requirements of the marine industry. Research and development efforts at this stage focus on material science innovations that enhance corrosion resistance, reduce weight, and improve strength, as well as advancements in microelectronics for sensor and control unit integration. Effective supply chain management and strategic sourcing are paramount to ensure cost-effectiveness and consistency in material quality, mitigating risks associated with supply chain disruptions and price volatility for critical raw materials and sub-components. Strong relationships with these upstream partners are essential for maintaining a competitive edge and fostering continuous innovation within the market.

Moving downstream, the value chain encompasses the manufacturing, assembly, and integration of marine steering systems, followed by their distribution and eventual deployment in vessels. Manufacturers of marine steering systems source components from upstream suppliers and then undertake complex assembly processes, including precision machining, hydraulic system integration, and electronic controls programming. This stage often involves significant investment in specialized machinery, skilled labor, and rigorous testing protocols to ensure products meet stringent performance and safety standards. After manufacturing, products move through various distribution channels. Direct channels involve manufacturers selling directly to large shipyards, naval contractors, or major vessel owners, particularly for customized or high-volume orders. This direct approach allows for closer collaboration, technical support, and tailored solutions for specific vessel designs. The direct channel also facilitates efficient feedback loops, enabling manufacturers to quickly respond to customer needs and market demands, crucial for the development of highly specialized steering solutions for complex marine applications such as dynamic positioning systems for offshore vessels.

Indirect distribution channels play a vital role, especially for smaller steering systems, aftermarket sales, and reaching a broader customer base. This typically involves a network of authorized distributors, wholesalers, and marine equipment retailers. These intermediaries provide crucial logistical support, warehousing, sales expertise, and often local technical support and installation services, particularly for recreational boating and smaller commercial vessel segments. The indirect channel effectively broadens market reach and accessibility, serving diverse customer needs, from DIY boat owners to small-scale commercial fishermen. Aftermarket services, including maintenance, repair, and replacement parts, form another critical part of the downstream value chain, providing ongoing revenue streams and ensuring the long-term operational integrity of steering systems. Furthermore, the integration of these systems into vessels at shipyards, followed by sea trials and commissioning, represents the final stage of product deployment. Both direct and indirect distribution strategies are essential for a comprehensive market penetration, catering to the varying scale, complexity, and geographical dispersion of customer demands within the marine steering system market. Effective management of both direct and indirect channels is key to optimizing market presence and customer satisfaction.

Marine Steering System Market Potential Customers

The potential customers for marine steering systems are diverse, encompassing a wide spectrum of end-users and buyers across various maritime sectors, each with unique requirements and purchasing criteria. Primarily, the market serves commercial shipping companies, which include operators of cargo ships, container vessels, bulk carriers, tankers, and passenger ferries. These customers prioritize reliability, durability, fuel efficiency, and seamless integration with other bridge systems to ensure safe and economical operation on long voyages and in busy port environments. Their buying decisions are often influenced by total cost of ownership, compliance with international maritime regulations (such as IMO standards), and the availability of global service networks. For large commercial fleets, the ability to procure standardized, easily maintainable systems that offer consistent performance across diverse vessel types is a significant factor, alongside solutions that support automation and crew workload reduction. The increasing adoption of smart shipping technologies also means these customers seek steering systems that are compatible with advanced navigation, remote monitoring, and autonomous operation capabilities, representing a substantial segment driven by operational efficiency and regulatory compliance.

Another major segment of potential customers comprises recreational boat owners, including individuals purchasing yachts, motorboats, sportfishing vessels, sailboats, and personal watercraft. For these buyers, ease of use, comfort, responsiveness, and aesthetics are paramount. They often seek systems that enhance the boating experience, offering smooth control, minimal effort, and often, features like autopilot integration for relaxed cruising. Manufacturers targeting this segment focus on intuitive designs, ergonomic steering wheels, and systems that offer a blend of performance and luxury. The recreational market is highly sensitive to trends in boating leisure and disposable incomes, with a growing demand for advanced electronics, quiet operation, and systems that are easy to install and maintain by either professional marine service providers or the owners themselves. This customer base values innovative features that add convenience and enjoyment to their boating activities, such as joystick control, precision steering for docking, and integration with modern infotainment and navigation displays, indicating a strong preference for user-friendly and feature-rich solutions.

Naval forces and defense contractors represent a critical segment, demanding highly specialized, robust, and often redundant steering systems for military vessels, patrol boats, frigates, destroyers, and submarines. For these customers, reliability under extreme conditions, rapid response, precision in tactical maneuvers, and survivability are non-negotiable. Their purchasing decisions are driven by stringent performance specifications, military standards, cybersecurity robustness, and the ability to operate in challenging combat environments. The naval segment often requires custom-engineered solutions with advanced features like stealth capabilities, shock resistance, and integration with complex combat management systems. Offshore energy companies, operating supply vessels, anchor handling tugs, and research vessels, also constitute a significant customer group, prioritizing robust systems capable of dynamic positioning and precise maneuverability in demanding offshore conditions. Furthermore, shipyards and boat builders act as direct buyers of marine steering systems, integrating them into new vessel constructions. They seek reliable suppliers who can provide systems that meet diverse client specifications, adhere to production schedules, and offer strong technical support, ensuring seamless integration into their shipbuilding processes and contributing to the overall quality and marketability of their vessels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.95 Billion |

| Market Forecast in 2032 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Steering System Market Key Technology Landscape

The marine steering system market is undergoing significant technological evolution, characterized by a continuous drive towards enhanced precision, greater automation, improved efficiency, and seamless integration with broader vessel control systems. One of the most prominent advancements is the increasing adoption of electro-hydraulic and fully electric steering systems. Electro-hydraulic systems combine the power of hydraulics with the precision and flexibility of electronic controls, offering features like variable steering ratios, autopilot integration, and "follow-up" steering modes. These systems provide superior responsiveness, reduced effort, and can be easily interfaced with other navigation electronics such as GPS and charting systems. Fully electric steering systems, on the other hand, eliminate hydraulic fluid entirely, relying on electric motors and actuators. These systems are lauded for their environmental benefits (no oil spills), energy efficiency, quieter operation, and significantly reduced maintenance requirements, aligning with the industry's push for greener shipping. They also offer enhanced diagnostic capabilities and greater design flexibility, often leading to simpler installation and greater reliability, particularly for vessels operating in sensitive marine environments.

Another critical technological trend is the integration of advanced sensor technology and digital communication protocols. Modern marine steering systems incorporate sophisticated sensors such as rudder angle indicators, pressure sensors, and position feedback sensors that provide real-time data to electronic control units (ECUs). This data is then processed to ensure accurate rudder positioning and to provide feedback on system health. Communication within these systems is increasingly managed via robust digital networks like CAN bus (Controller Area Network) or Ethernet-based protocols, which allow for high-speed, reliable data exchange between the helm, the steering gear, and other bridge systems. This level of connectivity is fundamental for implementing features such as dynamic positioning, joystick control, and fly-by-wire steering, where operator inputs are digitally transmitted and translated into precise steering commands. The use of redundant communication pathways and fault-tolerant architectures is also a growing practice to enhance safety and reliability, especially in critical applications like naval vessels and large commercial ships, where system failure is not an option.

Furthermore, the market is seeing a surge in technologies that support increased automation and intelligent control, particularly relevant with the rise of autonomous vessel concepts. This includes the development of sophisticated autopilots that can not only maintain a heading but also learn and adapt to sea conditions, optimizing steering performance over time. Remote diagnostics and monitoring capabilities, often leveraging cloud-based platforms and IoT (Internet of Things) principles, allow operators and manufacturers to remotely monitor the health and performance of steering systems, enabling predictive maintenance and proactive troubleshooting. This remote capability significantly reduces operational costs and minimizes vessel downtime. Additionally, advancements in human-machine interface (HMI) design are making steering controls more intuitive and ergonomic, featuring touchscreens, customizable displays, and even haptic feedback, which enhance crew efficiency and reduce fatigue. The ongoing research and development in artificial intelligence and machine learning algorithms are also paving the way for adaptive and predictive steering solutions, further refining control precision and contributing to fuel savings, marking a significant leap forward in the technological landscape of marine steering systems.

Regional Highlights

- North America: This region is characterized by a mature recreational boating market, driven by a strong leisure culture and high disposable incomes, particularly in the United States and Canada. Demand for advanced, user-friendly, and comfortable steering systems for yachts, sportfishing boats, and personal watercraft is consistent. The commercial and naval sectors also contribute, with a focus on technological upgrades and compliance with local maritime regulations, alongside a growing interest in automated and semi-autonomous vessel technologies.

- Europe: A hub for innovation and home to several leading marine steering system manufacturers, Europe showcases strong demand, especially from the luxury yacht segment and specialized commercial vessels (e.g., offshore support, ferries). Strict environmental regulations and a focus on sustainability drive the adoption of efficient electro-hydraulic and electric steering solutions. Countries like Germany, Norway, Italy, and the UK are key markets for both new builds and retrofits, emphasizing precision engineering and integrated bridge systems.

- Asia Pacific (APAC): The largest and fastest-growing market globally, APAC's dominance is attributed to its massive shipbuilding industry, led by China, South Korea, and Japan, which are primary producers of commercial vessels. Rapid industrialization, increasing maritime trade, and significant investments in naval modernization programs across the region further fuel demand. The recreational boating market is also expanding, albeit from a smaller base, offering substantial future growth opportunities, particularly for cost-effective and reliable steering solutions.

- Latin America: This region represents an emerging market with growing potential, driven by expanding maritime trade, increasing offshore oil and gas exploration activities (e.g., Brazil, Mexico), and investments in port infrastructure. Demand is primarily for robust and reliable steering systems for commercial vessels, fishing fleets, and offshore support vessels. While recreational boating is smaller than in North America or Europe, it is gradually expanding, creating new avenues for growth.

- Middle East and Africa (MEA): Growth in the MEA region is spurred by strategic waterway importance, investments in oil and gas and shipping infrastructure, and expanding tourism. Countries in the GCC (Gulf Cooperation Council) are investing in luxury yacht segments, while Africa's developing coastal economies contribute to demand for commercial and fishing vessel steering systems. Geopolitical factors and fluctuating oil prices can influence market dynamics, but long-term infrastructure projects provide a stable foundation for growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Steering System Market.- Dometic Group (Seastar Solutions)

- ZF Marine Propulsion Systems LLC

- Hydrive Engineering Pty Ltd

- Manoeuvre Group (Opacmare)

- Marine Hydraulic Engineering Co. Ltd.

- Hypro Marine

- Ultraflex Group

- Lewmar Marine

- Vetus NV

- Kobelt Manufacturing Co. Ltd.

- Cramm Yachting Systems

- Jastram Engineering Ltd.

- Kawasaki Heavy Industries, Ltd.

- Wills Marine (Pty) Ltd.

- Brunswick Corporation (Mercury Marine)

- Side-Power (Sleipner Motor AS)

- Bosch Rexroth AG

- ABB Ltd.

- Kongsberg Maritime AS

- Raymarine (A FLIR Company)

Frequently Asked Questions

Analyze common user questions about the Marine Steering System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of marine steering systems available today?

The primary types of marine steering systems include manual (cable-driven), hydraulic, electro-hydraulic, and fully electric systems. Manual systems are simple and cost-effective for smaller vessels. Hydraulic systems offer power assistance for a wide range of vessels. Electro-hydraulic combines electronic controls with hydraulic power for enhanced precision, while fully electric systems provide high efficiency, reduced maintenance, and advanced integration capabilities for modern vessels, often seen in autonomous applications.

How is Artificial Intelligence (AI) influencing the development of marine steering systems?

AI is profoundly influencing marine steering systems by enabling adaptive steering algorithms for improved fuel efficiency and course accuracy. It facilitates predictive maintenance by analyzing system data, allowing for timely interventions. Furthermore, AI is crucial for the development of autonomous and semi-autonomous navigation capabilities, enhancing decision support for operators, optimizing routes, and significantly contributing to overall maritime safety by reducing human error and improving responsiveness in complex scenarios.

What are the key drivers propelling the growth of the Marine Steering System Market?

Key drivers include the consistent growth in global seaborne trade and the expanding recreational boating industry, necessitating reliable and efficient steering. Technological advancements in automation and electric propulsion also push demand for sophisticated systems. Additionally, stringent international maritime regulations concerning safety and emissions compel vessel operators to upgrade to modern, compliant steering technologies, along with the rising interest in autonomous shipping initiatives.

What challenges does the marine steering system market face regarding advanced technology adoption?

The market faces challenges such as the high initial cost of advanced electro-hydraulic and fully electric systems, which can deter smaller buyers. The complexity of integrating these sophisticated technologies with existing vessel infrastructure and other navigation electronics also poses a significant hurdle. Furthermore, regulatory frameworks for certifying new, highly automated steering solutions are still evolving, and increasing cybersecurity concerns for connected systems represent a substantial restraint, alongside the need for specialized technical expertise for maintenance and repair.

Which geographical region holds the largest share in the Marine Steering System Market and why?

The Asia Pacific region currently holds the largest market share in the marine steering system market. This dominance is primarily driven by its robust and leading shipbuilding industry, with countries like China, South Korea, and Japan being major global producers of commercial and naval vessels. Significant investments in maritime infrastructure, expanding international trade, and growing naval modernization programs across the region further contribute to its leading position, alongside a developing recreational boating sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager