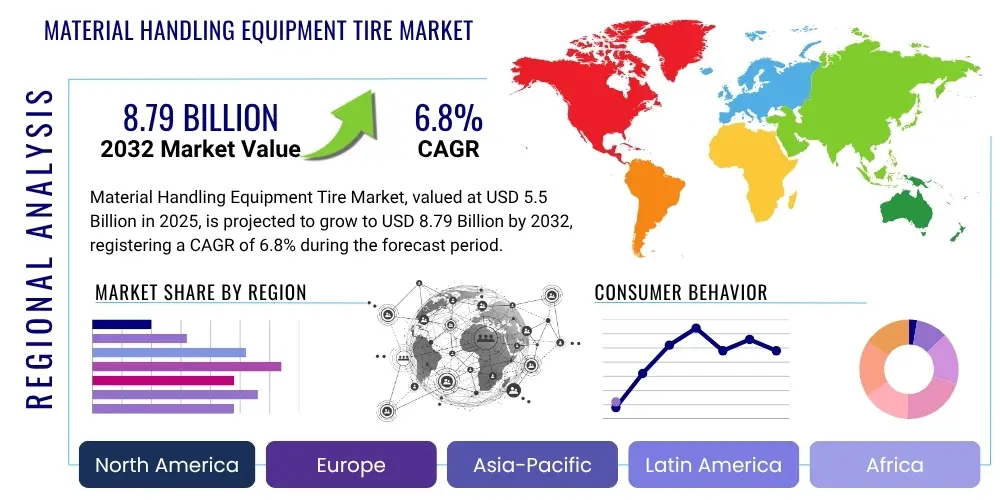

Material Handling Equipment Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429071 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Material Handling Equipment Tire Market Size

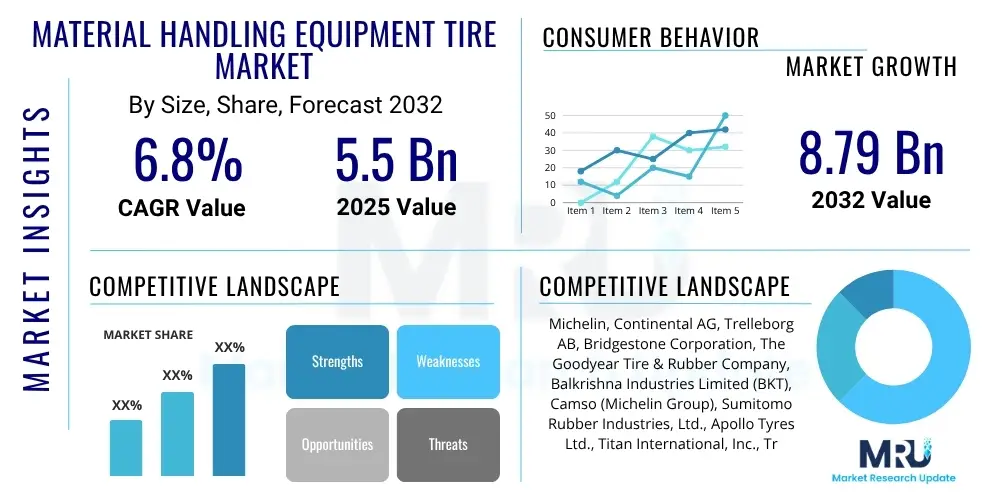

The Material Handling Equipment Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 5.5 Billion in 2025 and is projected to reach USD 8.79 Billion by the end of the forecast period in 2032.

Material Handling Equipment Tire Market introduction

The Material Handling Equipment Tire Market is an integral component of the global logistics, manufacturing, and industrial sectors, providing critical support for the efficient movement of goods and materials across various applications. Material handling equipment, such as forklifts, automated guided vehicles (AGVs), cranes, and port equipment, relies heavily on specialized tires designed to withstand extreme loads, harsh operating conditions, and demanding environments. These tires are engineered for durability, stability, and operational efficiency, directly impacting the productivity and safety of industrial operations.

The product description encompasses a range of tire types, including solid, pneumatic, polyurethane, and press-on tires, each tailored for specific performance requirements and ground surfaces. Major applications span warehousing, distribution centers, manufacturing facilities, seaports, airports, construction sites, and mining operations. The primary benefits derived from these tires include enhanced equipment stability, reduced downtime due to punctures or wear, improved energy efficiency for electric vehicles, and increased operational safety for personnel. The market's growth is predominantly driven by the robust expansion of e-commerce, the increasing adoption of automation and robotics in logistics, significant investments in infrastructure development, and the continuous need for optimized supply chain management.

Material Handling Equipment Tire Market Executive Summary

The Material Handling Equipment Tire Market is experiencing dynamic growth, propelled by evolving business trends centered on automation, sustainability, and technological integration. E-commerce expansion and the subsequent demand for faster, more efficient warehousing and logistics operations are fueling the need for advanced material handling equipment and, consequently, high-performance tires. Businesses are increasingly investing in automated systems like AGVs and robotic forklifts, which require specialized tires for precision, longevity, and low rolling resistance. Furthermore, there is a growing emphasis on sustainable manufacturing practices, driving the demand for eco-friendly tire materials and energy-efficient designs to reduce carbon footprints across industrial operations.

Regional trends indicate a significant market expansion in the Asia Pacific (APAC) region, attributed to rapid industrialization, burgeoning manufacturing sectors, and substantial investments in logistics infrastructure, particularly in countries like China, India, and Southeast Asia. North America and Europe, while mature markets, are witnessing a steady demand driven by the modernization of existing fleets and the adoption of advanced, high-performance tires that support automation and improve operational efficiency. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth as industrial and commercial activities intensify, leading to increased material handling needs. These regions are prioritizing infrastructure development and expanding their manufacturing capabilities, creating new opportunities for tire manufacturers.

Segment trends highlight the continued dominance of solid tires, especially in indoor and high-intensity applications where puncture resistance and load-bearing capacity are paramount. Pneumatic tires remain crucial for outdoor and rough-terrain operations, providing cushioning and traction. The demand for polyurethane and press-on tires is steadily increasing, particularly for specialized applications and electric material handling equipment due to their non-marking properties and low rolling resistance. The aftermarket segment holds a substantial share, driven by the replacement cycle of tires, while the OEM segment benefits from new equipment sales. Overall, the market is characterized by a shift towards longer-lasting, more durable, and technologically integrated tire solutions to meet the rigorous demands of modern material handling environments.

AI Impact Analysis on Material Handling Equipment Tire Market

Common user questions regarding the impact of AI on the Material Handling Equipment Tire Market frequently revolve around how artificial intelligence can enhance tire performance, extend lifespan, and optimize operational efficiency. Key themes include the potential for predictive maintenance driven by AI, the integration of smart sensors into tires for real-time data collection, and the role of AI in improving tire manufacturing processes. Users are keen to understand how AI can reduce downtime, improve safety, and contribute to more sustainable operations in a highly demanding industrial environment. The expectations are high for AI to transform tire management from a reactive process to a proactive, data-driven approach, leading to significant cost savings and improved productivity across the material handling sector.

- Predictive maintenance analytics for tire wear and tear, preventing unexpected failures.

- Optimization of tire pressure and temperature through real-time AI-driven monitoring systems.

- Enhanced operational efficiency by advising optimal tire selection based on specific load and terrain data.

- Integration with autonomous material handling equipment for optimized traction and longevity.

- Improved manufacturing processes through AI-driven quality control and material optimization.

- Smart inventory management for tire replacements based on usage patterns and predictive models.

- Contribution to sustainability by optimizing tire lifespan and reducing waste.

DRO & Impact Forces Of Material Handling Equipment Tire Market

The Material Handling Equipment Tire Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, all shaped by prevailing impact forces. Major drivers include the rapid expansion of the e-commerce sector globally, which necessitates efficient warehousing and logistics infrastructure, consequently increasing the demand for material handling equipment and their specialized tires. The growing trend of automation and robotics in industrial operations, particularly the adoption of Automated Guided Vehicles (AGVs) and autonomous forklifts, drives the need for high-performance, durable tires. Furthermore, substantial investments in infrastructure development across developing economies, coupled with increasing manufacturing activities worldwide, further bolster market growth. The inherent benefits of specialized tires, such as enhanced safety, operational efficiency, and reduced downtime, continue to be strong motivators for adoption.

However, the market also faces considerable restraints. Volatility in the prices of raw materials, primarily natural and synthetic rubber, carbon black, and steel, directly impacts production costs and profit margins for tire manufacturers. Intense competition among market players leads to pricing pressures, challenging smaller manufacturers. The relatively high replacement cost of specialized material handling equipment tires can also be a deterrent for some end-users, especially small and medium-sized enterprises. Additionally, the fragmented nature of the aftermarket segment, characterized by numerous local distributors and varying quality standards, poses challenges in maintaining consistent product quality and service.

Despite these challenges, significant opportunities abound within the market. The development and adoption of smart tires equipped with sensors for real-time monitoring of pressure, temperature, and wear present a lucrative avenue for growth, aligning with the industry's push towards IoT and predictive maintenance. The increasing focus on sustainability and environmental regulations is driving demand for eco-friendly and energy-efficient tire solutions, encouraging innovation in material composition and manufacturing processes. Moreover, tapping into emerging markets in Southeast Asia, Africa, and Latin America, where industrialization is accelerating, offers substantial growth prospects. The continuous need for customized tire solutions for niche applications, such as cold storage or explosive environments, also provides manufacturers with opportunities for product differentiation and market expansion. The overarching impact forces, including global economic growth, rapid technological advancements, and evolving regulatory landscapes concerning safety and environmental standards, continue to shape the trajectory and competitive dynamics of this vital market.

Segmentation Analysis

The Material Handling Equipment Tire Market is extensively segmented to reflect the diverse operational requirements and technological advancements within various industrial applications. These segmentations allow for a granular understanding of market dynamics, enabling manufacturers and suppliers to tailor their product offerings and strategies effectively. Key segments are typically categorized by product type, application, end-use industry, and sales channel, each demonstrating unique growth patterns and demand drivers. The varied demands across different industries for specific load capacities, durability, traction, and resistance to environmental factors necessitate this comprehensive approach to market analysis, highlighting the specialized nature of material handling tire solutions.

- By Product Type

- Solid Tires

- Pneumatic Tires

- Polyurethane Tires

- Press-On Tires

- Other Specialty Tires

- By Application

- Forklifts

- Automated Guided Vehicles (AGVs)

- Cranes

- Port Equipment

- Ground Support Equipment

- Mining Equipment

- Construction Equipment

- Agricultural Equipment (Industrial Usage)

- By End-Use Industry

- Logistics & Warehousing

- Manufacturing

- Retail & E-commerce

- Ports & Terminals

- Construction

- Mining

- Waste Management

- Food & Beverage

- Automotive

- Pharmaceuticals

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Material

- Natural Rubber

- Synthetic Rubber

- Polyurethane

- Composites

Value Chain Analysis For Material Handling Equipment Tire Market

The value chain for the Material Handling Equipment Tire Market begins with the upstream analysis, involving the procurement of essential raw materials. This stage primarily includes suppliers of natural rubber plantations, synthetic rubber manufacturers (derived from petrochemicals), carbon black producers, steel cord manufacturers, textile cord suppliers, and various chemical additives producers. The quality and availability of these raw materials directly impact the final product's performance and cost. Key factors at this stage include global commodity prices, supply chain stability, and adherence to environmental and labor standards by raw material providers. Strong relationships with reliable suppliers are crucial for maintaining consistent product quality and mitigating supply risks.

Moving downstream, the value chain encompasses tire manufacturing, distribution, and end-user consumption. Tire manufacturers transform raw materials into finished tires, involving complex processes such as compounding, molding, curing, and quality testing. These manufacturers invest heavily in research and development to innovate new compounds, designs, and smart tire technologies. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves sales directly from manufacturers to Original Equipment Manufacturers (OEMs) who integrate the tires into their material handling equipment. Indirect distribution, primarily for the aftermarket segment, involves a network of authorized dealers, distributors, wholesalers, and retailers who supply replacement tires to end-users.

The effectiveness of the distribution channel is paramount for market penetration and customer reach. Both direct and indirect channels play vital roles in ensuring product availability, technical support, and after-sales service. OEMs benefit from direct relationships that allow for custom tire development and bulk procurement. The aftermarket thrives on extensive distributor networks that can provide quick replacements and service to a vast array of end-users. Aftermarket distributors also play a critical role in educating customers about appropriate tire selection and maintenance, influencing purchasing decisions. Efficient logistics and inventory management across the entire distribution network are essential to meet the diverse and often urgent demands of industrial customers, ensuring that the right tires are available at the right time and place to minimize operational downtime.

Material Handling Equipment Tire Market Potential Customers

The Material Handling Equipment Tire Market caters to a broad spectrum of end-users and buyers across numerous industries that rely on the efficient movement of goods and materials. These customers represent the backbone of global commerce and manufacturing, necessitating durable and reliable tire solutions for their operations. The diverse applications of material handling equipment mean that potential customers range from vast multinational corporations to small local businesses, each with unique requirements regarding tire performance, longevity, and cost-effectiveness. Understanding these varied customer profiles is crucial for manufacturers and distributors to effectively segment the market and develop targeted product offerings and marketing strategies.

Primary end-users include logistics and warehousing companies, which operate extensive fleets of forklifts, pallet jacks, and AGVs to manage inventory, pick orders, and prepare shipments. Manufacturing facilities, spanning industries like automotive, heavy machinery, food and beverage, and electronics, utilize material handling equipment for in-plant transport of components, finished goods, and raw materials. The rapidly expanding retail and e-commerce sectors are significant consumers, driving demand for tires that support continuous, high-volume operations in distribution centers. Ports and terminals, along with airports, represent another critical customer segment, where heavy-duty cranes, reach stackers, and ground support equipment require specialized tires capable of handling immense loads and abrasive surfaces.

Furthermore, construction companies and mining operations represent key buyers, relying on robust material handling tires for rough terrain, extreme conditions, and heavy-duty applications. Waste management and recycling facilities also utilize equipment that requires specialized tires resistant to punctures and harsh environments. The healthcare and pharmaceutical industries, with their stringent hygiene and precision requirements, also use material handling equipment that demands specific tire characteristics such as non-marking properties and low rolling resistance. Essentially, any enterprise involved in the movement, storage, control, and protection of materials and products throughout the process of manufacturing, distribution, consumption, and disposal is a potential customer for specialized material handling equipment tires, highlighting the market's extensive reach and critical importance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.5 Billion |

| Market Forecast in 2032 | USD 8.79 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental AG, Trelleborg AB, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Balkrishna Industries Limited (BKT), Camso (Michelin Group), Sumitomo Rubber Industries, Ltd., Apollo Tyres Ltd., Titan International, Inc., Triangle Tyre Co., Ltd., Toyo Tire Corporation, CEAT Ltd., MRF Tyres, Pirelli & C. S.p.A., Yokohama Rubber Co., Ltd., Hankook Tire & Technology Co., Ltd., Maxam Tire International, LLC, Zhongce Rubber Group Co., Ltd. (ZC Rubber), Shandong Linglong Tyre Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Material Handling Equipment Tire Market Key Technology Landscape

The Material Handling Equipment Tire Market is increasingly integrating advanced technologies to enhance performance, durability, and operational intelligence, moving beyond traditional rubber compounds and basic designs. A pivotal technological shift involves the development of smart tires, which incorporate sensors directly into the tire structure or on the rim. These sensors continuously monitor critical parameters such as tire pressure, temperature, load, and wear levels, transmitting data wirelessly to fleet management systems. This real-time data allows for proactive maintenance, optimizing tire lifespan, improving fuel efficiency, and significantly reducing the risk of unexpected downtime due to tire failures. The integration of IoT (Internet of Things) platforms with these smart tires enables comprehensive data analytics, facilitating predictive maintenance strategies and enhancing overall fleet management efficiency.

Another significant technological advancement lies in the innovation of advanced rubber compounds and alternative materials. Manufacturers are investing heavily in research and development to create highly specialized rubber formulations that offer superior resistance to cuts, abrasions, and punctures, while also providing enhanced traction and lower rolling resistance. This includes the use of silica-reinforced compounds, advanced polymers, and proprietary synthetic rubber blends designed for specific applications, such as high heat environments or challenging outdoor terrains. Furthermore, there is a growing trend towards sustainable and eco-friendly materials, with an emphasis on using recycled content, bio-based polymers, and designing tires that are more energy-efficient throughout their lifecycle. These material innovations contribute to longer tire life, reduced environmental impact, and improved operational economics for end-users.

Beyond material science and smart features, manufacturing processes are also benefiting from technological advancements. Automated production lines, advanced robotics, and artificial intelligence-driven quality control systems are becoming more prevalent, ensuring greater precision, consistency, and efficiency in tire production. Digital design and simulation tools are used extensively to optimize tire tread patterns, structural integrity, and performance characteristics before physical prototyping, significantly reducing development cycles and costs. The emergence of 3D printing technologies is also explored for rapid prototyping of specialized tire components or for creating customized, small-batch solutions for niche material handling applications. These combined technological efforts aim to deliver tires that are not only more robust and intelligent but also more aligned with the evolving demands of automated and sustainable material handling operations.

Regional Highlights

- North America: A mature market characterized by high adoption of automation and advanced material handling equipment. Demand is driven by the modernization of warehousing and logistics infrastructure, emphasizing durability, efficiency, and smart tire technologies. The presence of major e-commerce players and robust manufacturing sectors ensures stable growth.

- Europe: Similar to North America, Europe is a well-established market with a strong focus on sustainability, safety regulations, and technological innovation. The region sees steady demand for high-performance tires, driven by strict environmental norms and the push towards electric and autonomous material handling solutions. Germany, France, and the UK are key contributors.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, expanding manufacturing bases (particularly in China, India, Japan, and South Korea), and booming e-commerce activities. Increased investment in logistics infrastructure and port development is a significant driver, leading to high demand for both OEM and aftermarket tires.

- Latin America: An emerging market with significant growth potential, driven by infrastructure development projects, increasing manufacturing output, and expanding retail sectors. Countries like Brazil, Mexico, and Argentina are witnessing growing adoption of material handling equipment, creating demand for durable and cost-effective tire solutions.

- Middle East and Africa (MEA): Another emerging region showing considerable growth, primarily due to rising investments in oil and gas, mining, construction, and logistics infrastructure. The development of new ports and free zones further contributes to the demand for material handling equipment tires, with key markets including UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Material Handling Equipment Tire Market.- Michelin

- Continental AG

- Trelleborg AB

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Balkrishna Industries Limited (BKT)

- Camso (Michelin Group)

- Sumitomo Rubber Industries, Ltd.

- Apollo Tyres Ltd.

- Titan International, Inc.

- Triangle Tyre Co., Ltd.

- Toyo Tire Corporation

- CEAT Ltd.

- MRF Tyres

- Pirelli & C. S.p.A.

- Yokohama Rubber Co., Ltd.

- Hankook Tire & Technology Co., Ltd.

- Maxam Tire International, LLC

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Shandong Linglong Tyre Co., Ltd.

Frequently Asked Questions

What are the primary types of tires used in material handling equipment?

The primary types include solid tires for puncture resistance and heavy loads, pneumatic tires for cushioning and traction on uneven surfaces, polyurethane tires for non-marking and energy efficiency, and press-on tires for compact electric equipment.

How does the growth of e-commerce influence the Material Handling Equipment Tire Market?

The e-commerce boom drives demand for faster, more efficient warehousing and logistics, increasing the need for forklifts, AGVs, and other material handling equipment, thereby boosting the market for durable and specialized tires.

What is a "smart tire" in the context of material handling?

A smart tire integrates sensors to monitor parameters like pressure, temperature, and wear in real time, providing data for predictive maintenance, optimizing performance, and enhancing operational safety and efficiency.

Which region is expected to show the highest growth in the Material Handling Equipment Tire Market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth, driven by rapid industrialization, manufacturing expansion, and significant investments in logistics and infrastructure.

What are the main challenges faced by manufacturers in this market?

Key challenges include raw material price volatility, intense market competition leading to pricing pressures, and the need for continuous innovation to meet evolving demands for durability, efficiency, and smart features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager