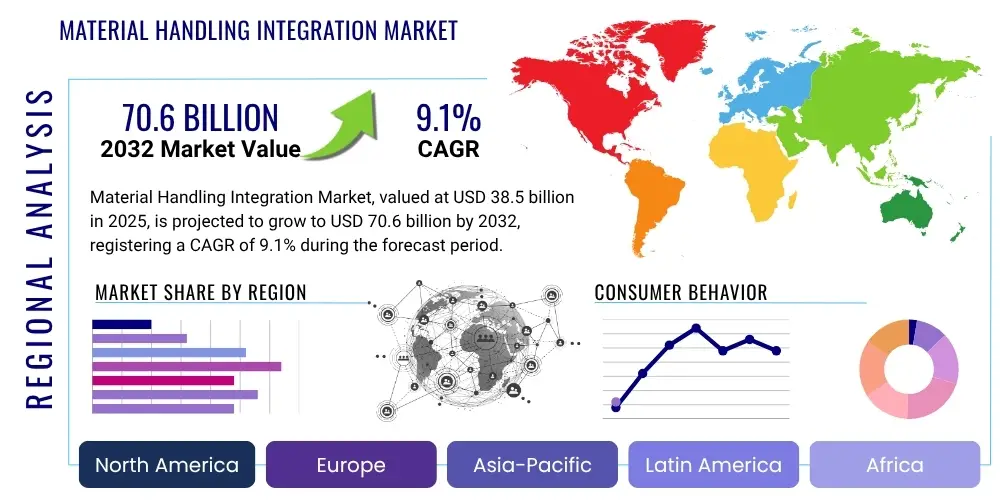

Material Handling Integration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428498 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Material Handling Integration Market Size

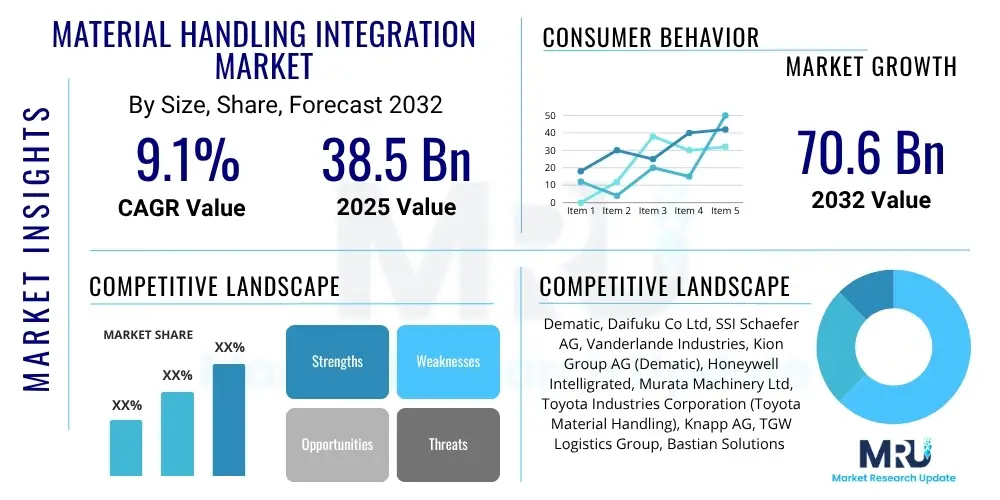

The Material Handling Integration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% between 2025 and 2032. The market is estimated at USD 38.5 billion in 2025 and is projected to reach USD 70.6 billion by the end of the forecast period in 2032.

Material Handling Integration Market introduction

The Material Handling Integration Market encompasses the design, implementation, and optimization of interconnected systems and technologies for managing, moving, storing, and protecting materials within a facility or across a supply chain. This sector provides holistic solutions that combine various material handling equipment, software, and automation technologies into a seamless, efficient operational flow. The goal is to enhance productivity, reduce operational costs, improve safety, and optimize space utilization by intelligently coordinating diverse components such as conveyors, automated guided vehicles (AGVs), automated storage and retrieval systems (AS/RS), robotics, and warehouse management systems (WMS).

Product descriptions within this market range from sophisticated robotic picking and packing systems to intelligent conveyor networks, high-density storage solutions, and advanced data analytics platforms that monitor and control material flow. Major applications span a wide array of industries, including e-commerce and retail for order fulfillment, manufacturing for assembly line supply and finished goods handling, automotive for parts delivery and vehicle assembly, food and beverage for perishable goods management, and pharmaceuticals for precise inventory control. The integration of these systems is crucial for businesses looking to modernize their logistics and production processes, addressing challenges posed by rising labor costs, increasing demand for faster delivery, and the growing complexity of global supply chains.

The primary benefits derived from material handling integration include significant improvements in operational efficiency, substantial reductions in labor costs and manual errors, enhanced safety for workers, and optimized inventory management. These integrated solutions contribute to higher throughput, better space utilization, and improved product traceability, directly supporting business agility and competitiveness. Key driving factors propelling market growth include the explosive expansion of e-commerce, which necessitates rapid and accurate order fulfillment; the increasing scarcity and cost of manual labor; the ongoing global push towards industrial automation and Industry 4.0; and the urgent need for more resilient and transparent supply chains in response to various disruptions. Furthermore, technological advancements in robotics, artificial intelligence, and data analytics are continually expanding the capabilities and appeal of integrated material handling systems, fostering greater adoption across diverse industry verticals.

Material Handling Integration Market Executive Summary

The Material Handling Integration Market is experiencing robust growth, driven by an accelerating global shift towards automation and digital transformation within industrial and logistics sectors. Business trends indicate a strong emphasis on smart warehouses, flexible manufacturing, and resilient supply chains, pushing enterprises to invest heavily in integrated solutions that offer superior operational efficiency, cost savings, and enhanced safety. The proliferation of e-commerce, coupled with escalating consumer expectations for rapid delivery, has catalyzed significant demand for highly automated and integrated material handling systems capable of processing vast volumes of orders with speed and accuracy. Furthermore, labor shortages and rising wage costs in developed and emerging economies alike are compelling businesses to adopt automated systems to maintain competitive operational expenses and improve productivity, making integration a critical strategic imperative.

Regionally, Asia Pacific is projected to emerge as the fastest-growing market, primarily fueled by the rapid industrialization, expansion of manufacturing bases, and burgeoning e-commerce penetration in countries like China, India, and Southeast Asian nations. North America and Europe, while more mature markets, continue to demonstrate substantial investment in upgrading existing infrastructure and adopting next-generation automation technologies to enhance competitiveness and address labor constraints. Latin America, the Middle East, and Africa are also witnessing gradual but steady adoption, driven by infrastructure development projects, foreign investments, and the growing need for optimized logistics in these regions. These regional dynamics are shaped by varying levels of economic development, technological adoption rates, regulatory environments, and the specific pressures faced by local industries, with advanced regions focusing on sophisticated, data-driven integration while developing regions prioritize foundational automation.

Segment trends within the Material Handling Integration Market highlight a significant surge in demand for robotics and automation hardware, including collaborative robots, AGVs, and autonomous mobile robots (AMRs), which are becoming increasingly sophisticated and versatile. Software solutions, particularly Warehouse Management Systems (WMS), Warehouse Execution Systems (WES), and Manufacturing Execution Systems (MES) with advanced analytics and AI capabilities, are integral to achieving seamless integration and optimized operational control. The services segment, encompassing consulting, installation, maintenance, and support, is also expanding rapidly as companies require expert assistance in designing, deploying, and maintaining complex integrated systems. Industry-specific solutions for e-commerce, automotive, and food and beverage sectors are leading the adoption, showcasing the increasing specialization and customization required by end-users. This evolution underscores a market moving towards more intelligent, interconnected, and adaptive material handling ecosystems, where data-driven insights and predictive capabilities play a crucial role in operational excellence.

AI Impact Analysis on Material Handling Integration Market

User inquiries regarding AI's impact on material handling integration frequently center on its potential to revolutionize operational efficiency, enhance predictive capabilities, and address complex logistical challenges. Common questions revolve around how AI can optimize real-time routing for AGVs and robots, improve inventory accuracy through advanced vision systems, enable predictive maintenance for equipment, and personalize order fulfillment processes. Users are keen to understand the extent to which AI can mitigate labor dependencies, reduce operational costs, and create more adaptive and resilient supply chains. Concerns often emerge regarding the implementation complexity, data security, the ethical implications of autonomous decision-making, and the potential for job displacement, highlighting a desire for balanced insights into both the opportunities and challenges presented by AI adoption in this domain. There is a strong expectation that AI will deliver tangible improvements in speed, accuracy, and overall intelligence of material handling operations.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from material handling equipment to predict potential failures, enabling proactive maintenance and minimizing costly downtime.

- Optimized Routing and Navigation: AI powers intelligent path planning for AGVs and AMRs, dynamically adjusting routes in real-time to avoid congestion, improve throughput, and reduce energy consumption.

- Improved Inventory Management: AI-driven systems provide more accurate inventory forecasting, automate cycle counting through vision systems, and optimize storage slotting, leading to reduced stockouts and overstocking.

- Intelligent Order Picking and Packing: Robotic picking systems integrated with AI can identify, grasp, and sort various items with greater precision and speed, adapting to diverse product characteristics and order requirements.

- Real-time Decision Making: AI algorithms process vast amounts of operational data from WMS, WES, and other systems to provide real-time insights and recommendations for optimizing workflows, resource allocation, and troubleshooting.

- Demand Forecasting Accuracy: AI improves the accuracy of demand forecasting by analyzing historical data, seasonal trends, and external factors, allowing for better planning of material flow and resource deployment.

- Quality Control and Inspection: Machine vision systems augmented by AI can perform automated quality checks on incoming and outgoing materials, identifying defects or inconsistencies with high accuracy and speed.

- Workforce Augmentation: AI tools assist human operators by providing guided tasks, identifying inefficiencies, and automating repetitive processes, allowing the workforce to focus on more complex and value-added activities.

- Supply Chain Resiliency: AI enables more adaptive supply chains by simulating various scenarios, identifying potential disruptions, and suggesting optimal contingency plans for material flow.

- Energy Optimization: AI systems can manage energy consumption of automated equipment by optimizing operational schedules and identifying areas for efficiency improvements.

DRO & Impact Forces Of Material Handling Integration Market

The Material Handling Integration Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all shaped by significant impact forces. Key drivers include the exponential growth of the e-commerce sector, demanding faster and more efficient fulfillment operations, alongside rising labor costs and a persistent shortage of skilled labor across various industries, which compel businesses to seek automated solutions. The increasing complexity of global supply chains, requiring greater visibility, accuracy, and resilience, further fuels the adoption of integrated systems. Moreover, the inherent benefits of automation, such as improved safety, enhanced productivity, and reduced operational errors, serve as powerful incentives for investment. These drivers collectively push companies towards comprehensive material handling integration to maintain competitiveness and meet evolving market demands.

However, the market also faces considerable restraints that temper its growth. The most significant is the high initial capital investment required for implementing sophisticated integrated material handling systems, which can be a substantial barrier for small and medium-sized enterprises (SMEs). The complexity associated with integrating disparate hardware and software components from multiple vendors also presents a challenge, demanding specialized expertise and careful project management. Additionally, the lack of a adequately skilled workforce capable of operating, maintaining, and troubleshooting these advanced systems can hinder adoption and optimal utilization. Resistance to change within organizations and concerns regarding the security of increasingly interconnected operational data further contribute to these restraints, requiring careful strategic planning and change management to overcome.

Despite these challenges, numerous opportunities are poised to propel the market forward. The ongoing advancements in technologies such as robotics, artificial intelligence, machine learning, and the Internet of Things (IoT) are continuously enhancing the capabilities and cost-effectiveness of integrated material handling solutions. The increasing adoption of Industry 4.0 principles, emphasizing smart factories and interconnected systems, creates a fertile ground for sophisticated integration. Furthermore, the growing focus on sustainability and environmental concerns presents an opportunity for integrators to offer energy-efficient and optimized solutions that reduce waste and carbon footprint. The expansion into emerging economies, characterized by developing industrial infrastructure and growing consumer markets, also offers significant untapped potential for new deployments. These opportunities are amplified by impact forces such as rapid technological innovation, evolving regulatory frameworks promoting workplace safety, and shifts in global economic conditions that necessitate operational efficiency and resilience.

Segmentation Analysis

The Material Handling Integration Market is comprehensively segmented across various dimensions to provide a granular understanding of its structure, dynamics, and growth trajectories. These segmentations allow for a detailed analysis of market trends, adoption patterns, and competitive landscapes across different product types, application areas, industry verticals, and functional capabilities. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor product offerings, and devise effective market entry and growth strategies. The market's diverse nature reflects the broad spectrum of operational needs and technological requirements prevalent across modern manufacturing, warehousing, and logistics environments, driving both generalized and highly specialized integrated solutions.

- By Component:

- Hardware:

- Conveyors (Belt, Roller, Chain, Pallet, Sortation)

- Automated Storage and Retrieval Systems (AS/RS) (Unit-load, Mini-load, Vertical Lift Modules)

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Robotics (Articulated, SCARA, Delta, Cartesian, Collaborative)

- Cranes and Hoists

- Forklifts and Pallet Jacks (Automated, Manual)

- Palletizers and Depalletizers

- Carousels (Horizontal, Vertical)

- Barcode Scanners and RFID Readers

- Software:

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Manufacturing Execution Systems (MES)

- Enterprise Resource Planning (ERP) Integration Modules

- Material Flow Control Systems (MFCS)

- Simulation and Modeling Software

- Data Analytics and Business Intelligence

- Cloud-based Solutions

- Services:

- Consulting and Design

- Installation and Commissioning

- Maintenance and Support

- System Upgrades and Modernization

- Training and Education

- Managed Services

- Hardware:

- By Application:

- Assembly

- Packaging and Palletizing

- Storage and Retrieval

- Transportation and Logistics

- Picking and Sorting

- Loading and Unloading

- Quality Control and Inspection

- By Industry Vertical:

- E-commerce and Retail

- Manufacturing (Discrete, Process)

- Automotive

- Food and Beverage

- Pharmaceuticals and Healthcare

- Chemicals and Petrochemicals

- Aerospace and Defense

- Consumer Goods

- 3PL and Logistics

- Post and Parcel

- Electronics and Semiconductors

- By Operation Type:

- Automated Systems

- Semi-Automated Systems

- Manual Systems (integrated with automation)

Value Chain Analysis For Material Handling Integration Market

The value chain for the Material Handling Integration Market is a complex ecosystem involving various stages, from component manufacturing to end-user deployment and ongoing support. At the upstream level, the chain begins with raw material suppliers providing metals, plastics, and electronic components, followed by specialized manufacturers producing individual material handling equipment such as conveyors, robotics, AS/RS, and software developers creating advanced WMS and WES solutions. These suppliers focus on innovation, quality, and cost-effectiveness to provide the foundational elements of integrated systems. Research and development activities also play a crucial upstream role, driving technological advancements in automation, AI, and IoT that improve system capabilities and efficiency, ensuring a continuous pipeline of enhanced components and software tools for integrators.

Midstream, the value chain is dominated by material handling integrators, who act as orchestrators. These integrators are responsible for understanding client needs, designing bespoke solutions, sourcing components from various manufacturers, engineering the layout, installing the hardware, configuring the software, and ensuring seamless interoperability between all system elements. Their expertise in project management, system engineering, and software integration is paramount to delivering a functional and optimized integrated solution. This stage often involves significant consulting, customization, and rigorous testing to ensure the integrated system meets specific operational requirements and performance benchmarks. Integrators often collaborate closely with equipment manufacturers and software providers to ensure compatibility and efficiency, acting as a crucial bridge between diverse technological offerings and end-user demands.

Downstream, the value chain extends to the end-users across various industries, including e-commerce, manufacturing, automotive, food and beverage, and pharmaceuticals, who adopt and operate these integrated systems. The distribution channels for material handling integration solutions can be both direct and indirect. Direct sales involve integrators working directly with large enterprise clients to design and implement complex, large-scale projects. Indirect channels include partnerships with third-party logistics (3PL) providers, system resellers, and value-added resellers (VARs) who might offer integrated solutions as part of a broader service portfolio or cater to smaller businesses. Post-sales services, including maintenance, spare parts supply, technical support, and system upgrades, form a critical part of the downstream value chain, ensuring the long-term operational efficiency and lifecycle management of the installed systems. This comprehensive approach ensures that the initial investment continues to deliver value over its operational lifespan.

Material Handling Integration Market Potential Customers

Potential customers for Material Handling Integration solutions are diverse, spanning a wide array of industries that seek to optimize their internal logistics, warehousing, and manufacturing processes. Predominantly, these solutions are targeted towards enterprises grappling with the complexities of high-volume material flow, labor shortages, and the imperative for rapid, accurate operations. The primary end-users are typically large-scale manufacturing facilities that require precise material sequencing for assembly lines, and vast distribution centers, especially those serving the rapidly expanding e-commerce sector, which demand efficient order fulfillment and shipping capabilities. Companies facing intense competitive pressures and those with complex supply chains find significant value in these integrated systems, as they offer pathways to substantial operational improvements and cost reductions.

Beyond the immediate production and distribution environments, a significant segment of potential customers includes third-party logistics (3PL) providers who manage warehousing and transportation for multiple clients. These 3PLs leverage integrated material handling systems to offer competitive services, scale operations efficiently, and meet diverse client needs without extensive manual intervention. The automotive industry, with its intricate assembly processes and just-in-time inventory requirements, represents another major customer base. Similarly, pharmaceutical and food and beverage companies, constrained by stringent regulatory compliance and strict cold chain requirements, are prime candidates for integrated solutions that ensure traceability, product integrity, and swift delivery. Any industry facing high throughput demands, pressure to reduce operational costs, or challenges in managing a consistent and reliable workforce constitutes a potential buyer of these sophisticated material handling integration offerings, making the market broadly applicable across the industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 38.5 billion |

| Market Forecast in 2032 | USD 70.6 billion |

| Growth Rate | 9.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dematic, Daifuku Co Ltd, SSI Schaefer AG, Vanderlande Industries, Kion Group AG (Dematic), Honeywell Intelligrated, Murata Machinery Ltd, Toyota Industries Corporation (Toyota Material Handling), Knapp AG, TGW Logistics Group, Bastian Solutions (Toyota Advanced Logistics), Beumer Group, Fives Group, Swisslog (KUKA AG), FlexLink (COESIA Group), Savoye, Kardex Remstar, Grenzebach Group, Witron Logistik + Informatik GmbH, Cimcorp Oy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Material Handling Integration Market Key Technology Landscape

The Material Handling Integration Market is underpinned by a rapidly evolving technological landscape, driven by the principles of Industry 4.0 and the increasing demand for intelligent, interconnected, and autonomous operations. Robotics, including articulated robots, SCARA robots, and especially collaborative robots (cobots), are central to flexible automation, performing tasks like picking, packing, assembly, and palletizing with growing dexterity and safety. Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) represent a crucial technology for material transport, offering flexible and scalable solutions for moving goods within warehouses and factories, often navigating dynamically without fixed infrastructure, significantly improving operational flexibility compared to traditional fixed conveyors. These mobile robotic systems are becoming more sophisticated with advanced sensor fusion, AI-powered navigation, and fleet management software.

Automated Storage and Retrieval Systems (AS/RS) remain a cornerstone technology for high-density storage and efficient retrieval, encompassing various forms such as unit-load AS/RS for pallets and mini-load AS/RS for smaller items, along with shuttle systems and vertical lift modules. These systems maximize space utilization and provide rapid access to inventory. Complementing the hardware, advanced software solutions like Warehouse Management Systems (WMS) and Warehouse Execution Systems (WES) are critical for orchestrating material flow, managing inventory, optimizing labor, and integrating various automation technologies into a unified operational platform. These systems are increasingly leveraging artificial intelligence and machine learning algorithms for demand forecasting, predictive analytics, and real-time decision-making, transforming warehouses into truly intelligent hubs. Data analytics and business intelligence tools extract actionable insights from the vast amounts of operational data generated by these systems, enabling continuous improvement and strategic planning.

Furthermore, the Internet of Things (IoT) plays a pivotal role by connecting diverse material handling equipment, sensors, and devices, enabling real-time data collection and communication. This connectivity facilitates comprehensive monitoring, remote diagnostics, and predictive maintenance, ensuring high system uptime and operational reliability. Machine vision systems, integrated with AI, are enhancing quality control, item identification, and robotic guidance, contributing to greater accuracy and efficiency in processes like picking and inspection. Cloud computing provides the infrastructure for scalable, flexible, and accessible software solutions, enabling data sharing across multiple sites and facilitating remote management. The convergence of these technologies – robotics, AI, IoT, and advanced software – is creating highly adaptive, resilient, and optimized material handling ecosystems capable of meeting the dynamic challenges of modern supply chains and production environments, leading to significant advancements in productivity and cost-efficiency.

Regional Highlights

- North America: This region represents a mature yet dynamic market, characterized by early adoption of automation and a strong drive for technological innovation. The US, in particular, is a major contributor, fueled by the vast e-commerce sector, high labor costs, and a strong focus on supply chain resilience. Investments are concentrated in upgrading existing infrastructure with advanced robotics, AI-driven solutions, and sophisticated WMS platforms to enhance efficiency and address labor shortages. Canada and Mexico also show steady growth, driven by manufacturing and cross-border logistics.

- Europe: The European market is a significant hub for material handling integration, with Germany, the UK, France, and the Netherlands leading the charge. This region emphasizes precision engineering, Industry 4.0 initiatives, and sustainable automation solutions. High labor costs and a strong regulatory environment promoting workplace safety encourage the adoption of advanced robotics and AS/RS. There is a growing trend towards modular and flexible systems that can adapt to varying production demands and increasingly complex supply chains within the EU.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by rapid industrialization, burgeoning e-commerce markets, and increasing manufacturing output in countries like China, India, Japan, South Korea, and Southeast Asian nations. The region benefits from large consumer bases, rising disposable incomes, and significant government investments in infrastructure and industrial modernization. Low-cost automation and scalable solutions are particularly attractive, as businesses seek to enhance competitiveness and cope with the immense volume of goods.

- Latin America: This region is witnessing steady growth in material handling integration, primarily in countries such as Brazil, Mexico, and Argentina. Growth is driven by increasing foreign direct investment in manufacturing, expanding retail sectors, and the development of logistics infrastructure. While adoption rates might be slower than in more developed regions, there is a clear trend towards automating core warehousing and distribution functions to improve efficiency and reduce operational costs as regional economies mature.

- Middle East and Africa (MEA): The MEA market is an emerging region for material handling integration, characterized by significant infrastructure development projects, diversification of economies away from oil, and growi

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager