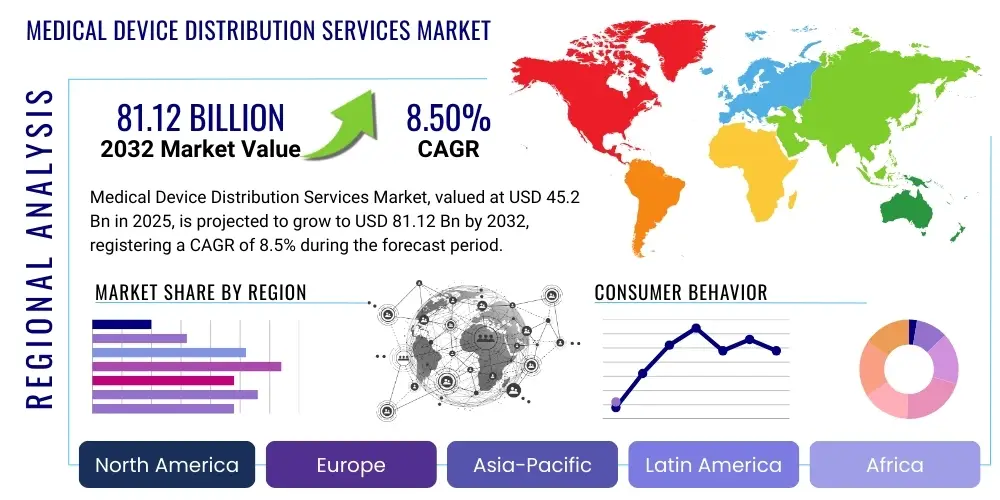

Medical Device Distribution Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427621 | Date : Oct, 2025 | Pages : 239 | Region : Global | Publisher : MRU

Medical Device Distribution Services Market Size

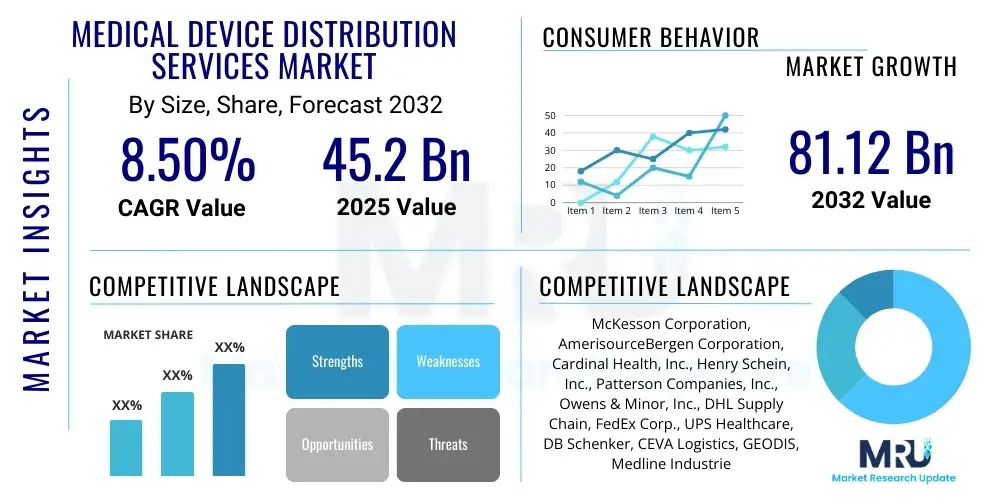

The Medical Device Distribution Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 45.2 billion in 2025 and is projected to reach USD 81.12 billion by the end of the forecast period in 2032.

Medical Device Distribution Services Market introduction

The Medical Device Distribution Services Market encompasses a wide array of specialized logistical and supply chain solutions tailored for the efficient and compliant movement of medical devices from manufacturers to healthcare providers and end-users. These services are critical for maintaining the integrity and accessibility of vital medical equipment, instruments, and consumables across diverse healthcare settings. The increasing complexity of medical devices, coupled with stringent regulatory requirements and the global nature of healthcare supply chains, has underscored the indispensable role of expert distribution services.

These services typically include warehousing, inventory management, transportation, cold chain logistics, regulatory compliance consulting, and value-added services such as kitting and assembly. Major applications span across hospitals, clinics, diagnostic centers, ambulatory surgical centers, and a growing segment of home care. The primary benefits derived from these services include enhanced operational efficiency, reduced logistical costs, assured regulatory adherence, minimized product damage or loss, and extended market reach for medical device manufacturers. This specialized ecosystem ensures that critical healthcare products are delivered precisely when and where they are needed, maintaining patient safety and supporting effective clinical outcomes.

Key driving factors propelling the markets growth include the global aging population, rising prevalence of chronic diseases demanding continuous medical intervention, and sustained technological advancements leading to a proliferation of new and sophisticated medical devices. Furthermore, the increasing healthcare expenditure worldwide, coupled with the expansion of healthcare infrastructure in emerging economies, creates a robust demand for sophisticated and reliable distribution networks. The necessity for strict compliance with diverse and evolving regulatory frameworks, such as those from the FDA and EMA, also mandates the use of specialized distribution partners, further solidifying the markets growth trajectory.

Medical Device Distribution Services Market Executive Summary

The Medical Device Distribution Services Market is characterized by dynamic business trends reflecting an emphasis on efficiency, technological integration, and a patient-centric approach. Key developments include a strong push towards supply chain digitalization, marked by the adoption of advanced analytics, AI, and IoT for enhanced visibility and predictive capabilities. Consolidation among distributors is also evident, aiming to achieve economies of scale and offer more comprehensive service portfolios. There is a growing focus on specialized logistics, particularly for high-value, sensitive, or temperature-controlled medical devices, alongside a nascent shift towards direct-to-patient distribution models for certain home care devices. Manufacturers are increasingly outsourcing logistics to 3PLs to leverage their expertise and reduce operational complexities.

Regionally, mature markets in North America and Europe continue to dominate due to established healthcare infrastructures, significant healthcare spending, and stringent regulatory environments that necessitate expert distribution. However, the Asia Pacific region is rapidly emerging as a high-growth area, driven by expanding healthcare access, a large patient pool, increasing medical tourism, and improving logistics infrastructure. Latin America and the Middle East & Africa are also demonstrating steady growth, fueled by rising investments in healthcare and increasing demand for modern medical technologies. Regulatory harmonization initiatives in various regions are shaping cross-border distribution strategies.

Segment-wise, the market is experiencing robust growth across various device types, with diagnostic devices, surgical instruments, and medical implants forming significant revenue streams due to the high volume of procedures and diagnostic tests. The home care devices segment is witnessing accelerated growth, driven by an aging population and a preference for at-home healthcare. In terms of service type, warehousing, transportation, and cold chain logistics remain core offerings, with regulatory consulting and value-added services gaining prominence as manufacturers seek end-to-end solutions. The end-user landscape sees hospitals and clinics as primary clients, though ambulatory surgical centers and home care settings are expanding their share.

AI Impact Analysis on Medical Device Distribution Services Market

Users frequently inquire about artificial intelligences transformative potential in streamlining complex medical device supply chains, particularly concerning enhanced efficiency, cost reduction, and improved compliance. Common questions revolve around AIs ability to optimize inventory levels, predict demand fluctuations, and automate warehousing operations, alongside concerns regarding data security, the ethical implications of autonomous decision-making, and the initial investment required for AI integration. There is a clear expectation for AI to bring greater transparency and responsiveness to distribution processes, mitigating risks associated with product recalls and ensuring timely delivery of critical medical devices. Users anticipate that AI will revolutionize everything from route optimization and cold chain monitoring to fraud detection and predictive maintenance of logistics equipment, ultimately leading to a more robust and resilient supply chain.

- Enhanced demand forecasting and inventory optimization through machine learning algorithms, reducing stockouts and overstocking.

- Automated warehouse management systems (WMS) leveraging AI for robotic picking, sorting, and storage, improving operational speed and accuracy.

- Optimized transportation routes and logistics planning using AI to minimize transit times, fuel consumption, and delivery costs.

- Predictive maintenance for logistics infrastructure and vehicles, ensuring operational continuity and reducing unplanned downtime.

- Real-time tracking and monitoring of sensitive medical devices, including cold chain integrity, via AI-powered IoT analytics.

- Improved regulatory compliance by automating document verification, risk assessment, and tracking of expiration dates.

- Personalized distribution strategies based on patient data and localized healthcare needs, supporting direct-to-patient models.

- Enhanced security and fraud detection within the supply chain through AI-driven anomaly detection and data pattern analysis.

DRO & Impact Forces Of Medical Device Distribution Services Market

The Medical Device Distribution Services Market is significantly influenced by a combination of powerful drivers, inherent restraints, and emerging opportunities, all shaped by various impact forces. Key drivers include the ever-expanding global healthcare sector, propelled by an aging population and the increasing prevalence of chronic diseases necessitating a continuous supply of medical devices. Technological advancements in medical devices themselves, coupled with the globalization of manufacturing and consumption, further fuel the demand for sophisticated and reliable distribution networks. Additionally, the growing emphasis on efficient supply chain management to reduce operational costs and enhance patient outcomes, alongside increasingly stringent regulatory landscapes, compels manufacturers to rely on specialized distribution partners, thereby driving market expansion. The desire for faster market access and product availability also plays a crucial role.

Conversely, several factors restrain market growth. The high capital investment required for establishing and maintaining advanced logistics infrastructure, including temperature-controlled warehousing and specialized transportation, poses a significant barrier. The complex and often disparate regulatory frameworks across different geographies create compliance challenges and increase operational overheads. Supply chain disruptions, such as those experienced during global health crises or geopolitical events, can severely impact the movement of goods, leading to delays and shortages. Concerns regarding data security for sensitive patient and product information, alongside the scarcity of skilled logistics professionals knowledgeable in medical device handling, further constrain market development. The inherent complexities of managing diverse product portfolios with varying storage and handling requirements also add to operational challenges.

Opportunities within the market abound, particularly in emerging economies where healthcare infrastructure is developing rapidly and demand for modern medical devices is escalating. The increasing adoption of telemedicine and home care models opens new avenues for direct-to-patient distribution services. The growing trend towards personalized medicine and biologics necessitates advanced cold chain logistics capabilities, presenting a lucrative niche. Furthermore, the integration of advanced digital technologies like IoT, AI, and blockchain for enhanced supply chain visibility, predictive analytics, and process automation offers significant growth potential and efficiency gains. Strategic partnerships and collaborations between manufacturers and logistics providers, alongside investments in sustainable and resilient supply chain practices, are also key opportunity areas. The markets impact forces, including the bargaining power of both buyers (healthcare providers) and suppliers (logistics technology providers), the threat of new entrants leveraging technology, the potential for substitute services, and the intensity of competitive rivalry among existing distributors, continually shape its evolution and strategic direction.

Segmentation Analysis

The Medical Device Distribution Services Market is comprehensively segmented based on various critical parameters, providing a detailed understanding of its underlying dynamics and diverse operational facets. These segmentations allow for a granular analysis of market trends, consumer behavior, and competitive landscapes across different service offerings, device categories, end-user groups, and distribution channels. Understanding these segments is crucial for stakeholders to identify growth opportunities, tailor service portfolios, and formulate targeted market strategies, ensuring efficient and compliant delivery of medical devices throughout the global healthcare ecosystem.

- By Service Type:

- Logistics & Transportation

- Warehousing & Storage

- Inventory Management

- Regulatory Compliance & Consulting

- Reverse Logistics

- Cold Chain Logistics

- Value-Added Services (e.g., Kitting, Labeling, Assembly)

- By Device Type:

- Diagnostic Devices

- Surgical Instruments

- Medical Implants & Prosthetics

- Life Support Devices

- Imaging Devices

- Home Care Devices

- Hospital Furniture & Equipment

- Consumables

- Others

- By End-User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Home Care Settings

- Research & Academic Institutions

- Pharmaceutical & Biotech Companies (for medical device components)

- By Channel:

- Direct Distribution

- Third-Party Logistics (3PL)

- Wholesalers & Distributors

- E-commerce Platforms

Medical Device Distribution Services Market Value Chain Analysis

The value chain for Medical Device Distribution Services begins upstream with raw material and component suppliers who provide critical inputs to medical device manufacturers. These manufacturers then design, develop, and produce a vast array of medical devices, ranging from simple consumables to complex surgical equipment. This upstream segment is characterized by innovation, quality control, and adherence to design specifications. Manufacturers often rely on a global network of suppliers, which introduces complexities related to sourcing, intellectual property, and international trade regulations. The efficiency of this initial stage directly impacts the quality and cost of the final medical device, setting the foundation for the entire distribution process. Effective supplier relationship management and robust quality assurance protocols are paramount here.

Following manufacturing, the midstream segment of the value chain focuses on the actual distribution services. This involves an intricate network of logistics providers, warehouses, and transportation channels. Medical devices are collected from manufacturing sites, transported to central or regional distribution centers, and then carefully stored under specific conditions, often requiring strict temperature and humidity controls, particularly for sensitive items. Inventory management systems play a crucial role in tracking stock, managing expiration dates, and optimizing storage space. Transportation involves specialized carriers equipped to handle fragile, high-value, or temperature-sensitive goods, ensuring secure and timely delivery. Regulatory compliance, including customs clearance for international shipments and adherence to national health authority guidelines, is a core component of this stage, often managed by dedicated regulatory consulting services provided by distributors.

Downstream, the value chain reaches its end-users, primarily healthcare providers such as hospitals, clinics, ambulatory surgical centers, and diagnostic centers. Increasingly, home care settings and individual patients are also becoming direct recipients of medical devices. The distribution channels can be broadly categorized into direct and indirect models. Direct distribution involves manufacturers shipping products directly to end-users, often for specialized or high-volume items, allowing for greater control but requiring significant internal logistics capabilities. Indirect distribution, more prevalent, leverages third-party logistics (3PL) providers, wholesalers, and specialized medical distributors. These partners offer expertise in fragmented markets, handle diverse product portfolios, and provide value-added services like kitting, sterilization, and repair. The selection of distribution channels heavily depends on the device type, market reach requirements, regulatory complexities, and the manufacturers strategic objectives. Effective downstream management ensures product availability, supports patient care, and facilitates reverse logistics for returns or recalls.

Medical Device Distribution Services Market Potential Customers

The primary potential customers and end-users of Medical Device Distribution Services are diverse, encompassing the entire spectrum of healthcare providers and institutions that rely on a steady and compliant supply of medical equipment. Hospitals represent a significant customer segment, given their extensive demand for a wide range of devices, from surgical instruments and diagnostic equipment to life support systems and patient monitoring tools. Their complex operational needs necessitate robust logistics for both routine supplies and emergency demands, often requiring just-in-time delivery and specialized handling for critical devices. Clinics and ambulatory surgical centers (ASCs) also form a substantial customer base, requiring efficient distribution for their focused range of procedures and diagnostic services, often valuing flexibility and responsiveness from their distribution partners.

Diagnostic centers are another key customer segment, requiring a precise and timely supply of imaging devices, laboratory equipment, and reagents, many of which are temperature-sensitive and have strict shelf-life requirements. The growing trend of home care settings has expanded the customer base to include individual patients and home healthcare providers who require direct delivery of durable medical equipment, mobility aids, and consumables, often necessitating specialized last-mile delivery solutions and patient education. Furthermore, research and academic institutions, involved in medical innovation and clinical trials, are also critical customers, needing secure and compliant distribution for research-grade devices and prototypes, often with highly specialized storage and transportation needs.

Beyond direct patient care facilities, pharmaceutical and biotechnology companies, particularly those involved in combination products or medical device components, may also engage medical device distribution services. Government health agencies and disaster relief organizations frequently require large-scale, rapid deployment of medical devices during public health emergencies or humanitarian crises, forming a specialized but crucial customer segment. The increasing complexity of healthcare supply chains and the global reach of medical device manufacturing mean that manufacturers themselves are often customers, outsourcing their logistics to specialized distribution service providers to leverage expertise, reduce costs, and ensure regulatory compliance, thereby allowing them to focus on core competencies of innovation and product development.

Medical Device Distribution Services Market Key Technology Landscape

The Medical Device Distribution Services Market is undergoing a profound technological transformation, driven by the need for enhanced efficiency, transparency, and regulatory compliance throughout the supply chain. Central to this evolution are advanced data analytics and Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies enable sophisticated demand forecasting, inventory optimization, and predictive analytics for logistics planning, reducing waste and improving responsiveness to market fluctuations. AI-powered systems can analyze vast datasets to identify optimal shipping routes, predict potential delays, and even automate decision-making in warehouse operations, thereby significantly streamlining the distribution process. The integration of AI extends to quality control, allowing for automated inspections and anomaly detection, further enhancing product integrity and safety.

The Internet of Things (IoT) plays a crucial role in providing real-time visibility and monitoring across the distribution network. IoT sensors embedded in packaging, warehouse facilities, and transportation vehicles can track critical parameters such as temperature, humidity, light exposure, and location. This is particularly vital for cold chain logistics, ensuring that temperature-sensitive medical devices, biologics, and pharmaceuticals maintain their efficacy from manufacture to point of use. RFID (Radio Frequency Identification) technology complements IoT by offering precise tracking and tracing capabilities for individual devices, enabling efficient inventory management, rapid recall identification, and robust anti-counterfeiting measures. This enhanced traceability is essential for meeting stringent regulatory requirements and bolstering patient safety.

Furthermore, enterprise-level software solutions such as Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) are foundational for modern distribution operations. These systems automate and optimize various logistical tasks, from receiving and put-away to order picking, packing, and shipping. Blockchain technology is emerging as a promising tool for creating immutable and transparent records of every transaction and movement within the supply chain, significantly improving data integrity, reducing fraud, and simplifying audit trails for regulatory compliance. Robotic process automation (RPA) is also gaining traction, automating repetitive administrative tasks and enhancing operational speed and accuracy. The convergence of these technologies creates an intelligent, interconnected, and highly efficient ecosystem, ensuring the secure and timely delivery of medical devices while navigating the complex global regulatory landscape.

Regional Highlights

- North America: Dominates the market due to its mature healthcare infrastructure, high healthcare expenditure, significant presence of leading medical device manufacturers, and stringent regulatory environment. The United States is the largest market, driven by technological advancements, an aging population, and a sophisticated logistics network. Canada also contributes significantly with its universal healthcare system and growing demand for advanced medical technologies.

- Europe: A major market fueled by well-established healthcare systems, increasing prevalence of chronic diseases, and favorable government initiatives for medical device innovation. Germany, the United Kingdom, and France are key contributors, benefiting from high R&D investments, advanced logistics infrastructure, and a strong focus on regulatory compliance, particularly with EU MDR.

- Asia Pacific: Expected to witness the highest growth rate during the forecast period. This growth is attributed to a rapidly expanding population, increasing healthcare access and expenditure, improving medical infrastructure, and a rising awareness of advanced medical treatments. China, India, and Japan are at the forefront, driven by their large patient pools, growing medical tourism, and government support for healthcare reforms and local manufacturing.

- Latin America: Demonstrates steady growth, supported by increasing investments in healthcare infrastructure, rising demand for medical devices, and improving economic conditions. Brazil and Mexico are leading countries, characterized by their large populations and ongoing efforts to modernize healthcare facilities and expand access to advanced medical technologies.

- Middle East & Africa: Emerging as a promising market due to increasing healthcare investments, a growing burden of non-communicable diseases, and initiatives to diversify economies beyond oil. The UAE and Saudi Arabia are key players, investing heavily in building world-class healthcare facilities and adopting advanced medical technologies, driving demand for specialized distribution services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Device Distribution Services Market.- McKesson Corporation

- AmerisourceBergen Corporation

- Cardinal Health, Inc.

- Henry Schein, Inc.

- Patterson Companies, Inc.

- Owens & Minor, Inc.

- DHL Supply Chain

- FedEx Corp.

- UPS Healthcare

- DB Schenker

- CEVA Logistics

- GEODIS

- Medline Industries, LP

- B. Braun Melsungen AG (through its distribution network)

- Movianto (part of Walden Group)

Frequently Asked Questions

What are the primary drivers for growth in the Medical Device Distribution Services Market?

The market is primarily driven by an aging global population, the increasing prevalence of chronic diseases, technological advancements in medical devices, rising healthcare expenditure, and the growing demand for efficient, compliant supply chain management.

How does AI impact the efficiency and accuracy of medical device distribution?

AI significantly enhances efficiency through optimized demand forecasting, automated inventory management, predictive route planning, and real-time monitoring of sensitive products. It improves accuracy by reducing human error in warehousing and ensuring stringent regulatory compliance.

What role does cold chain logistics play in medical device distribution?

Cold chain logistics is crucial for distributing temperature-sensitive medical devices, such as certain diagnostic reagents, vaccines, and biologics. It ensures these products maintain their efficacy and safety by controlling temperature throughout the entire supply chain, preventing spoilage or degradation.

Which regions are expected to experience the most significant growth in this market?

The Asia Pacific region is anticipated to exhibit the highest growth, fueled by expanding healthcare infrastructure, increasing healthcare expenditure, a large population base, and rising adoption of advanced medical technologies in countries like China, India, and Japan.

What are the key challenges faced by medical device distribution service providers?

Key challenges include navigating complex and varying regulatory landscapes, managing high capital investments for infrastructure, mitigating supply chain disruptions, ensuring data security, and addressing the scarcity of skilled personnel with specialized knowledge in medical logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager