Medical Device Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427305 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Medical Device Packaging Market Size

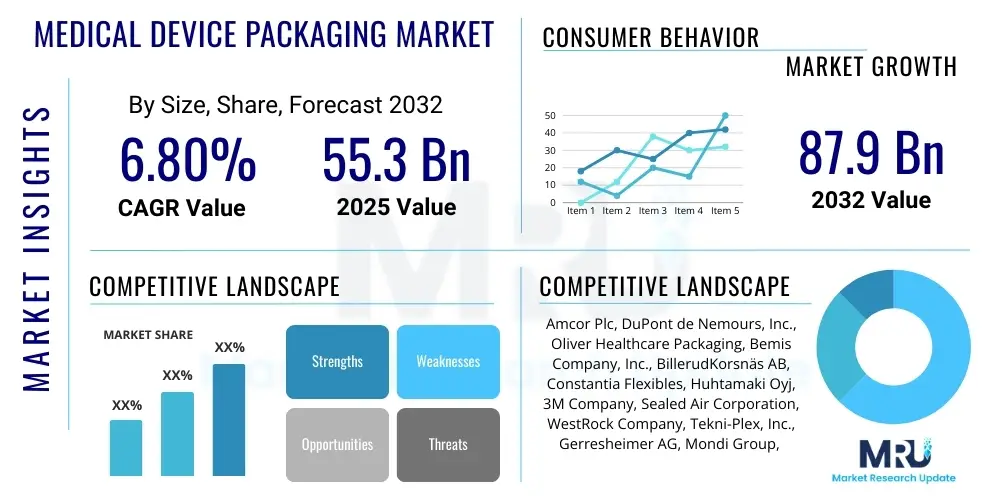

The Medical Device Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 55.3 billion in 2025 and is projected to reach USD 87.9 billion by the end of the forecast period in 2032.

Medical Device Packaging Market introduction

The Medical Device Packaging Market encompasses a wide range of specialized solutions designed to protect medical instruments, implants, and pharmaceutical products from physical damage, contamination, and environmental factors throughout their lifecycle. This critical sector ensures the sterility, integrity, and efficacy of medical devices from manufacturing through sterilization, distribution, storage, and eventual use in healthcare settings. The demand for robust and compliant packaging solutions is driven by stringent regulatory requirements, the increasing complexity of medical devices, and the continuous innovation within the healthcare industry. Effective packaging is paramount for patient safety and product performance, making it an indispensable component of the medical device ecosystem.

Medical device packaging includes primary, secondary, and tertiary packaging forms, utilizing materials such as plastics (PET, PVC, PE, PP), paper, aluminum, and glass. Key applications span a vast array of medical products, including surgical instruments, diagnostic kits, implantable devices, sterile disposables, and pharmaceutical delivery systems. The inherent benefits of advanced medical packaging include enhanced product protection, extended shelf life, simplified sterilization processes, tamper-evidence, and improved traceability, all while meeting rigorous regulatory standards from bodies like the FDA and EMA. These benefits directly contribute to reducing healthcare-associated infections and ensuring the safe delivery of critical medical technologies to patients worldwide.

Several factors propel the growth of this market, including the global rise in chronic diseases, an aging population demanding more medical interventions, and the increasing adoption of single-use disposable medical devices. Furthermore, the expansion of the healthcare sector in emerging economies, coupled with significant investments in research and development for new device technologies, necessitates advanced packaging solutions that can accommodate these innovations. The ongoing focus on supply chain efficiency and sustainability also influences packaging material and design choices, driving innovation in eco-friendly and cost-effective solutions.

Medical Device Packaging Market Executive Summary

The Medical Device Packaging Market is currently experiencing robust growth, propelled by a confluence of evolving business trends. Industry participants are increasingly focused on developing sustainable packaging solutions, driven by corporate social responsibility initiatives and growing consumer and regulatory pressures. There is a discernible shift towards lightweight, recyclable, and biodegradable materials without compromising barrier integrity or sterilization compatibility. Furthermore, the integration of smart packaging technologies, such as RFID tags and QR codes, is enhancing supply chain visibility, inventory management, and anti-counterfeiting efforts, providing added value beyond basic product protection.

Regional trends significantly influence market dynamics. North America and Europe continue to dominate the market due to their mature healthcare infrastructures, stringent regulatory environments, and high adoption rates of advanced medical technologies. However, the Asia Pacific region is emerging as a critical growth hub, fueled by expanding healthcare access, rising disposable incomes, and increasing investments in medical device manufacturing within countries like China and India. These regions present substantial opportunities for packaging manufacturers to localize production and tailor solutions to specific market needs and regulatory landscapes.

Segmentation trends indicate a strong demand for sterile barrier packaging, particularly for implantable and surgical devices, where maintaining sterility is paramount. Thermoformed trays and flexible packaging solutions are gaining traction due to their versatility, cost-effectiveness, and ability to accommodate various device geometries. Material-wise, plastics, especially specialized polymers, remain dominant, but there is an accelerating trend towards hybrid solutions incorporating paper, foil, and bio-based materials to meet specific protection requirements and sustainability goals. The market is also witnessing consolidation, with key players expanding their global footprints and technological capabilities through strategic mergers and acquisitions to offer comprehensive packaging solutions.

AI Impact Analysis on Medical Device Packaging Market

User inquiries concerning AIs influence on the medical device packaging market frequently center on how artificial intelligence can enhance efficiency, quality control, and supply chain management. Common questions explore AIs role in optimizing packaging design for new, complex medical devices, its potential to automate inspection processes for defects, and its application in predicting demand fluctuations to streamline inventory. There is also significant interest in AIs capacity to integrate with smart packaging for real-time monitoring of product integrity and environmental conditions, as well as its contribution to ensuring regulatory compliance and combating counterfeiting. Users seek to understand both the transformative benefits and potential challenges, such as data security and implementation costs, associated with AI adoption in this critical sector.

- AI-powered visual inspection systems can detect microscopic defects in packaging materials or seals with higher accuracy and speed than human operators, significantly improving quality control and reducing manufacturing waste.

- Predictive analytics driven by AI algorithms can optimize supply chain logistics by forecasting demand, identifying potential bottlenecks, and suggesting optimal inventory levels, leading to reduced storage costs and improved delivery times for medical devices.

- AI can assist in the design and prototyping phase of medical device packaging by simulating material performance under various conditions, enabling faster iteration and selection of the most suitable, cost-effective, and compliant packaging solutions.

- Machine learning models can analyze vast datasets of regulatory guidelines and historical compliance issues, providing actionable insights to ensure that packaging designs and labeling consistently meet evolving global standards, minimizing risks of recalls.

- The integration of AI with smart packaging solutions allows for real-time monitoring of temperature, humidity, and shock during transit and storage, enabling proactive intervention to prevent damage or degradation of sensitive medical devices.

- AI algorithms can analyze market trends and competitor strategies to identify gaps and opportunities in medical device packaging, informing product development and market entry strategies for packaging manufacturers.

- Robotic process automation (RPA) powered by AI enhances the efficiency of packaging lines, improving throughput and reducing labor costs while maintaining precision and consistency in sterile environments.

- AI-driven solutions can contribute to sustainability efforts by optimizing material usage, identifying opportunities for lightweighting, and improving waste management processes within packaging operations.

DRO & Impact Forces Of Medical Device Packaging Market

The Medical Device Packaging Market is shaped by a powerful interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the relentless growth of the global medical device industry itself, fueled by an aging population, increasing prevalence of chronic diseases, and advancements in medical technologies that require sophisticated packaging. Regulatory frameworks, such as those imposed by the FDA, EMA, and ISO standards, are also significant drivers, mandating stringent requirements for packaging integrity, sterilization, and labeling, thus pushing for continuous innovation and higher quality standards across the market. Furthermore, the rising adoption of single-use and disposable medical devices, particularly in emerging economies, significantly contributes to the demand for efficient and cost-effective packaging solutions.

Despite robust growth, the market faces several restraints. The high cost associated with developing and manufacturing advanced, compliant medical device packaging, especially for sterile and complex devices, poses a barrier to entry and can increase overall product costs. Stringent and evolving regulatory requirements, while a driver for innovation, also present a significant challenge, as manufacturers must continually invest in research and development to ensure their packaging meets the latest standards, often leading to prolonged approval processes. Additionally, volatility in raw material prices, particularly for specialized plastics and barrier films, can impact production costs and profit margins for packaging providers.

Opportunities within the market are abundant. The growing trend towards sustainable packaging presents a substantial opportunity for manufacturers to innovate with recyclable, biodegradable, and renewable materials, catering to increasing environmental consciousness and corporate mandates. The integration of smart packaging technologies, including RFID, NFC, and sensors for temperature and humidity monitoring, offers enhanced traceability, security, and supply chain efficiency, creating new value propositions. Moreover, the expansion of personalized medicine and home healthcare services necessitates novel packaging solutions that are easy to use, portable, and maintain device integrity outside traditional clinical settings, opening avenues for customized and patient-centric designs.

Segmentation Analysis

The Medical Device Packaging Market is extensively segmented to reflect the diverse requirements and applications within the healthcare sector. Understanding these segments is crucial for market participants to tailor their strategies, product offerings, and go-to-market approaches. Segmentation typically occurs across material types, packaging forms, product types, applications, and geographic regions, each presenting unique demands and growth trajectories. The complex nature of medical devices, ranging from simple disposables to highly sensitive implantable technologies, necessitates a broad spectrum of packaging solutions, driving continuous innovation across all segments to meet specific protection, sterilization, and regulatory needs.

Key drivers influencing these segments include the increasing emphasis on patient safety, the demand for extended shelf life, and the need for tamper-evident and child-resistant features. Furthermore, the global shift towards more sustainable practices is profoundly impacting material choices and design principles across all packaging forms. The markets dynamic nature ensures that each segment is constantly evolving, with new materials, technologies, and designs emerging to address specific challenges, such as advanced sterilization compatibility, enhanced barrier properties, and improved user-friendliness for healthcare professionals and patients alike. This granular understanding allows stakeholders to identify niche opportunities and capitalize on burgeoning trends.

- By Material Type:

- Plastics (Polyethylene, Polypropylene, PET, PVC, Polystyrene, Polyamide, others)

- Paper & Paperboard (Medical-grade paper, Tyvek)

- Glass (Ampoules, Vials, Syringes)

- Metals (Aluminum foil, other alloys)

- Others (Foils, films, composites)

- By Packaging Form:

- Flexible Packaging (Pouches, Bags, Lids, Blister packs, Wraps, Films)

- Rigid Packaging (Trays, Clamshells, Boxes, Cases, Bottles, Containers)

- Semi-Rigid Packaging (Folding cartons, Thermoformed trays)

- By Product Type:

- Sterile Packaging (Sterile barrier systems, Sterilization pouches & rolls)

- Non-Sterile Packaging (Secondary packaging, Transport packaging)

- By Application:

- Surgical & Medical Instruments (Scalpels, Catheters, Syringes)

- In-vitro Diagnostic Products (Test kits, Reagents)

- Implants (Orthopedic implants, Cardiovascular implants)

- Electronic Medical Devices (Monitors, Pacemakers)

- Medical Disposables (Gloves, Gowns, Masks)

- Pharmaceutical & Biopharmaceutical Packaging (Pre-filled syringes, Vials)

- Others (Dental supplies, Ophthalmic products)

- By End-User:

- Medical Device Manufacturers

- Contract Packaging Organizations (CPOs)

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Others (Research institutions, Diagnostic laboratories)

- By Sterilization Method Compatibility:

- Ethylene Oxide (EtO) Sterilization

- Gamma Sterilization

- E-beam Sterilization

- Steam Sterilization (Autoclave)

- Others (Hydrogen Peroxide Plasma, Sterilization by Filtration)

Medical Device Packaging Market Value Chain Analysis

The value chain for the Medical Device Packaging Market is a complex and interconnected network, beginning with raw material suppliers and extending through manufacturers, converters, and distributors to the end-users. At the upstream level, the chain involves suppliers of specialized polymers, medical-grade papers, foils, and other critical materials. These suppliers play a fundamental role in providing high-purity, biocompatible, and sterlization-compatible materials that meet stringent regulatory standards. Innovation in material science at this stage directly influences the performance and cost-effectiveness of the final packaging solution, with a growing emphasis on sustainable and advanced barrier properties. Collaboration between material suppliers and packaging manufacturers is crucial to develop tailored solutions for evolving medical device requirements.

Further down the chain, packaging converters transform these raw materials into various packaging forms, such as thermoformed trays, flexible pouches, and rigid containers. This stage involves sophisticated manufacturing processes, including extrusion, lamination, sealing, and printing, often conducted in controlled environments to maintain cleanliness and prevent contamination. These converters frequently specialize in medical-grade packaging, possessing the necessary certifications and expertise for sterile barrier systems. The distribution channel then takes over, which can be direct, from packaging manufacturers to medical device companies, or indirect, involving third-party logistics providers and specialized distributors who handle inventory, warehousing, and transportation, often under strict temperature and humidity controls.

The direct distribution model often involves large medical device manufacturers procuring packaging directly from a limited number of approved, specialized suppliers to ensure quality control and integrated supply chain management. This allows for closer collaboration on custom designs and bulk purchasing advantages. Conversely, indirect channels are frequently utilized by smaller medical device companies or for specific product lines, leveraging the extensive network and expertise of distributors to reach a broader market efficiently. These distributors ensure timely delivery and adherence to cold chain requirements where applicable, playing a vital role in maintaining the integrity of medical device packaging until it reaches the end-user, such as hospitals, clinics, or contract packaging organizations.

Medical Device Packaging Market Potential Customers

The primary potential customers and end-users of medical device packaging are diverse, encompassing various entities within the expansive healthcare ecosystem, each with unique needs and regulatory compliance requirements. At the forefront are medical device manufacturers, who represent the largest segment of demand. These companies require packaging for everything from complex surgical instruments and implantable devices to diagnostic kits and disposable medical supplies. Their needs are driven by the specific characteristics of their devices, requiring packaging that is compatible with sterilization methods, offers robust protection, ensures sterility, and facilitates ease of use for healthcare professionals. Packaging choices for this group are often dictated by material science innovation, cost-effectiveness, and stringent regulatory adherence.

Another significant customer segment includes pharmaceutical and biotechnology companies. While their primary focus is drug packaging, many also produce combination products (e.g., pre-filled syringes, drug-coated stents) or diagnostic reagents that necessitate specialized medical device packaging. Their demands frequently overlap with those of traditional medical device manufacturers, particularly concerning sterile packaging, tamper-evidence, and child-resistant features. Additionally, contract manufacturing organizations (CMOs) and contract packaging organizations (CPOs) serve as crucial intermediaries, providing outsourced manufacturing and packaging services for smaller companies or for specialized projects. These entities require a broad range of packaging solutions and often drive innovation in efficient, scalable, and compliant packaging processes.

Beyond manufacturers and their partners, hospitals, clinics, and other healthcare providers indirectly influence packaging demand through their purchasing decisions and requirements for product presentation, ease of opening, and waste disposal. While they do not directly purchase raw packaging materials, their preferences for user-friendly, clearly labeled, and environmentally responsible packaging can steer design and material choices up the supply chain. Furthermore, research institutions and diagnostic laboratories also represent a niche but important customer base, needing specialized packaging for sensitive samples, reagents, and laboratory equipment, where maintaining integrity and preventing contamination are paramount. The overarching trend across all these customer segments is a demand for packaging that balances functionality, safety, compliance, and increasingly, sustainability.

Medical Device Packaging Market Key Technology Landscape

The Medical Device Packaging Market is characterized by a dynamic and evolving technology landscape, continuously innovating to meet the stringent demands of safety, sterility, and regulatory compliance. One critical area of technological advancement lies in barrier materials, where multi-layer films, advanced coatings, and specialized polymers are being developed to provide superior protection against moisture, oxygen, and microbial contamination. These innovations are essential for extending the shelf life of sensitive medical devices and maintaining their sterile integrity throughout complex supply chains. Furthermore, the development of breathable barrier materials, such as Tyvek, allows for gas sterilization while maintaining a sterile barrier, catering to a wide range of medical device types.

Another significant technological focus is on sterilization compatibility and validation. Packaging materials must withstand various sterilization processes—including Ethylene Oxide (EtO), Gamma Irradiation, E-beam, and Steam (Autoclave)—without compromising their physical properties or barrier function. This necessitates materials with specific chemical compositions and structural integrity, alongside rigorous testing protocols. Advancements in seal integrity technologies, such as improved heat-sealing methods and adhesive formulations, are also crucial to prevent breaches and ensure the sterility of the packaged device. These technologies directly contribute to preventing healthcare-associated infections and ensuring patient safety, making them central to medical device packaging design.

Beyond core protective functions, the market is witnessing the integration of smart packaging technologies. This includes the incorporation of RFID (Radio-Frequency Identification) tags, NFC (Near Field Communication) labels, and QR codes for enhanced traceability, inventory management, and anti-counterfeiting measures. Sensors capable of monitoring temperature, humidity, and shock are also being embedded or attached to packaging to provide real-time data on environmental conditions during transit, particularly for temperature-sensitive biologics and advanced medical devices. These digital innovations not only improve supply chain efficiency and security but also enable data-driven decision-making, offering a new level of intelligence and control over the medical device journey from manufacturing to the point of use. Additionally, advancements in sustainable packaging materials, including bio-based plastics and fully recyclable alternatives, are gaining traction as the industry moves towards more environmentally responsible solutions.

Regional Highlights

- North America: Dominates the market due to its advanced healthcare infrastructure, significant R&D investments, stringent regulatory environment, and high adoption rate of sophisticated medical devices. The United States is a key contributor, driven by a large aging population and a robust pharmaceutical and biotechnology sector.

- Europe: A mature market with strong regulatory frameworks, such as the Medical Device Regulation (MDR), driving demand for high-quality, compliant packaging. Germany, the UK, and France are leading contributors, focusing on innovation in sustainable and smart packaging solutions.

- Asia Pacific: Expected to exhibit the highest growth rate, fueled by improving healthcare accessibility, increasing healthcare expenditure, a large patient pool, and growing medical device manufacturing capabilities in countries like China, India, and Japan. Investment in healthcare infrastructure and rising disposable incomes are key drivers.

- Latin America: Shows promising growth potential due to expanding healthcare sectors, government initiatives to improve medical facilities, and increasing demand for modern medical devices, particularly in Brazil and Mexico. Regulatory harmonization efforts are also contributing to market development.

- Middle East & Africa: Emerging as a market with considerable opportunities, driven by increasing healthcare investments, a rising prevalence of chronic diseases, and efforts to modernize healthcare systems, particularly in the Gulf Cooperation Council (GCC) countries and South Africa.

- United States: A primary market for innovative medical device packaging, characterized by strict FDA regulations, high demand for sterile packaging for complex devices, and early adoption of smart packaging technologies.

- Germany: A leading European market, known for its high-quality medical device manufacturing and strong focus on precision, sustainability, and advanced materials in packaging.

- China: The fastest-growing market in Asia Pacific, propelled by a massive patient population, expanding domestic medical device production, and increasing healthcare spending.

- Japan: An established market with a strong emphasis on technological sophistication, quality, and precision in medical device packaging, catering to an aging demographic and advanced healthcare system.

- India: A rapidly emerging market, driven by a large and growing population, increasing awareness of healthcare, and government initiatives promoting domestic medical device manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Device Packaging Market.- Amcor Plc

- DuPont de Nemours, Inc.

- Oliver Healthcare Packaging

- Bemis Company, Inc. (now part of Amcor Plc)

- BillerudKorsnäs AB

- Constantia Flexibles

- Huhtamaki Oyj

- 3M Company

- Sealed Air Corporation

- WestRock Company

- Tekni-Plex, Inc.

- Gerresheimer AG

- Mondi Group

- Berry Global Inc.

- Catalent, Inc.

- Nelipak Healthcare Packaging

- Printpack Inc.

- Schur Flexibles Group

- SGD Pharma

- Wipak Group

Frequently Asked Questions

What are the primary factors driving growth in the Medical Device Packaging Market?

The Medical Device Packaging Market is primarily driven by the global aging population, the rising prevalence of chronic diseases requiring increased medical interventions, and continuous advancements in medical device technology. Additionally, stringent regulatory requirements mandating high standards for product sterility and safety, alongside the growing adoption of single-use disposable medical devices, significantly contribute to market expansion.

How do regulatory standards impact medical device packaging design and materials?

Regulatory standards from bodies like the FDA, EMA, and ISO play a critical role, dictating strict requirements for material biocompatibility, packaging integrity, sterilization compatibility, and labeling. These regulations ensure patient safety and product efficacy, compelling manufacturers to invest in advanced materials and design processes that meet rigorous validation and compliance criteria, thereby preventing contamination and maintaining sterility throughout the products shelf life.

What role does sustainability play in the future of medical device packaging?

Sustainability is becoming an increasingly vital factor, driving innovation towards eco-friendly packaging solutions. This includes the development and adoption of recyclable, biodegradable, and renewable materials, as well as lightweight designs to reduce carbon footprint. Manufacturers are actively exploring sustainable alternatives to align with corporate social responsibility goals and evolving consumer and regulatory demands for environmentally conscious products.

What are "smart packaging" technologies and how are they used in medical devices?

Smart packaging technologies in medical devices integrate features like RFID tags, NFC labels, QR codes, and embedded sensors into packaging. These technologies enable enhanced traceability, real-time monitoring of environmental conditions (e.g., temperature, humidity), improved inventory management, and robust anti-counterfeiting measures. They provide crucial data throughout the supply chain, ensuring product integrity and authenticity from manufacturing to point of use.

What types of materials are most commonly used for medical device packaging and why?

Plastics, including polyethylene, polypropylene, and PET, are predominantly used due to their versatility, barrier properties, and compatibility with various sterilization methods. Medical-grade paper and Tyvek are essential for breathable sterile barriers. Glass is used for injectable solutions and diagnostics due to its inertness. Aluminum foil provides excellent barrier protection. The selection depends on the devices specific needs, sterilization method, and required shelf life, prioritizing sterility, protection, and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager