Medical Terminology Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428507 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medical Terminology Software Market Size

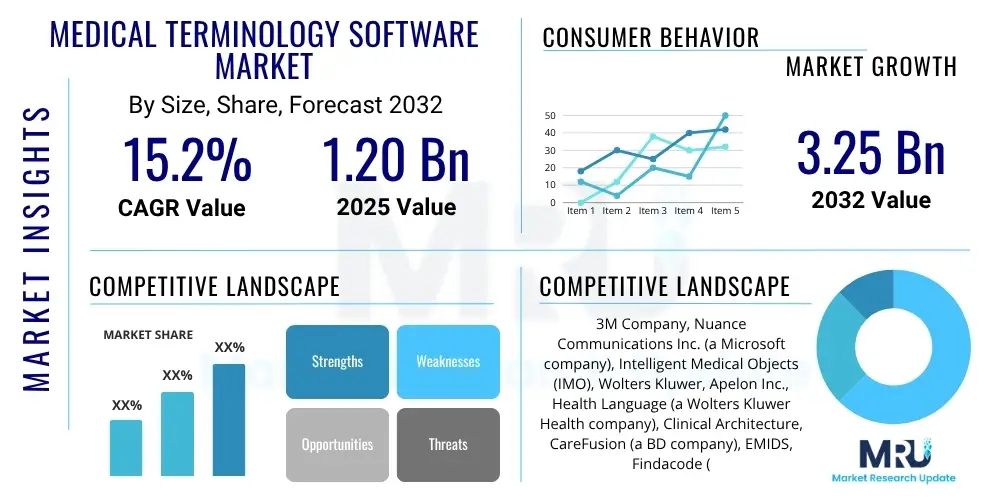

The Medical Terminology Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% between 2025 and 2032. The market is estimated at USD 1.20 Billion in 2025 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2032.

Medical Terminology Software Market introduction

The Medical Terminology Software Market encompasses a range of digital solutions designed to standardize, manage, and process complex medical language. These specialized software products convert various clinical terms, diagnoses, procedures, and drugs into universally recognized codes and structured data, facilitating seamless communication and data exchange within the healthcare ecosystem. The primary objective is to enhance accuracy, interoperability, and efficiency in clinical documentation, medical billing, research, and educational settings. By providing a consistent framework for medical language, the software helps in overcoming inconsistencies arising from diverse linguistic and contextual interpretations.

Product descriptions typically highlight features like Natural Language Processing (NLP) capabilities, integration with Electronic Health Records (EHR) and Electronic Medical Records (EMR) systems, and support for international coding standards such as ICD-10, SNOMED CT, CPT, and LOINC. Major applications span across clinical documentation improvement, revenue cycle management, health information exchange, and clinical research data abstraction. The benefits derived from employing such software are substantial, including reduced coding errors, improved claims processing, enhanced data quality for analytics, and better adherence to regulatory compliance requirements. These systems streamline workflows, empower healthcare professionals with precise information, and contribute significantly to patient safety and quality of care.

Driving factors for the market's robust growth include the increasing adoption of EHR systems globally, which necessitates efficient data entry and retrieval using standardized terminology. Furthermore, the rising complexity of medical coding and billing, coupled with stringent regulatory mandates for data accuracy and interoperability, compels healthcare organizations to invest in advanced terminology management solutions. The growing demand for robust healthcare analytics to derive actionable insights from clinical data also fuels market expansion. Additionally, the continuous evolution of medical science introduces new terms and concepts, requiring dynamic and adaptable software solutions to maintain up-to-date and consistent terminology across various healthcare operations.

Medical Terminology Software Market Executive Summary

The Medical Terminology Software Market is witnessing transformative business trends characterized by a significant shift towards cloud-based deployment models and a growing emphasis on AI and machine learning integration to enhance automation and predictive capabilities. Healthcare providers and payers are increasingly seeking comprehensive solutions that offer robust interoperability, seamless integration with existing IT infrastructure, and advanced analytical features to improve operational efficiency and patient outcomes. The adoption of subscription-based Software-as-a-Service (SaaS) models is gaining traction, offering greater flexibility and scalability for diverse organizational needs, while also lowering upfront investment costs for end-users.

Regional trends indicate North America as the dominant market, primarily driven by stringent regulatory frameworks, high healthcare expenditure, and widespread adoption of advanced healthcare IT solutions, particularly within the United States. Europe also demonstrates a mature market with steady growth, propelled by initiatives focused on digital health transformation and cross-border health information exchange. Asia Pacific, however, is emerging as the fastest-growing region, attributed to increasing healthcare infrastructure development, rising awareness of health IT benefits, and government initiatives promoting digital health adoption in countries like China and India. Latin America and the Middle East & Africa regions are also showing nascent growth, driven by investments in modernizing healthcare systems and improving data management capabilities.

Segmentation trends highlight the increasing preference for integrated software solutions that can seamlessly connect with various healthcare systems, offering a holistic approach to terminology management. Cloud-based deployment models are outperforming on-premise solutions due to their inherent scalability, accessibility, and reduced IT overheads. Among applications, clinical documentation and billing and claims management remain the largest segments, underscoring the critical role of accurate terminology in revenue cycle integrity and patient record precision. The healthcare provider segment continues to be the primary end-user, though pharmaceutical companies and research institutions are showing increasing demand for terminology software to manage clinical trial data and drug information effectively.

AI Impact Analysis on Medical Terminology Software Market

User inquiries concerning AI's influence on medical terminology software frequently revolve around its potential to revolutionize coding accuracy, automate tedious tasks, and enhance the interpretation of unstructured clinical data. Common questions delve into how AI can manage the constantly evolving medical lexicon, address ethical considerations related to data privacy and algorithmic bias, and whether it will ultimately displace human medical coders. There is significant user expectation for AI to deliver more intelligent, predictive, and context-aware solutions that can reduce administrative burdens, improve clinical decision-making, and ensure better compliance with complex regulatory requirements. Users are keen to understand the practical applications of AI, such as natural language processing for deeper insights from patient notes, and how it can contribute to a more interconnected and efficient healthcare system, moving beyond mere standardization to intelligent interpretation and application of medical language.

- Enhanced accuracy and consistency in medical coding and terminology mapping, reducing human error.

- Automated extraction and classification of clinical data from unstructured sources like physician notes and discharge summaries using Natural Language Processing (NLP).

- Predictive coding and smart suggestions for relevant medical terms and codes, accelerating documentation and billing processes.

- Real-time clinical decision support by identifying potential gaps or inconsistencies in patient records based on standardized terminology.

- Improved interoperability through AI-driven semantic integration, bridging gaps between disparate healthcare systems.

- Facilitation of drug discovery and clinical research by enabling more efficient analysis and standardization of vast datasets.

- Personalized medicine enablement through granular analysis of patient data using precise, AI-managed terminology.

DRO & Impact Forces Of Medical Terminology Software Market

The Medical Terminology Software Market is significantly influenced by a confluence of driving forces, restraining factors, and emerging opportunities, all of which shape its growth trajectory and competitive landscape. Key drivers include the escalating adoption rates of Electronic Health Records (EHR) and Electronic Medical Records (EMR) systems across healthcare facilities worldwide, which inherently require robust terminology management for effective data input and retrieval. Simultaneously, the increasing complexity of medical coding standards and the stringent regulatory mandates, such as HIPAA in the U.S. and GDPR in Europe, for data accuracy, privacy, and interoperability, compel healthcare organizations to invest in sophisticated software solutions. Furthermore, the growing imperative to reduce healthcare costs by minimizing administrative overheads, enhancing billing accuracy, and improving revenue cycle management acts as a powerful catalyst for market expansion. The continuous demand for high-quality, standardized clinical data for advanced analytics, population health management, and value-based care initiatives further propels the market forward.

However, the market also faces considerable restraints that could temper its growth. The high initial investment costs associated with acquiring, implementing, and maintaining advanced medical terminology software solutions can be a significant barrier for smaller healthcare providers or those with limited IT budgets. The complexity of integrating these new systems with existing legacy IT infrastructure, which often involves overcoming compatibility issues and data migration challenges, also poses a substantial hurdle. Concerns regarding data security and patient privacy, especially with cloud-based deployments and the processing of sensitive health information, necessitate robust safeguards and compliance measures, adding to the operational complexities. Moreover, a lack of universal standardization across different healthcare systems and regions can hinder seamless data exchange and interoperability, despite the software’s primary function to standardize.

Amidst these challenges, significant opportunities are emerging that promise to revitalize and expand the market. The rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) technologies present a potent opportunity to integrate intelligent automation, natural language processing, and predictive analytics into terminology software, making it more efficient and accurate. The global expansion of telehealth services, accelerated by recent global health crises, creates new avenues for remote patient monitoring and virtual care, demanding sophisticated terminology management for digital consultations and data. Furthermore, the untapped potential in emerging economies, where healthcare digitalization is still in its nascent stages but rapidly growing, offers substantial growth prospects. The increasing focus on personalized medicine and precision health also necessitates granular, standardized data, paving the way for specialized terminology software solutions capable of handling complex genomic and phenotypic information, thus opening new application areas for market players.

Segmentation Analysis

The Medical Terminology Software Market is comprehensively segmented to provide a detailed understanding of its diverse components and evolving dynamics. This segmentation helps in analyzing market trends, identifying growth opportunities, and understanding the specific needs of various end-users across different operational contexts. The market is typically categorized by product type, deployment model, application, and end-user, each representing distinct functionalities and target audiences.

- By Product Type

- Standalone Software

- Integrated Software

- By Deployment Model

- On-premise

- Cloud-based

- By Application

- Clinical Documentation

- Billing and Claims Management

- Research and Development

- Education

- Others (e.g., Public Health Surveillance, Clinical Decision Support)

- By End-User

- Healthcare Providers (Hospitals, Clinics, Ambulatory Surgical Centers)

- Healthcare Payers (Insurance Companies)

- Pharmaceutical and Biotechnology Companies

- Academic & Research Institutions

- Government and Public Health Organizations

Value Chain Analysis For Medical Terminology Software Market

The value chain for the Medical Terminology Software Market begins with upstream activities involving core software development, linguistic expertise, and data acquisition. This stage focuses on creating the foundational algorithms, Natural Language Processing (NLP) models, and comprehensive medical lexicons that form the backbone of the software. Key players in this segment include specialized software developers, data scientists, and medical terminologists who collaborate to build and maintain vast databases of medical terms, codes, and their relationships. Sourcing and licensing of various medical coding standards (e.g., ICD-10, SNOMED CT) from relevant bodies also constitutes a crucial upstream activity.

Midstream activities primarily involve the refinement, integration, and distribution of the software. This includes customizing generic terminology engines for specific healthcare workflows, ensuring seamless integration with Electronic Health Records (EHR) and other hospital information systems, and developing user-friendly interfaces. Distribution channels for medical terminology software are diverse, encompassing both direct and indirect approaches. Direct sales involve vendors engaging directly with healthcare organizations, offering tailored solutions, implementation services, and ongoing support. Indirect channels include partnerships with EHR vendors, healthcare IT consultants, and value-added resellers (VARs) who bundle terminology software with broader healthcare solutions, extending market reach and penetration.

Downstream analysis focuses on the end-users and the final application of the software. Healthcare providers, including hospitals, clinics, and diagnostic centers, utilize the software for accurate clinical documentation, efficient billing, and streamlined data analysis. Healthcare payers leverage it for claims processing and fraud detection, while pharmaceutical companies and research institutions apply it for managing clinical trial data and drug classification. The value created at this stage is manifested in improved operational efficiency, enhanced data quality, better regulatory compliance, and ultimately, superior patient care outcomes. Post-sales support, training, and continuous software updates are also critical downstream activities that ensure sustained value delivery to customers.

Medical Terminology Software Market Potential Customers

The potential customer base for Medical Terminology Software is broad and multifaceted, spanning across various segments of the healthcare industry and related sectors. The primary end-users are healthcare providers, including large hospital networks, independent clinics, physician practices, ambulatory surgical centers, and diagnostic laboratories. These organizations are driven by the need for precise clinical documentation, efficient revenue cycle management, and compliance with complex regulatory standards, making terminology software an essential tool for their daily operations and strategic objectives.

Beyond direct patient care facilities, healthcare payers, such as private health insurance companies, government healthcare programs (e.g., Medicare, Medicaid), and third-party administrators, represent another significant customer segment. For payers, medical terminology software is crucial for accurate claims processing, fraud detection, policy management, and comprehensive risk assessment, ensuring the integrity and efficiency of their financial operations. The ability to standardize and interpret diverse medical data helps them in making informed decisions regarding reimbursement and coverage.

Furthermore, pharmaceutical and biotechnology companies are increasingly adopting these solutions to manage vast amounts of data generated from drug development, clinical trials, and post-market surveillance. Academic and research institutions utilize terminology software for robust data analysis in clinical studies, epidemiological research, and medical education, facilitating the precise classification and interpretation of scientific findings. Government and public health organizations also form a vital customer group, employing these solutions for disease surveillance, health policy planning, and large-scale data aggregation to monitor population health trends and implement effective public health interventions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.20 Billion |

| Market Forecast in 2032 | USD 3.25 Billion |

| Growth Rate | 15.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Nuance Communications Inc. (a Microsoft company), Intelligent Medical Objects (IMO), Wolters Kluwer, Apelon Inc., Health Language (a Wolters Kluwer Health company), Clinical Architecture, CareFusion (a BD company), EMIDS, Findacode (a Xactware company), Orion Health, CodeRyte (a 3M Company), Data Integrity Inc., Dolbey Systems Inc., M*Modal (a 3M Company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Terminology Software Market Key Technology Landscape

The Medical Terminology Software Market is underpinned by a sophisticated array of technologies that enable its core functionalities and drive its continuous evolution. At the forefront are Natural Language Processing (NLP) and Natural Language Understanding (NLU) technologies, which are crucial for interpreting unstructured clinical text, such as physician notes, discharge summaries, and radiology reports, and converting them into structured, codifiable data. These technologies are essential for semantic extraction, entity recognition, and context-aware understanding of medical language, allowing the software to accurately map clinical concepts to standardized terminologies like SNOMED CT and ICD codes. The advancements in deep learning models have significantly enhanced the precision and recall of NLP algorithms in this domain.

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are increasingly integrated into terminology software to provide advanced capabilities such as predictive coding, intelligent suggestions, and automated quality assurance. These AI-driven tools learn from vast datasets of medical records and coding patterns to improve accuracy, reduce manual effort, and identify potential coding errors or inconsistencies in real-time. This includes machine learning models for classification, clustering, and anomaly detection, which help in streamlining the coding process and improving the overall integrity of medical data. The integration of AI extends to facilitating interoperability by intelligently mapping disparate terminologies across different healthcare systems, fostering more seamless data exchange.

Cloud computing infrastructure is another foundational technology, enabling the widespread adoption of Medical Terminology Software through Software-as-a-Service (SaaS) models. Cloud-based solutions offer scalability, flexibility, and remote accessibility, reducing the need for costly on-premise hardware and maintenance. This deployment model facilitates rapid updates, enhances data security through centralized management, and supports real-time collaboration across geographically dispersed healthcare entities. Furthermore, robust Application Programming Interfaces (APIs) are vital for seamless integration with existing Electronic Health Record (EHR) systems, Laboratory Information Systems (LIS), Picture Archiving and Communication Systems (PACS), and other healthcare IT platforms, ensuring that terminology management is embedded directly into clinical and administrative workflows. Semantic web technologies and ontologies are also playing a growing role in formalizing medical knowledge and enabling more sophisticated reasoning and inference capabilities within these software systems.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature healthcare IT infrastructure, high adoption rates of EHR systems, and stringent regulatory requirements for accurate coding and billing, particularly in the United States. Significant investments in digital health and the presence of key market players further bolster its dominance.

- Europe: Europe is a substantial market, with strong growth propelled by government initiatives promoting e-health and interoperability across member states. Countries like Germany, the UK, and France are leading in the adoption of medical terminology software due to increasing healthcare expenditure and a focus on improving patient data management and clinical outcomes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This growth is attributed to developing healthcare infrastructure, rising awareness of healthcare IT benefits, increasing government initiatives for digital health, and a large patient population in countries such as China, India, and Japan. Economic growth and improving healthcare access are key drivers.

- Latin America: This region is an emerging market, with increasing investments in healthcare modernization and digital transformation. Countries like Brazil and Mexico are gradually adopting advanced healthcare IT solutions, including terminology software, to enhance efficiency and address growing healthcare demands.

- Middle East and Africa (MEA): The MEA region is witnessing nascent growth, primarily driven by increasing healthcare spending, government visions for smart healthcare cities, and a growing recognition of the importance of standardized medical data. Adoption is gradual but shows potential as healthcare infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Terminology Software Market.- 3M Company

- Nuance Communications Inc. (a Microsoft company)

- Intelligent Medical Objects (IMO)

- Wolters Kluwer

- Apelon Inc.

- Health Language (a Wolters Kluwer Health company)

- Clinical Architecture

- CareFusion (a BD company)

- EMIDS

- Findacode (a Xactware company)

- Orion Health

- CodeRyte (a 3M Company)

- Data Integrity Inc.

- Dolbey Systems Inc.

- M*Modal (a 3M Company)

- Optum (UnitedHealth Group)

- Cerner Corporation (now Oracle Health)

- Epic Systems Corporation

- MedDRA (International Council for Harmonisation)

- Lexi-Comp (a Wolters Kluwer Health company)

Frequently Asked Questions

What is medical terminology software?

Medical terminology software standardizes and manages complex healthcare language, converting clinical terms, diagnoses, and procedures into universally recognized codes for improved communication, accuracy, and interoperability across healthcare systems.

How does medical terminology software improve healthcare operations?

It enhances operations by reducing coding errors, streamlining billing and claims processing, improving the accuracy of clinical documentation, and enabling better data quality for analytics and regulatory compliance, leading to increased efficiency and patient safety.

What are the main types of deployment for medical terminology software?

The primary deployment models are on-premise, where the software is installed and managed locally on an organization's servers, and cloud-based (SaaS), which offers remote access, scalability, and reduced IT overheads through internet-hosted services.

How does AI impact the medical terminology software market?

AI significantly impacts the market by enabling advanced Natural Language Processing (NLP) for unstructured data, automating coding, providing predictive suggestions, and enhancing data accuracy and interoperability, leading to more efficient and intelligent solutions.

What are the key challenges in adopting medical terminology software?

Key challenges include high initial implementation costs, complexity of integrating with existing legacy IT systems, ensuring robust data security and patient privacy, and addressing the lack of universal standardization across diverse healthcare environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager