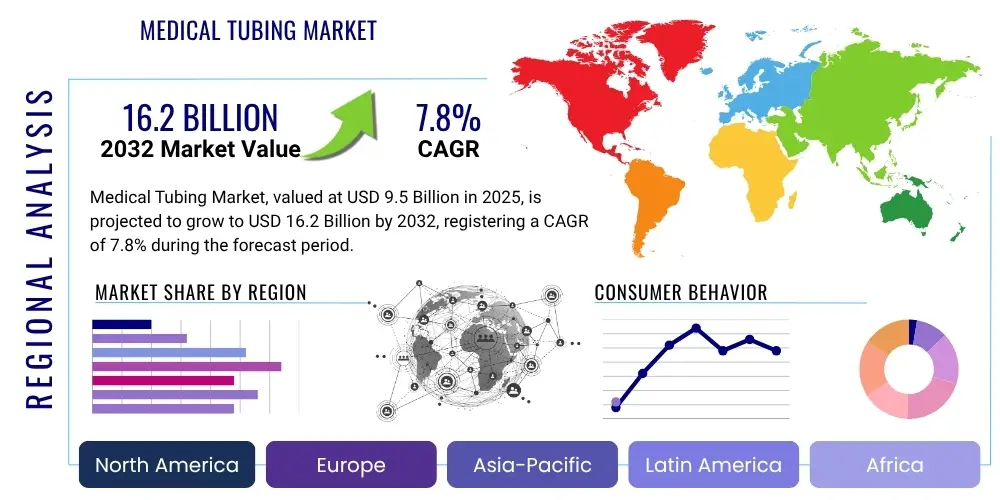

Medical Tubing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429117 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Medical Tubing Market Size

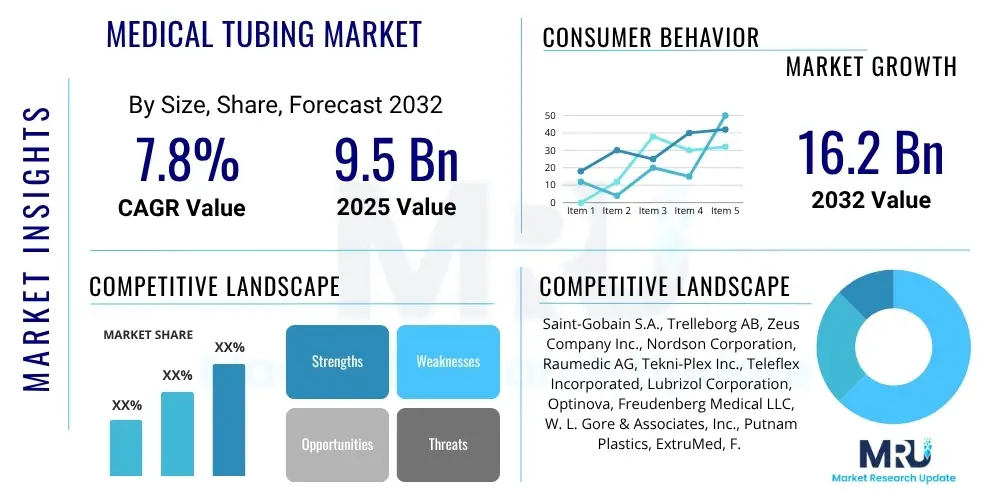

The Medical Tubing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 9.5 Billion in 2025 and is projected to reach USD 16.2 Billion by the end of the forecast period in 2032.

Medical Tubing Market introduction

The medical tubing market is an indispensable segment of the global healthcare industry, encompassing a wide array of specialized tubes designed for medical and pharmaceutical applications. These essential components facilitate various critical functions, including fluid transfer, drug delivery, drainage, ventilation, and diagnostic procedures. Products within this market range from simple, single-lumen tubes used in intravenous drip sets to complex multi-lumen and co-extruded tubes integral to advanced catheters and minimally invasive surgical devices. The market's growth is fundamentally driven by the escalating global demand for healthcare services, advancements in medical technology, and the increasing prevalence of chronic diseases requiring long-term medical care.

Medical tubing is engineered from diverse materials such as polyvinyl chloride (PVC), silicone, thermoplastic elastomers (TPEs), polyolefins (polyethylene, polypropylene), and high-performance fluoropolymers (PTFE, FEP). Each material is selected based on its unique properties, including biocompatibility, flexibility, chemical resistance, tensile strength, and sterilizability, tailored to specific medical applications. Major applications span across cardiology, urology, respiratory care, gastroenterology, and drug delivery systems, forming the backbone of modern patient treatment and monitoring. The inherent benefits of these products, such as precise fluid control, reduced infection risks, and enhanced patient comfort, underscore their critical role in improving overall patient outcomes and operational efficiency within healthcare settings.

Key driving factors for the medical tubing market include an aging global population, which necessitates more frequent medical interventions and chronic disease management, leading to increased demand for various medical devices incorporating tubing. Furthermore, significant technological advancements in medical device design, particularly in minimally invasive surgery, are propelling the need for sophisticated and high-performance tubing solutions. The expansion of healthcare infrastructure globally, especially in emerging economies, coupled with rising healthcare expenditures and a growing awareness of patient safety, also contribute substantially to market expansion. The continuous innovation in materials science, leading to the development of more biocompatible and durable tubing, further bolsters market growth.

Medical Tubing Market Executive Summary

The global medical tubing market is experiencing robust expansion, characterized by a dynamic interplay of technological advancements, evolving healthcare needs, and strategic business trends. A significant shift towards more specialized and high-performance tubing, particularly for minimally invasive procedures and drug delivery systems, is observable across the industry. Manufacturers are focusing on developing innovative materials that offer superior biocompatibility, flexibility, and chemical resistance, aligning with stringent regulatory requirements and increasing demands for enhanced patient safety. Mergers, acquisitions, and strategic partnerships are prevalent as companies seek to consolidate market share, expand product portfolios, and penetrate new geographical markets, reflecting a highly competitive landscape driven by product differentiation and supply chain optimization.

From a regional perspective, North America continues to dominate the medical tubing market, attributed to its advanced healthcare infrastructure, significant research and development investments, and high adoption rates of sophisticated medical devices. Europe also holds a substantial share, driven by stringent quality standards and a strong emphasis on innovative medical technologies. However, the Asia Pacific region is projected to exhibit the highest growth rate during the forecast period. This growth is fueled by expanding healthcare access, rising disposable incomes, burgeoning medical tourism, and increasing government initiatives aimed at improving healthcare facilities in countries like China, India, and Japan. Latin America, the Middle East, and Africa are emerging as promising markets due to improving economic conditions and developing healthcare systems, although they currently represent smaller market shares.

Segmentation trends highlight a growing preference for specialty polymer tubing, such as thermoplastic elastomers and fluoropolymers, over traditional materials like PVC, owing to their enhanced performance characteristics and compliance with environmental regulations. The application segment for catheters and drug delivery systems is expected to retain its leading position, driven by the increasing incidence of cardiovascular diseases, urological disorders, and chronic conditions requiring targeted drug administration. Furthermore, the demand for single-use medical tubing is escalating, spurred by concerns over infection control and the rising adoption of disposable medical products across hospitals, ambulatory surgical centers, and homecare settings. This trend underscores a broader industry focus on sterile, efficient, and patient-centric solutions.

AI Impact Analysis on Medical Tubing Market

User inquiries regarding Artificial Intelligence's impact on the medical tubing market frequently revolve around its potential to revolutionize manufacturing processes, enhance product quality, and streamline operational efficiencies. Common themes include how AI can improve precision during extrusion, automate defect detection, and optimize material formulations for specific applications. Users are particularly interested in AI's role in predictive maintenance for production machinery, anticipating equipment failures before they occur, thereby reducing downtime and increasing output. There is also significant curiosity about AI-driven insights for market demand forecasting and supply chain management, aiming for better inventory control and reduced waste within a complex global distribution network.

Concerns often include the initial investment costs associated with integrating AI technologies, the need for specialized data scientists and engineers, and data privacy implications when handling production metrics and potentially sensitive product specifications. However, expectations remain high for AI to deliver substantial improvements in product consistency, material utilization, and regulatory compliance by providing real-time analytics and intelligent process control. The ability of AI to analyze vast datasets from manufacturing lines to identify subtle deviations and recommend corrective actions is seen as a key enabler for higher quality standards and faster time-to-market for innovative medical tubing solutions, ultimately contributing to safer and more effective medical devices.

- Enhanced quality control: AI-powered vision systems detect microscopic defects, ensuring compliance with stringent medical standards.

- Predictive maintenance: AI algorithms analyze machine performance data to forecast equipment failures, minimizing downtime and optimizing production schedules.

- Optimized material selection: AI assists in identifying ideal polymer blends for specific tubing applications based on biocompatibility, flexibility, and strength requirements.

- Improved design and prototyping: AI simulations accelerate the design process for complex tubing geometries, reducing development cycles.

- Smart inventory management: AI predicts demand fluctuations, optimizing raw material procurement and finished product inventory levels to prevent shortages or overstock.

- Supply chain optimization: AI streamlines logistics, identifies bottlenecks, and ensures timely delivery of materials and products across global networks.

DRO & Impact Forces Of Medical Tubing Market

The medical tubing market is significantly shaped by a confluence of drivers, restraints, and opportunities, alongside various impacting forces that collectively determine its growth trajectory. Key drivers include the global demographic shift towards an aging population, which inherently leads to an increased incidence of chronic diseases requiring continuous medical care and surgical interventions. This trend directly fuels the demand for a broad spectrum of medical devices, many of which are critically dependent on advanced medical tubing. Furthermore, the persistent innovations in medical technology, particularly in the realm of minimally invasive surgery and sophisticated drug delivery systems, necessitate high-performance, specialized tubing solutions, thereby propelling market expansion. Rising healthcare expenditures worldwide and growing awareness regarding patient safety and infection control also serve as strong market accelerators, advocating for sterile, disposable, and biocompatible tubing products.

However, the market also faces considerable restraints that temper its growth potential. Foremost among these are the stringent regulatory frameworks imposed by health authorities such as the FDA, EMA, and other national bodies, which mandate extensive testing, certification, and compliance, often leading to prolonged product development cycles and increased costs. The volatility in raw material prices, particularly for specialized polymers, presents another significant challenge, impacting manufacturing costs and profit margins. Moreover, the lack of standardized regulatory requirements across different regions can complicate market entry and expansion for global players. The environmental concerns associated with plastic waste from disposable medical tubing also present a long-term restraint, pushing for the development of more sustainable and biodegradable materials, which in turn demands significant research and development investments.

Opportunities within the medical tubing market are predominantly found in the development of advanced, high-performance materials such as bioresorbable polymers, antimicrobial coatings, and smart tubing with integrated sensors, which promise enhanced functionality and patient outcomes. The growing demand for customized tubing solutions tailored for specific medical applications or patient anatomies offers lucrative avenues for specialized manufacturers. Expanding healthcare infrastructure in emerging economies, coupled with increasing medical tourism, presents untapped markets for product penetration. Furthermore, the increasing adoption of home healthcare services is creating a demand for user-friendly, reliable, and portable medical tubing solutions. Impact forces such as rapid technological obsolescence, geopolitical instability affecting supply chains, and the ongoing push for cost containment within healthcare systems continuously influence strategic decisions and market dynamics.

Segmentation Analysis

The medical tubing market is comprehensively segmented to address the diverse requirements of the global healthcare industry, reflecting the wide range of materials, applications, structures, and end-users involved. This segmentation allows for a granular understanding of market dynamics, identifying specific growth pockets and evolving preferences across different medical procedures and clinical settings. Each segment's growth is influenced by unique technological advancements, regulatory pressures, and clinical demands, necessitating specialized product development and market strategies. Understanding these distinct segments is crucial for manufacturers to tailor their offerings, optimize production, and effectively target their sales efforts, ensuring relevance and competitiveness in a rapidly advancing medical landscape.

The primary segmentation categories include materials, which define the tubing's physical and chemical properties; applications, which specify the medical procedures or devices where tubing is utilized; structures, detailing the design complexity of the tubing; and end-users, identifying the primary consumers of these products. For instance, the demand for silicone tubing is primarily driven by its biocompatibility and flexibility, making it ideal for long-term implants, whereas fluoropolymers are chosen for their chemical inertness and high-temperature resistance in more specialized applications. Similarly, the growth in multi-lumen tubing reflects the increasing complexity of patient care, requiring simultaneous fluid delivery and monitoring. This detailed segmentation allows stakeholders to track market trends, innovate purposefully, and align with the ever-evolving demands of modern medicine.

- By Material:

- Polyvinyl Chloride (PVC)

- Silicone

- Thermoplastic Elastomers (TPEs)

- Polyolefins (Polyethylene, Polypropylene)

- Fluoropolymers (PTFE, FEP, PFA)

- Other Polymers (e.g., Polyurethane, Nylon)

- By Application:

- Catheters (IV, Urinary, Cardiovascular, Specialty)

- Drug Delivery Systems

- Biopharmaceutical Processing

- Respiratory and Anesthesia

- Peristaltic Pump Tubing

- Dialysis Tubing

- IV Sets

- Laboratory and Diagnostic Equipment

- Other Applications

- By Structure:

- Single-lumen Tubing

- Multi-lumen Tubing

- Co-extruded Tubing

- Tapered Tubing

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Homecare Settings

- Research and Academic Institutes

- Medical Device Manufacturers

Value Chain Analysis For Medical Tubing Market

The value chain for the medical tubing market commences with the upstream segment, primarily involving raw material suppliers who provide specialized polymers, additives, and compounds essential for medical-grade tubing production. These suppliers are critical as they must meet stringent quality standards, including biocompatibility and regulatory compliance, to ensure the safety and efficacy of the final medical devices. Key raw materials include medical-grade PVC, silicone, various thermoplastic elastomers, polyolefins, and high-performance fluoropolymers. The quality and consistency of these raw materials directly impact the subsequent manufacturing processes and the performance attributes of the finished tubing products, making robust supplier relationships and quality assurance protocols vital at this initial stage.

Moving downstream, the core of the value chain involves medical tubing manufacturers who transform these raw materials into finished tubing through advanced processes like extrusion, molding, and secondary operations such as cutting, flaring, tipping, and assembly. This stage requires significant investment in specialized machinery, cleanroom facilities, and skilled labor to ensure precision, sterility, and adherence to exact specifications. Following manufacturing, these tubing products are either sold directly to large medical device original equipment manufacturers (OEMs) for integration into complex devices like catheters, endoscopes, and respiratory circuits, or they are supplied to specialized distributors who cater to a broader range of smaller medical device assemblers and healthcare providers.

Distribution channels play a crucial role in delivering medical tubing to its end-users. Direct sales involve manufacturers establishing direct relationships with major medical device companies and large hospital networks, often involving customized solutions and bulk orders. Indirect channels, on the other hand, leverage a network of specialized medical distributors, wholesalers, and third-party logistics providers. These intermediaries provide market reach, inventory management, and regional distribution, particularly to smaller clinics, diagnostic centers, and homecare providers. The efficiency and reliability of both direct and indirect distribution networks are paramount to ensure timely delivery of sterile and compliant medical tubing, which directly impacts patient care and healthcare operations globally.

Medical Tubing Market Potential Customers

The primary potential customers and end-users of medical tubing are diverse, reflecting the extensive application of these products across the healthcare continuum. Hospitals and specialty clinics represent a significant segment, consistently requiring a broad range of medical tubing for everyday operations, including intravenous fluid administration, surgical procedures, patient monitoring, and various diagnostic tests. These institutions prioritize tubing that offers superior biocompatibility, sterility, ease of use, and compatibility with a wide array of medical devices, ensuring optimal patient outcomes and efficient workflow within their complex environments. Their purchasing decisions are often influenced by regulatory compliance, product reliability, and vendor reputation.

Another crucial customer segment comprises medical device manufacturers who integrate medical tubing as an essential component into their finished products. These manufacturers produce catheters, endoscopes, ventilator circuits, drug delivery pumps, and many other critical devices where tubing functionality is paramount. For these buyers, key considerations include the tubing's dimensional accuracy, material properties (such as flexibility, lubricity, and chemical resistance), and the ability to withstand sterilization processes without degradation. Customization capabilities, technical support, and the ability to meet specific design specifications are highly valued by medical device OEMs, establishing long-term partnerships with tubing suppliers.

Beyond traditional healthcare facilities and device manufacturers, the medical tubing market also serves ambulatory surgical centers (ASCs), diagnostic laboratories, and increasingly, homecare settings. ASCs require reliable, cost-effective tubing solutions for outpatient procedures, while diagnostic labs depend on precision tubing for fluid handling in analytical instruments. The burgeoning homecare sector, driven by an aging population and a preference for care outside institutional settings, creates a growing demand for user-friendly, safe, and robust medical tubing for applications like continuous positive airway pressure (CPAP) machines, enteral feeding, and home infusion therapies. Pharmaceutical and biotechnology companies also procure specialized tubing for bioprocessing and drug manufacturing, emphasizing sterility and chemical inertness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 16.2 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain S.A., Trelleborg AB, Zeus Company Inc., Nordson Corporation, Raumedic AG, Tekni-Plex Inc., Teleflex Incorporated, Lubrizol Corporation, Optinova, Freudenberg Medical LLC, W. L. Gore & Associates, Inc., Putnam Plastics, ExtruMed, F. Lampert & Co. GmbH, NewAge Industries Inc., Puritan Medical Products, Pexco LLC, Vention Medical, Vanguard Products Corporation, ADVANSA S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Tubing Market Key Technology Landscape

The medical tubing market is at the forefront of technological innovation, constantly evolving to meet the demands for enhanced safety, functionality, and precision in medical applications. A foundational technology remains advanced extrusion processes, which have evolved to allow for the production of incredibly thin-walled, high-tolerance tubing, as well as complex multi-lumen and co-extruded designs. These processes enable manufacturers to create tubing with multiple internal channels for simultaneous delivery of fluids, gases, or signals, critical for sophisticated catheters and diagnostic devices. The advent of micro-extrusion further permits the creation of miniaturized tubing for minimally invasive procedures, pushing the boundaries of what is possible in medical interventions.

Beyond basic extrusion, several cutting-edge technologies are shaping the market. Laser welding and bonding techniques are increasingly used to create seamless, robust connections between different tubing segments or components, minimizing potential leak points and improving product integrity. Surface modification technologies, such as plasma treatment and specialized coatings (e.g., hydrophilic, antimicrobial), are vital for enhancing biocompatibility, reducing friction for easier insertion, and preventing biofilm formation and infection. These advancements directly address critical clinical needs for safer and more effective patient care, especially for long-term implantable devices.

Furthermore, the integration of smart technologies is emerging as a significant trend. This includes the incorporation of miniature sensors within tubing for real-time monitoring of pressure, temperature, or fluid flow, providing immediate feedback to clinicians. Material science continues to drive innovation with the development of bioresorbable polymers for temporary implants, shape memory polymers for adaptable devices, and sustainable, biodegradable materials to address environmental concerns. Automation in manufacturing, coupled with artificial intelligence for quality control and predictive maintenance, ensures high-volume production of consistently high-quality, defect-free medical tubing, thereby maintaining rigorous industry standards and boosting operational efficiency.

Regional Highlights

The global medical tubing market exhibits distinct regional dynamics, influenced by varying healthcare infrastructures, regulatory landscapes, demographic trends, and economic conditions. Each major region contributes uniquely to the market's overall growth and innovation, presenting diverse opportunities and challenges for manufacturers and suppliers. North America, for instance, stands as a mature yet highly dynamic market, characterized by extensive research and development activities, early adoption of advanced medical technologies, and significant investments in healthcare. The stringent regulatory environment in regions like the United States and Canada ensures high product quality and safety standards, driving demand for premium, high-performance medical tubing solutions across a wide range of applications from cardiology to diagnostics.

Europe represents another prominent market, driven by its well-established healthcare systems, an aging population, and a strong emphasis on technological innovation and environmental sustainability. Countries such as Germany, France, and the UK are major contributors, with robust medical device manufacturing sectors and high adoption rates of advanced medical tubing, particularly those made from specialized polymers and equipped with enhanced features. The European Union's Medical Device Regulation (MDR) has further impacted the market, pushing manufacturers to ensure higher levels of clinical evidence and post-market surveillance, consequently elevating product quality and traceability. This regulatory stringency, while challenging, fosters a market for innovative and highly compliant tubing solutions.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for medical tubing, propelled by rapidly expanding healthcare infrastructure, increasing healthcare expenditure, and a burgeoning patient population. Countries like China, India, Japan, and South Korea are witnessing significant growth due to rising medical tourism, improving access to advanced medical treatments, and a growing middle class with higher disposable incomes. The demand for cost-effective yet reliable medical tubing is particularly high in this region, driven by the expansion of public and private hospitals and the increasing prevalence of chronic diseases. Latin America, the Middle East, and Africa (MEA) are emerging markets, characterized by developing healthcare systems and increasing government investments in health, suggesting future growth potential although currently holding smaller market shares.

- North America: Dominant market due to advanced healthcare infrastructure, high R&D spending, and early adoption of innovative medical devices.

- Europe: Strong market driven by stringent regulatory frameworks, an aging population, and focus on high-quality, technologically advanced medical tubing.

- Asia Pacific (APAC): Fastest-growing market, fueled by expanding healthcare access, rising disposable incomes, and increasing prevalence of chronic diseases in countries like China and India.

- Latin America: Emerging market with growing healthcare expenditure and improving access to medical facilities, leading to increased demand for basic and specialty tubing.

- Middle East and Africa (MEA): Gradually growing market, supported by developing healthcare infrastructure and increasing investments in health tourism and medical facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Tubing Market.- Saint-Gobain S.A.

- Trelleborg AB

- Zeus Company Inc.

- Nordson Corporation

- Raumedic AG

- Tekni-Plex Inc.

- Teleflex Incorporated

- Lubrizol Corporation

- Optinova

- Freudenberg Medical LLC

- W. L. Gore & Associates, Inc.

- Putnam Plastics

- ExtruMed

- F. Lampert & Co. GmbH

- NewAge Industries Inc.

- Puritan Medical Products

- Pexco LLC

- Vention Medical

- Vanguard Products Corporation

- ADVANSA S.A.

Frequently Asked Questions

What materials are primarily used in medical tubing manufacturing?

Medical tubing is predominantly manufactured using materials such as Polyvinyl Chloride (PVC), silicone, thermoplastic elastomers (TPEs), polyolefins (polyethylene, polypropylene), and high-performance fluoropolymers (PTFE, FEP). These materials are chosen for their specific properties like biocompatibility, flexibility, chemical resistance, and sterilizability, crucial for various medical applications.

How does medical tubing contribute to patient safety and healthcare efficiency?

Medical tubing ensures patient safety by facilitating sterile fluid transfer, precise drug delivery, and effective waste drainage, thereby minimizing the risk of infection and adverse reactions. Its reliability and precise specifications contribute to the efficient operation of medical devic

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager