Medical Waste Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427948 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Medical Waste Management Market Size

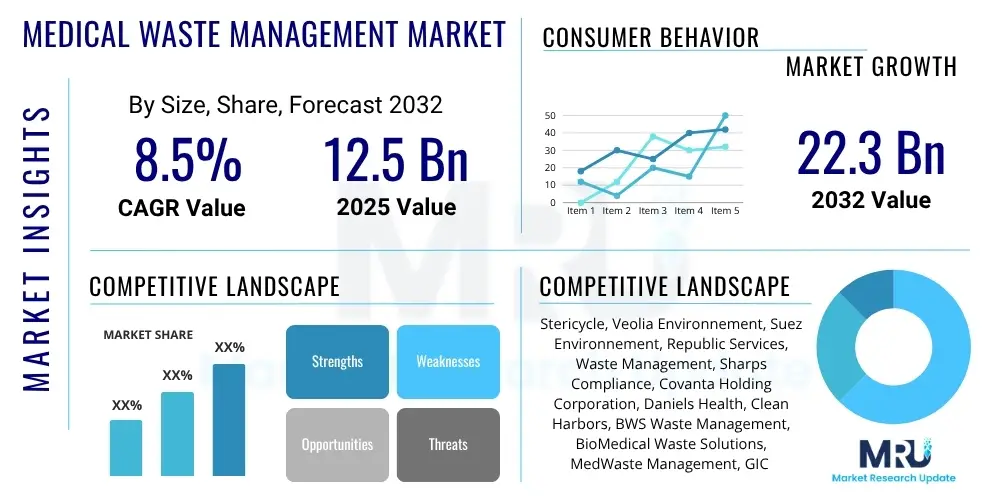

The Medical Waste Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 22.3 Billion by the end of the forecast period in 2032.

This robust growth is primarily driven by the escalating volume of medical waste generated globally, a direct consequence of an expanding global population, increasing healthcare infrastructure, and a rising prevalence of chronic and infectious diseases requiring extensive medical interventions. The imperative for effective waste management solutions is further amplified by stringent regulatory frameworks imposed by governmental and environmental agencies worldwide, aiming to mitigate the environmental and public health risks associated with improper disposal. These regulations compel healthcare facilities to adopt advanced and compliant waste management practices, thereby fueling market expansion.

Moreover, continuous technological advancements in waste treatment and disposal methods, such as non-incineration technologies like autoclaving, microwave irradiation, and chemical disinfection, are enhancing efficiency and environmental safety, making them increasingly viable alternatives. The rising awareness regarding the hazardous nature of medical waste among healthcare professionals and the general public also contributes significantly to the demand for specialized management services. This confluence of factors creates a fertile ground for sustained market development, attracting investments and innovations across the medical waste management value chain.

Medical Waste Management Market introduction

The Medical Waste Management Market encompasses the entire lifecycle of medical waste, from segregation and collection to transportation, treatment, and final disposal. Medical waste, often categorized as biomedical waste, includes any waste generated during the diagnosis, treatment, or immunization of human beings or animals, in research activities pertaining thereto, or in the production or testing of biologicals. This broad definition covers a range of materials from sharps and pathological waste to pharmaceutical residues and radioactive substances, each requiring specific handling protocols due to their potential for infection, toxicity, or environmental harm. The market's primary objective is to ensure safe, efficient, and environmentally sound management of these hazardous materials, thereby protecting public health and preventing ecological contamination.

Major applications of medical waste management services are found across diverse healthcare settings, including hospitals, clinics, diagnostic laboratories, research institutions, blood banks, and pharmaceutical manufacturing facilities. The product description of these services involves offering comprehensive solutions tailored to the specific needs of each waste generator, encompassing on-site segregation training, specialized containers, regulated waste pickup schedules, advanced treatment technologies, and compliant disposal or recycling options. Service providers play a crucial role in navigating the complex regulatory landscape, ensuring that all waste handling processes adhere to local, national, and international standards.

The benefits derived from an efficient medical waste management system are manifold, including the prevention of healthcare-associated infections (HAIs), reduction of environmental pollution, protection of waste handlers and the community, and compliance with legal mandates. Key driving factors propelling this market include the global increase in healthcare expenditure, the burgeoning geriatric population requiring more medical care, the proliferation of diagnostic and surgical procedures, and heightened public awareness regarding environmental sustainability. These elements collectively underscore the critical importance and growth trajectory of the medical waste management sector, making it an indispensable component of the modern healthcare ecosystem.

Medical Waste Management Market Executive Summary

The Medical Waste Management Market is experiencing a period of significant expansion, driven by a confluence of evolving business trends, distinct regional dynamics, and intricate segment-specific shifts. Business trends indicate a strong move towards outsourcing medical waste management to specialized third-party providers, driven by healthcare facilities seeking to optimize operational costs, enhance compliance, and leverage expert capabilities. There is also an increasing emphasis on adopting sustainable and environmentally friendly waste treatment technologies, moving away from traditional incineration towards autoclaving, microwave irradiation, and chemical disinfection. Furthermore, digitalization and automation are beginning to streamline logistics and tracking within the waste management process, improving efficiency and accountability.

Regional trends reveal diverse growth patterns, with developed economies like North America and Europe demonstrating mature markets characterized by stringent regulations and advanced infrastructure, focusing on innovation and sustainability. Meanwhile, Asia Pacific is emerging as a high-growth region, propelled by rapidly developing healthcare infrastructure, increasing population density, and improving regulatory enforcement. Latin America, the Middle East, and Africa are also witnessing considerable growth, albeit from a lower base, as healthcare access expands and awareness of proper waste disposal practices increases. These regional variations create unique opportunities and challenges for market participants, necessitating tailored strategies for market penetration and expansion.

Segment trends highlight the growing importance of hazardous medical waste management, particularly for sharps and pathological waste, due to their high infection risk and stringent disposal requirements. The treatment and disposal segment continues to dominate, with a shift towards non-incineration methods gaining traction. Moreover, the pharmaceutical and biotechnology sector is becoming a more significant generator segment, demanding specialized services for drug disposal and related waste. Innovations in recycling and waste-to-energy technologies are also shaping the market, offering new avenues for resource recovery and sustainable waste utilization, thus contributing to the overall market's dynamic evolution.

AI Impact Analysis on Medical Waste Management Market

Common user questions related to the impact of AI on the Medical Waste Management Market frequently revolve around how artificial intelligence can enhance efficiency, improve safety, and reduce costs. Users are keen to understand if AI can optimize waste segregation processes, predict waste generation volumes more accurately, or automate parts of the logistics chain. Concerns often include the initial investment required for AI implementation, data privacy issues associated with monitoring and tracking, and the potential for job displacement. Expectations lean towards AI providing smarter, more sustainable, and less error-prone waste management systems, leading to better compliance and environmental outcomes. The overarching theme is a desire for tangible improvements in operational effectiveness and strategic decision-making through AI integration.

The integration of Artificial Intelligence (AI) into the Medical Waste Management Market holds transformative potential, primarily by enhancing data analysis, operational efficiency, and predictive capabilities. AI algorithms can process vast amounts of data from waste streams, identifying patterns in waste generation by type, volume, and source. This granular insight enables healthcare facilities and waste management providers to optimize segregation strategies at the point of generation, reducing cross-contamination and improving the purity of recyclable materials. Such improvements in upstream management are crucial for minimizing the volume of hazardous waste requiring specialized treatment, thereby lowering overall disposal costs and environmental impact.

Furthermore, AI can significantly streamline logistics and transportation by optimizing collection routes, scheduling pickups based on real-time waste levels, and predicting maintenance needs for vehicles and equipment. Machine learning models can forecast waste generation trends based on patient admissions, seasonal disease patterns, and procedural volumes, allowing for more accurate resource allocation and capacity planning. This predictive capability reduces inefficiencies, minimizes the risk of overflowing waste containers, and ensures timely and compliant removal. Moreover, AI-powered image recognition can assist in auditing waste streams for proper segregation, providing instant feedback and improving compliance among staff, thus elevating safety standards for both healthcare workers and waste handlers.

- AI-driven optimization of waste segregation at source, improving purity and reducing hazardous waste volume.

- Predictive analytics for waste generation forecasting, enhancing resource allocation and logistics planning.

- Automated route optimization for collection and transportation, reducing fuel consumption and operational costs.

- Real-time monitoring and tracking of waste containers and streams, improving accountability and compliance.

- AI-powered image recognition for waste auditing and staff training, minimizing errors and improving safety.

- Enhanced decision-making through data-driven insights for strategic planning and regulatory adherence.

- Development of smart waste bins with sensors for capacity monitoring, leading to on-demand collection.

DRO & Impact Forces Of Medical Waste Management Market

The Medical Waste Management Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that dictate its growth trajectory and operational landscape. Drivers for market expansion are robust and multifaceted, primarily fueled by the global surge in healthcare expenditure and an ever-increasing volume of medical waste generated due to population growth, advancements in medical treatments, and the rising prevalence of chronic and infectious diseases. The imperative for stringent regulatory compliance, driven by heightened environmental and public health concerns, mandates proper waste handling and disposal, thereby creating a sustained demand for specialized management services. Furthermore, growing public and governmental awareness about the risks associated with improper waste disposal acts as a significant catalyst, pushing for more responsible and sustainable practices across the healthcare sector.

Despite the strong tailwinds, the market faces notable restraints that can impede its growth. High capital investment required for establishing and maintaining advanced waste treatment facilities and sophisticated logistical infrastructure poses a significant barrier, especially for emerging economies. The complexity of the regulatory landscape, which often varies significantly across regions and even within countries, adds layers of compliance challenges and operational costs for market players. Moreover, a lack of adequate awareness and proper waste segregation practices in some developing regions, coupled with the high operational costs associated with specialized treatment and transportation, can hinder the adoption of comprehensive medical waste management solutions.

Opportunities within this dynamic market are abundant and promising, particularly in the realm of technological innovation and sustainable practices. The emergence of advanced non-incineration treatment technologies, such as autoclaving, microwave irradiation, and chemical disinfection, presents environmentally superior and cost-effective alternatives. Furthermore, increasing public-private partnerships are facilitating investment in infrastructure development and technology adoption. The growing focus on waste-to-energy solutions and resource recovery from non-hazardous medical waste streams also opens new avenues for revenue generation and environmental sustainability. Additionally, the expansion of healthcare services in underserved regions and the burgeoning medical tourism sector offer substantial growth prospects for market participants seeking to broaden their geographical footprint and service offerings.

Segmentation Analysis

The Medical Waste Management Market is extensively segmented to reflect the diverse nature of waste, services, and generators involved, providing a granular view of market dynamics and opportunities. This detailed segmentation allows for a comprehensive analysis of various market niches, enabling stakeholders to identify key growth areas and tailor strategies effectively. Understanding these segments is crucial for both service providers aiming to optimize their offerings and healthcare facilities seeking efficient and compliant waste management solutions. The market's complexity necessitates a clear categorization to address specific waste types, treatment requirements, and generator profiles, ensuring that regulatory mandates and environmental objectives are met across the entire value chain.

Segmentation by type of waste differentiates hazardous from non-hazardous medical waste, with further sub-segmentation into sharps, pathological, pharmaceutical, chemical, and radioactive waste, each demanding unique handling and disposal protocols. Service segmentation delineates the various stages of waste management, from collection and transportation to treatment, disposal, and recycling, highlighting the specialized expertise required at each step. Generator segmentation identifies the primary sources of medical waste, such as hospitals, clinics, diagnostic centers, and research laboratories, allowing for customized service provisions based on their specific operational scales and waste profiles. This structured approach to market analysis ensures that all critical aspects of medical waste management are adequately addressed and understood.

The continuous evolution of healthcare practices and medical technologies, coupled with ever-tightening environmental regulations, constantly refines these segmentation categories. For instance, the growing focus on reducing the environmental footprint of healthcare has spurred innovation in recycling and waste minimization within the non-hazardous segment, while the increasing complexity of pharmaceutical waste demands more sophisticated and compliant disposal methods. Therefore, a dynamic understanding of these market segments is vital for businesses to adapt, innovate, and maintain a competitive edge in the evolving medical waste management landscape.

- By Type of Waste

- Hazardous Medical Waste

- Non-Hazardous Medical Waste

- Sharps Waste

- Pathological Waste

- Pharmaceutical Waste

- Chemical Waste

- Radioactive Waste

- Genotoxic Waste

- Other Wastes

- By Service

- Collection, Transportation & Storage

- Treatment & Disposal

- Incineration

- Autoclaving

- Chemical Treatment

- Microwave Irradiation

- Plasma Pyrolysis

- Biological Treatment

- Other Treatment Methods

- Recycling

- Consulting Services

- By Generator

- Hospitals

- Clinics & Physician Offices

- Diagnostic Laboratories

- Research Laboratories

- Blood Banks

- Pharmaceutical & Biotechnology Companies

- Long-term Care Facilities

- Ambulatory Surgical Centers

- Veterinary Facilities

- Other Healthcare Facilities

Value Chain Analysis For Medical Waste Management Market

The value chain for the Medical Waste Management Market is a complex, multi-stage process involving numerous stakeholders, from the point of waste generation to its final disposition. Upstream analysis focuses on the initial stages where medical waste is generated and initially managed within healthcare facilities. This involves critical activities such as waste segregation at the source, proper labeling, packaging, and temporary storage in designated areas. The efficiency and accuracy of these upstream processes are paramount, as they directly impact the safety of healthcare personnel, prevent cross-contamination, and ensure compliance with regulatory standards. Training of healthcare staff in proper waste handling protocols is a key upstream activity, forming the foundation for an effective overall waste management system. The choice of appropriate containers and temporary storage solutions also falls under upstream considerations, directly influencing the subsequent stages of the value chain.

Midstream activities primarily involve the collection, transportation, and initial processing of medical waste. Specialized waste management companies typically perform these functions, utilizing specially designed vehicles and trained personnel to safely collect waste from generators. Transportation adheres to strict regulations concerning vehicle specifications, routing, and emergency response protocols to prevent spills or exposure during transit. Upon arrival at a treatment facility, waste may undergo further sorting or preparation before entering the treatment phase. This stage is crucial for ensuring the integrity of the waste stream and preparing it for the most appropriate and compliant treatment method, minimizing risks to both human health and the environment.

Downstream analysis encompasses the treatment, disposal, and potential recycling or recovery of medical waste. Treatment methods vary significantly depending on the waste type, ranging from incineration for pathological and highly infectious waste to non-incineration technologies like autoclaving, microwave irradiation, and chemical disinfection for other hazardous wastes. The goal is to render the waste harmless before final disposal in authorized landfills or, in some cases, to recover valuable resources through recycling processes. Distribution channels in this market are predominantly direct, with healthcare facilities contracting directly with specialized medical waste management companies. Indirect channels might involve intermediary logistics providers in fragmented markets or regions with limited specialized services. Both direct and indirect channels must maintain rigorous compliance with environmental and health regulations throughout the entire waste management process to ensure public safety and environmental protection.

Medical Waste Management Market Potential Customers

Potential customers for the Medical Waste Management Market represent a broad spectrum of entities involved in healthcare delivery, research, and related industries that generate various types of medical waste. The primary end-users and buyers of these services are hospitals, ranging from large university teaching hospitals to small community medical centers. Hospitals are significant waste generators due to their extensive operations, including surgical procedures, patient care, diagnostic tests, and pharmacy services, producing a diverse mix of hazardous and non-hazardous medical waste that requires compliant and efficient management. Their substantial waste volumes and complex operational environments make them central to the market's demand landscape, often seeking comprehensive, integrated solutions from specialized waste management providers.

Beyond hospitals, clinics and physician offices constitute a substantial segment of potential customers. This category includes general practitioners, specialized clinics (e.g., dental, dermatology, oncology), and outpatient surgical centers. Although individually they may generate smaller volumes of waste compared to hospitals, their collective numbers are immense, creating a widespread need for reliable waste disposal services. Diagnostic laboratories, encompassing pathology labs, microbiology labs, and imaging centers, also represent key customers, particularly due to the generation of biohazardous materials, sharps, and chemical waste. Research laboratories, including academic institutions, government labs, and private biotechnology firms, are another critical segment, often dealing with highly specialized and sometimes radioactive waste, demanding expert management.

Furthermore, pharmaceutical and biotechnology companies are significant buyers, especially concerning the disposal of expired drugs, contaminated materials from manufacturing processes, and research waste. Blood banks, long-term care facilities, home healthcare providers, and even veterinary clinics also require specialized medical waste management services, tailored to their specific waste profiles and regulatory obligations. The increasing complexity of medical procedures, coupled with a growing emphasis on environmental stewardship and public health safety, ensures a continuous and expanding customer base for medical waste management solutions across the entire healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2032 | USD 22.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stericycle, Veolia Environnement, Suez Environnement, Republic Services, Waste Management, Sharps Compliance, Covanta Holding Corporation, Daniels Health, Clean Harbors, BWS Waste Management, BioMedical Waste Solutions, MedWaste Management, GIC Medical Waste, Red Bag Solutions, Triumvirate Environmental, Casella Waste Systems, Sanpro Medical Waste, CytoCulture International, Heritage Environmental Services, Remondis AG & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Waste Management Market Key Technology Landscape

The Medical Waste Management Market is undergoing a significant technological transformation, driven by the need for more efficient, environmentally friendly, and cost-effective waste treatment solutions. Historically, incineration was the predominant method for disposing of hazardous medical waste, effectively reducing volume and sterilizing infectious materials. However, concerns regarding air pollution and the emission of toxic byproducts like dioxins and furans have propelled the adoption of non-incineration technologies. These advanced alternatives are now at the forefront of the technological landscape, offering safer and more sustainable approaches to waste management. Innovations in this area are continuous, aiming to minimize environmental impact while maximizing pathogen destruction and resource recovery.

Among the leading non-incineration technologies, autoclaving remains a widely used and highly effective method. It employs steam sterilization under high pressure to neutralize infectious waste, rendering it safe for subsequent disposal in municipal landfills or further processing for recycling. Microwave irradiation is another prominent technology, utilizing electromagnetic energy to heat and sterilize waste, often in conjunction with steam, providing an efficient and compact treatment solution. Chemical treatment involves the use of disinfectants to chemically inactivate pathogens, a method particularly suitable for liquid waste and certain solid medical waste types. These technologies collectively reduce the reliance on combustion, aligning with global environmental protection goals and stringent regulatory standards.

Further technological advancements include plasma pyrolysis, an emerging technology that uses extremely high temperatures generated by plasma torches to break down waste into its elemental components, producing energy and inert residue with minimal emissions. This method holds significant promise for high-temperature treatment of complex hazardous waste. Beyond treatment, the technological landscape also encompasses innovations in waste logistics and tracking, such as RFID tags, GPS tracking systems, and IoT-enabled smart bins. These digital tools enhance visibility, improve route optimization, and ensure real-time monitoring of waste streams, thereby improving efficiency, compliance, and accountability throughout the entire medical waste management value chain. The continuous evolution of these technologies is pivotal in shaping the future of the market.

Regional Highlights

Regional dynamics play a pivotal role in shaping the Medical Waste Management Market, with varying economic conditions, healthcare infrastructure developments, and regulatory frameworks influencing market growth across different geographies. North America, encompassing the United States and Canada, represents a mature market characterized by highly stringent regulatory landscapes and well-established healthcare systems. The region leads in adopting advanced non-incineration technologies and outsourcing services, driven by a strong emphasis on environmental protection and public health safety. High healthcare expenditure and continuous technological advancements further propel market expansion, with a focus on sustainable and compliant waste disposal practices across both large hospital networks and smaller healthcare facilities.

Europe stands as another significant market, where robust environmental policies and the presence of major medical waste management players drive innovation and market growth. Countries like Germany, France, and the UK demonstrate strong adherence to EU directives on waste management, fostering a market geared towards advanced treatment and resource recovery. The region is witnessing a steady shift towards sustainable practices, including increased recycling of non-hazardous medical waste and the adoption of waste-to-energy solutions. The aging population and continued investment in healthcare infrastructure also contribute to a steady demand for efficient medical waste management services throughout the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapidly developing economies, burgeoning populations, and substantial investments in healthcare infrastructure, particularly in countries like China, India, and Southeast Asian nations. While regulatory enforcement is still evolving in some parts, increasing awareness, coupled with the rising volume of medical waste, is accelerating the adoption of modern waste management practices. Latin America, the Middle East, and Africa (MEA) are also experiencing significant growth, driven by expanding access to healthcare, rising medical tourism, and efforts to improve public health standards. These regions present substantial opportunities for market players to introduce advanced technologies and establish robust waste management systems, catering to diverse local needs and regulatory environments.

- North America: Mature market with stringent regulations, high adoption of advanced technologies, and strong outsourcing trends.

- Europe: Driven by robust environmental policies, focus on sustainable practices, and steady investment in healthcare infrastructure.

- Asia Pacific (APAC): Fastest-growing region due to rapidly expanding healthcare infrastructure, increasing population, and evolving regulatory frameworks.

- Latin America: Growth spurred by expanding healthcare access and increasing awareness of proper waste management.

- Middle East & Africa (MEA): Emerging market with opportunities driven by medical tourism, infrastructure development, and improving health standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Waste Management Market.- Stericycle

- Veolia Environnement

- Suez Environnement

- Republic Services

- Waste Management

- Sharps Compliance

- Covanta Holding Corporation

- Daniels Health

- Clean Harbors

- BWS Waste Management

- BioMedical Waste Solutions

- MedWaste Management

- GIC Medical Waste

- Red Bag Solutions

- Triumvirate Environmental

- Casella Waste Systems

- Sanpro Medical Waste

- CytoCulture International

- Heritage Environmental Services

- Remondis AG & Co. KG

Frequently Asked Questions

Analyze common user questions about the Medical Waste Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is medical waste management and why is it important?

Medical waste management involves the safe handling, treatment, and disposal of waste generated from healthcare activities. It is crucial for preventing infections, protecting public health, minimizing environmental pollution, and ensuring compliance with strict regulatory standards.

What are the main types of medical waste?

Medical waste is broadly categorized into hazardous and non-hazardous. Hazardous types include sharps (needles), pathological (human tissues), infectious (contaminated materials), pharmaceutical (expired drugs), and chemical waste. Non-hazardous waste is similar to general municipal waste.

What are the primary methods for treating medical waste?

Primary treatment methods include non-incineration technologies like autoclaving (steam sterilization), microwave irradiation, and chemical disinfection, which are increasingly favored for their environmental benefits. Incineration is still used for certain waste types but is less common due to emission concerns.

Who are the main generators of medical waste?

The main generators include hospitals, clinics, physician offices, diagnostic laboratories, research facilities, blood banks, and pharmaceutical companies. Each generates different types and volumes of waste requiring specialized management solutions.

How do regulations impact the medical waste management market?

Regulations are a major driving force, mandating strict protocols for segregation, storage, transportation, and disposal. Compliance with these diverse local, national, and international laws is essential for all market participants, fostering demand for specialized services and innovative, compliant technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager