Medicinal and Aromatic Plant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428272 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Medicinal and Aromatic Plant Market Size

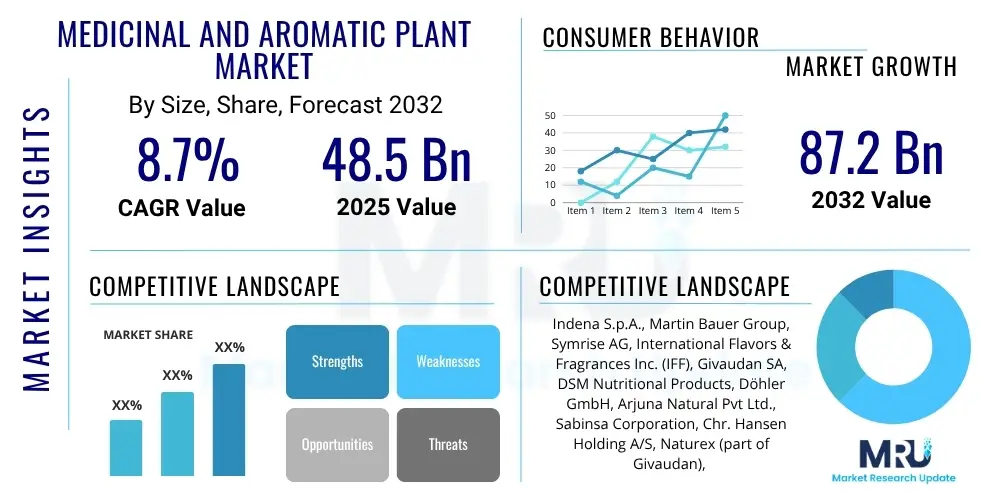

The Medicinal and Aromatic Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 48.5 billion in 2025 and is projected to reach USD 87.2 billion by the end of the forecast period in 2032. This robust growth trajectory is underpinned by a global paradigm shift towards natural and sustainable health solutions, alongside escalating research and development efforts in phytomedicine and botanical extracts, signaling a strong and sustained expansion in demand.

Medicinal and Aromatic Plant Market introduction

The Medicinal and Aromatic Plant (MAP) market encompasses a vast and diverse range of plant species globally, valued for their intrinsic therapeutic, aromatic, and flavoring properties. These plants serve as indispensable raw materials across an expansive spectrum of industries, including pharmaceuticals, nutraceuticals, cosmetics and personal care, food and beverages, and the burgeoning aromatherapy sector. Their significance is rooted in a rich historical legacy of traditional medicine systems, which have now gained renewed scientific validation and widespread consumer acceptance. The market’s dynamism is intrinsically linked to the growing global preference for natural, organic, and plant-derived products, a trend that reflects heightened consumer health consciousness, environmental awareness, and a persistent demand for alternatives to synthetic compounds. This profound shift underscores a collective recognition of the efficacy and safety profiles associated with nature-based solutions.

The core product offerings within this market include whole or raw plant materials, various forms of extracts, essential oils, powders, and encapsulated ingredients. These diverse forms enable their application in an extensive array of finished goods, from herbal remedies and dietary supplements to functional foods, natural fragrances, and cosmeceuticals. Major applications span the treatment of various ailments, enhancement of well-being, preservation of food, and provision of sensory attributes in consumer products. The inherent benefits of MAPs, such as their complex profiles of bioactive compounds, adaptogenic qualities, anti-inflammatory properties, and antimicrobial effects, are increasingly recognized and scientifically validated, further solidifying their demand as versatile and potent ingredients in modern consumer goods.

Driving factors for this market's impressive expansion include the escalating global prevalence of chronic diseases, which has spurred interest in complementary and alternative medicines as part of holistic health management. Furthermore, an aging global population seeking natural solutions for age-related health issues, coupled with rising disposable incomes in emerging economies, contributes significantly to market growth by increasing purchasing power for premium natural products. The sustainable sourcing trend and increased investment in research and development to discover novel compounds and applications from MAPs are also critical propellers, ensuring a steady stream of innovative products and validating existing traditional uses. This confluence of factors creates a fertile ground for sustained market growth and innovation, fostering a dynamic environment for both established players and new entrants.

Medicinal and Aromatic Plant Market Executive Summary

The Medicinal and Aromatic Plant (MAP) market is experiencing transformative growth, shaped by several overarching business, regional, and segment-specific trends. From a business perspective, there is a pronounced shift towards ethical sourcing, sustainable cultivation practices, and robust supply chain management to ensure product quality and environmental responsibility. Investment in advanced extraction technologies and research and development for novel applications of phytochemicals is escalating, driven by pharmaceutical companies seeking new drug leads and nutraceutical firms developing functional ingredients. Furthermore, strategic collaborations and mergers among growers, processors, and end-product manufacturers are becoming more common, aiming to consolidate expertise and market reach, fostering greater efficiency and innovation across the value chain. This consolidation reflects a maturing market focused on quality, traceability, and scaling production to meet evolving global demands for natural ingredients.

Regionally, the market exhibits varied yet compelling growth dynamics. Asia Pacific remains a dominant force, not only as a primary source of raw materials due to its rich biodiversity and established traditional medicine systems but also as a rapidly expanding consumer market. Countries like China and India are at the forefront, leveraging their indigenous knowledge and investing heavily in modern cultivation and processing infrastructure. North America and Europe continue to be significant consumers, driven by strong health and wellness trends, a preference for organic products, and supportive regulatory frameworks for natural health products. These regions are also hubs for advanced research and product innovation, particularly in the cosmetics, personal care, and nutraceutical segments, where consumer demand for efficacy, safety, and natural origin is paramount, fostering a competitive and innovation-driven landscape.

Segment-wise, the market is witnessing robust growth across several categories. The essential oils segment is experiencing strong momentum, largely due to its widespread adoption in aromatherapy, personal care products, and household cleaning, driven by consumer demand for natural fragrances and therapeutic benefits. Herbal extracts are also a significant growth area, propelled by their increasing integration into dietary supplements, functional foods, and traditional herbal remedies, with a focus on standardized potency. Within these segments, there is a rising demand for standardized extracts with guaranteed levels of active compounds, reflecting a broader market trend towards evidence-based natural solutions. The pharmaceutical application of MAPs continues to be a high-value segment, with ongoing clinical trials validating plant-derived compounds for various therapeutic indications, highlighting the market's potential for both traditional and modern medicine integration and contributing to its overall expansion.

AI Impact Analysis on Medicinal and Aromatic Plant Market

User inquiries frequently highlight the critical need for innovation and efficiency in the traditionally resource-intensive and often inconsistent Medicinal and Aromatic Plant (MAP) market. Common questions revolve around how Artificial Intelligence (AI) can address persistent challenges such as the variability in plant chemical profiles due to environmental factors, the difficulty in rapid identification of novel therapeutic compounds, and the complexities of ensuring traceability and preventing adulteration in lengthy supply chains. There's a strong desire to understand AI's capabilities in optimizing cultivation practices for sustainable yields, enhancing the precision of active compound extraction, and significantly accelerating the drug discovery pipeline. Users anticipate AI will provide data-driven insights to mitigate risks and unlock new opportunities for product development and market expansion, thereby revolutionizing the sector from farm to consumer.

The core concerns expressed by users also extend to the ethical implications and data privacy aspects of deploying AI in agricultural and scientific research settings. While there is enthusiasm for AI's potential to standardize quality, reduce reliance on manual labor, and foster scientific discovery, there are also questions about the accessibility of such advanced technologies for small-scale farmers and traditional practitioners, and the potential impact on traditional knowledge systems. The expectation is that AI tools should not only boost productivity and discovery but also support sustainable practices and foster equitable growth across the diverse stakeholders in the MAP value chain. Therefore, the integration of AI is seen as a multifaceted endeavor that requires careful consideration of both technological capabilities and socio-economic impacts, ensuring that innovation benefits all participants.

Ultimately, users envision AI as a transformative force capable of bringing unprecedented levels of precision, predictability, and innovation to the MAP market. From real-time monitoring of plant health to sophisticated predictive analytics for market demand and consumer preferences, the potential applications are broad and deeply impactful. The overarching theme is one of leveraging AI to achieve greater efficiency, enhance the efficacy and safety of plant-derived products, and ensure the long-term sustainability of botanical resources. This convergence of traditional botanical wisdom with cutting-edge artificial intelligence promises to reshape how medicinal and aromatic plants are cultivated, processed, researched, and brought to market, driving a new era of evidence-based natural solutions and solidifying the market's future trajectory.

- AI-powered precision agriculture: Optimizing irrigation, fertilization, and pest control through real-time data analysis from sensors and drones, leading to enhanced yield and active compound concentration in MAPs.

- Machine learning for predictive modeling: Forecasting plant growth, harvest times, and potential disease outbreaks, thereby improving resource management, reducing crop losses, and ensuring consistent raw material supply.

- Genomic selection and breeding: Utilizing AI to analyze plant genomes, identify desirable genetic traits for increased potency, resilience, or specific phytochemical production, and accelerate the development of superior MAP varieties.

- AI-driven drug discovery and lead optimization: Expediting the screening of vast libraries of plant compounds, predicting their biological activity, identifying potential therapeutic targets, and accelerating preclinical research for novel pharmaceutical applications.

- Automated quality control and adulteration detection: Employing computer vision, spectral analysis (e.g., NIR, Raman spectroscopy), and machine learning to rapidly assess raw material quality, detect contaminants, and ensure product authenticity and purity.

- Blockchain integration with AI for supply chain transparency: Creating immutable records of MAP origin, cultivation, processing, and distribution, enhancing traceability, combating counterfeiting, and verifying ethical and sustainable sourcing claims.

- Robotics in cultivation and harvesting: Implementing autonomous systems for tasks such as planting, weeding, and selective harvesting, reducing labor costs, improving efficiency, and ensuring gentle handling of delicate plant materials.

- Personalized medicine and nutrition recommendations: AI platforms analyzing individual health data, genetic predispositions, and lifestyle factors to recommend specific MAP-derived supplements or remedies tailored to personal needs.

- Market trend prediction and consumer insights: Leveraging AI to analyze vast datasets of consumer behavior, social media trends, and sales data to inform product development, marketing strategies, and inventory management for MAP products.

- Environmental impact assessment and sustainability management: AI models to monitor biodiversity, deforestation rates, water usage, and carbon footprint associated with MAP cultivation, guiding sustainable practices and conservation efforts.

DRO & Impact Forces Of Medicinal and Aromatic Plant Market

The Medicinal and Aromatic Plant (MAP) market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating global consumer demand for natural and organic products, fuelled by heightened health consciousness and a growing aversion to synthetic ingredients. The rising prevalence of chronic diseases has further amplified the interest in complementary and alternative medicines, positioning MAPs as crucial components in preventive healthcare and wellness routines, supported by an increasing body of scientific evidence. Additionally, substantial investments in research and development within phytochemistry and pharmacology are continually uncovering new therapeutic applications and validating traditional uses, thus broadening the market's scope and credibility. Government initiatives and public awareness campaigns promoting traditional medicine systems in various countries also provide a significant impetus for growth, creating a supportive ecosystem for MAP cultivation and commercialization by integrating them into national health strategies.

Despite these powerful drivers, the market faces significant restraints that temper its potential. The supply chain for MAPs is inherently volatile and often fragmented, heavily reliant on wild harvesting in many regions, which poses risks of over-exploitation, inconsistent supply, and ethical concerns regarding biodiversity. Susceptibility to adverse climate change impacts, including altered growing seasons, extreme weather events, and increased pest infestations, directly threatens crop yields and raw material availability, leading to price fluctuations. Furthermore, the absence of standardized cultivation practices and quality control measures across different regions leads to variability in active compound content, complicating regulatory compliance and eroding consumer trust. Stringent and often divergent regulatory frameworks for botanical ingredients in different countries, particularly concerning claims, safety, and labeling, present substantial hurdles for market entry and product commercialization. The high initial investment required for certified organic cultivation and advanced processing technologies also acts as a barrier for smaller players, hindering scalability and market innovation.

However, these challenges are balanced by compelling opportunities for market expansion and innovation. The development and adoption of sustainable cultivation methods, such as organic farming, agroforestry, and vertical farming, promise to stabilize supply chains, ensure consistent quality, and reduce environmental impact, addressing key restraints. Technological advancements in precision agriculture, biotechnology, and advanced extraction techniques offer avenues for enhancing yield, potency, and purity of MAP-derived products, creating premium ingredient opportunities. Moreover, the exploration of untapped biodiversity, particularly in regions rich in endemic flora, presents opportunities for discovering novel compounds with unique therapeutic properties for pharmaceutical and nutraceutical applications. The growing trend of product diversification, including the integration of MAPs into functional foods, beverages, and personalized nutrition solutions, also opens up new revenue streams and consumer bases. External impact forces, such as evolving consumer preferences towards holistic wellness and personalized health, geopolitical stability influencing trade routes and raw material access, and increasing environmental sustainability pressures from regulatory bodies and consumers, continuously reshape the market landscape, demanding adaptive strategies from industry participants who can demonstrate both efficacy and environmental responsibility.

Segmentation Analysis

The Medicinal and Aromatic Plant market is intricately segmented to provide a comprehensive and nuanced understanding of its complex structure, enabling stakeholders to discern specific trends, identify high-growth areas, and tailor strategic initiatives effectively. This meticulous classification allows for a detailed examination of diverse product categories, their varied applications across multiple industries, the different forms in which these plants are processed and utilized, and the distinct end-user sectors driving demand. Each segment is characterized by unique market dynamics, including varying supply chain structures, regulatory requirements, consumer preferences, and competitive landscapes. Analyzing these segments individually and in relation to one another is pivotal for developing targeted market penetration strategies, optimizing product portfolios, and anticipating future shifts in consumer and industrial demand for plant-derived ingredients across the globe.

Understanding the interplay between these segments provides critical insights for product innovation and market positioning. For instance, the demand for essential oils (a 'Type' segment) is significantly influenced by the growth in aromatherapy and personal care ('Application' segments), while the preference for extracts (a 'Form' segment) is driven by the nutraceutical and pharmaceutical industries ('End-Use Industry' segments). The geographical distribution of these segments also highlights regional biodiversity and cultural practices influencing cultivation and consumption patterns, with Asia Pacific, for example, dominating the supply of many traditional herbs. Such granular analysis aids businesses in navigating the market's complexities, from raw material sourcing and processing decisions to distribution strategies and marketing campaigns, ultimately facilitating informed decision-making and sustainable growth within this dynamic and evolving market. The emphasis on standardization, scientific validation, and traceability continues to bridge traditional practices with modern industrial requirements across all segments, ensuring product integrity and consumer trust.

- By Type: This segment categorizes MAPs based on their botanical origin and primary characteristics, influencing their core applications.

- Herbs: Includes leafy green plants or parts used for medicinal or culinary purposes, known for their therapeutic compounds. Examples include Turmeric, Ginseng, Echinacea, Chamomile, Peppermint, and Basil.

- Spices: Refers to aromatic plant parts, typically seeds, fruits, roots, bark, or flowers, primarily used for flavoring, preservation, and medicinal properties. Key examples are Ginger, Cinnamon, Cardamom, Clove, Black Pepper, and Saffron.

- Essential Oils: Concentrated hydrophobic liquids containing volatile aromatic compounds extracted from plants, valued for their distinct aromas and therapeutic effects. Common ones include Lavender Oil, Tea Tree Oil, Eucalyptus Oil, Lemon Oil, and Rosemary Oil.

- Resins: Solid or semi-solid amorphous organic substances exuded from trees or plants, often used for incense, perfumes, and traditional medicine. Examples are Frankincense, Myrrh, Benzoin, and Copaiba.

- Gums: Polysaccharide-based substances extracted from plants, forming viscous solutions or gels, utilized as thickeners, emulsifiers, and stabilizers in various industries. This includes Gum Arabic, Guar Gum, Xanthan Gum, and Karaya Gum.

- Others: Encompasses less conventional or specific categories like seaweeds, lichens, specific plant roots or barks not traditionally classified as herbs or spices, such as Ashwagandha Root and Willow Bark.

- By Application: This segment outlines the primary industries and end-uses for MAPs and their derivatives, reflecting diverse market demands.

- Pharmaceuticals: Involves the use of MAPs in drug formulations, herbal medicinal products, and as active pharmaceutical ingredient (API) development for treating various diseases, often with scientific validation.

- Nutraceuticals & Dietary Supplements: Pertains to their integration into health supplements, functional foods, and beverages aimed at improving health, preventing disease, and enhancing physical or cognitive performance.

- Cosmetics & Personal Care: Includes the incorporation of MAPs in skincare, haircare, oral care, and beauty products for their natural fragrances, active beneficial ingredients, and preservative properties.

- Food & Beverages: Utilized as natural flavorings, colorings, preservatives, and functional ingredients in processed foods, drinks, confectionery, and various culinary applications.

- Aromatherapy & Spa Products: Focuses on the application of essential oils and plant extracts for therapeutic, relaxing, or stimulating effects in professional spa settings and for home-use wellness products.

- Agricultural & Animal Feed: Involves the use of MAPs as natural pesticides, growth promoters, and feed additives for livestock and aquaculture, promoting health and reducing reliance on synthetic chemicals.

- Others: Encompasses industrial fragrances, natural dyes, biopesticides, and specific niche industrial applications not covered in the primary categories.

- By Form: This segment categorizes MAPs based on their processed state or presentation, indicating their readiness for specific industrial uses.

- Whole/Raw: Unprocessed or minimally processed plant parts, such as dried leaves, whole roots, or fresh flowers, often used in traditional remedies or for bulk processing.

- Powder: Dried and finely ground plant material, typically used in capsules, tablets, functional food ingredients, or cosmetic formulations for ease of integration.

- Extracts: Concentrated preparations obtained by extracting active compounds using various solvents or methods, available in liquid, solid, or paste forms (e.g., tinctures, oleoresins).

- Essential Oils: Volatile aromatic compounds obtained via distillation or cold pressing, primarily valued for their aroma and therapeutic properties in concentrated form.

- Fresh: Recently harvested plant material, typically for immediate local use in culinary applications, fresh juices, or specialized traditional medicine preparations.

- Encapsulated: Active compounds or extracts enclosed in a protective shell for controlled release, improved stability, taste masking, or enhanced bioavailability, especially in nutraceuticals.

- By End-Use Industry: This segment directly identifies the type of industry or business that purchases and utilizes MAPs as raw materials or ingredients, highlighting market demand sources.

- Pharmaceutical Industry: Large-scale drug manufacturers and research institutions that develop and produce medicines from botanical sources.

- Nutraceutical Industry: Companies producing dietary supplements, functional foods, and health-enhancing beverages that leverage MAP benefits.

- Cosmetic & Personal Care Industry: Manufacturers of beauty, skincare, haircare, and hygiene products incorporating natural plant ingredients.

- Food & Beverage Industry: Producers of processed foods, drinks, confectionery, and culinary ingredients that utilize MAPs for flavor, color, and function.

- Aromatherapy Clinics & Wellness Centers: Businesses offering therapeutic essential oil treatments, holistic health services, and selling aromatherapy products.

- Agricultural Sector: Farms and companies utilizing plant-based solutions for crop protection, soil enrichment, and animal health management.

Value Chain Analysis For Medicinal and Aromatic Plant Market

The value chain for the Medicinal and Aromatic Plant (MAP) market is a multi-layered and often complex network, beginning with meticulous upstream activities centered on the cultivation, wild harvesting, and initial collection of botanical raw materials. This foundational stage involves a diverse set of actors, including small-scale farmers, large agricultural enterprises, and indigenous communities engaged in sustainable wildcrafting across various ecosystems. Emphasis at this stage is placed on ensuring genetic purity, employing sustainable agricultural practices such as organic farming and agroforestry, and adhering to organic certifications to maintain the integrity and quality of the raw materials. Key considerations here include soil quality, climate conditions, pest management, and the crucial timing of harvest to maximize the concentration of active compounds, ultimately dictating the quality of all downstream products. Effective management of this initial phase is paramount for the entire value chain's success and sustainability, often requiring significant investment in local infrastructure, community engagement, and knowledge transfer.

Midstream activities primarily encompass the processing and primary manufacturing stages. This involves initial post-harvest treatments such as drying, cleaning, crushing, and grinding the raw plant material to prepare it for further extraction. Following these preliminary steps, more sophisticated processes are employed, including various extraction techniques such as solvent extraction, steam distillation (for essential oils), supercritical fluid extraction (SFE), and cold pressing. These processes transform raw botanicals into concentrated extracts, essential oils, powders, and oleoresins, which serve as key ingredients for various industries. Manufacturers at this stage are critical for ensuring the purity, potency, and standardization of active ingredients, often requiring specialized equipment, expertise in phytochemistry, and adherence to stringent quality control standards like Good Manufacturing Practices (GMP). The efficiency and technological sophistication of these processing units directly impact the cost-effectiveness, competitive advantage, and overall quality of the derived ingredients supplied to subsequent stages.

The downstream segment of the value chain involves the formulation, final manufacturing, and distribution of finished products to end-consumers. This stage sees the integration of MAP-derived ingredients into a vast array of consumer goods, including pharmaceuticals (e.g., herbal medicines, API production), nutraceuticals (e.g., capsules, tablets, functional beverages), cosmetics (e.g., creams, serums, shampoos), and food products (e.g., flavorings, preservatives). Distribution channels are diverse and include direct business-to-business (B2B) sales to large industrial buyers seeking bulk ingredients or customized solutions, and indirect channels involving wholesalers, distributors, brokers, and extensive retail networks (both brick-and-mortar stores and rapidly expanding e-commerce platforms). The direct channel emphasizes strategic partnerships and technical support for industrial clients, while indirect channels focus on reaching a broader consumer base through established infrastructure. The success of this final stage hinges on effective marketing, brand building, and navigating complex logistics to ensure products reach target markets efficiently and competitively, often requiring strict compliance with local packaging, labeling, and import regulations.

Medicinal and Aromatic Plant Market Potential Customers

The Medicinal and Aromatic Plant (MAP) market caters to a broad and diverse clientele, with potential customers spanning various industrial sectors and consumer segments, each with distinct demands and specifications for plant-derived products. Pharmaceutical companies represent a significant customer base, actively seeking standardized botanical extracts and isolated phytochemicals for novel drug discovery, the development of herbal medicinal products, and as active pharmaceutical ingredients (APIs) in conventional medicines. These companies require high purity, rigorous scientific validation, and consistent quality, adhering to strict regulatory guidelines for safety and efficacy. Their demand is driven by the search for new therapeutic solutions, often leveraging traditional knowledge validated by modern science, and a desire to integrate natural compounds into their pipelines, recognizing the growing consumer preference for 'natural' pharmaceuticals with proven benefits.

Another major segment of potential customers includes nutraceutical and dietary supplement manufacturers, who utilize MAPs for formulating health-enhancing products such as vitamins, minerals, herbal supplements, and functional foods and beverages. These customers prioritize ingredients that offer specific health benefits—like immune support, digestive health, cognitive enhancement, or stress reduction—and often seek proprietary blends or standardized extracts with guaranteed levels of active compounds to support marketing claims. The cosmetics and personal care industry is also a substantial consumer, integrating MAPs for their natural fragrances, antioxidant properties, anti-inflammatory effects, and skin-conditioning benefits in a wide array of products, from skincare and haircare to oral care and fragrances. Their demand is propelled by the clean beauty trend, consumer desire for natural and organic labels, and the proven effectiveness of plant-derived compounds in topical applications, emphasizing sustainable sourcing and transparency.

Furthermore, the food and beverage industry constitutes a vital customer segment, employing MAPs as natural flavorings, colorings, preservatives, and functional ingredients in products ranging from specialty teas, health drinks, and confectioneries to processed foods and culinary spices. This sector seeks ingredients that enhance sensory appeal, extend shelf life, and provide additional health attributes, catering to the growing demand for functional foods. The burgeoning aromatherapy and spa industry, along with wellness centers and practitioners, also forms a key customer group, demanding high-quality essential oils and botanical extracts for therapeutic applications and relaxation purposes, with a strong focus on purity and authenticity. Beyond these, the agricultural sector is emerging as a buyer, utilizing MAPs for bio-pesticides and natural animal feed additives to promote animal health and reduce reliance on synthetic chemicals. Overall, the potential customer landscape is characterized by a strong demand for traceability, sustainability, scientific backing, and versatility in application, making supplier transparency and consistent quality paramount for market success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 48.5 Billion |

| Market Forecast in 2032 | USD 87.2 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Indena S.p.A., Martin Bauer Group, Symrise AG, International Flavors & Fragrances Inc. (IFF), Givaudan SA, DSM Nutritional Products, Döhler GmbH, Arjuna Natural Pvt Ltd., Sabinsa Corporation, Chr. Hansen Holding A/S, Naturex (part of Givaudan), Euromedic Biotech Inc., Kalsec Inc., Blue California, Vidya Herbs Pvt. Ltd., Lipoid GmbH, Sensoril (Natreon Inc.), Pharmactive Biotech Products, S.L., Bionova Scientific Inc., Herbamed AG, BI Nutraceuticals, Xi'an Tian Guangyuan Biotech Co., Ltd., Nissin Foods Holdings Co., Ltd. (via botanical ingredients division), Takasago International Corporation, Robertet Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medicinal and Aromatic Plant Market Key Technology Landscape

The Medicinal and Aromatic Plant (MAP) market is undergoing a significant transformation driven by the integration of cutting-edge technologies aimed at enhancing efficiency, quality, and sustainability across its entire value chain. One of the paramount technological advancements lies in the field of biotechnology, which includes genetic engineering, tissue culture propagation, and metabolic engineering. These biotechnological tools enable the precise modification of plant genomes to increase the yield of active compounds, improve disease resistance, and adapt MAPs to diverse environmental conditions, thereby ensuring a consistent and high-quality supply of raw materials. Additionally, micropropagation techniques facilitate the rapid multiplication of superior plant varieties, reducing reliance on wild harvesting and promoting sustainable cultivation practices. This genetic precision ensures the uniformity and potency critical for pharmaceutical and nutraceutical applications, moving beyond the inherent variability traditionally associated with wild-sourced botanicals and enhancing overall product integrity.

In the realm of cultivation and harvesting, the adoption of precision agriculture techniques is revolutionizing how MAPs are grown. This includes the deployment of Internet of Things (IoT)-enabled sensors for real-time monitoring of soil moisture, nutrient levels, and plant health, alongside drone technology for aerial imaging and targeted application of resources. These tools allow for data-driven decision-making, optimizing irrigation, fertilization, and pest management, ultimately leading to higher yields, reduced environmental impact, and lower operational costs. Robotics and automation are also emerging for tasks such as planting, weeding, and selective harvesting, particularly for labor-intensive crops, ensuring greater efficiency, minimizing manual errors, and protecting the delicate plant materials. Furthermore, climate-controlled environments like greenhouses and vertical farms are increasingly being utilized to cultivate specific MAPs, offering highly controlled conditions for optimal growth, minimizing external contaminants, and enabling year-round production, thus mitigating risks associated with unpredictable weather patterns and ensuring supply consistency.

Post-harvest processing and quality assurance are equally benefiting from advanced technological innovations. Sophisticated extraction methods, such as supercritical fluid extraction (SFE) using CO2, microwave-assisted extraction (MAE), ultrasound-assisted extraction (UAE), and enzyme-assisted extraction, are being employed to obtain high-purity extracts with enhanced bioactivity and specific phytochemical profiles, while minimizing solvent residues and environmental impact. These techniques offer superior control over the extraction process, allowing for targeted isolation of desired compounds with greater efficiency. Complementary to extraction are advanced analytical techniques like High-Performance Liquid Chromatography (HPLC), Gas Chromatography-Mass Spectrometry (GC-MS), Nuclear Magnetic Resonance (NMR), and Near-Infrared (NIR) spectroscopy. These methods are crucial for comprehensive phytochemical profiling, quantifying active compounds, detecting adulteration, and ensuring the authenticity, purity, and safety of MAP ingredients and finished products, meeting stringent global regulatory standards and building essential consumer trust. The convergence of these technologies promises to transform the MAP market into a more scientifically rigorous, efficient, and sustainable industry capable of meeting complex global demands.

Regional Highlights

- North America: This region exhibits robust growth, primarily driven by a highly health-conscious consumer base and strong demand for natural health products, organic personal care items, and functional foods. The United States and Canada are leading markets, characterized by advanced research and development infrastructure, favorable regulatory environments for dietary supplements and natural health products, and a sophisticated retail ecosystem for botanical ingredients. There is a significant emphasis on transparent sourcing, clean labels, and scientific validation of plant-based products, pushing companies towards sustainable practices and innovative product formulations. The trend towards personalized nutrition and increasing acceptance of herbal remedies within mainstream healthcare systems further propel market expansion. Investments in domestic cultivation and processing technologies are also gaining traction to ensure supply security and quality control, making it a pivotal region for innovation and consumption.

- Europe: As a mature market with a deep-rooted history of traditional herbal medicine, Europe is experiencing a strong resurgence in the Medicinal and Aromatic Plant sector. This renewed interest is underpinned by stringent quality and safety regulations for herbal medicinal products, high consumer demand for natural cosmetics, 'clean label' food ingredients, and a growing embrace of phytotherapy. Countries such as Germany, France, Italy, and the UK are prominent players in cultivation, advanced processing, and consumption. The European market places a strong emphasis on organic certifications, ethical sourcing, and adherence to pharmacopoeial standards. Significant investments in research into the efficacy and mechanisms of action of botanical compounds are also prevalent, driving innovation in both traditional herbal medicines and modern pharmaceutical applications, with a clear focus on sustainability and environmental stewardship throughout the supply chain, ensuring high-quality product offerings.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from unparalleled biodiversity, deeply entrenched traditional medicine systems such as Ayurveda (India) and Traditional Chinese Medicine (China), and a rapidly expanding middle-class population with increasing disposable incomes. This region serves as a major global hub for the cultivation and supply of a vast array of MAP raw materials. Countries like China, India, and various Southeast Asian nations are significant producers and increasingly sophisticated consumers. The market here is characterized by a blend of traditional practices with modern scientific validation, substantial government support for indigenous medicine, and burgeoning investment in modern processing technologies and export-oriented production facilities. The growing urbanization and shift towards preventative healthcare further fuel demand for plant-based solutions, making APAC a powerhouse for both raw material supply and product consumption, with considerable potential for further expansion and technological integration in the coming years.

- Latin America: This region possesses extraordinary natural resources and an unparalleled diversity of plant species, making it an emerging and high-potential market for Medicinal and Aromatic Plants. Countries such as Brazil, Mexico, and Colombia are particularly notable for their unique indigenous plant varieties and a rapidly growing export potential for specialized botanical ingredients, including superfoods and novel compounds. The market is increasingly focusing on value-added processing and promoting sustainable harvesting practices, driven by both expanding local consumption and robust international demand for unique phytocompounds and essential oils. Efforts are being made to establish scientific validation for traditional plant uses and to formalize regulatory frameworks, attracting foreign investment and fostering local economic development. The emphasis on biodiversity conservation and fair trade practices is also a growing priority, aiming to leverage natural wealth responsibly while supporting local communities and ensuring long-term resource availability.

- Middle East and Africa (MEA): This region holds significant potential, particularly for aromatic plants and traditional remedies that have been part of local cultures for centuries. Countries like Egypt, Morocco, South Africa, and parts of East Africa are recognized for specific plant species, essential oil production (e.g., rose, argan), and the use of indigenous herbs in traditional healing systems. The market is in a developing phase, influenced by increasing health consciousness, rapid urbanization, and government initiatives aimed at promoting local agriculture, diversifying economies, and boosting exports of high-value botanical products. While challenges remain in terms of robust infrastructure, standardized cultivation practices, and regulatory harmonization, there is a growing interest from international players seeking novel ingredients and sustainable sourcing opportunities. The unique traditional knowledge of the region combined with modern investment holds promise for future market expansion and the development of unique product offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medicinal and Aromatic Plant Market.- Indena S.p.A.

- Martin Bauer Group

- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Givaudan SA

- DSM Nutritional Products

- Döhler GmbH

- Arjuna Natural Pvt Ltd.

- Sabinsa Corporation

- Chr. Hansen Holding A/S

- Naturex (part of Givaudan)

- Euromedic Biotech Inc.

- Kalsec Inc.

- Blue California

- Vidya Herbs Pvt. Ltd.

- Lipoid GmbH

- Sensoril (Natreon Inc.)

- Pharmactive Biotech Products, S.L.

- Bionova Scientific Inc.

- Herbamed AG

- BI Nutraceuticals

- Xi'an Tian Guangyuan Biotech Co., Ltd.

- Nissin Foods Holdings Co., Ltd. (via botanical ingredients division)

- Takasago International Corporation

- Robertet Group

Frequently Asked Questions

Analyze common user questions about the Medicinal and Aromatic Plant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Medicinal and Aromatic Plant market globally?

The market's expansion is significantly driven by a global surge in consumer demand for natural, organic, and plant-derived products, fueled by increasing health consciousness and a desire for sustainable alternatives. Rising awareness of chronic disease prevalence and interest in complementary therapies, alongside substantial investments in research and development for novel botanical applications, are also key propellers. Government support for traditional medicine systems further stimulates growth by integrating MAPs into national health strategies.

In which major industries are Medicinal and Aromatic Plants primarily utilized?

Medicinal and Aromatic Plants (MAPs) find extensive applications across a diverse range of industries. These include pharmaceuticals for drug development and herbal remedies; nutraceuticals for dietary supplements and functional foods; cosmetics and personal care for natural ingredients and fragrances; food and beverages for flavorings, colorings, and functional properties; and aromatherapy for therapeutic essential oils. They are also increasingly used in the agricultural sector for natural pest control and animal feed additives.

What role does sustainability play in the current Medicinal and Aromatic Plant market landscape?

Sustainability is a paramount concern shaping the MAP market. Growing awareness of environmental degradation, over-harvesting, and biodiversity loss drives strong demand for ethically sourced and sustainably cultivated plants. Companies are increasingly adopting organic farming, fair trade practices, and advanced technologies to ensure responsible resource management, minimize ecological footprints, and meet consumer and regulatory expectations for environmental and social responsibility. Supply chain traceability and certifications are critical for validating sustainability claims.

What key technological advancements are influencing the production and processing of Medicinal and Aromatic Plants?

The MAP market is being transformed by several key technological advancements. These include biotechnology (e.g., genetic improvement, tissue culture) for enhancing yield and quality; precision agriculture (e.g., IoT sensors, drones, AI) for optimized cultivation; advanced extraction methods (e.g., supercritical fluid extraction, microwave-assisted extraction) for higher purity and potency of extracts; and sophisticated analytical techniques (e.g., HPLC, GC-MS, NMR) for stringent quality control, authentication, and detection of adulteration. Robotics and automation are also emerging for efficient harvesting and processing.

Which geographical regions are dominant or rapidly growing in the Medicinal and Aromatic Plant market, and why?

Asia Pacific (APAC) is the dominant and fastest-growing region, owing to its rich biodiversity, deeply established traditional medicine systems (e.g., TCM, Ayurveda), and a rapidly expanding middle class. North America and Europe are significant consumer markets driven by high health consciousness, demand for natural products, and robust R&D. Latin America and the Middle East & Africa are emerging with substantial growth potential due to their unique flora and increasing investment in local production and exports, aiming to leverage natural wealth responsibly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager