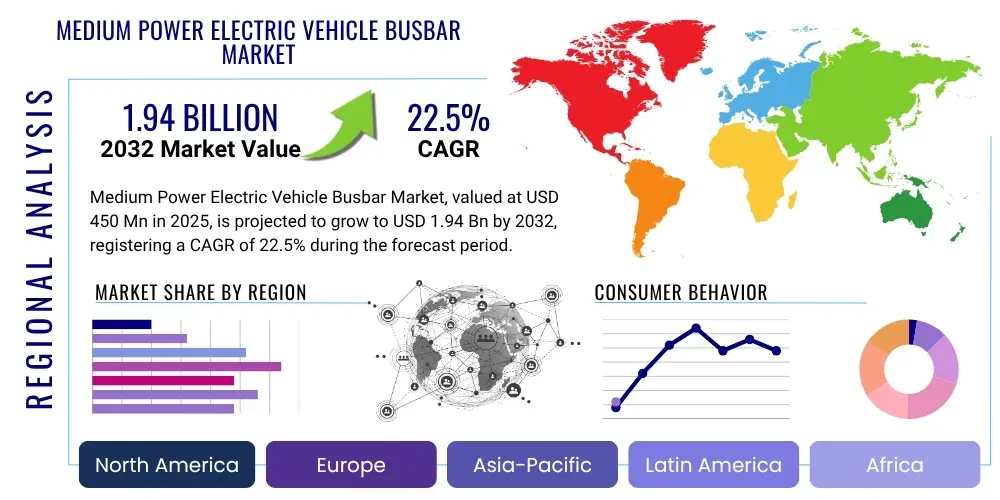

Medium Power Electric Vehicle Busbar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430243 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Medium Power Electric Vehicle Busbar Market Size

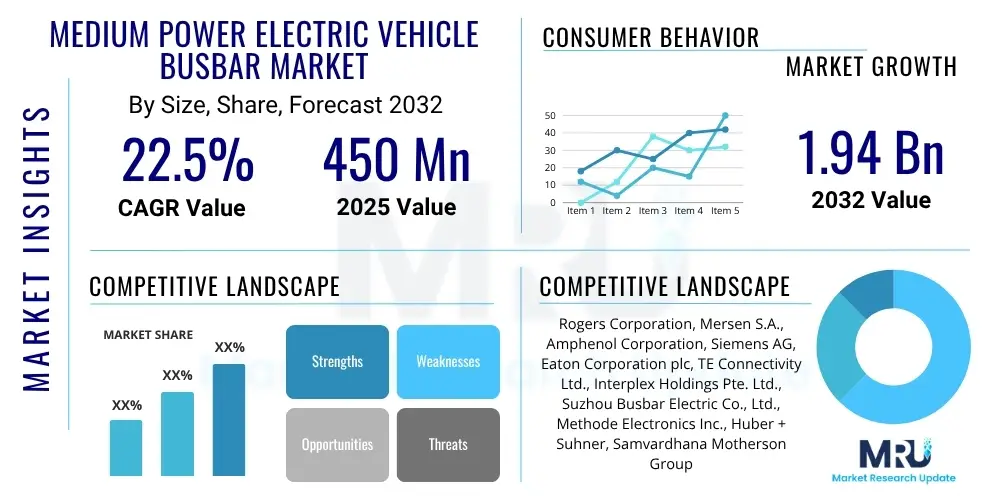

The Medium Power Electric Vehicle Busbar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2032. The market is estimated at USD 450 Million in 2025 and is projected to reach USD 1.94 Billion by the end of the forecast period in 2032.

Medium Power Electric Vehicle Busbar Market introduction

The Medium Power Electric Vehicle Busbar Market represents a cornerstone within the burgeoning electric vehicle industry, providing the essential infrastructure for efficient and safe power distribution. Busbars, distinct from traditional wiring, are robust metallic strips or bars meticulously engineered to conduct substantial electrical currents, acting as a centralized connection point for various high-voltage circuits in an EV. In the context of medium power electric vehicles—a category encompassing a wide array of passenger cars, light-duty commercial vans, and smaller urban electric buses—these busbars are indispensable. They play a critical role in managing the intricate flow of high currents and voltages across the powertrain, thereby ensuring optimal operational performance, system reliability, and passenger safety. Their design is a complex balance of electrical conductivity, thermal management, and mechanical integrity, specifically tailored to the demanding environment of an electric vehicle.

The product's functional advantages are multifaceted and directly contribute to the overall efficiency and attractiveness of electric vehicles. Medium power EV busbars are prized for their superior electrical conductivity, which minimizes energy losses during power transmission and enhances the responsiveness of the vehicle's electrical systems. Crucially, they offer enhanced thermal management capabilities, effectively dissipating heat generated by high current flows, thereby preventing overheating and extending the lifespan of critical components like batteries and inverters. Furthermore, their compact and rigid form factor allows for significant space-saving and weight reduction compared to conventional wiring harnesses, which translates into improved vehicle range, greater design flexibility, and better overall packaging within the vehicle chassis. These inherent benefits position busbars as technologically advanced and economically viable alternatives to traditional cabling, driving their widespread adoption across various EV applications.

The robust growth trajectory of this market is primarily underpinned by the accelerating global transition to electric mobility, a phenomenon fueled by increasingly stringent environmental regulations and substantial government incentives aimed at promoting EV adoption. Developments in battery technology, particularly the ongoing push towards higher energy densities and faster charging capabilities, necessitate more sophisticated and reliable power distribution systems, with busbars at their core. Additionally, the rapid expansion of global EV charging infrastructure, encompassing both public and private charging solutions, further amplifies the demand for high-performance busbars capable of handling significant power loads during rapid charging cycles. The confluence of these driving factors, coupled with continuous innovation in material science and manufacturing techniques, ensures a vibrant and expanding market for medium power electric vehicle busbars.

Medium Power Electric Vehicle Busbar Market Executive Summary

The Medium Power Electric Vehicle Busbar Market is currently undergoing a period of significant dynamism and expansion, shaped by robust global EV adoption and continuous technological advancements. Key business trends underscore a strong industry focus on innovation, particularly in the realm of advanced material compositions such as high-strength aluminum alloys and sophisticated composite materials. These innovations aim to achieve critical objectives like enhanced electrical conductivity, superior thermal dissipation, and substantial weight reduction, all while maintaining cost-effectiveness. Furthermore, there is an accelerating trend towards automation and precision manufacturing techniques within the busbar industry. Manufacturers are leveraging advanced robotics and digital quality control systems to meet the exacting quality standards and scalability requirements demanded by the rapidly growing EV production volumes. Strategic collaborations, often long-term partnerships, between busbar suppliers and leading EV original equipment manufacturers (OEMs) are becoming increasingly vital. These alliances facilitate co-development of highly customized busbar solutions that are seamlessly integrated into next-generation EV platforms, thereby strengthening supply chain resilience and accelerating market penetration for innovative products.

Geographically, the Asia Pacific (APAC) region stands as the undisputed leader in the Medium Power EV Busbar Market, largely attributable to its dominant position in global electric vehicle manufacturing and sales, with countries like China, Japan, and South Korea at the forefront. This regional dominance is further reinforced by strong governmental support for EV initiatives, well-established automotive supply chains, and a burgeoning consumer base readily adopting electric mobility. Europe is experiencing remarkable growth, driven by ambitious regional decarbonization targets, stringent environmental regulations, and significant governmental and private sector investments in EV infrastructure. Nations such as Germany, Norway, and France are pioneering EV adoption, fueling a corresponding surge in demand for high-performance and compliant busbar solutions. Similarly, North America is witnessing an accelerated market expansion, supported by favorable federal and state-level policies, substantial incentives for EV purchases, and a rapid increase in domestic EV manufacturing capabilities across the United States and Canada, creating a robust demand for localized busbar production.

From a segmentation perspective, the market is profoundly influenced by the industry's shift towards higher voltage architectures, with 800V systems emerging as a significant growth catalyst due to their promise of faster charging and improved power delivery efficiency. While copper continues to be the preferred material for its unparalleled conductivity, aluminum busbars are steadily gaining market share, driven by their lightweight characteristics and more favorable cost profile, particularly for applications where weight reduction is paramount. In terms of application, busbars within battery modules and power distribution units (PDUs) represent the largest and most critical segments, reflecting their foundational role in an EV's power management system. Although passenger electric vehicles constitute the largest end-user segment, the demand from electric commercial vehicles and urban electric buses is experiencing a notable upward trend, indicating a broadening spectrum of applications and an increasing need for specialized, robust busbar solutions tailored to different vehicle performance requirements and operational environments.

AI Impact Analysis on Medium Power Electric Vehicle Busbar Market

Common user inquiries frequently center on the transformative potential of artificial intelligence (AI) to enhance every stage of the busbar lifecycle within electric vehicles, specifically exploring its capacity for optimizing design parameters, streamlining manufacturing processes, and ensuring operational reliability. Users are keen to understand how AI can address complex challenges such as precise thermal management, proactive fault detection, and intelligent supply chain orchestration. Key themes emerging from these questions highlight expectations that AI will significantly shorten product development cycles, markedly improve the reliability and longevity of busbar systems, facilitate predictive maintenance schedules, and elevate the overall safety standards in the sophisticated power architectures of modern EVs. Furthermore, there is considerable interest in AI's role in accelerating the integration of novel materials and advanced fabrication techniques, enabling busbar manufacturers to continuously adapt to the evolving industry demands for higher performance, greater power density, and reduced weight, thereby pushing the boundaries of current technological capabilities and fostering a new era of efficiency and innovation in the medium power EV busbar sector.

- AI-driven generative design software autonomously optimizes busbar layouts, considering electrical, thermal, and mechanical constraints to enhance performance while minimizing material waste and weight.

- Predictive maintenance algorithms, powered by AI, analyze real-time sensor data from integrated busbar systems to forecast potential failures, enabling proactive interventions and reducing vehicle downtime.

- Automated optical inspection (AOI) systems, leveraging advanced AI vision, perform rapid and highly accurate quality control, identifying even microscopic defects in busbar manufacturing processes, ensuring superior product consistency.

- AI-enabled supply chain management platforms optimize material procurement, inventory levels, and logistics for raw materials like copper and aluminum, improving responsiveness and mitigating supply chain disruptions.

- Machine learning models are employed in battery management systems (BMS) to utilize integrated busbar sensor data for more precise current distribution, thermal profiling, and overall battery health monitoring, extending battery life.

- Robotics integrated with AI enhance manufacturing lines, allowing for highly accurate and repeatable processes such as bending, welding, and insulation application, thereby increasing production throughput and reducing human error.

- AI simulation tools accelerate the virtual testing of new busbar designs under various operating conditions, significantly reducing the need for costly physical prototypes and speeding up time-to-market for innovative solutions.

DRO & Impact Forces Of Medium Power Electric Vehicle Busbar Market

The Medium Power Electric Vehicle Busbar Market is profoundly shaped by a complex interplay of driving forces, inherent restraints, and compelling opportunities, all operating under the influence of broader impact forces that dictate market trajectory. At the forefront of market acceleration are significant drivers such as the burgeoning global adoption of electric vehicles, fueled by a collective governmental and societal push towards sustainable transportation solutions. This surge is amplified by increasingly stringent global emission regulations and substantial government incentives, including purchase subsidies, tax breaks, and infrastructure development grants, all designed to catalyze the transition to EVs. Crucially, continuous advancements in battery technology, which consistently deliver higher energy densities, longer ranges, and critically, faster charging capabilities, directly elevate the demand for busbar solutions capable of handling enhanced power loads efficiently and safely. The rapid and extensive expansion of global EV charging infrastructure, especially the proliferation of high-power DC fast-charging networks, further necessitates the development and deployment of robust busbars engineered to manage substantial current flows during accelerated charging cycles, thereby sustaining and propelling market demand.

However, the market also contends with several formidable restraints that can impede its otherwise rapid growth. A significant challenge lies in the volatile and often unpredictable pricing of key raw materials, predominantly high-grade copper and aluminum. These fluctuations can exert considerable pressure on manufacturing costs, impacting profitability and overall market stability for busbar producers. The intrinsic complexity of thermal management in high-power EV systems poses ongoing and intricate design challenges; busbars must not only conduct electricity but also efficiently dissipate heat to prevent performance degradation, ensure system longevity, and, critically, maintain operational safety within confined spaces. Furthermore, the persistent lack of universal standardization across different EV manufacturers regarding busbar designs, dimensions, and material specifications can hinder economies of scale in mass production, leading to increased customization costs and longer lead times. Lastly, global supply chain vulnerabilities, periodically exacerbated by geopolitical events, trade tensions, or public health crises, represent a continuous risk to the timely procurement of essential materials and the smooth execution of production schedules, creating uncertainties for market players.

Despite these challenges, the Medium Power EV Busbar Market presents a wealth of compelling opportunities for innovation and strategic growth. The ongoing research and development into advanced materials, including innovative composite busbars, lightweight conductive alloys, and superior insulation technologies, offers promising avenues for enhancing performance, significantly reducing vehicle weight, and improving the overall durability and safety of EV power systems. The automotive industry's accelerating migration towards 800V and even higher voltage EV architectures is creating a substantial demand for a new generation of busbars specifically designed to manage extreme electrical loads with superior isolation properties and enhanced thermal performance, opening entirely new design paradigms. Moreover, the increasing integration of Vehicle-to-Grid (V2G) technologies, which enable EVs to feed power back into the grid, along with the continuous drive for ultra-lightweight components to maximize EV range, are collectively opening novel application areas and fostering innovative design solutions for busbar manufacturers. These evolving technological and market dynamics underscore a sector ripe for strategic investments, continuous research, and collaborative development, promising sustained expansion and technological breakthroughs.

Segmentation Analysis

The Medium Power Electric Vehicle Busbar Market is systematically segmented to offer a granular and insightful perspective into its multifaceted components and underlying growth drivers. This comprehensive segmentation methodology enables a precise and actionable analysis of market dynamics, identification of competitive landscapes, and strategic targeting of emerging opportunities across various product categories, application domains, and geographical regions. Each segment is meticulously defined to reflect the fundamental characteristics, technological requirements, and evolving demands of the dynamic electric vehicle industry, encompassing both the specific conductive materials utilized in busbar construction and the critical functional roles busbars perform within diverse EV architectures. A thorough understanding of these discrete segments is paramount for all market stakeholders, including manufacturers, suppliers, and investors, as it empowers them to identify promising niche markets, strategically optimize their product development pipelines, and meticulously tailor their business strategies to align with the specific needs and trends prevalent in each sub-market, thereby maximizing their potential for success and market penetration.

- By Material

- Copper: Valued for its excellent electrical conductivity, high thermal conductivity, and mechanical strength, making it ideal for high-current applications.

- Aluminum: Chosen for its lightweight properties and cost-effectiveness, offering a good balance of conductivity and weight reduction, particularly in larger busbar systems.

- Other Alloys: Includes specialized materials like copper-nickel alloys for specific thermal or mechanical properties, and silver-plated busbars for ultra-low contact resistance in critical junctions.

- By Voltage Type

- 400V Systems: The current predominant voltage architecture in many EVs, requiring robust busbars for efficient power distribution.

- 800V Systems: An rapidly emerging standard for next-generation EVs, demanding busbars with enhanced insulation, thermal management, and safety features for ultra-fast charging and higher power delivery.

- Other High Voltage Systems: Encompassing experimental or niche applications exceeding 800V, pushing the boundaries of current busbar technology and material science.

- By Application

- Battery Modules and Packs: Critical for connecting individual battery cells and modules, ensuring efficient current flow, voltage equalization, and thermal management within the battery system.

- Power Distribution Units (PDU): Centralized hubs that distribute high-voltage power from the battery to various EV subsystems, requiring highly reliable and compact busbar assemblies.

- Inverters and Converters: Essential for transmitting power between the battery and electric motors, where busbars handle alternating and direct current conversion with minimal losses.

- Onboard Chargers: Facilitate AC to DC power conversion for battery charging, utilizing busbars for efficient internal power routing.

- Motor Connections: Direct links between inverters and electric motors, requiring robust busbars to withstand high currents and vibrations.

- Other Power Electronics: Includes connections in DC-DC converters, auxiliary power units, and other high-voltage components throughout the EV.

- By Vehicle Type

- Passenger Electric Vehicles (BEV, PHEV): The largest and most diverse segment, covering various car models from sedans to SUVs, demanding compact, high-performance, and lightweight busbar solutions.

- Commercial Electric Vehicles (Light and Medium Duty): Includes electric vans, trucks, and delivery vehicles, requiring durable and robust busbars capable of handling heavier loads and continuous operation.

- Electric Buses and Coaches: Demands extremely high-power busbars for large battery capacities and powerful traction systems, prioritizing reliability, safety, and longevity in public transport applications.

Value Chain Analysis For Medium Power Electric Vehicle Busbar Market

The value chain for the Medium Power Electric Vehicle Busbar Market is an intricately structured ecosystem, extending comprehensively from the initial sourcing of raw materials to the ultimate integration into the final electric vehicle and potential aftermarket services. The upstream segment of this value chain is fundamentally centered on the rigorous procurement of essential raw materials. This primarily involves high-grade conductive metals such as electrolytic copper and various aluminum alloys, alongside an array of advanced insulation materials, including epoxy resins, specialized polymers like polyphenylene sulfide (PPS) or polybutylene terephthalate (PBT), and other dielectric plastics crucial for electrical isolation. Suppliers in this initial stage are critically focused on ensuring consistent quality, achieving optimal cost-effectiveness through efficient sourcing strategies, and increasingly, adhering to sustainable and ethically responsible material procurement practices, reflecting growing industry demand for eco-friendly manufacturing. Reliability of supply and material purity are paramount at this foundational stage, as they directly impact the performance and safety of the final busbar product.

Moving into the midstream, this segment is dominated by specialized busbar component manufacturers who undertake the complex process of transforming raw materials into precision-engineered busbars ready for integration. This involves a series of sophisticated fabrication techniques, including high-precision stamping and bending to achieve intricate geometries, advanced welding processes (such as laser welding or friction stir welding) for robust connections, and meticulous lamination processes for multi-layered busbars. This stage also crucially involves the application of specialized coatings, such as tin or silver plating for enhanced conductivity and corrosion resistance, and the meticulous overmolding or encapsulation with dielectric insulation to ensure maximum electrical safety and thermal performance. These manufacturing steps are highly capital-intensive and require significant expertise in material science and engineering, with a strong emphasis on achieving tight tolerances and consistent quality, as any deviation can impact the overall efficiency and safety of the EV's power system.

The downstream analysis focuses on the pivotal integration of these manufactured busbars into broader electric vehicle systems. This segment primarily involves Tier 1 automotive suppliers who specialize in assembling complex sub-components like battery packs, advanced inverters, power distribution units (PDUs), and onboard charging modules. These Tier 1 suppliers then deliver these integrated sub-assemblies to major Electric Vehicle Original Equipment Manufacturers (EV OEMs) for final vehicle assembly. The predominant distribution channel within this value chain is characterized by direct sales and the establishment of long-term strategic partnerships between busbar manufacturers and either Tier 1 suppliers or directly with EV OEMs. This direct approach is favored due to the often highly customized nature and critical functional importance of busbar solutions, requiring close technical collaboration and co-development. While indirect channels, involving specialized distributors, may exist for smaller volume orders, aftermarket components, or prototyping, the industry norm leans heavily towards direct engagement to ensure seamless integration, adherence to stringent specifications, and efficient problem-solving throughout the product lifecycle. The robustness and collaborative efficiency of this entire value chain are indispensable for supporting the rapid advancements and escalating production demands of the global electric vehicle industry, with an unwavering focus on quality, innovation, and strategic alliances at every critical juncture.

Medium Power Electric Vehicle Busbar Market Potential Customers

The landscape of potential customers and end-users for medium power electric vehicle busbars is highly diverse, reflecting the multifaceted components and systems that constitute modern electric vehicles. At the forefront of this customer base are the Electric Vehicle Original Equipment Manufacturers (EV OEMs). This category encompasses a broad spectrum of companies, ranging from well-established global automotive giants that are rapidly transitioning their product portfolios towards electrification, to agile and innovative pure-play EV startups pioneering new vehicle designs. These OEMs require highly specialized, often customized, busbar solutions that form the very backbone of their vehicle's electrical architecture. Busbars are indispensable for functions such as efficient power transfer within sophisticated battery packs, providing robust connections to high-performance electric motors, and ensuring seamless integration with advanced onboard power electronics, all crucial for the vehicle's overall operational integrity and performance.

Another critically important customer segment comprises battery pack manufacturers and module integrators. These specialized companies focus on the intricate process of assembling individual battery cells into larger modules, and then combining these modules into complete, high-voltage battery packs. Within these packs, busbars are fundamental for establishing reliable series and parallel connections between cells and modules, facilitating effective thermal management, and ensuring equitable power distribution throughout the entire battery system. Their demand for busbars is intrinsically linked to the need for components that offer exceptional robustness, maintain a compact form factor, exhibit superior thermal efficiency, and can reliably withstand the rigorous and dynamic operating conditions inherent to battery systems. The quality and design of these busbars directly contribute to optimal battery performance, extend battery longevity, and are vital for preventing safety incidents within the EV's most critical power source.

Furthermore, an indispensable customer base consists of Tier 1 automotive suppliers, particularly those renowned for their expertise in developing and manufacturing advanced power electronics, inverters, converters, and onboard charging systems. These suppliers integrate high-quality busbars into their sophisticated component assemblies, which are subsequently supplied to EV OEMs for final vehicle integration. The growing market for high-power DC fast charging stations also identifies charging infrastructure developers as a nascent yet rapidly expanding customer segment. These developers require specialized busbars engineered for efficient and safe power distribution within their high-capacity charging units, capable of handling substantial current loads during rapid charging processes. Lastly, specialized engineering firms, research and development institutions, and aftermarket component suppliers also represent niche but important segments within the market. These entities procure busbars for prototyping new EV technologies, conducting advanced research on power distribution, or providing replacement and upgrade components for existing electric vehicles, driving demand for both standard and highly customized busbar solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 450 Million |

| Market Forecast in 2032 | USD 1.94 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rogers Corporation, Mersen S.A., Amphenol Corporation, Siemens AG, Eaton Corporation plc, TE Connectivity Ltd., Interplex Holdings Pte. Ltd., Suzhou Busbar Electric Co., Ltd., Methode Electronics Inc., Huber + Suhner, Samvardhana Motherson Group, U-Shin Ltd., Storm Power Components, Prettl group, FJZ Electric Power Technology, Luvata, SCHOTT AG, Woco Industrietechnik GmbH, Hitachi Metals Ltd., Furukawa Electric Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medium Power Electric Vehicle Busbar Market Key Technology Landscape

The Medium Power Electric Vehicle Busbar Market is defined by a dynamic and continually advancing technological landscape, driven primarily by the relentless pursuit of enhanced efficiency, superior safety standards, and increased power density within the evolving electric vehicle industry. A cornerstone of this innovation lies within materials science, specifically in the development of cutting-edge conductive materials. While high-purity copper continues its dominance due to its exceptional electrical conductivity, there is an accelerated focus on high-strength aluminum alloys and innovative composite materials. These alternatives offer a compelling combination of excellent conductivity with significant weight reduction, a critical factor for extending EV range and improving overall vehicle performance. Furthermore, sophisticated surface treatments and specialized coatings, such as precise silver plating for ultra-low contact resistance or nickel plating for superior corrosion protection, are becoming increasingly common to optimize electrical connections, enhance durability, and extend the operational lifespan of busbar systems, ensuring long-term reliability in demanding EV environments.

Insulation technology constitutes another pivotal area of intense research and development, with manufacturers concentrating on engineering highly durable, thermally stable, and electrically robust dielectric materials. Advanced polymers, high-performance epoxy resins, and innovative laminated insulation solutions are being meticulously developed to withstand the extreme thermal fluctuations, harsh environmental conditions, and intense mechanical vibrations intrinsically associated with EV operations. These insulation layers are not merely protective; they are fundamental for maintaining electrical isolation, preventing critical electrical short circuits, and crucially, mitigating the risk of thermal runaway events within sensitive battery packs. Significant technological advancements in manufacturing processes are also evident, including the widespread adoption of high-precision stamping, advanced laser welding techniques for intricate connections, and highly automated bending processes. These techniques ensure the production of complex busbar geometries with extremely tight tolerances, which are indispensable for the compact and highly integrated power architectures characteristic of modern electric vehicles, enabling greater design flexibility and optimized packaging.

Beyond materials and manufacturing, an emerging and significant technological trend involves the integration of smart features and advanced sensor technologies directly into busbar systems. This includes the seamless incorporation of miniature temperature sensors, highly accurate current sensors, and precise voltage monitoring points within the busbar structure. Such integration facilitates real-time data acquisition, providing critical operational intelligence to the battery management systems (BMS) and other vehicle control units. This real-time data is invaluable for enabling sophisticated thermal management strategies, instantaneous fault detection, and the implementation of predictive maintenance protocols, all of which collectively contribute to enhancing the overall reliability, operational safety, and longevity of the EV's entire electrical system. Moreover, the accelerating industry-wide transition towards 800V and even higher voltage architectures in electric vehicles is a profound technological driver. This shift mandates the development of busbars capable of handling significantly elevated voltages with superior electrical isolation, enhanced current carrying capacity, and optimized thermal performance, leading to entirely new design paradigms, material selection criteria, and rigorous testing requirements for next-generation busbar solutions.

Regional Highlights

- North America: This region is experiencing significant market acceleration, propelled by robust governmental support through incentives like federal tax credits for EV purchases and substantial investments in charging infrastructure expansion. The increasing establishment and expansion of domestic EV manufacturing facilities in the United States and Canada are also key drivers, fostering localized supply chains and reducing reliance on imports, while consumer adoption continues to grow steadily.

- Europe: The European market demonstrates exceptional growth, primarily driven by the region's ambitious decarbonization agendas, extremely stringent vehicle emission regulations, and extensive public and private sector investments in building a comprehensive EV ecosystem. Countries such as Germany, Norway, France, and the UK are at the forefront of EV adoption and technological innovation, creating high demand for advanced, compliant busbar solutions.

- Asia Pacific (APAC): APAC maintains its dominant position in the Medium Power EV Busbar market, largely due to the region being the global epicenter for EV production and sales, with China, Japan, and South Korea leading the charge. Strong governmental support for electric mobility initiatives, well-established and sophisticated automotive manufacturing bases, coupled with rapid urbanization and a large consumer base, collectively contribute to unparalleled demand and market growth.

- Latin America: This region represents an emerging but promising market, characterized by increasing governmental and private sector investments in developing EV technology and associated infrastructure. Countries like Brazil and Mexico are witnessing the initial stages of EV adoption and the emergence of local manufacturing and assembly initiatives, signaling significant long-term growth potential for busbar demand as the electric mobility transition gains momentum.

- Middle East and Africa (MEA): The MEA region is a nascent market for electric vehicles and associated components, with growth primarily driven by government initiatives focused on economic diversification, reducing reliance on fossil fuels, and promoting sustainable development. Investments in smart city projects, renewable energy integration, and public transportation electrification are slowly but steadily creating new opportunities for the Medium Power EV Busbar market, though the adoption rate remains comparatively lower than in more developed regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medium Power Electric Vehicle Busbar Market.- Rogers Corporation

- Mersen S.A.

- Amphenol Corporation

- Siemens AG

- Eaton Corporation plc

- TE Connectivity Ltd.

- Interplex Holdings Pte. Ltd.

- Suzhou Busbar Electric Co., Ltd.

- Methode Electronics Inc.

- Huber + Suhner

- Samvardhana Motherson Group

- U-Shin Ltd.

- Storm Power Components

- Prettl group

- FJZ Electric Power Technology

- Luvata

- SCHOTT AG

- Woco Industrietechnik GmbH

- Hitachi Metals Ltd.

- Furukawa Electric Co. Ltd.

Frequently Asked Questions

What is a busbar in a medium power electric vehicle?

A busbar in a medium power electric vehicle (EV) is a rigid, metallic strip or bar primarily composed of copper or aluminum, specifically engineered to conduct and distribute high electrical currents. Unlike traditional insulated wiring harnesses, busbars provide a more compact, efficient, and reliable method of connecting critical high-voltage components, such as individual battery cells, entire battery modules, power inverters, and sophisticated power distribution units (PDUs). Their design minimizes resistive losses and enhances thermal dissipation, making them indispensable for the optimal functioning and electrical architecture of modern EVs.

Why are busbars crucial for the performance and safety of medium power EVs?

Busbars are absolutely crucial for the performance and safety of medium power EVs due to several key factors. They ensure highly efficient power transfer throughout the vehicle's electrical system, minimizing voltage drop and energy loss, which directly translates to improved vehicle range and charging efficiency. Their robust and precise design allows for effective heat management, dissipating excess heat generated by high current flows, thereby preventing overheating that could degrade component lifespan or, critically, lead to thermal runaway events within the battery. By offering secure and stable connections, busbars enhance overall system reliability, reduce the risk of electrical faults like short circuits, and contribute significantly to the vehicle's overall safety profile under demanding operational conditions.

What are the primary materials used in manufacturing medium power EV busbars?

The primary materials used in manufacturing medium power EV busbars are predominantly high-purity copper and aluminum. Copper is highly favored for its exceptional electrical conductivity, superior thermal conductivity, and inherent mechanical strength, making it ideal for applications requiring maximum current transfer efficiency. Aluminum, on the other hand, is increasingly chosen for its lightweight properties and cost-effectiveness, offering a valuable balance of good conductivity and significant weight reduction, which is critical for improving EV range. These conductive core materials are almost always paired with advanced insulating polymers, such as epoxy resins, polycarbonates, or specialized films, which provide essential electrical isolation, protect against environmental factors, and ensure thermal stability within the busbar assembly.

How will 800V architectures impact the design and demand for EV busbars?

The widespread adoption of 800V architectures in electric vehicles will profoundly impact both the design and demand for EV busbars. From a design perspective, it will necessitate significantly enhanced electrical insulation properties, superior thermal management capabilities to handle increased heat generation, and potentially the use of different, more robust material alloys to safely and efficiently manage higher voltages and currents. This technological shift will drive a surge in demand for highly specialized, high-performance busbars that can reliably meet these more stringent new requirements for isolation, current density, and thermal dissipation, thereby fueling innovation and requiring advanced manufacturing processes across the industry.

What future trends are expected to shape the Medium Power EV Busbar Market?

Several key future trends are expected to significantly shape the Medium Power EV Busbar Market. These include a strong emphasis on the adoption of increasingly lightweight materials and composite solutions to further reduce vehicle weight and extend range. There will be a growing integration of smart sensing capabilities directly into busbar designs, enabling real-time data collection for advanced battery management systems and predictive maintenance. Advancements in sophisticated thermal management solutions, such as integrated cooling channels or phase-change materials, will become crucial. Furthermore, the development of busbars specifically optimized for Vehicle-to-Grid (V2G) applications and highly modular, easily scalable designs will be critical. Lastly, continuous customization for higher voltage systems beyond 800V and the demand for busbars compatible with new battery chemistries will drive ongoing innovation and market growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager