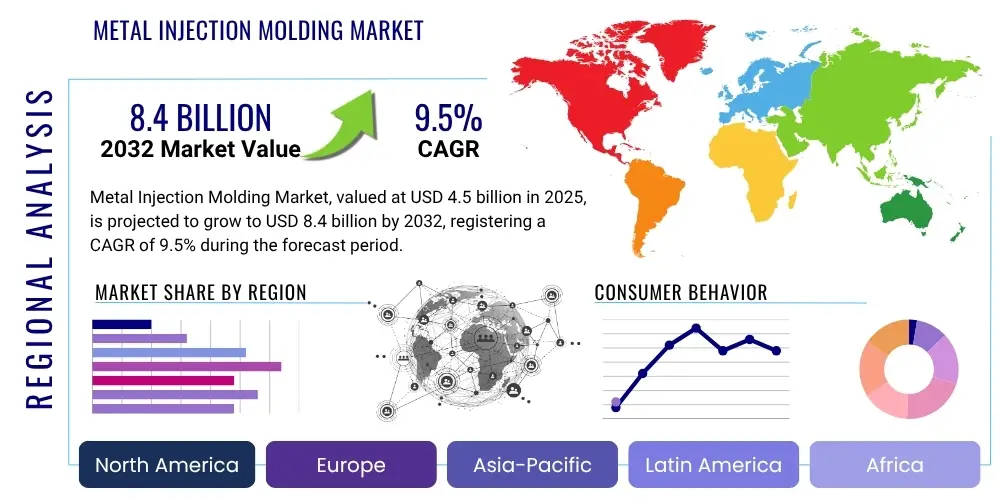

Metal Injection Molding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428981 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Metal Injection Molding Market Size

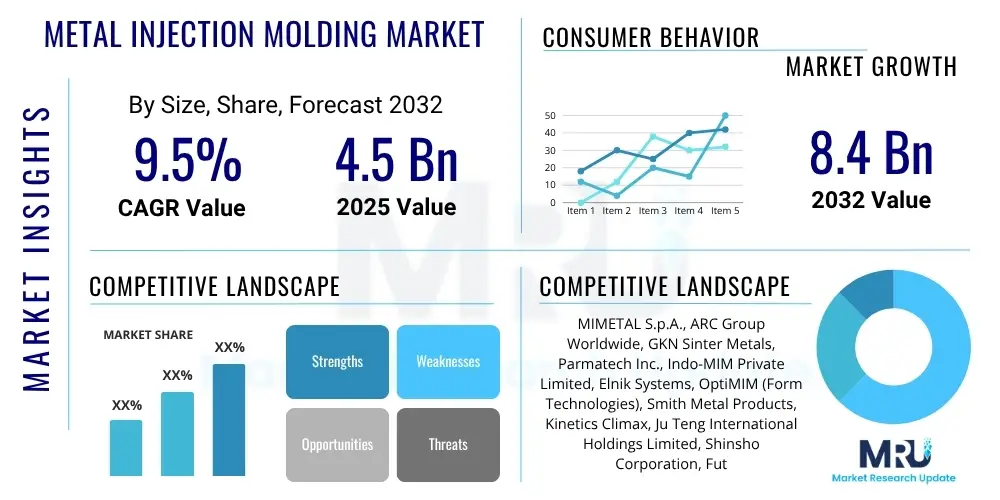

The Metal Injection Molding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 4.5 billion in 2025 and is projected to reach USD 8.4 billion by the end of the forecast period in 2032.

Metal Injection Molding Market introduction

The Metal Injection Molding (MIM) market leverages an advanced manufacturing process, combining the robust material capabilities of powdered metallurgy with the design flexibility inherent in plastic injection molding. This innovative synergy enables the cost-effective mass production of small, complex, and high-precision metal components. These parts often exhibit superior mechanical properties compared to those achieved through traditional machining or investment casting. MIM technology allows for intricate designs, thin walls, and tight tolerances, producing near-net-shape geometries that significantly reduce the need for extensive post-processing and minimize material waste, thereby offering substantial cost advantages for high-volume applications and contributing to overall manufacturing efficiency.

MIM parts are fabricated from diverse metal alloys, including various grades of stainless steels, low alloy steels, and specialized titanium. Major applications span critical sectors: the automotive industry utilizes MIM for lightweight powertrain and safety components; medical and dental fields employ it for precision surgical instruments and orthodontic brackets; and consumer electronics benefit from miniaturized components in devices. The core benefits of MIM include an excellent surface finish, enhanced mechanical strength, and the unique ability to consolidate multiple complex parts into a single, integrated component. This part consolidation drastically reduces assembly costs, streamlines manufacturing processes, and ultimately leads to improved product performance and reliability across numerous applications, solidifying MIM's strategic importance.

Key driving factors propelling market growth include the escalating global demand for miniaturized and lightweight components across sectors like electronics and medical devices, where spatial and weight constraints are paramount. The automotive industry's continuous drive for fuel efficiency, performance enhancements, and complex component integration further fuels MIM adoption. Additionally, the growing application of intricate geometries in diverse industrial contexts, coupled with ongoing advancements in material science and sophisticated processing techniques, continuously broadens the scope of MIM applications. These factors collectively position MIM as a preferred manufacturing solution for manufacturers seeking highly efficient, precise, and high-quality production of complex metal parts, driving its robust market expansion.

Metal Injection Molding Market Executive Summary

The Metal Injection Molding (MIM) market is experiencing dynamic expansion, underpinned by several significant business trends. A prominent trend involves the increasing formation of strategic partnerships and collaborations between MIM manufacturers, material suppliers, and end-use industries. These alliances are crucial for fostering innovation, particularly in developing specialized alloys and advanced processing techniques tailored to specific application demands, thereby enhancing material properties and expanding the range of MIM applications. Furthermore, substantial investments in automation and digital manufacturing solutions, including real-time process monitoring and simulation software, are consistently boosting production efficiency, shortening lead times, and improving overall part quality, positioning MIM as a highly competitive alternative to traditional manufacturing methods.

Regional dynamics within the MIM market highlight Asia Pacific as a dominant force, driven by rapid industrialization, burgeoning electronics manufacturing, and a robust automotive sector in countries like China, Japan, and South Korea. This region benefits from extensive manufacturing capacities and a skilled workforce. North America and Europe also demonstrate sustained growth, fueled by stringent regulatory demands in medical and aerospace industries requiring high-precision components, alongside continuous investments in advanced materials R&D. Emerging markets in Latin America and the Middle East and Africa are gradually increasing MIM adoption as local manufacturing capabilities expand and industrial demand for advanced components rises, indicating future growth potential.

Segment trends reveal that stainless steel maintains the largest market share due to its excellent corrosion resistance and mechanical properties, making it ideal for medical, automotive, and consumer goods. However, demand for soft magnetic materials is rapidly growing, propelled by advancements in electric vehicles and consumer electronics that require high-performance magnetic components. The medical and dental end-use segment is projected to exhibit the highest growth rate, driven by the escalating need for complex, sterile, and biocompatible instruments and devices. The automotive sector continues to show substantial demand as vehicle manufacturers integrate more MIM parts for critical objectives such as weight reduction and performance optimization, sustaining its market relevance.

AI Impact Analysis on Metal Injection Molding Market

Users are keen to understand how artificial intelligence (AI) can significantly enhance the efficiency, precision, and adaptability of Metal Injection Molding (MIM). Key user concerns and expectations revolve around leveraging AI for implementing advanced predictive maintenance, optimizing complex process parameters to drastically reduce defects, and accelerating the discovery of novel materials and efficient design iterations for intricate MIM components. While acknowledging potential initial investment costs and the critical need for a skilled workforce to manage AI-driven systems, there is a strong collective expectation that AI will deliver transformative improvements in yield consistency, minimize material waste, and unlock capabilities for even more complex component designs, ultimately making MIM more competitive and responsive to evolving industrial demands.

- AI-driven predictive analytics optimize machine maintenance, minimizing downtime and increasing operational uptime.

- Machine learning algorithms precisely fine-tune complex process parameters, ensuring consistent part quality and reducing scrap rates.

- AI accelerates new material development by simulating properties and performance, identifying optimal compositions.

- Generative design tools, powered by AI, create highly optimized and complex part geometries suitable for MIM, enhancing functional performance.

- Automated quality inspection systems using AI vision identify subtle defects rapidly and accurately, improving product reliability.

- Real-time process monitoring with AI provides immediate feedback and adaptive adjustments, boosting manufacturing efficiency.

- AI-enabled supply chain optimization enhances inventory management and logistics for MIM raw materials and finished components.

- AI assists in optimizing mold design and gating systems through simulation, reducing tooling costs and improving fill rates.

- Machine learning can predict final sintered part properties based on green part characteristics and processing conditions, ensuring adherence to specifications.

DRO & Impact Forces Of Metal Injection Molding Market

The Metal Injection Molding (MIM) market is primarily driven by the escalating global demand for miniaturized, high-precision, and complex metal components across various industries. The continuous advancements in consumer electronics, medical devices, and automotive sectors necessitate parts that offer superior mechanical properties, excellent surface finish, and intricate geometries, which MIM technology is uniquely positioned to deliver. Furthermore, the inherent cost-effectiveness of MIM for high-volume production, largely due to reduced material waste and minimal post-processing requirements, makes it an increasingly attractive manufacturing solution when compared to traditional methods like machining or investment casting. These economic advantages are crucial in competitive global markets, pushing manufacturers to adopt MIM for greater efficiency and competitive edge.

However, the market faces significant restraints, including the relatively high initial tooling costs associated with MIM, which can be prohibitive for small batch productions or rapid prototyping projects where volumes do not justify the upfront investment. The inherent limitations on part size and weight also restrict MIM's application scope to smaller components, preventing its widespread adoption for larger industrial parts. Additionally, specific material compatibility challenges and the complexity of precise process control, demanding highly skilled operators and meticulous atmospheric conditions, can pose technical hurdles. These factors collectively impact the market's growth trajectory and necessitate continuous innovation in process refinement and material development to overcome existing limitations.

Opportunities for growth are abundant within the MIM market. Expansion into emerging, high-growth industries such as aerospace and defense, where lightweight and high-strength components are paramount, presents a substantial avenue for market penetration. The ongoing development of novel metal alloys and advanced ceramic-metal composites specifically tailored for MIM processes is continuously opening new application frontiers, offering enhanced performance characteristics. Furthermore, profound advancements in manufacturing automation, digital twin technology, and the integration of artificial intelligence are poised to revolutionize MIM operations, promising improvements in efficiency, reductions in defects, and broader design capabilities. The global drive towards sustainable manufacturing practices also positions MIM favorably due to its reduced material waste, aligning with environmental objectives.

Segmentation Analysis

The Metal Injection Molding market is comprehensively segmented based on fundamental material types, which dictate the final properties and functional performance of the components, allowing for diverse applications tailored to specific industry requirements. This segmentation highlights MIM's versatility in handling various metallic compositions. Further segmentation by end-use industry showcases the broad adoption of MIM components across critical sectors that consistently demand high-precision, complex parts for enhanced product performance and miniaturization. These segmentation strategies are crucial for understanding intricate market dynamics, identifying specific growth pockets, and developing highly targeted marketing and product development initiatives that align with evolving technological and industrial needs, ensuring focused market engagement.

- By Material Type: This segment analyzes the market based on the type of metal powder used in the MIM process.

- Stainless Steel: Widely utilized for its excellent corrosion resistance and strength, found in medical, automotive, and consumer goods.

- Low Alloy Steel: Valued for high strength and hardness, typically employed in firearms and demanding industrial applications.

- Soft Magnetic Materials: Essential for electronic components, sensors, and electric vehicle parts requiring specific magnetic properties.

- Titanium: Predominantly used in medical implants, aerospace, and high-performance applications due to its superior strength-to-weight ratio and biocompatibility.

- Ceramics: A growing niche segment for applications demanding extreme hardness, wear resistance, and high-temperature stability.

- Others: Includes specialized alloys such as tungsten, copper alloys, and precious metals for unique, high-value applications.

- By End-Use Industry: This segment categorizes the market based on the final application sectors where MIM components are integrated.

- Automotive: For engine components, transmission parts, sensor housings, and safety features requiring precision and durability.

- Medical and Dental: Critical for surgical instruments, orthodontic appliances, implantable devices, and drug delivery systems due to precision and biocompatibility.

- Consumer Products: Utilized in electronics, watches, and sporting goods for miniaturization, aesthetic appeal, and complex functional parts.

- Industrial: Applications in machinery, tooling, fluid power, and automation requiring wear-resistant and high-strength components.

- Aerospace and Defense: For lightweight, high-performance components in aircraft engines, missile systems, and armaments.

- Electronics: Integral for connectors, heat sinks, micro-gears, and housings in smartphones, tablets, and other electronic devices.

- Others: Encompasses firearms, energy sector components, and general hardware, showcasing the broad applicability of MIM technology.

Value Chain Analysis For Metal Injection Molding Market

The Metal Injection Molding (MIM) market's value chain commences with critical upstream activities, primarily focusing on raw material procurement and the meticulous preparation of specialized feedstock. This initial stage involves sourcing ultra-fine, high-quality metal powders, typically ranging from 0.5 to 20 micrometers, which are then precisely mixed with a carefully selected polymer binder system. This binder imparts thermoplastic properties, enabling the metal powder to be injection molded. Key players at this stage include specialized powder manufacturers and compounders who rigorously control particle size, morphology, and binder composition to ensure optimal flowability during injection molding and ultimately, the integrity and performance of the final MIM part. The consistency and quality of this feedstock are paramount, directly influencing the final component's structural integrity, dimensional accuracy, and mechanical properties.

Midstream activities encompass the core MIM manufacturing processes: injection molding, debinding, and sintering. This segment begins with injecting the prepared feedstock into a mold to form a "green part." This is followed by a crucial "debinding" process, which meticulously removes the polymeric binder through thermal, solvent, or catalytic methods, leaving a porous "brown part." The final and most critical step is high-temperature "sintering," where the brown part is heated to near its melting point in a controlled atmosphere, causing metal particles to fuse and densify, achieving the desired mechanical strength and dimensional stability. Distribution channels then move these finished MIM components to end-user industries. Direct channels often involve sales from the MIM manufacturer to large OEMs, facilitating customized solutions and technical support. Indirect channels utilize distributors or third-party logistics to reach a broader range of smaller clients or specialized regional markets, ensuring wider market penetration.

Downstream activities focus on the integration of MIM components into final products across diverse end-use industries, including automotive, medical, electronics, and aerospace. This stage also includes any necessary post-processing, such as precision surface finishing, specialized heat treatment to enhance mechanical properties, or complex assembly operations. These steps can be performed either by the MIM manufacturer, offering a complete turnkey solution, or directly by the end-user. Close collaboration between MIM manufacturers and their end-user customers is essential at this stage. This partnership ensures that the delivered components rigorously meet precise application requirements, adhere to stringent performance specifications, and ultimately contribute significantly to product innovation and sustained market demand, creating a feedback loop for continuous improvement and next-generation solutions.

Metal Injection Molding Market Potential Customers

The primary potential customers for Metal Injection Molding (MIM) products are end-users and Original Equipment Manufacturers (OEMs) across numerous industrial sectors that share a common demand for high volumes of small, exceptionally complex, and precision metal components. These discerning customers actively seek advanced manufacturing solutions capable of consistently delivering cost-effectiveness for mass production, superior material properties, and the crucial ability to produce intricate geometries that would be either prohibitively expensive or technically unfeasible with conventional manufacturing methods. Their buying decisions are significantly influenced by factors such as the total cost of ownership, the consistent reliability and performance of MIM parts, the robustness of the supply chain, and, crucially, the demonstrated capability of MIM suppliers to consistently meet stringent quality standards and tight dimensional tolerance requirements, often dictated by regulatory bodies or high-performance application needs.

Key end-user segments include the automotive industry, which utilizes MIM for critical applications such as precise sensor housings, intricate gears, and various small functional parts essential for improving fuel efficiency, reducing emissions, and enhancing overall vehicle performance and safety. The medical and dental sectors represent another immensely important customer base, characterized by a persistent demand for MIM parts suitable for surgical instruments, orthodontic brackets, and a growing array of implantable devices, where MIM's ability to deliver both biocompatibility and meticulous precision is paramount. Manufacturers in the highly competitive consumer electronics industry extensively leverage MIM for miniature camera modules, robust hinges for foldable devices, and other intricate internal components fundamental to enabling compact, lightweight, and high-performance electronic gadgets. Furthermore, manufacturers of industrial machinery, specialized aerospace and defense equipment, and high-performance firearms also constitute substantial customer bases, consistently relying on MIM for specialized components that demand exceptional strength, unparalleled durability, and rigorous adherence to performance specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 billion |

| Market Forecast in 2032 | USD 8.4 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MIMETAL S.p.A., ARC Group Worldwide, GKN Sinter Metals, Parmatech Inc., Indo-MIM Private Limited, Elnik Systems, OptiMIM (Form Technologies), Smith Metal Products, Kinetics Climax, Ju Teng International Holdings Limited, Shinsho Corporation, Future High-Tech Co., Ltd., Netshape Technologies, CMG Technologies, Dongmu Precision Manufacturing, FineMIM Precision, Kyocera Corporation, Allegheny Technologies Incorporated, Hitachi Metals Ltd., Schunk Sintermetalltechnik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Injection Molding Market Key Technology Landscape

The Metal Injection Molding (MIM) market is profoundly shaped by a continuously evolving and sophisticated technological landscape encompassing significant advancements in materials science, state-of-the-art process equipment, and highly intelligent software solutions. At the foundational core are the highly specialized injection molding machines, meticulously engineered with robust construction and precision control systems to expertly handle the unique rheological characteristics of metal feedstock – typically its high viscosity and abrasive nature. These machines ensure consistent and defect-free filling of extraordinarily intricate mold cavities, which is paramount for producing high-quality green parts. Substantial technological progress has also been achieved in the formulation of innovative binder systems, with ongoing R&D focused on creating binders that exhibit enhanced rheological properties, facilitate faster and more efficient debinding processes, and possess reduced environmental footprints, driving sustainable production cycles.

The debinding and subsequent sintering stages represent another critically important technological frontier within the MIM process. Advanced debinding furnaces utilize sophisticated methods—including controlled thermal degradation, precise solvent extraction, and highly efficient catalytic processes—each meticulously optimized for specific binder systems to ensure complete and gentle removal of organic components from the green part. Following debinding, state-of-the-art sintering furnaces, operating at exceptionally high temperatures and within meticulously controlled inert or reducing atmospheres, are utilized to facilitate the metallurgical bonding of metal particles. Innovations here include vacuum sintering for high-purity materials, hot isostatic pressing (HIP) to reduce porosity, and advanced rapid thermal processing techniques, all elevating part quality, enhancing density, and expanding the range of high-performance alloys that can be successfully processed, broadening MIM's application scope.

Beyond core machinery, the modern MIM technological landscape integrates highly sophisticated simulation software and advanced real-time process monitoring systems. Tools leveraging Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) are increasingly employed to accurately simulate the entire molding process, predict potential defects, and optimize complex mold designs before physical tooling is manufactured. This predictive capability dramatically reduces costly design iterations and accelerates time-to-market. Furthermore, in-situ monitoring technologies, synergistically coupled with artificial intelligence (AI) and machine learning (ML) algorithms, are revolutionizing MIM operations. These systems provide immediate, actionable feedback on critical process parameters, enabling advanced capabilities such as predictive maintenance, automated quality control, and adaptive process adjustments in real time, ultimately solidifying MIM's position as a leading-edge and highly competitive advanced manufacturing technique.

Regional Highlights

- North America: A mature and innovation-driven market, primarily fueled by strong demand from the medical, aerospace, and defense sectors. High adoption of advanced manufacturing technologies and substantial R&D investments drive continuous innovation, with the United States leading in high-value, specialized component production.

- Europe: Exhibits robust growth, especially in Germany, France, and the UK, propelled by automotive, industrial, and medical device industries. Stringent quality standards, a strong emphasis on precision engineering, and investments in automation and sustainable practices contribute to market expansion.

- Asia Pacific (APAC): Dominates the global MIM market due to rapid industrialization, a colossal manufacturing base, and increasing demand from the automotive, electronics, and consumer goods sectors, particularly in China, Japan, and India. Cost-effective production capabilities and rising disposable incomes further fuel growth.

- Latin America: An emerging MIM market with increasing industrialization and automotive production in Brazil and Mexico. Presents significant opportunities for market penetration as local manufacturing capabilities expand and demand for advanced components grows, supported by regional economic development.

- Middle East and Africa (MEA): Shows gradual MIM adoption, driven by investments in industrial infrastructure and the automotive sector in countries like South Africa and the UAE. Its long-term growth potential is linked to economic diversification and advancements in local manufacturing ecosystems, fostering demand for high-tech components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Injection Molding Market.- MIMETAL S.p.A.

- ARC Group Worldwide

- GKN Sinter Metals

- Parmatech Inc.

- Indo-MIM Private Limited

- Elnik Systems

- OptiMIM (Form Technologies)

- Smith Metal Products

- Kinetics Climax

- Ju Teng International Holdings Limited

- Shinsho Corporation

- Future High-Tech Co., Ltd.

- Netshape Technologies

- CMG Technologies

- Dongmu Precision Manufacturing

- FineMIM Precision

- Kyocera Corporation

- Allegheny Technologies Incorporated

- Hitachi Metals Ltd.

- Schunk Sintermetalltechnik GmbH

Frequently Asked Questions

What is Metal Injection Molding (MIM) and how does it fundamentally differ from traditional powder metallurgy?

Metal Injection Molding (MIM) is an advanced manufacturing process that combines fine metal powders with a thermoplastic binder to create a moldable feedstock. This feedstock is then injection molded into a "green part," leveraging principles from plastic injection molding. The core difference from traditional powder metallurgy (which uses direct compaction of coarser powders) lies in MIM's ability to achieve significantly greater geometric complexity, finer details, and higher final densities after the binder is removed (debinding) and the part is sintered at high temperatures. MIM delivers near-net-shape components with intricate features that would be challenging or costly to achieve through other powder-based methods, making it ideal for precision engineering applications.

Which industries are the primary beneficiaries of Metal Injection Molding components?

Metal Injection Molding components find extensive application across several key industries. The automotive sector utilizes MIM for precision gears, sensor housings, and various lightweight powertrain and safety components. In the medical and dental fields, MIM produces intricate surgical instruments, orthodontic brackets, and implantable devices that demand both biocompatibility and meticulous precision. The consumer electronics industry leverages MIM for miniaturized camera modules, robust hinges, and complex internal components for smartphones and wearables. Furthermore, MIM serves industrial applications such as fluid power systems and tooling, and is crucial for specialized components in aerospace and defense, all benefiting from its capacity for complexity, strength, and high-volume production.

What are the most significant advantages of employing MIM technology compared to conventional metal forming methods?

The most significant advantages of employing MIM technology include its unparalleled ability to produce highly complex and intricate geometries, often consolidating multiple parts into one, which is difficult or impossible with traditional methods like machining or stamping. MIM also achieves excellent surface finishes, often reducing or eliminating the need for post-processing. It delivers superior mechanical properties and high part densities comparable t

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Metal Injection Molding Parts (MIM Parts) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Metal Injection Molding Parts (MIM Parts) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Metal Injection Molding Parts (MIM Parts) Market Size Report By Type (Stainless Steel, Steel, Alloy Steel, Other Metal), By Application (Medical, Industrial, Automotive, Electronics, Firearms, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Metal Injection Molding Metal Powder Market Statistics 2025 Analysis By Application (Aviation, Automotive, Electronic, Medical, Other), By Type (Cobalt-chrome, Stainless Steel, Titanium Alloys, Tungsten Carbides, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metal Injection Molding Binder Market Statistics 2025 Analysis By Application (Aviation, Automotive, Electronic, Medical, Other), By Type (Polyethylene Base Type, Synthetic or Natural Wax Type, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager