Metal & Mining Wastewater Recovery Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428690 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Metal & Mining Wastewater Recovery Systems Market Size

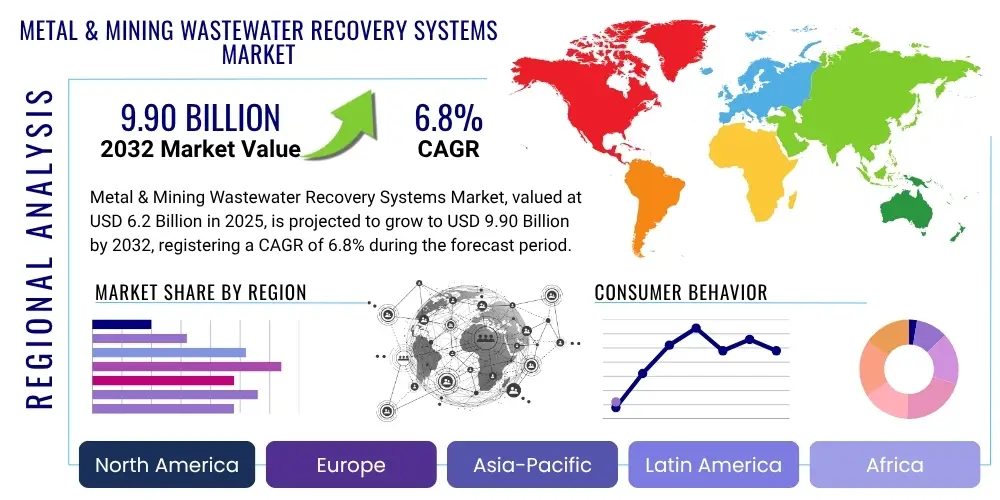

The Metal & Mining Wastewater Recovery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $6.2 Billion in 2025 and is projected to reach $9.90 Billion by the end of the forecast period in 2032.

Metal & Mining Wastewater Recovery Systems Market introduction

The Metal & Mining Wastewater Recovery Systems market is vital for sustainable operations within the global metal and mining industries. These systems encompass a comprehensive suite of technologies and processes designed to treat, purify, and enable the reuse of wastewater generated during various stages of metal extraction, mineral processing, and refining. The primary objective is to minimize fresh water consumption, reduce the volume and toxicity of discharged effluents, and recover valuable resources that might otherwise be lost. These recovery systems are instrumental in mitigating the environmental impact of mining activities, which are often water-intensive and can produce complex waste streams containing heavy metals, suspended solids, and other contaminants.

Product descriptions for these systems typically include advanced filtration units such as membrane bioreactors (MBRs), reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF) systems, as well as chemical precipitation, ion exchange, and evaporation/crystallization technologies. They are engineered to handle diverse wastewater characteristics, from acidic mine drainage to process water laden with dissolved minerals. Major applications span the entire mining lifecycle, including mine dewatering, mineral concentration plants (e.g., copper, gold, iron ore), tailings ponds management, and metallurgical processing facilities for both ferrous and non-ferrous metals. The implementation of these systems provides substantial benefits, including enhanced regulatory compliance with increasingly stringent environmental standards, significant reductions in operational costs through water reuse, conservation of finite freshwater resources, and a positive contribution to corporate social responsibility (CSR) initiatives.

The market is predominantly driven by several critical factors. Foremost among these are the global increase in water scarcity, which compels industries to seek alternative water sources, and the escalating pressure from environmental protection agencies for industries to adopt Zero Liquid Discharge (ZLD) or near-ZLD solutions. Furthermore, advancements in water treatment technologies, coupled with the rising economic viability of resource recovery from wastewater, such as critical minerals or process chemicals, are significant accelerators. The inherent need for operational efficiency and the drive to reduce long-term liabilities associated with environmental pollution also play a pivotal role in driving the adoption of these sophisticated wastewater recovery systems.

Metal & Mining Wastewater Recovery Systems Market Executive Summary

The Metal & Mining Wastewater Recovery Systems market is experiencing robust growth driven by a confluence of environmental imperatives, regulatory pressures, and economic opportunities. Business trends indicate a strong shift towards integrated, smart, and automated systems that offer higher recovery rates and lower operational expenditures. Companies are increasingly investing in modular and scalable solutions that can adapt to varying wastewater compositions and volumes, reflecting a broader industry move towards agility and efficiency. Furthermore, there is a pronounced emphasis on circular economy principles, where wastewater is not merely treated but viewed as a valuable source for water reuse and resource reclamation, impacting business models to focus on sustainable practices and long-term value creation. Strategic partnerships between technology providers and mining operators are also becoming more common, facilitating tailored solutions and accelerating market penetration for advanced technologies.

Regional trends reveal significant market expansion in Asia Pacific, particularly in countries like China, India, and Australia, owing to their vast mining operations, rapid industrialization, and evolving environmental regulations. Latin America, with its rich mineral resources and substantial mining investments, also presents a high-growth trajectory. North America and Europe, while more mature markets, are characterized by stringent environmental enforcement and a strong drive for technological innovation and adoption of advanced ZLD systems, pushing demand for sophisticated solutions. The Middle East and Africa regions are emerging markets, with new mining projects and increasing awareness of water conservation driving initial adoption, albeit with challenges related to infrastructure and investment capacity. These regional dynamics are shaping competitive landscapes and investment priorities, leading to localized product development and service offerings.

In terms of segment trends, the market is witnessing strong growth in advanced membrane technologies suchologies such as reverse osmosis and ultrafiltration due to their high efficiency in removing dissolved solids and contaminants, making water suitable for various industrial reuses. Evaporation and crystallization technologies are also gaining traction, especially for achieving Zero Liquid Discharge (ZLD) in challenging wastewater streams. The application segment sees significant demand from mineral processing, where water is extensively used, and from mine dewatering activities, crucial for safe and efficient operations. The market for specific metal types, such as copper and gold mining, continues to be a major driver due to the sheer volume of water consumed and wastewater generated. Overall, the market is trending towards comprehensive, multi-stage treatment solutions that combine different technologies to achieve optimal water quality for varied reuse applications, thereby maximizing water recovery and minimizing environmental impact.

AI Impact Analysis on Metal & Mining Wastewater Recovery Systems Market

Common user questions regarding AI's impact on Metal & Mining Wastewater Recovery Systems frequently revolve around how artificial intelligence can enhance efficiency, reduce operational costs, and improve the reliability of these complex systems. Users are keen to understand the practical applications of AI in real-time monitoring, predictive maintenance, and optimization of treatment processes, alongside concerns about the initial investment, data security, and the need for specialized skills for implementation and management. There is significant interest in AI's ability to address variability in wastewater composition and flow rates, providing more adaptive and robust treatment outcomes. Expectations are high for AI to deliver greater precision, automate routine tasks, and facilitate better decision-making, ultimately contributing to more sustainable and economically viable mining operations.

- Enhanced real-time monitoring and data analytics for process optimization.

- Predictive maintenance of equipment, reducing downtime and operational costs.

- Automated chemical dosing and system adjustments based on wastewater characteristics.

- Improved anomaly detection in water quality and system performance.

- Optimization of energy consumption in treatment processes through smart controls.

- Development of self-learning systems that adapt to changing conditions.

- Better resource recovery (e.g., metals, chemicals) through precise control.

- Advanced forecasting of water demand and supply within mining sites.

- Integration with IoT for comprehensive plant management and remote operation.

- Decision support systems for compliance and environmental risk management.

DRO & Impact Forces Of Metal & Mining Wastewater Recovery Systems Market

The Metal & Mining Wastewater Recovery Systems market is shaped by a powerful combination of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the escalating global freshwater scarcity, which necessitates efficient water reuse; increasingly stringent environmental regulations imposing stricter limits on industrial wastewater discharge; and the economic benefits derived from reduced operational costs, lower water acquisition expenses, and potential resource recovery from waste streams. Furthermore, growing public and corporate emphasis on environmental sustainability and corporate social responsibility (CSR) initiatives significantly propel the adoption of these systems. Technological advancements, leading to more efficient and cost-effective treatment solutions, also serve as a crucial market accelerator, fostering innovation and broadening application scope.

Conversely, several restraints impede market growth. The high initial capital investment required for implementing sophisticated wastewater recovery systems can be a significant barrier, particularly for smaller mining operations or those in developing economies with limited access to financing. The complex and highly variable composition of mining wastewater, often containing a mixture of heavy metals, suspended solids, dissolved salts, and other recalcitrant contaminants, poses considerable technical challenges for effective treatment and consistent water quality. Additionally, the lack of skilled personnel capable of operating and maintaining advanced wastewater treatment technologies can hinder widespread adoption, particularly in remote mining locations. The operational intensity and potential for membrane fouling or equipment corrosion also add to the complexity and cost of maintenance.

Despite these challenges, substantial opportunities exist for market expansion. The growing trend towards Zero Liquid Discharge (ZLD) systems presents a lucrative avenue, especially in regions facing severe water stress or strict environmental policies. The development and deployment of modular and decentralized treatment solutions can cater to diverse site requirements and enable more flexible scaling of operations. Emerging economies with burgeoning mining sectors, such as those in Southeast Asia, Africa, and parts of Latin America, represent untapped markets with high growth potential. Moreover, the integration of advanced digitalization, IoT, and AI into wastewater management systems offers opportunities for improved efficiency, predictive maintenance, and enhanced resource recovery. The focus on recovering valuable by-products from wastewater, beyond just clean water, further enhances the economic attractiveness and sustainability profile of these systems, opening new revenue streams for operators.

Segmentation Analysis

The Metal & Mining Wastewater Recovery Systems market is meticulously segmented to provide a detailed understanding of its diverse components and dynamics. This comprehensive segmentation allows for a precise analysis of market trends, technological preferences, and application-specific demands, offering valuable insights for stakeholders. The market is typically segmented by technology, application, type of metal or mineral, and end-use industry, each playing a crucial role in shaping the overall market landscape. Understanding these segments is fundamental for strategic planning, product development, and market entry strategies, as different segments exhibit unique growth patterns and competitive intensities, influenced by regulatory frameworks and regional mining activities.

- By Technology

- Membrane Filtration (Reverse Osmosis, Ultrafiltration, Nanofiltration, Microfiltration, Membrane Bioreactors)

- Evaporation and Crystallization (Mechanical Vapor Recompression, Thermal Evaporation)

- Chemical Precipitation and Coagulation/Flocculation

- Biological Treatment (Aerobic, Anaerobic)

- Ion Exchange

- Adsorption

- Electrochemical Treatment (Electrocoagulation, Electrooxidation)

- Advanced Oxidation Processes (AOPs)

- Other Treatment Technologies

- By Application

- Mineral Processing Wastewater Treatment

- Mine Dewatering

- Tailings Management

- Smelting & Refining Operations

- Mine Site Runoff and Stormwater Management

- Acid Mine Drainage (AMD) Treatment

- Other Industrial Mining Applications

- By Type of Metal/Mineral

- Copper Mining

- Gold Mining

- Iron Ore Mining

- Bauxite and Alumina Refining

- Nickel Mining

- Uranium Mining

- Coal Mining

- Other Metal & Mineral Mining (e.g., Zinc, Lead, Platinum, Silver)

- By End-Use Industry

- Ferrous Metals Mining & Processing

- Non-Ferrous Metals Mining & Processing

- Precious Metals Mining & Processing

- Industrial Minerals Mining & Processing

- Energy Minerals Mining (e.g., Coal, Uranium)

Value Chain Analysis For Metal & Mining Wastewater Recovery Systems Market

The value chain for the Metal & Mining Wastewater Recovery Systems market is intricate, involving various stakeholders from upstream raw material providers to downstream end-users and support services. Upstream activities primarily involve the sourcing and manufacturing of critical components such as membranes, pumps, filters, chemical reagents, and control systems. This segment includes specialized chemical companies providing coagulants, flocculants, and pH adjusters, as well as equipment manufacturers producing advanced filtration units, evaporators, and biological reactors. Research and development institutions also play an upstream role in innovating new materials and processes that enhance treatment efficiency and reduce costs. The quality and availability of these components directly influence the performance and cost-effectiveness of the overall recovery systems, driving innovation in materials science and engineering.

Midstream activities in the value chain involve the integration and assembly of these components into complete wastewater recovery systems. This includes engineering, procurement, and construction (EPC) firms that design, build, and install bespoke solutions for mining and metal processing clients. System integrators and technology providers are crucial in combining various treatment units, instrumentation, and automation software to create a functional and optimized recovery plant. These entities often provide consulting services, feasibility studies, and pilot projects to ensure the system is tailored to the specific needs and wastewater characteristics of a mining operation, bridging the gap between component manufacturing and final installation.

Downstream analysis focuses on the distribution channels, end-users, and post-installation support services. Distribution can be direct, where technology providers sell and install systems directly to large mining corporations, often through long-term contracts. Indirect channels involve partnerships with local distributors, agents, or engineering consulting firms that have regional market access and expertise. The primary end-users are large-scale mining companies, metallurgical plants, and other facilities involved in metal extraction and processing, ranging from open-pit mines to underground operations and beneficiation plants. Post-sales services, including operation and maintenance (O&M) contracts, spare parts supply, technical support, and performance monitoring, are critical for ensuring the long-term efficiency and reliability of these systems, creating ongoing revenue streams and fostering strong client relationships. This comprehensive value chain ensures that complex wastewater challenges in the metal and mining sectors are addressed effectively.

Metal & Mining Wastewater Recovery Systems Market Potential Customers

The primary potential customers for Metal & Mining Wastewater Recovery Systems are diverse entities within the global mining and metallurgical industries, each facing unique challenges related to water management and environmental compliance. These include major multinational mining corporations operating large-scale, multi-site operations across various geographies, which require sophisticated and robust solutions for vast volumes of complex wastewater. Such corporations often prioritize systems that offer high water recovery rates, resource reclamation capabilities, and significant cost savings, alongside adherence to stringent global environmental standards. Their purchasing decisions are influenced by long-term sustainability goals, operational efficiency, and the need to mitigate environmental risks associated with their large footprint.

Mid-tier and smaller independent mining companies also represent a significant customer segment. While they might operate on a smaller scale, their need for efficient wastewater treatment remains critical, especially given increasingly localized environmental regulations and community pressures. These companies often seek modular, cost-effective, and easy-to-operate solutions that can be adapted to specific site conditions and project lifecycles. Contract miners, who operate on behalf of other companies, are also potential buyers or influencers, as they are responsible for operational efficiency and often look for integrated solutions that enhance their service offerings and compliance capabilities. The end-users or buyers of these systems are ultimately responsible for the environmental performance and operational economics of their facilities, making them direct stakeholders in the adoption and successful implementation of wastewater recovery technologies.

Beyond traditional mining operations, potential customers extend to metallurgical processing plants, smelters, and refineries that handle the subsequent stages of metal extraction and purification, generating their own distinct wastewater streams. These facilities require specialized treatment systems to manage high concentrations of dissolved metals, salts, and chemical reagents used in their processes. Furthermore, government agencies and public utilities involved in regulating mining impacts or managing regional water resources may indirectly act as influencers or enablers for the adoption of these systems through policies, funding, or infrastructure projects. The increasing global focus on circular economy principles and resource recovery broadens the customer base to any entity that stands to benefit from reusing water or reclaiming valuable materials from their industrial wastewater, solidifying the market for Metal & Mining Wastewater Recovery Systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $6.2 Billion |

| Market Forecast in 2032 | $9.90 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies, Veolia Water Technologies, Suez, Xylem Inc., Fluence Corporation Limited, Pentair plc, Aquatech International LLC, GE Water & Process Technologies (now SUEZ), Degremont (Suez), Gradiant Corporation, Hach Company, Kurita Water Industries Ltd., Ovivo, SLUDGEHAMMER, Met-Chem, Water Standard, Koch Separation Solutions, Lenntech BV, WSP Global Inc., Barrick Gold Corporation (for internal systems) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal & Mining Wastewater Recovery Systems Market Key Technology Landscape

The Metal & Mining Wastewater Recovery Systems market is characterized by a dynamic and evolving technology landscape, continuously driven by the need for higher efficiency, lower operating costs, and stricter regulatory compliance. Membrane-based separation technologies are foundational, including Reverse Osmosis (RO), Ultrafiltration (UF), Nanofiltration (NF), and Microfiltration (MF). RO systems are widely used for desalination and removing dissolved salts, while UF and NF effectively remove suspended solids, colloids, and organic macromolecules, preparing water for further treatment or reuse. Membrane Bioreactors (MBRs) combine biological treatment with membrane filtration, offering enhanced effluent quality and reduced footprint compared to conventional activated sludge processes.

Thermal separation technologies, particularly Evaporation and Crystallization, are crucial for achieving Zero Liquid Discharge (ZLD) in highly contaminated wastewater streams. These systems, including Mechanical Vapor Recompression (MVR) and multi-effect evaporators, concentrate pollutants into a solid residue, allowing for the recovery of high-quality water. Chemical treatment processes such as chemical precipitation, coagulation, and flocculation remain essential for removing heavy metals and suspended solids by converting soluble contaminants into insoluble forms that can be settled or filtered. Advanced Oxidation Processes (AOPs), which involve the generation of highly reactive hydroxyl radicals, are gaining traction for degrading refractory organic pollutants and enhancing biodegradability in complex wastewater.

Other significant technologies include Ion Exchange for selective removal of specific ions like heavy metals or nitrates, and Adsorption using activated carbon or specialized resins for removing organic compounds and certain inorganic pollutants. Electrochemical treatment methods, such as electrocoagulation and electrooxidation, offer alternatives for treating difficult waste streams by using electrical current to destabilize pollutants and facilitate their removal. The trend is towards integrated, multi-barrier treatment trains that combine several of these technologies to achieve comprehensive wastewater purification, tailored to the specific characteristics of mining effluents, and enabling the recovery of both water and valuable resources. Furthermore, real-time monitoring, automation, and predictive analytics are increasingly being integrated to optimize system performance and reduce operational complexities.

Regional Highlights

- North America: This region exhibits a mature market characterized by stringent environmental regulations, particularly concerning mine effluent discharge and water quality. There is a strong emphasis on adopting advanced treatment technologies, including ZLD solutions, driven by corporate sustainability initiatives and high operational standards. Key countries like the United States and Canada, with significant mining operations across various minerals, are leaders in technological innovation and investment in high-efficiency wastewater recovery systems. The scarcity of water in certain mining regions, such as the southwestern U.S., further accelerates the adoption of water reuse technologies.

- Europe: Europe is defined by its robust environmental policies and a proactive approach to water resource management and circular economy principles. Countries such as Germany, Sweden, and Finland, known for their advanced industrial practices and mining activities, are significant markets. The focus here is on sustainable mining, minimizing environmental footprint, and technological leadership in areas like membrane filtration and advanced oxidation processes. Research and development in efficient and ecological treatment solutions are highly emphasized.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market due to extensive mining operations, rapid industrialization, and burgeoning populations. Countries like China, Australia, India, and Indonesia possess vast mineral reserves and significant metal processing industries. While regulatory enforcement varies, there is a clear trend towards stricter environmental norms, particularly in response to pollution challenges and water stress. This drives substantial investment in new and upgraded wastewater recovery infrastructure, with a strong demand for cost-effective and scalable solutions.

- Latin America: This region is a major global hub for mining, particularly for copper, gold, and iron ore, making it a critical market for wastewater recovery systems. Countries such as Chile, Peru, Brazil, and Mexico have substantial mining investments and face increasing pressure to manage water resources sustainably, especially in arid regions. Growing environmental awareness and evolving regulatory landscapes are driving the adoption of modern treatment technologies, often influenced by international mining corporations operating in the area.

- Middle East and Africa (MEA): The MEA region is an emerging market with significant potential, primarily driven by new mining projects and the extreme water scarcity prevalent in many parts of the Middle East and North Africa. Countries like Saudi Arabia, South Africa, and parts of West Africa are investing in mining expansion. The demand for wastewater recovery is spurred by the necessity to conserve fresh water and comply with developing environmental regulations, often influenced by international standards for large-scale projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal & Mining Wastewater Recovery Systems Market.- Evoqua Water Technologies

- Veolia Water Technologies

- Suez

- Xylem Inc.

- Fluence Corporation Limited

- Pentair plc

- Aquatech International LLC

- GE Water & Process Technologies (now SUEZ)

- Degremont (Suez)

- Gradiant Corporation

- Hach Company

- Kurita Water Industries Ltd.

- Ovivo

- SLUDGEHAMMER

- Met-Chem

- Water Standard

- Koch Separation Solutions

- Lenntech BV

- WSP Global Inc.

- Barrick Gold Corporation (for internal systems development and implementation)

Frequently Asked Questions

Analyze common user questions about the Metal & Mining Wastewater Recovery Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Metal & Mining Wastewater Recovery Systems?

Metal & Mining Wastewater Recovery Systems are technologies and processes designed to treat and recycle water used in mining and metal processing, reducing fresh water consumption and minimizing environmental discharge of contaminants.

Why is wastewater recovery important in the mining industry?

It is crucial for environmental compliance, conserving freshwater resources, reducing operational costs, and mitigating the ecological impact of mining activities, especially in water-scarce regions.

What key technologies are used for wastewater recovery in metal and mining?

Key technologies include membrane filtration (RO, UF, NF), evaporation/crystallization, chemical precipitation, biological treatment, ion exchange, and advanced oxidation processes.

Which regions are leading the adoption of these systems?

Asia Pacific, North America, and Europe are leading regions due to extensive mining operations, stringent regul

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager