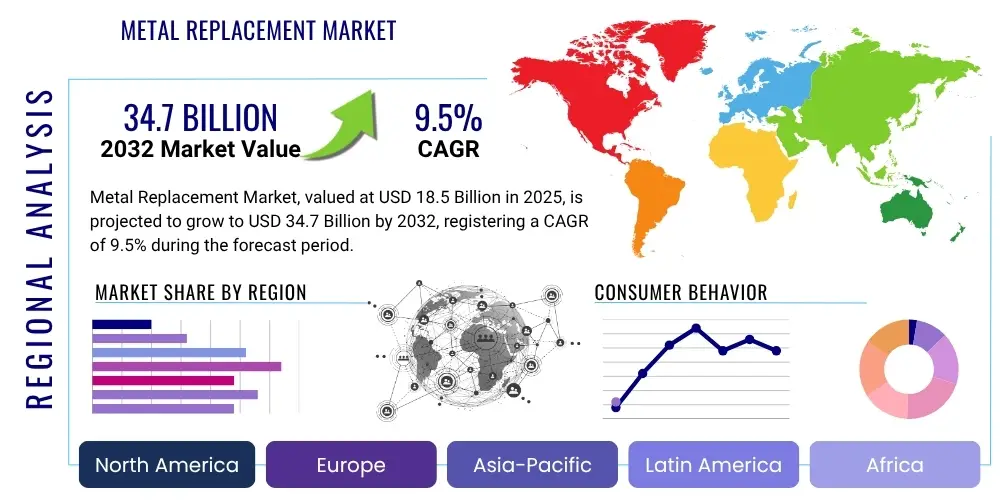

Metal Replacement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428473 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Metal Replacement Market Size

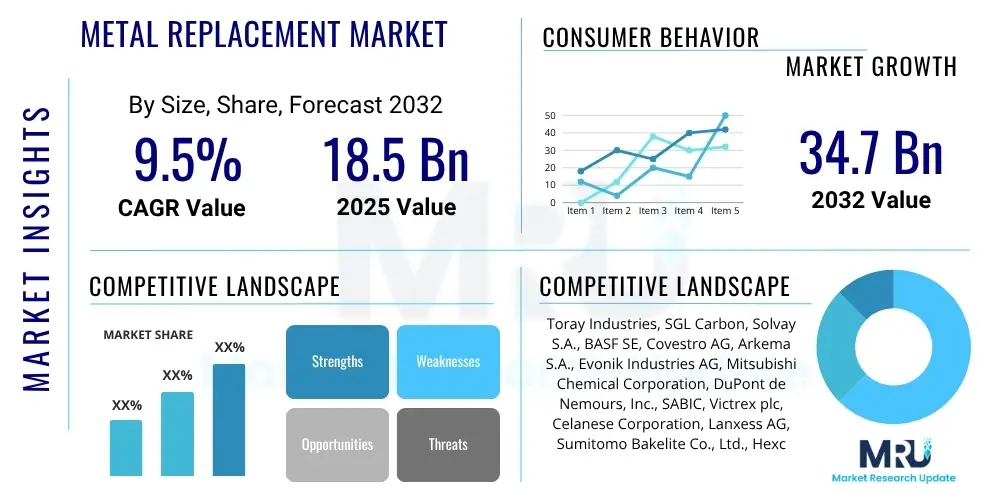

The Metal Replacement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $34.7 Billion by the end of the forecast period in 2032.

Metal Replacement Market introduction

The Metal Replacement Market encompasses the growing trend of substituting traditional metallic components with lightweight, high-performance materials such as advanced plastics, composites, and ceramics in various industrial applications. This shift is primarily driven by the imperative to reduce weight, enhance fuel efficiency, improve corrosion resistance, and offer greater design flexibility compared to conventional metals. These alternative materials provide superior performance characteristics, including higher strength-to-weight ratios, better fatigue resistance, and excellent chemical inertness, making them ideal for demanding environments.

Products in this market range from carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs) to engineering plastics like PEEK, polyamide, and polycarbonate, as well as specialized ceramics. These materials find extensive application across a multitude of sectors. Major applications span the automotive industry, where they contribute to vehicle lightweighting for improved fuel economy and reduced emissions, and the aerospace and defense sector, where weight reduction is critical for operational efficiency and payload capacity. Furthermore, the medical device industry leverages these materials for biocompatibility and sterilization advantages, while electrical and electronics, industrial machinery, and consumer goods sectors also increasingly adopt them for their unique benefits.

The core benefits driving this market include significant weight reduction, leading to lower energy consumption and operational costs, particularly in transportation. Other key advantages are enhanced resistance to corrosion and chemical degradation, which extends product lifespan and reduces maintenance requirements, along with greater design freedom, allowing for complex geometries and integrated functionalities. These factors, combined with stringent environmental regulations pushing for lighter and more sustainable products, and a continuous demand for performance enhancement across industries, are propelling the Metal Replacement Market forward.

Metal Replacement Market Executive Summary

The Metal Replacement Market is experiencing robust growth, fueled by several overarching business trends focused on efficiency, sustainability, and technological advancement. Industries globally are prioritizing lightweighting initiatives to meet stringent environmental regulations and consumer demands for energy-efficient products, making material substitution a critical strategy. Furthermore, advancements in manufacturing processes, such as additive manufacturing and advanced composite fabrication techniques, are enabling the cost-effective production of complex non-metallic components, expanding the feasible applications for metal replacement materials and driving market innovation.

Regional dynamics play a significant role in shaping the market landscape. Asia Pacific is emerging as a dominant force due to rapid industrialization, burgeoning manufacturing sectors, particularly in automotive and electronics, and increasing investments in infrastructure development across countries like China, India, and Japan. North America and Europe, while mature markets, continue to lead in research and development, particularly in aerospace, defense, and medical sectors, driving demand for high-performance and specialized metal replacement solutions. Latin America, the Middle East, and Africa are also witnessing gradual adoption, driven by infrastructure projects and growing industrial bases, albeit at a slower pace.

Segment-wise, the market is primarily driven by the robust growth of composite materials, especially carbon fiber and glass fiber reinforced polymers, which offer exceptional strength-to-weight ratios. Engineering plastics are also gaining significant traction due to their versatility, cost-effectiveness, and ease of processing. The automotive industry remains the largest end-use segment, continually seeking lighter materials for electric vehicles and internal combustion engine vehicles alike to enhance range and reduce emissions. Aerospace and defense applications are also pivotal, with a strong focus on high-performance composites for structural integrity and fuel efficiency. The medical and electrical and electronics sectors are likewise contributing substantially, valuing material properties such as biocompatibility and electrical insulation.

AI Impact Analysis on Metal Replacement Market

Users frequently inquire about how Artificial Intelligence can revolutionize material selection, design optimization, and manufacturing processes within the Metal Replacement Market. Common concerns revolve around the complexity of integrating AI systems into existing workflows, the reliability of AI-driven material predictions, and the potential impact on human jobs. However, there is a strong expectation that AI will accelerate research and development, enhance material performance prediction, improve manufacturing precision, and unlock new application possibilities, leading to more efficient and innovative metal replacement solutions. The focus is on leveraging AI to overcome current limitations and enhance competitive advantage.

- AI-driven material discovery and selection: Optimizing material properties for specific applications.

- Generative design for lightweight structures: Creating complex, optimized geometries for non-metallic parts.

- Predictive analytics for manufacturing processes: Enhancing efficiency, reducing waste, and improving quality in composite and plastics fabrication.

- Quality control and defect detection: Automating inspection processes for metal replacement components.

- Supply chain optimization: Managing raw material sourcing and logistics for advanced materials.

- Personalized product development: Tailoring material solutions to unique customer requirements at scale.

- Simulation and modeling acceleration: Rapid prototyping and testing of new designs and materials.

DRO & Impact Forces Of Metal Replacement Market

The Metal Replacement Market is significantly influenced by a confluence of drivers, restraints, and opportunities, alongside various impact forces that shape its trajectory. The primary drivers include the escalating demand for lightweight materials across multiple industries, particularly automotive and aerospace, where weight reduction directly translates to improved fuel efficiency and reduced emissions. Additionally, the superior corrosion resistance of advanced plastics and composites compared to metals offers extended product lifespans and lower maintenance costs, further accelerating their adoption. Enhanced design flexibility provided by these materials allows for the creation of intricate components that are often impossible or prohibitively expensive to produce with traditional metals, opening up new avenues for innovation. Stringent environmental regulations aimed at reducing carbon footprints and promoting sustainability also compel industries to seek lighter and more resource-efficient material solutions, thereby boosting the metal replacement trend.

However, the market faces notable restraints. The initial high cost associated with advanced materials like carbon fiber composites and high-performance engineering plastics can be a significant barrier to entry for some applications, particularly those with tight budget constraints. The complex processing requirements for certain non-metallic materials, such as specialized molding techniques for composites or specific temperature controls for plastics, can also add to manufacturing costs and require significant capital investment in machinery and expertise. Furthermore, while many metal replacement materials offer excellent properties, they may have limitations in extreme high-temperature environments or under exceptionally high stress loads, where traditional metals still excel, thus restricting their application in certain critical areas. The nascent stage of recycling infrastructure for some composite materials also poses environmental challenges, which may deter adoption in a circular economy context.

Despite these challenges, substantial opportunities exist, particularly with the rapid proliferation of electric vehicles (EVs), where lightweighting is paramount for extending battery range and improving overall performance. Advancements in additive manufacturing (3D printing) are revolutionizing the production of complex, customized metal replacement parts, making them more accessible and cost-effective. The development of bio-based and recycled composites offers a sustainable alternative, aligning with global environmental goals and expanding the market's appeal. Moreover, the continuous innovation in material science is leading to the creation of new hybrid materials with enhanced properties, broadening the scope of metal replacement applications. The interplay of these drivers, restraints, and opportunities, coupled with impact forces such as fluctuating raw material prices and geopolitical influences on supply chains, will collectively determine the future growth and evolution of the Metal Replacement Market.

Segmentation Analysis

The Metal Replacement Market is comprehensively segmented across various dimensions, primarily by material type, application, and end-use industry, providing a granular view of its diverse landscape. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and competitive strategies within specific niches. Understanding these segments is crucial for stakeholders to identify key growth areas, tailor product development, and refine market entry strategies. Each segment possesses unique characteristics and growth trajectories influenced by technological advancements, regulatory environments, and specific industry demands, thereby highlighting the complex interplay of factors within the broader market.

- By Material Type:

- Composites

- Carbon Fiber Reinforced Polymers (CFRP)

- Glass Fiber Reinforced Polymers (GFRP)

- Aramid Fiber Reinforced Polymers (AFRP)

- Natural Fiber Composites

- Engineering Plastics

- Polyether Ether Ketone (PEEK)

- Polyamide (PA)

- Acrylonitrile Butadiene Styrene (ABS)

- Polycarbonate (PC)

- Polypropylene (PP)

- Polyethylene (PE)

- Polyphenylene Sulfide (PPS)

- Polyurethane (PU)

- Advanced Ceramics

- Alumina

- Silicon Carbide

- Zirconia

- Hybrid Materials

- Composites

- By Application:

- Structural Components

- Non-Structural Components

- Electrical & Electronic Parts

- Wear Components

- Fluid Handling Components

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Medical

- Electrical & Electronics

- Industrial Machinery

- Consumer Goods

- Building & Construction

- Sports & Leisure

- Marine

Value Chain Analysis For Metal Replacement Market

The value chain for the Metal Replacement Market is complex and encompasses several distinct stages, beginning with the sourcing of raw materials and extending through various processing steps to the final end-use application. Upstream activities involve the production of fundamental components such as resins (epoxy, polyester, vinyl ester), fibers (carbon, glass, aramid), and various additives like fillers, stabilizers, and catalysts. Key players in this segment are chemical manufacturers and material suppliers who provide the foundational building blocks for advanced plastics and composites. The quality and availability of these raw materials directly impact the properties and cost-effectiveness of the final metal replacement solutions, making this a critical stage in the value chain.

Midstream activities involve the transformation of these raw materials into usable forms. This includes compounding, where resins are mixed with fibers and additives to create specific formulations, and component manufacturing, which utilizes various processes like injection molding for plastics, and advanced composite fabrication methods such as resin transfer molding (RTM), pultrusion, filament winding, and compression molding for composites. Manufacturers at this stage specialize in converting raw materials into semi-finished products or finished components that meet stringent performance and design specifications. Downstream activities involve the integration of these metal replacement components into final products by Original Equipment Manufacturers (OEMs) across industries like automotive, aerospace, medical, and electronics. This stage often requires close collaboration between material suppliers, component manufacturers, and OEMs to ensure optimal performance and seamless integration.

Distribution channels in the Metal Replacement Market are diverse, ranging from direct sales to large OEMs to indirect channels involving distributors and specialized agents who cater to smaller businesses or niche markets. Direct sales are often preferred for high-volume or highly customized applications, allowing for direct communication and technical support between the manufacturer and the end-user. Indirect channels provide broader market reach and logistical support, particularly for standardized products or those requiring specialized handling. Both direct and indirect models are essential for market penetration, ensuring that metal replacement solutions reach a wide array of potential customers efficiently. The effectiveness of these channels is crucial for market growth and competitive advantage.

Metal Replacement Market Potential Customers

The potential customers for the Metal Replacement Market are incredibly diverse, spanning numerous industries that prioritize lightweighting, enhanced performance, and cost-efficiency. At the forefront are Original Equipment Manufacturers (OEMs) in sectors where even marginal weight reduction can lead to significant operational benefits or compliance with stringent regulations. These include automotive manufacturers seeking to improve fuel economy for internal combustion engines and extend the range of electric vehicles, as well as aerospace and defense companies focused on increasing payload capacity and reducing operational costs. These OEMs are typically looking for integrated solutions that meet precise engineering specifications and can be scaled for mass production.

Beyond the major OEMs, Tier-1 and Tier-2 suppliers within these industries also represent substantial customer segments. These suppliers specialize in producing sub-components and assemblies that are then supplied to larger manufacturers. For instance, automotive parts suppliers producing lightweight body panels, engine components, or interior parts are key buyers of metal replacement materials. Similarly, suppliers of aircraft interiors, landing gear components, or weapon systems require advanced non-metallic materials. Their purchasing decisions are often driven by contractual obligations with OEMs and the need to offer innovative, cost-effective, and high-performance solutions.

Furthermore, the medical device industry, with its demand for biocompatible, sterilizable, and imaging-friendly materials, represents a growing customer base for metal replacement, especially for surgical instruments, implants, and diagnostic equipment. Electrical and electronics manufacturers utilize these materials for insulation, heat dissipation, and structural integrity in devices ranging from consumer electronics to industrial sensors. Industrial machinery and equipment manufacturers also seek metal replacement for wear parts, structural components, and parts exposed to corrosive environments, aiming for increased durability and reduced maintenance. The wide applicability of these materials across such varied end-use industries underscores the broad spectrum of potential customers seeking to leverage the advantages of metal replacement solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $34.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, SGL Carbon, Solvay S.A., BASF SE, Covestro AG, Arkema S.A., Evonik Industries AG, Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., SABIC, Victrex plc, Celanese Corporation, Lanxess AG, Sumitomo Bakelite Co., Ltd., Hexcel Corporation, Plasan Sasa Ltd., Gurit Holding AG, Teijin Limited, Cytec Solvay Group, Ensinger GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Replacement Market Key Technology Landscape

The Metal Replacement Market is profoundly shaped by a dynamic and evolving technological landscape, driven by continuous innovation in material science, processing techniques, and manufacturing methodologies. A core technological area is the advancement in composite manufacturing processes, which are critical for producing high-performance, lightweight components. Techniques such as Resin Transfer Molding (RTM), Vacuum Assisted Resin Transfer Molding (VARTM), pultrusion, filament winding, and automated fiber placement (AFP) are continually being refined to improve production efficiency, reduce cycle times, and enhance component consistency and quality. These technologies enable the creation of complex geometries with superior mechanical properties, crucial for aerospace and automotive applications.

Another pivotal technological advancement lies in the field of high-performance engineering plastics. Innovations in polymer chemistry have led to the development of new grades of materials like PEEK, PA, and PPS with enhanced thermal, chemical, and mechanical properties, making them suitable for increasingly demanding applications that previously relied exclusively on metals. Precision injection molding techniques for these advanced plastics allow for the mass production of intricate parts with tight tolerances, offering a cost-effective alternative to metal fabrication. Furthermore, technologies for surface modification and functionalization of plastics and composites are improving their wear resistance, electrical conductivity, or biocompatibility, expanding their application scope into new domains.

Additive manufacturing, commonly known as 3D printing, represents a transformative technology within the metal replacement sector. It allows for the production of highly complex, customized, and lightweight parts with minimal material waste, accelerating prototyping and enabling on-demand manufacturing. Techniques like Fused Deposition Modeling (FDM) for engineering plastics and Selective Laser Sintering (SLS) for composite powders are becoming increasingly sophisticated, capable of producing components with properties comparable to traditionally manufactured parts. This technology significantly reduces design constraints and offers unparalleled flexibility in creating optimized structures for metal replacement. Alongside these, advanced simulation and modeling software plays a critical role in material selection, design optimization, and process validation, reducing development costs and accelerating time-to-market for new metal replacement solutions.

Regional Highlights

- North America: This region is characterized by significant investments in research and development, particularly within the aerospace, defense, and medical sectors. The presence of major automotive OEMs and a strong emphasis on electric vehicle development drive the adoption of lightweight metal replacement materials. Strict regulatory standards regarding fuel efficiency and emissions also contribute to market growth, fostering innovation in materials and manufacturing processes.

- Europe: Europe stands as a mature market with a strong focus on sustainable manufacturing, circular economy principles, and stringent environmental regulations. Germany, France, and the UK are key contributors, especially in the automotive industry, where lightweighting is critical for meeting CO2 emission targets, and in the aerospace sector. Advanced material research and strong industrial infrastructure support market expansion.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid industrialization, expanding manufacturing bases, and increasing demand from emerging economies like China, India, and Southeast Asian countries. The burgeoning automotive, electronics, and construction industries, coupled with government initiatives promoting local manufacturing, are significant growth catalysts. Cost-effectiveness and increasing awareness of material benefits also fuel adoption.

- Latin America: This region shows a gradual but steady growth in the metal replacement market, primarily influenced by developments in the automotive and construction sectors. Countries like Brazil and Mexico are leading the adoption due to their growing industrial capacities and increasing foreign investments in manufacturing. The focus is on adopting established technologies for cost-efficient solutions.

- Middle East and Africa (MEA): The MEA region is experiencing growth driven by infrastructure development projects, investments in the aerospace industry, and an expanding oil and gas sector seeking corrosion-resistant materials. The focus on diversification from traditional industries and the adoption of advanced technologies are creating new opportunities for metal replacement applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Replacement Market.- Toray Industries

- SGL Carbon

- Solvay S.A.

- BASF SE

- Covestro AG

- Arkema S.A.

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- SABIC

- Victrex plc

- Celanese Corporation

- Lanxess AG

- Sumitomo Bakelite Co., Ltd.

- Hexcel Corporation

- Plasan Sasa Ltd.

- Gurit Holding AG

- Teijin Limited

- Cytec Solvay Group

- Ensinger GmbH

Frequently Asked Questions

What is metal replacement?

Metal replacement involves substituting traditional metallic components with advanced lightweight materials like composites, engineering plastics, or ceramics to achieve improved performance, weight reduction, corrosion resistance, and greater design flexibility.

What are the primary benefits of metal replacement?

The main benefits include significant weight reduction, leading to better fuel efficiency or extended range in vehicles, superior corrosion and chemical resistance, extended product lifespan, enhanced design freedom for complex geometries, and often reduced manufacturing and maintenance costs.

Which industries are leading in metal replacement adoption?

The automotive industry leads in adopting metal replacement for lightweighting and efficiency. Aerospace and defense, medical devices, and electrical and electronics sectors are also major adopters, driven by performance, safety, and functional requirements.

What challenges exist in metal replacement?

Key challenges include the high initial cost of advanced materials and specialized processing equipment, potential limitations in extreme temperature or stress conditions for certain materials, and the need for new recycling infrastructure for complex composites.

How does sustainability factor into metal replacement?

Metal replacement contributes to sustainability by reducing overall product weight, which lowers energy consumption and emissions throughout the product lifecycle. The development of bio-based and recycled metal replacement materials further enhances its environmental benefits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager