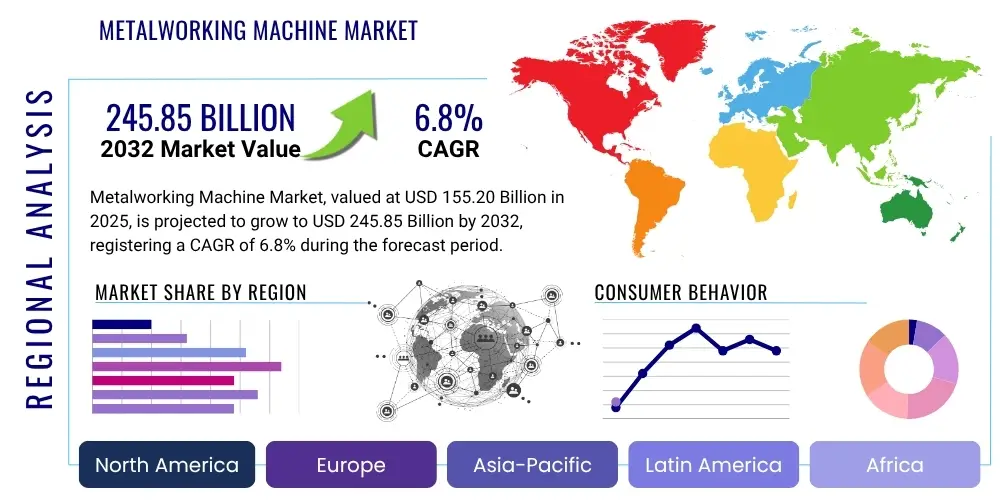

Metalworking Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429000 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Metalworking Machine Market Size

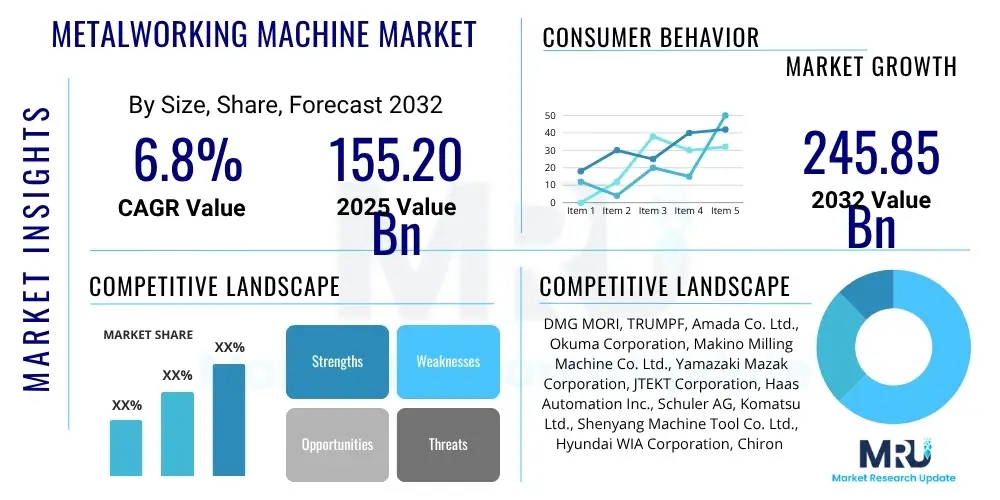

The Metalworking Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $155.20 billion in 2025 and is projected to reach $245.85 billion by the end of the forecast period in 2032.

Metalworking Machine Market introduction

The metalworking machine market encompasses a broad range of industrial equipment designed to cut, shape, form, grind, or otherwise modify metal workpieces. These machines are fundamental to modern manufacturing, enabling the production of components with high precision and efficiency across various industries. The core products include Computer Numerical Control (CNC) machines, conventional lathes, milling machines, grinding machines, laser cutting machines, and additive manufacturing systems, each serving specific operational requirements for shaping metals into desired forms.

Major applications for metalworking machines span critical sectors such as automotive, aerospace and defense, general manufacturing, heavy machinery, and medical devices, where the demand for precise and complex metal parts is consistently high. These machines offer significant benefits including enhanced production speed, superior accuracy, reduced labor costs, and the capability to produce intricate designs that would be unfeasible with manual methods. Furthermore, the increasing integration of automation and smart technologies boosts their productivity and operational safety.

Key driving factors for market growth include the accelerating pace of industrialization in emerging economies, the global push towards automation and smart manufacturing practices, and the continuous demand for high-precision components in advanced technological products. The evolution of materials science and the need to process new, harder alloys also necessitate more sophisticated and powerful metalworking machines, thereby stimulating innovation and market expansion.

Metalworking Machine Market Executive Summary

The global metalworking machine market is currently experiencing robust business trends characterized by an increasing adoption of Industry 4.0 principles, including the integration of IoT, AI, and advanced robotics into manufacturing processes. This shift is leading to the development of smart factories that leverage data analytics for predictive maintenance, optimized production scheduling, and real-time quality control. There is a strong emphasis on customization and flexible manufacturing solutions to meet diverse consumer demands and shorter product lifecycles, driving investment in versatile and reconfigurable machinery.

Regionally, Asia Pacific continues to dominate the market due to rapid industrialization, substantial government investments in manufacturing infrastructure, and a burgeoning automotive and electronics sector, particularly in countries like China, India, and Japan. Europe, led by Germany and Italy, remains a hub for technological innovation and high-quality machine production, focusing on advanced CNC systems and precision engineering. North America is experiencing steady growth, driven by modernization efforts in its aerospace and defense industries, coupled with a renewed focus on domestic manufacturing capabilities.

Segment-wise, the market is seeing significant growth in CNC machines due to their unparalleled precision, automation capabilities, and efficiency. Additive manufacturing, while still a niche, is rapidly gaining traction for prototyping and specialized component production, offering design freedom and material efficiency. The forming segment is also expanding, driven by demand for lightweighting in automotive and aerospace industries. Overall, the market is trending towards more intelligent, interconnected, and energy-efficient machines that can contribute to sustainable manufacturing practices.

AI Impact Analysis on Metalworking Machine Market

Common user questions regarding AI's impact on the metalworking machine market often revolve around how artificial intelligence can enhance machine efficiency, facilitate predictive maintenance, improve product quality, and potentially reshape the workforce. Users are keen to understand the practical applications of AI in real-time process optimization, defect detection, and adaptive manufacturing, along with concerns about the investment required and the readiness of existing infrastructure to integrate AI solutions. There is also significant interest in AI's role in making metalworking machines more autonomous and capable of self-correction, reducing reliance on constant human oversight.

Based on these inquiries, the key themes include the potential for AI to revolutionize operational intelligence by processing vast amounts of machine data to identify patterns, predict failures before they occur, and automatically adjust parameters for optimal performance. Concerns often center on data security, the need for specialized skills to manage AI-driven systems, and the initial costs associated with AI implementation. Expectations are high for AI to drive significant advancements in manufacturing precision, reduce waste, and improve overall factory output through enhanced decision-making capabilities.

The influence of AI is expected to extend beyond individual machine optimization to holistic factory management, enabling greater synchronization across production lines and supply chains. Users anticipate that AI will contribute to more resilient and adaptable manufacturing ecosystems, capable of responding swiftly to market changes and unforeseen disruptions, ultimately driving a new era of smart manufacturing within the metalworking industry.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures, minimizing downtime and optimizing maintenance schedules.

- Optimized Process Parameters: AI systems continuously monitor and adjust machine settings (e.g., feed rate, cutting speed) in real-time for improved efficiency and quality.

- Advanced Quality Control: AI-powered vision systems detect microscopic defects and inconsistencies, ensuring superior product quality and reducing scrap rates.

- Generative Design and Simulation: AI assists engineers in optimizing part designs for material usage, strength, and manufacturability, reducing development cycles.

- Adaptive Manufacturing: Machines can adapt to variations in raw materials or environmental conditions, maintaining consistent output and quality.

- Autonomous Operation: AI enables machines to perform tasks with minimal human intervention, from setup to execution and troubleshooting.

- Supply Chain Optimization: AI helps forecast demand, manage inventory, and optimize logistics for metalworking components and finished goods.

- Improved Worker Safety: AI can monitor operational environments and identify potential hazards, alerting personnel or automatically initiating safety protocols.

DRO & Impact Forces Of Metalworking Machine Market

The metalworking machine market is propelled by significant drivers such as the global adoption of Industry 4.0 principles, which emphasize automation, data exchange, and smart manufacturing. The increasing demand for precision components across various end-use industries, including automotive, aerospace, and medical devices, also fuels market growth. Furthermore, government initiatives in several countries supporting manufacturing sector development, coupled with rapid industrialization and urbanization in emerging economies, contribute substantially to market expansion. The continuous need for efficiency improvements and cost reductions in production processes also drives the adoption of advanced metalworking technologies.

However, the market faces several restraints, including the high initial capital investment required for advanced metalworking machines, which can be a barrier for small and medium-sized enterprises. A persistent shortage of skilled labor capable of operating and maintaining complex CNC and automated systems also hinders market growth. Economic slowdowns and geopolitical uncertainties can lead to reduced industrial output and investment in new machinery. Additionally, stringent environmental regulations regarding energy consumption and waste disposal for manufacturing processes can add to operational costs, impacting profitability.

Opportunities within the market abound, particularly in the realm of additive manufacturing and hybrid machines that combine traditional and additive techniques, offering new possibilities for complex geometries and customized production. The increasing focus on smart factories and the integration of IoT and AI for real-time monitoring and predictive analytics present significant growth avenues. Furthermore, the development of advanced materials requiring specialized processing capabilities opens up new niches for innovative machine designs. The shift towards electrification in the automotive industry also presents opportunities for new component manufacturing needs.

Impact forces on the market are multifaceted, including technological advancements that constantly introduce more efficient and precise machinery, pushing manufacturers to upgrade their existing fleets. Globalization influences market dynamics through international trade policies, tariffs, and cross-border collaborations. Economic stability dictates investment capacities and consumer demand for manufactured goods. Environmental regulations are increasingly impacting design and operational aspects, pushing for more sustainable and energy-efficient metalworking solutions. These forces collectively shape the competitive landscape and strategic direction of the market.

Segmentation Analysis

The metalworking machine market is broadly segmented based on various attributes, providing a detailed view of its intricate structure and diverse applications. This segmentation allows for a comprehensive understanding of market dynamics, identifying key areas of growth, technological advancements, and shifts in demand patterns across different industry verticals and machine types. The primary categories for segmentation typically include product type, technology used, the end-user industry, and the operational mode of the machines, each revealing distinct market characteristics and competitive landscapes.

Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and investment decisions effectively. For instance, the demand for cutting machines might be driven by the aerospace sector requiring high precision, while forming machines could see growth in the automotive industry focusing on lightweight components. Similarly, the increasing adoption of automated technologies points towards a market favoring sophisticated CNC systems over conventional machinery, reflecting the overarching trend towards Industry 4.0 and smart manufacturing across the global industrial landscape.

- By Product Type

- Cutting Machines (e.g., Lathes, Milling Machines, Grinding Machines, Drilling Machines, Laser Cutting Machines, Waterjet Cutting Machines, Plasma Cutting Machines)

- Forming Machines (e.g., Press Brakes, Bending Machines, Punching Machines, Shearing Machines, Forging Machines, Roll Forming Machines)

- Welding Machines (e.g., Arc Welding, Resistance Welding, Laser Welding)

- Additive Manufacturing Machines (e.g., 3D Metal Printers - Powder Bed Fusion, Directed Energy Deposition)

- Finishing Machines (e.g., Deburring Machines, Polishing Machines)

- By Technology

- Computer Numerical Control (CNC) Machines

- Conventional Machines

- Hybrid Machines

- By End-User Industry

- Automotive

- Aerospace and Defense

- General Manufacturing

- Heavy Machinery

- Electronics and Electrical

- Medical Devices

- Tool and Die

- Shipbuilding

- By Operation

- Automated

- Semi-Automated

- Manual

Value Chain Analysis For Metalworking Machine Market

The value chain for the metalworking machine market begins with upstream activities, involving the sourcing and processing of raw materials such as steel, aluminum, and various alloys that form the structural components of the machines. This stage also includes the development and supply of critical electrical and electronic components, control systems, sensors, and specialized software that enable the sophisticated functions of modern metalworking machines. Key players in this segment are material suppliers, component manufacturers, and technology providers specializing in automation and control systems, all contributing foundational elements to the final product.

Midstream activities involve the design, manufacturing, assembly, and testing of the metalworking machines by original equipment manufacturers (OEMs). This phase encompasses research and development for new machine capabilities, integration of advanced technologies like CNC, IoT, and AI, and adherence to strict quality and safety standards. After manufacturing, the machines move through distribution channels, which can be direct or indirect, to reach the end-user. Direct channels involve OEMs selling directly to large industrial clients, often through their own sales teams and service networks.

Indirect channels involve a network of distributors, dealers, and agents who facilitate sales, provide local support, and sometimes offer value-added services such as installation, training, and maintenance. These intermediaries play a crucial role in market penetration, especially in regions where OEMs do not have a direct presence. Downstream activities focus on the end-users who operate these machines for various manufacturing processes. This stage also includes post-sales services such as maintenance, spare parts supply, technical support, and eventual machine upgrades or replacements, ensuring the continued operational efficiency and longevity of the equipment throughout its lifecycle.

Metalworking Machine Market Potential Customers

Potential customers and end-users of metalworking machines encompass a vast array of industries that rely heavily on precision metal component manufacturing. The automotive industry stands as a significant buyer, utilizing these machines for producing engine blocks, chassis components, transmission parts, and body panels, driven by continuous innovation in vehicle design and the shift towards electric vehicles. The aerospace and defense sectors are also critical customers, demanding exceptionally high-precision and robust parts for aircraft, spacecraft, and military equipment, where safety and reliability are paramount and material processing is often complex.

Beyond these major sectors, the general manufacturing industry forms a broad customer base, including small workshops and large-scale factories producing a diverse range of products from consumer goods to industrial tools. The heavy machinery industry, encompassing construction, mining, and agricultural equipment manufacturers, requires metalworking machines for fabricating large, durable components. The electronics and electrical industries also procure these machines for creating intricate parts for devices, while the medical device sector depends on them for producing highly precise and sterile instruments and implants.

Essentially, any industry involved in the fabrication, assembly, or repair of metal components is a potential customer for metalworking machines. This includes tool and die makers, shipbuilding companies, energy sector firms, and infrastructure developers. The diverse needs of these end-users drive the market for a wide range of metalworking machines, from basic conventional models to highly advanced, automated, and intelligent systems, necessitating continuous innovation from machine manufacturers to meet specific application requirements and production scales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $155.20 Billion |

| Market Forecast in 2032 | $245.85 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DMG MORI, TRUMPF, Amada Co. Ltd., Okuma Corporation, Makino Milling Machine Co. Ltd., Yamazaki Mazak Corporation, JTEKT Corporation, Haas Automation Inc., Schuler AG, Komatsu Ltd., Shenyang Machine Tool Co. Ltd., Hyundai WIA Corporation, Chiron Group SE, Doosan Machine Tools Co. Ltd., INDEX-Werke GmbH & Co. KG, GF Machining Solutions, Bystronic AG, Flow International Corporation, Hardinge Inc., Kennametal Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metalworking Machine Market Key Technology Landscape

The metalworking machine market is undergoing a significant technological transformation, driven by advancements aimed at enhancing precision, efficiency, and automation. Computer Numerical Control (CNC) technology remains foundational, offering unparalleled accuracy and repeatability through programmed instructions, and it continues to evolve with more intuitive interfaces and advanced algorithms for complex machining operations. The integration of the Internet of Things (IoT) is increasingly prevalent, enabling real-time data collection from machines, which is crucial for monitoring performance, predicting maintenance needs, and optimizing production processes. This connectivity facilitates the creation of interconnected manufacturing environments.

Artificial Intelligence (AI) and Machine Learning (ML) are emerging as pivotal technologies, applied in areas such as predictive maintenance, quality control through intelligent vision systems, and optimization of cutting parameters. These AI-driven solutions enhance machine autonomy, reduce human intervention, and improve decision-making capabilities within the manufacturing workflow. Robotics is another key technology, with collaborative robots (cobots) and advanced industrial robots being integrated into metalworking processes for tasks like material handling, machine tending, and even complex assembly, improving both speed and safety on the factory floor.

Additive Manufacturing (3D metal printing) is revolutionizing prototyping and the production of complex, lightweight components, offering design freedom previously unattainable with traditional methods. Digital Twin technology, creating virtual replicas of physical machines or entire production lines, allows for simulation, testing, and optimization in a digital environment before physical implementation, thereby reducing risks and costs. Cloud computing supports the storage and analysis of vast datasets generated by smart machines, facilitating remote monitoring and distributed manufacturing. Furthermore, advancements in materials science drive the development of machines capable of processing superalloys and composites with greater efficiency and precision, expanding the capabilities of modern metalworking technology.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global metalworking machine market, primarily due to rapid industrialization, extensive government support for manufacturing sectors, and a booming automotive industry. Countries like China, Japan, South Korea, and India are major contributors. China stands as the largest consumer and producer, driven by its vast manufacturing base and continued investment in advanced technologies. Japan is a leader in precision and high-tech machine tools, while India and Southeast Asian nations are rapidly expanding their manufacturing capabilities.

- Europe: Europe is a significant market for metalworking machines, known for its innovation, high-quality engineering, and advanced manufacturing practices. Germany, Italy, and Switzerland are key players, with a strong focus on high-precision CNC machines, automation, and intelligent manufacturing solutions. The automotive, aerospace, and general engineering sectors are major end-users, driving demand for sophisticated and efficient machinery. Stringent quality standards and a strong emphasis on R&D further cement Europe's position.

- North America: The North American market is characterized by a strong emphasis on technological modernization, automation, and the adoption of Industry 4.0 principles. The United States is the primary market, driven by robust aerospace and defense industries, significant investment in automotive manufacturing, and a growing focus on reshoring manufacturing operations. There is increasing demand for advanced CNC machines, robotics, and integrated solutions that improve productivity and reduce labor costs.

- Latin America: This region presents emerging opportunities for the metalworking machine market, with countries like Brazil, Mexico, and Argentina seeing increased industrial activity. Growth is largely propelled by automotive production, infrastructure development, and mining sectors. While still smaller than other regions, increasing foreign investments and efforts to modernize manufacturing facilities are contributing to a steady rise in demand for both conventional and advanced metalworking equipment.

- Middle East and Africa (MEA): The MEA region is a developing market for metalworking machines, primarily driven by investments in infrastructure, oil and gas, and diversification of economies away from fossil fuels. Countries like Saudi Arabia, UAE, and South Africa are investing in local manufacturing capabilities, leading to increased demand for machinery. However, political instability and fluctuating oil prices can influence market dynamics and investment patterns in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metalworking Machine Market.- DMG MORI

- TRUMPF

- Amada Co. Ltd.

- Okuma Corporation

- Makino Milling Machine Co. Ltd.

- Yamazaki Mazak Corporation

- JTEKT Corporation

- Haas Automation Inc.

- Schuler AG

- Komatsu Ltd.

- Shenyang Machine Tool Co. Ltd.

- Hyundai WIA Corporation

- Chiron Group SE

- Doosan Machine Tools Co. Ltd.

- INDEX-Werke GmbH & Co. KG

- GF Machining Solutions

- Bystronic AG

- Flow International Corporation

- Hardinge Inc.

- Kennametal Inc.

Frequently Asked Questions

What is the primary driver of the metalworking machine market?

The primary driver of the metalworking machine market is the global shift towards automation and the adoption of Industry 4.0 principles, coupled with a consistent demand for high-precision components across key industries like automotive, aerospace, and general manufacturing. This drives continuous investment in advanced and efficient machinery.

How is Industry 4.0 influencing metalworking machines?

Industry 4.0 significantly influences metalworking machines by integrating technologies such as IoT, AI, and robotics. This enables smart factories with real-time data analysis, predictive maintenance, remote monitoring, and enhanced automation, leading to higher efficiency, improved quality, and greater production flexibility.

Which region dominates the metalworking machine market?

The Asia Pacific (APAC) region currently dominates the global metalworking machine market. This dominance is attributed to rapid industrialization, substantial government investments in manufacturing infrastructure, and robust growth in key end-user industries, particularly in countries like China, Japan, and India.

What are the key technological advancements in metalworking machines?

Key technological advancements include advanced Computer Numerical Control (CNC) systems, pervasive integration of IoT for connectivity, Artificial Intelligence (AI) for process optimization and predictive maintenance, additive manufacturing (3D metal printing), and robotics for automation. Digital twin technology is also gaining traction for simulation and optimization.

What challenges does the metalworking machine market face?

The metalworking machine market faces challenges such as high initial capital investment costs for advanced machinery, a shortage of skilled labor to operate complex systems, economic uncertainties leading to fluctuating industrial investments, and increasing pressure from stringent environmental regulations concerning energy consumption and waste management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager