Micro-Electro-Mechanical System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430044 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Micro-Electro-Mechanical System Market Size

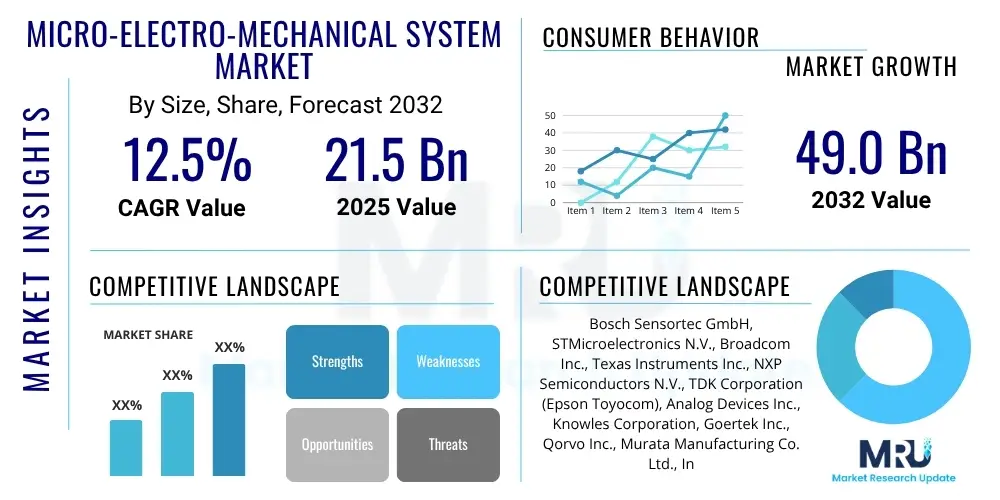

The Micro-Electro-Mechanical System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 21.5 billion in 2025 and is projected to reach USD 49.0 billion by the end of the forecast period in 2032.

Micro-Electro-Mechanical System Market introduction

The Micro-Electro-Mechanical System (MEMS) market encompasses a vast array of miniaturized devices that integrate mechanical elements, sensors, actuators, and sophisticated electronics on a common silicon substrate, all fabricated using advanced microfabrication technology. These devices are meticulously engineered to interact with their environment by sensing, processing, or manipulating physical parameters at the micro-scale, offering unparalleled precision, efficiency, and functionality. MEMS technology is inherently interdisciplinary, drawing upon principles from mechanical engineering, electrical engineering, materials science, and semiconductor manufacturing to produce components that are significantly smaller, consume less power, and deliver higher performance than their macroscopic counterparts, thereby enabling groundbreaking capabilities across numerous applications.

Major applications for MEMS are pervasive, ranging from critical automotive safety systems, such as accelerometers for instantaneous airbag deployment and gyroscopes for electronic stability control, to ubiquitous consumer electronics, including pressure sensors in wearables and microphones in smartphones and smart speakers. In healthcare, MEMS are vital for advanced diagnostic devices, minimally invasive surgical tools, and precise drug delivery systems. The inherent benefits of MEMS, such as extreme miniaturization, improved accuracy and reliability, reduced manufacturing costs through batch processing, and enhanced operational efficiency, are collectively driving their widespread adoption. Key driving factors propelling market growth include the escalating global demand for smart, connected devices within the rapidly expanding Internet of Things (IoT) ecosystem, continuous advancements in automotive electronics for autonomous driving and electric vehicles, sophisticated medical diagnostics demanding point-of-care solutions, and the increasing need for high-precision industrial automation solutions across manufacturing and logistics sectors.

Micro-Electro-Mechanical System Market Executive Summary

The Micro-Electro-Mechanical System market is experiencing dynamic and robust expansion, largely attributable to ongoing technological innovations and the pervasive integration of smart technologies across a wide array of vertical industries. Prominent business trends within the market include a strategic pivot towards advanced packaging solutions that enable higher integration density and improved performance, a noticeable increase in mergers and acquisitions aimed at consolidating technological expertise and market share, and a growing emphasis on developing highly customized MEMS solutions tailored for niche industrial, medical, and specialized consumer applications. Moreover, the industry is witnessing significant and sustained investments in research and development, particularly focused on enhancing sensor sensitivity, optimizing energy efficiency, and exploring novel materials and fabrication techniques for next-generation MEMS devices, all contributing to a fiercely competitive yet innovative market landscape.

From a regional perspective, the Asia Pacific continues to assert its dominance in the global MEMS market, primarily owing to its extensive consumer electronics manufacturing capabilities, a rapidly expanding automotive industry, and substantial governmental support for semiconductor and advanced manufacturing initiatives. North America and Europe remain pivotal contributors, particularly excelling in high-value and high-complexity segments such as aerospace and defense, advanced medical diagnostics, and sophisticated industrial automation, underpinned by robust R&D ecosystems and a propensity for early adoption of cutting-edge technologies. Segment-wise, MEMS sensors, encompassing accelerometers, gyroscopes, and pressure sensors, consistently represent the largest revenue-generating category, driven by their indispensable role in mobile devices, automotive safety systems, and industrial monitoring. However, MEMS actuators, including microfluidic devices, micromirrors, and micro-pumps, are forecasted to exhibit an accelerated growth trajectory, stimulated by breakthroughs in personalized healthcare, optical communication networks, and immersive augmented and virtual reality applications, signalling a continuous diversification of market opportunities and technological advancements.

AI Impact Analysis on Micro-Electro-Mechanical System Market

Users frequently express considerable interest in understanding the profound impact of Artificial Intelligence (AI) on the Micro-Electro-Mechanical System (MEMS) market. Common inquiries revolve around how AI can enhance MEMS device performance, the emergence of entirely new application domains facilitated by AI-MEMS convergence, and the inherent challenges associated with integrating complex AI algorithms with miniature MEMS structures. Specific concerns often include AI's capability to efficiently process the enormous volumes of data generated by MEMS sensors, its potential to enable predictive analytics for system reliability, and its role in fostering autonomous decision-making capabilities at the edge. The collective sentiment indicates a strong expectation that AI will be a transformative force, enabling MEMS to evolve from basic data acquisition tools into intelligent, self-optimizing components that significantly elevate system efficiency, accuracy, and operational autonomy across a broad spectrum of industries, despite existing complexities in data management and processing at the micro-scale.

- AI enables sophisticated data processing and interpretation from MEMS sensors, transforming raw data into actionable, contextual insights.

- Facilitates the development of intelligent MEMS for AI-powered edge computing devices, which reduce data latency and bandwidth requirements by processing information closer to the source.

- Drives the implementation of advanced predictive maintenance capabilities in industrial MEMS applications through AI-driven anomaly detection and pattern recognition.

- Significantly improves the calibration, self-correction, and adaptive functionality of MEMS devices, thereby extending their operational lifespan and enhancing measurement accuracy.

- Supports the creation of advanced sensor fusion applications by seamlessly integrating and analyzing data from multiple disparate MEMS sensors using complex AI algorithms.

- Optimizes MEMS design, simulation, and manufacturing processes through machine learning, leading to accelerated development cycles and reduced production costs.

- Plays a crucial role in enabling sophisticated autonomous systems, such as self-driving vehicles, advanced robotics, and unmanned aerial vehicles, by providing AI-enhanced MEMS input.

- Contributes to significant improvements in the energy efficiency of MEMS operations through AI-managed power consumption, dynamic resource allocation, and optimized duty cycling.

- Enables novel human-machine interfaces, gesture recognition systems, and context-aware devices by interpreting subtle movements and environmental cues from AI-driven MEMS data.

- Advances medical diagnostics and drug delivery systems through the AI-powered analysis of MEMS data, facilitating personalized healthcare solutions and real-time patient monitoring.

DRO & Impact Forces Of Micro-Electro-Mechanical System Market

The Micro-Electro-Mechanical System market is significantly propelled by an array of powerful drivers, foremost among them being the escalating global demand for miniaturized, high-performance, and highly integrated electronic components across virtually every industrial sector. The ubiquitous proliferation of the Internet of Things (IoT), coupled with the burgeoning ecosystem of connected devices, has created an immense and continuous need for compact, energy-efficient, and highly sensitive MEMS sensors and actuators. Furthermore, the relentless advancements in the automotive industry, particularly in advanced driver-assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies, are fueling exponential demand for MEMS accelerometers, gyroscopes, pressure sensors, and specialized environmental sensors crucial for safety and operational efficiency. Similarly, transformative breakthroughs in the healthcare sector, specifically in portable diagnostic equipment, implantable medical devices, and precision drug delivery systems, increasingly rely on sophisticated MEMS technology to enable patient-centric and minimally invasive solutions.

Despite these robust growth drivers, the MEMS market navigates several persistent restraints, including the substantial upfront investment required for intensive research and development activities, which often span several years before commercialization. The inherent complexity of MEMS manufacturing processes, demanding specialized cleanroom facilities, advanced lithography, and precise etching techniques, further contributes to high production costs and necessitates highly skilled expertise. Challenges related to integrating diverse MEMS components into larger, heterogeneous systems, often compounded by a lack of universal standardization across various platforms and applications, also present significant hurdles for widespread adoption and interoperability. However, the market is rife with significant opportunities in nascent and rapidly evolving application areas such as augmented reality (AR) and virtual reality (VR) headsets, the advanced infrastructure required for 5G communication networks, highly precise medical implants for personalized medicine, and the rapid development of smart city initiatives. The burgeoning paradigm of AI at the edge computing also presents a fertile ground for novel MEMS functionalities and intelligent sensor fusion. Broader external impact forces such as the accelerated pace of technological obsolescence, global economic volatility impacting consumer spending and industrial investment cycles, stringent regulatory frameworks in highly sensitive sectors like healthcare and automotive, and an intensely competitive landscape characterized by continuous innovation and intellectual property battles, all collectively exert a profound influence on the market's trajectory and strategic direction.

Segmentation Analysis

The Micro-Electro-Mechanical System market is meticulously segmented to offer comprehensive insights into its intricate structure and diverse operational facets. This multi-dimensional segmentation categorizes the market based on distinct product types, their myriad applications across a spectrum of industries, and the ultimate end-use sectors, thereby providing a granular understanding of the market's value proposition and varied customer requirements. Such a detailed breakdown is crucial for stakeholders to accurately identify specific growth pockets, formulate targeted product development strategies, and effectively analyze the competitive dynamics prevalent within individual market niches. The expansive reach of MEMS technology ensures that this multi-faceted analysis can uncover both established market drivers and emerging opportunities across traditional and cutting-edge industrial landscapes.

Further dissecting the market through segmentation reveals how different types of MEMS devices, such as sensors and actuators, cater to unique functional needs across diverse applications like automotive safety, consumer electronics, and medical diagnostics. This granular view allows businesses to pinpoint optimal areas for strategic investment, develop highly specialized products, and refine their marketing approaches to address specific end-user demands more effectively. Understanding the interplay between these segments is vital for predicting future market shifts, mitigating potential risks associated with technological obsolescence, and capitalizing on the rapid advancements transforming the MEMS industry. This approach ensures that market players can maintain agility and responsiveness in a continually evolving technological environment, ensuring sustained relevance and competitive advantage.

- By Type:

- Sensors

- Accelerometers

- Gyroscopes

- Pressure Sensors

- Microphones

- RF MEMS

- Optical MEMS (e.g., Micromirrors for DLP projectors, optical switches)

- Environmental Sensors (e.g., humidity, temperature, gas, particulate matter)

- Magnetic Sensors

- Actuators

- Microfluidic Devices (e.g., for lab-on-a-chip, drug delivery)

- Micro-pumps

- Inkjet Print Heads

- Micromirror Arrays

- RF Switches and Tuners

- Microgrippers

- By Application:

- Automotive

- Safety Systems (e.g., Airbag Deployment, Electronic Stability Control, Roll-over Detection)

- Infotainment Systems

- Engine & Powertrain Control

- Tire Pressure Monitoring Systems (TPMS)

- Advanced Driver-Assistance Systems (ADAS)

- Consumer Electronics

- Smartphones & Tablets (e.g., screen orientation, noise cancellation)

- Wearable Devices (e.g., fitness trackers, smartwatches)

- Gaming Consoles (e.g., motion sensing)

- Laptops & PCs (e.g., HDD protection)

- Digital Cameras (e.g., image stabilization)

- Smart Home Devices

- Healthcare

- Medical Implants (e.g., Cochlear Implants, pressure monitoring)

- Diagnostic Devices (e.g., Blood glucose monitors, point-of-care testing)

- Drug Delivery Systems (e.g., insulin pumps)

- Surgical Tools (e.g., miniature endoscopy)

- Patient Monitoring Systems

- Industrial

- Process Control & Automation

- Test & Measurement Equipment

- Robotics

- Condition Monitoring & Predictive Maintenance

- Asset Tracking

- Aerospace & Defense

- Navigation & Guidance Systems (e.g., IMUs)

- Control Systems

- Drones & Unmanned Aerial Vehicles (UAVs)

- Avionics

- High-G Sensors

- Telecommunications

- Optical Switching and Networking

- RF Filters & Oscillators

- Fiber Optic Components

- Antenna Tuning

- By End-Use Industry:

- Automotive OEMs

- Consumer Electronics Manufacturers

- Medical Device Manufacturers

- Industrial Equipment Manufacturers

- Aerospace & Defense Contractors

- Telecommunication Service Providers

- Energy Sector (e.g., oil & gas exploration, renewable energy monitoring)

- Environmental Monitoring Agencies

Value Chain Analysis For Micro-Electro-Mechanical System Market

The value chain of the Micro-Electro-Mechanical System market is a highly complex and interconnected ecosystem, initiating with upstream activities that focus on the meticulous sourcing and processing of specialized raw materials and the concurrent development of high-precision fabrication equipment. This foundational stage involves a diverse group of suppliers providing semiconductor-grade silicon wafers, advanced ceramic substrates, and specialized polymers, all of which are critical for MEMS device performance. Concurrently, a specialized segment of equipment manufacturers supplies sophisticated tools for photolithography, etching, and thin-film deposition, which are indispensable for the intricate microfabrication processes. The consistent quality and timely availability of these foundational elements directly influence the efficiency, cost-effectiveness, and ultimate performance of the subsequent MEMS manufacturing stages, thereby establishing a fundamental dependency within the initial phases of the entire value chain.

Moving downstream, the value chain progresses through MEMS device manufacturers, who utilize these raw materials and equipment to transform them into functional micro-components such as sensors and actuators. These components are then often passed to module assemblers and system integrators who incorporate the individual MEMS devices into larger, more complex electronic systems and eventually into finished end-products. The distribution channels in the MEMS market are multifaceted and strategically employed. Direct sales approaches are frequently favored for large-volume contracts with major Original Equipment Manufacturers (OEMs) and for highly customized MEMS solutions that necessitate close collaboration throughout the design and integration phases. Conversely, indirect channels, which typically involve an extensive network of distributors, value-added resellers, and online marketplaces, are leveraged to achieve broader market reach, particularly targeting small to medium-sized enterprises (SMEs) and facilitating the widespread availability of standardized MEMS components. This strategic blend of direct and indirect distribution ensures both the cultivation of deep, strategic partnerships for complex, high-value projects and efficient, scalable market penetration for more commoditized MEMS products, optimizing overall market accessibility and responsiveness.

Micro-Electro-Mechanical System Market Potential Customers

The Micro-Electro-Mechanical System market serves an expansive and diverse base of potential customers, spanning multiple high-growth industries that increasingly rely on miniaturized and intelligent sensing and actuation capabilities. Foremost among these are leading automotive manufacturers, who are integrating MEMS sensors and actuators into a wide range of critical applications, including advanced driver-assistance systems (ADAS), precise engine management, sophisticated infotainment systems, and indispensable safety features like airbag deployment, electronic stability control, and tire pressure monitoring. Similarly, major consumer electronics brands represent a substantial customer segment, heavily dependent on MEMS for components such as accelerometers, gyroscopes, and pressure sensors in smartphones, wearables, gaming devices, and smart home appliances, all contributing to enhanced user experience and product miniaturization.

Beyond these prominent sectors, the healthcare industry stands as a rapidly expanding customer segment, utilizing MEMS in pioneering medical implants, advanced portable diagnostic equipment like lab-on-a-chip devices, and highly precise drug delivery systems. Industrial automation firms constitute another crucial client base, leveraging MEMS for predictive maintenance in heavy machinery, sophisticated process control, and advanced robotics, demanding unparalleled reliability and accuracy in harsh environments. Aerospace and defense contractors are also vital customers, employing MEMS in highly sensitive navigation systems, advanced avionics, and unmanned aerial vehicles (UAVs). Furthermore, telecommunication equipment providers integrate specialized RF MEMS for signal filtering and switching in 5G infrastructure, while emerging sectors like environmental monitoring and smart infrastructure development are also increasingly adopting MEMS solutions, further diversifying the array of potential buyers for MEMS products and solutions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 21.5 billion |

| Market Forecast in 2032 | USD 49.0 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Sensortec GmbH, STMicroelectronics N.V., Broadcom Inc., Texas Instruments Inc., NXP Semiconductors N.V., TDK Corporation (Epson Toyocom), Analog Devices Inc., Knowles Corporation, Goertek Inc., Qorvo Inc., Murata Manufacturing Co. Ltd., Infineon Technologies AG, TE Connectivity Ltd., Honeywell International Inc., Sensata Technologies Inc., Microchip Technology Inc., Kionix Inc. (ROHM Co. Ltd.), OMRON Corporation, GE Sensing & Inspection Technologies, Panasonic Corporation, Denso Corporation, Fuji Electric Co., Ltd., Hitachi Ltd., Maxim Integrated (Analog Devices), Micron Technology Inc., Qualcomm Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micro-Electro-Mechanical System Market Key Technology Landscape

The technological landscape of the Micro-Electro-Mechanical System market is a dynamic arena, continuously reshaped by groundbreaking advancements in microfabrication techniques that enable the creation of increasingly smaller, more complex, and superior-performing devices. The foundational backbone of MEMS manufacturing primarily rests upon silicon-based processes, extensively leveraging methodologies borrowed from integrated circuit fabrication. These include highly precise techniques such as photolithography for patterning, various etching processes (e.g., Deep Reactive Ion Etching - DRIE for high aspect ratios, and wet etching for anisotropic features), and thin-film deposition methods (e.g., PVD, CVD) for material layering. These sophisticated processes are crucial for the meticulous patterning and sculpting of intricate three-dimensional microstructures on silicon wafers, which are indispensable for the diverse functionalities of MEMS components. Beyond traditional silicon, the industry is actively exploring and integrating advanced materials like piezoelectric ceramics, specialized polymers, amorphous silicon, and novel two-dimensional materials such as graphene, all of which are expanding the functional range and performance characteristics of next-generation MEMS devices.

Significant innovation is also being driven by advanced packaging technologies, which are vital for integrating miniature MEMS chips into robust, functional systems without compromising their delicate structures. Techniques such as Through-Silicon Vias (TSV) enable true 3D integration, while wafer-level packaging (WLP) and System-in-Package (SiP) solutions facilitate higher integration density, improved electrical performance, and drastically reduced form factors, all essential for the miniaturization demanded by contemporary end-products. Furthermore, the seamless integration of MEMS with wireless communication capabilities, sophisticated sensor fusion algorithms, and edge AI processing is dramatically enhancing the intelligence, connectivity, and autonomy of these devices, fostering their deployment within complex IoT ecosystems and autonomous systems. Emerging technological frontiers include microfluidics, enabling advanced lab-on-a-chip applications for point-of-care diagnostics, and continuous refinement of RF MEMS for high-frequency communication and tunable devices, collectively opening up vast new avenues for market growth and transformative applications. This synergistic convergence of advanced fabrication, innovative packaging, and intelligent integration technologies is absolutely pivotal in sustaining the rapid pace of innovation within the fiercely competitive MEMS industry.

Regional Highlights

- North America: This region stands as a formidable hub for MEMS innovation, research, and adoption, particularly within the highly demanding aerospace and defense, advanced medical technology, and high-tech consumer electronics sectors. It benefits immensely from substantial public and private R&D investments, a robust ecosystem of leading technology companies, pioneering research institutions, and a strong propensity for the early adoption of advanced MEMS solutions across autonomous systems, robotics, and smart infrastructure initiatives. Government funding agencies, such as DARPA, actively sponsor cutting-edge MEMS research, fostering continuous technological development and market expansion for novel applications like quantum MEMS and AI accelerators embedded at the edge. The region's vibrant venture capital environment further fuels innovation, pushing the boundaries of MEMS capabilities.

- Europe: Characterized by a highly sophisticated manufacturing base, particularly within the automotive industry and a strong focus on industrial automation, Europe represents a critical market for MEMS technology. Countries such as Germany, France, and the Netherlands lead in the integration of MEMS for precision engineering, critical automotive safety systems, and advanced smart factory applications, often driven by the Industry 4.0 paradigm. Furthermore, the region exhibits considerable growth in healthcare applications, including advanced diagnostics and therapeutic devices, and a growing emphasis on environmental monitoring solutions, propelled by stringent regulatory standards and an aging population requiring cutting-edge medical technologies. Initiatives like Horizon Europe also drive collaborative R&D in MEMS.

- Asia Pacific (APAC): The APAC region continues to solidify its position as the largest and most rapidly expanding market for MEMS globally, primarily attributed to its unparalleled dominance in consumer electronics manufacturing, a burgeoning and highly competitive automotive sector, and significant governmental investments in semiconductor technology and smart infrastructure development. Economic powerhouses such as China, South Korea, Japan, and Taiwan are at the forefront as major production hubs, capitalizing on immense scale manufacturing capabilities and an insatiable consumer demand for smartphones, wearables, IoT devices, and electric vehicles. The region is also witnessing intensified R&D efforts and strategic governmental support aimed at fostering indigenous MEMS development and reducing reliance on foreign technology.

- Latin America: This region represents an emerging and progressively significant market for MEMS technology, driven by increasing industrialization, urbanization, and a growing digital economy. There is a notable uptick in adoption within the automotive industry, particularly in countries like Brazil and Mexico, attributed to rising domestic vehicle production, stricter safety regulations, and the integration of advanced electronics. The consumer electronics market is also expanding, leading to a steady rise in demand for MEMS components in imported and domestically assembled devices. While still developing compared to other global powerhouses, Latin America offers substantial growth opportunities as its technological infrastructure matures and its manufacturing capabilities advance, alongside burgeoning applications in agricultural technology and natural resource management.

- Middle East and Africa (MEA): The MEA region is experiencing steady, albeit more nascent, growth in the MEMS market, largely propelled by ambitious government-led initiatives for economic diversification away from traditional oil-based economies and significant investments in smart city projects, such as NEOM in Saudi Arabia. The energy sector, particularly oil and gas exploration and production, demands specialized MEMS sensors for harsh environment monitoring and process control. Additionally, there is a growing impetus for advancements in healthcare infrastructure and telecommunications, leading to increased adoption of MEMS-enabled devices. The region's increasing focus on technological modernization and infrastructure development across various sectors is expected to substantially bolster the demand for MEMS products and solutions in the coming years, particularly in areas like asset tracking and environmental sensing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro-Electro-Mechanical System Market.- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Broadcom Inc.

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- TDK Corporation (Epson Toyocom)

- Analog Devices Inc.

- Knowles Corporation

- Goertek Inc.

- Qorvo Inc.

- Murata Manufacturing Co. Ltd.

- Infineon Technologies AG

- TE Connectivity Ltd.

- Honeywell International Inc.

- Sensata Technologies Inc.

- Microchip Technology Inc.

- Kionix Inc. (ROHM Co. Ltd.)

- OMRON Corporation

- GE Sensing & Inspection Technologies

- Panasonic Corporation

- Denso Corporation

- Fuji Electric Co., Ltd.

- Hitachi Ltd.

- Maxim Integrated (now part of Analog Devices)

- Micron Technology Inc.

- Qualcomm Technologies, Inc.

- Dacsa S.A. (Spain)

- Freudenberg Sealing Technologies (Germany)

- Silicon Sensing Systems Ltd. (UK)

Frequently Asked Questions

What are the primary applications of MEMS technology?

MEMS technology is widely applied across critical sectors, including automotive for advanced safety systems (e.g., airbag deployment, ADAS) and engine control, consumer electronics for ubiquitous devices like smartphones and wearables (e.g., accelerometers, gyroscopes, microphones), healthcare for pioneering medical implants and diagnostic devices, industrial automation for precision process control and robotics, and aerospace & defense for highly accurate navigation and control systems.

How is AI profoundly influencing the MEMS market?

AI is profoundly influencing the MEMS market by enabling intelligent data processing, enhancing predictive maintenance capabilities, and facilitating sophisticated sensor fusion from multiple MEMS devices. It fosters the development of smart edge computing devices, improves device calibration and self-correction, and optimizes both MEMS design and manufacturing processes, ultimately leading to more autonomous, efficient, and reliable systems.

What significant challenges currently face the growth of the MEMS market?

The MEMS market faces several significant challenges including substantial research and development costs, the inherent complexity and specialized nature of microfabrication processes, difficulties in integrating diverse MEMS components into larger, heterogeneous electronic systems, and the persistent lack of universal industry-wide standardization. These factors can collectively impede widespread market adoption and extend the time-to-market for innovative products.

Which geographical region currently dominates the global MEMS market, and what are the reasons?

The Asia Pacific (APAC) region currently dominates the global MEMS market. This dominance is primarily driven by its unparalleled strength in consumer electronics manufacturing, a rapidly expanding and technologically advanced automotive industry, and substantial governmental investments aimed at boosting the semiconductor sector and developing smart infrastructure. The immense consumer demand for smart and connected devices also significantly contributes to its market leadership.

What are the core types of MEMS devices and their fundamental functions?

MEMS devices are fundamentally categorized into two core types: sensors and actuators. Key sensor types include accelerometers (measuring acceleration), gyroscopes (measuring angular velocity), pressure sensors, microphones, and RF MEMS (for wireless communication). Key actuator types include microfluidic devices (manipulating fluids), micro-pumps, and inkjet print heads, each designed to perform specific mechanical or physical tasks at the micro-scale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wireless Microphone Market Size Report By Type (Handheld, Clip On, Bodypack, Micro-Electro-Mechanical System (MEMS) Microphone, Electret Condenser Microphone (ECMS)), By Application (Entertainment, Corporate, Education), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Semiconductor Stepper Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Immersion, Dry, EUV, ArF, KrF, G,H,I-Line), By Application (Micro-Electro-Mechanical System (MEMS), LED Devices, Advanced Packaging, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager