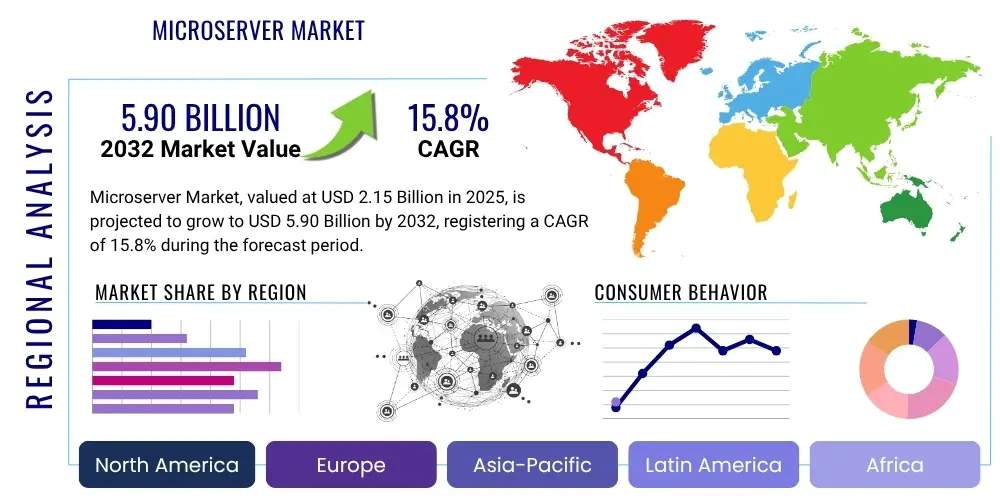

Microserver Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429253 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Microserver Market Size

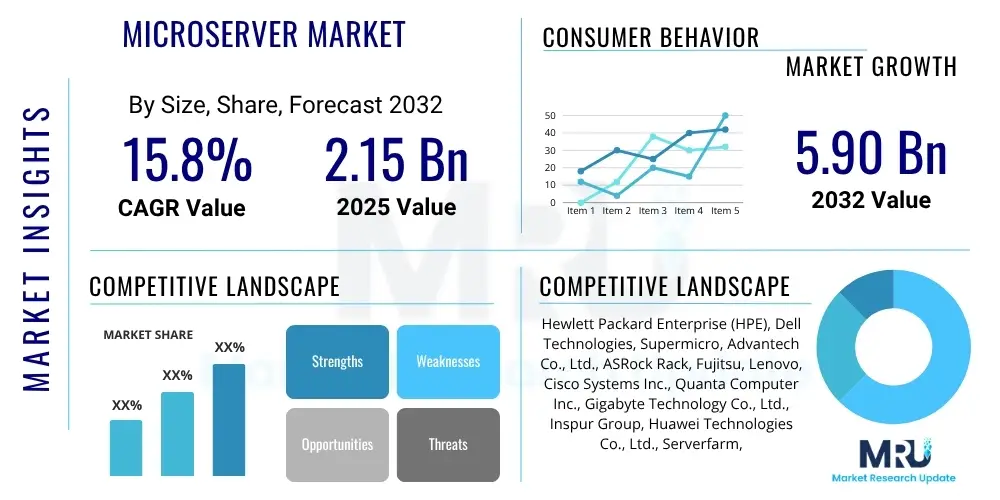

The Microserver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2025 and 2032. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 5.90 Billion by the end of the forecast period in 2032. This robust growth trajectory is primarily driven by the increasing demand for energy-efficient, space-saving, and cost-effective computing solutions across various industries, particularly for workloads that prioritize high density and low power consumption over raw computational power.

The continuous expansion of cloud computing, the proliferation of edge computing deployments, and the escalating data volumes generated by IoT devices are significant catalysts propelling the microserver market forward. Organizations are increasingly seeking infrastructure solutions that can manage distributed workloads effectively while minimizing operational expenditure and environmental footprint. Microservers, with their optimized design for specific tasks, offer a compelling alternative to traditional servers in these scenarios, ensuring sustained market expansion throughout the forecast period.

Microserver Market introduction

The Microserver Market encompasses compact, low-power server units designed for specific, often distributed, computing tasks. These servers typically feature multiple independent compute nodes, each containing its own processor, memory, and storage, integrated into a shared chassis. This architecture allows for high density, energy efficiency, and modular scalability, making them suitable for environments where space and power are premium considerations. Microservers are built to handle horizontal scaling, efficiently running numerous parallel workloads rather than a few highly intensive ones.

Key applications of microservers span a wide array of sectors, including web hosting, cloud computing infrastructure, edge computing, content delivery networks (CDNs), big data analytics, and Internet of Things (IoT) deployments. They excel in scenarios requiring thousands of simultaneous, moderately demanding tasks, such as serving static web pages, processing transaction logs, or managing vast numbers of connected devices. Their compact form factor and lower power draw contribute to significant operational savings, reducing both electricity consumption and cooling requirements in data centers.

The primary benefits of adopting microservers include substantial reductions in total cost of ownership (TCO) through lower power consumption, increased rack density, and simplified management for scaled-out applications. These systems provide a cost-effective and environmentally friendly approach to managing modern, distributed workloads. Driving factors for the microserver market include the escalating demand for scalable and flexible IT infrastructure, the shift towards cloud-native architectures, the rapid growth of data at the edge, and the imperative for organizations to optimize their data center energy efficiency in response to rising energy costs and environmental concerns.

Microserver Market Executive Summary

The microserver market is experiencing dynamic growth, propelled by several converging business, regional, and segment trends. From a business perspective, there is an accelerating shift towards hyperscale data center operations and the proliferation of edge computing infrastructures, both of which heavily leverage microserver architectures for their efficiency and scalability. Enterprises are increasingly recognizing the economic advantages and performance suitability of microservers for horizontally scalable workloads, leading to broader adoption beyond traditional web hosting into areas like big data processing and artificial intelligence inference at the edge. The demand for compact, power-efficient solutions that can reduce operational expenditure (OpEx) remains a core driver, shaping procurement strategies across industries.

Regionally, North America and Europe currently dominate the microserver market due to the presence of major cloud service providers, early adoption of advanced data center technologies, and robust IT infrastructure. However, the Asia Pacific (APAC) region is poised for the most rapid growth, fueled by rapid digitalization, increasing internet penetration, expanding data center construction, and government initiatives promoting digital transformation. Emerging economies in Latin America, the Middle East, and Africa are also showing promising signs of growth as they modernize their IT landscapes and invest in localized data processing capabilities, especially for telecommunications and nascent cloud services.

Segmentation trends highlight a growing interest in ARM-based processors within the microserver domain, challenging the traditional dominance of x86 architecture, primarily due to ARM's superior power efficiency for specific workloads. Applications such as web hosting, content delivery, and edge analytics continue to be strongholds, but there is also emerging demand from new use cases like private cloud deployments and specialized High-Performance Computing (HPC) clusters. The market is also seeing innovation in terms of integration with software-defined infrastructure and containerization technologies, enhancing the flexibility and manageability of microserver deployments. These trends collectively underscore a vibrant market evolution, geared towards optimized, scalable, and sustainable computing solutions.

AI Impact Analysis on Microserver Market

Common user questions regarding AI's impact on the Microserver Market frequently revolve around whether microservers are powerful enough for AI workloads, if AI will increase or decrease demand for these systems, and how microservers contribute to AI at the edge. Users often inquire about the specialized hardware requirements for AI, particularly for inference tasks, and how microservers fit into the broader AI computing landscape, especially concerning energy efficiency and data locality. There is also interest in understanding if the rise of AI will necessitate a complete overhaul of server infrastructure or if microservers can be effectively integrated for specific AI-driven functions.

Based on these inquiries, key themes indicate a strong expectation for microservers to play a crucial role in the distributed and energy-efficient execution of AI workloads, particularly for inference at the edge rather than intensive training. Users anticipate that microservers will be optimized for lower-power AI accelerators and specialized chipsets, enabling real-time data processing closer to the source of data generation. Concerns often touch upon balancing the need for computational power with the inherent low-power design of microservers, suggesting a focus on specific AI tasks that align with microserver strengths. The market anticipates an increased demand for microservers equipped to handle the unique demands of AI, emphasizing efficiency, scalability, and integration capabilities for evolving AI ecosystems.

The integration of AI capabilities, particularly for inference, is expected to significantly drive the evolution and adoption of microservers. As AI models become more ubiquitous and are deployed in real-world scenarios across various industries, the need for efficient, low-latency processing at the edge becomes paramount. Microservers, with their compact form factor and energy-efficient architecture, are ideally suited to meet these demands, enabling AI-powered applications to operate closer to data sources in environments where power and space are limited. This convergence positions microservers as a critical component in the expanding AI infrastructure, supporting the decentralized nature of many AI applications.

- Enhanced processing capabilities for AI inference at the edge, driving demand for specialized microserver configurations.

- Optimized power consumption for continuous AI operations in distributed environments, reducing operational costs.

- Increased demand for microservers to support localized AI model deployment, enabling faster decision-making and reduced network latency.

- Development of microservers with integrated AI accelerators and specialized System-on-Chips (SoCs) for specific AI tasks.

- Expansion of microserver applications in smart cities, autonomous vehicles, industrial IoT, and surveillance for AI-driven analytics.

- Focus on energy-efficient AI infrastructure, where microservers offer a sustainable solution compared to traditional high-power servers.

DRO & Impact Forces Of Microserver Market

The Microserver Market is significantly influenced by a confluence of driving forces, restraining factors, and emerging opportunities. Key drivers include the exponential growth in cloud computing services and the corresponding need for scalable, power-efficient data center infrastructure. The escalating demand for data center optimization, characterized by a focus on reducing operational costs and environmental impact, further propels microserver adoption. Additionally, the rapid proliferation of edge computing deployments, driven by IoT devices and real-time data processing requirements, positions microservers as an ideal solution for distributed workloads due to their compact size and low power consumption. The continuous evolution of processors, particularly ARM-based architectures, offering improved performance per watt, also acts as a strong market driver.

However, the market faces several restraints that could impede its growth. Performance limitations for highly intensive, single-threaded workloads remain a challenge, as microservers are primarily optimized for horizontally scalable, parallel tasks. Intense competition from traditional enterprise servers, which continue to evolve with enhanced efficiency and versatility, also poses a significant hurdle. Furthermore, concerns regarding vendor lock-in, the complexity of integrating diverse microserver architectures into existing IT ecosystems, and the initial investment required for transitioning infrastructure can deter potential adopters. The perception that microservers are less robust for mission-critical applications compared to conventional servers also acts as a psychological barrier for some enterprises.

Despite these restraints, abundant opportunities exist for market expansion. The increasing demand for AI and Machine Learning (ML) inference capabilities at the edge creates a lucrative niche for microservers, which can efficiently process data closer to its source. The ongoing rollout of 5G infrastructure globally necessitates compact, low-power computing solutions for base stations and network edge locations, presenting a substantial growth avenue. Moreover, specialized High-Performance Computing (HPC) applications requiring modular and energy-efficient processing units, and the emergence of new markets in developing regions undergoing digital transformation, offer significant growth potential. Impact forces include rapid technological advancements in processor design, evolving data center energy efficiency regulations, and economic factors influencing IT infrastructure spending, all of which shape the competitive landscape and adoption patterns.

Segmentation Analysis

The Microserver Market is meticulously segmented to provide a granular understanding of its diverse landscape and to identify key growth areas. These segmentations are critical for stakeholders to tailor products, services, and strategies effectively, addressing the specific needs of various end-users and applications. The market is primarily analyzed based on processor type, application, end-use industry, and component, each offering unique insights into market dynamics and growth drivers. Understanding these segments allows for targeted innovation and market penetration strategies, aligning product development with evolving industry demands and technological shifts.

The segmentation by processor type, for instance, highlights the competitive landscape between traditional x86 architectures and the rapidly advancing ARM-based processors, which are gaining traction due to their superior power efficiency for certain workloads. Application-based segmentation underscores the primary use cases driving demand, from foundational web hosting to cutting-edge edge computing and AI inference. End-use industry analysis reveals the verticals most actively adopting microserver technology, such as IT & Telecom and BFSI, offering insights into industry-specific requirements and growth potential. Finally, the component segmentation distinguishes between hardware and associated software, emphasizing the comprehensive solutions required for microserver deployment and management, including virtualization and orchestration platforms.

- By Processor Type

- x86 (Intel Atom, Intel Xeon D, AMD Opteron X)

- ARM-based Processors

- Other (e.g., RISC-V)

- By Application

- Web Hosting

- Cloud Computing

- Data Centers

- Edge Computing

- Big Data Analytics

- IoT (Internet of Things)

- Content Delivery Networks (CDNs)

- Virtualization

- Other (e.g., Specialized HPC, Private Cloud)

- By End-Use Industry

- IT & Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Retail & Consumer Goods

- Manufacturing

- Healthcare

- Government & Public Sector

- Education

- Media & Entertainment

- Other (e.g., Energy, Transportation)

- By Component

- Hardware (Servers, Networking Components, Storage Devices)

- Software (Operating Systems, Virtualization Software, Management Software)

Value Chain Analysis For Microserver Market

The value chain for the Microserver Market commences with upstream activities involving key component suppliers. This segment includes manufacturers of processors (such as Intel, AMD, and ARM licensees), memory modules (DRAM, NAND flash), storage devices (SSDs, HDDs), and network interface cards. These suppliers play a critical role in providing the foundational technologies and raw materials that dictate the performance, efficiency, and cost of microserver units. Innovation and strategic partnerships within this upstream segment are crucial for driving advancements in microserver capabilities, particularly in areas like power efficiency and computational density, directly impacting the downstream offerings and market competitiveness.

Moving downstream, the value chain progresses through microserver manufacturers and system integrators who assemble, configure, and often customize these components into complete server systems. These entities are responsible for the design, manufacturing, quality control, and testing of microserver units and integrated racks. Further down the chain, solution providers and data center operators integrate microservers into larger IT infrastructures, often bundling them with software-defined networking, virtualization, and cloud management platforms. This phase focuses on delivering scalable, manageable, and performant computing environments to the ultimate end-users, ensuring seamless operation and optimal resource utilization.

The distribution channels for microservers are typically bifurcated into direct and indirect models. Direct sales involve manufacturers selling directly to large enterprises, hyperscale cloud providers, and government entities, often through dedicated sales teams and customized contracts. This approach allows for direct communication, tailored solutions, and stronger client relationships. Indirect channels involve a network of value-added resellers (VARs), distributors, and system integrators who market and sell microservers to a broader range of small and medium-sized enterprises (SMEs) and specialized niche markets. These partners often provide additional services such as installation, maintenance, and support, thereby extending the market reach of microserver manufacturers and providing comprehensive solutions to end-users who may lack extensive in-house IT expertise. Both direct and indirect channels are vital for market penetration and catering to the diverse purchasing preferences and technical requirements of various customer segments.

Microserver Market Potential Customers

Potential customers for the Microserver Market represent a broad spectrum of entities driven by the need for scalable, energy-efficient, and cost-effective computing solutions. Cloud service providers stand as primary buyers, requiring vast numbers of servers to host web applications, virtual machines, and storage services for their global clientele. Their imperative for high density and low operational costs aligns perfectly with the microserver value proposition. Similarly, telecommunication companies are increasingly adopting microservers to power 5G infrastructure, network function virtualization (NFV), and edge computing nodes, enabling faster data processing closer to end-users and reducing network latency.

Beyond these large-scale operators, enterprises of varying sizes are critical end-users. Small and medium-sized enterprises (SMEs) often leverage microservers for basic web hosting, file storage, and running specific departmental applications due to their affordability and ease of deployment. Larger enterprises utilize microservers within their data centers for specific workloads such as big data analytics, content delivery, and specialized internal cloud deployments, aiming to optimize resource utilization and energy consumption. Government agencies and research institutions also form a significant customer base, employing microservers for scientific computing, data archiving, and supporting various digital initiatives where modularity and efficiency are paramount.

Furthermore, the rapid expansion of the Internet of Things (IoT) ecosystem positions IoT device manufacturers and solution providers as growing potential customers. Microservers are ideal for processing and analyzing the enormous volumes of data generated by IoT devices at the edge, reducing the reliance on centralized cloud resources and enabling real-time decision-making. Industries like retail, manufacturing, and healthcare are increasingly investing in edge-based IoT solutions, driving demand for compact, rugged, and efficient microserver units capable of operating in diverse environments outside traditional data centers. This diversified demand across industries underscores the versatility and broad applicability of microserver technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2032 | USD 5.90 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hewlett Packard Enterprise (HPE), Dell Technologies, Supermicro, Advantech Co., Ltd., ASRock Rack, Fujitsu, Lenovo, Cisco Systems Inc., Quanta Computer Inc., Gigabyte Technology Co., Ltd., Inspur Group, Huawei Technologies Co., Ltd., Serverfarm, Penguin Computing (a subsidiary of SMART Global Holdings), StackVelocity, ZT Systems, Eaton Corporation, Vertiv Holdings Co., Iron Mountain Inc., Equinix, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microserver Market Key Technology Landscape

The technology landscape of the Microserver Market is characterized by continuous innovation aimed at optimizing performance, power efficiency, and density. At the core are various processor architectures, predominantly x86-based processors such as Intel Atom and Xeon D, and AMD Opteron X series, which have historically dominated the server market. However, ARM-based processors are rapidly gaining significant traction due to their inherently lower power consumption and high core count densities, making them exceptionally well-suited for scaled-out workloads and edge computing scenarios. This competition between processor types is driving significant advancements in instruction set architectures and System-on-Chip (SoC) designs, which integrate multiple functionalities onto a single chip for enhanced efficiency.

Beyond processors, the microserver technology landscape encompasses advancements in memory and storage solutions. The adoption of high-speed, energy-efficient DDR4 and increasingly DDR5 RAM is crucial for balancing performance with power constraints. Similarly, the shift towards NVMe SSDs (Non-Volatile Memory Express Solid State Drives) for faster data access and boot times, alongside traditional HDDs for bulk storage, defines the storage tier. Networking components are also critical, with integration of 10 Gigabit Ethernet (10GbE) and even 25/50/100GbE for high-throughput applications, ensuring efficient data flow between microserver nodes and the broader network infrastructure. These hardware innovations collectively contribute to the compact, modular design philosophy of microservers.

Furthermore, software-defined infrastructure plays an integral role in maximizing the utility and manageability of microserver deployments. Technologies such as virtualization (e.g., VMware, KVM), containerization (e.g., Docker, Kubernetes), and cloud orchestration platforms are essential for efficiently deploying, managing, and scaling workloads across microserver clusters. Advanced cooling solutions, including liquid cooling and optimized airflow designs, are also becoming more prevalent to manage thermal dissipation in high-density microserver racks, contributing to overall energy efficiency. The convergence of these hardware and software innovations defines the robust and evolving technological foundation of the microserver market, enabling greater flexibility, automation, and operational efficiency for diverse computing needs.

Regional Highlights

- North America: Dominates the microserver market, driven by the strong presence of hyperscale data centers, major cloud service providers, and a high rate of technological adoption. Significant investments in advanced IT infrastructure and edge computing deployments across various industries contribute to its leading position. The region benefits from robust R&D activities and a mature ecosystem for server hardware and software.

- Europe: A significant market for microservers, characterized by increasing digitalization, a strong focus on energy efficiency in data centers, and the implementation of stringent environmental regulations. Countries like Germany, the UK, and France are leading the adoption, particularly in telecommunications, manufacturing, and BFSI sectors, driven by the need for localized data processing and cloud expansion.

- Asia Pacific (APAC): Projected to be the fastest-growing region in the microserver market. This growth is fueled by rapid industrialization, widespread internet penetration, and aggressive investments in data center construction and digital infrastructure, especially in emerging economies like China, India, and Southeast Asian countries. The expansion of e-commerce, smart cities, and IoT initiatives are key accelerators.

- Latin America: An emerging market experiencing steady growth due to increasing digital transformation efforts, rising internet usage, and investments in cloud infrastructure and telecommunication networks. Countries such as Brazil and Mexico are at the forefront, with growing demand from local enterprises and government bodies seeking cost-effective and scalable IT solutions.

- Middle East and Africa (MEA): Demonstrates nascent but promising growth, driven by government initiatives to diversify economies away from oil, increased adoption of cloud services, and the development of smart city projects. Investments in data centers and telecommunications infrastructure in countries like the UAE, Saudi Arabia, and South Africa are creating new opportunities for microserver adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microserver Market.- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Supermicro

- Advantech Co., Ltd.

- ASRock Rack

- Fujitsu

- Lenovo

- Cisco Systems Inc.

- Quanta Computer Inc.

- Gigabyte Technology Co., Ltd.

- Inspur Group

- Huawei Technologies Co., Ltd.

- Serverfarm

- Penguin Computing (a subsidiary of SMART Global Holdings)

- StackVelocity

- ZT Systems

- Eaton Corporation

- Vertiv Holdings Co.

- Iron Mountain Inc.

- Equinix, Inc.

Frequently Asked Questions

What is a microserver and how does it differ from traditional servers?

A microserver is a compact, low-power server designed for specific, often distributed, computing tasks. Unlike traditional servers that prioritize raw processing power for intensive workloads, microservers emphasize energy efficiency, high density, and modular scalability for tasks such as web hosting and edge computing.

What are the primary applications of microservers in today's IT infrastructure?

Microservers are predominantly used in web hosting, cloud computing infrastructure, edge computing, content delivery networks (CDNs), big data analytics, and Internet of Things (IoT) deployments due to their efficiency in handling numerous parallel, moderately demanding tasks.

How do microservers contribute to energy efficiency in data centers?

Microservers are designed with lower power consumption per node and a higher density per rack unit compared to traditional servers. This design significantly reduces overall electricity usage and cooling requirements, leading to substantial energy savings and a lower operational footprint for data centers.

What role do ARM-based processors play in the microserver market?

ARM-based processors are increasingly significant in the microserver market due to their superior power efficiency and high core count densities, making them ideal for scaled-out workloads and specialized edge computing applications where performance per watt is a critical metric.

How is AI impacting the demand and development of microservers?

AI is driving demand for microservers, particularly for inference workloads at the edge, where efficient, low-latency processing is crucial. This is leading to the development of microservers with integrated AI accelerators and specialized SoCs to support distributed AI applications and real-time data analysis closer to the source.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager