Military Transmit and Receive Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431186 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Military Transmit and Receive Module Market Size

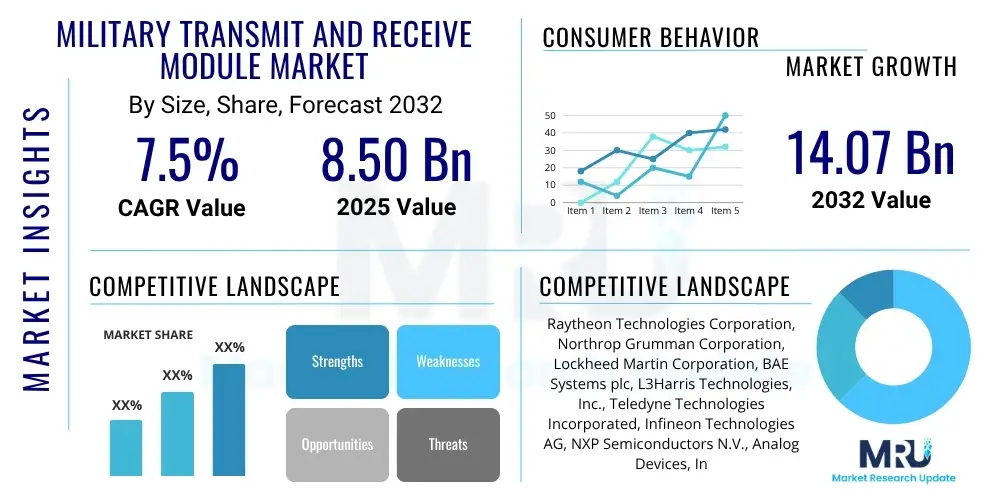

The Military Transmit and Receive Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 8.50 Billion in 2025 and is projected to reach USD 14.07 Billion by the end of the forecast period in 2032.

Military Transmit and Receive Module Market introduction

The Military Transmit and Receive Module market represents a foundational and rapidly evolving segment within the broader defense electronics industry, providing essential components for modern military radar, electronic warfare (EW), and sophisticated communication systems. These modules, commonly known as T/R modules, are compact, high-performance integrated circuits designed to efficiently transmit high-power radio frequency (RF) signals and sensitively receive weak incoming signals. They are indispensable for enabling the advanced capabilities required in today's complex and contested operational environments, serving as the core building blocks for Active Electronically Scanned Array (AESA) technology which is critical for next-generation defense platforms.

A typical Military Transmit and Receive Module incorporates a multitude of functionalities within a small footprint, including power amplifiers (PAs) for transmission, low noise amplifiers (LNAs) for reception, phase shifters, attenuators, and control circuitry. These components are increasingly leveraging advanced semiconductor materials such as Gallium Nitride (GaN) and Gallium Arsenide (GaAs). GaN, in particular, offers superior power density, higher efficiency, and better thermal performance, which are crucial attributes for military applications demanding robust operation under extreme conditions. The integration of these advanced materials allows for the development of modules that deliver enhanced performance while simultaneously reducing Size, Weight, Power, and Cost (SWaP-C), a paramount concern for modern military platform designers.

The major applications of these modules span across critical defense domains, including advanced AESA radars used in fighter aircraft, naval vessels, and ground-based air defense systems for unparalleled situational awareness and precision targeting. They are also vital for electronic warfare systems, facilitating jamming, deception, and electronic protection against adversary threats, as well as enabling secure, high-bandwidth communication links for command, control, and intelligence gathering. The benefits derived from these sophisticated modules are manifold: they provide significantly extended detection and tracking ranges, dramatically improve targeting accuracy, enable higher data rates for critical communications, and facilitate multi-mission capabilities from a single system. The market is primarily propelled by escalating global defense expenditures, ongoing military modernization initiatives aimed at replacing legacy systems, the persistent demand for more sophisticated and multi-functional surveillance and engagement systems, and increasing geopolitical instability driving nations to enhance their defensive and offensive capabilities.

Military Transmit and Receive Module Market Executive Summary

The Military Transmit and Receive Module market is projected for substantial growth, driven by an accelerating global defense landscape marked by modernization and technological innovation. Business trends highlight a strong industry focus on advanced materials science, with significant research and development investments directed towards Gallium Nitride (GaN) technology due to its superior power handling, efficiency, and thermal characteristics. Manufacturers are increasingly adopting modular and open-architecture designs to enhance system flexibility, reduce integration complexities, and facilitate easier upgrades and maintenance throughout the product lifecycle. Miniaturization remains a key strategic imperative, addressing the stringent Size, Weight, Power, and Cost (SWaP-C) requirements of next-generation defense platforms. The market also exhibits a trend towards increased collaboration and consolidation among defense prime contractors and specialized component suppliers, aimed at pooling expertise, streamlining supply chains, and achieving economies of scale in this highly capital-intensive sector.

From a regional perspective, North America continues to hold the dominant market share, primarily attributed to the substantial defense budget of the United States, its robust defense industrial base, and its leadership in military technology innovation. This region benefits from significant government funding for advanced radar, electronic warfare, and communication system development. The Asia Pacific region is poised to be the fastest-growing market, propelled by rapidly increasing defense expenditures from major economies like China, India, Japan, and South Korea, all of whom are actively engaged in comprehensive military modernization programs and indigenous technology development. European countries, including the UK, France, and Germany, demonstrate consistent investment in T/R module technologies to maintain technological parity and enhance their national security postures, often through multinational defense initiatives. The Middle East and Africa (MEA) region also contributes to market growth, driven by geopolitical instability and the strategic imperative to acquire advanced defense systems.

Segmentation analysis reveals key areas of market concentration and growth. The radar systems application segment is anticipated to maintain its leading market position, underscoring the indispensable role of advanced radar in modern defense for surveillance, targeting, and air defense. However, the electronic warfare (EW) segment is projected to experience the most rapid growth, fueled by the escalating sophistication of adversarial threats and the urgent global demand for enhanced electronic protection and attack capabilities. Technologically, GaN-based modules are swiftly gaining market share and are expected to be the fastest-growing segment, gradually replacing older Gallium Arsenide (GaAs) and Silicon Germanium (SiGe) technologies in new designs due to their performance advantages. In terms of frequency bands, the X-band remains highly versatile and widely adopted for its optimal balance of range and resolution, while demand for Ku-band and Ka-band modules is growing for satellite communications and high-resolution imaging applications, reflecting a diversified technological adoption across various defense needs.

AI Impact Analysis on Military Transmit and Receive Module Market

There is a growing discourse among industry stakeholders and end-users regarding the transformative potential of Artificial Intelligence (AI) on the Military Transmit and Receive Module market. Common user questions often revolve around how AI can enhance the performance capabilities of these modules, particularly in dynamic and contested environments. Users are keen to understand AI's role in optimizing signal processing, enabling cognitive electronic warfare, facilitating autonomous decision-making within integrated systems, and its implications for real-time threat analysis and data security. There is a strong expectation that AI will usher in a new era of adaptability and intelligence for T/R modules, transitioning them from static components to dynamic, learning systems that can intelligently perceive, adapt, and respond to complex, rapidly evolving combat scenarios. However, the integration of AI also raises significant concerns related to cybersecurity vulnerabilities, the reliability and trustworthiness of autonomous systems in critical defense applications, and the ethical considerations surrounding AI-driven warfare, demanding robust frameworks for secure and responsible deployment.

- AI-driven cognitive electronic warfare for dynamic, adaptive jamming and intelligent countermeasure selection against complex threats.

- Enhanced signal processing and target detection through AI algorithms, improving the classification and tracking of elusive targets.

- Predictive maintenance for T/R modules, utilizing AI to monitor component health and predict failures, thereby increasing operational readiness and reducing downtime.

- Integration of T/R modules with autonomous military platforms, enabling self-organizing radar networks and intelligent communication routing.

- Real-time situational awareness improvements via AI-powered sensor fusion, processing data from multiple T/R modules for comprehensive threat assessment.

- Automated beamforming and steering optimization, allowing T/R modules to intelligently direct RF energy for improved spectral efficiency and covert operations.

- Development of AI-enabled resilient communication links, enhancing resistance to jamming and cyberattacks through intelligent frequency hopping and modulation.

DRO & Impact Forces Of Military Transmit and Receive Module Market

The Military Transmit and Receive Module market is profoundly shaped by a confluence of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and evolutionary path. Key drivers underpinning market expansion include the consistent and often increasing global defense budgets, which are frequently propelled by escalating geopolitical tensions, regional conflicts, and the perceived need for enhanced national security. This financial commitment enables nations to invest heavily in advanced defense capabilities. Furthermore, ongoing military modernization initiatives worldwide, focused on upgrading legacy systems with cutting-edge radar, electronic warfare, and communication technologies, significantly bolster demand for high-performance T/R modules. Technological advancements, particularly in semiconductor materials like Gallium Nitride (GaN) and Gallium Arsenide (GaAs), which offer superior power, efficiency, and frequency performance, act as crucial market accelerators. The growing emphasis on multi-functional systems that can integrate multiple capabilities (e.g., radar, EW, communications) within a single module also drives innovation and adoption.

However, several significant restraints pose challenges to the market's unbridled growth. The exceptionally high costs associated with the research, development, and sophisticated manufacturing processes of these advanced modules create substantial barriers to market entry and often lead to protracted product development cycles. Strict government regulations, complex export control policies, and rigorous certification requirements imposed by defense agencies further complicate market access and increase compliance burdens for manufacturers. The inherently long procurement cycles characteristic of defense acquisition programs often result in delayed orders, extended revenue recognition periods, and necessitate long-term financial planning. Additionally, the reliance on a limited number of highly specialized suppliers for critical raw materials and components can introduce supply chain vulnerabilities, potential bottlenecks, and expose manufacturers to pricing pressures, impacting overall production efficiency and cost-effectiveness.

Despite these impediments, the market presents compelling opportunities for growth and innovation. The expanding adoption of Gallium Nitride (GaN) technology across an increasingly wider array of military platforms represents a primary growth avenue, as GaN modules continue to demonstrate unmatched performance advantages over older technologies. Emerging markets in the Asia Pacific and the Middle East, characterized by their rapidly increasing defense expenditures and strategic aspirations, offer significant untapped potential for new sales, strategic partnerships, and technology transfer initiatives. Moreover, the escalating focus on integrating robust cybersecurity measures within all defense electronics, including T/R modules, creates new demand for secure hardware and software solutions that can withstand sophisticated cyber threats. The continuous push for miniaturization and enhanced integration of multiple functionalities into single, highly compact modules also opens doors for innovative product development, expanding the utility and cost-effectiveness for end-users. The broader impact forces, such as the dynamic geopolitical climate directly influencing defense spending, economic fluctuations affecting national budgets, and the rapid pace of technological obsolescence necessitating continuous R&D investment, collectively shape the competitive landscape and strategic direction of the market.

Segmentation Analysis

The Military Transmit and Receive Module market is meticulously segmented to offer a granular understanding of its diverse components, technological underpinnings, and extensive application spectrum. This comprehensive segmentation provides invaluable insights for market stakeholders, enabling the identification of high-growth niches, understanding competitive dynamics, and formulating targeted strategic initiatives. The market's structure is primarily categorized based on the foundational semiconductor material utilized, the specific application domain of the module, the military platform into which it is integrated, and the operational frequency band it is designed to operate within, each offering distinct performance characteristics and market relevance.

Segmentation by type highlights the critical role of semiconductor technology in defining module performance and efficiency. Gallium Nitride (GaN) modules represent the cutting edge, offering superior power density, higher breakdown voltage, and improved thermal characteristics, making them increasingly preferred for high-power radar and electronic warfare systems. Gallium Arsenide (GaAs) technology, while mature, remains vital for specific applications demanding extremely low noise amplification and high-frequency operation, particularly in smaller systems. Silicon Germanium (SiGe) modules are also present, often utilized in more cost-sensitive applications or where integration with silicon CMOS processes is advantageous. The application segmentation delineates the primary use cases, with radar systems and electronic warfare (EW) dominating due to their critical role in modern defense. Communication systems, missile guidance, and other specialized applications such as Identification Friend or Foe (IFF) and navigation systems constitute other important segments, each demanding tailored module designs and performance parameters.

Further segmentation by platform categorizes modules based on their deployment environment, recognizing the unique design and operational constraints of different military assets. Airborne platforms, encompassing fighter jets, bombers, and unmanned aerial vehicles (UAVs), require modules that are exceptionally lightweight, compact, and resilient to extreme temperatures and vibrations. Naval platforms, including frigates, destroyers, and aircraft carriers, demand robust modules capable of enduring harsh marine environments and often requiring higher power output for long-range surveillance. Ground-based systems, such as mobile radar units, armored vehicles, and static air defense installations, prioritize ruggedness and reliability. The emerging space platform segment, for satellites and orbital assets, emphasizes radiation hardening, extreme reliability, and minimal SWaP-C. Lastly, segmentation by frequency band addresses the specific portions of the electromagnetic spectrum in which the modules operate, ranging from lower L-Band for long-range surveillance and air traffic control to higher C-band, X-band, Ku-band, Ka-band, and millimeter-wave (mmWave) bands for high-resolution imaging, precision targeting, and secure, high-bandwidth communication, each offering specific advantages for diverse military operational requirements and dictating distinct design considerations.

- By Type:

- Gallium Nitride (GaN)

- Gallium Arsenide (GaAs)

- Silicon Germanium (SiGe)

- By Application:

- Radar Systems

- Electronic Warfare (EW) Systems

- Communication Systems

- Missile Guidance

- Other Applications (e.g., IFF, Navigation, Target Acquisition)

- By Platform:

- Airborne (e.g., Fighter Jets, UAVs, Reconnaissance Aircraft)

- Naval (e.g., Frigates, Destroyers, Aircraft Carriers, Submarines)

- Ground Based (e.g., Mobile Radar, Vehicle-Mounted Systems, Static Installations)

- Space (e.g., Satellites, Orbital Platforms)

- By Frequency Band:

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- Ka-Band

- Millimeter Wave (mmWave)

Value Chain Analysis For Military Transmit and Receive Module Market

The value chain for the Military Transmit and Receive Module market is a complex, multi-tiered structure characterized by specialized expertise, rigorous quality control, and close collaboration among various stakeholders. The upstream segment of this value chain is centered on fundamental research and development, along with the provision of critical raw materials and foundational components. This involves suppliers of high-purity semiconductor wafers, such as silicon carbide (SiC) substrates for Gallium Nitride (GaN) devices and Gallium Arsenide (GaAs) substrates, which are essential for high-performance RF components. Manufacturers of specialized passive components like capacitors, resistors, inductors, and filters, along with providers of advanced packaging solutions, also form a crucial part of the upstream segment. This initial phase is highly capital-intensive and research-driven, requiring deep scientific knowledge in materials science, semiconductor physics, and advanced manufacturing processes to produce the high-reliability, high-performance foundations demanded by military specifications.

Moving further down the value chain, the core manufacturing of the T/R modules themselves takes place. This stage is typically undertaken by specialized microelectronics companies, often with dedicated defense divisions, or by the in-house manufacturing arms of larger defense prime contractors. It encompasses the intricate design and fabrication of Monolithic Microwave Integrated Circuits (MMICs), which integrate multiple RF functionalities onto a single chip. These MMICs are then assembled onto substrates, integrated with other discrete components, and encased in robust housings to form the complete T/R module. This stage involves sophisticated assembly techniques, precision engineering, and extensive testing and qualification processes to ensure that each module meets the stringent military standards for performance, environmental resilience, and reliability under extreme operational conditions. The downstream segment of the value chain is dominated by defense prime contractors and large-scale system integrators. These entities procure the completed T/R modules and integrate them into larger, complex defense systems, such as advanced AESA radar arrays, comprehensive electronic warfare suites, or secure satellite communication terminals for various military platforms. They are responsible for the overall system design, extensive system-level testing, and final delivery to the ultimate end-users.

The distribution channels for Military Transmit and Receive Modules are predominantly direct, reflecting the highly specialized nature of the product, the strategic importance of national security applications, and the need for close technical collaboration. Direct sales facilitate a close working relationship between the module manufacturers and defense prime contractors or governmental defense agencies. This model allows for highly customized solutions, ensures intellectual property protection, and enables stringent quality control and supply chain visibility throughout the procurement process. Due to the sensitive nature and bespoke requirements of these components, indirect distribution channels involving commercial distributors are less common, although specialized defense distributors may handle logistics for specific sub-components, repair parts, or support smaller contractors in certain regions. However, for core system integration and strategic procurements, direct engagement between the manufacturer and the system integrator or government remains the prevailing and preferred model, fostering long-term strategic relationships crucial for national defense capabilities and technological development.

Military Transmit and Receive Module Market Potential Customers

The primary potential customers and ultimate end-users for Military Transmit and Receive Modules are governmental defense organizations and the major defense prime contractors they partner with. These entities are directly responsible for national security, defense planning, and the procurement of advanced military equipment globally. At the highest level, Ministries of Defense and analogous governmental bodies in various countries dictate strategic defense requirements, allocate substantial budgets, and drive the acquisition processes for military platforms. These modules are fundamental components for both modernizing existing military assets and developing entirely new generations of defense systems, making these governmental organizations indispensable clients for T/R module manufacturers.

Within these governmental defense structures, specific branches of the armed forces—including the Army, Navy, and Air Force—represent distinct customer segments, each possessing unique operational requirements that influence the demand for specialized T/R modules. For instance, naval forces require modules optimized for robust performance in maritime radar and electronic warfare systems, capable of withstanding corrosive saltwater environments and extreme weather conditions. Air forces demand lightweight, compact, and high-performance modules for integration into advanced airborne radar systems, electronic warfare pods, and communication suites for fighter jets, surveillance aircraft, and unmanned aerial vehicles (UAVs). Ground-based forces utilize these modules in mobile battlefield radar systems, tactical communication networks, and air defense systems, prioritizing ruggedness, reliability, and interoperability in diverse terrestrial environments.

Moreover, leading global defense prime contractors and major aerospace companies serve as crucial immediate customers. Organizations such as Raytheon Technologies, Northrop Grumman, Lockheed Martin, BAE Systems, and L3Harris Technologies are significant integrators that either purchase T/R modules from specialized component manufacturers or produce them in-house for seamless integration into their larger system offerings. These integrated systems, ranging from complete radar systems to entire aircraft or naval vessels, are then delivered to defense ministries worldwide. These prime contractors often engage in close, long-term collaboration with T/R module suppliers during the early design and development phases to ensure optimal system performance, technical compatibility, and adherence to stringent military specifications, effectively acting as the critical intermediary between component suppliers and the ultimate military end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 8.50 Billion |

| Market Forecast in 2032 | USD 14.07 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, L3Harris Technologies, Inc., Teledyne Technologies Incorporated, Infineon Technologies AG, NXP Semiconductors N.V., Analog Devices, Inc., Qorvo, Inc., Wolfspeed, Inc., MACOM Technology Solutions Holdings, Inc., Saab AB, Leonardo S.p.A., Israel Aerospace Industries (IAI), Thales Group, Mitsubishi Electric Corporation, Toshiba Corporation, ELTA Systems Ltd. (a subsidiary of IAI), General Dynamics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Transmit and Receive Module Market Key Technology Landscape

The Military Transmit and Receive Module market operates within a highly sophisticated and continuously advancing technological landscape, driven by the relentless demand for enhanced performance, superior efficiency, and increased operational versatility in military applications. A transformative development has been the widespread adoption and maturation of Gallium Nitride (GaN) semiconductor technology, particularly GaN-on-Silicon Carbide (SiC). GaN offers significantly higher power density, efficiency, and exceptional thermal conductivity compared to traditional Gallium Arsenide (GaAs) devices, enabling the development of more compact, powerful, and reliable modules capable of operating at higher frequencies and temperatures. This shift to GaN is revolutionizing power amplifiers and enabling the next generation of radar and electronic warfare systems with substantially extended range, improved resolution, and enhanced electronic counter-countermeasure capabilities.

Another pivotal technological advancement defining this market is the sophisticated design and manufacturing of Monolithic Microwave Integrated Circuits (MMICs). MMICs integrate multiple critical RF functions—such as amplifiers, phase shifters, attenuators, and switches—onto a single semiconductor chip, drastically reducing the size, weight, and power consumption of T/R modules. This profound miniaturization is paramount for platforms with severe Size, Weight, Power, and Cost (SWaP-C) constraints, including unmanned aerial vehicles (UAVs), advanced fighter aircraft, and space-based systems. Concurrently, the pervasive implementation of Active Electronically Scanned Array (AESA) technology has become the standard for modern radar systems. AESA radars leverage hundreds or thousands of individual T/R modules, each capable of independent phase and amplitude control, which collectively enables agile beam steering, multi-function operation (e.g., simultaneous surveillance and targeting), and enhanced stealth capabilities, significantly improving situational awareness and operational flexibility.

Beyond core hardware, the market is increasingly integrating advanced digital and software-defined technologies. Digital beamforming (DBF) is gaining significant traction, allowing for even greater flexibility in beam control, enabling the generation of multiple simultaneous beams, and vastly enhancing interference suppression capabilities. The principles of Software-Defined Radio (SDR) are also profoundly influencing module design, facilitating reconfigurable functionality and adaptability to different operational requirements, frequency bands, and threat environments through software updates rather than hardware modifications. Furthermore, advanced thermal management solutions, encompassing novel cooling techniques and materials like liquid cooling or advanced heat pipes, are becoming indispensable for ensuring the reliable and long-term operation of high-power T/R modules by efficiently dissipating the significant heat generated. These converging technological trends collectively underscore a strategic move towards more intelligent, highly integrated, and adaptive modules that are capable of responding to the dynamic and complex demands of modern military operations with unprecedented efficiency and precision.

Regional Highlights

- North America: This region consistently maintains its position as the dominant force in the Military Transmit and Receive Module market, primarily driven by the colossal defense spending and technological leadership of the United States. The U.S. benefits from an extensive defense industrial base, robust government funding for advanced research and development, and an unceasing commitment to technological superiority in radar, electronic warfare, and communication systems. Canada also contributes to regional demand, albeit on a smaller scale, through its own defense modernization programs. The region's sustained emphasis on developing and deploying cutting-edge defense technologies ensures continued market expansion.

- Europe: The European market demonstrates steady and incremental growth, influenced by the strategic defense requirements of major economies such as the UK, France, Germany, and Italy. Collaborative defense initiatives, increasing geopolitical uncertainties, and the need to maintain national security against evolving threats drive significant investments in sophisticated T/R module technology. European nations are actively pursuing the development of indigenous defense industrial capabilities to reduce reliance on external suppliers, fostering local innovation and manufacturing expertise within the continent.

- Asia Pacific (APAC): Expected to be the fastest-growing region globally, APAC is characterized by rapidly escalating defense expenditures, particularly from economic powerhouses like China, India, South Korea, and Japan. These countries are intensely focused on comprehensive military modernization programs, including the acquisition and indigenous development of advanced fighter jets, sophisticated naval vessels, and integrated air defense systems, all of which are heavily reliant on advanced T/R modules. Persistent regional geopolitical tensions and territorial disputes further accelerate the demand for cutting-edge defense electronics and components.

- Middle East and Africa (MEA): This region presents significant market potential, propelled by ongoing geopolitical instability, regional conflicts, and the strategic imperative for enhanced defense, surveillance, and deterrence capabilities. Key purchasing nations include Saudi Arabia, the UAE, Israel, and Turkey. While procurement often involves substantial imports of advanced defense systems and components from North American and European manufacturers, there is a growing trend towards localized production, technology transfer initiatives, and strategic partnerships aimed at bolstering regional defense industrial bases and achieving greater self-sufficiency in critical defense technologies.

- Latin America: The market in Latin America is comparatively smaller in scale but exhibits consistent, albeit gradual, growth. Key contributing countries include Brazil, Argentina, and Mexico, which are primarily focused on upgrading existing military platforms and acquiring new systems for border security, counter-narcotics operations, and maritime surveillance. Budgetary constraints often lead to a pragmatic focus on cost-effective solutions, life-cycle extensions for current fleets, and targeted acquisitions to address specific security challenges rather than broad-scale modernization programs seen in other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Transmit and Receive Module Market.- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Teledyne Technologies Incorporated

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Qorvo, Inc.

- Wolfspeed, Inc.

- MACOM Technology Solutions Holdings, Inc.

- Saab AB

- Leonardo S.p.A.

- Israel Aerospace Industries (IAI)

- Thales Group

- Mitsubishi Electric Corporation

- Toshiba Corporation

- ELTA Systems Ltd. (a subsidiary of IAI)

- General Dynamics Corporation

Frequently Asked Questions

What is a military transmit and receive module and its primary function?

A military transmit and receive (T/R) module is a critical electronic component in advanced defense systems. Its primary function is to efficiently convert digital signals into high-power radio frequency (RF) signals for transmission and to sensitively detect and process weak incoming RF signals for reception, forming the core of modern radar, electronic warfare, and communication systems.

What are the key military applications where T/R modules are indispensable?

Military T/R modules are indispensable in various key applications including Active Electronically Scanned Array (AESA) radars for advanced surveillance and targeting, sophisticated electronic warfare (EW) systems for jamming and protection, secure satellite and ground-based communication networks, and precision missile guidance systems.

How is Gallium Nitride (GaN) technology influencing the Military Transmit and Receive Module market?

Gallium Nitride (GaN) technology is profoundly influencing the market by enabling the development of T/R modules with significantly higher power density, superior efficiency, and enhanced thermal performance. This results in more compact, lighter, and robust defense systems with extended operational ranges and improved capabilities, driving widespread modernization across military platforms.

What are the main factors driving the growth of the military T/R module market?

The main factors driving market growth include increasing global defense budgets driven by geopolitical tensions, ongoing military modernization programs aimed at upgrading legacy systems, continuous advancements in semiconductor materials, and the rising demand for multi-functional and highly integrated defense electronics.

What are the most significant technological trends shaping the future of military T/R modules?

The most significant technological trends shaping the market's future include the pervasive adoption of GaN-on-SiC technology, advanced Monolithic Microwave Integrated Circuit (MMIC) designs for miniaturization, integration with Active Electronically Scanned Array (AESA) systems, the implementation of digital beamforming for enhanced flexibility, and the growing influence of Artificial Intelligence (AI) for cognitive functionalities and predictive maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager