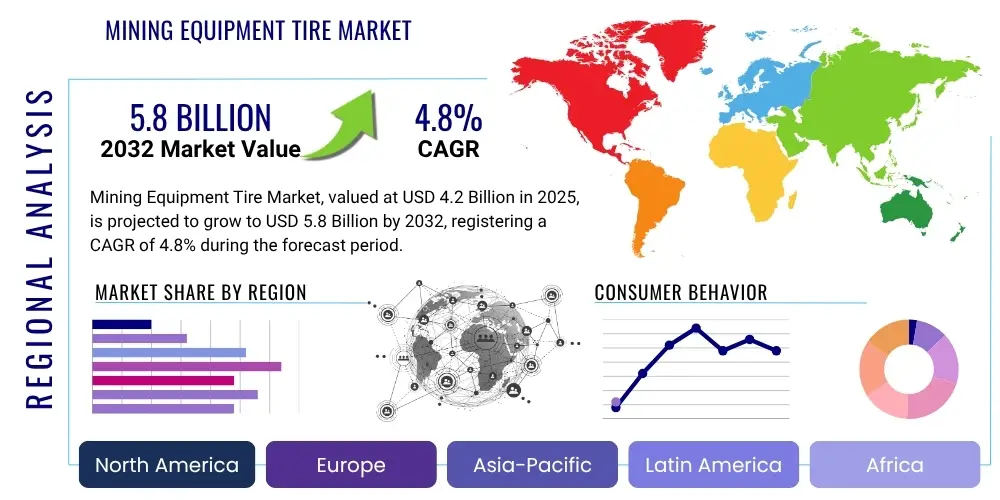

Mining Equipment Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429065 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mining Equipment Tire Market Size

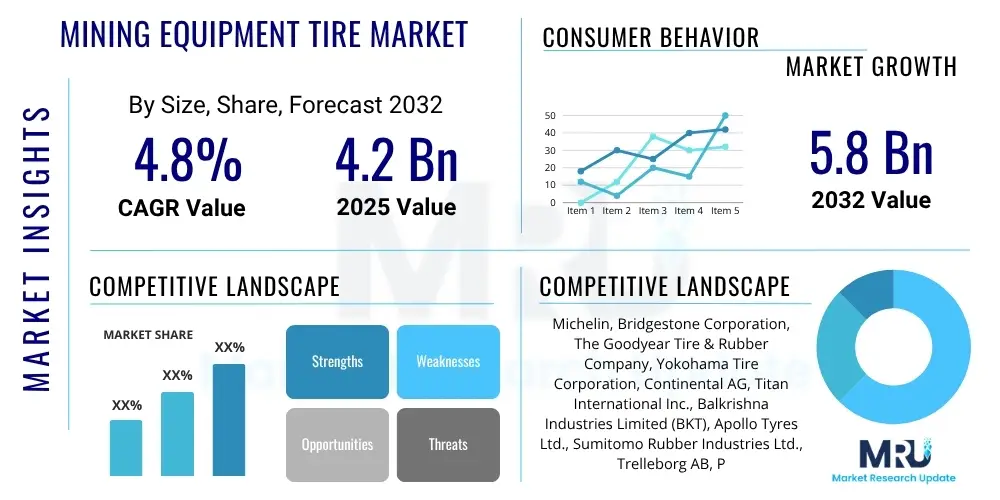

The Mining Equipment Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2032.

Mining Equipment Tire Market introduction

The Mining Equipment Tire Market encompasses the production, distribution, and sale of specialized tires designed for heavy-duty machinery utilized in mining operations across the globe. These tires are engineered to withstand extreme conditions, including abrasive surfaces, heavy loads, sharp rocks, and harsh temperatures, which are characteristic of both open-pit and underground mining environments. Their robust construction is critical for ensuring the safety, efficiency, and operational continuity of mining vehicles such as dump trucks, wheel loaders, excavators, and dozers, forming an indispensable component of the global mineral extraction industry.

The core product in this market is the off-the-road (OTR) tire, specifically tailored for mining applications. These tires typically feature deep treads, reinforced sidewalls, and advanced rubber compounds to offer superior resistance to cuts, punctures, and heat buildup. Major applications span across various mining sectors including coal, iron ore, copper, gold, and other mineral extraction, as well as quarrying and large-scale construction projects that involve significant earthmoving. The primary benefits derived from these specialized tires include enhanced equipment uptime, reduced operational costs through improved durability and longer lifespan, and increased safety for personnel working in challenging terrains.

Driving factors for the Mining Equipment Tire Market are intrinsically linked to the global demand for minerals and raw materials, driven by urbanization, industrialization, and infrastructure development, particularly in emerging economies. The increasing scale of mining operations, coupled with the growing adoption of larger, more powerful mining equipment, necessitates higher performance and more durable tires. Furthermore, technological advancements in tire manufacturing, focusing on material science and smart tire integration, are continuously improving product offerings and stimulating market growth by providing solutions that contribute to overall operational efficiency and sustainability within the mining sector.

Mining Equipment Tire Market Executive Summary

The Mining Equipment Tire Market is poised for steady expansion, propelled by robust global demand for essential minerals and raw materials. Business trends indicate a significant push towards enhancing operational efficiency and safety in mining, which translates into a greater emphasis on premium, technologically advanced tires that offer extended lifespan and superior performance in arduous conditions. Manufacturers are increasingly investing in research and development to produce tires that can withstand extreme pressures, resist damage more effectively, and integrate with modern equipment telemetry systems, fostering a market environment focused on innovation and value addition beyond basic functionality.

Regional trends highlight the Asia Pacific region as a primary growth engine, fueled by extensive mining activities in countries such as China, India, and Australia, alongside rapid industrialization and infrastructure development. North America and Europe, while mature markets, are characterized by high adoption rates of advanced tire technologies and a strong focus on sustainability and regulatory compliance. Latin America and the Middle East & Africa also present significant opportunities, driven by their vast mineral reserves and ongoing investments in mining exploration and production, leading to a diversified geographic landscape of demand and supply.

In terms of segment trends, radial tires are expected to gain further traction due to their enhanced durability, fuel efficiency, and comfort compared to bias-ply tires, making them preferred for larger, more sophisticated mining equipment. The aftermarket segment continues to hold a dominant share, reflecting the ongoing need for replacement tires throughout the operational life of mining machinery, while the OEM segment benefits from new equipment sales. Growth in demand for tires for ultra-class haul trucks and large loaders signifies a shift towards larger-scale, higher-productivity mining operations, impacting tire design and manufacturing priorities. The market overall is adapting to evolving mining practices, including autonomous vehicles, by developing tires that can meet new performance parameters and integration requirements.

AI Impact Analysis on Mining Equipment Tire Market

Common user questions regarding AI's impact on the Mining Equipment Tire Market often revolve around how artificial intelligence can extend tire life, optimize maintenance schedules, enhance safety, and contribute to overall operational efficiency within mining environments. Users are keen to understand the practical applications of AI in predictive maintenance, real-time performance monitoring, and the integration of smart tire technologies with autonomous mining systems. There is also significant interest in how AI-driven insights can lead to more sustainable practices, such as reducing fuel consumption and minimizing tire waste through optimized usage and retreading decisions, alongside concerns about the initial investment costs and the complexity of implementing such advanced systems in existing fleets.

- Predictive Maintenance: AI algorithms analyze tire data (pressure, temperature, load) to forecast wear patterns and schedule maintenance proactively, reducing unexpected downtime and extending tire lifespan.

- Operational Optimization: AI-driven systems monitor tire performance in real-time, providing insights for operators to adjust driving behaviors, speeds, and routes to minimize tire stress and fuel consumption.

- Enhanced Safety: AI contributes to safety by identifying potential tire failures before they occur and alerting operators, preventing accidents caused by blowouts or structural damage.

- Autonomous Mining Integration: AI is crucial for integrating smart tires with autonomous vehicles, allowing tires to communicate performance data directly to the vehicle's central control system for optimized navigation and load management.

- Supply Chain and Inventory Management: AI can optimize the inventory of mining tires, forecasting demand based on operational data and market conditions, ensuring availability while minimizing holding costs.

- Design and Material Innovation: AI assists in the design phase by simulating tire performance under various conditions, helping engineers develop more durable and efficient compounds and structures.

DRO & Impact Forces Of Mining Equipment Tire Market

The Mining Equipment Tire Market is shaped by a confluence of driving factors, restrictive elements, and emerging opportunities, all contributing to dynamic impact forces. A primary driver is the escalating global demand for minerals and metals, fueled by industrial growth, urbanization, and the expanding infrastructure sector, particularly in developing economies. This sustained demand directly translates into increased mining activities and a greater need for heavy machinery, consequently boosting the demand for specialized tires. Furthermore, technological advancements in mining equipment, leading to larger and more powerful vehicles, necessitate equally advanced and robust tires capable of handling heavier loads and operating at higher efficiencies.

Conversely, several restraints impede market growth. The significant capital expenditure associated with purchasing and maintaining specialized mining tires poses a challenge for mining companies, especially smaller operations. Fluctuations in raw material prices, particularly for natural rubber and steel, directly impact manufacturing costs and tire prices, affecting market stability. Environmental regulations and sustainability concerns are also becoming more stringent, pushing manufacturers to develop eco-friendlier tires and disposal methods, which can increase production complexities and costs. Moreover, the long lifespan of mining tires, despite being a benefit, can slow down the replacement cycle, particularly during economic downturns.

Despite these challenges, substantial opportunities exist. The development of "smart tires" equipped with sensors for real-time monitoring of pressure, temperature, and wear offers significant potential for enhancing operational efficiency, safety, and predictive maintenance. The growing trend of retreading and repairing tires presents a cost-effective and sustainable alternative, extending tire life and reducing waste. Furthermore, the expansion of autonomous mining operations opens new avenues for specialized tire development that can communicate seamlessly with intelligent vehicle systems. These impact forces collectively drive innovation, compel strategic decision-making among market players, and dictate the evolving landscape of the mining equipment tire industry, constantly balancing the need for productivity with cost-efficiency and environmental stewardship.

Segmentation Analysis

The Mining Equipment Tire Market is comprehensively segmented to provide a clear understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying key growth areas, and understanding the specific needs of various end-users. The market is typically broken down by tire type, equipment type, application, and sales channel, each reflecting distinct operational requirements and market characteristics. These segmentations are critical for both manufacturers and mining companies to optimize product development, procurement, and strategic planning, ensuring that the right tire solutions are deployed for specific operational demands and environmental conditions.

- By Tire Type

- Radial

- Bias

- By Equipment Type

- Dump Trucks

- Loaders

- Dozers

- Graders

- Scrapers

- Other Mining Equipment (e.g., excavators, underground mining vehicles)

- By Application

- Open Pit Mining

- Underground Mining

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Mining Equipment Tire Market

The value chain for the Mining Equipment Tire Market is a complex network involving several stages, beginning with raw material extraction and culminating in the end-use and eventual disposal or recycling of tires. At the upstream level, the value chain is dominated by suppliers of critical raw materials, including natural rubber, synthetic rubber, steel wire, carbon black, and various chemical additives. These suppliers play a fundamental role in dictating the quality, cost, and availability of the foundational components necessary for tire manufacturing. Innovations in material science at this stage directly impact the performance, durability, and cost-effectiveness of the final tire products, influencing overall market competitiveness and sustainability efforts.

Midstream activities involve the intricate processes of tire manufacturing, undertaken by major global and regional tire producers. This stage includes research and development for new tire designs and compounds, production using advanced machinery and technologies, and quality control. Manufacturers leverage proprietary technologies to engineer tires that meet the specific and demanding requirements of mining environments, focusing on resistance to cuts, heat, and heavy loads. The efficiency of manufacturing processes, including automation and supply chain integration, is crucial for cost optimization and timely delivery to meet fluctuating market demands.

Downstream activities encompass distribution, sales, and aftermarket services. Distribution channels can be both direct and indirect. Direct channels involve tire manufacturers selling directly to large mining corporations or original equipment manufacturers (OEMs) for new mining vehicles. Indirect channels involve a network of independent distributors, dealers, and service centers that provide sales, installation, maintenance, and repair services to a broader range of mining operations. These aftermarket services are critical, as they ensure optimal tire performance, extend tire life through proper maintenance and retreading, and contribute significantly to the overall value proposition for end-users. The effectiveness of this downstream network is paramount for customer satisfaction, brand loyalty, and sustained market penetration.

Mining Equipment Tire Market Potential Customers

The primary potential customers for the Mining Equipment Tire Market are diverse entities operating within the global extractive industries and large-scale infrastructure development. Foremost among these are mining companies involved in the extraction of various minerals, including coal, iron ore, copper, gold, diamonds, and industrial minerals. These companies operate extensive fleets of heavy machinery, such as massive haul trucks, wheel loaders, dozers, and excavators, all of which require specialized tires designed for extreme durability and performance in challenging terrains. Their purchasing decisions are driven by factors such as tire longevity, resistance to damage, fuel efficiency, and the availability of robust after-sales support to minimize downtime and maximize productivity.

Another significant customer segment comprises original equipment manufacturers (OEMs) of heavy mining and construction machinery. These manufacturers procure tires directly from tire producers to equip new vehicles before they are sold to end-users. Their requirements often involve specific tire specifications that integrate seamlessly with their equipment designs and operational parameters, making them crucial partners for tire manufacturers. The relationship between tire manufacturers and OEMs is vital for establishing product presence and ensuring that new machinery enters the market with optimal tire solutions. These partnerships also often drive innovation in tire technology, as OEMs continuously seek improved performance from component suppliers.

Furthermore, large-scale construction firms involved in major earthmoving projects, quarrying operations, and civil engineering works also represent a substantial customer base. While their primary focus might not be mineral extraction, the type of equipment and the operational conditions often mirror those found in mining, necessitating similar heavy-duty off-the-road tires. Equipment rental companies that lease out heavy machinery to various industries also form an important customer group, requiring a reliable supply of durable and cost-effective tires for their diverse fleets. These customers prioritize tires that can withstand varied conditions and offer a high return on investment through extended wear and reduced maintenance requirements, underpinning the multifaceted demand dynamics within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 5.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Yokohama Tire Corporation, Continental AG, Titan International Inc., Balkrishna Industries Limited (BKT), Apollo Tyres Ltd., Sumitomo Rubber Industries Ltd., Trelleborg AB, Prometeon Tyre Group, Pirelli & C. S.p.A., Triangle Tyre Co., Ltd., Double Coin Holdings Ltd., JK Tyre & Industries Ltd., Maxam Tire International S.a.r.l., Camso (A Michelin Group Brand), Specialty Tires of America Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining Equipment Tire Market Key Technology Landscape

The Mining Equipment Tire Market is characterized by a dynamic technology landscape, continually evolving to meet the stringent demands of modern mining operations for enhanced safety, efficiency, and sustainability. A critical technological advancement involves the development of advanced rubber compounds and materials. Manufacturers are investing heavily in creating proprietary synthetic rubber blends, enhanced with silica, carbon black, and other reinforcing agents, to produce tires that offer superior resistance to cuts, abrasions, and heat buildup. These compounds are designed to withstand extreme loads and harsh environmental conditions, significantly extending tire lifespan and reducing the frequency of replacements, which directly impacts operational costs and productivity.

Another pivotal technological area is the integration of smart tire technologies. This includes Tire Pressure Monitoring Systems (TPMS) and more sophisticated embedded sensors that collect real-time data on tire pressure, temperature, load, and tread wear. These sensors provide crucial insights that enable predictive maintenance, alerting operators to potential issues before they escalate into failures and allowing for optimized tire usage patterns. The data generated by smart tires can be integrated with larger fleet management systems and artificial intelligence platforms, facilitating data-driven decision-making for tire management, route optimization, and even influencing autonomous vehicle operations, thereby contributing to overall operational intelligence and safety.

Furthermore, innovations in tire construction, such as reinforced carcasses, specialized bead designs, and optimized tread patterns, contribute significantly to performance improvements. Radial tire technology continues to advance, offering better load distribution, reduced rolling resistance for improved fuel efficiency, and a more comfortable ride compared to traditional bias-ply tires. The focus on retreading technology is also gaining traction, utilizing advanced bonding agents and sophisticated vulcanization processes to extend the life of worn tires, offering a cost-effective and environmentally friendly alternative to purchasing new tires. These technological advancements collectively aim to reduce downtime, enhance safety, lower total cost of ownership, and contribute to the environmental stewardship of mining operations.

Regional Highlights

- North America: This region represents a mature market with significant adoption of advanced mining technologies and robust safety regulations. Key countries like the United States and Canada, with extensive mineral resources and established mining industries, drive demand for high-performance and technologically integrated mining tires. The emphasis here is on efficiency, automation, and sustainable practices.

- Europe: The European market is characterized by stringent environmental regulations and a strong focus on innovation in tire manufacturing. Countries such as Germany, Sweden, and Finland, with advanced engineering capabilities, contribute to the demand for specialized, high-durability tires, including those compatible with electric and autonomous mining equipment. Emphasis is also placed on retreading and recycling initiatives.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily due to extensive mining operations in countries like China, Australia, India, and Indonesia. Rapid industrialization, urbanization, and infrastructure development in the region are driving unprecedented demand for minerals, consequently boosting the mining equipment tire market. The region sees significant investment in both new equipment and aftermarket tire sales.

- Latin America: This region is rich in mineral resources, particularly copper, iron ore, and precious metals, making it a crucial market for mining equipment tires. Countries such as Chile, Brazil, and Peru are major mining hubs, experiencing growth driven by global commodity prices and foreign investments. The market is dynamic, with a focus on robust and cost-effective tire solutions for challenging geological conditions.

- Middle East and Africa (MEA): The MEA region is an emerging market with substantial untapped mineral wealth. Countries like South Africa, Saudi Arabia, and various African nations are witnessing increased exploration and mining activities, fueled by government initiatives and foreign direct investment. The demand in MEA is growing steadily, particularly for durable tires capable of operating in harsh desert and remote environments, with a strong aftermarket presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining Equipment Tire Market.- Michelin

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Yokohama Tire Corporation

- Continental AG

- Titan International Inc.

- Balkrishna Industries Limited (BKT)

- Apollo Tyres Ltd.

- Sumitomo Rubber Industries Ltd.

- Trelleborg AB

- Prometeon Tyre Group

- Pirelli & C. S.p.A.

- Triangle Tyre Co., Ltd.

- Double Coin Holdings Ltd.

- JK Tyre & Industries Ltd.

- Maxam Tire International S.a.r.l.

- Camso (A Michelin Group Brand)

- Specialty Tires of America Inc.

Frequently Asked Questions

What is the projected growth rate of the Mining Equipment Tire Market?

The Mining Equipment Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032, driven by increasing global demand for minerals and technological advancements.

What are the key factors driving the demand for mining equipment tires?

The key factors driving demand include the escalating global consumption of minerals and raw materials, sustained growth in mining activities worldwide, and continuous infrastructure development projects.

Which regions are expected to dominate the Mining Equipment Tire Market?

The Asia Pacific region is expected to dominate the market due to extensive mining operations and rapid industrialization, while North America and Europe will maintain significant shares with high technology adoption.

How is AI impacting the Mining Equipment Tire Market?

AI is impacting the market through predictive maintenance, real-time performance optimization, enhanced safety features, and seamless integration with autonomous mining equipment, improving overall efficiency and lifespan.

What are the main types of tires used in mining equipment?

The main types of tires used in mining equipment are radial tires and bias-ply tires, with radial tires gaining preference due to their superior durability, fuel efficiency, and enhanced comfort for operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager