Mixed Signal IC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428220 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Mixed Signal IC Market Size

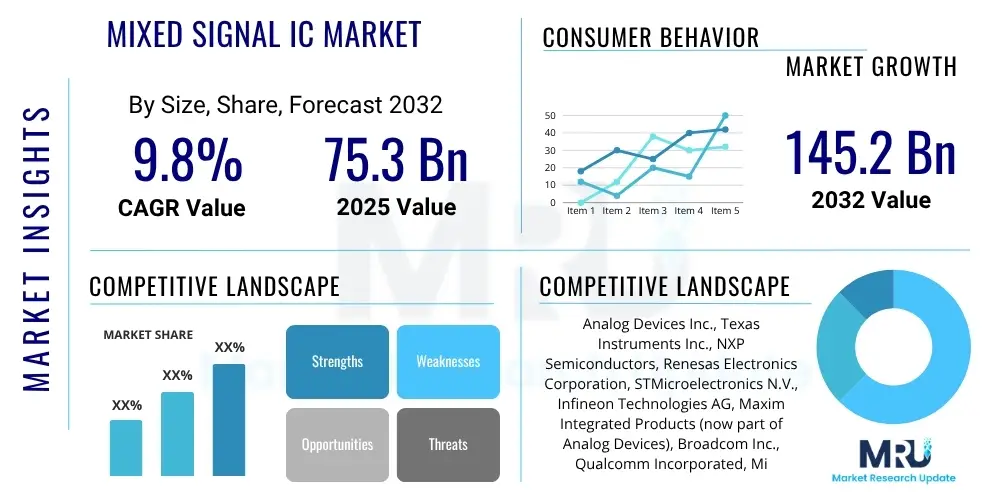

The Mixed Signal IC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at USD 75.3 Billion in 2025 and is projected to reach USD 145.2 Billion by the end of the forecast period in 2032. This substantial growth is underpinned by the increasing demand for advanced electronic systems across various industries, including automotive, consumer electronics, telecommunications, and industrial automation. The integration of analog and digital functionalities on a single chip offers significant advantages in terms of size, power consumption, and performance, making mixed signal ICs indispensable components in modern electronic design. The continuous innovation in semiconductor manufacturing processes and design methodologies further fuels this expansion.

The trajectory of the Mixed Signal IC market is influenced by several macroeconomic and technological factors. Economic growth in emerging markets drives consumer spending on electronic devices, subsequently boosting the demand for these integrated circuits. Furthermore, the global push towards digitalization and automation in industrial settings necessitates robust and efficient data processing capabilities, which mixed signal ICs are uniquely positioned to provide. The increasing complexity of signal processing tasks, from high-speed data conversion to intricate sensor interfacing, solidifies the critical role of mixed signal ICs in future technological advancements and market growth, highlighting their pervasive integration across diverse application sectors and evolving technological landscapes.

Mixed Signal IC Market introduction

The Mixed Signal IC Market encompasses integrated circuits that combine both analog and digital functionalities on a single chip. These highly sophisticated devices are essential for bridging the gap between the real world's continuous analog signals and the discrete digital data processed by microprocessors and digital signal processors (DSPs). They enable a wide array of critical operations, including data conversion (Analog-to-Digital Converters - ADCs and Digital-to-Analog Converters - DACs), signal conditioning, power management, and radio frequency (RF) front-end processing. The primary objective of mixed signal ICs is to optimize system performance, reduce board space, minimize power consumption, and lower overall system costs by integrating complex functionalities into a compact form factor. They are foundational components in virtually every modern electronic system, facilitating the interaction between human interfaces, sensors, and digital computation engines. This intricate integration addresses the inherent challenges of managing disparate signal types, ensuring seamless communication and robust system operation in demanding environments.

Product descriptions for mixed signal ICs vary widely based on their intended application and specific functionality. For instance, high-speed ADCs are designed for telecommunications and medical imaging, while precision DACs are crucial for industrial control systems and audio applications. Power management ICs (PMICs) integrate voltage regulators, battery chargers, and power sequencing capabilities to efficiently manage power distribution in portable devices and complex electronic systems. RF mixed signal ICs are vital for wireless communication, incorporating components like low-noise amplifiers, mixers, and synthesizers to handle radio frequency signals effectively. These specialized designs exemplify the versatility and crucial importance of mixed signal ICs in enabling the diverse functionalities required by today's advanced electronic ecosystems, from consumer gadgets to sophisticated infrastructure.

Major applications for mixed signal ICs span across numerous industries. In consumer electronics, they are found in smartphones, tablets, smart wearables, and digital cameras for audio processing, image capture, and power management. The automotive sector relies on them for advanced driver-assistance systems (ADAS), infotainment systems, engine control units, and electric vehicle battery management. In telecommunications, mixed signal ICs are critical for base stations, optical networking equipment, and high-speed data communication. Industrial automation uses them in programmable logic controllers (PLCs), sensor interfaces, and motor control systems. Medical devices, aerospace and defense, and data centers also represent significant application areas. The benefits of using mixed signal ICs include enhanced performance due to optimized signal paths, reduced system complexity, lower power consumption leading to longer battery life, and improved reliability through integrated design. The driving factors for market growth include the proliferation of IoT devices, the rise of 5G technology, increasing demand for autonomous vehicles, and the continuous advancement in analog and digital semiconductor technologies that enable higher levels of integration and performance, pushing the boundaries of what is electronically possible.

Mixed Signal IC Market Executive Summary

The Mixed Signal IC Market is experiencing robust expansion driven by pervasive digitalization across global industries and the relentless demand for more integrated, efficient, and high-performance electronic solutions. Business trends indicate a strong emphasis on strategic partnerships and mergers & acquisitions among leading semiconductor companies to consolidate market share, expand product portfolios, and gain access to advanced technologies. There is a clear shift towards specialized mixed signal solutions tailored for specific high-growth applications, such as artificial intelligence (AI) at the edge, automotive electrification, and high-speed data centers. Companies are heavily investing in research and development to introduce next-generation mixed signal ICs that offer higher precision, lower power consumption, and increased integration density, thereby addressing the evolving needs of their clientele. This competitive landscape fosters innovation and accelerates the development of novel solutions, pushing the technological envelope. The strategic alliances are particularly important for sharing expertise and resources required for complex mixed-signal design, which demands a broad spectrum of engineering capabilities.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market, primarily due to its robust manufacturing base for consumer electronics, automotive components, and telecommunications infrastructure, particularly in countries like China, Taiwan, South Korea, and Japan. North America and Europe also maintain significant market shares, driven by strong R&D investments, advanced industrial automation, and the proliferation of high-tech industries. Emerging economies in Latin America, the Middle East, and Africa are showing nascent but accelerating growth, fueled by increasing digital transformation initiatives, infrastructure development, and rising disposable incomes. Geopolitical factors and trade policies, such as ongoing trade tensions between major economic blocs, can influence regional supply chains and manufacturing strategies, potentially leading to regionalized production hubs and diversified sourcing. The strategic importance of semiconductor self-sufficiency also plays a role in national investment policies, further shaping regional market dynamics and fostering local innovation ecosystems.

Segment trends highlight strong growth in high-performance data converters, power management ICs, and RF mixed signal ICs. The increasing demand for IoT devices, which require efficient power management and precise sensor interfacing, is boosting the PMIC segment. The expansion of 5G networks and advanced wireless communication standards is driving the RF mixed signal segment. Furthermore, the automotive sector's transition towards electric vehicles and autonomous driving is significantly increasing the demand for highly integrated and robust mixed signal ICs for sensor fusion, motor control, and battery management systems. Analog front-ends (AFEs) for industrial and medical applications are also experiencing substantial growth due to the need for precise data acquisition and signal conditioning. These trends underscore the pervasive nature of mixed signal technology and its foundational role in enabling the next generation of intelligent, connected, and autonomous systems across a multitude of industries and applications, from smart homes to complex industrial operations, ensuring continued evolution and adaptation to new technological demands.

AI Impact Analysis on Mixed Signal IC Market

The impact of Artificial Intelligence (AI) on the Mixed Signal IC market is profound and multifaceted, reflecting a significant paradigm shift in how electronic systems are designed and utilized. Common user questions often revolve around how mixed signal ICs can support AI workloads at the edge, the challenges of integrating AI processing with traditional analog signal paths, and the requirements for power efficiency and compact form factors in AI-driven devices. Users are concerned with the latency associated with data processing, the need for high-speed data conversion to feed AI algorithms, and the reliability of mixed signal components in computationally intensive AI environments. There's also a keen interest in how AI can optimize the design and testing of mixed signal ICs themselves, potentially reducing development cycles and improving performance. The convergence of AI and mixed signal technology is anticipated to drive innovation in areas such as intelligent sensors, autonomous systems, and advanced communication infrastructure, demanding more sophisticated and adaptable mixed signal solutions that can handle complex data streams with unprecedented efficiency.

- AI accelerators require high-bandwidth, low-latency mixed signal interfaces for data acquisition from sensors (analog input) and control of actuators (analog output).

- Edge AI devices drive demand for highly integrated and ultra-low-power mixed signal ICs, especially PMICs and specialized ADCs/DACs, to perform inferencing locally.

- Increased complexity of AI algorithms necessitates faster and more precise data converters (ADCs/DACs) to handle the vast amounts of analog data input for processing.

- AI is being utilized in the design automation of mixed signal ICs, optimizing layout, routing, and verification processes to reduce time-to-market and enhance performance.

- Mixed signal ICs are crucial for sensor fusion in AI-driven autonomous systems, combining data from various analog sensors (radar, lidar, cameras) for environmental perception.

- Power management units (PMUs) and voltage regulators within mixed signal architectures are being optimized with AI techniques for dynamic power scaling, improving efficiency for varying AI workloads.

- Neuromorphic computing architectures, which mimic the human brain, often incorporate mixed signal components to simulate neural networks directly in hardware, enabling energy-efficient AI.

- The growth of AI in healthcare, industrial IoT, and telecommunications requires robust and reliable mixed signal ICs capable of operating in diverse and sometimes harsh environments.

- AI-driven testing and characterization of mixed signal ICs can identify subtle anomalies and optimize performance parameters more effectively than traditional methods, enhancing quality assurance.

DRO & Impact Forces Of Mixed Signal IC Market

The Mixed Signal IC market is significantly shaped by a confluence of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating proliferation of IoT devices across consumer, industrial, and medical sectors, all of which require sophisticated mixed signal interfaces for sensor data acquisition, processing, and communication. The rapid advancements in 5G technology, demanding high-frequency RF mixed signal ICs and high-speed data converters for base stations and end-user devices, also represent a substantial growth impetus. Furthermore, the increasing complexity of modern electronic systems in automotive (ADAS, EVs), industrial automation (Industry 4.0), and data centers (high-speed interconnects) necessitates higher levels of integration, lower power consumption, and enhanced performance, which mixed signal ICs are uniquely positioned to deliver. The continuous miniaturization of electronic devices and the push for greater energy efficiency further amplify the demand for these integrated solutions, making them indispensable components in an ever-evolving technological landscape that values compact, powerful, and sustainable designs. This pervasive demand underscores the fundamental role of mixed signal ICs in enabling the next generation of intelligent and connected technologies.

However, the market also faces considerable restraints. The inherent complexity of designing and manufacturing mixed signal ICs, which involves integrating sensitive analog components with noise-generating digital circuits on the same silicon, poses significant technical challenges and extends development cycles. This complexity necessitates highly specialized engineering talent and advanced fabrication processes, leading to higher research and development costs. Intense price competition within the semiconductor industry, coupled with increasing pressure on profit margins, can hinder investments in next-generation technologies. Moreover, the long product life cycles in certain end-use industries, such as automotive, can slow down the adoption of newer mixed signal IC technologies. Supply chain disruptions, as evidenced by recent global events, can also severely impact production and lead times, creating volatility in market supply and demand dynamics. These challenges require sustained innovation and strategic resource allocation to mitigate risks and maintain market competitiveness amidst a rapidly evolving technological environment.

Despite these restraints, numerous opportunities abound for the Mixed Signal IC market. The burgeoning fields of artificial intelligence (AI) and machine learning (ML) at the edge present a vast opportunity, as these applications require highly efficient mixed signal ICs for localized data processing, sensor interfacing, and power management in devices like smart speakers, drones, and autonomous robots. The ongoing trend of electrification in the automotive sector, including electric vehicles (EVs) and hybrid electric vehicles (HEVs), creates significant demand for power management ICs and motor control mixed signal solutions. The expansion of smart cities and smart infrastructure initiatives globally will drive the need for mixed signal ICs in smart meters, environmental sensors, and intelligent lighting systems. Additionally, advancements in medical wearables and implantable devices, which require ultra-low power and highly precise mixed signal ICs, offer a compelling growth avenue. The strategic emphasis on analog and mixed signal expertise by semiconductor companies to differentiate their offerings and capture niche markets further contributes to the overall market opportunities, driving innovation towards specialized and high-value solutions. These evolving applications signify a rich fertile ground for future development and market penetration.

Segmentation Analysis

The Mixed Signal IC market is meticulously segmented to provide a granular understanding of its diverse landscape, enabling stakeholders to identify specific growth drivers, market challenges, and emerging opportunities. This segmentation typically categorizes the market based on product type, application, end-use industry, and geographic region. Each segment exhibits unique characteristics, technological requirements, and competitive dynamics, reflecting the varied demands for integrating analog and digital functionalities across a broad spectrum of electronic systems. Understanding these segments is crucial for strategic planning, product development, and market entry decisions, allowing companies to tailor their offerings to specific vertical markets and consumer needs with greater precision. The intricate interplay of these segmentation criteria provides a comprehensive view of the market's structure and future growth potential, highlighting areas of particular innovation and investment.

- By Product Type

- Data Converters (ADCs, DACs)

- High-Speed Data Converters

- Precision Data Converters

- General Purpose Data Converters

- Mixed Signal Amplifiers (Op-Amps, Comparators)

- Power Management ICs (PMICs)

- Voltage Regulators (LDOs, Switching Regulators)

- Battery Management ICs

- Power Factor Correction (PFC) ICs

- LED Driver ICs

- RF Mixed Signal ICs (Transceivers, Mixers, PLLs, LNAs)

- Interface ICs (Ethernet, USB, HDMI, PCIe)

- Timing ICs (Oscillators, Clock Generators)

- Audio & Video ICs (Codecs, Amplifiers)

- Sensor Interface ICs

- Data Converters (ADCs, DACs)

- By Application

- Consumer Electronics

- Smartphones & Tablets

- Wearables

- Digital Cameras

- Gaming Consoles

- Home Appliances

- Automotive

- ADAS (Advanced Driver-Assistance Systems)

- Infotainment Systems

- Powertrain & Chassis Control

- Body Electronics

- EV/HEV Systems

- Telecommunications

- Wireless Infrastructure (5G Base Stations)

- Wired Communications (Fiber Optics, Routers)

- Satellite Communication

- Industrial

- Factory Automation

- Process Control

- Test & Measurement Equipment

- Robotics

- Power Tools

- Medical & Healthcare

- Diagnostic Imaging

- Patient Monitoring

- Medical Implantables

- Wearable Medical Devices

- Aerospace & Defense

- Avionics

- Radar Systems

- Communication Systems

- Guidance & Navigation

- Data Processing

- Servers & Data Centers

- Storage Devices

- Consumer Electronics

- By End-Use Industry

- Electronics & IT

- Automotive

- Telecommunication

- Manufacturing

- Healthcare

- Defense & Government

- Others

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Mixed Signal IC Market

The value chain for the Mixed Signal IC market is a complex ecosystem involving multiple stages, from raw material sourcing to end-product integration. Upstream analysis begins with the suppliers of fundamental raw materials, including high-purity silicon wafers, photoresists, various gases, and specialty chemicals. These materials are critical for the semiconductor manufacturing process. Following raw material procurement, the value chain moves into the intellectual property (IP) and design phase, where specialized design houses and integrated device manufacturers (IDMs) develop complex circuit architectures and algorithms for mixed signal functionalities. This stage involves extensive R&D to optimize performance, power efficiency, and integration density, leveraging advanced electronic design automation (EDA) tools. The expertise in both analog and digital design is paramount here, as it directly influences the quality and competitiveness of the final IC product. This initial phase sets the foundation for the entire production cycle, demanding substantial investment in both human capital and sophisticated technological resources to create innovative and highly differentiated mixed signal solutions.

Midstream activities primarily involve semiconductor fabrication, or "foundry services," where silicon wafers are processed and transformed into integrated circuits. This fabrication process includes photolithography, etching, deposition, and ion implantation, requiring state-of-the-art manufacturing facilities and advanced process technologies. After fabrication, the wafers undergo assembly, packaging, and rigorous testing to ensure functionality, reliability, and adherence to performance specifications. This critical stage identifies and screens out defective chips, minimizing failures in downstream applications. Many companies operate as fabless semiconductor firms, outsourcing their manufacturing to specialized foundries (like TSMC, GlobalFoundries, UMC), while others maintain their own integrated manufacturing facilities (IDMs). The choice between these models impacts operational costs, control over the production process, and market agility. Both models heavily rely on sophisticated quality control measures and advanced testing methodologies to guarantee that the mixed signal ICs meet the demanding standards required for their intended applications, ensuring robust performance and longevity in real-world scenarios.

Downstream analysis focuses on the distribution channels and end-use integration of mixed signal ICs. Completed and tested ICs are distributed through a network of distributors, value-added resellers, and directly to original equipment manufacturers (OEMs). Direct distribution is common for large-volume customers and strategic partnerships, allowing for close collaboration on product specifications and supply chain management. Indirect distribution via specialized distributors allows smaller customers and a broader market reach. These OEMs then integrate the mixed signal ICs into their final electronic products, such as smartphones, automotive systems, industrial control units, and medical devices. The success of mixed signal ICs is ultimately determined by their performance within these end products and their ability to meet the stringent requirements of diverse applications. The entire value chain is characterized by intense collaboration, technological innovation, and a global supply network, emphasizing efficient logistics and close coordination between all stakeholders to ensure timely delivery and market responsiveness. This intricate network underscores the global interdependence within the semiconductor industry, driven by continuous innovation and market demand.

Mixed Signal IC Market Potential Customers

The potential customers for the Mixed Signal IC market are incredibly diverse, spanning virtually every industry that relies on modern electronic systems for their operations or product offerings. These end-users, or buyers of the product, are primarily Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers who integrate mixed signal ICs into their final products. In the consumer electronics sector, key customers include manufacturers of smartphones, tablets, smart wearables, digital cameras, smart home devices, and audio equipment, all requiring sophisticated mixed signal components for audio processing, image capture, power management, and wireless connectivity. These manufacturers consistently seek ICs that offer higher integration, lower power consumption, and enhanced performance to differentiate their products in a highly competitive market, catering to evolving consumer expectations for advanced features and longer battery life, thereby driving continuous innovation in the mixed signal IC design space. The rapid refresh cycles of consumer devices also contribute significantly to sustained demand for next-generation mixed signal solutions.

The automotive industry represents a rapidly expanding customer base, particularly with the acceleration of electric vehicles (EVs), hybrid electric vehicles (HEVs), and Advanced Driver-Assistance Systems (ADAS). Automotive OEMs and Tier 1 suppliers are significant buyers, utilizing mixed signal ICs for engine control units (ECUs), infotainment systems, battery management systems (BMS), power steering, braking systems, and various sensor interfaces (radar, lidar, cameras). The stringent reliability and safety requirements of automotive applications necessitate robust and high-performance mixed signal ICs capable of operating in harsh environments, driving demand for specialized and certified components. The transition towards autonomous driving further amplifies this demand, as these systems rely heavily on complex sensor fusion and real-time data processing, which are fundamentally enabled by advanced mixed signal technologies. This sector demands not only high performance but also adherence to strict safety standards, such as ISO 26262, making product qualification a critical aspect for suppliers.

Beyond consumer and automotive, the industrial, telecommunications, and healthcare sectors are substantial potential customers. Industrial automation companies and equipment manufacturers procure mixed signal ICs for programmable logic controllers (PLCs), robotics, motor control, factory automation systems, and test & measurement equipment, where precision and reliability are paramount. Telecommunications equipment providers, including manufacturers of 5G base stations, optical networking hardware, and wireless access points, depend on high-speed RF mixed signal ICs and data converters for efficient data transmission and reception. In healthcare, medical device manufacturers use mixed signal ICs for diagnostic imaging equipment, patient monitoring systems, and wearable medical devices, requiring ultra-low power consumption and high accuracy. Aerospace and defense contractors also represent a critical, albeit niche, market for high-reliability, ruggedized mixed signal ICs. These diverse applications underscore the ubiquitous demand for mixed signal ICs across critical infrastructure and advanced technological domains, highlighting their indispensable role in supporting technological progress and fostering innovation across a myriad of industries globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 75.3 Billion |

| Market Forecast in 2032 | USD 145.2 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices Inc., Texas Instruments Inc., NXP Semiconductors, Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, Maxim Integrated Products (now part of Analog Devices), Broadcom Inc., Qualcomm Incorporated, Microchip Technology Inc., ON Semiconductor Corporation, MediaTek Inc., Cirrus Logic Inc., Cypress Semiconductor (now part of Infineon), Skyworks Solutions Inc., Murata Manufacturing Co., Ltd., ROHM Co., Ltd., Dialog Semiconductor (now part of Renesas), Silicon Labs, Semtech Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mixed Signal IC Market Key Technology Landscape

The Mixed Signal IC market is characterized by a dynamic and evolving technology landscape, driven by the relentless pursuit of higher performance, greater integration, and lower power consumption. Key technologies employed in the design and manufacturing of mixed signal ICs encompass advanced process nodes, sophisticated design methodologies, and innovative packaging techniques. FinFET (Fin Field-Effect Transistor) and FD-SOI (Fully Depleted Silicon-On-Insulator) technologies are becoming increasingly prevalent, enabling the integration of high-performance digital logic with sensitive analog circuits at smaller geometries (e.g., 28nm, 16nm, 7nm and beyond). These advanced processes address critical challenges such as leakage current, power efficiency, and noise reduction, which are particularly important when analog and digital components coexist on the same substrate. The ability to minimize interference between these disparate circuit types is a hallmark of cutting-edge mixed signal design, requiring mastery of both physics and circuit theory. This relentless pursuit of smaller and more efficient transistors is fundamental to meeting the demands of next-generation electronic systems, particularly in areas like mobile computing and artificial intelligence, where power and performance are paramount.

In terms of design methodologies, advanced Electronic Design Automation (EDA) tools play a crucial role. These tools facilitate the complex co-simulation and verification of analog and digital blocks, enabling designers to predict and mitigate issues like crosstalk, substrate noise, and electromagnetic interference (EMI) before fabrication. Techniques such as hierarchical design, intellectual property (IP) reuse, and design for manufacturability (DFM) are essential for managing the intricate nature of mixed signal circuits and accelerating time-to-market. Furthermore, innovative architectural approaches like delta-sigma modulation for ADCs and advanced digital calibration techniques are continuously being developed to achieve higher precision and wider dynamic ranges in data converters, essential for applications such as high-fidelity audio and precision instrumentation. The integration of embedded microcontrollers and digital signal processors (DSPs) alongside analog front-ends (AFEs) creates highly versatile System-on-Chip (SoC) solutions, simplifying system design for end-users and enabling a greater degree of programmability and adaptability in diverse applications. This comprehensive approach to design ensures that the sophisticated capabilities of mixed signal ICs can be fully harnessed.

Packaging technology is another critical aspect of the mixed signal IC landscape. Advanced packaging solutions, including System-in-Package (SiP), Through-Silicon Vias (TSVs), and wafer-level packaging (WLP), are vital for achieving higher integration density, reducing parasitic effects, and improving thermal performance. These techniques allow for the stacking of different dies (e.g., analog, digital, memory) or the integration of passive components within the package, leading to more compact, higher-performance, and lower-cost modules. The growing demand for mixed signal ICs in harsh environments, such as automotive and industrial applications, also drives the need for robust and reliable packaging materials and processes that can withstand extreme temperatures, vibrations, and humidity. Furthermore, the development of heterogeneous integration, where components manufactured on different processes are combined, is a key trend, allowing designers to select the optimal process for each function while integrating them into a single, cohesive system. These advancements in packaging are not just about miniaturization; they are about optimizing performance, power, and reliability for increasingly complex and demanding applications, ensuring that the physical integration keeps pace with the innovation in silicon design and functionality.

Regional Highlights

- North America: This region is a significant hub for advanced semiconductor R&D and high-tech industries, driving demand for high-performance mixed signal ICs in data centers, aerospace & defense, medical devices, and automotive applications. Strong governmental support for domestic semiconductor manufacturing and innovation further bolsters market growth. Key contributions come from the U.S., particularly Silicon Valley, known for its innovation in both analog and digital chip design.

- Europe: Europe exhibits robust growth, primarily fueled by its strong automotive industry, particularly in Germany, France, and Italy, where the transition to electric vehicles and autonomous driving is creating substantial demand for advanced mixed signal solutions. Industrial automation and healthcare sectors also contribute significantly, with a focus on precision analog and power management ICs. Regulatory pushes for energy efficiency further drive the market.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for mixed signal ICs globally. This dominance is attributed to the presence of major electronics manufacturing hubs in China, Taiwan, South Korea, and Japan, coupled with a vast consumer electronics market. The rapid rollout of 5G infrastructure, increasing adoption of IoT devices, and the expanding automotive sector in countries like China and India are key growth drivers, making it a critical region for production and consumption.

- Latin America: This region is an emerging market with gradual growth, driven by increasing industrialization, infrastructure development, and growing penetration of consumer electronics. Countries like Brazil and Mexico are leading the adoption, with a focus on automotive manufacturing and a growing demand for telecommunications equipment. Investment in smart grid technologies and renewable energy also contributes to the mixed signal IC market.

- Middle East & Africa (MEA): The MEA region is experiencing nascent but steady growth, primarily influenced by governmental initiatives aimed at economic diversification, smart city development, and investments in telecommunications infrastructure. The United Arab Emirates and Saudi Arabia are pivotal in this growth, with a focus on advanced technologies in energy, security, and digital transformation projects. Increasing consumer disposable income also drives demand for electronic devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mixed Signal IC Market.- Analog Devices Inc.

- Texas Instruments Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Broadcom Inc.

- Qualcomm Incorporated

- Microchip Technology Inc.

- ON Semiconductor Corporation

- MediaTek Inc.

- Cirrus Logic Inc.

- Skyworks Solutions Inc.

- Murata Manufacturing Co., Ltd.

- ROHM Co., Ltd.

- Silicon Labs

- Semtech Corporation

- Maxim Integrated Products (now part of Analog Devices)

- Dialog Semiconductor (now part of Renesas)

- Cypress Semiconductor (now part of Infineon)

Frequently Asked Questions

Analyze common user questions about the Mixed Signal IC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Mixed Signal ICs and why are they important in modern electronics?

Mixed Signal ICs are integrated circuits that combine both analog and digital functionalities on a single chip, effectively bridging the gap between real-world analog signals (like sound, light, temperature) and digital data processing. They are crucial for converting analog inputs to digital data, managing power, and enabling wireless communication, making them foundational components in virtually all contemporary electronic devices, from smartphones to autonomous vehicles. Their importance stems from their ability to reduce system complexity, minimize power consumption, and enhance overall performance by integrating diverse functions into a compact, efficient package, which is vital for miniaturization and energy efficiency trends in electronics.

Which industries are the primary drivers of demand for Mixed Signal ICs?

The primary industries driving demand for Mixed Signal ICs are consumer electronics, automotive, telecommunications, industrial, and healthcare. Consumer electronics, including smartphones and wearables, require them for audio, video, and power management. The automotive sector relies on them for ADAS, infotainment, and EV battery management. Telecommunications extensively uses them for 5G infrastructure and high-speed data transmission. Industrial automation demands precision for control systems, while healthcare utilizes them for medical imaging and patient monitoring devices. These sectors continually push for higher integration, lower power, and enhanced performance, fueling market growth for these essential components.

How does the integration of AI impact the Mixed Signal IC market?

The integration of AI profoundly impacts the Mixed Signal IC market by driving demand for high-performance, low-latency, and power-efficient solutions, particularly for edge AI applications. AI accelerators require sophisticated mixed signal interfaces for rapid data acquisition and control. The immense data processing needs of AI algorithms necessitate faster and more precise data converters. Furthermore, AI techniques are increasingly used in the design and optimization of mixed signal ICs themselves, leading to improved performance and shorter development cycles. Mixed signal ICs are also fundamental to sensor fusion in AI-driven autonomous systems, enabling comprehensive environmental perception, and efficient power management for AI workloads. This symbiosis positions mixed signal ICs as crucial enablers for the widespread adoption of AI technologies across various domains.

What are the key technological trends influencing Mixed Signal IC development?

Key technological trends influencing Mixed Signal IC development include the adoption of advanced process nodes like FinFET and FD-SOI for higher integration and power efficiency. There's a strong emphasis on sophisticated Electronic Design Automation (EDA) tools for complex co-simulation and verification of analog and digital circuits to mitigate noise and interference. Advanced packaging solutions such as System-in-Package (SiP) and heterogeneous integration are crucial for further miniaturization and enhanced performance. Additionally, the development of innovative architectures for data converters, power management, and RF transceivers, along with integrating embedded microcontrollers, drives mixed signal IC capabilities. These trends collectively aim to meet the growing demands for higher precision, lower power, and increased functionality in modern electronic systems, ensuring continuous innovation and market relevance in an ever-evolving technological landscape.

What challenges does the Mixed Signal IC market face?

The Mixed Signal IC market faces several significant challenges. The primary challenge lies in the inherent complexity of designing and manufacturing these ICs, which involves integrating sensitive analog components with noise-generating digital circuits on the same silicon, demanding specialized expertise and advanced fabrication processes. This complexity leads to higher research and development costs and extended development cycles. Intense price competition within the semiconductor industry, coupled with pressure on profit margins, can also constrain investments. Furthermore, global supply chain disruptions and geopolitical trade tensions introduce volatility and uncertainty. The need for robust talent in highly specialized mixed signal design is also a persistent challenge, requiring continuous investment in education and skill development to address the increasing technological demands of the industry. These factors collectively create a dynamic and demanding environment for market participants, necessitating strategic innovation and adaptability to navigate successfully.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager