Mobile Card Reader Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428051 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Mobile Card Reader Market Size

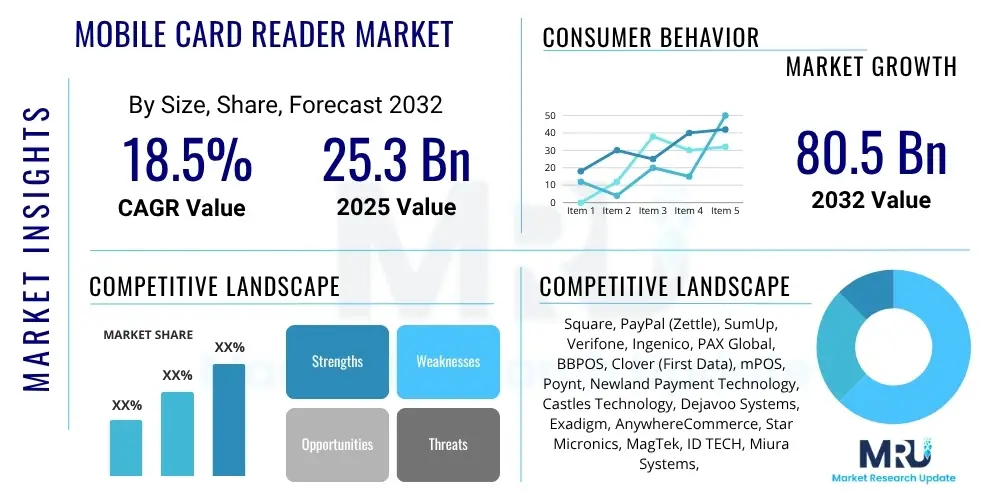

The Mobile Card Reader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 25.3 billion in 2025 and is projected to reach USD 80.5 billion by the end of the forecast period in 2032.

Mobile Card Reader Market introduction

The Mobile Card Reader Market encompasses devices that enable merchants to accept card payments using a smartphone or tablet. These innovative solutions transform a mobile device into a point-of-sale (POS) terminal, offering unprecedented flexibility and accessibility for businesses of all sizes. The core functionality involves securely reading payment card data, whether via magnetic stripe, EMV chip, or Near Field Communication (NFC) for contactless transactions, and then transmitting this data to a payment processor for authorization. The evolution of these devices has been rapid, moving from simple audio jack dongles to sophisticated standalone and integrated terminals with advanced security features and robust processing capabilities. This technological progression has democratized payment acceptance, allowing even the smallest businesses to participate in the digital economy.

Major applications for mobile card readers span a wide array of industries, including retail, hospitality, food services, healthcare, transportation, and field services. Small and medium-sized enterprises (SMEs), sole proprietors, and mobile service providers such as plumbers, electricians, and independent consultants have particularly benefited from the low cost of entry and portability offered by these devices. Beyond traditional sales, mobile card readers facilitate payments at pop-up shops, farmers' markets, outdoor events, and even for home delivery services, expanding the reach of businesses beyond conventional storefronts. The increasing consumer preference for cashless transactions further propels their adoption, making them an indispensable tool for modern commerce.

The primary benefits of mobile card readers include enhanced convenience for both merchants and customers, increased sales opportunities due to broader payment acceptance, improved operational efficiency, and access to valuable sales data. Key driving factors for market growth include the global surge in digital payment adoption, the proliferation of smartphones and tablets, the increasing number of micro-merchants and SMEs, the ongoing shift towards cashless societies, and the demand for flexible and affordable payment processing solutions. Additionally, advancements in payment security technologies, such as tokenization and end-to-end encryption, along with the rollout of 5G networks, are further bolstering market expansion by fostering greater trust and faster transaction speeds.

Mobile Card Reader Market Executive Summary

The Mobile Card Reader Market is experiencing robust expansion, fundamentally reshaping the landscape of payment acceptance across diverse sectors. Business trends highlight a strong emphasis on seamless integration with existing POS systems, cloud-based analytics, and value-added services such as inventory management and customer relationship management (CRM) tools. There is a discernible shift towards subscription-based models and integrated solutions that offer a comprehensive ecosystem rather than just a standalone hardware product, appealing to businesses seeking consolidated operational efficiencies. Furthermore, partnerships between payment processors, device manufacturers, and software developers are creating more robust and user-friendly platforms, driving market consolidation and innovation. The demand for customizable solutions that cater to specific industry needs, from healthcare to mobile food vending, is also a prominent trend.

Regional trends indicate North America and Europe as dominant markets, characterized by high digital payment penetration, a large base of SMEs, and advanced technological infrastructure. However, Asia Pacific, particularly countries like India, China, and Southeast Asian nations, is emerging as the fastest-growing region, fueled by rapid smartphone adoption, government initiatives promoting digital payments, and a vast unbanked or underbanked population increasingly using mobile-first financial services. Latin America and the Middle East & Africa are also showing significant potential, driven by financial inclusion initiatives, burgeoning e-commerce sectors, and the desire to modernize payment infrastructures. Localized payment preferences and regulatory frameworks are key considerations influencing market dynamics in each region, requiring tailored solutions from market players.

Segmentation trends reveal a dynamic evolution across device types, connectivity, end-users, and technologies. Standalone and integrated mobile POS solutions are gaining traction over simpler dongle-based readers, driven by their enhanced functionality, security, and ability to handle higher transaction volumes. EMV chip and NFC-enabled readers are becoming standard due to global security mandates and the rising popularity of contactless payments. The retail and hospitality sectors remain primary end-users, but significant growth is observed in field services, healthcare, and transportation, where the portability and flexibility of mobile card readers are paramount. The market is also witnessing a convergence of hardware and software, with sophisticated payment applications and loyalty programs becoming integral parts of the mobile card reader ecosystem, offering richer experiences for both merchants and consumers.

AI Impact Analysis on Mobile Card Reader Market

User questions surrounding AI's impact on the Mobile Card Reader Market frequently revolve around how artificial intelligence can enhance security, streamline operations, and personalize customer experiences. Users are keen to understand if AI can predict fraudulent transactions more accurately, automate reconciliation processes, or provide deeper insights into consumer spending patterns. There is also interest in AI's role in developing more intelligent interfaces for mobile POS systems, potentially reducing human error and speeding up transactions. Expectations include AI-driven features that offer real-time business recommendations, dynamic pricing capabilities, and highly targeted marketing campaigns directly integrated with payment data, fundamentally transforming the value proposition of mobile card readers beyond mere transaction processing.

- Enhanced Fraud Detection: AI algorithms can analyze vast datasets of transaction patterns in real-time to identify and flag suspicious activities with higher accuracy than traditional rule-based systems, significantly reducing fraudulent chargebacks and enhancing payment security for merchants and consumers.

- Personalized Customer Experiences: AI can leverage payment data, purchase history, and even external factors to offer personalized recommendations, loyalty incentives, and dynamic discounts at the point of sale, fostering stronger customer engagement and driving repeat business.

- Optimized Inventory and Sales Forecasting: Integrating mobile card reader data with AI-powered analytics can provide real-time insights into sales trends, enabling businesses to optimize inventory levels, forecast demand more accurately, and make informed purchasing decisions, minimizing waste and maximizing profitability.

- Automated Reconciliation and Reporting: AI can automate the reconciliation of transactions, categorize expenses, and generate comprehensive financial reports, significantly reducing manual effort, improving accuracy, and providing businesses with clearer financial oversight.

- Voice-Activated and Gesture-Based Payments: Future mobile card readers could incorporate AI for voice command processing or gesture recognition, offering hands-free payment options that enhance convenience and accessibility, particularly in fast-paced retail environments or for users with disabilities.

- Predictive Maintenance for Devices: AI can monitor the performance of mobile card reader hardware, predict potential failures before they occur, and alert merchants for proactive maintenance, ensuring device uptime and seamless transaction processing.

- Smart Customer Support: AI-powered chatbots and virtual assistants can provide instant support for troubleshooting mobile card reader issues, answer common queries, and guide users through complex functionalities, improving user experience and reducing the burden on human support staff.

- Dynamic Pricing Strategies: AI can analyze various factors such as competitor pricing, customer demand, inventory levels, and even time of day to suggest or automatically implement dynamic pricing, maximizing revenue opportunities for businesses.

DRO & Impact Forces Of Mobile Card Reader Market

The Mobile Card Reader Market is significantly influenced by a confluence of drivers, restraints, and opportunities, all shaped by overarching impact forces. Key drivers include the exponential growth in digital payment adoption globally, spurred by consumer demand for convenience and contactless options, particularly in the wake of public health concerns. The proliferation of smartphones and tablets worldwide serves as a fundamental enabler, as these devices are the host platforms for mobile card readers. Furthermore, the increasing number of small and medium-sized enterprises (SMEs) and micro-merchants, especially in emerging economies, seeking cost-effective and flexible payment solutions, acts as a powerful catalyst for market expansion. The desire for financial inclusion and the modernization of payment infrastructures in various regions also contribute substantially to the market’s upward trajectory, making digital transactions accessible to a broader population segment.

However, the market faces several restraints that could impede its growth. Security concerns, particularly regarding data breaches, fraud, and the secure handling of sensitive payment information, remain a significant challenge. While technology has advanced, consumer and merchant apprehension regarding the safety of mobile transactions persists, necessitating continuous innovation in encryption and compliance. High transaction fees imposed by payment processors can deter smaller businesses or those with low-margin products from adopting these solutions. Moreover, a lack of awareness or understanding among certain merchant demographics, especially in less technologically advanced regions, about the benefits and operational simplicity of mobile card readers, presents an adoption barrier. Regulatory complexities and varying compliance standards across different countries also add layers of challenge for global market players.

Despite these restraints, numerous opportunities are poised to propel the market forward. The integration of mobile card readers with loyalty programs, advanced analytics, and inventory management systems creates a comprehensive ecosystem that offers greater value to merchants, moving beyond simple payment processing. The expansion into emerging markets, characterized by large unbanked populations and rapid digitalization, represents a vast untapped potential for market players. Furthermore, the continuous innovation in contactless payment technologies, including NFC, and the adoption of new payment methods like QR codes, enhance the utility and appeal of mobile card readers. Strategic partnerships between payment solution providers, mobile network operators, and financial institutions are also opening new avenues for market penetration and service diversification, fostering a more interconnected payment landscape and driving greater adoption among a wider range of merchants.

Segmentation Analysis

The Mobile Card Reader Market is extensively segmented to reflect the diverse technological offerings, application areas, and end-user requirements within the global payment ecosystem. This segmentation provides a granular view of market dynamics, enabling stakeholders to understand specific growth drivers, competitive landscapes, and opportunities across various product types, connectivity options, target industries, and underlying technologies. The categorization facilitates targeted product development, strategic marketing initiatives, and tailored service offerings to address the unique demands of different market niches. Understanding these segments is crucial for identifying emerging trends and adapting business strategies to the evolving digital payment landscape.

- By Type:

- Dongle Card Readers: Typically connect via audio jack or USB, offering basic functionality and high portability.

- Standalone Card Readers: Dedicated devices with their own screens and keypads, often connecting via Bluetooth or Wi-Fi, offering more robust features.

- Integrated mPOS Solutions: Comprehensive systems combining hardware and software, often featuring larger touchscreens and advanced functionalities beyond just card reading.

- By Connectivity:

- Bluetooth: Most common for wireless connection to smartphones/tablets.

- USB: Direct wired connection for reliability.

- Wi-Fi: Allows for network connectivity, often used in standalone devices.

- Audio Jack: Older generation, less common now but still in use for basic dongles.

- Cellular (3G/4G/5G): Integrated SIM for independent connectivity, particularly in standalone and integrated devices.

- By End-User:

- Retail: Small boutiques, department stores, pop-up shops.

- Restaurant & Hospitality: Cafes, food trucks, hotels, delivery services.

- Healthcare: Clinics, mobile health services, pharmacies.

- Transportation: Taxis, ride-sharing, public transit.

- Field Services: Plumbers, electricians, contractors.

- Government & Public Sector: Licensing offices, mobile services.

- Others: Non-profit organizations, educational institutions, personal services.

- By Technology:

- EMV Chip & PIN: Secure standard for chip card transactions requiring a PIN.

- Magnetic Stripe: Traditional stripe reading, still prevalent but declining in security.

- NFC (Near Field Communication): For contactless payments (tap-to-pay).

- QR Code Payments: Increasingly popular in certain regions, often integrated into mPOS apps.

Value Chain Analysis For Mobile Card Reader Market

The value chain of the Mobile Card Reader Market involves a complex interplay of various stages, from raw material sourcing to the end-user adoption, defining the flow of value creation. Upstream analysis focuses on the suppliers of critical components such as microcontrollers, secure elements, display screens, batteries, and communication modules (Bluetooth, Wi-Fi, cellular). These suppliers, often specialized in electronics manufacturing, dictate the cost structure, quality, and technological capabilities of the final device. Research and development activities, including the design of secure payment protocols and robust hardware architectures, also represent a crucial upstream activity, driven by technological innovation and adherence to evolving payment standards like EMVCo. Ensuring a stable and high-quality supply chain for these components is paramount for manufacturers to maintain competitive pricing and product reliability in a rapidly evolving market.

Midstream activities primarily encompass the manufacturing, assembly, and software development for the mobile card readers. This stage involves converting raw components into finished devices and integrating them with proprietary or third-party payment processing software. Device manufacturers, often working in collaboration with payment service providers (PSPs) and financial institutions, focus on creating user-friendly interfaces, robust security features, and compliance with industry regulations such as PCI DSS. The development of accompanying mobile applications that transform a smartphone into a comprehensive POS system is also a critical part of this stage, adding significant value through features like inventory management, sales reporting, and customer analytics. Quality control, certification processes, and scalability of production are key considerations at this stage to meet market demand and ensure product integrity.

Downstream analysis delves into the distribution channels and the ultimate reach to end-users. Direct channels include manufacturers selling directly to merchants via their websites or dedicated sales teams, offering direct support and often bundled services. Indirect channels involve a broader network, including payment processors, acquiring banks, telecommunication companies, electronics distributors, and value-added resellers (VARs) who integrate mobile card readers into broader POS solutions or offer them as part of their service packages. These intermediaries play a vital role in market penetration, particularly for reaching diverse merchant segments and geographic regions. The final stage involves the deployment, merchant onboarding, ongoing customer support, and software updates for the mobile card readers. Effective direct and indirect distribution strategies, coupled with robust post-sales support, are crucial for widespread adoption and sustained market growth, building merchant loyalty and trust in the payment ecosystem.

Mobile Card Reader Market Potential Customers

Potential customers for mobile card readers are exceptionally diverse, spanning a wide spectrum of business sizes and operational models, united by the need for flexible, efficient, and accessible payment acceptance. The largest segment comprises small and medium-sized enterprises (SMEs), including independent retailers, boutique shops, cafes, food trucks, and local service providers like hairdressers, plumbers, and artisans. These businesses often operate with limited budgets and benefit immensely from the low upfront costs, ease of setup, and portability that mobile card readers offer, enabling them to compete effectively with larger establishments by accepting modern payment methods without significant infrastructure investment. The convenience of transforming an existing smartphone or tablet into a full-fledged POS system democratizes payment processing, fostering economic growth within this crucial business segment.

Beyond traditional SMEs, mobile card readers cater significantly to micro-merchants, sole proprietors, and individuals engaging in informal commerce. This includes farmers market vendors, pop-up shop operators, artists selling at craft fairs, home-based businesses, and even individuals conducting peer-to-peer transactions for goods or services. For these users, traditional POS systems are often prohibitively expensive or too complex, making mobile card readers an ideal, straightforward solution for secure and convenient transaction processing. The simplicity and accessibility of these devices lower the barrier to entry for digital payment acceptance, expanding the addressable market for payment services and contributing to financial inclusion in many regions.

Furthermore, larger enterprises with mobile workforces or specific use cases also represent significant potential customers. This encompasses field service companies (e.g., HVAC repair, delivery services), transportation providers (e.g., taxis, ride-sharing, mobile ticketing), healthcare providers (e.g., mobile clinics, home health services), and event management companies. For these businesses, the ability to accept payments on-the-go, away from a fixed storefront, is critical for operational efficiency and customer satisfaction. Mobile card readers enable seamless transactions at the point of interaction, improving cash flow and providing real-time data integration with enterprise resource planning (ERP) systems. The versatility and adaptability of these devices make them invaluable tools across a broad range of industries seeking to modernize and streamline their payment acceptance processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 25.3 billion |

| Market Forecast in 2032 | USD 80.5 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Square, PayPal (Zettle), SumUp, Verifone, Ingenico, PAX Global, BBPOS, Clover (First Data), mPOS, Poynt, Newland Payment Technology, Castles Technology, Dejavoo Systems, Exadigm, AnywhereCommerce, Star Micronics, MagTek, ID TECH, Miura Systems, SZZT Electronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Card Reader Market Key Technology Landscape

The Mobile Card Reader Market is characterized by a rapidly evolving technological landscape, driven by the continuous need for enhanced security, improved efficiency, and greater convenience in payment processing. At the forefront of this evolution is EMV (Europay, MasterCard, and Visa) chip technology, which has become the global standard for secure card present transactions. EMV chip readers dramatically reduce fraud by generating unique cryptograms for each transaction, making card cloning significantly more difficult compared to traditional magnetic stripe cards. Alongside EMV, Near Field Communication (NFC) technology is pivotal, enabling contactless payments where customers simply tap their cards or mobile devices (via Apple Pay, Google Pay, etc.) to complete a transaction, offering speed and hygiene benefits that have gained prominence, especially in recent years. These two technologies form the bedrock of modern secure and efficient mobile payment acceptance.

Beyond the core card reading capabilities, the market heavily relies on robust wireless connectivity standards. Bluetooth Low Energy (BLE) is predominantly used for connecting the mobile card reader hardware to a smartphone or tablet, offering energy efficiency and reliable communication. For standalone or integrated mobile POS devices, Wi-Fi and cellular (3G, 4G, and increasingly 5G) connectivity are crucial, allowing for independent operation without tethering to a separate mobile device, and ensuring continuous transaction processing even in areas with limited Wi-Fi access. The integration of GPS capabilities in some advanced mobile readers also enables location-based services, fraud prevention, and more accurate transaction geotagging, enhancing both security and merchant insights. The ongoing advancements in these wireless communication protocols are vital for supporting faster, more reliable, and secure payment experiences in diverse environments.

Security remains a paramount concern, driving innovations in encryption, tokenization, and secure element technologies. End-to-end encryption (E2EE) ensures that card data is encrypted from the moment it is captured by the reader until it reaches the payment processor, preventing sensitive information from being intercepted in plain text. Tokenization replaces actual card numbers with unique, randomized tokens, further safeguarding data by ensuring that even if a system is breached, no actual card numbers are compromised. Secure elements, either embedded within the reader hardware or leveraging mobile device security features, provide a tamper-resistant environment for storing cryptographic keys and processing sensitive payment data. Furthermore, the development of secure SDKs (Software Development Kits) and APIs (Application Programming Interfaces) allows for seamless integration of payment functionality into third-party applications while maintaining high security standards. These technological advancements collectively contribute to building a trustworthy and resilient mobile payment ecosystem for merchants and consumers alike.

Regional Highlights

- North America: A mature market characterized by high digital payment adoption, widespread EMV compliance, and a strong presence of key payment processing innovators. The U.S. and Canada lead in mobile POS solutions, driven by a large SME base and consumer demand for convenient payment options.

- Europe: Exhibits robust growth, especially in Western Europe, due to strong regulatory support for digital payments (e.g., PSD2), high smartphone penetration, and the rapid expansion of contactless payment acceptance. Countries like the UK, Germany, and France are key contributors, with rising adoption among micro-merchants and hospitality sectors.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive smartphone adoption, rapid urbanization, government initiatives promoting cashless economies (e.g., India's UPI, China's WeChat Pay/Alipay dominance), and a vast underserved merchant base. China, India, and Southeast Asian countries are pivotal to this growth.

- Latin America: Demonstrating significant potential driven by increasing financial inclusion efforts, a growing e-commerce sector, and a strong desire to modernize traditional payment systems. Brazil and Mexico are leading the charge in adopting mobile card reader solutions to cater to a diverse merchant landscape.

- Middle East and Africa (MEA): An emerging market experiencing rapid digitalization, increasing smartphone penetration, and government support for digital transformation initiatives. Countries in the GCC region and South Africa are key growth areas, with a focus on enhancing payment accessibility and security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Card Reader Market.- Square

- PayPal (Zettle)

- SumUp

- Verifone

- Ingenico

- PAX Global

- BBPOS

- Clover (First Data)

- mPOS

- Poynt

- Newland Payment Technology

- Castles Technology

- Dejavoo Systems

- Exadigm

- AnywhereCommerce

- Star Micronics

- MagTek

- ID TECH

- Miura Systems

- SZZT Electronics

Frequently Asked Questions

What is a mobile card reader and how does it work?

A mobile card reader is a portable device that connects to a smartphone or tablet, transforming it into a mobile point-of-sale (mPOS) system. It allows merchants to accept credit and debit card payments anywhere. It works by securely reading card data (magnetic stripe, EMV chip, or NFC contactless) and sending it to a payment processor via the connected mobile device's internet connection for authorization and settlement.

What are the primary benefits of using a mobile card reader for businesses?

The primary benefits include increased payment flexibility, allowing businesses to accept cards on the go; expanded customer reach by catering to cashless consumers; lower setup costs compared to traditional POS systems; improved operational efficiency through quick transactions; and access to valuable sales data and analytics via companion apps. It empowers small businesses and mobile merchants to compete effectively.

How secure are mobile card readers, and what measures are in place to protect sensitive data?

Modern mobile card readers are highly secure, utilizing EMV chip technology, end-to-end encryption (E2EE), and tokenization to protect sensitive card data. They comply with industry standards like PCI DSS. Data is encrypted at the point of capture and often replaced with a unique token, ensuring that actual card numbers are not stored or transmitted in an unsecure manner, significantly reducing fraud risks.

Which types of businesses benefit most from adopting mobile card reader technology?

Small and medium-sized enterprises (SMEs), micro-merchants, mobile businesses, and service providers benefit significantly. This includes retailers, restaurants, food trucks, pop-up shops, field service technicians (plumbers, electricians), healthcare providers, and independent contractors. Any business needing to accept payments outside a traditional storefront, or seeking an affordable and flexible payment solution, is an ideal candidate.

What are the future trends expected to impact the Mobile Card Reader Market?

Future trends include greater integration with AI for enhanced fraud detection and personalized customer experiences, wider adoption of biometric authentication, continued growth in contactless and QR code payments, expansion into emerging markets, and the development of more sophisticated integrated mPOS solutions offering comprehensive business management features beyond just payment processing, leveraging 5G connectivity for faster and more reliable transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager