Mobile Satellite Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430823 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Mobile Satellite Services Market Size

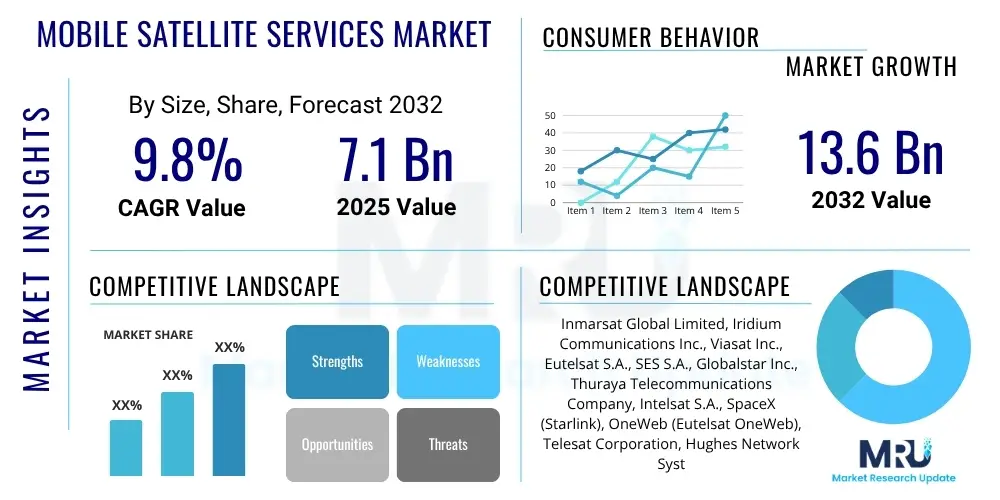

The Mobile Satellite Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at USD 7.1 Billion in 2025 and is projected to reach USD 13.6 Billion by the end of the forecast period in 2032.

Mobile Satellite Services Market introduction

The Mobile Satellite Services (MSS) market provides essential communication capabilities to users in areas lacking robust terrestrial network infrastructure, serving as a vital link for critical operations and remote connectivity across the globe. These services encompass a comprehensive range of offerings, including voice, data, video, and sophisticated machine-to-machine (M2M) communications, delivered through an intricate network of geostationary Earth orbit (GEO), medium Earth orbit (MEO), and increasingly, low Earth orbit (LEO) satellites. The inherent benefit of MSS lies in its unparalleled global reach, robust network resilience, and independence from ground-based infrastructure, making it indispensable for maritime, aviation, defense, energy, and emergency response sectors where consistent and reliable connectivity is paramount for safety and operational continuity.

The primary product offerings within the MSS market have evolved significantly, ranging from narrowband services designed for basic voice communication and low-speed data transmission to high-throughput broadband solutions facilitating extensive internet access, high-definition video streaming, and complex cloud-based applications. These advanced services are supported by state-of-the-art satellite constellations and sophisticated ground infrastructure, ensuring seamless communication across vast geographical expanses, including remote landmasses, expansive oceans, and even polar regions. Major applications span across critical infrastructure monitoring, global fleet management, disaster recovery communications, air traffic control, offshore oil and gas operations, military intelligence gathering, and providing internet access for isolated communities and humanitarian aid efforts. The market is characterized by continuous technological innovation, aimed at enhancing bandwidth capacity, significantly reducing signal latency, and improving the overall cost-effectiveness and accessibility of satellite-based communication solutions for a broader user base.

Key benefits derived from leveraging Mobile Satellite Services include unparalleled global coverage, which ensures connectivity even in the most remote or challenging environments, robust network resilience that operates independently of local terrestrial infrastructure, and highly reliable communication capabilities during natural disasters, network outages, or geopolitical disruptions. These critical advantages are powerful driving factors for sustained market expansion, alongside the burgeoning global demand for ubiquitous connectivity in an increasingly interconnected world. The rapid proliferation of Internet of Things (IoT) devices deployed in remote or mobile environments, the escalating reliance on M2M communications for optimizing operational efficiency across various industrial sectors, and the growing need for secure, reliable communications for governmental and defense applications further fuel market growth. Moreover, significant technological advancements, particularly in the realm of LEO satellite technology, are transforming the market by offering significantly lower latency and higher bandwidth solutions, thereby attracting a more diverse array of users and applications.

Mobile Satellite Services Market Executive Summary

The Mobile Satellite Services market is undergoing a period of dynamic expansion, fueled by the escalating demand for reliable, global connectivity across an increasingly diverse range of sectors and geographic locations. Current business trends indicate a significant strategic shift towards hybrid communication solutions, seamlessly integrating satellite networks with terrestrial infrastructure to create robust and pervasive connectivity ecosystems. This is coupled with the rapid, large-scale expansion of LEO satellite constellations, which are fundamentally enhancing service capabilities by offering significantly increased speeds and drastically reduced latency. This profound evolution is enabling an entirely new spectrum of use cases and substantially expanding the addressable market beyond its traditional vertical segments. Regionally, the market exhibits pronounced growth in emerging economies, particularly within the Asia Pacific and African continents, driven by ambitious infrastructure development projects, the pressing need for connectivity in remote and rural areas, and the increased adoption of MSS in critical sectors such as maritime and energy.

Prevailing business trends are distinctly marked by an intensified level of competition, originating from both established incumbent players and a wave of innovative new entrants, particularly those deploying advanced LEO constellations such as Starlink by SpaceX and the revitalized OneWeb network. A strong and persistent emphasis is placed on the research and development of highly flexible, software-defined satellites and the strategic integration of 5G standards into next-generation satellite networks. This integration aims to enable truly seamless, multi-orbit connectivity, effectively blurring the lines between satellite and terrestrial communication. Furthermore, the market is witnessing a growing focus on direct-to-device (D2D) satellite communication capabilities, with the ambitious goal of providing ubiquitous connectivity directly to standard consumer smartphones. Strategic partnerships, joint ventures, and mergers and acquisitions are increasingly common tactics employed by companies seeking to consolidate market share, leverage complementary technological expertise, and offer more comprehensive, end-to-end communication solutions to a broader client base.

Current segment trends emphatically underscore the escalating importance of high-speed data services, progressively surpassing the traditional dominance of voice communications. This paradigm shift is primarily driven by the exponential proliferation of Internet of Things (IoT) and Machine-to-Machine (M2M) applications across a multitude of industries, including the expansive maritime sector, the dynamic aviation industry, and the critical oil and gas sector. The demand for high-throughput satellite (HTS) services is expanding at an accelerated pace, as modern users require substantially greater bandwidth for activities such as high-definition video streaming, secure cloud access for business-critical applications, and the real-time transmission of complex operational data. While geostationary (GEO) satellites continue to serve vital fixed and broadcasting needs effectively, the emergence of LEO and MEO systems is rapidly capturing segments that demand lower latency and more dynamic, adaptable coverage. These include applications like real-time tracking, sophisticated autonomous vehicle communication, and enhanced mobile broadband for users situated in remote or underserved areas. This strategic diversification of satellite orbits allows for the development and deployment of highly tailored solutions that precisely address specific industry requirements, contributing significantly to the overall dynamism and innovation within the mobile satellite services market.

AI Impact Analysis on Mobile Satellite Services Market

Common user questions regarding the pervasive impact of Artificial Intelligence (AI) on the Mobile Satellite Services market frequently center around its profound potential to significantly enhance network efficiency, rigorously optimize resource allocation, and fundamentally improve service delivery across a complex global infrastructure. Users often inquire about how AI can effectively manage and derive actionable insights from the vast amounts of telemetry and operational data generated by sprawling satellite constellations, predict imminent network failures before they occur, or extensively automate sophisticated ground operations. There is also considerable interest in understanding AI's multifaceted role in personalizing the user experience, streamlining intricate maintenance procedures, and crucially bolstering cybersecurity measures within the inherently vulnerable satellite communication infrastructures. The overarching expectation is that AI will emerge as a truly transformative force, enabling the development and deployment of smarter, more resilient, and ultimately more cost-effective MSS solutions that can adapt to ever-changing demands and challenges.

- Enhanced network optimization: AI algorithms intelligently manage bandwidth, allocate resources dynamically across diverse satellite and terrestrial networks, and route traffic efficiently, minimizing congestion and significantly improving quality of service for end-users.

- Predictive maintenance: AI analyzes extensive telemetry data from satellites and ground equipment to anticipate potential hardware failures or performance degradations, enabling proactive maintenance scheduling that reduces costly downtime and extends asset lifespans.

- Automated anomaly detection: AI systems continuously monitor vast streams of satellite operational data for unusual patterns or deviations, quickly identifying anomalies or potential threats, which is crucial for maintaining network integrity and robust security against evolving cyberattacks.

- Improved spectral efficiency: AI-driven beamforming and advanced modulation techniques maximize the utilization of available radio spectrum, allowing for higher data rates and increased communication capacity within existing or future satellite infrastructures, optimizing scarce resources.

- Personalized user services: AI can dynamically adapt service offerings, connectivity profiles, and bandwidth allocation based on individual user behavior, geographical location, and real-time application needs, providing a more tailored, efficient, and responsive mobile satellite experience.

- Advanced data processing and analysis: AI processes massive volumes of satellite-generated data, from ubiquitous IoT sensor readings to complex Earth observation imagery, extracting actionable insights for a wide array of critical applications including environmental monitoring, climate change research, and precise resource management.

- Ground segment automation: AI streamlines complex ground station operations by automating tasks such as antenna pointing, sophisticated signal processing, and comprehensive network monitoring, thereby significantly reducing operational costs and the need for extensive human intervention.

DRO & Impact Forces Of Mobile Satellite Services Market

The Mobile Satellite Services market is profoundly influenced by a complex interplay of driving factors, restrictive elements, and dynamic emerging opportunities, all of which are continuously shaped by various pervasive impact forces. A primary driver fueling market expansion is the escalating global demand for ubiquitous connectivity, particularly vital in remote, underserved, and geographically challenging regions where terrestrial networks are absent or unreliable. This is further amplified by the rapid proliferation of Internet of Things (IoT) and Machine-to-Machine (M2M) devices that necessitate global coverage for effective deployment and operation. Additionally, the critical and non-negotiable need for resilient communication infrastructure in disaster management scenarios, enabling rapid response and coordination when traditional networks fail, acts as a significant catalyst. These combined forces collectively push the market towards continuous innovation, technological advancement, and strategic expansion across new verticals and geographies. However, the market concurrently faces considerable restraints, including the inherently high initial capital investment required for satellite design, manufacturing, launch, and ground infrastructure development, which can pose significant barriers to entry and limit the pace of expansion. Furthermore, the finite nature of orbital slots and the increasingly congested radio spectrum present technical and regulatory challenges. Latency issues historically associated with geostationary satellites can affect real-time, interactive applications, although LEO constellations are actively addressing this.

Opportunities for substantial market growth are abundant and continuously emerging, largely stemming from relentless advancements in satellite technology, most notably the widespread development and deployment of Low Earth Orbit (LEO) constellations. These LEO systems promise significantly lower latency, substantially higher bandwidth, and more dynamic coverage patterns, thereby opening entirely new market segments and use cases previously unfeasible with traditional GEO systems. The strategic integration of MSS with 5G terrestrial networks presents a transformative opportunity to create seamless, highly resilient hybrid communication environments, which enhance overall network coverage, capacity, and reliability. Furthermore, the increasing demand for direct-to-device (D2D) satellite communication capabilities, aimed at providing connectivity directly to standard consumer smartphones, represents a burgeoning and potentially mass-market opportunity. The expansion of highly specialized MSS solutions tailored for distinct vertical industries, such as maritime, aviation, energy, and mining, which have unique and demanding communication requirements, alongside the growing focus on governmental and defense applications for secure, resilient, and mission-critical communications, all contribute to a robust and positive outlook for market expansion and diversification. These evolving opportunities demand agile business models and innovative technological approaches to fully capitalize on their potential.

The impact forces exerted on the Mobile Satellite Services market are multifaceted and encompass a wide array of technological, regulatory, economic, and geopolitical factors. Technological advancements, such as the miniaturization of satellites, the development of advanced antenna designs (e.g., phased arrays), and the advent of software-defined payloads, continuously reshape the capabilities, performance, and cost structures of MSS, fostering greater flexibility and efficiency. Regulatory frameworks, including international spectrum allocation policies, national licensing requirements, and orbital debris mitigation standards, play an absolutely critical role in enabling or hindering market entry, dictating operational parameters, and shaping the competitive landscape. Global and regional economic conditions, including overall GDP growth, investment cycles in space technology, and the financial health of key end-user industries, directly influence funding for new satellite projects, the pace of technological adoption, and the affordability of MSS for businesses and governments. Finally, geopolitical stability, international treaties, and cross-border cooperation are vital for seamless satellite launches, ensuring reliable orbital access, and facilitating the uninterrupted provision of services across diverse national boundaries. These complex and interconnected forces collectively dictate the overall pace, direction, and long-term sustainability of market evolution.

Segmentation Analysis

The Mobile Satellite Services market is meticulously segmented to accurately reflect the wide array of technological offerings, diverse application areas, and distinct end-user requirements that collectively characterize this highly dynamic and rapidly evolving industry. This comprehensive segmentation approach provides a granular and insightful view of overarching market dynamics, enabling a much deeper understanding of the specific growth drivers, prevailing market trends, and unique market opportunities that exist within each defined category. Such a structured analysis is indispensable for stakeholders to effectively navigate the complexities of the MSS landscape. The primary criteria for segmentation are carefully chosen to cover the complete spectrum of service delivery, including the specific type of service offered, the operational platform from which the service is accessed, the distinct orbital altitude of the satellites employed, and the diverse range of end-user industries that heavily rely on these critical communication capabilities. This multi-dimensional approach is instrumental in helping market participants and analysts alike to precisely analyze market shifts, strategically tailor their service solutions to meet specific demands, and identify the most lucrative niches for future investment and expansion.

- Service Type: This segment categorizes MSS offerings based on the nature of the communication provided, reflecting varied bandwidth and application needs.

- Voice Services: Essential for basic communication in remote areas, mission-critical situations, and safety-at-sea.

- Data Services: Encompassing low-speed messaging to high-speed broadband internet for operational data, email, and cloud access.

- Video Services: Primarily used for live broadcasting from remote locations, surveillance, and video conferencing.

- M2M and IoT Services: Dedicated for connecting devices, sensors, and machines for asset tracking, remote monitoring, and telemetry data transmission.

- Platform: This segmentation identifies the environment or context from which the mobile satellite services are primarily utilized.

- Land Mobile Services: For vehicles, personnel, and fixed-site operations in remote terrestrial areas.

- Maritime Services: Critical for commercial shipping, cruise lines, fishing vessels, and leisure boats globally.

- Aeronautical Services: Providing communication for commercial airlines, private jets, and military aircraft during flight.

- Portable and Fixed-to-Mobile Services: Including handheld terminals, VSATs, and transportable solutions for temporary deployments.

- Orbit Type: This segment differentiates services based on the altitude and characteristics of the satellite constellations.

- Geostationary Earth Orbit (GEO): Offers wide coverage from a fixed position, ideal for broadcast and stable connections.

- Medium Earth Orbit (MEO): Provides a balance of coverage and lower latency, suitable for enterprise and government applications.

- Low Earth Orbit (LEO): Characterized by very low latency and high-speed data, enabling new applications like direct-to-device and pervasive broadband.

- End User: This segmentation focuses on the distinct industries and sectors that are the primary consumers of MSS.

- Government and Defense: For secure, resilient, and global communication in military operations, intelligence, and national security.

- Maritime (Commercial, Leisure, Fishing): For vessel operations, crew welfare, navigation, and fleet management.

- Aviation (Commercial, General, Military): For in-flight connectivity, air traffic management, and operational communications.

- Energy (Oil and Gas, Mining): For remote site connectivity, operational control, and safety in challenging environments.

- Media and Entertainment: For live news gathering, remote broadcasting, and content delivery.

- Emergency Services and Disaster Management: For establishing critical communication links during crises when terrestrial networks fail.

- Enterprise and Commercial: For remote offices, logistics, construction, and global supply chain management.

- Agriculture and Forestry: For precision farming, remote monitoring of assets, and environmental data collection.

Value Chain Analysis For Mobile Satellite Services Market

The value chain for the Mobile Satellite Services market represents a highly intricate and interconnected series of activities, commencing from the initial conceptualization and sophisticated manufacturing of satellite hardware to the ultimate delivery of specialized communication services to the end-user. The upstream segment of this extensive chain is fundamentally driven by specialized satellite manufacturers, who meticulously design, construct, and rigorously test the complex spacecraft, ensuring their operational integrity and longevity in orbit. Concurrently, launch service providers are critical entities, solely responsible for the precise and safe deployment of these advanced satellites into their designated orbits. Furthermore, this segment includes highly specialized ground segment equipment providers, who supply the essential array of antennas, sophisticated modems, network management systems, and other critical infrastructure necessary for establishing and maintaining effective satellite communication links. These foundational elements are absolutely critical for establishing and sustaining the robust infrastructure required for seamless MSS operations.

Progressing downstream, the value chain involves the core role of satellite operators who are responsible for the complex management of entire satellite constellations and their associated global ground networks. These operators typically provide wholesale satellite capacity and foundational network services to a diverse range of partners. This raw capacity is then strategically acquired and utilized by MSS service providers, who expertly package these foundational services into highly tailored, value-added solutions designed for specific end-users and vertical markets. These service providers often enhance the base offering through the integration of complementary technologies, comprehensive customer support, and the development of specialized applications. Integrators and various forms of distributors play an indispensable role in effectively bringing these sophisticated services to a broad and diverse market, reaching numerous vertical industries and spanning wide geographical regions. Their concerted efforts are essential in ensuring that satellite connectivity is not only accessible but also efficiently deployed and optimally managed across a wide array of client bases, thereby bridging the crucial gap between the highly complex satellite infrastructure and the direct communication needs of the end-user.

The distribution channels for Mobile Satellite Services are notably varied and highly adaptive, meticulously reflecting the diverse customer base, their unique operational environments, and their distinct service requirements. Direct sales approaches are commonly employed for large-scale enterprise clients, governmental contracts, and defense organizations, where bespoke solutions, extensive integration services, and dedicated, long-term support are frequently required due owing to the mission-critical nature of their operations. Conversely, indirect channels, encompassing a wide network of Value Added Resellers (VARs), master distributors, and regional dealers, are absolutely essential for effectively reaching smaller businesses, individual professional customers, and highly specialized niche markets. These strategic channel partners often provide crucial localized installation services, ongoing maintenance support, and dedicated customer service, thereby significantly extending the geographical reach of MSS providers and enabling the customization of services to meet specific regional demands and regulatory landscapes. The inherent complexity of the entire MSS value chain necessitates strong, collaborative partnerships and seamless coordination across all stages, from manufacturing to last-mile delivery, to consistently deliver robust, reliable, and high-performance mobile satellite communication solutions to a globally dispersed user base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.1 Billion |

| Market Forecast in 2032 | USD 13.6 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inmarsat Global Limited, Iridium Communications Inc., Viasat Inc., Eutelsat S.A., SES S.A., Globalstar Inc., Thuraya Telecommunications Company, Intelsat S.A., SpaceX (Starlink), OneWeb (Eutelsat OneWeb), Telesat Corporation, Hughes Network Systems LLC, Gilat Satellite Networks Ltd., ST Engineering iDirect, EchoStar Corporation, Omnispace LLC, Kymeta Corporation, AST SpaceMobile Inc., Ligado Networks LLC, Orbcomm Inc., Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Satellite Services Market Potential Customers

The Mobile Satellite Services market serves an expansive and diverse spectrum of end-users and buyers, each characterized by unique connectivity requirements primarily driven by their specific operational environments, geographical locations, and mission-critical communication needs. The primary potential customers fundamentally include entities that operate in inherently remote, austere, or highly mobile environments where traditional terrestrial network infrastructure is either entirely unavailable, critically unreliable, or demonstrably insufficient to meet their operational demands. These encompass maritime operators, who require unwavering, constant connectivity across vast ocean expanses for critical navigation, crew welfare, regulatory compliance, and the efficient transmission of operational data. Similarly, aviation companies rely on MSS for secure air-to-ground communication, essential flight operations, and providing passenger connectivity. Governmental bodies, particularly for defense, homeland security, and public safety applications, utilize MSS for resilient, independent, and secure communication channels.

Furthermore, a substantial and growing demand originates from the energy sector, specifically targeting oil and gas companies operating remote offshore platforms or geographically isolated exploration sites, as well as mining firms that necessitate robust, reliable communication for their extensively dispersed operations and sophisticated asset tracking systems. Emergency services and disaster relief organizations represent a critical segment of consumers, heavily relying on MSS for the rapid deployment of temporary communication infrastructure in areas severely affected by natural calamities, civil emergencies, or other large-scale disruptions where conventional networks have failed. Media and entertainment companies frequently leverage MSS for live broadcasting from remote or challenging locations, ensuring real-time content delivery and high-quality media transmission without dependence on local infrastructure. Additionally, a rapidly expanding segment of enterprise and commercial clients, particularly those involved in global logistics, precision agriculture, and sustainable forestry, increasingly seek MSS for comprehensive asset tracking, remote environmental monitoring, and the efficient management of widely distributed operational sites.

The highly varied and specialized communication needs of these diverse end-users directly shape and drive the offerings within the MSS market, leading to the development of tailored solutions that range from essential voice and messaging services to advanced high-speed broadband and dedicated IoT/M2M platforms. For example, maritime customers typically require not only global voice and broadband data for vessel operations and crew communication but also specialized safety-of-life services. Conversely, defense and national security clients prioritize highly secure, resilient, and encrypted satellite links capable of operating under adverse conditions. The ongoing expansion and technological maturation of LEO satellite constellations are attracting an entirely new cohort of potential customers, including individual consumers in traditionally underserved areas and a broader range of enterprises seeking more cost-effective, lower-latency broadband options. Identifying, thoroughly understanding, and actively responding to the nuanced requirements of these varied customer segments are absolutely crucial for market participants to effectively tailor their services, innovate strategically, and capture the substantial growth opportunities presented by the evolving Mobile Satellite Services market.

Mobile Satellite Services Market Key Technology Landscape

The Mobile Satellite Services market is currently undergoing a profound technological transformation, propelled by relentless innovations aimed at substantially enhancing communication capacity, significantly reducing latency, and dramatically improving the overall cost-effectiveness of satellite-based communication solutions. High-throughput satellites (HTS) represent a foundational cornerstone of this evolution, meticulously employing advanced frequency reuse techniques and sophisticated spot beam technology to deliver significantly more bandwidth and higher data rates compared to traditional wide-beam satellites, thereby effectively supporting bandwidth-intensive applications such such as video streaming and cloud computing. Furthermore, the advent and widespread deployment of software-defined satellites and highly flexible payloads are revolutionizing operations, allowing operators to dynamically adjust coverage areas, adapt capacity distribution, and reconfigure frequency bands in orbit, which enables unprecedented adaptability to changing market demands and optimal resource utilization throughout the satellite's operational lifespan. These advanced technologies are absolutely crucial for expanding the breadth and depth of service offerings and diligently meeting the ever-increasing user expectations for superior performance and flexibility in satellite communications.

Simultaneously, advancements in ground segment technologies are equally pivotal in driving this market evolution, including the continuous development of highly advanced modems and compact, efficient terminals that can process and transmit higher volumes of data with improved spectral efficiency. This also includes the widespread adoption of sophisticated phased array antennas that offer electronic beam steering capabilities without any mechanical movement, providing rapid reconfigurability and tracking of multiple satellites. Inter-satellite links (ISLs), which are particularly vital for the rapidly expanding LEO and MEO constellations, enable satellites to communicate directly with each other in space, significantly reducing reliance on extensive ground station networks and minimizing latency by routing data through optimal space paths. The integration of 5G Non-Terrestrial Networks (NTN) standards is another profoundly significant technological development, specifically aimed at seamlessly extending 5G cellular connectivity to remote, rural, and mobile areas by incorporating satellite components directly into the global 5G ecosystem. This promises a unified, pervasive, and highly resilient network architecture that bridges terrestrial and space-based communication.

Other crucial technologies that are actively shaping and defining the contemporary MSS landscape include highly advanced beamforming techniques, which allow for the precise direction of satellite signals to specific geographical areas or user terminals, thereby maximizing signal strength and minimizing interference. Network Function Virtualization (NFV) is another transformative technology, enabling the virtualization of various network functions within the ground segment infrastructure, which significantly enhances the flexibility, scalability, and cost-efficiency of satellite ground networks. Furthermore, the increasing strategic application of Artificial Intelligence (AI) and Machine Learning (ML) for comprehensive network management, sophisticated predictive analytics, and proactive cybersecurity measures is profoundly optimizing MSS operations, ensuring consistently high availability, robust performance, and enhanced security against evolving threats. These collective technological innovations and strategic integrations contribute synergistically to fostering a more dynamic, efficient, versatile, and secure Mobile Satellite Services market, capable of addressing an increasingly broad range of applications and diverse user demands across various critical sectors globally.

Regional Highlights

- North America: This region consistently stands as a dominant force in the Mobile Satellite Services market, distinguished by the early and widespread adoption of advanced satellite technologies, substantial governmental and defense spending on secure and resilient communication infrastructure, and the formidable presence of leading global satellite operators and innovative service providers. The robust demand for critical communications spans across vital sectors such as oil and gas, maritime, and aviation. Significant investments in the deployment and expansion of cutting-edge LEO constellations, exemplified by Starlink and OneWeb operations, are powerfully propelling market growth. Furthermore, intensive research and development activities in next-generation satellite technology and the seamless integration with emerging 5G terrestrial networks represent key strategic drivers in this highly dynamic region.

- Europe: Europe represents a mature and highly developed MSS market, characterized by strong, consistent demand emanating from its extensive maritime industry, particularly for commercial shipping, offshore energy operations, and yachting, as well as its significant aviation and governmental sectors. The region greatly benefits from supportive and progressive regulatory frameworks, substantial investments in critical satellite infrastructure by prominent entities like the European Space Agency (ESA), and a keen strategic focus on advanced applications such as autonomous shipping, intelligent transportation systems, and comprehensively connected vehicles. The pervasive push for digitalization across diverse industries and a pronounced emphasis on robust disaster preparedness further fuel the accelerated adoption of MSS solutions across the continent.

- Asia Pacific (APAC): The APAC region is demonstrably poised for exceptionally rapid growth within the MSS market, primarily driven by the burgeoning demand for ubiquitous connectivity in its numerous developing economies, the vast expanse of its remote and rural areas, and increasing strategic investment in crucial telecommunications infrastructure. Major countries such as India, China, and the diverse nations of Southeast Asia are collectively witnessing a significant surge in maritime and aviation traffic, alongside a critical and urgent need for resilient disaster management communications. Proactive government initiatives aimed at bridging the pervasive digital divide and the expansive growth of resource-intensive industries such as mining and energy in remote geographical areas serve as powerful market catalysts, accelerating MSS uptake.

- Latin America: This region presents substantial and largely untapped opportunities for the expansion of MSS, particularly in providing essential support to its vital resource-based industries, including agriculture, mining, and oil and gas, which frequently operate in geographically challenging and extensively underserved areas. The pressing need for reliable and resilient communication infrastructure in disaster-prone regions and for providing basic connectivity to remote, isolated communities also acts as a significant demand driver. Strategic investments in infrastructure development and supportive government programs specifically aimed at expanding digital access and inclusion further contribute to the steady development and maturation of the MSS market across Latin America.

- Middle East and Africa (MEA): The MEA region is experiencing significant and sustained growth in the MSS market due to its vast geographical expanses, the often underdeveloped terrestrial infrastructure in many parts of the continent, and its immense strategic importance in global oil and gas production. Governments across the region are increasingly investing in satellite communications for robust defense applications, comprehensive public safety initiatives, and to facilitate broader economic diversification away from traditional resource reliance. The dynamic maritime sector, coupled with the escalating demand for high-speed broadband connectivity in remote and rural areas, also serves as a crucial and powerful growth driver in this rapidly evolving region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Satellite Services Market.- Inmarsat Global Limited

- Iridium Communications Inc.

- Viasat Inc.

- Eutelsat S.A.

- SES S.A.

- Globalstar Inc.

- Thuraya Telecommunications Company

- Intelsat S.A.

- SpaceX (Starlink)

- OneWeb (Eutelsat OneWeb)

- Telesat Corporation

- Hughes Network Systems LLC

- Gilat Satellite Networks Ltd.

- ST Engineering iDirect

- EchoStar Corporation

- Omnispace LLC

- Kymeta Corporation

- AST SpaceMobile Inc.

- Ligado Networks LLC

- Orbcomm Inc.

- Honeywell International Inc.

Frequently Asked Questions

What is Mobile Satellite Services (MSS)?

Mobile Satellite Services (MSS) encompass voice, data, and video communications delivered via satellite to mobile or remote users, providing essential connectivity in areas beyond the reach of terrestrial networks. These services are vital for sectors such as maritime, aviation, defense, and emergency response, ensuring global communication and operational continuity.

How are LEO satellites changing the MSS market?

LEO satellites are profoundly transforming the MSS market by offering significantly reduced latency and substantially increased bandwidth compared to traditional GEO systems. This enables faster, more responsive internet access, supporting novel applications like real-time data analytics, high-definition video conferencing, and direct-to-device connectivity for standard smartphones, thereby expanding market accessibility and utility.

What are the main applications of MSS?

Key applications of MSS include mission-critical maritime and aeronautical communications, secure government and defense operations, remote oil and gas exploration, rapid disaster recovery efforts, reliable connectivity for remote enterprises, and efficient M2M/IoT solutions for global asset tracking, environmental monitoring, and telemetry data collection in challenging environments.

What are the primary challenges faced by the MSS market?

The MSS market faces several significant challenges, including the inherently high initial capital investment required for satellite deployment and ground infrastructure development, complex regulatory hurdles in international spectrum allocation, intense competition from expanding and improving terrestrial networks, and the ongoing challenge of achieving broad cost-effectiveness for mass-market adoption to compete with widely available cellular services.

How does MSS compare to traditional terrestrial communication?

MSS offers unparalleled global coverage, making it indispensable for remote, maritime, and airborne environments where terrestrial networks are non-existent. While generally associated with higher costs and potentially greater latency (especially for GEO systems), MSS provides unique resilience, independence from local infrastructure, and reach for mission-critical and safety-of-life applications, a crucial advantage over purely terrestrial alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager