Mobile Video Surveillance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429637 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Mobile Video Surveillance Market Size

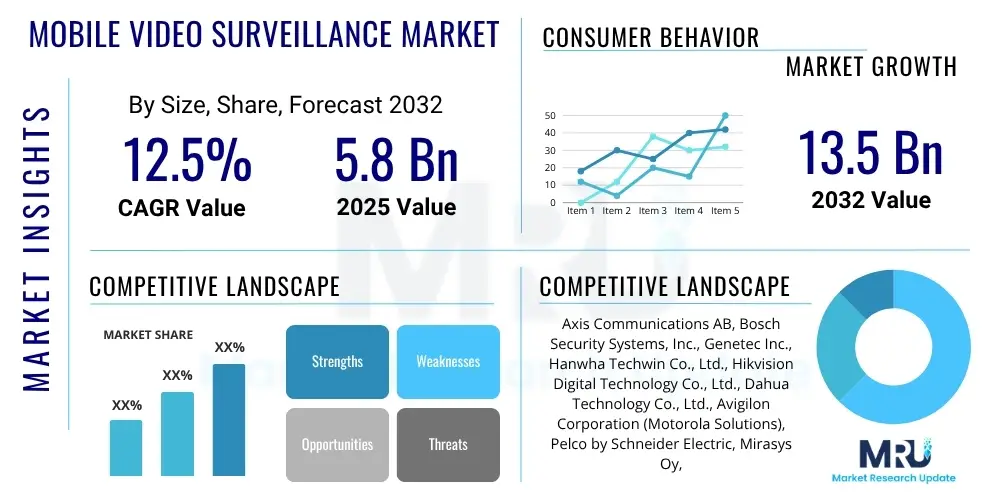

The Mobile Video Surveillance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2032.

Mobile Video Surveillance Market introduction

The Mobile Video Surveillance Market encompasses a wide range of sophisticated systems designed for real-time monitoring and recording of activities in dynamic, non-fixed environments. These systems integrate various components such as cameras, storage devices, communication modules, and advanced software to provide comprehensive security solutions across diverse applications. The core product offering revolves around portable or vehicle-mounted surveillance units that can transmit data wirelessly or store it locally for later analysis, enabling proactive security measures and post-incident investigations. The increasing need for on-the-go security and monitoring solutions, driven by evolving threats and regulatory compliance, underpins the market's robust expansion. These systems are crucial for maintaining situational awareness in remote or moving contexts where traditional fixed surveillance is impractical or impossible.

Major applications for mobile video surveillance solutions span across public transportation, law enforcement, emergency services, commercial fleets, and industrial logistics. In public transit, these systems enhance passenger safety, prevent vandalism, and deter criminal activities on buses, trains, and taxis. For law enforcement, mobile surveillance provides critical evidence collection capabilities, officer safety monitoring, and support for tactical operations in the field. Commercial fleets utilize these systems for asset tracking, driver behavior monitoring, and cargo security, leading to improved operational efficiency and reduced insurance costs. The benefits derived from deploying mobile video surveillance are numerous, including enhanced safety and security, improved operational oversight, effective incident management, and the provision of verifiable evidence for legal proceedings or investigations, ultimately contributing to a safer and more accountable environment.

Several pivotal factors are driving the substantial growth of the Mobile Video Surveillance Market. The rising global demand for advanced security solutions in response to increasing crime rates and terror threats is a primary catalyst. Furthermore, the rapid technological advancements in camera resolution, wireless connectivity (such as 5G), data compression, and artificial intelligence integration are significantly enhancing the capabilities and effectiveness of mobile surveillance systems, making them more appealing to a broader range of end-users. The expanding adoption of smart city initiatives and the widespread deployment of public transportation infrastructure also contribute to market growth, as these sectors increasingly integrate mobile surveillance to ensure public safety and manage traffic efficiently. Moreover, stringent regulatory requirements for safety and security across various industries, coupled with the decreasing cost of hardware components, are further accelerating the market's expansion.

Mobile Video Surveillance Market Executive Summary

The Mobile Video Surveillance Market is experiencing dynamic shifts, characterized by significant business trends, evolving regional landscapes, and distinct segment growth trajectories. Key business trends include the strong emphasis on integrated solutions that combine hardware, software, and services, moving beyond standalone products to comprehensive security ecosystems. There is a growing demand for cloud-based storage and video management systems, driven by scalability, accessibility, and cost-efficiency advantages. Furthermore, strategic partnerships and collaborations among technology providers, system integrators, and telecommunication companies are becoming more prevalent to offer holistic and interoperable solutions, addressing the complex requirements of diverse end-users. Mergers and acquisitions are also playing a role in consolidating market share and expanding technological portfolios, especially in specialized areas like AI-powered analytics and edge computing.

Regionally, North America and Europe continue to be dominant markets, primarily due to advanced technological infrastructure, high security spending, and stringent regulatory frameworks mandating surveillance in public and commercial sectors. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization, significant investments in smart city projects, expanding public transportation networks, and increasing awareness regarding public safety in developing economies such as China, India, and Southeast Asian countries. Latin America and the Middle East and Africa are also showing promising growth, albeit from a smaller base, driven by infrastructure development and the increasing adoption of surveillance technologies in sectors like oil and gas, mining, and transportation to combat security challenges and improve operational efficiency.

In terms of segmentation, the market is observing strong growth across all major categories. The hardware segment, particularly advanced IP cameras and recording devices, maintains a substantial share due to continuous innovation in image quality and durability suitable for mobile environments. The software and services segments are experiencing accelerated growth, fueled by the demand for sophisticated video analytics, cloud platforms, and managed surveillance services that offer enhanced operational intelligence and flexibility. Application-wise, the transportation and law enforcement sectors remain the largest adopters, with significant expansion anticipated in commercial fleets and smart city initiatives as mobile surveillance becomes an integral component of urban security and management strategies. The shift towards wireless and AI-enabled solutions is profoundly influencing these segment trends, making systems more versatile and intelligent.

AI Impact Analysis on Mobile Video Surveillance Market

Common user questions regarding the impact of AI on the Mobile Video Surveillance Market frequently revolve around how artificial intelligence enhances traditional surveillance capabilities, its role in improving efficiency, the accuracy of advanced analytics, and concerns related to privacy and ethical deployment. Users are particularly interested in AI's ability to automate monitoring, reduce false alarms, enable predictive security measures, and process vast amounts of video data more effectively than human operators. There are high expectations for AI to transform mobile surveillance from a reactive recording system into a proactive, intelligent security platform capable of real-time threat detection and rapid response. Additionally, questions often arise about the integration complexity of AI models, the computational resources required for edge processing, and the development of robust, bias-free AI algorithms that perform reliably across diverse environmental conditions and demographic variations, underscoring both the optimism and the practical challenges associated with AI adoption in this domain.

- AI significantly enhances real-time threat detection through automated object recognition, suspicious behavior analysis, and anomaly detection, reducing reliance on constant human monitoring.

- Predictive analytics powered by AI allows for proactive security measures by identifying patterns and potential risks before incidents occur, improving overall security posture.

- Facial recognition and license plate recognition capabilities are becoming highly accurate with AI, enabling rapid identification of individuals or vehicles of interest, crucial for law enforcement and access control.

- Edge AI processing minimizes latency and bandwidth requirements by analyzing video data directly on the device, enabling faster decision-making and efficient data management in mobile environments.

- AI-driven video summarization and intelligent search features drastically reduce the time and effort required for post-incident investigations, making vast video archives manageable and actionable.

- Reduced false alarms due to AI's ability to differentiate between significant events and environmental noise, leading to more focused and efficient security responses.

- Improved operational efficiency through automated alerts, resource optimization, and data-driven insights for strategic deployment of security personnel and assets.

DRO & Impact Forces Of Mobile Video Surveillance Market

The Mobile Video Surveillance Market is influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory and market dynamics. Key drivers include the escalating need for public safety and security across various sectors, coupled with increasing concerns over crime and terrorism. The expansion of smart city initiatives globally, which integrate advanced surveillance as a foundational element for urban management, is also a significant growth catalyst. Technological advancements in camera resolution, wireless communication, and data storage solutions continually enhance the effectiveness and versatility of mobile surveillance systems, making them indispensable for modern security strategies. Furthermore, the rising adoption of mobile surveillance in public transportation, commercial fleets, and law enforcement for operational efficiency and accountability purposes is propelling market expansion. Strict regulatory mandates for security and passenger safety across numerous industries also create a sustained demand for these advanced monitoring solutions.

Despite the strong growth drivers, the market faces several notable restraints that could temper its expansion. High initial investment costs for sophisticated mobile surveillance systems, particularly those integrating advanced AI and analytics, can be a barrier for smaller organizations or those with limited budgets. Concerns surrounding privacy and data security, especially with the deployment of advanced facial recognition and tracking technologies, pose significant ethical and regulatory challenges, potentially leading to public resistance and stricter legislative oversight. The complexity of integrating diverse surveillance components and managing vast amounts of video data, particularly in heterogeneous network environments, can also be a technical hurdle. Furthermore, limited bandwidth availability in remote or rural areas can restrict the real-time functionality of high-definition mobile surveillance systems, impacting their widespread adoption in certain geographies.

However, substantial opportunities exist for market participants to innovate and expand. The increasing demand for cloud-based video surveillance as a service (VSaaS) offers scalable, flexible, and cost-effective solutions, opening new avenues for subscription-based business models. The emergence of 5G technology is poised to revolutionize mobile surveillance by providing ultra-high bandwidth and low-latency connectivity, enabling seamless real-time streaming of 4K and 8K video from moving platforms, which will significantly enhance the capabilities of mobile systems. The integration of advanced artificial intelligence and machine learning for predictive analytics, anomaly detection, and automated incident response presents significant opportunities for value addition and differentiation. Additionally, the untapped potential in emerging economies, driven by rapid urbanization and infrastructure development, provides a fertile ground for market expansion, particularly in public transport and smart city projects. Developing ruggedized and energy-efficient systems for harsh mobile environments also represents a critical area for product innovation.

Segmentation Analysis

The Mobile Video Surveillance Market is comprehensively segmented to provide a detailed understanding of its diverse components, technologies, applications, and end-user adoption patterns. This granular breakdown helps identify key growth areas, competitive landscapes, and strategic opportunities across various market dimensions. The segmentation typically includes categories based on component type, technology utilized, application areas, and the specific end-user industries that deploy these solutions. Each segment exhibits unique growth drivers and challenges, reflecting the specialized requirements and operational contexts within the broader mobile surveillance ecosystem. This multi-faceted analysis is crucial for stakeholders to tailor their product offerings and market strategies effectively.

- By Component:

- Hardware:

- Cameras (Analog, IP, Thermal, PTZ)

- Recorders (DVR, NVR, Hybrid)

- Storage Devices (On-board, External, Cloud)

- Monitors

- Other Accessories (Mounts, Cables, Power Supplies)

- Software:

- Video Management Software (VMS)

- Video Analytics Software (Facial Recognition, LPR, Object Detection, Behavior Analysis)

- Cloud-based Software

- Services:

- Installation and Integration Services

- Maintenance and Support Services

- Managed Video Surveillance Services (VSaaS)

- Consulting Services

- Hardware:

- By Type:

- Wired Mobile Video Surveillance

- Wireless Mobile Video Surveillance

- By Application:

- Transportation:

- Buses and Coaches

- Trains and Subways

- Taxis and Ride-sharing

- Commercial Vehicles (Trucks, Vans)

- Marine Vessels

- Aviation (Ground Support)

- Law Enforcement:

- Police Patrol Cars

- SWAT Vehicles

- Body-worn Cameras

- Commercial:

- Retail Security Vehicles

- Construction Site Monitoring

- Event Security

- Logistics and Supply Chain

- Industrial:

- Mining Operations

- Oil and Gas Facilities

- Utility Infrastructure

- Defense and Military

- Healthcare (Ambulances, Mobile Clinics)

- Transportation:

- By End-User:

- Government and Public Sector

- Commercial Enterprises

- Industrial Sector

- Transportation Agencies

- By Resolution:

- SD (Standard Definition)

- HD (High Definition)

- Full HD

- 4K and Above

- By Technology:

- Analog

- IP (Internet Protocol)

Value Chain Analysis For Mobile Video Surveillance Market

The value chain of the Mobile Video Surveillance Market is a complex ecosystem, beginning with upstream raw material suppliers and extending through manufacturing, system integration, distribution, and ultimately to the end-users. Upstream analysis involves the procurement of crucial components such as image sensors, processors, memory chips, optical lenses, communication modules, and robust casing materials. Key players in this stage are semiconductor manufacturers, optical component providers, and specialized material suppliers who provide the foundational elements for surveillance hardware. The quality and availability of these components directly impact the performance, durability, and cost-effectiveness of the final mobile surveillance systems, making supplier relationships and supply chain resilience critical for market success. Innovations in these upstream technologies, such as advancements in sensor sensitivity or processing power, often drive subsequent innovations in the final products.

Moving downstream, the value chain encompasses the manufacturing and assembly of mobile surveillance hardware, development of proprietary software, and integration of various components into complete systems. This stage involves camera manufacturers, NVR/DVR producers, and software developers who create video management platforms and advanced analytics solutions. System integrators play a pivotal role here, designing customized solutions, installing hardware, configuring software, and ensuring seamless operation within specific client environments, which often involve integrating with existing security infrastructure. The market is increasingly shifting towards bundled solutions where hardware, software, and services are offered as a comprehensive package, emphasizing the importance of end-to-end capabilities from a single vendor or a consortium of partners.

Distribution channels for mobile video surveillance products and services are diverse, ranging from direct sales to indirect channels. Direct distribution involves manufacturers or solution providers selling directly to large enterprises, government agencies, or public sector clients, often through dedicated sales teams and specialized contracts. Indirect channels include a network of authorized distributors, value-added resellers (VARs), and security system integrators who market, sell, and install solutions to a broader customer base, including small and medium-sized businesses (SMBs) and individual consumers. Online marketplaces and e-commerce platforms are also gaining traction, especially for standardized or smaller-scale mobile surveillance products. The choice of distribution channel often depends on the target market segment, the complexity of the solution, and the geographical reach desired by the vendor, with strong partnerships being essential for extensive market penetration and efficient customer service.

Mobile Video Surveillance Market Potential Customers

The potential customers for mobile video surveillance solutions are incredibly diverse, spanning across various sectors that prioritize safety, security, operational efficiency, and accountability in dynamic environments. At the forefront are government and public sector entities, including law enforcement agencies, emergency services, and urban municipalities. These organizations utilize mobile surveillance in police patrol vehicles, ambulances, fire trucks, and public transport systems to enhance public safety, deter crime, collect evidence, and ensure rapid response during emergencies. Their purchasing decisions are often driven by regulatory compliance, citizen safety mandates, and the need for robust, reliable, and secure systems that can withstand harsh operating conditions and integrate with existing command and control centers.

Another significant segment of potential customers comprises commercial enterprises and the transportation industry. Commercial fleet operators, including logistics companies, taxi services, and delivery companies, are increasingly adopting mobile surveillance to monitor driver behavior, ensure cargo security, prevent theft, and reduce insurance liabilities. Retail businesses with mobile units or pop-up stores, as well as construction companies managing remote sites, also represent key end-users seeking flexible and scalable security solutions. For these customers, the benefits extend beyond security to include operational intelligence, improved fleet management, dispute resolution, and overall business optimization, with return on investment being a crucial factor in their purchasing decisions.

Furthermore, the industrial sector, including mining, oil and gas, and utilities, constitutes a growing customer base. These industries operate in remote, often hazardous, environments where fixed surveillance can be impractical. Mobile video surveillance provides critical monitoring capabilities for asset protection, worker safety, perimeter security, and compliance with environmental regulations. Private security firms also serve as significant buyers, deploying mobile surveillance units for event security, mobile patrols, and temporary site monitoring. The increasing awareness about the versatility and advanced capabilities, particularly with AI integration, of mobile surveillance systems is continually expanding the spectrum of potential customers, pushing adoption into niche applications that require adaptable and intelligent monitoring solutions beyond traditional fixed setups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axis Communications AB, Bosch Security Systems, Inc., Genetec Inc., Hanwha Techwin Co., Ltd., Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Avigilon Corporation (Motorola Solutions), Pelco by Schneider Electric, Mirasys Oy, IndigoVision Group plc, Verkada Inc., Eagle Eye Networks, Inc., Mobotix AG, Teledyne FLIR LLC, Panasonic i-PRO Sensing Solutions Co., Ltd., Kenwood Corporation, BriefCam (Canon), Milestone Systems A/S, Vivotek Inc., LILIN USA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Video Surveillance Market Key Technology Landscape

The Mobile Video Surveillance Market is profoundly shaped by a continuously evolving technological landscape, driven by the demand for higher performance, greater efficiency, and enhanced intelligence. Key technologies underpinning this market include advanced imaging sensors, which deliver superior video quality and low-light performance, crucial for capturing clear evidence in varied conditions. High-definition (HD), Full HD, and 4K resolution cameras are becoming standard, providing granular detail necessary for facial recognition and license plate identification. Furthermore, robust compression algorithms like H.265 are essential for managing the massive data streams generated by these high-resolution cameras, enabling efficient storage and transmission over limited bandwidths inherent in mobile environments. The development of specialized lenses, including varifocal and wide-angle options, also enhances the versatility of mobile camera deployments, allowing for broader coverage and adaptability to different operational scenarios.

Connectivity and data management are critical technological pillars for mobile surveillance. The widespread adoption of wireless communication technologies, including 4G LTE and increasingly 5G, is transforming mobile video surveillance by enabling real-time streaming and remote access with significantly reduced latency and increased bandwidth. This allows for immediate situational awareness and rapid response capabilities, crucial for applications like law enforcement and emergency services. On-board storage solutions, such as ruggedized solid-state drives (SSDs) and Network Video Recorders (NVRs) designed for mobile use, ensure data integrity and continuous recording even when wireless connectivity is intermittent or unavailable. Cloud-based video management systems (VMS) are gaining traction, offering scalable storage, remote access, and centralized management capabilities, which streamline operations for large fleets or distributed surveillance networks, providing flexibility and reducing local infrastructure costs.

Perhaps the most transformative technological advancement is the integration of Artificial Intelligence (AI) and Machine Learning (ML). AI-powered video analytics are revolutionizing mobile surveillance by automating tasks that previously required extensive human intervention. This includes object detection and classification (e.g., distinguishing between people, vehicles, and animals), facial recognition, license plate recognition (LPR), abnormal behavior detection, and predictive analytics that can identify potential threats based on patterns. Edge computing, where AI processing occurs directly on the surveillance device rather than in the cloud or a central server, significantly reduces latency, conserves bandwidth, and enhances data privacy. These intelligent capabilities not only improve the accuracy and efficiency of threat detection but also enable proactive security measures, transforming mobile surveillance systems into sophisticated, intelligent security platforms capable of delivering actionable insights and supporting automated decision-making in dynamic, complex operational environments.

Regional Highlights

- North America: This region holds a significant share of the Mobile Video Surveillance Market, driven by high security spending, stringent regulatory compliance for public safety, and early adoption of advanced technologies. The presence of key market players and strong government initiatives for smart cities and law enforcement modernization further boost market growth. Investments in intelligent transportation systems and school bus safety programs also contribute substantially.

- Europe: Europe is another major market, characterized by mature infrastructure, a strong focus on public security, and robust adoption in transportation and commercial sectors. Countries like the UK, Germany, and France are leading the integration of mobile surveillance in public transport, city surveillance, and logistics, driven by concerns over terrorism and organized crime. GDPR compliance significantly influences data handling and privacy aspects in this region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure development, and increasing government investments in smart cities and public transportation networks in countries such as China, India, Japan, and South Korea. Growing awareness regarding security and the rising disposable income contribute to the expanding commercial and industrial adoption of mobile surveillance solutions.

- Latin America: This region is experiencing steady growth in the Mobile Video Surveillance Market, primarily due to increasing crime rates and the need for enhanced security in public spaces and commercial sectors. Countries like Brazil, Mexico, and Argentina are investing in surveillance for public transportation and law enforcement to address security challenges and improve citizen safety, though economic instabilities can sometimes impede faster adoption rates.

- Middle East and Africa (MEA): The MEA region presents significant growth potential, driven by infrastructure development projects, increased foreign direct investment, and a heightened focus on security in critical sectors such as oil and gas, tourism, and transportation. Countries like Saudi Arabia, UAE, and South Africa are key contributors, investing heavily in modern surveillance technologies to ensure national security and protect economic assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Video Surveillance Market.- Axis Communications AB

- Bosch Security Systems, Inc.

- Genetec Inc.

- Hanwha Techwin Co., Ltd.

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Avigilon Corporation (Motorola Solutions)

- Pelco by Schneider Electric

- Mirasys Oy

- IndigoVision Group plc

- Verkada Inc.

- Eagle Eye Networks, Inc.

- Mobotix AG

- Teledyne FLIR LLC

- Panasonic i-PRO Sensing Solutions Co., Ltd.

- Kenwood Corporation

- BriefCam (Canon)

- Milestone Systems A/S

- Vivotek Inc.

- LILIN USA

Frequently Asked Questions

What is Mobile Video Surveillance and why is it important?

Mobile Video Surveillance refers to sophisticated security systems designed for monitoring and recording activities in dynamic, non-fixed environments, typically from vehicles or portable units. It is crucial for enhancing safety, providing evidence, improving operational oversight in sectors like law enforcement, public transportation, and commercial logistics, where traditional fixed surveillance is impractical. Its importance lies in offering real-time situational awareness and post-incident analysis capabilities for mobile assets and personnel, thereby deterring crime, resolving disputes, and ensuring accountability in moving contexts.

How is AI transforming the Mobile Video Surveillance Market?

AI is profoundly transforming the Mobile Video Surveillance Market by integrating advanced analytics that enable automated threat detection, facial and license plate recognition, and predictive security. It enhances efficiency by reducing false alarms, facilitating intelligent search capabilities for forensic analysis, and providing real-time actionable insights through object classification and behavior analysis. This shift makes mobile surveillance systems proactive and intelligent, moving beyond mere recording to active, data-driven security platforms that can support automated decision-making and rapid response in dynamic environments.

What are the primary applications of Mobile Video Surveillance systems?

The primary applications of Mobile Video Surveillance systems are extensive and include public transportation (buses, trains, taxis) for passenger safety and operational monitoring, law enforcement (police vehicles, body-worn cameras) for evidence collection and officer safety, and commercial fleets for driver behavior, cargo security, and asset tracking. Additionally, these systems are used in industrial settings like mining and oil and gas for site security and worker safety, as well as for temporary event security and construction site monitoring. These applications highlight the versatility and critical role of mobile surveillance across various sectors.

What are the key challenges facing the Mobile Video Surveillance Market?

The Mobile Video Surveillance Market faces several key challenges, including the high initial investment costs for advanced systems, which can deter smaller organizations. Significant concerns exist regarding privacy and data security, especially with AI-driven analytics, leading to public apprehension and regulatory scrutiny. Technical complexities in integrating diverse hardware and software components, managing vast volumes of high-resolution video data, and ensuring reliable connectivity in areas with limited bandwidth also pose substantial hurdles for widespread adoption and efficient operation in dynamic mobile environments.

Which regions are leading in the adoption of Mobile Video Surveillance?

North America and Europe currently lead in the adoption of Mobile Video Surveillance, driven by robust security infrastructure, high security spending, and stringent regulatory frameworks. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by extensive urbanization, significant investments in smart city projects, and expanding public transportation networks. Regions like Latin America and the Middle East and Africa are also showing promising growth, albeit from a smaller base, as they focus on infrastructure development and addressing increasing security challenges across various sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager