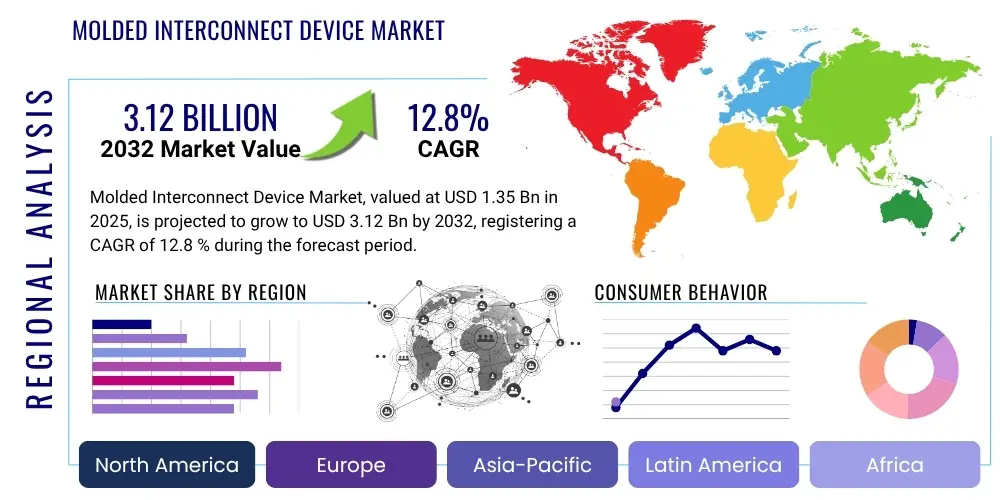

Molded Interconnect Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427879 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Molded Interconnect Device Market Size

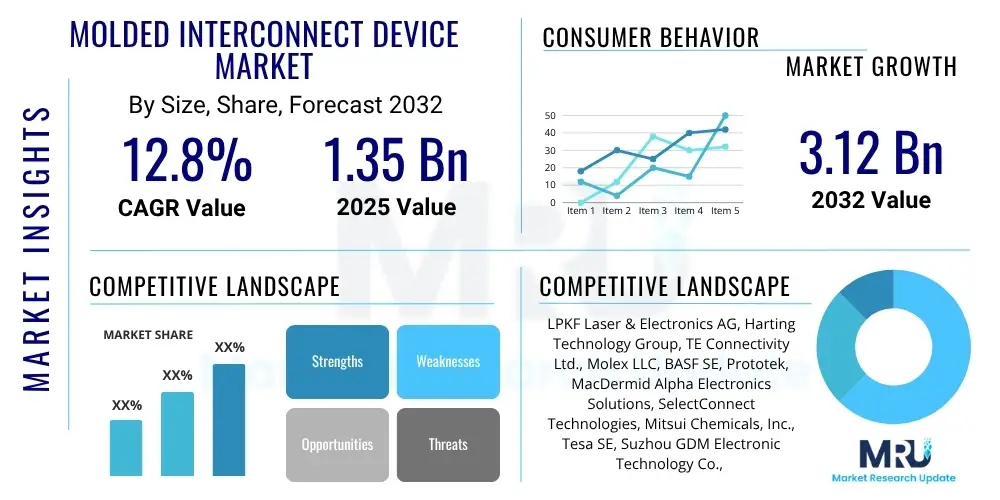

The Molded Interconnect Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2032. The market is estimated at USD 1.35 Billion in 2025 and is projected to reach USD 3.12 Billion by the end of the forecast period in 2032.

Molded Interconnect Device Market introduction

Molded Interconnect Devices (MIDs) represent a transformative technology enabling the integration of electrical and mechanical functions onto a single three-dimensional molded component. This innovative approach allows for the elimination of traditional printed circuit boards (PCBs) and associated wiring, leading to significant advantages in product design and manufacturing. MIDs are typically produced by molding thermoplastic materials and then selectively activating and metallizing specific areas to create conductive paths and mount electronic components.

The core benefit of MIDs lies in their ability to achieve miniaturization, weight reduction, and enhanced design flexibility for a wide array of electronic products. By combining structural and electrical functionality, MIDs simplify assembly processes, reduce component count, and improve overall system reliability. This makes them particularly appealing for applications where space and weight are critical considerations, or where complex geometric forms are required for optimal performance and aesthetics.

Major applications for Molded Interconnect Devices span across diverse industries, including automotive electronics for sensors and control units, medical devices for compact diagnostic tools and implants, consumer electronics for smartphones and wearables, and industrial automation for compact sensor modules. Driving factors for their adoption include the relentless demand for smaller, lighter, and more functionally integrated electronic devices, coupled with advancements in material science and manufacturing processes like Laser Direct Structuring (LDS) and two-shot molding technologies. These factors collectively position MIDs as a pivotal technology for future electronic innovation.

Molded Interconnect Device Market Executive Summary

The Molded Interconnect Device (MID) market is experiencing robust growth, driven by pervasive trends towards miniaturization, increased functional integration, and the rising demand for smart and connected devices across various sectors. Business trends indicate a shift towards collaborative partnerships between material suppliers, molding specialists, and electronics manufacturers to innovate new applications and streamline production. There is also a notable emphasis on developing more sustainable and cost-effective manufacturing processes, including advancements in additive manufacturing techniques for MID production, which promise greater design freedom and rapid prototyping capabilities.

Regional trends highlight Asia Pacific as a dominant and rapidly expanding market for MIDs, primarily due to the region's strong manufacturing base for consumer electronics, automotive components, and medical devices, coupled with significant investments in research and development. Europe and North America also demonstrate substantial growth, propelled by strict regulatory requirements for medical devices, advancements in automotive electrification, and robust industrial automation sectors. These regions are focusing on high-value, high-performance MID applications.

Segment trends reveal that the automotive industry continues to be a primary driver for MID adoption, utilizing the technology for compact sensor modules, LED lighting systems, and advanced driver-assistance systems (ADAS) where reliability and space efficiency are paramount. The consumer electronics segment, particularly in wearables and portable devices, is another significant growth area, leveraging MIDs for their lightweight and form-factor advantages. Furthermore, the medical sector is increasingly adopting MIDs for miniaturized diagnostic equipment and implantable devices, benefiting from their biocompatibility and precision manufacturing capabilities. Technological advancements in materials and metallization processes are continuously expanding the potential applications across these key segments.

AI Impact Analysis on Molded Interconnect Device Market

User inquiries concerning AI's influence on the Molded Interconnect Device (MID) market frequently revolve around how artificial intelligence can optimize design processes, enhance manufacturing efficiency, and enable new functionalities in MID applications. Common questions explore AI's role in predictive maintenance of production lines, generative design for complex 3D circuits, and real-time quality control. There is also significant interest in AI's potential to facilitate the integration of more sophisticated sensor arrays and smart features into MIDs, pushing the boundaries of what these devices can achieve in terms of intelligence and autonomy within various end-products.

Stakeholders often express expectations regarding AI's ability to reduce development cycles and material waste by simulating performance and identifying optimal design parameters before physical prototyping. They also anticipate that AI-driven analytics will unlock deeper insights from manufacturing data, leading to continuous process improvements and higher yield rates. Furthermore, the convergence of AI with MIDs is seen as a pathway to develop next-generation smart components that can self-monitor, adapt to environmental changes, and communicate seamlessly within larger IoT ecosystems, ultimately creating more resilient and intelligent electronic systems.

- AI-powered generative design for complex 3D circuit layouts, optimizing space and performance.

- Predictive maintenance of MID manufacturing equipment, reducing downtime and operational costs.

- Enhanced quality control through AI-driven visual inspection and anomaly detection during production.

- Optimization of material selection and process parameters using machine learning algorithms.

- Development of smart MIDs with embedded AI for edge computing and sensor data processing.

- Improved supply chain efficiency and demand forecasting for MID components and raw materials.

DRO & Impact Forces Of Molded Interconnect Device Market

The Molded Interconnect Device (MID) market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. Key drivers include the ever-increasing demand for miniaturization and weight reduction in electronic devices, particularly within the automotive, medical, and consumer electronics sectors. The shift towards electrification in vehicles mandates more compact and robust sensor modules, while advancements in portable medical diagnostics require highly integrated and space-efficient components. Furthermore, the proliferation of the Internet of Things (IoT) and smart wearables fuels the need for MIDs that can combine complex functionalities in small form factors. These factors collectively exert a strong positive force on market expansion.

However, the market also faces notable restraints. The high initial investment required for specialized manufacturing equipment, such as sophisticated laser structuring systems and two-shot molding machines, can deter smaller players. The complexity of the manufacturing processes, which involve precise material selection, metallization, and assembly, demands specialized expertise and stringent quality control. Additionally, limitations in material compatibility for certain high-temperature or high-frequency applications, along with a lack of universal standardization across different MID technologies, present challenges for broader adoption and scalability across diverse industries. These factors necessitate continuous innovation to overcome technical barriers and reduce entry costs.

Opportunities for growth are abundant, particularly with emerging applications in advanced driver-assistance systems (ADAS), 5G infrastructure, and sophisticated medical implants that require unprecedented levels of integration and reliability. The development of new materials with enhanced performance characteristics and the refinement of additive manufacturing techniques for MIDs promise to further expand design possibilities and reduce production lead times. The push for sustainable manufacturing also offers an opportunity for MIDs, as their integrated nature can lead to reduced material usage and simpler recycling processes compared to multi-component assemblies. The confluence of these impact forces shapes the competitive landscape and strategic direction of the global MID market.

Segmentation Analysis

The Molded Interconnect Device (MID) market is intricately segmented to reflect the diverse applications, materials, and manufacturing processes that define this innovative technology. Understanding these segments is crucial for analyzing market dynamics, identifying growth opportunities, and formulating targeted business strategies. The segmentation highlights the various technological approaches and end-use industries that leverage MIDs to achieve advanced functional integration and design efficiencies, ranging from high-volume consumer goods to highly specialized industrial and medical applications.

- By Process:

- Laser Direct Structuring (LDS)

- Two-Shot Molding

- Film Insert Molding (FIM)

- Hot Embossing

- Other Processes (e.g., Inkjet Printing, Aerosol Jet Printing)

- By Material:

- Thermoplastics (e.g., LCP, PEEK, PA, PC, ABS)

- Ceramics

- Other Composites

- By Application:

- Automotive (e.g., Sensors, ADAS modules, Lighting, Interior controls)

- Consumer Electronics (e.g., Smartphones, Wearables, Laptops, IoT devices)

- Medical (e.g., Diagnostic tools, Hearing aids, Surgical instruments, Implantables)

- Industrial (e.g., Sensors, Actuators, Robotics, Control systems)

- Telecommunications (e.g., Antennas, RF modules, Base stations)

- Aerospace and Defense (e.g., Avionic systems, Communication devices)

- Other Applications

Value Chain Analysis For Molded Interconnect Device Market

The value chain for the Molded Interconnect Device (MID) market is a complex ecosystem involving several key stages, from raw material sourcing to end-product integration, reflecting specialized expertise at each step. Upstream activities begin with material suppliers who provide specialized engineering thermoplastics, ceramics, and conductive pastes or plating chemicals. These materials are crucial for the performance and reliability of MIDs, requiring specific properties such as thermal stability, dielectric strength, and adhesion characteristics. Research and development in advanced materials also occurs at this stage, focusing on enhancing performance and exploring new functionalities. The quality and availability of these raw materials directly impact the cost and production capabilities downstream.

Midstream activities primarily involve component manufacturers specializing in the molding and metallization processes. This includes manufacturers of high-precision injection molding machines, laser direct structuring (LDS) equipment, and specialized plating lines. Companies in this segment possess the core technological expertise in designing and manufacturing the 3D molded substrates and selectively applying conductive traces. There are also firms that specialize in the assembly and integration of electronic components onto the MIDs, adding active and passive electronic parts to create fully functional modules. This stage is highly capital-intensive and requires significant technical know-how.

Downstream activities encompass the distribution channels and end-product manufacturers. Distribution can be both direct, where MID manufacturers supply components directly to large original equipment manufacturers (OEMs) in industries like automotive or consumer electronics, and indirect, through specialized distributors who cater to smaller businesses or niche markets. End-users, the ultimate buyers, integrate MIDs into their final products, benefiting from the miniaturization, weight savings, and functional integration offered by the technology. The efficiency of this value chain, from material innovation to final product assembly, is critical for the overall market growth and competitive positioning of MID suppliers.

Molded Interconnect Device Market Potential Customers

The primary potential customers for Molded Interconnect Devices (MIDs) are Original Equipment Manufacturers (OEMs) across a broad spectrum of industries that prioritize miniaturization, functional integration, and enhanced reliability in their electronic products. The automotive industry stands out as a significant end-user, with demand stemming from the increasing complexity of vehicle electronics, including advanced driver-assistance systems (ADAS), sophisticated sensor arrays for autonomous driving, LED lighting modules, and compact control units for electric vehicles. These manufacturers seek MIDs to reduce weight, save space, and improve the robustness of components in harsh automotive environments.

Another major segment of potential customers is the consumer electronics industry, particularly manufacturers of smartphones, wearables, smart home devices, and other portable gadgets. These companies are constantly striving to create thinner, lighter, and more aesthetically pleasing products with increased functionality. MIDs enable the integration of antennas, sensors, and connectors directly into the device housing, offering significant design freedom and space optimization that is highly valued in competitive consumer markets. The relentless pace of innovation in this sector ensures a continuous demand for advanced integration solutions like MIDs.

Furthermore, the medical device sector represents a growing customer base for MIDs. Manufacturers of diagnostic equipment, hearing aids, surgical tools, and implantable devices require components that are extremely small, precise, and often biocompatible. MIDs provide the ideal platform for integrating complex electronic functions into miniature devices, offering advantages in terms of sterility, reliability, and custom geometries essential for medical applications. Beyond these, industrial automation, telecommunications (especially for 5G components), and aerospace & defense industries also form crucial customer segments, valuing MIDs for their robust performance in demanding environments and their ability to facilitate complex, high-frequency circuit integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.35 Billion |

| Market Forecast in 2032 | USD 3.12 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LPKF Laser & Electronics AG, Harting Technology Group, TE Connectivity Ltd., Molex LLC, BASF SE, Prototek, MacDermid Alpha Electronics Solutions, SelectConnect Technologies, Mitsui Chemicals, Inc., Tesa SE, Suzhou GDM Electronic Technology Co., Ltd., Arburg GmbH + Co KG, Evonik Industries AG, Cicor Group, DSM Engineering Materials, Possehl Electronics GmbH, Shenzhen Sunshine Global Logistics Co., Ltd., Huizhou Foryou General Electronics Co., Ltd., Canon Inc., Fraunhofer IFAM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molded Interconnect Device Market Key Technology Landscape

The Molded Interconnect Device (MID) market is characterized by a sophisticated technological landscape that underpins its unique capabilities for 3D functional integration. At the forefront are advanced molding techniques, primarily two-shot injection molding and Laser Direct Structuring (LDS). Two-shot molding involves sequential injection of two different thermoplastic materials into a single mold, where one material is specially formulated to be activated for metallization. This process allows for precise spatial separation of conductive and non-conductive areas, forming the basis for complex circuit geometries directly on the molded part. It offers high precision and is particularly suitable for high-volume production.

Laser Direct Structuring (LDS) is another pivotal technology, offering immense design flexibility and rapid prototyping capabilities. In the LDS process, a laser beam selectively activates a special additive within a thermoplastic material, creating a micro-roughened surface that can then be chemically plated with conductive metals like copper, nickel, and gold. This method allows for very fine line structures and complex 3D patterns, making it ideal for antenna designs, sensors, and intricate electronic modules. The precision of laser technology enables a high degree of miniaturization and intricate circuit integration that would be challenging with conventional PCB manufacturing.

Beyond molding and laser processes, the MID market leverages significant advancements in materials science and plating chemistry. Development of new engineering thermoplastics with improved thermal stability, dielectric properties, and enhanced adhesion for metallization is ongoing. Innovations in electroless and electrolytic plating solutions ensure robust and reliable conductive paths with excellent adhesion and conductivity. Furthermore, the integration of additive manufacturing technologies, such as 3D printing of conductive inks or materials with embedded circuitry, is emerging as a disruptive force, promising even greater design freedom, reduced tooling costs, and expedited development cycles for highly customized MIDs, pushing the boundaries of what is achievable in electronic device integration.

Regional Highlights

- North America: A significant market driven by robust demand from the automotive (ADAS, EVs), medical (diagnostics, wearables), and aerospace & defense sectors. Strong R&D infrastructure and high adoption of advanced manufacturing technologies contribute to its growth.

- Europe: Characterized by stringent quality standards and a strong focus on industrial automation and high-precision medical devices. Germany, in particular, is a hub for automotive electronics and advanced manufacturing, driving MID adoption.

- Asia Pacific (APAC): Dominates the global market due to its expansive manufacturing base for consumer electronics (smartphones, IoT), automotive components, and industrial equipment. Countries like China, Japan, South Korea, and Taiwan are key players in production and innovation.

- Latin America: An emerging market with growing automotive manufacturing and increasing investment in industrialization. Adoption of MIDs is expected to accelerate as electronic manufacturing expands.

- Middle East and Africa (MEA): Currently a smaller market, but with increasing investments in infrastructure, smart city projects, and industrial diversification, opportunities for MID adoption are gradually expanding, particularly in telecom and industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molded Interconnect Device Market.- LPKF Laser & Electronics AG

- Harting Technology Group

- TE Connectivity Ltd.

- Molex LLC

- BASF SE

- Prototek

- MacDermid Alpha Electronics Solutions

- SelectConnect Technologies

- Mitsui Chemicals, Inc.

- Tesa SE

- Suzhou GDM Electronic Technology Co., Ltd.

- Arburg GmbH + Co KG

- Evonik Industries AG

- Cicor Group

- DSM Engineering Materials

- Possehl Electronics GmbH

- Shenzhen Sunshine Global Logistics Co., Ltd.

- Huizhou Foryou General Electronics Co., Ltd.

- Canon Inc.

- Fraunhofer IFAM

Frequently Asked Questions

What are Molded Interconnect Devices (MIDs)?

Molded Interconnect Devices (MIDs) are three-dimensional thermoplastic components that integrate mechanical and electrical functionalities into a single part, serving as both a structural element and a circuit carrier. They reduce assembly complexity and enable miniaturization by eliminating traditional PCBs and wiring.

What are the primary benefits of using MIDs?

MIDs offer significant benefits including miniaturization, weight reduction, enhanced design freedom, improved reliability due to fewer connections, simplified assembly processes, and cost savings in certain applications by consolidating multiple parts into one.

Which industries widely adopt Molded Interconnect Devices?

MIDs are predominantly adopted in the automotive industry for sensors and control units, consumer electronics for smartphones and wearables, medical devices for compact diagnostics, and industrial applications for robotics and automation.

What are the main manufacturing processes for MIDs?

The primary manufacturing processes for MIDs include Laser Direct Structuring (LDS), which uses a laser to activate a plastic surface for metallization, and two-shot molding, which sequentially injects two different materials to define conductive and non-conductive areas before plating.

How is AI impacting the Molded Interconnect Device market?

AI is impacting the MID market by enabling generative design for optimal 3D circuits, predictive maintenance for manufacturing, enhanced quality control, and the development of smart MIDs with embedded intelligence for edge computing and advanced sensor integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager