Mortgage Lender Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427828 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Mortgage Lender Market Size

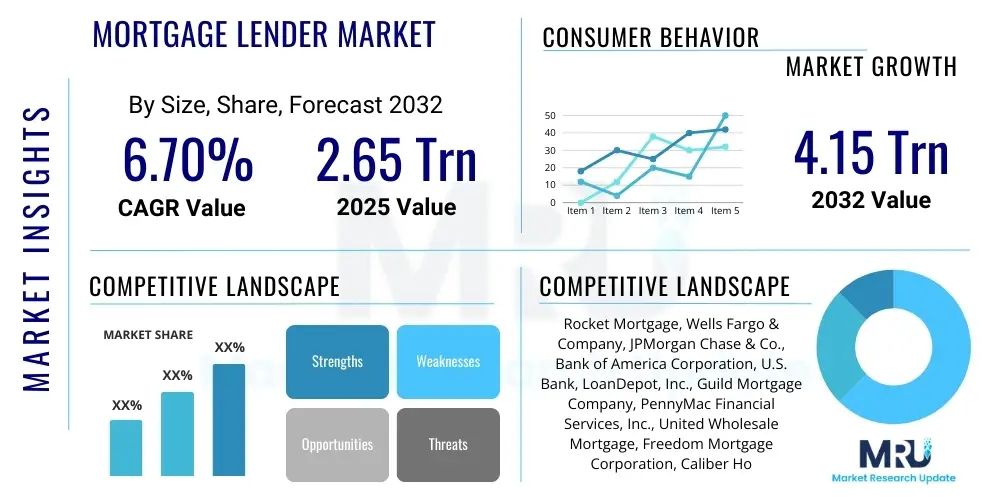

The Mortgage Lender Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 2.65 Trillion in 2025 and is projected to reach USD 4.15 Trillion by the end of the forecast period in 2032.

Mortgage Lender Market introduction

The Mortgage Lender Market represents a critical and foundational segment within the global financial services industry, primarily focused on providing capital to individuals and entities for the purchase, construction, or refinancing of residential and commercial real estate. This expansive market involves a diverse array of financial institutions, including traditional banks, credit unions, and a growing number of non-bank mortgage lenders, all operating within a complex regulatory framework. The core product offering encompasses various loan types, such as conventional fixed-rate and adjustable-rate mortgages, as well as government-backed options like FHA, VA, and USDA loans, each designed to meet specific borrower needs, risk profiles, and property characteristics. These products facilitate essential transactions that underpin economic stability and wealth creation, making homeownership accessible to a wide demographic spectrum. The primary applications of these loans are centered around new home purchases, enabling individuals to acquire their first home or move into a new property, alongside refinancing existing mortgages to secure more favorable terms or extract equity for other financial purposes. This dynamic environment is continually shaped by economic indicators, technological advancements, and shifting consumer expectations.

The profound benefits derived from the mortgage lending market extend beyond individual homeownership, contributing significantly to broader economic health through job creation in the construction and real estate sectors, and fostering capital circulation. Key driving factors propelling the growth and evolution of this market include prevailing interest rates, which directly influence the affordability and demand for mortgage products; robust economic growth and employment figures, which enhance consumer confidence and eligibility for loans; and sustained population growth coupled with urbanization trends, which collectively drive a consistent demand for housing units. Furthermore, continuous technological advancements, particularly in digital lending platforms, artificial intelligence, and data analytics, are acting as powerful catalysts, improving operational efficiencies, streamlining the application process, and enhancing the overall customer experience. A stable and predictable regulatory environment, while sometimes perceived as a restraint, also functions as a crucial driver by ensuring consumer protection, market integrity, and investor confidence, thereby fostering a more reliable lending ecosystem.

Mortgage Lender Market Executive Summary

The Mortgage Lender Market is undergoing a period of significant transformation, driven by an array of evolving business trends, regional specificities, and segment shifts. A paramount business trend is the accelerated pace of digitalization across the entire loan lifecycle, from online applications and automated underwriting to virtual closings, which is fundamentally reshaping how lenders interact with borrowers and process transactions. This technological embrace is further fueled by intense competition from both traditional and agile non-bank lenders, pushing institutions to innovate rapidly and prioritize a seamless, user-centric experience. Compliance remains a critical operational challenge, with lenders dedicating substantial resources to navigate complex and frequently changing regulatory landscapes, particularly concerning consumer protection and data security. The market also exhibits a pronounced focus on data-driven strategies, leveraging advanced analytics to personalize product offerings, optimize risk assessment, and enhance marketing effectiveness, ultimately striving for greater efficiency and competitive differentiation in a crowded market.

Regional dynamics within the mortgage lender market present a varied landscape. North America, particularly the United States and Canada, stands as a highly mature and competitive market characterized by advanced financial infrastructure and high consumer expectations for digital services. Europe, while experiencing increasing digitalization, remains fragmented due to diverse national regulations and economic conditions, with the UK and Germany leading in market size. The Asia-Pacific (APAC) region is emerging as a primary growth engine, propelled by rapid urbanization, expanding middle-class populations, and government support for affordable housing, particularly in economies like China, India, and Australia. Segment-wise, the market is observing a rising demand for specialized loan products tailored to niche borrower groups, such as self-employed individuals or those seeking sustainable/green mortgages. Refinancing activity continues to fluctuate based on interest rate cycles, while the long-term trend points towards greater adoption of flexible and hybrid mortgage products that cater to dynamic financial needs. These trends collectively underscore a market that is both resilient and adaptable, constantly reconfiguring itself in response to macro-economic forces and technological disruption.

AI Impact Analysis on Mortgage Lender Market

The pervasive integration of Artificial Intelligence (AI) into the Mortgage Lender Market has sparked widespread discussion and inquiry, with common user questions focusing on its potential to revolutionize operational efficiency, enhance decision-making accuracy, and personalize the borrower journey. Users frequently express interest in how AI can expedite the notoriously complex mortgage application and approval process, curious about the extent to which it can reduce turnaround times and minimize human intervention. Alongside these expectations of greater speed and convenience, significant concerns often arise regarding the ethical implications of AI-driven lending decisions, particularly the potential for algorithmic bias and its impact on fair housing principles. Data privacy and the security of sensitive financial information within AI systems are also recurring themes, reflecting a natural apprehension about advanced technologies handling personal data. Furthermore, users are keen to understand AI’s capabilities in sophisticated fraud detection, real-time market analysis, and its overarching effect on employment within the mortgage industry, anticipating both new opportunities and potential job displacement. These questions collectively underscore a desire for transparency and responsible innovation in the adoption of AI within a sector as crucial as housing finance.

AIs influence within the mortgage lending sector is undeniably transformative, fundamentally altering various stages of the loan lifecycle from initial prospecting to post-closing servicing. At the origination stage, AI-powered tools automate the collation and verification of vast quantities of borrower data and financial documents, dramatically cutting down processing times and reducing the incidence of human error. This automation extends to underwriting, where machine learning algorithms analyze complex credit profiles and risk factors with greater speed and precision than traditional methods, allowing lenders to make more informed decisions and offer tailored products. Beyond efficiency gains, AI significantly bolsters fraud detection capabilities by identifying anomalous patterns and suspicious activities that might elude human review, thereby safeguarding lenders and borrowers alike. For borrowers, this translates into a more seamless, expedited, and personalized experience, with AI-driven chatbots and virtual assistants providing instant support and guiding them through the application process. For lenders, it enables a strategic reallocation of human resources from mundane, repetitive tasks to more complex problem-solving, customer relationship management, and strategic planning, enhancing overall productivity and competitive advantage. The ability of AI to continuously learn and adapt to new data and market conditions also means improved predictive analytics, allowing lenders to anticipate market shifts, manage portfolios more effectively, and proactively address potential risks, thereby fostering a more robust and resilient mortgage lending ecosystem.

- Automated processing of loan applications and comprehensive document verification, significantly reducing manual effort and accelerating approval timelines.

- Enhanced credit risk assessment and scoring models, leveraging machine learning to analyze diverse data points for more accurate and predictive borrower profiles.

- Sophisticated real-time fraud detection mechanisms, identifying suspicious patterns and potential illicit activities with higher precision than conventional methods.

- Personalized mortgage product recommendations and tailored customer service interactions through AI-powered chatbots and intelligent virtual assistants, improving borrower satisfaction.

- Streamlined underwriting processes through algorithmic decision-making, enabling faster and more consistent loan decisions and optimizing resource allocation.

- Improved regulatory compliance by automating checks against evolving lending laws and standards, thereby minimizing human error and mitigating legal risks.

- Advanced predictive analytics for forecasting market trends, interest rate fluctuations, and borrower default probabilities, supporting strategic business planning and risk management.

- Optimization of loan servicing operations, including automated payment reminders, escrow management, and intelligent handling of common customer inquiries, enhancing efficiency post-origination.

DRO & Impact Forces Of Mortgage Lender Market

The Mortgage Lender Market is intricately shaped by a confluence of internal dynamics and external macro-economic and socio-political forces, with a clear delineation between drivers, restraints, opportunities, and broader impact forces. Key drivers for market growth prominently include robust economic expansion and stable employment rates, which collectively bolster consumer confidence and their capacity to undertake substantial financial commitments like mortgages. Furthermore, periods characterized by low or moderately increasing interest rates significantly enhance mortgage affordability, stimulating demand for both new home purchases and refinancing activities. Demographic shifts, such as increasing household formation, the aging population seeking reverse mortgages, and continued urbanization, provide a consistent and expanding base of potential borrowers. Technological advancements, particularly in digital platforms and data analytics, also serve as powerful drivers by increasing efficiency, reducing processing times, and making mortgage products more accessible and user-friendly, thereby expanding market reach and improving customer satisfaction.

Despite these growth catalysts, the market faces several significant restraints. Volatility in interest rates, especially abrupt or substantial increases, can swiftly diminish borrower affordability and dampen demand, often leading to a slowdown in market activity. The increasingly stringent and complex regulatory environment, while essential for consumer protection and financial stability, imposes substantial compliance costs and operational burdens on lenders, potentially stifling innovation and increasing barriers to entry. Economic downturns, marked by rising unemployment, reduced consumer spending, and declines in property values, directly impair borrowers ability to qualify for or repay loans, leading to higher default rates and tightened lending standards. Intense competition from a proliferating number of non-bank lenders, coupled with established financial institutions, puts downward pressure on profit margins and necessitates continuous investment in technology and customer service. Additionally, the inherent risk of housing market bubbles and subsequent corrections poses a systemic threat, capable of eroding asset values and severely constraining lending capacity across the industry.

Amidst these challenges, numerous strategic opportunities exist for market participants to capitalize on evolving trends and technological advancements. The ongoing digital transformation presents a significant opportunity for lenders to further optimize operations through advanced automation, leverage big data for personalized customer experiences, and explore innovative product delivery channels like fully online mortgages. Untapped or underserved markets, including niche borrower segments such as self-employed individuals, those with non-traditional credit histories, or emerging economies with growing middle classes, offer substantial growth potential for specialized lending solutions. The increasing global emphasis on Environmental, Social, and Governance (ESG) factors is creating demand for sustainable and "green" mortgage products, allowing lenders to align with broader societal values and attract a new segment of environmentally conscious borrowers and investors. Moreover, the strategic application of advanced data analytics and Artificial Intelligence not only refines risk management but also identifies market inefficiencies and informs proactive product development. Blockchain technology, while still nascent in the mortgage sector, offers a transformative opportunity to enhance transparency, security, and efficiency across the entire transaction lifecycle, from property title management to smart contract execution, promising to streamline processes and reduce costs in the long term.

Segmentation Analysis

The Mortgage Lender Market is characterized by a high degree of segmentation, which is fundamental for understanding its intricate structure, identifying specific growth drivers, and formulating targeted business strategies. This detailed segmentation allows market participants to dissect the market along various axes, providing granular insights into different borrower needs, lender capabilities, and product demands. By segmenting the market, lenders can more effectively tailor their offerings, marketing messages, and service delivery channels to resonate with specific customer groups, optimizing resource allocation and enhancing competitive advantage. This approach is crucial for navigating a market that is constantly influenced by demographic shifts, technological advancements, and evolving regulatory landscapes, enabling stakeholders to pinpoint high-potential areas and address specific market gaps. A comprehensive segmentation analysis provides the necessary framework to adapt to changing market dynamics and maintain relevance in a highly competitive and complex industry, fostering innovation and sustainable growth.

- By Loan Type:

- Conventional Mortgages (Fixed-Rate, Adjustable-Rate)

- Government-Backed Loans (FHA, VA, USDA)

- Jumbo Mortgages

- Interest-Only Mortgages

- Balloon Mortgages

- Bridge Loans

- By Lender Type:

- Commercial Banks and Savings Institutions

- Credit Unions

- Independent Mortgage Banks (IMBs)

- Mortgage Brokers

- Government-Sponsored Enterprises (GSEs, in a secondary market capacity)

- By Application:

- Home Purchase Mortgages (Primary Residence, Secondary Home)

- Refinance Mortgages (Rate-and-Term, Cash-Out)

- Home Equity Loans (HELs) and Home Equity Lines of Credit (HELOCs)

- Construction Loans

- Reverse Mortgages

- By Borrower Type:

- First-Time Homebuyers

- Repeat Homebuyers/Trade-Up Buyers

- Real Estate Investors (Individual, Institutional)

- Self-Employed Borrowers

- High-Net-Worth Individuals (HNWIs)

- Low-to-Moderate Income Borrowers

- By Property Type:

- Single-Family Residential

- Multi-Family Residential (2-4 Units)

- Condominiums and Townhouses

- Manufactured Homes

- Vacation/Secondary Homes

Mortgage Lender Market Value Chain Analysis

The Mortgage Lender Markets value chain is a multifaceted and interconnected ecosystem, commencing with the critical upstream activities of capital acquisition and extending through to the post-closing management of loans. Upstream operations primarily involve securing the necessary funding to originate mortgages, which for traditional banks often stems from customer deposits, while non-bank lenders heavily rely on capital markets, including warehouse lines of credit and securitization. This phase also critically includes relationships with technology providers that supply the foundational infrastructure, such as advanced Loan Origination Systems (LOS), Customer Relationship Management (CRM) platforms, and sophisticated data analytics tools, all of which are essential for operational efficiency, compliance adherence, and competitive agility. The quality and cost-effectiveness of these upstream inputs directly influence a lenders capacity to offer competitive rates and achieve profitable growth within the market.

Midstream activities encompass the core processes of loan origination and underwriting. Origination involves the crucial steps of marketing to potential borrowers, processing applications, collecting extensive financial documentation, and pre-approving loans based on initial eligibility criteria. Following this, the underwriting phase meticulously assesses the borrowers creditworthiness, income stability, and the collateral value of the property, culminating in the approval or denial of the loan. This stage requires a delicate balance of risk management, regulatory compliance, and customer service. Downstream, the value chain branches into loan servicing, where the lender or a third-party servicer manages the ongoing relationship with the borrower, including payment collection, escrow account administration, customer support, and default management. A pivotal component of the downstream market is the secondary mortgage market, where originated loans are often sold to institutional investors, such as Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, or are pooled and securitized into Mortgage-Backed Securities (MBS). This practice allows originators to replenish their capital, mitigate interest rate risk, and continue to fund new loans, thereby ensuring liquidity in the market. Distribution channels vary, ranging from direct channels where lenders engage directly with borrowers through their branch networks, online platforms, and in-house loan officers, to indirect channels involving mortgage brokers who act as intermediaries, connecting borrowers with multiple lenders to find the most suitable product. Each link in this value chain contributes to the overall efficiency, accessibility, and risk profile of the mortgage lending industry.

Mortgage Lender Market Potential Customers

The Mortgage Lender Market serves a broad and diverse base of potential customers, each driven by distinct motivations and possessing varying financial profiles and property acquisition goals. A significant primary segment consists of first-time homebuyers, typically younger individuals or families who are navigating the complexities of property ownership for the first time. This group often requires extensive educational support, guidance on available government-backed loan programs or down payment assistance, and comprehensive advisory services to understand the long-term financial commitments involved. Another substantial segment includes repeat buyers, comprising individuals or families who are either upgrading to a larger home, downsizing, relocating for work, or investing in a second property. These customers often have prior mortgage experience but seek competitive rates, flexible terms, and streamlined processes that align with their evolving financial circumstances and life stages, such as career advancements, family expansion, or retirement planning.

Beyond these direct purchase segments, a considerable portion of the markets potential customers consists of individuals seeking to refinance their existing mortgages. Their motivations can range from reducing their current interest rate to lower monthly payments, shortening their loan term to save on overall interest, or extracting cash equity from their property for purposes such as debt consolidation, home improvements, or other significant expenditures. Real estate investors, spanning from individual landlords purchasing single rental properties to large institutional funds acquiring extensive portfolios, represent another crucial customer group. These investors often require specialized financing structures, such as commercial mortgages or portfolio loans, and are primarily focused on the return on investment and favorable lending terms. Furthermore, a growing segment includes developers and builders who require construction loans to finance new residential projects, contributing to the housing supply. Each of these diverse customer segments necessitates tailored product offerings, nuanced marketing strategies, and specialized customer service approaches to effectively meet their unique financial needs and secure their business within a highly competitive mortgage landscape.

Mortgage Lender Market Key Technology Landscape

The Mortgage Lender Markets technological landscape is undergoing rapid and profound evolution, driven by the persistent demand for greater efficiency, enhanced customer experience, and robust regulatory compliance. At the core of this transformation are sophisticated Loan Origination Systems (LOS), which act as comprehensive digital platforms managing the entire mortgage application and underwriting workflow, from initial inquiry through to closing. These systems integrate various critical functions, including document management, automated data capture, credit checks, and compliance validation, thereby streamlining processes, minimizing manual intervention, and significantly reducing processing times. Concurrently, Customer Relationship Management (CRM) software is indispensable for lenders, enabling them to effectively track borrower interactions, personalize communications, manage leads, and cultivate long-term client relationships. The shift towards cloud-based solutions is also gaining immense traction, offering unparalleled scalability, flexibility, and improved data security for housing core lending operations, allowing lenders to adapt swiftly to market changes and expand their reach efficiently.

Beyond these foundational systems, advanced technologies are increasingly pivotal in shaping the future of mortgage lending. Artificial Intelligence (AI) and Machine Learning (ML) are becoming essential tools, powering predictive analytics for more accurate risk assessment, enabling advanced fraud detection capabilities, and facilitating personalized product recommendations tailored to individual borrower profiles. Robotic Process Automation (RPA) is widely adopted to automate repetitive, rule-based tasks such as data entry, reconciliation, and routine compliance checks, thereby freeing up human capital for more complex problem-solving, strategic analysis, and direct customer engagement. Blockchain technology, while still in its nascent stages of adoption, offers immense potential for creating immutable records, enhancing transparency across the value chain from property titles to smart contracts, and potentially accelerating transaction settlements. Furthermore, the widespread adoption of user-friendly digital portals, mobile applications, and electronic signature technologies (e-signatures) is critical for delivering a seamless, paperless, and highly convenient borrower experience, meeting the expectations of modern, digitally-native consumers and accelerating the overall mortgage lifecycle from application to funding.

Regional Highlights

- North America: This region, particularly the United States and Canada, represents a highly mature, competitive, and technologically advanced mortgage market. It is characterized by sophisticated financial products, high rates of digital adoption in lending, and a significant presence of both traditional banks and independent mortgage banks. The market here is notably influenced by federal interest rate policies and the operational activities of large government-sponsored enterprises.

- Europe: The European mortgage market is diverse and fragmented, reflecting the varying economic conditions, legal frameworks, and regulatory environments across individual countries. Major markets like the United Kingdom, Germany, and France boast robust mortgage sectors, with increasing digitalization trends. Nordic countries are particularly advanced in digital mortgage processing, while broader European integration efforts continue to shape cross-border lending and regulatory harmonization.

- Asia-Pacific (APAC): This region is rapidly emerging as a dynamic growth engine for the global mortgage market. Countries such as China, Australia, and India lead in market size, driven by rapid urbanization, a burgeoning middle class, and supportive government initiatives aimed at promoting homeownership. The APAC market is witnessing significant investment in digital lending infrastructure and fintech innovations, catering to a vast and increasingly tech-savvy population.

- Latin America: The mortgage market in Latin America is characterized by evolving regulatory landscapes, varying degrees of economic stability, and ongoing efforts to expand financial inclusion. Brazil and Mexico stand out as the largest mortgage markets within the region, with growth often spurred by government housing programs and initiatives to address housing shortages. Digital transformation in lending is still in relatively early stages but holds substantial long-term potential for market expansion.

- Middle East & Africa (MEA): The MEA region presents a nascent but steadily growing mortgage market, especially within the Gulf Cooperation Council (GCC) countries. Growth here is primarily fueled by a large expatriate population, government diversification strategies, and significant infrastructure development. In contrast, many parts of Africa face underdeveloped mortgage markets, but offer considerable long-term growth opportunities as economies stabilize and financial sectors mature. Islamic finance principles also play a crucial role in shaping mortgage products in several countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mortgage Lender Market.- Rocket Mortgage (Quicken Loans)

- Wells Fargo & Company

- JPMorgan Chase & Co.

- Bank of America Corporation

- U.S. Bank

- LoanDepot, Inc.

- Guild Mortgage Company

- PennyMac Financial Services, Inc.

- United Wholesale Mortgage (UWM)

- Freedom Mortgage Corporation

- Caliber Home Loans, Inc.

- AmeriHome Mortgage Company, LLC

- Fairway Independent Mortgage Corporation

- CrossCountry Mortgage, LLC

- PNC Financial Services Group, Inc.

Frequently Asked Questions

What is the projected growth trajectory for the Mortgage Lender Market?

The Mortgage Lender Market is projected for robust growth, with a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032, driven by ongoing digitalization, evolving demographic trends, and sustained global housing demand, reaching an estimated USD 4.15 Trillion by 2032.

How is artificial intelligence (AI) influencing risk assessment in mortgage lending?

AI significantly enhances risk assessment in mortgage lending by utilizing machine learning algorithms to analyze vast datasets, identify complex patterns, and predict creditworthiness and default probabilities with greater accuracy than traditional methods, leading to more informed and efficient lending decisions.

What are the main regulatory challenges currently impacting mortgage lenders?

Mortgage lenders face substantial regulatory challenges, including adapting to frequently changing compliance requirements, ensuring fair lending practices, safeguarding consumer data privacy, and managing the associated operational costs and complexities across diverse national and international jurisdictions.

Which geographical regions are expected to drive the most significant growth in the mortgage market?

The Asia-Pacific (APAC) region, notably countries such as China, India, and Australia, alongside emerging markets in Southeast Asia and parts of Latin America, are expected to drive significant growth due to rapid urbanization, increasing middle-class populations, and government support for homeownership initiatives.

How do independent mortgage banks (IMBs) differentiate themselves from traditional banks?

Independent mortgage banks (IMBs) often differentiate themselves through specialized product offerings, a stronger focus on digital customer experiences, greater agility in adapting to market changes, and by leveraging advanced technology to streamline the loan origination process, often resulting in quicker approvals and competitive rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mortgage Lender Market Statistics 2025 Analysis By Application (New house, Second-hand house), By Type (Residential, Commercial Estate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mortgage Lender Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Residential, Commercial Estate), By Application (New House, Second-hand House), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager