Multi-layer Ceramic Capacitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429932 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Multi-layer Ceramic Capacitor Market Size

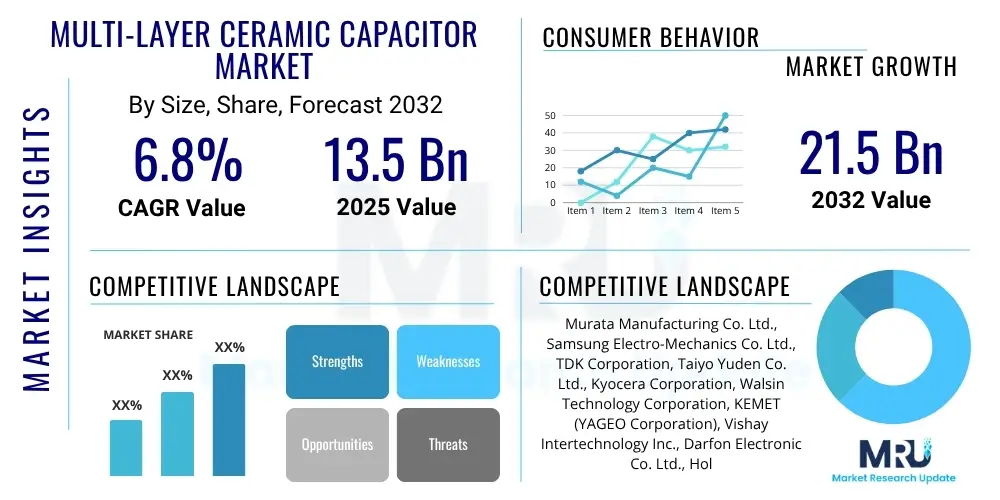

The Multi-layer Ceramic Capacitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $13.5 Billion in 2025 and is projected to reach $21.5 Billion by the end of the forecast period in 2032.

Multi-layer Ceramic Capacitor Market introduction

The Multi-layer Ceramic Capacitor (MLCC) market constitutes a foundational pillar within the global passive electronic components industry, serving as an indispensable element in the functionality and reliability of virtually all modern electronic devices. These compact, high-performance components are adept at storing electrical energy, filtering noise, and decoupling power supplies, making them crucial for signal integrity and power management across diverse circuit designs. Their inherent advantages, including exceptional frequency characteristics, low equivalent series resistance (ESR), and high volumetric efficiency, position them as preferred solutions over many alternative capacitor technologies. The continuous drive towards miniaturization, coupled with an increasing demand for enhanced performance and reliability in electronic systems, serves as a primary impetus for the sustained expansion and innovation within the MLCC market, influencing advancements in material science and manufacturing precision.

At its core, an MLCC is a sophisticated ceramic capacitor constructed from multiple alternating layers of ceramic dielectric material and metallic electrodes. These layers are meticulously stacked, compacted, and then subjected to a high-temperature sintering process to create a robust, monolithic structure. Terminations on opposing sides of the component connect to alternate electrode layers, establishing the capacitor’s electrical contacts. The manufacturing process demands extreme precision and advanced material science to achieve the desired capacitance values and voltage ratings within remarkably small physical dimensions. Key benefits derived from this design include superior thermal stability, a broad operating temperature range, minimal equivalent series inductance (ESL), and excellent high-frequency response. These attributes are critical for supporting the design trends of increasingly complex and densely packed electronic assemblies across numerous applications.

The ubiquity of MLCCs is evident across an extensive spectrum of major applications. In the consumer electronics domain, they are integral to the operation of smartphones, laptops, tablets, smart wearables, and various IoT devices, where they facilitate crucial power conditioning and high-speed signal processing. The automotive sector represents a rapidly growing demand segment, with MLCCs being essential for advanced driver-assistance systems (ADAS), electric vehicle (EV) powertrains, sophisticated infotainment systems, and robust safety features, necessitating components capable of high reliability under harsh environmental conditions. Furthermore, the telecommunications industry, particularly with the widespread deployment of 5G infrastructure and advanced networking equipment, relies heavily on MLCCs for optimized signal integrity and power filtering. Industrial automation, medical diagnostics, aerospace systems, and renewable energy technologies further underscore the broad utility and critical role of MLCCs in enabling technological progress. Key driving factors propelling this market forward include the global proliferation of connected devices, the rollout of next-generation 5G networks, accelerated adoption of electric and autonomous vehicles, and continuous advancements in portable and high-performance electronic devices.

Multi-layer Ceramic Capacitor Market Executive Summary

The Multi-layer Ceramic Capacitor (MLCC) market is currently navigating a period of dynamic expansion, characterized by significant technological advancements and shifting demand patterns globally. Key business trends underscore a strong emphasis on research and development, particularly in the creation of novel dielectric materials that enable higher capacitance in smaller form factors, addressing the persistent industry push for miniaturization. Strategic consolidation through mergers and acquisitions is also prevalent, as leading manufacturers seek to bolster their technological portfolios, expand production capacities, and achieve greater economies of scale to maintain competitive advantages. Furthermore, there is an increasing focus on fortifying global supply chains, investing in diversified manufacturing bases, and improving logistical efficiencies to mitigate risks associated with raw material price volatility and geopolitical instability, thereby ensuring a more resilient and agile market ecosystem.

From a regional perspective, Asia Pacific continues its dominant role in the global MLCC market, primarily driven by its unparalleled concentration of electronics manufacturing facilities and a rapidly expanding domestic market for electronic devices. Countries such as China, Japan, South Korea, and Taiwan are at the epicenter of both MLCC production and consumption, benefiting from robust investments in 5G network deployment, electric vehicle manufacturing, and extensive consumer electronics production. North America and Europe demonstrate a steady and significant growth trajectory, propelled by the increasing penetration of electric vehicles, the ongoing digitalization of industrial processes, and substantial investments in advanced telecommunications infrastructure. These regions are also leading innovators in high-reliability and specialized MLCC applications for sectors like aerospace, defense, and medical devices, stimulating a demand for sophisticated and customized components and encouraging global players to enhance their local R&D and manufacturing footprints.

Segmentation trends within the MLCC market reveal pronounced demand for specific product categories. High-capacitance MLCCs, predominantly utilizing Class II dielectrics such as X5R and X7R, are experiencing strong growth due to their essential role in power management and decoupling circuits in a vast array of electronic devices. Conversely, Class I MLCCs, exemplified by C0G (NP0) types, continue to be critical for applications requiring extreme temperature and voltage stability, such as precision timing and resonant circuits. The automotive sector stands out as a high-growth segment, fueled by the accelerating adoption of electric and hybrid vehicles and the increasing electronic content per vehicle, necessitating robust, high-voltage, and AEC-Q200 qualified MLCCs. The consumer electronics and telecommunications segments remain fundamental demand drivers, consistently requiring innovative MLCCs to support increasingly powerful, compact, and interconnected devices, illustrating the comprehensive and diversified growth profile of the Multi-layer Ceramic Capacitor market.

AI Impact Analysis on Multi-layer Ceramic Capacitor Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Multi-layer Ceramic Capacitor (MLCC) market frequently explore the dual impact of AI: its role as a demand driver for advanced MLCCs in AI-enabled products and its transformative potential within MLCC manufacturing processes. Users often inquire about the specific technical requirements that AI-powered devices, such as high-performance computing (HPC) systems, data centers, edge AI devices, and autonomous vehicles, impose on MLCCs, expecting higher density, ultra-low equivalent series inductance (ESL), superior thermal management, and enhanced reliability. There is also keen interest in how AI and machine learning (ML) algorithms can revolutionize MLCC production, from implementing predictive maintenance in complex fabrication lines to leveraging AI for advanced material discovery and optimization of dielectric properties, with the ultimate goals of improving yield rates, reducing manufacturing costs, and accelerating product development cycles. Furthermore, stakeholders often seek insights into how AI-driven simulation and design tools can facilitate the creation of next-generation MLCCs tailored precisely to the evolving demands of advanced AI hardware architectures.

- AI-powered computing systems, including GPUs and CPUs, necessitate ultra-high capacitance and low ESR/ESL MLCCs for stable power delivery.

- Edge AI devices drive demand for highly miniaturized MLCCs with low power consumption for compact and battery-operated applications.

- AI in MLCC manufacturing enables predictive maintenance of equipment, reducing downtime and improving production efficiency.

- Machine learning algorithms optimize process parameters in MLCC fabrication, leading to higher yield rates and improved quality consistency.

- AI assists in the discovery and development of novel dielectric materials, enhancing MLCC performance characteristics like capacitance density and temperature stability.

- AI-driven simulation tools accelerate the design and prototyping phases of new MLCC products, shortening time-to-market for advanced components.

- Supply chain management for MLCCs benefits from AI analytics, offering better demand forecasting and optimization of inventory and logistics.

- Autonomous driving systems require robust, high-reliability, and high-voltage MLCCs for critical control units, driving significant automotive sector demand.

- AI applications in 5G infrastructure, such as beamforming and massive MIMO, demand MLCCs with excellent high-frequency performance and stability.

- Data centers and cloud computing infrastructure rely on large quantities of high-capacitance MLCCs for power integrity in servers and networking equipment.

DRO & Impact Forces Of Multi-layer Ceramic Capacitor Market

The Multi-layer Ceramic Capacitor (MLCC) market is intricately shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that collectively define its growth trajectory and competitive dynamics. Understanding these elements is paramount for stakeholders to formulate effective strategies and navigate the evolving landscape. The persistent global demand for increasingly sophisticated and compact electronic devices forms the fundamental backdrop, pushing the boundaries for MLCC performance and driving continuous innovation. The market's resilience and adaptability are constantly tested by internal and external pressures, dictating investment decisions, research priorities, and market entry strategies for new and established players alike.

Key drivers propelling the MLCC market forward include the accelerating global rollout of 5G telecommunication networks, which demand vast quantities of high-frequency and stable MLCCs for base stations, network equipment, and end-user devices. The rapid electrification of the automotive industry, characterized by the surging production of electric vehicles (EVs) and hybrid electric vehicles (HEVs), creates significant demand for high-voltage, high-reliability MLCCs essential for power control units, battery management systems, and ADAS. Furthermore, the ubiquitous expansion of the Internet of Things (IoT) ecosystem, encompassing smart homes, industrial IoT, and wearable technologies, necessitates miniaturized and efficient MLCCs for power management and signal conditioning in a multitude of connected devices. The relentless pursuit of miniaturization across consumer electronics, aiming for thinner, lighter, and more powerful gadgets, continuously drives innovation in MLCC technology, demanding higher capacitance in smaller form factors and thereby sustaining market expansion.

Despite robust growth drivers, the MLCC market faces several significant restraints. Foremost among these is the inherent volatility in raw material prices, particularly for critical components such as barium titanate (for dielectrics) and precious metals like palladium, silver, and nickel (for electrodes). Fluctuations in the cost of these materials can profoundly impact manufacturing expenses, profit margins, and the final pricing of MLCCs. The complex, capital-intensive nature of MLCC manufacturing, requiring substantial investment in advanced equipment, specialized cleanroom environments, and highly skilled technical personnel, acts as a significant barrier to entry for new competitors. Moreover, geopolitical tensions, trade disputes, and natural disasters can disrupt global supply chains, leading to material shortages, extended lead times, and increased operational uncertainties. Stricter environmental regulations pertaining to material sourcing and manufacturing waste disposal also impose additional compliance costs and operational complexities on MLCC producers, challenging traditional manufacturing paradigms.

Opportunities within the MLCC market are substantial and diverse, largely stemming from ongoing technological mega-trends and emerging application areas. The burgeoning market for high-capacitance MLCCs, driven by the increasing power integrity requirements of high-performance computing and data center applications, represents a lucrative growth avenue. The continued advancements in industrial automation, robotics, and smart factory initiatives create a sustained demand for robust and reliable MLCCs in industrial control systems and power supplies. Furthermore, the medical device sector, with its stringent reliability and miniaturization requirements for implantable devices, diagnostic equipment, and wearable health monitors, offers niche yet high-value opportunities for specialized MLCCs. Emerging applications in renewable energy systems, space technology, and advanced communication platforms also present long-term growth prospects, encouraging manufacturers to invest in research and development for next-generation MLCCs that can withstand extreme conditions and deliver enhanced performance. Strategic collaborations between MLCC manufacturers and end-use industry leaders are also opening new pathways for customized component development.

The MLCC market is profoundly influenced by several overarching impact forces. Technological innovation remains a paramount force, constantly reshaping component requirements and accelerating the obsolescence of older technologies, thereby compelling continuous R&D investment. Global economic conditions, including GDP growth, consumer spending power, and industrial output, directly influence the demand for electronic devices and, consequently, MLCCs. Supply-demand imbalances, often stemming from sudden spikes in demand or disruptions in production capacity, can lead to significant lead time extensions and price volatility, challenging market stability. Furthermore, the competitive landscape, characterized by a concentrated market with a few dominant players alongside numerous specialized manufacturers, drives aggressive innovation, efficiency improvements, and strategic differentiation efforts. Regulatory frameworks, including international trade policies, environmental standards, and product safety certifications, also exert considerable influence on market access, manufacturing practices, and product specifications, shaping the overall operational environment for MLCC stakeholders.

Segmentation Analysis

The Multi-layer Ceramic Capacitor (MLCC) market is meticulously segmented across various critical dimensions, providing a granular and insightful perspective into its intricate dynamics and diverse demand profiles. This comprehensive segmentation is instrumental for market participants to identify lucrative niches, understand specific application requirements, and formulate targeted product development and marketing strategies. It reflects the broad spectrum of MLCC types available, each tailored for distinct performance characteristics and operational environments, ranging from general-purpose consumer electronics to highly specialized automotive, industrial, and medical applications. The distinctions within these segments are driven by technological advancements, material science innovations, and the evolving demands of electronic system designers who seek optimized components for specific functionalities like filtering, decoupling, and timing.

A deeper examination of these segments reveals varying growth trajectories and market saturation levels. For instance, the Class II MLCC segment, particularly those utilizing X5R and X7R dielectrics, consistently garners the largest market share due to their high capacitance values and suitability for widespread power management and general-purpose decoupling applications in consumer electronics, telecommunications, and automotive infotainment systems. Conversely, the Class I MLCCs, such as C0G (NP0) types, though lower in capacitance, are indispensable in precision applications requiring exceptional temperature stability and minimal capacitance change, including resonant circuits, filters, and medical implants. Voltage segmentation is crucial for safety-critical and high-power applications, with high-voltage MLCCs experiencing robust demand in EV charging infrastructure, industrial power supplies, and LED lighting. Each end-use industry segment also presents unique opportunities and challenges, influencing material specifications, reliability standards, and supply chain logistics, compelling manufacturers to innovate and differentiate their product portfolios to capture specific market needs and maintain competitive relevance in a rapidly evolving technological landscape.

- By Type

- Class I MLCCs (Temperature Compensating)

- C0G (NP0)

- U2J

- Class II MLCCs (High Dielectric Constant)

- X5R

- X7R

- Y5V

- Z5U

- X6S

- X7S

- Class I MLCCs (Temperature Compensating)

- By Dielectric Material

- Barium Titanate (BaTiO3) based (for X5R, X7R, etc.)

- Calcium Titanate (CaTiO3) based (for C0G/NP0)

- Strontium Titanate (SrTiO3) based

- Others (e.g., Magnesium Titanate)

- By Voltage Range

- Low Voltage MLCCs (Typically up to 50V, e.g., 6.3V, 10V, 16V, 25V)

- Medium Voltage MLCCs (Typically 50V to 500V, e.g., 100V, 250V, 450V)

- High Voltage MLCCs (Above 500V, e.g., 630V, 1kV, 2kV, 3kV and higher)

- By Capacitance Range

- Low Capacitance (pF range)

- Medium Capacitance (nF range)

- High Capacitance (µF range)

- By Chip Size (EIA Standard)

- 0201

- 0402

- 0603

- 0805

- 1206

- 1210

- Larger Sizes (e.g., 1812, 2220)

- By Application

- Decoupling/Bypassing Circuits

- Filtering (EMI/RFI Suppression)

- Timing Circuits

- Resonant Circuits

- Energy Storage/Smoothing

- Coupling/DC Blocking

- Sensing and Protection

- By End-Use Industry

- Consumer Electronics

- Smartphones and Tablets

- Laptops and PCs

- Wearables

- Televisions and Displays

- Home Appliances

- Automotive

- Advanced Driver-Assistance Systems (ADAS)

- Powertrain and Engine Control Units (ECUs)

- Infotainment and Telematics

- Body Electronics and Lighting

- Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) systems

- Telecommunications

- 5G Infrastructure (Base Stations, Routers)

- Network Equipment

- Mobile Devices (Handsets)

- Satellite Communication

- Industrial

- Industrial Automation and Control Systems

- Power Supplies and Converters

- Test and Measurement Equipment

- LED Lighting Systems

- Robotics

- Medical Devices

- Imaging Systems (MRI, CT scanners)

- Diagnostic Equipment

- Implantable Devices

- Wearable Health Monitors

- Aerospace and Defense

- Avionics

- Radar Systems

- Satellite Systems

- Energy

- Renewable Energy Systems (Solar Inverters, Wind Turbines)

- Smart Grid Infrastructure

- Consumer Electronics

Value Chain Analysis For Multi-layer Ceramic Capacitor Market

The value chain for the Multi-layer Ceramic Capacitor (MLCC) market is a sophisticated and highly interconnected network, beginning with the meticulous sourcing and processing of specialized raw materials at the upstream end. This critical stage involves the procurement of high-purity ceramic powders, such as barium titanate, calcium titanate, and strontium titanate, which serve as the dielectric layers. Equally important are the metallic electrode materials, including palladium, silver, nickel, and copper, alongside termination materials. Key suppliers in this segment are tasked with delivering materials that meet stringent purity, particle size, and consistency specifications, as these factors directly dictate the electrical performance, reliability, and manufacturing yield of the final MLCC product. Strategic partnerships and long-term contracts with these upstream raw material providers are crucial for MLCC manufacturers to ensure a stable supply, manage cost volatility, and maintain product quality, forming the fundamental bedrock of the entire MLCC production ecosystem.

Midstream activities encompass the complex and technologically advanced manufacturing processes that transform raw materials into finished MLCCs. This involves a multi-step sequence including slurry preparation, precise screen printing of alternating ceramic dielectric and electrode layers, high-pressure stacking and lamination, dicing into individual components, and a critical high-temperature co-firing (sintering) process that consolidates the layers into a monolithic block. Subsequent steps include termination application, electroplating (nickel and tin), and rigorous electrical testing and sorting. Leading MLCC manufacturers, such as Murata Manufacturing, Samsung Electro-Mechanics, TDK Corporation, Taiyo Yuden, and Kyocera, continuously invest heavily in proprietary technologies, automation, and advanced quality control systems to achieve ultra-miniaturization, higher capacitance densities, and enhanced reliability. Value is added through sophisticated engineering, stringent quality assurance protocols, and the ability to produce a vast array of MLCCs with diverse specifications, thereby converting basic materials into high-performance, mission-critical electronic components.

Downstream analysis focuses on the distribution and sales channels that bridge the gap between MLCC manufacturers and their incredibly diverse customer base, which primarily consists of original equipment manufacturers (OEMs) and original design manufacturers (ODMs) across various industries. Distribution strategies are multifaceted, often employing a combination of direct sales to large-volume, strategic accounts requiring customized solutions or extensive technical support, and indirect sales channels. The indirect channels typically involve a global network of authorized electronics component distributors, regional resellers, and increasingly, specialized online marketplaces. These distributors play a crucial role in inventory management, providing vital logistical support, offering localized technical assistance, and serving a broad customer base, including small to medium-sized enterprises. The efficiency and reach of these distribution networks are paramount for ensuring timely product delivery, facilitating market penetration into new geographies and emerging application areas, and ensuring that MLCCs are readily accessible to the myriad of end-use applications in consumer electronics, automotive, telecommunications, industrial, and medical sectors worldwide.

Multi-layer Ceramic Capacitor Market Potential Customers

The Multi-layer Ceramic Capacitor (MLCC) market targets an incredibly broad and diverse customer base, encompassing virtually every industry sector that integrates electronic circuitry into its products. At the forefront are original equipment manufacturers (OEMs) and original design manufacturers (ODMs) within the highly dynamic consumer electronics industry. This segment includes global giants producing smartphones, laptops, tablets, smart wearables, gaming consoles, smart home devices, and high-definition televisions. These manufacturers require immense volumes of MLCCs for power regulation, signal filtering, noise suppression, and high-speed data processing, all within increasingly compact and energy-efficient designs. The relentless pace of innovation and rapid product refresh cycles in consumer electronics ensure a consistent, high-volume demand for advanced, miniaturized, and cost-effective MLCC solutions.

Another profoundly significant and rapidly expanding customer segment is the automotive industry, particularly driven by the accelerating transition towards electric vehicles (EVs), hybrid electric vehicles (HEVs), and advanced driver-assistance systems (ADAS). Automotive OEMs and their Tier 1 suppliers demand MLCCs that meet exceptionally stringent reliability, extended temperature range, and vibration resistance standards (e.g., AEC-Q200 qualification) for mission-critical applications such as powertrain control units, battery management systems, infotainment systems, sophisticated sensors, and safety features. The exponential increase in electronic content per vehicle, coupled with the move towards autonomous driving, translates into a robust and high-value demand for robust, high-voltage, and long-life MLCCs that can withstand harsh operating environments and ensure vehicle safety and performance over extended periods.

Furthermore, telecommunications equipment manufacturers represent a vital customer base, propelled by the global deployment of 5G networks, data centers, and sophisticated network infrastructure. These customers require high-frequency, stable, and often compact MLCCs for base stations, routers, switches, mobile devices, and fiber optic communication systems, where signal integrity and power efficiency are paramount. The industrial sector, encompassing automation, robotics, power management systems, test and measurement equipment, and renewable energy infrastructure, also constitutes a substantial pool of potential customers, demanding ruggedized and high-reliability MLCCs for harsh industrial environments. Finally, the medical device industry, with its stringent requirements for ultra-reliable, often specialized, and sometimes biocompatible MLCCs for imaging equipment, diagnostic tools, and critical implantable devices, forms a high-value, niche market segment. Aerospace and defense contractors also seek high-performance, ruggedized MLCCs for avionics, radar systems, and satellite applications where absolute reliability and performance under extreme conditions are non-negotiable, highlighting the pervasive and demanding customer landscape for Multi-layer Ceramic Capacitors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $13.5 Billion |

| Market Forecast in 2032 | $21.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co. Ltd., Samsung Electro-Mechanics Co. Ltd., TDK Corporation, Taiyo Yuden Co. Ltd., Kyocera Corporation, Walsin Technology Corporation, KEMET (YAGEO Corporation), Vishay Intertechnology Inc., Darfon Electronic Co. Ltd., Holy Stone Enterprise Co. Ltd., Johanson Dielectrics Inc., Microchip Technology Inc., Knowles Corporation, NIC Components Corp., Cornell Dubilier Electronics Inc., KOA Corporation, Panasonic Corporation, AVX Corporation (Kyocera AVX), SEMCO, Syfer Technology (Knowles) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multi-layer Ceramic Capacitor Market Key Technology Landscape

The technological landscape of the Multi-layer Ceramic Capacitor (MLCC) market is characterized by relentless innovation aimed at meeting the ever-increasing demands for enhanced performance, greater miniaturization, improved reliability, and expanded operational capabilities. A primary area of focus lies in material science, specifically the development of advanced ceramic dielectric materials. Research is heavily invested in creating new formulations of barium titanate and other titanate compounds with higher dielectric constants, allowing for greater capacitance values in smaller volumes. Simultaneously, efforts are directed towards improving the temperature stability and voltage linearity of these materials, ensuring consistent performance across a wide range of operating conditions, which is critical for demanding applications in automotive and industrial sectors. The shift towards base metal electrodes (BMEs) like nickel and copper, replacing more expensive palladium and silver, is another significant material innovation, driving cost reduction while maintaining or improving performance.

Manufacturing process technologies are equally pivotal in shaping the MLCC market. The ability to produce ultra-thin dielectric layers (often less than one micrometer thick) and consistently stack hundreds of these layers with high precision is fundamental to achieving high capacitance densities in sub-millimeter packages. Advancements in screen printing, tape casting, and lamination techniques are continuously being refined to enhance accuracy, reduce defects, and improve overall production yield. High-temperature co-firing processes, essential for sintering the multi-layered structure, are also subject to ongoing optimization to control grain growth and microstructural integrity. Furthermore, the integration of automation, robotics, and advanced quality control systems, often leveraging artificial intelligence and machine learning, is transforming MLCC fabrication by ensuring higher consistency, minimizing human error, and enabling predictive maintenance, thereby boosting manufacturing efficiency and reliability.

Beyond material and process innovations, other key technological trends include the development of MLCCs with specialized features. This encompasses robust termination technologies, such as soft terminations (conductive epoxy or polymer layers) designed to mitigate the risk of flex cracking in surface mount applications, especially critical in automotive environments. There is also a strong emphasis on developing high-voltage MLCCs capable of operating reliably at several kilovolts, crucial for EV power systems, industrial power supplies, and medical imaging equipment. Moreover, research into high-frequency performance optimization, including ultra-low equivalent series inductance (ESL) designs, is vital for demanding telecommunications and high-speed data processing applications. The ongoing drive towards embedding passive components within printed circuit boards or integrating them into semiconductor packages also points to future technological directions, aiming for further space savings and performance enhancements. These combined technological efforts underscore the market's commitment to delivering cutting-edge solutions that support the next generation of electronic devices and systems.

Regional Highlights

- Asia Pacific (APAC): This region unequivocally dominates the global Multi-layer Ceramic Capacitor market, primarily serving as the world's leading hub for electronics manufacturing. Countries such as China, Japan, South Korea, and Taiwan house major MLCC producers and a vast network of consumer electronics, automotive, and telecommunications OEMs. The substantial investments in 5G infrastructure deployment, rapid growth in electric vehicle production, and a booming consumer electronics market continue to drive unparalleled demand and production capacity in APAC. The region benefits from well-established supply chains, advanced manufacturing capabilities, and a large, skilled workforce, solidifying its pivotal role in the global MLCC landscape.

- North America: The North American market exhibits significant and consistent growth, fueled by the accelerating adoption of electric vehicles, the ongoing expansion of advanced industrial automation, and substantial investments in data center infrastructure and high-performance computing. The region also demonstrates robust demand for high-reliability MLCCs in specialized sectors such as defense, aerospace, and medical devices, where component failure is not an option. A strong emphasis on technological innovation and extensive research and development activities in advanced electronics further contributes to the demand for sophisticated, high-performance MLCCs, pushing manufacturers to offer cutting-edge solutions tailored to stringent regional requirements.

- Europe: As a mature yet steadily growing market for MLCCs, Europe's demand is largely propelled by its powerful automotive industry, particularly the accelerating shift towards electric vehicle production and sophisticated in-car electronics. The region also shows strong growth in industrial IoT applications, renewable energy systems, and high-quality industrial controls, necessitating MLCCs with exceptional reliability and extended operational lifetimes. Countries like Germany, France, and the UK are key contributors, emphasizing precision engineering and specialized MLCCs that meet rigorous quality standards and environmental regulations. European manufacturers and end-users often seek custom solutions for niche, high-value applications.

- Latin America: The Latin American market for Multi-layer Ceramic Capacitors is an emerging region, experiencing gradual but consistent growth. This expansion is primarily attributed to increasing industrialization across various countries, rising penetration of consumer electronics, and nascent but growing automotive manufacturing capacities. While smaller in scale compared to other major regions, Latin America presents promising opportunities for market expansion as its economies develop, digital infrastructure improves, and local manufacturing capabilities mature, creating new demand for electronic components across a range of applications.

- Middle East and Africa (MEA): The Middle East and Africa represent a developing market for MLCCs, driven by ongoing infrastructure development projects, increasing consumer electronics usage, and significant investments in telecommunications infrastructure, including the rollout of 5G networks. Growth in this region is progressive, with considerable potential for future expansion as digitalization initiatives gain momentum, industrial sectors diversify, and economic development stimulates broader adoption of electronic technologies. The demand is often for standard and mid-range MLCCs, but specialized requirements are emerging with technological advancements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multi-layer Ceramic Capacitor Market.- Murata Manufacturing Co. Ltd.

- Samsung Electro-Mechanics Co. Ltd.

- TDK Corporation

- Taiyo Yuden Co. Ltd.

- Kyocera Corporation

- Walsin Technology Corporation

- KEMET (YAGEO Corporation)

- Vishay Intertechnology Inc.

- Darfon Electronic Co. Ltd.

- Holy Stone Enterprise Co. Ltd.

- Johanson Dielectrics Inc.

- Microchip Technology Inc.

- Knowles Corporation

- NIC Components Corp.

- Cornell Dubilier Electronics Inc.

- KOA Corporation

- Panasonic Corporation

- AVX Corporation (Kyocera AVX)

- SEMCO

- Syfer Technology (Knowles)

Frequently Asked Questions

What is a Multi-layer Ceramic Capacitor (MLCC) and why is it essential?

A Multi-layer Ceramic Capacitor (MLCC) is a fundamental electronic component made of stacked ceramic dielectric and metal electrode layers. It is essential for its compact size, high capacitance, and excellent frequency response, serving critical roles in power filtering, signal decoupling, and energy storage across nearly all modern electronic circuits, ensuring their stable and efficient operation.

What are the key industries driving the demand for MLCCs?

The key industries driving MLCC demand are consumer electronics (smartphones, wearables), automotive (electric vehicles, ADAS), telecommunications (5G infrastructure), and industrial (automation, power supplies). These sectors require MLCCs for miniaturization, high performance, and reliability in their advanced electronic systems.

How do raw material costs influence the MLCC market?

Raw material costs, particularly for ceramic powders and precious metals used in electrodes, significantly influence the MLCC market by affecting manufacturing expenses, impacting product pricing strategies, and potentially causing supply chain volatility. Fluctuations can lead to increased operational costs and affect overall market stability.

What impact does Artificial Intelligence (AI) have on the MLCC market?

AI significantly impacts the MLCC market in two ways: it drives increased demand for high-performance and miniaturized MLCCs in AI-powered end-devices (e.g., AI accelerators, edge AI), and it optimizes MLCC manufacturing processes through predictive maintenance, enhanced quality control, and accelerated material discovery for next-generation components.

Which geographical region leads the global MLCC market and why?

The Asia Pacific region leads the global MLCC market due to its concentration of major electronics manufacturing hubs in countries like China, Japan, and South Korea. This dominance is driven by high demand from consumer electronics, automotive electrification, and 5G network expansion, supported by robust supply chains and extensive production capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager