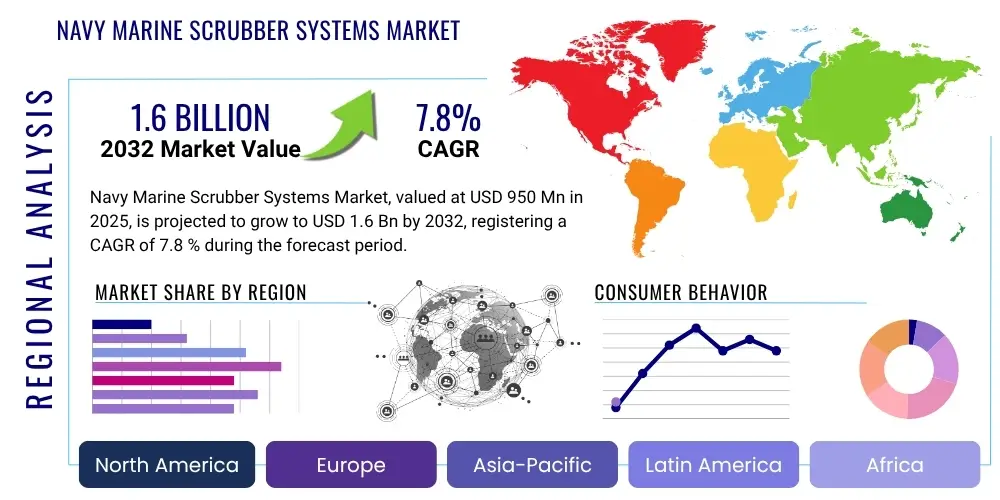

Navy Marine Scrubber Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427996 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Navy Marine Scrubber Systems Market Size

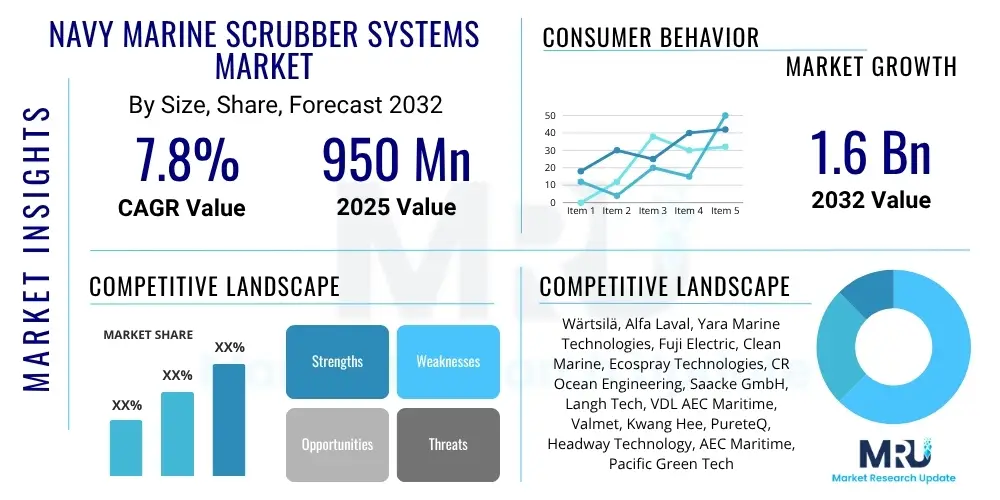

The Navy Marine Scrubber Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 950 Million in 2025 and is projected to reach USD 1.6 Billion by the end of the forecast period in 2032.

Navy Marine Scrubber Systems Market introduction

The Navy Marine Scrubber Systems Market encompasses the design, manufacturing, installation, and maintenance of exhaust gas cleaning systems specifically tailored for naval vessels and military maritime applications. These systems are critical for compliance with increasingly stringent global maritime environmental regulations, such as those set by the International Maritime Organization (IMO) under its IMO 2020 sulfur cap. While commercial shipping has been a primary driver for scrubber adoption, naval forces worldwide are also prioritizing environmental stewardship and operational sustainability, leading to the integration of these sophisticated emission control technologies into their fleets. The unique operational profiles of naval ships, which include varied speeds, mission durations, and power demands, necessitate highly robust, adaptable, and often compact scrubber solutions that can function effectively across diverse environmental conditions without compromising tactical capabilities or stealth requirements.

Product descriptions within this market segment typically refer to open-loop, closed-loop, and hybrid scrubber systems, each offering distinct advantages depending on the vessel's operational area and specific regulatory requirements. Open-loop systems utilize seawater to wash exhaust gases and discharge the wash water back into the sea, suitable for operations in open waters where discharge regulations permit. Closed-loop systems retain the wash water onboard for treatment and recirculation, ideal for environmentally sensitive areas or port operations. Hybrid systems offer the flexibility to switch between open-loop and closed-loop modes. Major applications span across various naval vessel types, including frigates, destroyers, aircraft carriers, patrol vessels, and support ships, all of which emit exhaust gases that contain harmful pollutants like sulfur oxides (SOx) and particulate matter. The adoption of these systems not only ensures regulatory compliance but also enhances the environmental footprint of naval operations, aligning with broader national and international sustainability goals.

The benefits of integrating marine scrubber systems into naval fleets are multi-faceted, extending beyond mere regulatory adherence. These systems allow vessels to continue using more cost-effective high-sulfur heavy fuel oil (HFO), offering significant operational cost savings compared to switching to more expensive low-sulfur fuels, which can be particularly advantageous for fleets with substantial fuel consumption. This economic benefit is a strong driving factor, alongside the imperative of reducing the environmental impact of naval activities. Furthermore, the strategic independence offered by fuel flexibility, without reliance on a single fuel type, is a critical consideration for military operations. Driving factors for market growth include the global push for decarbonization and cleaner maritime transport, ongoing fleet modernization programs by various navies, geopolitical considerations influencing fuel supply chains, and continuous technological advancements in scrubber efficiency and compactness. These elements collectively foster a robust demand environment for advanced Navy Marine Scrubber Systems.

Navy Marine Scrubber Systems Market Executive Summary

The Navy Marine Scrubber Systems Market is undergoing dynamic shifts, characterized by evolving business trends, distinct regional growth patterns, and significant segmentation developments. A prominent business trend is the increasing emphasis on integrated solutions, where scrubber manufacturers are collaborating with shipbuilding yards, engineering firms, and maintenance providers to offer comprehensive packages from design to after-sales support. This trend is driven by the complex nature of retrofitting existing naval vessels and the demand for seamless integration into newbuild programs, often involving highly customized solutions due to the specific structural and operational constraints of military ships. Consolidation within the market, driven by strategic acquisitions and partnerships, is also enabling larger players to offer a broader portfolio of technologies and services, aiming to capture a greater share of both commercial and naval segments. Furthermore, research and development efforts are intensifying, focusing on improving system efficiency, reducing footprint, enhancing material durability against corrosive exhaust gases and wash water, and integrating smart monitoring and control systems to optimize performance and minimize maintenance requirements.

Regionally, the market exhibits varied dynamics reflecting differing naval modernization priorities, regulatory landscapes, and shipbuilding capabilities. Asia-Pacific stands out as a significant growth region, propelled by the rapid expansion and modernization of navies in countries like China, India, South Korea, and Japan. These nations are not only major shipbuilding hubs but also possess substantial naval fleets that require continuous upgrades to meet international environmental standards and national strategic objectives. Europe, with its strong maritime heritage and stringent environmental regulations, also represents a mature but growing market, driven by the commitment of European navies to ecological responsibility and advanced technological adoption. North America, particularly the United States, is investing heavily in cleaner marine technologies for its expansive naval fleet, focusing on long-term sustainability and operational independence. Emerging markets in the Middle East and Latin America are also beginning to show interest, driven by aspirations to modernize their navies and enhance their global maritime standing.

Segmentation trends within the Navy Marine Scrubber Systems Market highlight a growing preference for hybrid systems due to their operational flexibility, allowing vessels to adapt to varying regulatory zones and port restrictions. While open-loop systems remain a cost-effective choice for open ocean transit, the increasing designation of Emission Control Areas (ECAs) and stricter wash water discharge limits are bolstering the demand for closed-loop and, more notably, hybrid configurations. The retrofit segment continues to be a substantial contributor to market growth, as existing naval vessels are upgraded to extend their operational lifespan in compliance with current and future regulations, often presenting engineering challenges dueoting to space and structural integration. The newbuild segment, on the other hand, offers opportunities for more optimized and integrated scrubber designs from the outset, leading to better performance and reduced installation complexities. Furthermore, the drive towards more modular and standardized components, despite the custom nature of naval projects, is a developing trend aimed at streamlining production and installation processes across both newbuild and retrofit applications.

AI Impact Analysis on Navy Marine Scrubber Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Navy Marine Scrubber Systems frequently center on enhancing operational efficiency, predictive maintenance capabilities, and advanced compliance monitoring. The core themes revolve around how AI can move these systems from reactive maintenance to proactive optimization, how it can process vast amounts of operational data to identify patterns for improved performance, and its potential to contribute to more autonomous and intelligent vessel operations. Common concerns also include data security for sensitive naval applications, the integration complexity with existing ship systems, and the need for robust, reliable AI algorithms that can perform under challenging maritime conditions. Expectations are high for AI to reduce human intervention, minimize downtime, and provide real-time insights that improve both environmental compliance and cost-effectiveness over the operational life of the scrubber system, thereby extending the strategic value of naval assets.

- AI-powered predictive maintenance: Machine learning algorithms analyze sensor data from scrubbers (e.g., pH levels, temperature, flow rates, exhaust gas composition) to forecast potential component failures, enabling proactive maintenance scheduling and reducing unscheduled downtime for critical naval operations.

- Optimized operational control: AI can process real-time environmental data (e.g., seawater salinity, alkalinity, port regulations) and vessel operational parameters to dynamically adjust scrubber settings, ensuring optimal performance and compliance while minimizing energy and chemical consumption.

- Enhanced compliance monitoring: AI systems can continuously monitor and report exhaust emissions and wash water quality, providing real-time verification of compliance with IMO regulations and internal naval environmental standards, automating reporting processes and flagging anomalies instantly.

- Autonomous system management: Future applications may involve AI taking over aspects of scrubber management, adjusting parameters, and initiating self-diagnosis routines without direct human oversight, contributing to reduced crew workload and improved operational continuity.

- Supply chain optimization for spares: AI can analyze historical usage patterns and predict future demand for scrubber consumables and spare parts, optimizing inventory levels, reducing logistics costs, and ensuring timely availability of necessary components for naval fleets globally.

- Improved design and R&D: AI can be utilized in the design phase for computational fluid dynamics (CFD) analysis, simulating various scrubber configurations and material choices to optimize efficiency, footprint, and corrosion resistance before physical prototyping, accelerating innovation cycles.

- Crew training and simulation: AI-driven simulations can provide realistic training environments for naval personnel operating and maintaining scrubber systems, allowing them to practice troubleshooting and operational adjustments in a safe, controlled virtual setting.

DRO & Impact Forces Of Navy Marine Scrubber Systems Market

The Navy Marine Scrubber Systems Market is profoundly influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its growth trajectory and competitive landscape. A primary driver is the pervasive and continually tightening global environmental regulations, particularly the IMO 2020 sulfur cap, which mandates a significant reduction in sulfur oxide (SOx) emissions from marine vessels. While naval vessels often have exemptions in certain scenarios, the general trend towards environmental responsibility means navies are increasingly adopting these technologies to align with national sustainability goals and uphold a positive public image. Furthermore, the economic advantage of continuing to use readily available and often cheaper high-sulfur heavy fuel oil (HFO), when combined with a scrubber, presents a compelling financial incentive compared to the higher cost of very low sulfur fuel oil (VLSFO). The steady increase in global seaborne trade, which often involves naval escort or protection duties, also indirectly drives demand as it necessitates the operation of more environmentally compliant support and operational vessels within naval fleets.

However, several significant restraints challenge market expansion. The substantial upfront capital investment required for purchasing and installing scrubber systems, especially the more advanced closed-loop or hybrid variants, can be a deterrent, particularly for navies with constrained budgets. The physical space constraints on many existing naval vessels present a considerable challenge for retrofitting, often requiring extensive structural modifications that add to complexity and cost. Operational complexities, including wash water treatment and disposal, managing system maintenance, and potential corrosion issues, also add to the ongoing operational expenditure. Additionally, the availability and cost of alternative compliance methods, such as switching to low-sulfur fuels or exploring alternative propulsion technologies like LNG or biofuels, provide competition and can divert investment away from scrubber solutions, especially as these alternatives become more viable and cost-effective over time. The diverse nature of naval vessel designs and missions further complicates standardization, leading to bespoke and more expensive solutions.

Opportunities within this market are substantial and diverse. The massive global fleet of existing naval vessels presents a significant opportunity for retrofitting, as many older ships will require upgrades to remain compliant and operationally relevant in a greener maritime environment. The continuous technological advancements in scrubber design, including the development of more compact, energy-efficient, and corrosion-resistant systems, open new avenues for adoption, particularly for vessels with limited space or demanding operational requirements. Moreover, the integration of digital technologies such as the Internet of Things (IoT) and artificial intelligence (AI) for real-time monitoring, predictive maintenance, and optimized operational control offers new value propositions that enhance system reliability and reduce through-life costs. Emerging naval powers, seeking to modernize their fleets and enhance their global standing, represent new markets for scrubber adoption. The broader impact forces include the bargaining power of buyers, primarily navies and national defense departments, who often demand highly customized, robust, and technologically advanced solutions, leading to intense competition among suppliers. The bargaining power of suppliers, particularly for critical components and specialized engineering services, also plays a role. The threat of substitutes, as mentioned with alternative fuels, and the potential threat of new entrants, especially innovative technology firms, maintain a dynamic competitive landscape, driving continuous innovation and efficiency improvements within the Navy Marine Scrubber Systems Market.

Segmentation Analysis

The Navy Marine Scrubber Systems Market is segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for targeted market analysis, highlighting specific growth areas and technological preferences across different applications and operational requirements within the naval sector. By dissecting the market along various dimensions, stakeholders can identify key trends in product adoption, geographical demand, and the strategic decisions influencing naval procurement and fleet modernization efforts. Understanding these segments is crucial for manufacturers to tailor their product offerings, for policymakers to anticipate environmental compliance challenges, and for defense strategists to plan sustainable fleet operations effectively, ensuring both ecological responsibility and operational readiness across global naval deployments. The distinct needs of naval vessels, compared to commercial ships, necessitate specialized segmentation to accurately capture market dynamics.

- By Type:

- Open-Loop Systems: Utilize seawater as a scrubbing agent and discharge the wash water back into the sea after treatment, suitable for open ocean operations where discharge is permitted.

- Closed-Loop Systems: Retain wash water onboard, treating and recirculating it, ideal for environmentally sensitive areas, freshwater operations, or port stays where open-loop discharge is restricted.

- Hybrid Systems: Offer the flexibility to operate in either open-loop or closed-loop mode, providing adaptability to varying regulatory environments and operational needs.

- By Fuel Type:

- Heavy Fuel Oil (HFO) Compatible: Systems designed to enable vessels to continue using less expensive high-sulfur heavy fuel oil while complying with emission regulations.

- Marine Distillate Oil (MDO)/Marine Gas Oil (MGO) Compatible: Systems that can also manage emissions from vessels primarily using lower sulfur distillate fuels, though less common for dedicated scrubbers.

- By Application:

- Naval Vessels: Specifically designed for military ships, including frigates, destroyers, aircraft carriers, submarines (support vessels), patrol vessels, and auxiliary ships. These often require robust, compact, and highly reliable systems.

- Commercial Vessels: Systems primarily for merchant fleets, though the underlying technology can sometimes be adapted for support vessels within a naval context.

- By Vessel Type:

- Newbuild Vessels: Scrubber systems integrated into the design and construction of newly commissioned naval ships, allowing for optimal space utilization and system integration.

- Retrofit Vessels: Installation of scrubber systems onto existing naval vessels, often posing significant engineering challenges due to structural and spatial constraints.

- By Component:

- Scrubber Towers: The main component where exhaust gases are washed.

- Wash Water Treatment Systems: Filters, centrifuges, and chemical treatment units for closed-loop and hybrid systems.

- Pumps and Piping: For managing exhaust gas flow and wash water circulation.

- Control Systems and Automation: For monitoring and optimizing scrubber performance.

- Storage Tanks: For wash water and chemical additives.

Value Chain Analysis For Navy Marine Scrubber Systems Market

The value chain for the Navy Marine Scrubber Systems Market is intricate, involving a series of sequential activities from raw material sourcing to final operational deployment and after-sales support. Upstream analysis reveals a critical dependence on suppliers of specialized raw materials, including high-grade corrosion-resistant alloys such as stainless steel and Hastelloy, various composite materials, and advanced plastics, which are essential for manufacturing scrubber towers, piping, and other components exposed to corrosive exhaust gases and wash water. Chemical suppliers providing reagents for wash water treatment also form a vital part of the upstream segment. Component manufacturers specializing in high-performance pumps, sophisticated control systems, sensors, and water treatment units are key to the functionality and reliability of the overall scrubber system. The quality and availability of these upstream inputs directly impact the final product's performance, durability, and cost-effectiveness, making strong supplier relationships and stringent quality control paramount for scrubber system manufacturers. Innovation in material science directly translates to more resilient and efficient systems.

In the midstream, the core activity is the design, engineering, and manufacturing of the scrubber systems themselves. This stage involves significant R&D investment to develop compact, energy-efficient, and robust solutions that meet the specific demands of naval vessels, including shock resistance, electromagnetic compatibility, and minimal footprint. System integrators and specialized marine engineering firms play a crucial role, often customizing standard scrubber designs to fit the unique architectural and operational requirements of different naval ship classes. Installation services are another critical midstream activity, requiring highly skilled labor for complex integration processes, especially for retrofitting existing vessels where space and structural modifications are challenging. Classification societies, such as Lloyd's Register, DNV, and ABS, provide essential third-party verification and certification services, ensuring that the scrubber systems comply with international maritime regulations and safety standards. This certification process is integral for naval forces seeking global operational interoperability and adherence to best practices.

Downstream analysis focuses on the distribution, sales, and ongoing support for Navy Marine Scrubber Systems. The primary end-users are national navies and defense ministries, which procure these systems either directly from manufacturers, through major shipbuilding yards for newbuild projects, or via specialist marine equipment suppliers for retrofit programs. Distribution channels can be direct, with manufacturers selling directly to naval procurement agencies or shipyards, particularly for large or highly customized orders. Indirect channels involve marine equipment distributors, agents, and engineering firms that act as intermediaries, providing regional support and specialized integration expertise. After-sales services, including maintenance, spare parts supply, technical support, and operational training for naval personnel, are incredibly important, given the critical nature and long operational lifecycles of naval assets. The direct and indirect channels often overlap, with direct engagement for procurement decisions and indirect channels facilitating localized support and service delivery. The robustness of the entire value chain, from raw material sourcing to long-term support, is crucial for ensuring the operational effectiveness and longevity of naval scrubber systems.

Navy Marine Scrubber Systems Market Potential Customers

The primary potential customers for Navy Marine Scrubber Systems are the various naval forces and defense ministries around the globe, encompassing a wide spectrum of maritime military organizations. These organizations operate diverse fleets of vessels, ranging from large aircraft carriers and amphibious assault ships to smaller patrol boats and auxiliary support vessels, all of which contribute to global maritime emissions. The increasing global emphasis on environmental sustainability, coupled with national commitments to reduce pollution, drives these governmental entities to seek advanced solutions for emission control. As such, procurement departments within defense ministries are key decision-makers, evaluating scrubber systems not just on compliance and efficiency, but also on factors such as reliability, maintainability, footprint, and compatibility with sensitive military operational environments, including stealth requirements and electromagnetic interference considerations. The strategic imperative to maintain a modern, capable, and environmentally responsible fleet is a significant motivator for investment in these technologies.

Beyond the direct naval forces, major national shipyards and shipbuilding consortia represent another critical segment of potential customers. These entities are responsible for the construction of new naval vessels and often undertake large-scale fleet modernization or retrofit programs. When building new ships, shipyards integrate scrubber systems as part of the initial design and construction, often working closely with scrubber manufacturers to ensure seamless integration and optimal performance. For retrofit projects, shipyards are contracted to remove existing exhaust systems and install new scrubber units, a complex engineering task that requires specialized expertise. Therefore, manufacturers of Navy Marine Scrubber Systems often target these shipyards directly, establishing partnerships and providing technical support throughout the design and installation phases. The long-term relationships forged with these shipyards are crucial for securing consistent business, as they are central to both newbuild and upgrade cycles of naval fleets.

Furthermore, specialized governmental agencies or bodies responsible for maritime security, coast guard operations, and oceanographic research also represent potential customers. While not strictly "naval" in the traditional sense, these organizations operate vessels that fall under similar environmental regulations and often share operational characteristics with military ships, including the need for robust and reliable systems. For instance, national coast guards, responsible for patrolling exclusive economic zones and enforcing maritime law, are increasingly adopting emission control technologies for their fleets to set a precedent for environmental stewardship. Similarly, research vessels, which conduct prolonged missions in sensitive marine environments, benefit significantly from scrubbers to minimize their ecological footprint. These auxiliary and specialized governmental fleets broaden the customer base, demonstrating a wider governmental commitment to cleaner maritime operations across all state-owned vessels. The overarching demand is for systems that offer both environmental compliance and operational resilience under demanding conditions, which is a hallmark of naval-grade equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 950 Million |

| Market Forecast in 2032 | USD 1.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, Alfa Laval, Yara Marine Technologies, Fuji Electric, Clean Marine, Ecospray Technologies, CR Ocean Engineering, Saacke GmbH, Langh Tech, VDL AEC Maritime, Valmet, Kwang Hee, PureteQ, Headway Technology, AEC Maritime, Pacific Green Technologies, Andritz AG, Sumitomo Heavy Industries Marine & Engineering Co. Ltd., Mitsubishi Heavy Industries, GEA Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Navy Marine Scrubber Systems Market Key Technology Landscape

The Navy Marine Scrubber Systems Market is characterized by a dynamic and evolving technology landscape, driven by the dual imperatives of stringent environmental compliance and the unique operational demands of naval vessels. A critical area of technological focus is material science, particularly the development and application of advanced corrosion-resistant alloys and composite materials. Given that scrubber components are constantly exposed to highly corrosive exhaust gases, acidic wash water, and harsh marine environments, the use of materials like high-grade stainless steels (e.g., Duplex, Super Duplex), Hastelloy, and specialized fiberglass reinforced plastics (FRP) is paramount to ensure system longevity, reliability, and reduced maintenance. Continuous research into these materials aims to enhance resistance to pitting corrosion and stress cracking, thereby extending the operational lifespan of the scrubber units and minimizing the through-life cost for naval forces. This material innovation is essential for ensuring robust systems that can withstand the rigors of military operations.

Another pivotal technological advancement involves sophisticated control systems and automation. Modern Navy Marine Scrubber Systems integrate advanced Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) that enable precise monitoring and control of key operational parameters such as exhaust gas temperature, wash water pH, flow rates, and pollutant levels. These systems often incorporate real-time data acquisition and analysis capabilities, allowing for instantaneous adjustments to optimize scrubbing efficiency and ensure continuous compliance with emission limits. The integration of Internet of Things (IoT) sensors and connectivity further enhances this, enabling remote monitoring, predictive maintenance analytics, and seamless data reporting to central command centers. This level of automation is crucial for naval applications, where manpower might be limited, and system reliability is non-negotiable, reducing the need for constant manual intervention and freeing up crew for other critical tasks. The robustness and cybersecurity of these control systems are also a major design consideration.

Furthermore, computational fluid dynamics (CFD) and advanced simulation techniques are increasingly being employed in the design and optimization of scrubber systems for naval applications. CFD allows engineers to model and predict the flow dynamics of exhaust gases and wash water within the scrubber tower, optimizing internal baffling and spray nozzle configurations to maximize contact efficiency and minimize pressure drop. This leads to more compact and energy-efficient designs, which are particularly advantageous for naval vessels where space and power consumption are at a premium. Innovations in hybrid scrubber technology, which offer the flexibility to switch between open-loop and closed-loop modes, also represent a key technological trend, driven by the need for adaptability across diverse regulatory zones. Moreover, advancements in wash water treatment technologies, including advanced filtration, flocculation, and pH neutralization units, are improving the environmental performance of closed-loop systems, ensuring that retained wash water meets stringent discharge or disposal standards. The convergence of these technological areas contributes to more intelligent, resilient, and environmentally compliant scrubber solutions for the global naval fleet.

Regional Highlights

- North America: This region is driven by the United States Navy's significant fleet modernization programs and Canada's commitment to environmental stewardship in its maritime operations. While the U.S. Navy often operates with specific exemptions, there is a growing internal push towards cleaner technologies to align with national environmental policies. Investments focus on retrofitting existing vessels and integrating advanced systems into newbuilds, prioritizing robust, reliable, and integrated solutions that do not compromise operational capabilities. Stringent national and local environmental regulations, particularly in coastal waters, also contribute to the demand.

- Europe: European nations demonstrate a strong commitment to environmental regulations, often leading global efforts in maritime decarbonization. Navies across the UK, Germany, France, Italy, and Scandinavia are actively integrating scrubber systems into their fleets, driven by both IMO 2020 compliance and stricter regional directives, such as those within the Baltic and North Sea ECAs. Strong shipbuilding capabilities and robust research and development in marine technology further support market growth. The region often prefers advanced hybrid and closed-loop systems due to sensitive coastal environments and high port state control.

- Asia Pacific (APAC): APAC is a dominant market due to the rapid expansion and modernization of major navies, including China, India, South Korea, and Japan. These countries are not only significant shipbuilding hubs but also have extensive maritime interests and growing geopolitical influence, leading to continuous investment in naval capabilities. The sheer volume of new naval vessel constructions and ambitious retrofit programs, coupled with increasing awareness and adoption of international environmental standards, makes APAC a critical growth engine for Navy Marine Scrubber Systems.

- Latin America: This region represents an emerging market, with several countries, such as Brazil, Argentina, and Chile, investing in naval fleet modernization and enhancing their maritime patrol capabilities. While financial constraints can be a factor, the growing emphasis on environmental compliance and the need to protect sensitive marine ecosystems are gradually driving the adoption of cleaner technologies, including scrubbers, in their naval vessels. Regional cooperation on environmental matters could further accelerate this trend.

- Middle East and Africa (MEA): Naval forces in the MEA region are increasing their investments in modernizing their fleets to protect vital shipping lanes and secure national interests. Countries like Saudi Arabia, UAE, and Egypt are acquiring new vessels and upgrading existing ones, which includes a focus on meeting international environmental standards. The growing maritime trade and strategic importance of the region's waterways necessitate a capable and increasingly compliant naval presence, creating demand for scrubber systems, particularly in newbuild projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Navy Marine Scrubber Systems Market.- Wärtsilä

- Alfa Laval

- Yara Marine Technologies

- Fuji Electric

- Clean Marine

- Ecospray Technologies

- CR Ocean Engineering

- Saacke GmbH

- Langh Tech

- VDL AEC Maritime

- Valmet

- Kwang Hee

- PureteQ

- Headway Technology

- AEC Maritime

- Pacific Green Technologies

- Andritz AG

- Sumitomo Heavy Industries Marine & Engineering Co. Ltd.

- Mitsubishi Heavy Industries

- GEA Group

Frequently Asked Questions

What are Navy Marine Scrubber Systems?

Navy Marine Scrubber Systems are specialized exhaust gas cleaning technologies installed on naval vessels to remove harmful pollutants, primarily sulfur oxides (SOx) and particulate matter, from engine exhaust. These systems ensure military ships comply with international and national environmental regulations, contributing to cleaner air and marine environments without compromising operational capabilities. They enable vessels to utilize more cost-effective high-sulfur fuels while maintaining environmental compliance.

Why are scrubbers important for naval fleets?

Scrubbers are important for naval fleets primarily to ensure compliance with increasingly stringent global maritime environmental regulations, such as IMO 2020, and to align with national environmental policies. They allow naval vessels to continue using readily available heavy fuel oil (HFO), offering strategic fuel flexibility and potential cost savings. Additionally, their adoption enhances the environmental image of naval forces and contributes to reducing their ecological footprint during operations worldwide.

What are the main types of marine scrubber systems used in naval applications?

The main types are open-loop, closed-loop, and hybrid systems. Open-loop systems use seawater to wash exhaust gases and discharge the treated wash water. Closed-loop systems recirculate wash water internally after treatment, retaining all by-products onboard. Hybrid systems offer the flexibility to switch between open-loop and closed-loop modes, providing adaptability for vessels operating in diverse regulatory zones and sensitive environmental areas.

What are the key benefits of installing a scrubber system on a naval vessel?

Key benefits include achieving compliance with environmental regulations, which is crucial for international operations and port access. They offer significant fuel flexibility, allowing the continued use of cheaper high-sulfur fuels and reducing reliance on more expensive low-sulfur alternatives. This translates into operational cost savings over the vessel's lifespan. Furthermore, scrubbers contribute to a reduced environmental impact, improving air quality and promoting naval sustainability initiatives, thus enhancing the public perception of naval operations.

What challenges are associated with implementing scrubbers in naval fleets?

Challenges include the substantial upfront capital investment and the significant space constraints on many existing naval vessels, which can make retrofitting complex and costly. Operational complexities, such as managing wash water treatment and disposal, and the need for robust systems that can withstand harsh military operational environments are also significant. Additionally, finding skilled personnel for maintenance and ensuring system integration with existing sensitive ship systems pose further hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager